Maybe you’ve heard the term before, but you’re still wondering to yourself, “What is a balance transfer credit card?” We’ll explore this topic in the article that follows.

A balance transfer credit card is a credit card that lets you transfer your existing balance to that card from another card.

The primary purpose of a balance transfer is to take advantage of a low or 0% introductory annual percentage rate (APR) offer on the new card so you can pay off your balance faster and save money while you do it. A balance transfer may also allow you to consolidate balances for multiple cards with multiple rates and payments into one card with one rate and payment.

Your new balance transfer card may also have other benefits that your current card doesn’t offer, such as no annual fee, an introductory APR for purchases or a richer rewards program.

Definition | Balance Transfer Cards | Considerations & FAQs

A Balance Transfer Card Eliminates Interest for a While

The benefit of a balance transfer card is the opportunity to pay less interest or no interest for a card balance you already have. Lowering or eliminating your monthly interest expense should help you pay off your balance faster since you won’t have to pay interest for that debt every month.

The catch is that introductory balance transfer APRs always come with an end date for when the introductory APR expires and the full APR kicks in for any portion of the balance you haven’t paid off. The longer the initial APR period and the lower the APR, the more opportunity you have to save while you pay down your balance.

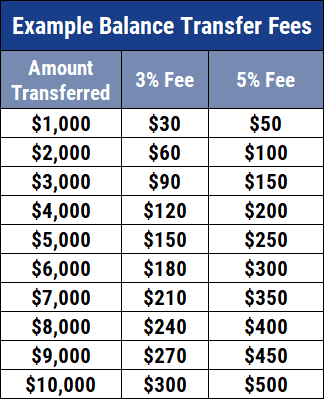

Balance transfer offers usually involve fees of 3% or 5% of the amount that you transfer to the card. The fee is charged to your card, so it adds to your debt at the time that you make the transfer.

Your balance transfer may also be subject to a limit, or cap, for the amount you can transfer over. If there’s no cap, your transfer limit will be your credit limit for that card, minus your balance fee.

Some balance transfer cards also charge an annual fee, which may be waived for the first year. An annual fee will cost you that amount every year you keep the card. The fee is charged to your card automatically, so that also adds to your debt every year.

While it’s fun to get a new card with new rewards and benefits, you should also consider other factors when selecting a balance transfer card. Read the disclosures and review the details of the balance transfer offer. Look for any fees you may be charged, the card’s current APR for purchases, and the APR you’ll pay for your transferred balance if you don’t pay it off before the introductory rate ends.

Best 0% Balance Transfer Cards

While there is no one best balance transfer card for all people and all purposes, some cards may be better than others for most people and most purposes.

Here are five balance transfer cards with no annual fee that you may want to consider:

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

You’ll want to consider several factors before choosing the best balance transfer card for you, such as the length of the intro period, balance transfer fee, and the interest rate that kicks in when the intro period is over.

6 Factors to Consider When Choosing a Balance Transfer Card

Think about which card attributes will create the best opportunity to reduce your debt. For example, you might accept a less-enticing rewards program if you can qualify for a card with a longer 0% introductory APR period. Here are five factors you should look for when you shop for a balance transfer card:

1. Length of Introductory APR Offer

Since the primary purpose of a balance transfer card is to lower the interest you’re paying so you can pay off your card debt faster, the introductory APR and its end date are the most important factor you should consider when you compare balance transfer cards. The best APR, of course, is a 0% APR since that zeroes out any interest for a set period.

If a balance transfer card doesn’t have a 0% introductory APR, it could still be a good card to consider if the introductory APR is significantly lower than the APR for your current card.

Six months is the minimum time frame for introductory APR offers. At the long end, you may find offers that last 18 months or longer. If you’re not absolutely sure you’ll be able to pay off your balance before your introductory APR expires, consider the APR you’ll pay after that as well.

2. Balance Transfer Fee

When you’re trying to reduce your card debt, the last thing you need is to tack on a hefty balance transfer fee. However, paying such a fee can make sense if the balance transfer offer will improve your overall card situation.

Transfer fees of 3% or 5% of your transferred balance with a minimum fee of $5 to $15 are common. If you transferred, say, $5,000, a 3% fee would be $150, and a 5% fee would be $250.

A balance transfer fee probably won’t wipe out your savings from the introductory APR, but if you find a card that allows a balance transfer without a fee, you may consider that a plus. One way you may be able to avoid this fee is to shop for a credit union balance transfer card that doesn’t charge a balance transfer fee.

3. Balance Transfer Time Frame to Qualify for Promotional Rate

Balance transfer offers tend to open and close within a short time frame — generally, 60 to 90 days — after your new card account is opened. You’ll need to complete your transfer requests during that time frame to take advantage of the balance transfer offer. A longer time frame may make it easier for you to transfer your balance without running up against a deadline.

4. Annual Fee

Cards that offer a lot of benefits and fabulous rewards generally charge higher annual fees than cards that offer just the basics. Since there are good balance transfer cards that don’t charge an annual fee, there’s little reason to choose one that does, unless another awesome perk captures your fancy, and you don’t mind paying a fee for it.

5. Rewards Program

A balance transfer card rewards program lets you get cash back, gift cards, travel opportunities, or other goodies when you make purchases with your card. Balance transfers aren’t purchases so they almost never count toward your rewards, but if you plan to use your card for purchases as well, you’ll want to look for one with a nice rewards program. Look for rewards you’re likely to use, not just dream about using.

6. Credit Needed to Qualify

You’ll typically need good or excellent credit to qualify for the best balance transfer cards. If your credit’s only mediocre, you may still qualify for some fair-credit balance transfer cards. Although the offers may not be as attractive, they could still improve your overall card situation.

How Do Balance Transfers Work?

usually isn’t complicated, but the process can differ among card issuers.

Some cards let you request one or more balance transfers when you complete your application. Others want you to wait until you’re approved to set up your transfers.

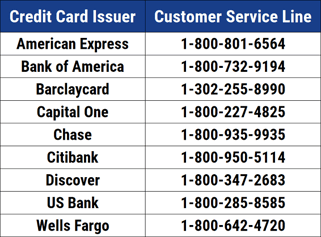

You may be able to set up the balance transfer online or you may need to call the card issuer. When you call, mention the balance transfer offer you want to use and provide the account numbers and amounts you want to transfer from each card.

Once your issuer has approved your request, your balance should be transferred automatically to your new card.

Be sure to make your card payment while your transfer request is being processed because some issuers can take several weeks to process a transfer. If you transfer only part of your balance, you’ll have to make payments to both cards going forward. If you’re not sure what you need to do to transfer a balance, call the issuer and ask for instructions.

By the way, if you have multiple cards, you may be able to transfer a balance from a card you already have to another card you already have. To find out if this strategy is an option for you, call your card issuers and ask them what your credit limit and current balance are, whether you can transfer a balance to your card, what your APR would be on the transferred debt, and how much you can transfer.

Your card issuer may offer you a promotional rate as an inducement to transfer all or part of your balance from another card.

Will a Balance Transfer Affect My Credit Score?

The short answer is yes. Any significant change you make in your use of credit can affect your scores. Getting a new card and transferring a balance is considered a significant change.

The more important question is not if your scores may be affected, but how they may be affected. That’s harder to answer because your scores may go up or down or both.

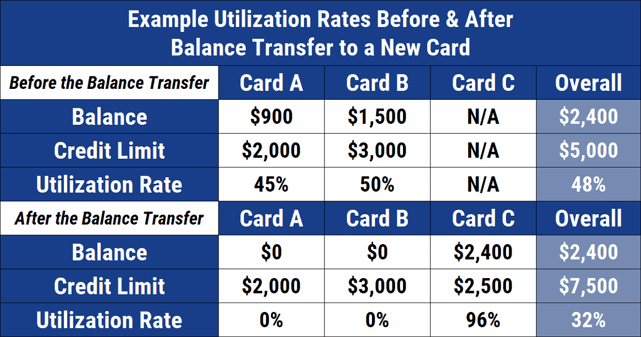

One of the many factors used in credit scores is the percentage of your available credit that you use. This is known as your credit utilization ratio. If you had just one credit card and you maxed it out, your utilization ratio would be 100%.

If you get a new card and transfer a balance to it, but don’t use more credit overall, you’ll have more unused credit available. That could lower your utilization ratio and improve your scores.

On the other hand, whenever you apply for a new card, the issuer will pull your scores and since you proactively applied, that pull will be considered a hard inquiry. One hard inquiry shouldn’t have much effect on your scores, but multiple hard inquiries can lower your scores.

The best way to improve your scores is to pay all your credit accounts on time every month.

What Happens if I Don’t Pay Off My Balance Transfer?

If your introductory APR expires before you’ve paid off the balance you transferred, you’ll be charged the card’s regular APR for that balance going forward until it’s paid off or transferred to another card.

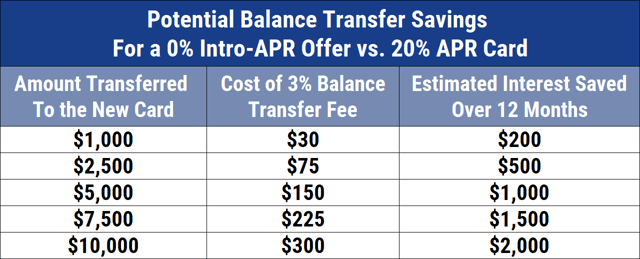

The risk of that regular — higher — APR is one reason you should think carefully before you transfer a balance. Make sure that you understand the balance transfer offer and that you feel confident it will improve your card situation overall. Below is a chart of the potential savings to be had with a 0% balance transfer offer.

While you may be able to transfer your balance again if you don’t pay it off, serial balance transfers aren’t a healthy financial habit. A better strategy is to pay off your balances and never charge more than you can afford to pay in any one month. When your balance is paid off every month, your card interest expense will be zero, your APR won’t matter, and you’ll never have a balance to transfer.

Can I Transfer a Balance Higher than My Credit Limit?

In a word, no.

A card’s credit limit is the maximum amount you can charge with that card. Since you can’t exceed that limit, you won’t be able to transfer more than that amount. For example, if your new card’s limit is $5,000, you’ll only be able to transfer up to $5,000, minus any balance transfer fee that will be charged to your card.

One way to work around this situation is to request a higher limit for your new card. Your card issuer will set your limit based on its policies and your credit history, among other factors. However, that doesn’t mean you can’t ask for more credit. Your issuer may say yes, no, or not now.

In the last case, you may be able to ask again and get your request approved after you make a few payments on time.

Another option is to transfer as much of your balance as you can, pay off some or all of that amount, and make another transfer of the rest of the balance. You may not get a low or 0% introductory APR for the second balance transfer, but your new APR may still be lower than your current APR, which could help you pay off your debt faster. Be sure to consider the balance transfer fee before you decide whether that second transfer makes sense.

A third option is to apply for a second balance transfer card. This strategy could help to protect your credit scores if you don’t max out either or both cards; however, the additional hard inquiry when you apply for the second card could have a small negative effect on your scores. You may be able to avoid this scenario altogether by shopping for a high-limit credit card.

Pay Off Your High-Interest Debt with a Balance Transfer

A balance transfer card is an opportunity to obtain new credit so you can pay off old debt. In theory, that’s a reasonable strategy if the new debt is cheaper (i.e., has a lower APR) than the old debt.

The risk is that, if you don’t pay off the new debt before the introductory APR expires, you could end up paying an even higher APR and you could run up more debt on your current card as well.

That’s a scenario card companies know and love. In fact, it’s why they offer balance transfer cards. If that risk is appropriate for you, there are some very good balance transfer cards to consider.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year] How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year]](https://www.cardrates.com/images/uploads/2017/06/how-to-transfer-credit-card-balance.jpg?width=158&height=120&fit=crop)

![What is a Credit Card Balance? Transfer to 0% ([updated_month_year]) What is a Credit Card Balance? Transfer to 0% ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/what-is-a-credit-card-balance.jpg?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year]) 9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/btandrewards.png?width=158&height=120&fit=crop)

![9 Best 0% Balance Transfer Credit Cards ([current_year]) 9 Best 0% Balance Transfer Credit Cards ([current_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_1495481012.jpg?width=158&height=120&fit=crop)

![7 Balance Transfer Cards With High Limits ([updated_month_year]) 7 Balance Transfer Cards With High Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Balance-Transfer-Cards-With-High-Limits.jpg?width=158&height=120&fit=crop)

![Are Balance Transfer Cards a Good Idea? ([updated_month_year]) Are Balance Transfer Cards a Good Idea? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Are-Balance-Transfer-Cards-a-Good-Idea.jpg?width=158&height=120&fit=crop)

![0% For 21 Months: Balance Transfer Cards ([current_year]) 0% For 21 Months: Balance Transfer Cards ([current_year])](https://www.cardrates.com/images/uploads/2023/04/0-Percent-Blance-Transfer-For-21-Months-Credit-Cards.png?width=158&height=120&fit=crop)