Consumers tend to like credit cards for several reasons. Credit cards offer a convenient and safe way to pay for goods and services, both online and in person.

Many credit cards also offer fee-free rewards programs or cash back that cardholders can enjoy courtesy of their everyday spending. And, finally, credit cards are one of only two common forms of credit where interest is entirely optional (the other being HELOCs).

Credit card users receive another considerable perk that shouldn’t be overlooked. When you open a credit card and manage it properly, it has the potential to help you build your credit reports and credit scores.

This credit building, when done right, will benefit cardholders for decades through competitive rates and terms on all forms of credit. Here’s how to get started.

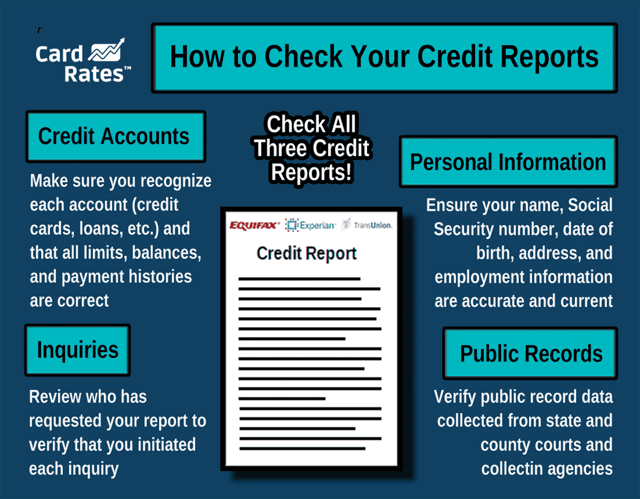

1. Review Your Credit Reports Before You Apply

Before you apply for a new credit card account, it’s always a good idea to review your credit report first. In fact, since you don’t know which of your credit reports a card issuer will evaluate to consider your application, you should check your credit reports from Experian, TransUnion, and Equifax.

Checking your FICO and VantageScore credit scores is also a good idea as they are a proxy for your credit health, and your credit scores will certainly be considered by credit card issuers.

Be on the lookout for red flags as you analyze your credit reports and scores. Any credit reporting errors, signs of identity theft, or inaccurate derogatory items could be cause for concern. If you discover a credit score that’s lower than expected, you should dig into the associated credit report to figure out what’s lowering your credit score.

With legitimate negative information on your credit reports (i.e., you really did forget to pay that power bill), you may consider contacting the creditor or collection agency to review your options.

Although it’s a long shot, you may be able to convince the creditor to remove the negative item from your report (typically after payment) as a courtesy. Otherwise, you’ll need to wait until the item is old enough to age off your credit report.

Credit reporting errors and identity theft are another story. If you find signs of either of these issues on your credit report, the Fair Credit Reporting Act (FCRA) empowers you to take action.

You can dispute credit errors with any (or all three) of the credit bureaus. In the case of identity theft, you may need to file an official report to send along with your dispute, such as the free report available at IdentityTheft.gov.

A word of warning: It may be tempting to assert that you’ve been the victim of fraud to get negative items off your credit reports when you really have not. Keep in mind that filing a false police report is a crime. Don’t do it. Be honest.

2. Choose the Best Card For Your Situation

Once you know where your credit stands, you can use this knowledge to choose the best credit card for you. With an excellent credit score, you may have your choice of available credit card offers. Bad credit, meanwhile, narrows your potential credit card choices.

It’s not a good idea to apply for a credit card when you know the issuer is likely to decline your request. For example, you don’t want to fill out an application for a premium rewards credit card with a bad credit score. A subprime or secured credit card would probably be a better fit in this situation.

A credit denial itself won’t damage your score — that’s a myth. But the hard credit inquiry that occurs when the lender processes your application may have a negative impact on your score. And if you pile up a bunch of hard credit inquiries in a short period, the impact on your credit score could be more severe.

In addition to knowing where your credit stands, it’s also wise to familiarize yourself with important credit card approval requirements before you apply. The more you know about the credit card application and approval process, the better prepared you will be.

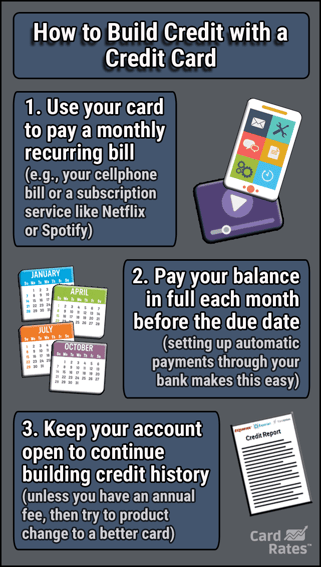

3. Always Pay Your Bill On Time

After opening a credit card account, one of the most important rules you will want to follow is never to pay late. If you break this rule and fall behind on your payments, it can cost you a lot of money. Late fees and the potential cost of penalty interest can quickly add up.

There can be other negative consequences to paying late as well. For example, your credit card issuer may slash your credit limit or close your account. The point being, nothing good comes from paying your bills late.

Perhaps the worst thing about paying your credit card late is that the account you hoped would give your credit score a boost is more likely to lower your scores instead. Late payments, especially recent late payments, have the potential to inflict serious credit score damage.

Payment history accounts for about one-third of the points in your FICO and VantageScore credit scores. It’s more important than any other credit score factor. So, when you pay your bills late, there’s a strong possibility your credit score may drop.

However, the opposite is true as well. Pay your bills on time every month, and the same account can help you build solid credit scores over time.

4. Watch Your Utilization Ratios

In addition to paying on time, another important rule is to be mindful of your credit card’s spending limit. Credit utilization, or the relationship between your credit card balances and available limits, has a meaningful influence on your credit scores.

When you maintain a low balance-to-limit ratio on your credit reports, your scores will benefit. And, of course, the opposite is true as well. Credit reports that indicate heavily utilized credit cards don’t tend to yield elite credit scores.

You can try several strategies to keep your utilization ratio low:

- Pay off your credit card balance before the statement closing date on your account.

- Make multiple payments to your credit card issuer per month.

- Ask your credit card issuer for a credit limit increase, but don’t increase spending at the same rate.

Above all, be sure to pay your full statement balance every month by the due date. This strategy is essential if you want to avoid both late payments and expensive interest fees.

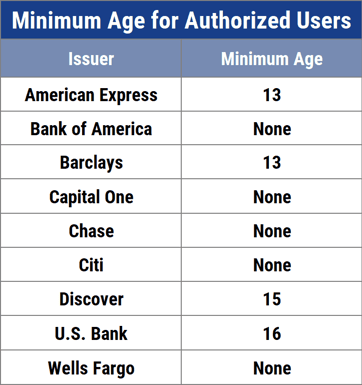

5. Consider Becoming an Authorized User

Becoming an authorized user on someone else’s account is another way a credit card may help you build credit. Authorized users are issued a credit card and have the same buying power as the primary cardholder, but without any of the liability for the debt.

Most credit card issuers will report the activity associated with a credit card account to the authorized user’s credit reports. But, there are a few pointers you should know about this strategy before you get started.

First, you’ll need to find someone who will agree to help you out. A spouse, parent, friend, or another family member with an existing credit card account is often a good fit, but your situation may differ. There is no rule about who can add authorized users to their credit card accounts.

Once you have found someone who is willing to add you as an authorized user, be sure they choose the credit card with caution.

The best type of credit card in this authorized user strategy is one with a clean payment history (i.e., no late payments) and low credit utilization. An older account is a bonus here as well.

A credit card with negative payment history, high utilization, or one that has just been opened may hurt your credit score rather than help it.

Finally, it’s important to remember that not all credit card issuers report authorized user accounts to the credit bureaus. If the account shows up on your credit reports, it has the potential to help you build your scores. But in cases where the card issuer doesn’t report the account, your credit will not benefit from the account.

Expect a Credit Score Within 6 Months

If your first credit card account is also the first account on your credit reports, you can expect to see a credit score no later than six months after the account opening, and possibly sooner. If you’ve already been approved for a new card and are wondering how to use it responsibly, we hope this guide will help you.

Always pay your bill on time and keep your balance well below the credit limit to earn and maintain solid credit scores, and, eventually, you’ll be offered the best interest rates and loan terms.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year]) How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-build-business-credit1.png?width=158&height=120&fit=crop)

![9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year]) 9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/without2.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![5 Best Secured Credit Cards to Build Credit ([updated_month_year]) 5 Best Secured Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/07/Best-Secured-Credit-Cards-to-Build-Credit.png?width=158&height=120&fit=crop)

![How to Leverage Credit Cards to Build Wealth ([updated_month_year]) How to Leverage Credit Cards to Build Wealth ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/How-to-Leverage-Credit-Cards-to-Build-Wealth.jpg?width=158&height=120&fit=crop)

![7 Prepaid Cards That Build Credit ([updated_month_year]) 7 Prepaid Cards That Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Prepaid-Cards-That-Build-Credit.jpg?width=158&height=120&fit=crop)