You are probably aware that you need to pay your bills on time if you want to earn and maintain solid credit scores. Payment history, after all, is the most important credit scoring factor in FICO’s credit scoring systems, worth 35% of your score points.

But what happens if you’re only a little late with your credit card payments? Should you expect your credit score to tank if, for example, you make a payment a couple of days after the due date on your account?

The truth is that you actually do have a little wiggle room when it comes to late payments and your credit reports. A credit card issuer won’t report you as late the moment your account becomes past due, but it’s not because they don’t want to do so. We’ll get into that a bit later.

But your card issuer may take other punitive actions against you that have nothing to do with credit reporting, such as assessing late fees and lowering your credit limits, when you miss a payment. It can even close your account, especially if you make it a habit of paying late. Your credit reports will remain safe, but only for so long.

Card Issuers Can’t Report You as Late Until 30 Days After Your Due Date

Credit card issuers, and all other lenders, do not (and in fact cannot) report your account as late to the credit bureaus the moment you are late with your payment. The credit reporting industry has a policy that requires their data furnishers (aka banks, credit unions, credit card issuers, etc.) to wait a full 30 days after the due date before reporting late payments on a consumer’s account.

In fact, there is no systemic method for reporting someone as being late by one to 29 days; it doesn’t exist.

The credit industry, like most industries, has a set of published standards. These standards are generally referred to as the Metro 2 standards, even though Metro 2 is a credit reporting language, not a set of standards. That’s a topic for a different article, though.

The standards are actually conferred to some 14,000 furnishers of information to the credit bureaus by a standards manual called the Credit Reporting Resource Guide or CRRG. This manual is published each year by the Consumer Data Industry Association (CDIA), which is the trade association of the credit bureaus.

It is recommended that data furnishers follow the CRRG guidance when they furnish consumer credit information to the three credit bureaus. This promotes consistency in reporting, meaning all 14,000 companies are following the same set of credit reporting standards. You know, the whole “rowing in the same direction” thing.

The standards are very clear as they pertain to reporting late payments. If an account is late by one to 29 days, creditors must report the account as current.

Current means the account is still in good standing from a credit reporting perspective, even if it’s considered late by the creditor.

So, if you really want to split hairs on this issue of credit card late payments, a creditor must wait 51 days after you receive your statement before a late payment can appear on your credit reports. It’s a legal requirement of the CARD Act of 2009 that the card issuer gives you a 21-day grace period, plus the 30-day waiting period the credit industry tacks on top of that.

The point is, if you end up with a late payment on your credit reports, you didn’t make a payment for a full 51 days after you received your statement.

It’s also worth mentioning that credit card issuers do not have to report late payments (or any other account details) to the credit bureaus. Credit reporting is entirely voluntary.

But if a credit card company chooses to share information with Experian, TransUnion, and/or Equifax, it must follow the rules outlined in both the Fair Credit Reporting Act (FCRA) and the CRRG.

The 30-day waiting period only exists for the first 30 days. If you miss a payment and eventually end up being 60 days late, the card issuer can report you as being 60 days late on day 60. There is no similar waiting period for any level of delinquency after the first cycle.

You can eventually be reported as being 30, 60, 90, 120, 150, and then 180+ days past due.

Why You Should Avoid All Late Payments

You may be able to get away with paying your credit card account a few days or even a few weeks late without hurting your credit scores. But there are several reasons why you should avoid managing your credit cards this way:

- Late Fees: A credit card issuer can’t report your account as past due to the credit bureaus until a full 30 days after your due date. But a card issuer can add a late fee to your account as soon as you miss your payment by one day. According to the Consumer Financial Protection Bureau (CFPB), late fees on credit cards can be as high as $30 for the first late payment and $41 for additional late payments within six billing cycles. The point being, paying your bills late can get expensive.

- Adverse Account Changes: If you make a habit of paying your credit card bills late, you could put your account in jeopardy. A credit card issuer may reduce your credit limit or close your account outright if it feels your level of risk as a borrower has become unacceptable.

- Room for Error: Paying your credit card after the due date can be a dangerous game. If you try to delay sending in payment because you’re overextended financially, those habits can catch up with you later. Something could go wrong with your plan and cause you to go past the 30-day mark before sending in a payment to your card issuer. If this happens, you will likely see a negative mark show up on your credit report and your credit scores could drop.

Card issuers are inclined to help you manage your payments if you’re struggling to keep up with them. It is in your best interest to reach out to them for help before your credit score takes a hit.

How Late Payments Affect Your Credit Scores

The purpose of credit scores is to predict the likelihood a consumer will pay a credit obligation 90 days late or more in the next 24 months. And if your credit report shows that you’ve already paid bills late in the past (especially in the recent past), the risk of you repeating those same late payment habits is higher. Credit scoring models will punish you as a result.

A bad credit score indicates to lenders that you are more likely to make late payments (90 days or later) over the next two years.

A good credit score, by contrast, indicates the exact opposite. Good scores indicate you’re more likely to pay your bills according to the terms of your credit card agreement.

There’s no question that late payments are a stain on your credit history and can be bad for your credit scores. But the exact credit score impact that late payment has can vary based on the factors below (and others):

- Recent late payments are worse than older late payments from a credit score standpoint.

- Frequent late payments can be more damaging than a single late payment.

- Accounts that are currently past due may cause more credit score damage than a bill that was late in the past, but you have since brought current.

- Late payment severity also matters — a 90-day late payment will probably be worse for your credit score than a 30-day late payment.

While there’s no way to predict exactly how much your score will decrease, it is reported that a single late payment can lower your score by 100 points.

Removing Late Payments From Your Credit Reports

If a late payment on your credit reports is accurate, you cannot force a creditor to remove it (at least not right away). According to the FCRA, late payments are allowed to remain on consumer credit reports for up to seven years.

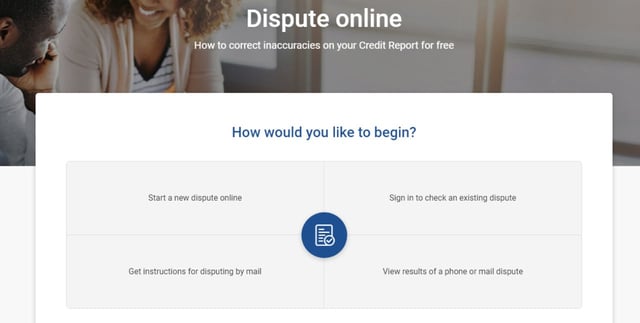

You do have the right to dispute incorrect or outdated late payments, of course. The FCRA allows you to dispute any information that you believe to be an error or that has been on your credit report for longer than the law allows.

But, I can tell you from my long experience that legitimate credit repair errors are much less frequent than you may think.

Aside from disputing credit reporting errors, there’s only one other way to get a late payment off your credit report early. You can ask your credit card company for a favor.

Your card issuer could make a goodwill adjustment and remove a late payment from your credit reports, but convincing a creditor to extend this courtesy is a long shot.

Pay the Minimum Due or Call Your Issuer For Help

Paying your credit card bill late could cost you extra money, put your account at risk, and potentially hurt your credit scores.

Even if you can’t afford to pay your full statement balance because of a financial emergency, it’s important to make at least the minimum payment on your credit card to keep your account open and in good standing. That way, you’ll keep your credit reports void of late payments.

If you know you aren’t able to submit an upcoming payment on time, reach out to your issuer and see if it can help with a temporary hardship accommodation.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.