Cards with balance transfer promotions can save you big bucks. You can use them to consolidate credit card balances and pay no (or reduced) interest for a set period. But a poor FICO score creates challenges when you apply for a balance transfer card, as most require a credit score of 600 or higher.

We’ve examined the credit card marketplace and found the best balance transfer cards for less-than-perfect credit. You may be able to use one of these cards to reduce your debt and boost your credit score efficiently.

-

Navigate This Article:

Best Balance Transfer Cards For 700+ Credit Score

Consumers with a FICO score of 700 have good credit. You should be eligible for the best credit cards, some providing balance transfer promotions.

- No Late Fees, No Penalty Rate, and No Annual Fee… Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% – 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% – 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Simplicity® Card offers an unbeatable 0% balance transfer promotion. Its promotional period is the longest currently available, and few credit cards can match it. Just know that credit cards can change their promotions without warning.

You must complete balance transfers within four months of the account opening for them to receive the 0% APR. This card also has low fees, free access to your FICO score, fraud protection, and a flexible due date to pay your monthly bill.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% – 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee – our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% – 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi® Diamond Preferred® Card is similar to the bank’s Simplicity Card. They both offer the same 0% balance transfer promotion, although their regular APRs may differ.

The City Diamond Preferred Card charges a low balance transfer fee for each transaction. It is slightly higher than the Simplicity Card’s balance transfer fee for eligible transactions (i.e., transfers made in the first four months). After four months, both cards have the same fee.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The 0% promotion from the Discover it® Balance Transfer card doesn’t last quite as long as those from the Citi cards, but it’s still a generous amount of time. And unlike its Citi competitors, this is a cash rewards credit card that pays cash back on all eligible purchases.

This Discover card also offers a one-year Cashback Match period to new cardmembers on the cash rewards that the card posts during the first 12 months after account opening. The 0% APR applies to all balance transfers during the promotion period, not just the transactions you post during the first four months. Once the promotional period ends, the regular APR will apply.

4. Chase Slate Edge℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Chase Slate Edge℠ card provides an excellent 0% balance transfer promotion that matches the one it offers for purchases. Slate Edge also offers programs to reduce your regular APR yearly and raise your credit limit after six months. It pays Chase Ultimate Rewards points on all eligible purchases.

If you also own a Sapphire Card, you can transfer your Chase Ultimate Rewards points from Slate Edge to Saphire and extend their value when you redeem them for travel. The card includes the My Chase Plan, which lets you break up card purchases into budget-friendly payments with no interest, just a fixed monthly fee.

- For a limited time, get a special 0% introductory APR on purchases and balance transfers for 21 billing cycles. After that, the APR is variable.

- Enjoy Cellphone Protection Coverage of up to $600 annually when you pay your monthly cellphone bill with your card

- View your credit score anytime, anywhere in the mobile app or online banking. It’s easy to enroll, easy to use, and free to U.S. Bank customers.

- Fraud Protection detects and notifies you of any unusual card activity to help prevent fraud

- Choose your payment due date

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 21 billing cycles

|

0% for 21 billing cycles

|

18.74% – 29.74% (Variable)

|

$0

|

Excellent Credit

|

Additional Disclosure: The information related to this card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this product.

The U.S. Bank Visa® Platinum Card offers 0% intro APR promotions for balance transfers and purchases. The balance transfer deal applies only to transactions you submit within 60 days of account opening.

The card’s low transaction fee for balance transfers doesn’t increase when the promotion ends. From time to time, the bank may offer you one of its fixed payment programs, including Extend Pay® Plans and Extend Pay® Loans, which allow you to pay off balances in fixed monthly payments over time.

Best Balance Transfers For 650+ Credit Score

A FICO score of 650 puts you in the upper tier of the fair credit range. The following balance transfer cards welcome applicants with fair credit.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The length of the 0% balance transfer promotion from the Citi Double Cash® Card is a little shorter than those of the Citi cards reviewed above. The balance transfer deal is still generous, but beware of the card’s four-month deadline for eligible transactions.

The card’s double cash deal sounds enticing, but it’s simply a higher flat rate on your purchases. You can redeem points for cash back as a statement credit, direct deposit, or mailed check. You can also redeem them for gift cards and travel or shop with points at Amazon.com and other merchants.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

Among the reviewed cards, the Citi Custom Cash® Card has the issuer’s shortest 0% APR promotion, which applies to balance transfers and purchases. As with the other Citi cards, this one limits its 0% APR to balance transfers you complete within four months of account opening.

While modest, the card’s signup bonus gives you double the usual introductory period to fulfill the spending requirement. The bank allows only one Citi Custom Cash Card account per customer. The bonus is unavailable if you received one for opening a new Citi Custom Cash Card account in the past 48 months.

- Earn up to 2% Cash Back Rewards when you redeem into an eligible TD Bank Deposit Account

- Bonus Cash Back: Earn $150 Cash Back in the form of a statement credit when you spend $1,000 within the first 90 days after account opening

- Earn unlimited cash back – no rotating categories, no caps or limits as long as your credit card account is open and in good standing

- 0% introductory APR balance transfers for the first 15 billing cycles after account opening, after which a variable APR will apply

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% for 15 months

|

20.24%, 25.24% or 30.24% (Variable)

|

$0

|

Good/Excellent

|

The TD Double Up℠ Credit Card is a product with a relatively short balance transfer promotion and a small signup bonus. But it offers a high cash back rate on all eligible purchases, a boon to consumers who want a straightforward cash rewards credit card.

The card’s balance transfer promotion does not impose an early deadline on eligible transactions. This Visa Signature card provides cellphone protection, purchase security, identity theft prevention, and extended warranties.

Best Balance Transfer For 600+ Credit Score

At 600, your FICO score is still in fair territory, which means you may be technically eligible for the cards in the previous section (i.e., 650+). But 600 is close to very poor credit, and if you have a troubled credit history, you may find it easier to apply for the following secured card.

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

You need only a $200 deposit to obtain the Discover it® Secured Credit Card because it doesn’t base eligibility on your credit score. The card offers a short, reduced-APR balance transfer promotion and tiered cash back rewards.

Unlike every other secured card, this one gives new cardmembers unlimited Cashback Match on all of the cash back posted by the end of the first year. You can instantly freeze your card if it’s lost or stolen, and the card provides enhanced protection against people-search websites.

What Are the Different FICO Scoring Ranges?

FICO originated consumer credit scoring and remains the standard in the market. FICO scores range from 300 to 850. Lenders use your credit score, among other factors, to assess your creditworthiness.

FICO Scores

Here are the FICO score ranges and what they signify:

- Very Poor (300-579): When your score is in this range, you will find it challenging to get an unsecured credit card, especially one with a balance transfer promotion. The Discover it® Secured Credit Card is an excellent choice since it offers reduced-rate balance transfers and doesn’t rely on credit scores for approval.

- Fair (580-669): While issuers may approve you for certain unsecured credit cards, you will face higher interest rates. The cards in the 650-plus group are appropriate choices for fair-credit consumers looking to consolidate credit through a balance transfer card.

- Good (670-739): This score range encompasses the average US consumer. Most lenders will approve your applications for loans and credit cards at this range, but perhaps not with the very best terms. Feel free to apply to any credit card offering a 0% APR on balance transfers.

- Very Good (740-799): A score in this range is above the US average. Creditors consider you a low-risk borrower and will typically offer you favorable terms for loans and credit cards.

- Excellent (800-850): This is the top score range and shows that you are an exceptional steward of your credit. When you want the best credit cards and loans, the world is your oyster. The only downside is how jealous your friends may be if they discover your score.

Individuals have up to three different scores — from Equifax, TransUnion, and Experian, the three major credit bureaus. Each bureau collects your credit information and calculates a new score each month.

FICO Score Factors

FICO scores rely on a range of credit data it groups into five major categories. The scoring model weights each category differently when calculating the total score.

Here are the five major FICO factors, along with their approximate weights in the scoring model:

- Payment history (35%): This category records your payments to credit accounts, including credit cards, installment loans, retail accounts, and mortgage loans. Overdue payments, bankruptcies, and other negative items will impact this part of your score. Conversely, timely payments can boost your score.

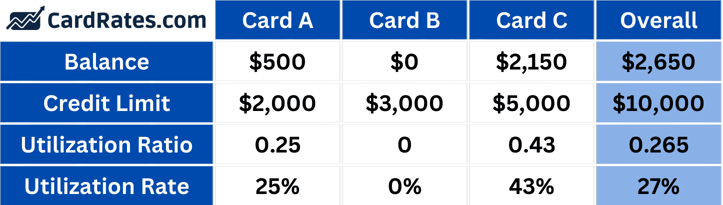

- Amounts Owed (30%): This factor considers the amount of money you owe to creditors and how that compares to your income (including your debt-to-income ratio, or DTI) and the total available credit you have, or your credit utilization ratio (CUR). A high utilization rate means you’re using a large percentage of your available credit, which can hurt your credit score by identifying you as a high-risk borrower. FICO views 1% as the target CUR you should try to achieve.

- Length of Credit History (15%): This factor considers how long your credit accounts have been active. Creditors believe an extended credit history of seven or more years is favorable because it is substantial evidence of your spending habits and payment behavior.

- Types of Credit in Use (10%): This category deals with your credit mix, including credit cards, retail accounts, installment loans, mortgage loans, etc. Having a broad mix of credit types is favorable because it indicates your experience managing different credit products.

- New Credit (10%): This includes the number of credit accounts you’ve opened recently and the number of recent hard inquiries on your credit report. Creditors may consider opening many new accounts in a short period to be desperate behavior, particularly for people who don’t have a long credit history. Only hard inquiries impact your credit, and they originate from creditors when you apply for a new credit card or loan. They remain on your credit report for two years but impact your score for only one year.

Understanding these factors can help you take steps to improve your credit score over time. You should focus most on the first two factors because they account for 65% of your FICO score. Credit scores are necessary, but other financial aspects may be considered, including income, employment history, and current debts.

Reporting mistakes can result in inaccurate scores, but you can challenge questionable items on your report by lodging disputes with the credit bureaus. Alternatively, you can hire a credit repair company to help remove inaccuracies from your reports.

FICO competes with other credit score providers, including VantageScore, that use unique scoring models and/or ranges. Always check the free credit scores that credit cards offer. If it isn’t your actual FICO score, it still may be a good indication of your credit standing.

What Is a Balance Transfer Credit Card?

Balance transfer credit cards allow you to transfer balances from one or more credit cards to a new card, often through an introductory 0% APR promotion. Your credit limit determines how much you can transfer. Balance transfers save money on interest and can help you pay off existing credit card debt faster.

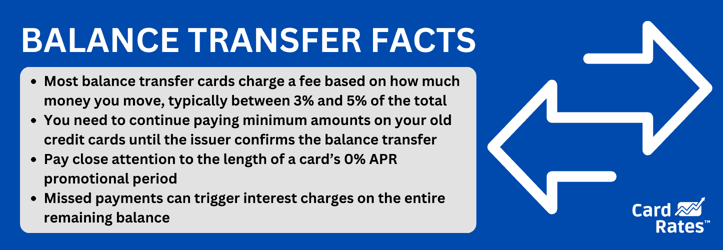

The typical balance transfer promotion runs six to 21 months from account opening. In most cases, you will not pay interest on the transferred balances during the promotion, although each transaction will trigger a fee — typically 3% to 5% of the amount you move. Some promotions offer reduced interest rates rather than a 0% APR.

Pay the minimum amounts due on your old credit cards until you receive confirmation that the transfer is complete. Don’t worry about overpaying — a credit card issuer will refund any overpayments at your request. Refunds may be a statement of credit, a check mailed to you, or a deposit to your bank account.

Many promotions impose a short deadline (i.e., two to four months) on balance transfers eligible for the special rate. For example, a card may offer a 0% APR for 21 months but only for transfers you complete during the first four months. The deadline usually isn’t a problem, as you have plenty of time to submit your transfer requests after opening the account.

After the promotion period ends, you’ll pay the card’s regular APR on any remaining balances. To avoid interest, pay off your balances in full before the promotion expires.

You must pay your credit card’s minimum amount due each month on time. The credit card can cancel an active balance transfer promotion if you miss a payment. It will then start charging you interest on the remaining balance.

How to Get a Balance Transfer Card

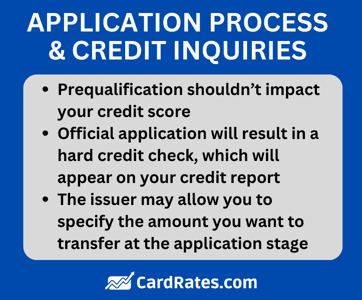

Applying for a balance transfer card is not very different from the process you’d follow to get a regular credit card. Many issuers will prequalify you for a credit card if you submit contact information and data about your income, employment, and housing costs.

Prequalifying doesn’t require a hard credit check and won’t impact your credit score. Although prequalification doesn’t guarantee final acceptance, it reveals whether the issuer is likely to approve your formal application.

If you prequalify for a credit card, you may need to enter additional information and permit a hard credit check. If you skip the prequalification step, you can apply for a card by entering your personal information. In either case, expect a quick decision.

Some issuers may allow you to specify an initial set of transfers when you apply for a balance transfer card. Otherwise, you can request transfers after approval.

Expect your new credit card to arrive three to 10 days after you sign the cardmember agreement. If the issuer rejects your application, it will send you a written Adverse Action Notice explaining the reasons behind the denial.

How To Arrange Balance Transfers

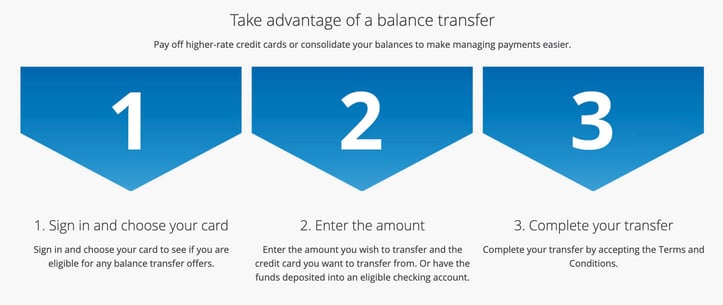

You typically arrange balance transfers online, although some issuers may allow you to do so over the phone or via a mobile app. As mentioned, some issuers let you request balance transfers during the application process.

Regardless of your application method, you’ll need the credit card account numbers and transfer amounts that you want to move. You also need the account number of the card that will receive the transferred balances.

The exact transfer procedure varies by issuer. For example, Chase online banking customers can click the “Transfer Balance” option next to the “Available Credit” heading on their card summary page.

Discover cardholders can find a balance transfer dialog in the “Credit Options” menu. The Discover it® Balance Transfer card lets you specify up to three balance transfer requests when you apply for the card.

The total you can transfer depends on your credit limit and the currently available amount. For example, if you have a $10,000 credit limit and a $4,000 balance from purchases, you can transfer up to $6,000 from other credit cards.

Provide the required information for each transfer and submit your request online. The card issuer will manage the rest behind the scenes. Sometimes, your other credit card issuers may contact you to confirm your request for a balance transfer (and maybe try to talk you out of it). It can take up to a few weeks to complete each balance transfer.

How Do Balance Transfers Affect My FICO Score?

Balance transfers may impact your FICO score, and the effect may be positive, negative, or neutral.

The most crucial factor is how your balance transfers affect your credit utilization ratio. Your overall CUR will be basically unchanged immediately after the transfers but should steadily decline as you pay down your consolidated debt.

You must avoid re-establishing balances on your old credit cards to improve your CUR. Your CUR can sharply rise if you start building up new balances.

You may decide to close a credit account after you’ve transferred away its balance. We advise you first to read our article “Is it Bad to Cancel a Credit Card?” to identify the advantages and disadvantages of closing a credit account. It’s often beneficial to keep old credit cards open and use them periodically. Doing so will help you maintain a low CUR and a longer average account age.

Obtaining a balance transfer card may slightly impact your credit score due to the hard credit check. This effect is minimal and shouldn’t figure into your overall transfer strategy.

What Is the Minimum Credit Score to Qualify For a Balance Transfer Credit Card?

You typically need a fair credit score (580 to 669) to get a balance transfer credit card, although you may qualify for a secured card despite a bad credit score. To be safe, you want to have a FICO score of at least 600 for an unsecured balance transfer card.

Secured card issuers typically don’t rely on credit scores when evaluating applicants. The Discover it® Secured Credit Card exemplifies this practice. A secured credit card is your best bet if you can’t qualify for an unsecured balance transfer card.

How Do I Go From a 600 to a 700 Credit Score Fast?

It usually takes months or years to improve your credit score significantly. But here are three suggestions for a quicker result.

- Pay off your credit card debts. Doing so will dramatically decrease your credit utilization ratio and increase your credit score. You should start seeing results in a month or two.

- Dispute derogatory items on your credit reports. This strategy only works if you have derogatory items that are inaccurate, obsolete, or unverifiable. The fastest method is to hire a credit repair service and subscribe to its most aggressive package. It may cost you up to $150 per month, but you can cancel once your credit reports are cleaner.

- Sign up for Experian Boost or similar programs. These can expand the universe of items that creditors report to the major credit bureaus. You typically connect your bank account to the program and select the bills you want to include (such as utilities and rent). You could see an instant, albeit modest, increase in your credit score.

Over the long run, paying your credit card bills on time and keeping debt levels low are the best ways to improve your credit score.

What Are the Pros and Cons of Balance Transfers?

Consider these pros and cons before you start transferring your balances.

Pros

Here are some compelling reasons to transfer balances:

Save money: 0% balance transfer promotions can save you hundreds or thousands in interest. The average credit card interest rate is 15.13% as of the Q2 2023, according to the Federal Reserve. If you have below-average credit, you face APRs as high as 36%. You can save money with a balance transfer card if you obtain a 0% introductory APR and pay down your debt within the promotional period.

Lower your debt: A 0% intro APR on a balance transfer card can accelerate your debt repayment. All of your money goes to pay down your principal balance and none to interest, even if you make the same monthly payments. But be sure to repay the entire balance before the promotion ends.

Consolidate debt: A balance transfer card lets you consolidate several credit card balances into a single new account. Doing so reduces the monthly payments you must remember, making your budget more manageable. A single monthly credit card payment is easier to remember than several payments throughout the month.

Build credit: A new balance transfer card may help you build credit, but only if you don’t close your old credit card accounts. Getting a new credit card will increase your total credit limit and, in turn, reduce your credit utilization ratio. This strategy is effective only if you don’t go on a shopping spree and increase your other credit balances. Reducing your debt-to-income (DTI) ratio can also help you build credit.

These pros only work if you practice self-discipline after you transfer balances. To get the most value from a 0% balance transfer card, repay your debt aggressively and don’t create new debt.

Cons

Before proceeding, you may want to consider these potential disadvantages of balance transfer cards.

Balance transfer fees: These are usually 3% or 5% of your transfer amount. For example, a 5% fee on a $8,000 transfer will cost you $400. The fee usually isn’t a big deal because your potential savings are so considerable. Use a balance transfer calculator to ensure the numbers work to your advantage.

Credit requirements: The balance transfer cards with the longest promotional periods require you to have a good credit rating. An issuer may reject your application if you have fair or bad credit.

Overdue payments: Cardholder agreements explain the penalties for delinquent payments. Many cards will terminate your balance transfer promotion if you miss a payment, and you will abruptly start paying interest on your remaining balance. Consider setting up automatic payments to avoid this scenario.

Resumption of regular APRs: Any balance remaining after the balance transfer promotion ends will accrue interest at the card’s regular APR. You may spend more than you save if you fail to eliminate your debt before the promotion expires.

The temptation to overspend: Paying on time and paying your entire monthly balance is the most cost-effective way to manage a credit card. It’s counterproductive to get a new balance transfer card, move all your balances to it, and then build new debts on your initial accounts. This behavior can consume your savings and damage your credit score.

Prudence dictates that you only apply for a new balance transfer credit card if you can stick with the program.

How Do Balance Transfers Compare to Consolidation Loans?

An alternative to balance transfers is a personal loan to consolidate your debt. Personal loans allow you to borrow a lump sum and repay your outstanding credit card debts without the need for a new card.

You can arrange for the lender to pay your balances directly to your credit cards, leaving you responsible for a single monthly payment at a fixed interest rate. You may save a significant amount because personal loans typically charge lower interest rates than credit cards.

Credit card consolidation through a personal loan can help you manage your budget because one monthly payment is easier to remember than multiple due dates. A consolidation loan also means you won’t have to apply for or manage a new credit card.

After consolidating your debt, consider putting all your credit cards in a drawer until you repay the loan. During the interim, use your debit card for shopping and paying bills.

Get the Best Balance Transfer Card For Your FICO Score

A low FICO score may limit your eligibility for a balance transfer card. But as this article shows, you can find an excellent card even if your credit is only fair — or worse.

Choose a balance transfer card based on its credit score requirements, promotional period, annual fee, the credit limit you’ll receive, and post-promotion APRs. Balance transfer credit cards can help you improve your credit, but you must practice discipline to obtain the best results.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Best Loans & Credit Cards: 650-700 Score ([updated_month_year]) 8 Best Loans & Credit Cards: 650-700 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/08/700.png?width=158&height=120&fit=crop)

![8 Best Loans & Credit Cards: 700-750 Score ([updated_month_year]) 8 Best Loans & Credit Cards: 700-750 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/09/7501.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards For a 700 Credit Score ([updated_month_year]) 5 Best Credit Cards For a 700 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/12/Credit-Cards-For-700-Credit-Score.jpg?width=158&height=120&fit=crop)

![9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year]) 9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/550-to-600-Credit-Scores.jpg?width=158&height=120&fit=crop)

![7 Best Loans & Credit Cards: 600-650 Score ([updated_month_year]) 7 Best Loans & Credit Cards: 600-650 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/650.png?width=158&height=120&fit=crop)

![7 Best Credit Cards By FICO Score ([updated_month_year]) 7 Best Credit Cards By FICO Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/fico.png?width=158&height=120&fit=crop)

![9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year]) 9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/btandrewards.png?width=158&height=120&fit=crop)