Amazon.com has spoiled us. It habituated us to fast shipping, something it had to do to compete with brick-and-mortar retail shopping. Now we expect everything we order to arrive at our door fast.

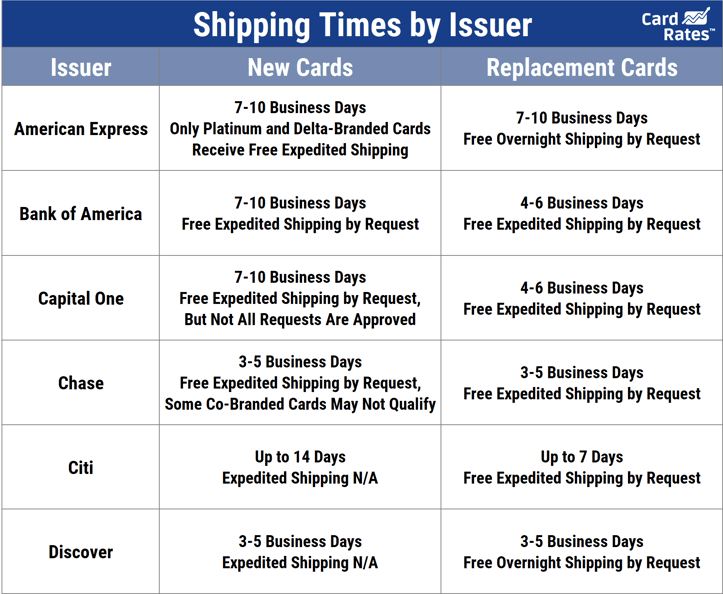

You’d think that the credit card industry was just as prompt, but typical shipment times are a glacial seven to 10 days to receive a new card, and three to seven days for a replacement. However, it’s only the major issuers that offer credit cards with expedited shipping of one to two days, either for free or for a fee.

Other smaller banks and credit unions may offer the service as well. Read on to discover the top 12 credit cards with the best expedited-shipping policies.

-

Navigate This Article:

Best Chase Cards with Expedited Shipping

Chase is the leading issuer in the United States of general-purpose credit cards, boasting 93 million cardholders and almost 32% of industry revenues. It’s known for having high customer satisfaction among cardholders.

Perhaps one reason for its positive service reputation is its shipping policy. Expedited shipping is available on all its cards, which may be mailed out on the same day and arrive in one to two days. You can request expedited shipping by calling its customer service number at 1-800-432-3117.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Best Capital One Cards with Expedited Shipping

Capital One has more than 45 million cardholders covering the spectrum of credit scores from poor to excellent. It offers around-the-clock customer service and free access to credit scores. It also offers in-person customer service at any of its 750 bank branches.

While Capital One doesn’t automatically offer expedited shipping on new cards, you can request expedited shipping, though there’s no guarantee it will be done. Make your request to Capital One customer service at 1-877-383-4802.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

Best Bank of America Cards with Expedited Shipping

Bank of America issued the first general-use credit card in 1958 and eventually grew to the Number 8 issuer with 32 million cardholders. It offers several cards, including co-branded ones.

Bank of America offers expedited shipping upon request, and some reviewers cite free expedited shipping on any new card if you ask for it. You can request expedited shipping by calling customer service at 1-855-307-3887.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don't expire as long as your account remains open.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% - 27.24% Variable APR on purchases and balance transfers

|

$95

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

+ See More Bank of America Cards

Best Discover Cards with Expedited Shipping

Discover is the smallest of the big four card processing networks (behind Visa, Mastercard, and American Express), yet it can be proud of having 57 million cardholders, including many with below-average credit scores. Its cards are well-regarded for their rewards, travel offers, and fraud protection.

Discover has split the difference between snail mail and expedited shipping by providing priority mail shipping on all cards. You don’t have to ask for it, it’s automatic and free. Expect your card to arrive in three to five business days. Also, many of its credit products have free overnight card replacement if yours is lost or stolen.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Can You Get a Credit Card Expedited?

Some issuers offer expedited shipping that’s free and easy to obtain. Others require a compelling reason and may charge a fee.

Or, you may encounter an issuer like Discover that offers free priority shipping in lieu of expedited shipping. Some issuers don’t offer expedited shipping at all, even if you’re willing to pay for it.

Most credit cards will arrive in seven to 10 days. Naturally, the shipment must wait on approval, so it makes sense (for several reasons) to apply for cards that offer a reasonably good chance of approval.

Often, an application enters pending status because some piece of information is missing. You can help the process by contacting the issuer’s customer service department and see what’s causing the delay. It may be as simple as verifying your employer or annual income.

Some issuers offer same-day approval. If you’re in a rush, choose one of them.

That way, you’ll know right away whether you have to apply somewhere else. That’s a lot better than waiting a few days before finding out your application was denied.

Another reason why it may take a while to receive a new credit card is that it must be manufactured. It’s faster to make a simple plastic card than a fancy heavy-weight. And we can imagine that some fabrication operations are more efficient than others.

How Long Does it Take for a Credit Card to Be Mailed?

Standard shipping requires about seven to 10 days for a card to arrive. That’s almost a 50% variance in delivery times.

What’s that three-day span all about? Part of it is doubtlessly due to how quickly the issuer gets the card into the capable hands of the postal service.

The major credit card issuers must keep costs down by operating efficiently. They handle millions of cards each year and any operational hiccups can cause unnecessary expenses or customer dissatisfaction.

Therefore, we may expect big issuers to get cards into the mail as soon as possible, meaning the same or next business day.

But, as we mentioned earlier, some cards may take longer to fabricate. For instance, heavy metallic or carbon-fiber cards may require more complicated fabrication techniques.

Card fabrication became more complicated a couple of years ago with the introduction of cards bearing EMV chips. These chips contain custom information that increases card security.

Initially, the new technology required extra processing time to manufacture, but those kinks by now have been worked out with virtually all new cards having chip technology.

We think it stands to reason that the issuers that offer overnight expedited shipping, such as Chase, must have extremely efficient card fabrication operations. They may be your best bet for quicker mailing, even when it’s not expedited.

Can You Use Credit the Same Day You’re Approved?

Perhaps you’re not aware of it, but some issuers allow immediate use of your credit card account without waiting for receipt of your physical card. This allows you to make card-not-present (CNP) purchases while the card is in transit.

Issuers can implement same-day usage in a couple of ways. The simplest is to send you your new account number.

That’s convenient, but it may not be the safest if they send you the number via email. If you are worried about security, you probably don’t want your credit card number arriving in an email. If your email is hacked, you’re open to fraud.

Alternatively, the issuer may offer virtual card numbers to use while you wait for your card to arrive. A virtual card has a random account number and is good for a single card-not-present transaction. You can get a new virtual number for each CNP purchase, which allows same-day use of your new credit card.

Capital One offers virtual card service through its Eno® assistant feature. Eno also tracks spending and monitors for fraud.

Select Citi cards provide virtual account numbers through its online interface, but you must first register the real account number. However, Citi immediately releases the real account number for only its co-branded cards.

Chase is another issuer that allows you to start using your card instantly. You can add your new card directly to your digital wallet without waiting for it to arrive. Chase allows you to use the card to check out online or in an app through Apple Pay, Google Pay, or Samsung Pay buttons. If you choose to make a purchase with your card in-store, you can simply select your Chase card in your digital wallet and tap to pay.

Bank of America will provide you with your credit card number upon approval, but only if you applied via the Bank of America mobile app. You can then use the card in your digital wallet.

Rest Assured You Have Options When in a Hurry

Our review of credit cards with expedited shipping reveals the 12 best cards for folks in a hurry. We give top honors to Chase for offering free expedited shipping and/or same-day mailing on all its cards.

We also appreciate Discover’s middle-of-the-road approach of shipping all cards via priority mail. The bottom line: When you want your card now, you’ve got good options.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![[current_year]‘s List of Subprime Credit Cards ([updated_month_year]) [current_year]‘s List of Subprime Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/list.jpg?width=158&height=120&fit=crop)

![Credit Scores Needed for Chase Cards in [current_year] Credit Scores Needed for Chase Cards in [current_year]](https://www.cardrates.com/images/uploads/2019/05/credit-score-needed-for-chase-cards-feat.jpg?width=158&height=120&fit=crop)

![9 Best Chase Credit Cards of [current_year] 9 Best Chase Credit Cards of [current_year]](https://www.cardrates.com/images/uploads/2019/06/Best-Chase-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![Approval Criteria For Credit Cards in [current_year] Approval Criteria For Credit Cards in [current_year]](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1846365490.jpg?width=158&height=120&fit=crop)

![Capital One Secured Credit Card Reviews of [current_year] Capital One Secured Credit Card Reviews of [current_year]](https://www.cardrates.com/images/uploads/2021/11/Capital-One-Secured-Credit-Card-Reviews.jpg?width=158&height=120&fit=crop)

![Capital One® Cards For Fair Credit in [current_year] Capital One® Cards For Fair Credit in [current_year]](https://www.cardrates.com/images/uploads/2020/09/shutterstock_124031281.jpg?width=158&height=120&fit=crop)

![The History of Credit Cards: 2000 B.C. – [current_year] A.D. The History of Credit Cards: 2000 B.C. – [current_year] A.D.](https://www.cardrates.com/images/uploads/2020/12/shutterstock_723428044.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards For Christmas Shopping ([current_year]) 8 Best Credit Cards For Christmas Shopping ([current_year])](https://www.cardrates.com/images/uploads/2021/11/Best-Credit-Cards-For-Christmas-Shopping.jpg?width=158&height=120&fit=crop)