Card payments can take a big bite out of your monthly paycheck. If you’re struggling to make those monthly payments, you may feel like you’re fighting a never-ending battle.

But what if there were a way — or several ways — to refinance, restructure or even eliminate your card debt and make your monthly payment smaller or even zero?

Fortunately, there are such ways and you may be able to take advantage of them. Here are nine with some important pros and cons for each.

1. Perform a Balance Transfer

You may already know that you can’t pay one credit card with another credit card because card companies don’t allow this type of transaction. But there is another way to use a card indirectly to pay another card. It’s called a balance transfer.

A balance transfer is an opportunity to refinance your card debt with another card as if you were using your new card to pay your old one. You’ll need to follow certain stipulations, but once the transfer is done, you’ll usually have a significantly lower minimum payment for at least part of your balance.

Some balance transfers involve a fee, but there are many good balance transfer cards with no balance transfer fee. Below are our top-rated balance transfer offers:

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

Balance transfers typically aren’t unlimited. How much debt you can transfer will be restricted by your new card’s credit limit.

If you want to refinance more debt than the limit allows, you’ll need a second and maybe a third balance transfer card to do so. Or, you can try calling the new card company and requesting a larger limit so you can transfer your total debt balance.

A balance transfer can help you get control of your debt, consolidate multiple card payments into one, and usually get a lower rate. Many balance transfer cards offer a 0% promotional balance transfer rate for an introductory period.

Before you transfer a balance, make sure you understand when your promotional rate will end and what your maximum rate will be after that.

You shouldn’t use balance transfer cards to increase your card debt. After you transfer your balance, make a budget and think about whether you should put away, cut up, or consider canceling any existing cards you no longer want to use.

2. Consolidate with a Home Equity Loan

If you’re a homeowner with untapped equity, you may be able to refinance your card debt by turning it into home equity debt. Equity is the value of your home minus the amount you owe on your existing mortgage.

One way to convert credit card debt to home equity debt is to refinance your mortgage and use the cash to pay down or pay off your card balances. Another way is to take out a home equity loan and use the proceeds to pay down or pay off your card debt.

You’ll end up with one, typically lower, payment for your home loan instead of multiple card payments each month. If you own a vacation or rental home that has equity, you may be able to use that property’s equity to refinance your card debt at a lower rate and with one monthly payment.

LendingTree is one such provider of home equity loans to help consumers consolidate card debt:

- Find lenders for new home purchases, refinancing, home equity loans, and reverse mortgages

- Lenders compete for your business

- Offers in minutes

- Receive up to 5 loan offers and select the right one for you

- Founded in 1996

- Over $250 billion in closed loan transactions

Whichever option you choose, you’ll need good credit, and you’ll have to pay some closing costs. To minimize your upfront out-of-pocket expense, choose a no-closing costs loan with a slightly higher interest rate.

Home loans typically have relatively lower rates because they’re secured with your home as collateral. If you don’t make your payment, your lender could foreclose and you could lose your home. Credit cards may be unsecured or secured with a deposit account.

3. Take Out a Personal Consolidation Loan

A personal loan for debt consolidation may be another good option to consider when you want to refinance your card debt. Personal loans are typically used for debt consolidation, financial emergencies, and big expenditures like a lavish wedding, once-in-a-lifetime vacation, or college costs other than tuition.

There are two types of personal loans:

- Secured personal loans require an asset, such as a car, boat, or deposit account as collateral. If you don’t make your payment, your lender could seize your collateral.

- Unsecured personal loans don’t require collateral. That’s why your rate will typically be higher with this type of loan.

Either type of personal loan can be used to refinance card debt. This strategy is so popular that personal loans are sometimes called credit card loans.

CashUSA.com and PersonalLoans.com are two lending networks we recommend that can help connect borrowers with personal loans to help pay down credit card debt.

- Loans from $500 to $10,000

- All credit types accepted

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- Loan amounts range from $1,000 to $35,000

- All credit types welcome to apply

- Lending partners in all 50 states

- Loans can be used for any purpose

- Fast online approval

- Funding in as few as 24 hours

Personal loans may involve fees as well as interest. Before you apply, you should research the costs and think carefully about whether this type of loan will improve your overall financial situation.

If you consolidate multiple credit cards into one personal loan, you’ll have one monthly payment and your rate may be lower, depending on the loan you choose and your cards’ current APRs. Your interest savings could be significant.

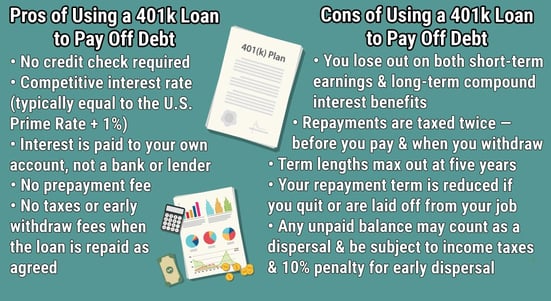

4. Leverage Your Retirement Account

Saving for retirement is an important financial goal for most people. In addition to providing a nest egg for your senior years, your retirement savings can also create opportunities for you to achieve other important financial goals while you’re still working.

One of those goals may be to refinance your card debt with one payment and a lower rate.

Whether your retirement savings are in an Individual Retirement Account (IRA), employer-sponsored 401(k), or self-employed retirement plan, you may be able to borrow against those funds to refinance your card debt with a significantly lower rate.

This strategy offers several benefits:

- You’ll pay interest into your own retirement account instead of to a lender.

- There’s no credit check.

- There’s no effect on your credit score.

On the other hand, this strategy also comes with some big disadvantages:

- You won’t earn any investment return for the funds you’ve tied up in your loan to refinance your card debt.

- You may not be able to make additional contributions to your retirement plan while you have your loan.

- If you leave your job for any reason and haven’t repaid or refinanced your loan, the sum you borrowed could be considered a taxable distribution. You may owe income tax, and you could be hit with an early withdrawal penalty.

There’s much to consider when determining if a withdrawal from your retirement plan is worth it.

5. Find a Debt Management Plan

A debt management plan doesn’t technically involve refinancing your card debt into a new loan. Instead, this strategy is what the name implies — a plan to manage and pay off your debt. It can be a good option to consider.

The NFCC is a network of nonprofit agencies that help folks better manage debt through tailored solutions.

To get started, you’ll need to contact an accredited, nonprofit credit counseling agency. Tell your credit counselor you want to set up a plan to make one payment each month toward your card debt. You’ll make that payment to the agency, which will use it to pay your card companies for you.

You’ll usually have to pay the full amounts you owe, but you may get lower rates and pay fewer fees with a debt management plan. Your card accounts usually will be closed, which could hurt your credit scores, but it will limit your ability to accrue more debt.

Many people who begin a debt management plan never finish it. If you’re willing to make the commitment and pay some modest fees to the credit counseling agency, it may work for you.

You can also try to set up a debt management plan yourself without the help of a credit counseling agency. Contact your card companies and ask about debt relief options. Explain why you’re struggling financially and what sort of accommodation you feel will enable you to pay off your credit card debt.

6. Settle Your Debts

Debt settlement could help you resolve your card debt, but it’s not easy. There are many pitfalls, and you could end up in a worse position financially than your current situation.

To use this approach, you’ll need to contact a debt settlement company. Typically, you’ll be instructed to stop paying your card companies. You’ll instead make one monthly payment to the debt settlement company, which will hold onto that money until it can negotiate a lower payoff amount with your credit card companies.

The debt settlement company then sends the money to your card companies, but, until then, you’ll have to deal with collection calls and letters from your card companies. You’ll continue to be charged interest, oftentimes at higher penalty rates, and you may be charged late payment and other penalty fees as well.

Your missed payments will hurt your credit scores and it will take time to rebuild your credit. Your card companies or their debt collection agencies may sue you to collect what you owe them.

You may have to wait many months before your card companies agree to negotiate with your debt settlement firm. Or they may decide not to negotiate at all. In that case, your credit will be damaged, and you’ll still owe the full amount of the debt.

Debt settlement can be expensive and risky. You could pay a lot of fees and end up with more debt rather than less.

7. Get a Cash-Out Auto Refinance Loan

Mention “cash-out refi” and most people think of home mortgages. But car loans can also be refinanced to get cash, which you can put toward your card debt. Since a car loan is secured by your vehicle, you may get a lower rate than that of your credit card.

To get a cash-out auto refinance loan, you must have equity in the vehicle, i.e. the car’s value is worth more than any outstanding loan balance. Some lenders will let you borrow 100% or more of your equity.

Cash-out auto refinance loans are available from banks, credit unions, and online providers, such as Auto Credit Express:

- Dealer partner network has closed over $1 billion in auto loans

- Can help those with bad credit, no credit, bankruptcy, and repossession

- Established in 1999

- Easy, 30-second pre-qualification form

- Bad-credit applicants must have $1500/month income to qualify

Auto loans can be risky because your lender can repossess your car if you don’t make your payments on time. That could make your financial situation worse if you need your ride to get to your job.

Another risk is that you could end up owing more than your car’s resale value, otherwise known as being upside down on a loan. If your car gets stolen or is wrecked and your insurance company pays out less than your loan balance, you’ll still have a car payment, but you won’t have a car.

8. Borrow Against Your Life Insurance

Life insurance offers important financial benefits for many families. It can also create an opportunity to refinance your card debt with a lower-rate loan.

There are two main types of life insurance:

- Term life

- Whole life, also called universal or “permanent” life

A term life policy expires after a set number of years and doesn’t have a cash value, so you won’t be able to borrow against it. Whole life doesn’t expire and has cash value you may be able to use to get a loan.

When you borrow against your whole life policy, your policy and its death benefit collateralize your loan. You won’t have to make monthly payments, but you will be charged interest, which will be added to your loan balance.

If you accumulate more unpaid interest than your policy’s cash value, your policy could lapse. If that happens, you may owe income tax and your policy’s death benefit could be reduced or zeroed out. For this reason, you should plan to repay this type of loan.

A life insurance loan doesn’t require a loan application or credit check, and it won’t affect your credit scores. How much you’ll be able to borrow will depend on your policy’s cash value.

9. Ask a Family Member for Help

Loans between family members can be stressful. If you receive a family loan and don’t repay it, you could damage your relationship with your “lender” and other family members. That’s not a risk to dismiss lightly.

That said, if you do have a family member who could help you refinance your card debt, a family loan could have some very significant benefits, such as:

- You’ll get immediate relief from your card debt.

- You won’t have to complete a loan application.

- You won’t face a credit check.

- You’ll probably get a favorable rate or even 0%.

- A late or missed payment won’t hurt your credit scores.

- Your family member won’t have to cosign for you to get a credit card or personal loan, which could affect the cosigner’s credit as well as yours.

When you ask for a family loan, be prepared to explain how much you need, how much you can afford to repay each month, and how the loan will help you improve your financial situation. You may want to share how you plan to reduce your spending, create an emergency fund if you don’t have one, and stick to a budget.

A family loan or gift may have income tax implications for your family member.

Is Consolidating Credit Cards Bad for Your Credit?

Whether consolidating your credit cards will help or hurt your credit depends on your personal situation. Lenders typically rely on your credit scores to determine how good your credit is.

Your scores are based on information in your credit reports. That information comes from your creditors, which include card companies, auto lenders, mortgage companies, student loan providers, and so on.

Credit scores are complicated, but, generally, when you pay your bills on time, your scores should improve, and when you pay your bills late or not at all, your scores will decline.

Credit scores are complicated, but, generally, when you pay your bills on time, your scores should improve, and when you pay your bills late or not at all, your scores will decline.

Consolidating your credit cards into a new loan could have either effect. If you’ve made late payments but can pay your consolidation loan on time every month, your credit may improve.

If you’ve generally made your payments on time, but you refinance into a bigger loan with a payment you can’t afford, your credit could start to suffer. Poor credit habits like applying for too many cards, maxing out your cards, or canceling multiple card accounts could also have a negative effect on your credit scores.

Only you know whether consolidating your card debt will help you pay on time, and, therefore, improve your credit.

When Should You Consolidate Credit Card Debt?

The easy answer is that you should consolidate your card debt when you’ve researched your options, chosen a strategy that feels right for you, made a plan to reduce your debt, and the timing feels right.

How will you know when the timing is right? Ask yourself, “If I consolidate my credit card debt now, will I be able to…

… get a lower combined rate?”

… make my payments on time?”

… better manage my debt?”

… pay off my debt within five years?”

… feel more optimistic about paying off my debt?”

… control my spending and not incur more debt?”

… afford any fees or costs of my credit card consolidation loan?”

… choose an option that feels right for my situation?”

… qualify for the consolidation loan that I want?”

If your credit score isn’t in great shape, you may want to wait and build up a better track record of on-time payments before you apply for a balance transfer card or credit card consolidation loan. Better credit usually means you’ll get more options, lower rates, and better card perks.

Can I Use My Credit Card After Debt Consolidation?

Whether you’ll be able to use your cards after you consolidate your credit card debt depends on the debt consolidation strategy you choose.

If you set up a debt management plan or work with a debt settlement company, your card accounts may be closed. If that happens, then no, you won’t be able to use your cards.

If you choose a strategy that allows you to keep your card accounts open, you should ask yourself a more important question: not can I use my cards, but should I use them?

If you’re able to control your spending, stick to a budget, and pay off your cards every month, and make the payments for your debt consolidation loan, then yes, you can continue to use your cards.

If you’re concerned — and you should be — that you may spend more than you can afford to with your cards, then you shouldn’t continue to use them after you consolidate your card debt.

Instead, you may want to:

- Lock your cards in a drawer, safe, or bank safety deposit box.

- Give your cards to a family member to keep for you.

- Cut up your cards.

- Ask your card companies to close your accounts.

Canceling your cards can hurt your credit score, but may still make sense if you’re tempted to use your cards to spend more than you should.

Remember, the purpose of debt consolidation is not to free up your cards so you can spend more, but to reduce the amount of debt you have, pay less interest, and decrease the number of payments you have to make every month.

Should I Consider Bankruptcy Instead of Debt Consolidation?

If refinancing or restructuring your card debt will enable you to manage it successfully, those options may be better for you than bankruptcy. If your situation feels hopeless and you can’t figure out another way to resolve it, bankruptcy could offer you some relief and a chance to improve your credit after your bankruptcy is completed.

Bankruptcy doesn’t involve refinancing or restructuring your card debt. Instead, this legal process could wipe out most or all of your card debt. Bankruptcy can also eliminate some other types of debt, such as certain personal loans or medical bills.

Bankruptcy will lower your credit scores and remain on your credit report for up to seven or 10 years, depending on the type of bankruptcy filing you choose.

A bankruptcy will remain on your credit report for up to 10 years.

If your credit is already impaired, further damage may not be as important a consideration as debt relief. If your credit is fair or better, the prospect of damaging it may be a reason to avoid bankruptcy.

Many bankruptcy attorneys offer a free initial consultation, so if you’re thinking about this strategy, it may be worth having that conversation even if you later decide not to do it. At least you’ll find out whether it’s an option for you, as not everyone qualifies.

Whatever You Choose, Get Started Today

The best way for you to refinance your card debt may depend on how much you’re struggling to manage it. If you simply want a lower rate, a balance transfer card with a 0% offer is a good solution.

If you don’t qualify for a balance transfer card or you need more relief than that, you should consider other strategies, up to and including bankruptcy.

If doing nothing will make your situation worse, go ahead and choose a strategy even if it may not be the perfect solution. Go with whatever’s good enough and get started today.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Auto Refinance Loans For Bad Credit ([updated_month_year]) 9 Best Auto Refinance Loans For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-Auto-Refinance-Loans-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![5 Best Refinance Auto Loans ([updated_month_year]) 5 Best Refinance Auto Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-Refinance-Auto-Loans.jpg?width=158&height=120&fit=crop)

![9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year]) 9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/Beverly-9Best.jpg?width=158&height=120&fit=crop)

![7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year]) 7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Ways-to-Manage-Credit-Card-Debt-When-Interest-Rates-Rise.jpg?width=158&height=120&fit=crop)

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![5 Ways a Credit Card Can Rebuild Your Credit ([updated_month_year]) 5 Ways a Credit Card Can Rebuild Your Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/5-ways-last-try.jpg?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)