Lower interest rates, better loan terms, and more affordable insurance premiums — these are just a few of the perks you may earn when you have good or great credit scores. A solid credit score can save you money and simplify your financial life in many other ways, in addition to paying less to finance your purchases.

If you have put in the effort to earn good credit, kudos on a job well done. But your work certainly isn’t done yet.

In addition to earning good credit scores, you’ll need to learn how to maintain and protect them as well. Read on for three ways to keep your scores in good health.

1. Watch Your 3 Credit Reports Closely

One of the most important steps you can take to keep your credit scores safe is to monitor all three of your credit reports for accuracy. Credit report errors and the fallout of fraud can quickly turn a good credit score into a lousy credit score.

If you’re not paying attention to your credit reports, you may not even realize there’s a problem until the next time you apply for financing.

You’re entitled to one free credit report from each bureau annually.

The good news is that it’s easy to check all three of your credit reports free of charge. You can claim a free credit report from each of the three consumer credit reporting companies — Experian, TransUnion, and Equifax — once every 12 months.

The website you need to visit to claim your free reports is AnnualCreditReport.com. Depending on the state you live in and other factors, you may be entitled to additional free credit reports as well.

NOTE: On April 20, 2020, the three credit reporting agencies announced they would provide free weekly credit reports from the same website, AnnualCreditReport.com. The free weekly reports will last through April 2021.

Once you access your three credit reports, go through each of them line by line. Search for any information that seems suspicious or incorrect.

For example, any accounts that don’t belong to you, incorrect late payments, or unauthorized credit inquiries could be signs of potential problems.

Credit report errors may damage your credit scores. If you find mistakes on your credit reports, you can dispute them with the credit reporting agencies.

According to the Fair Credit Reporting Act (FCRA), a credit bureau has 30 days to investigate your claim when you submit a dispute. And, if the credit reporting agency validates your dispute, the account will either be deleted from your credit reports or corrected.

2. Maintain On-Time Payments

One of the fastest ways to damage a credit score is to start missing payments. About 35% of the points in your FICO and VantageScore credit scores are based on the presence or lack of negative information on your credit reports. Even the occasional late payment has the potential to inflict damage to your credit scores.

If you’re wondering exactly how much a late payment may impact your credit score, that’s impossible to predict in the absence of analysis. Depending on the rest of the information on your credit report, a late payment may affect you differently than it does the next person. But frequent late payments may cause more serious credit score damage.

If you find yourself in a tight financial spot, a few strategies can protect your credit score from damage. First, remember that making at least your minimum credit card payments will help you avoid late fees.

Making only the minimum payment on a credit card isn’t a smart financial strategy in the long run. However, if your income is unexpectedly reduced, paying the minimum may help you keep your credit score safe.

You may also be able to ask your lender for help if you can’t afford to keep up with your bills due to a financial hardship. Some lenders and creditors may be willing to offer you a special payment accommodation until you can get back on your feet.

Be sure to ask your creditor detailed questions about what happens when the special payment accommodation period ends. You should also ask how your account will be reported to the credit bureaus in the meantime (e.g., current, past due, etc.).

Payment accommodations often come with many potential complications. So, you should only consider this option as a last resort. Continue making payments under the terms of your original agreement if you have the ability to do so.

3. Watch Your Credit Card Balances

When it comes to your credit cards, paying on time isn’t enough if you want to earn great credit scores. It’s also critical to pay attention to your credit card balances or, more specifically, how those balances relate to your credit card limits.

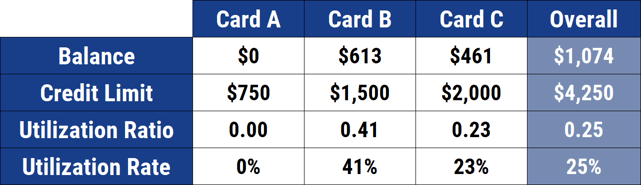

This relationship between your credit card balance and your overall credit limit is known as your credit utilization ratio.

Aside from your payment history, credit utilization is one of the most important factors in calculating your credit score. It is part of the category that is responsible for about one-third of the points in your FICO and VantageScore credit scores.

The credit utilization ratio refers to the percentage of your credit limit that you’re currently using or “utilizing” in the form of a balance.

For example, if you owe $500 on a credit card account that has a $1,000 limit, your utilization ratio is 50%. In other words, you’re utilizing half of your credit limit.

This chart calculates the overall credit utilization ratio across three credit accounts.

When your credit card balance increases on your credit report, your utilization ratio typically increases as well. This may result in a lower credit score.

The best way to manage your credit card account is to pay your full balance each month. Not only can this habit help you protect your credit score, but it can also save you a lot of money in interest fees at the same time.

The Bottom Line

Good credit doesn’t just happen. If you have excellent credit scores, you’ve probably worked hard over many years to earn them.

Earning good scores is only half of the battle, however. You must continue exercising the smart habits that have helped you achieve good credit in the first place if you want to keep that strong credit rating in the future.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![9 Ways to Make Money Using Credit Cards ([updated_month_year]) 9 Ways to Make Money Using Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Ways-to-Make-Money-Using-Credit-Cards--1.jpg?width=158&height=120&fit=crop)

![What Is Credit Card Refinancing? 6 Ways to Lower Rates ([updated_month_year]) What Is Credit Card Refinancing? 6 Ways to Lower Rates ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/What-Is-Credit-Card-Refinancing.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)