Shopping for a credit card isn’t quite as exciting as going shopping with a credit card — but you can’t do one without the other. And both require a bit of research and rational thinking if you want to avoid making a bad financial decision that could haunt you for years.

Thankfully, many major credit card issuers offer pre-qualifying applications that make it easier to narrow your choices and limit the hard inquiries placed on your credit report. And what’s even better, pre-applying for a credit card using one of these applications won’t hurt your credit rating.

Let’s take a look at a wide range of credit card pre-approval links from some of the most well-known issuers in the US Our list also includes credit cards with consumers in mind who have less-than-stellar credit.

-

Navigate This Article:

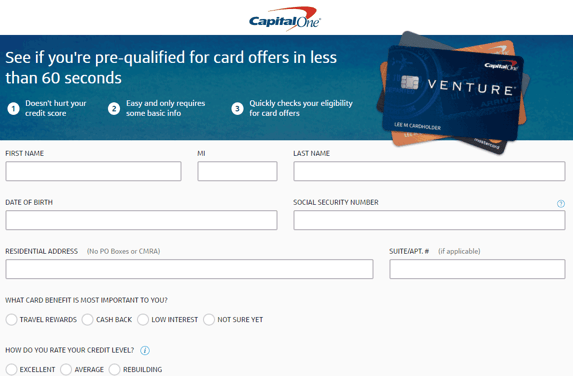

Credit Card Pre-Approval for Capital One

Capital One is among the most prolific credit card issuers in America, with more than 100 million cards in circulation. But just because everyone seems to have a Capital One card doesn’t mean the credit card company approves every applicant.

Instead of blindly applying for any Capital One card, you’re better served if you pre-qualify for one of the issuer’s offerings. The brief application requires basic information to identify the applicant — name, address, date of birth, and Social Security number.

You can also choose which type of card most interests you — be it a travel rewards, cash back, or low-interest rate card. You don’t have to answer this question if you have no preference. Just remember that Capital One limits consumers to only two cards from the issuer, so if you already have a pair of the company’s cards, you’ll likely receive a rejection for any application you submit.

Capital One will let you know if you pre-qualify for any of its cards a few moments after submitting your application. You’ll see which card(s) match your credit profile and the benefits related to each offering.

By doing this, you’ll limit your applications — and research — to only the cards you’re likely to be approved for. You may receive approval for one of our top-rated Capital One credit cards — which offer competitive interest rates and rich rewards. Check them out below.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

Credit Card Pre-Approval for Discover

Discover is one of the fastest-growing credit card issuers in America, thanks to its top-notch customer service ratings. Offering rich rewards is nothing new to Discover, as it was the first true rewards credit card when Sears launched the brand in 1986.

The issuer’s pre-qualifying application is a little longer than the average form. Discover asks about your current income, living situation, and bank account status, but the information helps the company decide which cards to match you with.

If the bank does approve you for one of its credit cards, you could end up reaping some huge rewards — like the ones offered by our top-rated cards below.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Credit Card Pre-Approval for Chase

Many consumers choose Chase cards because of the ultra-attractive Chase Ultimate Rewards program, which gives cardholders a wide array of rewards options that range from travel to cash back and merchandise.

Chase has notoriously high standards for approval, which makes pre-qualifying a smart decision. But Chase requires you to sign in to your Chase account to “Browse offers selected for you based on your relationship with Chase.” If you don’t already have a relationship with the bank, you can create an account and see which card offers it suggests, if any.

Not only will you need good-to-excellent credit for Chase to consider your application, (unless you’re a student, in which case you may qualify for the Chase Freedom® Student credit card without a credit history) but you’ll also have to pass the issuer’s 5/24 rule.

This rule states that if you have opened five or more new bank card accounts (credit or charge cards) within the last 24 months, you’ll most likely be rejected when applying for a new Chase credit card — even if you otherwise qualify.

Here are the issuer’s three most popular rewards cards, along with links to each card’s easy online application:

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Credit Card Pre-Approval for Citi

While most credit card issuers arm wrestle with each other to see who offers the richest rewards, Citi has quietly built a reputation for offering cards that help consumers eliminate debt fast while reducing interest fees and other charges.

This is most evident in the Citi Simplicity® Card, which offers an unheard-of introductory 0% interest period on balance transfers, though a balance transfer fee will apply. If you have an existing credit card balance that’s only growing because of interest charges, Citibank may have the solution to help you knock the debt out faster and more cheaply.

And Citi also has one of the easiest pre-qualifying applications to complete. Simply provide your name, address, and the last four digits of your Social Security number, and the bank will show you all of its cards that you may qualify for.

Those cards could include the popular offering above, or maybe another of our top-rated choices listed below.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024. - Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou® Points are redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% (Variable)

|

$95

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

Credit Card Pre-Approval for American Express

American Express is known for being an ultra-selective credit card issuer. You must have at least good credit to qualify for any of its cards — there are no student offers or cards for bad credit available. But you can check to see if you pre-qualify for any of its cards on its website in as little as 30 seconds.

American Express is also known for issuing charge cards, which are credit cards with no preset spending limit. These cards must be repaid in full each month unless you select purchases to repay over time — with interest — in the app or on the issuer’s website.

Amex has lucrative signup bonuses and rewards card offers, not to mention a great lineup of business credit card options. Below are our expert’s top-rated Amex cards, all available to consumers with good to excellent credit:

Credit Card Pre-Approval for Bad Credit

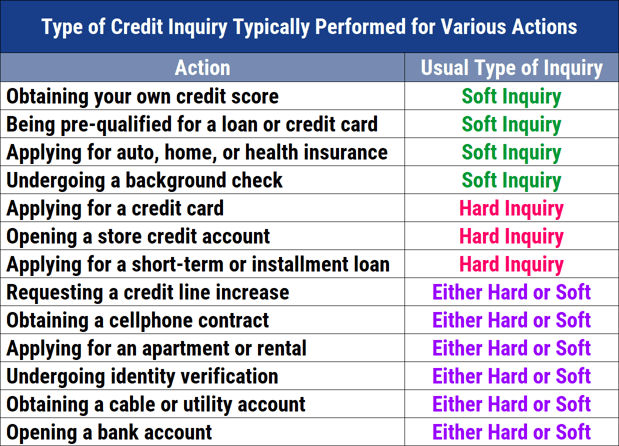

If you have bad or no credit, pre-qualifying for a credit card may be the most important part of your research process. That’s because every official credit card application you submit places a hard inquiry on your credit report. These inquiries signal to lenders that you’re looking for a loan or line of credit.

That may seem harmless enough, but if you accrue several of these marks on your credit file, lenders may see you as a higher credit risk. Each inquiry can bring your credit score down — and a lower credit score makes it even harder to qualify for a credit card.

Most credit scoring models allow two or three hard inquiries on your credit report over a two-year period. But more than that will negatively affect your score.

On the other hand, a prequalifying application only uses a soft inquiry, which doesn’t affect your credit score and will give you a better idea of the cards you may qualify for.

Several credit card issuers work with consumers who want to improve or establish their credit scores. Thankfully, many also offer pre-qualifying applications to make the approval process faster and less painful.

Check out our top options below for more cards that make it easier to rebuild — or establish — your credit profile.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 - $125

|

See website for Details*

|

This card is currently not available.

3. Mission Lane Visa® Credit Card

+ See More Credit Cards for Bad Credit

Which Credit Cards Offer Pre-Approval?

When shopping for a credit card, you’re best served by looking at issuers that offer pre-approval applications instead of specific cards that do the same. That’s because an issuer’s application may link you with several cards that you qualify for.

And like most things in life, there’s strength in numbers.

Take, for example, Capital One. By filling out the bank’s pre-approval application, you could receive several offers and then decide which one best matches your needs. If you go into your research with your heart set on one specific card, you increase the chance of being disappointed if you don’t qualify for that card.

Your best first step is to decide what matters most to you in a credit card. From there, you can decide which issuer offers the best options to fit your desires and attempt to pre-qualify with that bank.

If you’re looking for rewards, you may decide to pre-apply with Chase or Discover. If you need a good balance transfer card, or a card with a longer 0% introductory period, then you may want to consider Citi. Whichever you choose, keep your options open.

What’s the Difference Between Pre-Approved and Pre-Qualified?

Both terms sound very different but have very similar meanings.

Once upon a time, pre-approved meant the credit card issuer reviewed a soft pull of your credit report and would offer you a credit card if you decided to apply. That’s no longer the case.

Credit card issuers purchase large batches of consumer data from credit reporting bureaus. They use their filters to decide which consumers might meet their minimum standards for approval. They may give specific criteria to the bureau and receive several thousand credit files that meet those criteria. That’s how they choose who receives those pre-approval letters in the mail.

But they don’t actually guarantee approval — pre-approval is more of an invitation to apply for a credit card. It’s the issuer’s way of saying “You look like you might be a good match for our card. Feel free to apply, and we’ll see if we’re right.”

An issuer can’t guarantee approval, though, until they get to examine your full credit file. And that can’t happen until you apply.

So, even though you may think you’re pre-approved, the issuer could see something when it pulls your credit report that wasn’t visible before. And that could lead to a rejection or less attractive terms than what your pre-approval letter offered.

Still, many experts say that getting a pre-approval offer means you have around a 90% chance of receiving the card if you apply.

A pre-qualifying offer is very similar, but just as uncertain when it comes to approval. Credit card issuers send out millions of such letters each year, but only a percentage of the consumers who receive them will actually qualify for the card that’s offered.

That’s because the credit profile data used to determine pre-qualifications is far broader than the information used for pre-approvals. An issuer may purchase a batch of credit profiles, for example, with credit scores between 650 and 800, and send offers to everyone on the list.

Or, the issuer may apply a filter for consumers who haven’t had a late payment in the last three months. All of this information is useful, but not definitive.

Does Credit Card Pre-Approval Affect Credit Scores?

No, credit card pre-approval does not affect your credit scores. Credit card pre-approval is done through a soft pull of your credit report, which does not appear on your credit history.

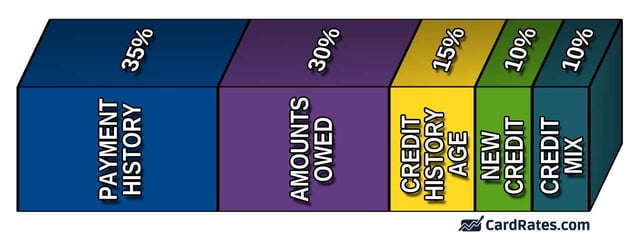

If you decide to apply for the card after receiving pre-approval, you will obtain a hard inquiry, which will appear on your credit history and may affect your credit score for up to one year, but only by a few points. The fear of obtaining a hard inquiry isn’t reason enough to avoid applying.

That’s because the new credit limit you receive upon approval may improve your credit, so you may not feel any negative effects from the inquiry. An increase in the amount of credit available to you can help lower your credit utilization if you have other credit card debt, or it may broaden your credit mix if this is your first credit card.

The possible effects of obtaining a credit card are unique to each consumer’s financial situation, we can’t definitively say this or that will happen — it’s all based on your unique credit history.

Can You Be Denied a Pre-Approved Credit Card?

As stated above, pre-approval is far from a guarantee. Any offer you receive comes from the version of your credit file the lender viewed — which often happens a month or two before you receive the offer.

A lot can happen in two months. If you’ve experienced any major changes to your credit score during that time, it could greatly impact your chances of final approval.

Even if your credit report doesn’t change in that time frame, you could still find yourself with a rejection, despite the pre-approval. That’s because the issuer doesn’t always examine every part of the soft credit pull before sending you an invitation to apply.

For example, the issuer may look for consumers who haven’t missed a payment in six months. That could trigger tens of thousands of letters sent to consumers across the country. But when one applies, and the issuer sees that he or she has three maxed-out credit cards, it likely won’t end in an offer.

That’s why pre-qualifying applications are helpful — when used with caution. On one hand, it could help you avoid rejection when it comes time to officially apply for a card. On the other, it could give you a false sense of confidence that you’ll receive a specific card that you may not otherwise qualify for.

The best way to truly gain confidence in your credit report is to view it yourself. The government allows every consumer one free credit report each year from each credit reporting bureau. While these reports won’t show you your actual credit score, they will show you all of the vital information that credit card issuers see when reviewing your application.

Make certain that your reports are up-to-date and only display accurate information before applying for a new credit card. Think of your application as a blind date. The credit card issuer doesn’t know who you are or what you look like — but you can spruce yourself up a bit and look better by knowing where your credit report stands and doing what you can to improve it before presenting yourself to the bank.

Reduce Your Chances of Rejection By Receiving Pre-Approval

Credit cards are like cookies. Cookies are yummy and easy to eat, but hard to put down. Credit card applications have a similar effect. If you’ve been rejected, you may feel tempted to apply for another card.

But, like cookies, the more applications you submit, the less satisfying the results. You can avoid collecting hard inquiries on your credit report by filling out a pre-qualifying application to the issuer of your choice. Not only will it give you a clearer picture of your finances, but it’ll keep those pesky inquiries at bay.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Discover Card Pre-Approval: 4 Best Offers to Prequalify ([updated_month_year]) Discover Card Pre-Approval: 4 Best Offers to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/09/discover-pre-approved.jpg?width=158&height=120&fit=crop)

![3 Steps to Credit One Pre-Approval ([updated_month_year]) 3 Steps to Credit One Pre-Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/CreditOneApp.png?width=158&height=120&fit=crop)

![18 Best Pre-Approval Credit Cards: 100% Online ([updated_month_year]) 18 Best Pre-Approval Credit Cards: 100% Online ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/preapprove-23.png?width=158&height=120&fit=crop)

![Capital One Pre-Approval: 5 Secrets to Prequalify ([updated_month_year]) Capital One Pre-Approval: 5 Secrets to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/capital-one-pre-qualify-1.png?width=158&height=120&fit=crop)

![Chase Pre-Approval: 6 Best Offers to Prequalify ([updated_month_year]) Chase Pre-Approval: 6 Best Offers to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/chase.png?width=158&height=120&fit=crop)

![7 Best Pre-Approval Auto Loans ([updated_month_year]) 7 Best Pre-Approval Auto Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Pre-Approval-Auto-Loans.jpg?width=158&height=120&fit=crop)

![5 Pre-Qualified Credit Cards For Bad Credit ([updated_month_year]) 5 Pre-Qualified Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Pre-Qualified-Credit-Cards-for-Bad-Credit.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5854' field_choice='title'] Credit Limit & Pre-Qualifying ([updated_month_year]) [card_field card_choice='5854' field_choice='title'] Credit Limit & Pre-Qualifying ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/shutterstock_662150614.jpg?width=158&height=120&fit=crop)