Knowing how to apply for a credit card with bad credit can make the difference between glorious approval and bone-crushing rejection. Well, maybe that’s a tiny overstatement, but if you’re going to apply for a new card, you may as well put the approval odds in your favor. Read on to see how.

-

Navigate This Article:

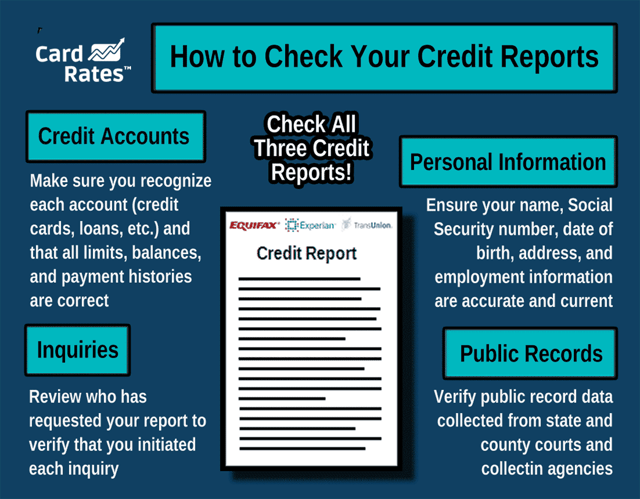

Step 1: Check Your Credit Reports

You want your credit reports to be free of errors before applying for a new credit card. Those errors can needlessly depress your credit score by dozens or hundreds of points, and that can damage your prospects for getting the card you want.

The three major credit bureaus (TransUnion, Experian, and Equifax) are central in determining your credit score. They compile the data they receive on your credit activity from lenders and creditors. The bureaus apply one or more scoring systems, such as FICO and VantageScore, to the data they receive to churn out your credit scores.

FICO, one of the most widely used credit scoring systems, uses a credit rating scale from 300 (worst credit) to 850 (perfect credit). The scale shows a borrower’s relative probability of defaulting on a debt in the next two years. Scores below 600 indicate that you have less-than-good credit and are a risky borrower.

It isn’t surprising that card issuers are wary of bad credit applicants. Issuers are in the business of making money from interest and fees, not losing it due to unpaid bills and write-offs.

That prospect brings us back to the credit bureaus. If their reports harbor erroneous information, it’s in your best interest to fix them.

You can start the process by ordering free copies of your reports, which you can do for free once a year through AnnualCreditReport.com. By the way, checking your own reports doesn’t affect your credit score.

You’ll need to check all three reports when you receive them because the credit bureaus don’t necessarily share information, and their regular credit card reports can differ.

The variation in data helps explain why each credit bureau may calculate different scores. Variations also arise from the exact interpretations each credit bureau applies to the scoring systems – there’s enough wiggle room to cause differences even if all the data is identical.

Credit card issuers may reference just one of your credit scores, but they may also average two or three scores when evaluating your application. You must have all credit report errors removed if you want to maximize your approval chances.

You can fix your reports yourself by disputing the errors, such as accounts you don’t recognize and transactions you didn’t authorize. Each credit bureau provides a way to file disputes online or by mail that they must adjudicate within 30 days.

If the credit bureau accepts your dispute, it will delete the offending item and notify anyone who received a copy of your credit report in the past six months. Should the bureau deny your dispute, you can appeal the decision by refiling with additional information. You can also append to the report a short statement containing your perspective on the item in question.

If all that sounds like a lot of work, consider hiring a credit repair service to do the heavy lifting for you. Reputable services aggressively challenge the questionable data on your reports. They are especially adept at asking creditors to verify items that hurt your credit score.

Typically, credit repair services charge between $50 and $150 per month, and subscriptions usually run from four to six months. You can cancel or extend your subscription at any time. The services guarantee that they will work hard on your behalf but may not successfully raise your credit score.

Whether your score improves or not, fixing your reports ensures that credit card issuers have accurate information when they process your application.

Step 2: Research Credit Cards For Bad Credit

Many credit cards out there specifically target consumers with less-than-perfect credit. But which cards should you consider?

We humbly recommend you start with the cards we at CardRates.com rank highest. We base our rankings on the terms, rewards, and ease of approval of each offer.

- Greater access to credit than before – $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you’ll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

- PREMIER Bankcard credit cards are for building credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- Credit Limit Increase Eligible after 12 months of consistent responsible account management.

- We report monthly to the Consumer Reporting Agencies to help you build your credit.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See Provider Website

|

See Provider Website

|

Fair/Poor

|

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- Brink’s knows Security! 24/7 access to a suite of security benefits to help keep your account armored.

- Get access to over 100,000 Brink’s Money ATMs.

- Get paid faster than a paper check with direct deposit.

- Add funds to your Brink’s Armored Account and use Brinks Armored debit card anywhere Debit Mastercard is accepted.

- Account opening is subject to registration and ID verification. Terms & fees Apply. Deposit Account is established by Pathward®, N.A., Member FDIC.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fees

|

Not applicable

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

+ See More Cards For Bad Credit

Pay attention to the credit card issuer. Some, including Credit One Bank, specialize in cards for bad credit (for example, the Credit One Bank® Platinum Visa® for Rebuilding Credit).

Capital One has excellent personal and business credit card offerings, including the Capital One® Spark® Classic for Business credit card for fair credit. It also offers a pair of highly-ranked secured cards and online banking features. (Information for this card not reviewed by or provided by Capital One.)

As you peruse our card reviews, pay attention to the APRs and fees the cards charge – some cards for people with a poor credit score come with all sorts of nuisance fees (e.g., setup, monthly maintenance, credit line increase) that you’d rather avoid. Then, ask yourself what rewards and benefits, if any, you get for your money.

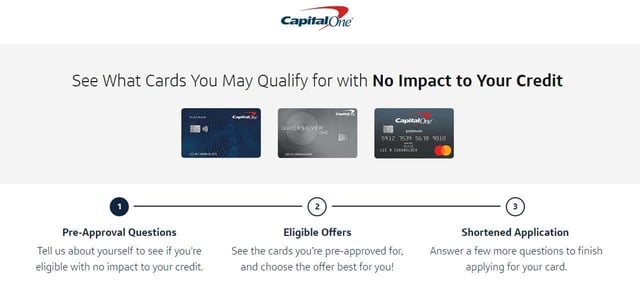

Step 3: Prequalify First

We recommend you first attempt to prequalify for a credit card before submitting an official application. Almost all credit cards have a prequalification process in which you submit basic information about your income and debts.

The value of this procedure is that it doesn’t involve a hard pull of your credit reports and so it won’t damage your credit score. FICO attributes 10% of your credit rating to your applications for new credit. Applying for a credit card or loan (such as a personal loan) results in a hard pull of your credit.

Only you can authorize a hard credit inquiry, and all other pulls, including you checking your credit score, are harmless. Each hard credit check for a credit card or bad credit loan can shave up to eight points off your score for up to a year.

Successfully obtaining preapproval for a credit card does not guarantee final approval. If the credit card company declines your preapproval request, at least you know not to hurt your credit rating by submitting an application.

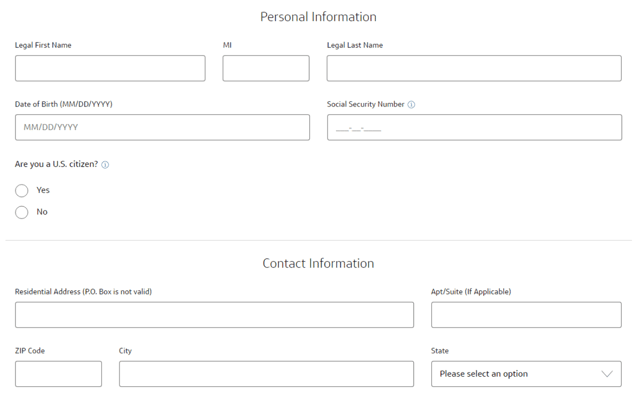

Step 4: Submit an Application

Applying for a credit card is almost identical to the prequalification process. You enter any additional data the issuer requires and click on the submit button. Most issuers respond immediately with a decision.

If the credit card company rejects your application, it must by law send you a written Adverse Action Notice explaining its reasoning. The letter will contain the reasons you were denied and the source of the credit score or information the credit card company used to make its decision.

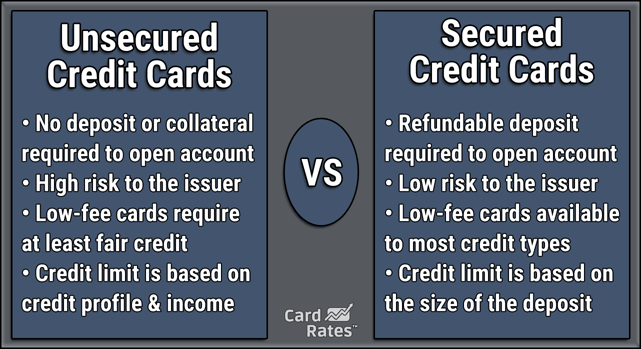

The notice is valuable because it tells you what to fix before reapplying for a card. For example, your rejection may stem from carrying too much debt. If you can’t fix the problem, it may be time to consider a secured credit card instead. Issuers of secured cards do not rely on your credit score or history when processing your application.

If you receive approval, you’ll receive a cardmember agreement for you to sign (or rather, e-sign). Read the contract carefully because surprises may lurk there, and understand the fees and conditions before signing the agreement.

Your card may charge you a signup fee (or program fee). If so, you will have to pay the fee before the issuer sends you the card. This fee may also be deducted from your initial credit limit. If you fail to fork over the money to the issuer before the deadline (typically 60 days), it will cancel your application.

Your credit card should arrive in seven to 10 days, although some issuers may expedite shipments for free or a fee. When your card comes, sign the back and acknowledge receipt of the card online or over the phone.

Sometimes, you need to use your credit card before it shows up in the mail. Some credit card companies support this need by issuing you a temporary, virtual account number that you can use until the card arrives.

What Does Bad Credit Mean in Terms of Credit Cards?

Bad credit does not make you a bad person, just one with a low credit score. As described earlier, the FICO scoring system divides consumers into groups based on their credit scores.

Issuers of unsecured credit cards understand both the obvious facts and the subtle nuances surrounding credit scores and design their products accordingly.

And, although it pains me to say it, most issuers of cards for bad credit know how to capitalize on desperation. That’s why the typical subprime unsecured credit card contains the following flaws:

- High interest rates: With some exceptions, expect to pay an APR of at least 25% when carrying a balance over multiple billing periods. The rates for cash advances are usually even higher.

- Many fees: All credit cards have fees, but cards for subprime consumers usually carry several nuisance charges unique to cards for poor credit. These fees may include a one-time setup charge, a monthly maintenance fee, a fee for authorized users, or a credit line increase fee, among other fees. Of course, other more typical fees apply, including an annual fee and charges for cash advances, late payments, and returned checks.

- No grace period: You may come across a card for bad credit that does not offer a grace period for purchases. While not mandatory, most credit cards have grace periods no shorter than 21 days. The period begins at the end of a billing cycle and extends to the payment due date. If you enter the billing cycle with no outstanding balance, you will not accrue interest on your purchase balance during the grace period. Cash advances and balance transfers do not have grace periods. If you choose a card with no grace period, you’ll immediately begin accruing interest on your purchases, and the accruals will continue until you pay your bill.

- Meager perks: Most subprime unsecured cards offer no rewards and few benefits. Do not expect cash back, miles, or points for your purchases. Nor is it likely you’ll find any signup bonuses or 0% introductory APR promotions. Benefits will probably be limited to fraud protection, credit reporting, and free credit scores. Interestingly, several secured credit cards offer rewards and good benefits, making me wonder why they shouldn’t be the go-to cards for consumers with bad credit.

- Low credit limits: Starting credit limits of $200 or $300 are the norm. Cards in this group that also charge an annual fee usually decrease your available credit by the fee amount until you pay it. You will have to pay any setup fees before the issuer ships you the card. You may be able to increase your credit line over time. Some cards charge a fee equal to a portion (usually 25%) of any limit increase you receive.

Unsecured cards for a poor credit score address the needs of consumers who cannot or won’t pay the deposit required by secured credit cards. Perhaps the best attribute of these cards is that you can use them for building credit (or rebuilding credit).

Can I Get a Credit Card If I Have a Bad Credit Score?

Yes, you can! We have seen unsecured cards that approve applicants with scores as low as 450, although you should expect it to be more difficult if your score is below 600.

If approval from an unsecured card eludes you, consider applying for a secured card instead. You don’t need a good credit score, or any score at all, to obtain a secured card.

As described earlier, secured cards are better than their unsecured counterparts in several ways, including lower cost, higher credit limits, and better perks. And you get all that without a credit check.

Which Credit Card Should I Apply For If I Have Bad Credit?

You’ll want to start searching for the ideal credit card by identifying why you need one. There are three general types of cards for you to consider:

- Cards for building credit: These cards can help you overcome credit mistakes or let you establish a credit history. Secured credit cards are ideal candidates since they will approve almost anyone and report your payments to all three credit bureaus. The only catch is that you’ll have to deposit at least $200 in collateral. Student credit cards are great for credit newbies who want to build credit. They have the virtues of secured cards without the deposit requirement. An unsecured card for bad credit will also work, although it may be more expensive and less rewarding than a secured or student card.

- Affordable cards: These offer relatively low APRs and fees despite your bad credit history. Look for cards with an APR below 20%, which is still expensive, but better than the 25% to 35% APRs that accompany unsecured cards for subprime consumers. Secured cards should charge lower interest rates, but it’s not always the case.

- Rewards cards: You’d like your credit card to reward you for your eligible purchases. This card type is rare among subprime unsecured cards, less rare for secured cards. Rewards cards may have higher APRs and are the best credit card type for cardholders who avoid interest charges by paying their entire balance each month. Look for cards that offer signup bonuses in addition to miles, points, or cash back on eligible purchases.

Once you select a credit card type, focus on the best credit card in that group. An excellent place to start is with the many reviews we at CardRates.com devote to cards for poor credit.

As you consider your choices, ask yourself how much it will cost to own a card and what you’ll get for your money. If you opt for a secured card, research how quickly you can upgrade to an unsecured card.

Factors to consider for an unsecured credit card include how much credit it will extend to you and whether credit limit increases are automatic. Make sure that the card provides you with a grace period to avoid immediate interest on your purchases. Avoid cards that charge setup, annual, or maintenance fees if possible.

How Long Does It Take to Get a Credit Card?

Now that you’ve finally identified the credit card that fits your needs best, you naturally will want to know how long the application, approval, and shipment will take. If you had excellent credit, the whole process might take as little as a few days. But that’s not you — yet. Cards for bad credit require a little more patience.

The advent of online applications cut days off the process, and we haven’t seen too many application forms that require more than 10 minutes to complete. Even if you first prequalify for the card, you should be able to submit the final application form in no more than 15 minutes.

Many credit cards can give you a decision instantly or in just a few minutes. What you hope to avoid is a response of “pending,” which may indicate one or more problems, including:

- Trouble verifying your identity

- Discrepancies between the information on your application and that on your credit reports

- A borderline credit history that requires further research by a real person

The issuer may ask you for documents to verify your application. For example, you may need to submit copies of your latest bank statement, pay stub, Social Security card, rent or mortgage bill, or previous tax returns. Depending on the nature of the delay, the pending status could last days or even weeks.

If you receive a thumbs up from the card issuer, you should expect your card to arrive in seven to 10 days. However, two types of cards require you first to send in money before the card can be shipped:

- Secured cards: You must complete your security deposit before the issuer releases your card. An electronic funds transfer is the fastest method and shouldn’t add more than one business day to the process. At the other extreme, you can mail the issuer a check. They call it snail mail because physical delivery can add a week or more to the process. Once the issuer receives your check, it must process it and wait for it to clear, which may cost you up to yet another week.

- Cards with setup fees: Several subprime cards require a setup fee that you must pay before an approved card can ship. The same delays that afflict security deposits for secured cards apply here. The issuer will likely cancel your application if you don’t pay the fee within 30 to 60 days. You can use delivery tracking to avoid a nightmare scenario where your check gets lost in the mail and causes the issuer to revoke its approval.

Some cards offer expedited delivery, often for a fee, but Discover always expedites shipments at no extra cost. If you need it right away, choose a card that offers same-day use via virtual credit card account numbers. For example, cards from Capital One can access Eno for virtual account numbers.

What Is a Store Card?

Store cards allow you to purchase items from select department stores, supermarkets, pharmacies, clothing stores, and dozens of other retailers. We are not referring to open-loop cards that offer rewards tied to merchant types.

Open-loop cards are typical unsecured cards accepted by virtually all merchants and processed by Visa, Mastercard, American Express, or Discover.

Instead, we’re talking about closed-loop store cards that allow you to make purchases from a single company. These store cards usually sport the company’s logo rather than that of a payments processor. Merchants issue store cards for in-store and online purchases. Prime examples are the store cards from Macy’s, Old Navy, and Target.

Store cards are usually easy to obtain, even with bad credit. In that way, a store card resembles a secured credit card or a prepaid card, both of which disregard your credit score. A prepaid card is a reloadable debit card that requires neither a credit record nor a bank account.

As with everything in life, store cards have their pros and cons. The advantages of store cards include:

- Signup discounts: Retailers often snag new store card customers on the checkout line by offering significant discounts for opening a store credit card account. Our friends at Credit Karma cite examples of 30% discounts from store cards. The deal may apply to just one purchase or all first-day transactions. Consider using a store card’s signup discount for savings on a big-ticket purchase.

- Easy approval: Closed-loop store cards encourage customers to apply by offering lenient approval terms. Since these cards are only valid at one merchant, they don’t have the same risk level as do open-loop cards. If the merchant checks your credit, your score may decline by a few points. However, stores that do hard pulls usually report your transactions to at least one of the major credit bureaus, giving you a chance to build credit or rebuild credit.

- Generous rewards: Store cards usually offer robust rewards that you can use to offset future purchases. Open-loop cards can’t compete with store card rewards. Of course, you can only use those rewards at the issuing store and can’t exchange them for cash back.

- Exclusive perks: Cardholders may get valuable benefits such as early access to sales, free shipping, complimentary alterations, and higher discounts on sale items.

- No annual fees: Store cards do not typically charge an annual fee. Other fees may apply, such as fees for late or returned payments.

Before you go running out to load your wallet with store cards from your favorite merchants, consider these disadvantages:

- High interest rates: You can expect an APR above 25% from most store cards. That’s why you should always pay the entire balance before the due date to avoid interest charges. Some cards offer 0% introductory APR promotions that give you more time to finance your purchases.

- Low spending limits: Sore cards generally maintain tight credit limits, at least at first. If you use the cards to finance purchases, low credit limits can increase your credit utilization ratio (credit used divided by total credit available) and hurt your credit score. If you keep your CUR below 30%, this won’t be a problem.

- Restricted usage: You can’t use your Macy’s credit card at the Banana Republic, and vice versa. Some store cards work with merchants affiliated with the issuer. For example, you can use your Banana Republic card at The Gap, its parent company.

- Restricted reward redemption: You can only use your rewards to pay for more purchases at the issuing store. That’s only useful if you want to buy more items from that store. At worst, you may find yourself buying things you didn’t really want and using cash to supplement any shortfall in your reward points.

- Deferred interest penalties: Some cards offer interest-free purchases that are actually interest-deferred. If you don’t pay the balance within a specified period, you’ll be charged all the interest that began accruing on the full balance from the day you made the purchase.

The bottom line is to be choosy when considering store cards. Before signing up, understand all the terms and conditions, and stick to merchants you usually patronize.

There’s a Credit Card Out There For You

You’ve got a lot to think about now that you know how to apply for a credit card with a bad credit score. With so many available choices, it makes sense to do a little research before committing to a particular card.

The good news is that a bad credit score is not a showstopper, especially if you apply for a secured credit card. That, in fact, is a great idea when you have bad credit since secured cards are usually cheaper and more rewarding than their unsecured counterparts.

Think of it this way: Would you rather put down a refundable $200 deposit on a secured card or fork over a $99 setup fee to open an unsecured account? ‘Nuff said.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year]) Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Is-It-Bad-to-Apply-For-Multiple-Credit-Cards-At-The-Same-Time.jpg?width=158&height=120&fit=crop)

![How to Apply for a Credit Card Online: 4 Easy Steps ([updated_month_year]) How to Apply for a Credit Card Online: 4 Easy Steps ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/07/How-to-Apply-for-a-Credit-Card-Online--1.jpg?width=158&height=120&fit=crop)

![7 Credit Card Requirements & Minimums to Apply ([updated_month_year]) 7 Credit Card Requirements & Minimums to Apply ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/req.png?width=158&height=120&fit=crop)

![Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year]) Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Apply-For-a-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![5 Steps to Apply for a Business Credit Card ([updated_month_year]) 5 Steps to Apply for a Business Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/How-to-Apply-for-a-Business-Credit-Card.jpg?width=158&height=120&fit=crop)

![Walmart Credit Card: Bad Credit OK? ([updated_month_year]) Walmart Credit Card: Bad Credit OK? ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/01/Walmart-Credit-Card.jpg?width=158&height=120&fit=crop)

![The 1 Discover Credit Card For Bad Credit ([updated_month_year]) The 1 Discover Credit Card For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Discover-Credit-Card-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Low APR Credit Cards For Bad Credit ([updated_month_year]) 7 Low APR Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_615601223-4.jpg?width=158&height=120&fit=crop)