There are plenty of reasons to apply for a prepaid card, especially if your relationship with banks is complicated. Many people find banks forbidding and branches exasperating. Not to mention all those mysterious fees. Think of a prepaid reloadable card as banking lite; it provides a few essential services without the drama (or overdraft fees).

We’ll review in this article how to get a prepaid debit card and, once you have it, how to use it effectively. Even if you’re not ready to cut up your credit cards or burn your checkbooks, you may decide these little plastic cards deserve a slot in your wallet.

-

Navigate This Article:

What to Look For in a Prepaid Card

You want a prepaid card that:

- has convenient reload options

- charges relatively low fees

- delivers rewards

- hosts an extensive ATM network

- provides a purchase cushion for small overdrafts

We give top ratings to the following prepaid debit cards. All are easy to purchase, activate, and register online or in-person at a retail location.

- Cashback – Earn 1% cash back on up to $3,000 in debit card purchases each month

- No. Fees. Period. That means you won’t be charged an account fee on our Cashback Debit account.

- Early Pay – Get your paycheck up to two days early with no charge

- No Credit Impact – You can apply without affecting your credit score.

- Fraud Protection – You’re never responsible for unauthorized debit card purchases. If you suspect someone else has used your debit card without your permission, let us know.

- Member FDIC

- Fee-free overdraft protection

- No minimum opening deposit and no minimum balance

- Add cash into your account at Walmart stores nationwide

- Cash access at over 60,000 no-fee ATMs nationwide

- 100% US-based customer service available 24/7

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

No Credit Needed

|

- Your Chime Checking Account comes with a Chime Visa® debit card, no monthly fees or maintenance fees.

- Avoid out-of-network ATM fees and access to 60,000+ fee-free ATMs¹ — more than the top 3 national banks combined!

- Direct deposits arrive up to 2 days early.²

- Disclosures: Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

- ¹Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

- ²Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

Not applicable

|

- Brink’s knows Security! 24/7 access to a suite of security benefits to help keep your account armored.

- Get access to over 100,000 Brink’s Money ATMs.

- Get paid faster than a paper check with direct deposit.

- Add funds to your Brink’s Armored Account and use Brinks Armored debit card anywhere Debit Mastercard is accepted.

- Account opening is subject to registration and ID verification. Terms & fees Apply. Deposit Account is established by Pathward®, N.A., Member FDIC.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fees

|

Not applicable

|

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

- Overdraft protection up to $200 with opt-in and eligible direct deposit*

- No monthly fees with eligible direct deposit, otherwise $5 per month

- Earn up to 7% cash back when you buy eGift Cards in the app

- Get your pay up to 2 days early – Get your government benefits up to 4 days early.*

- High-yield savings account, 4.50% APY paid quarterly on savings up to $5,000.*

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

All Credit Types Considered

|

If you are looking to introduce your children to debit card ownership, choose a card that offers family plans — they’re an excellent way for kids to learn about managing money.

Requirements to Apply For a Prepaid Debit Card

Perhaps the most important thing to understand about applying for a prepaid card is what isn’t required — a credit check or bank account.

You can have bad credit or no credit at all because debit cards do not check credit. Nor do you need a checking account because prepaid debit cards maintain your funds in their own accounts.

Debit prepaid cards usually require three things of primary applicants:

- You must be at least 18 years of age.

- Your personal information (i.e., name, address, date of birth, Social Security number) must be valid and complete.

- You must read the cardholder agreement and agree to be bound by, and comply with, its terms.

A few cards permit an alternative to your Social Security number, such as an Individual Taxpayer Identification Number (ITIN) or a foreign ID number. You may also have to provide a copy of your driver’s license, passport, or other official photo ID.

Family-oriented prepaid cards permit minors to be authorized users. The minimum age allowed for an authorized user varies from 6 to 13 among these cards.

Buying a Prepaid Card In-Store vs. Applying Online

The most convenient way to get a prepaid debit card is online, but if you want a physical card right away, you’ll need to purchase it in the store.

If you sign up online, expect card delivery in seven to 10 days unless you pay for expedited shipping. The issuer may give you a virtual card account number you can use for card-not-present (CNP) transactions until your card arrives.

Both methods of getting a card share three stages:

- Card acquisition: You fill out an online form with the requested information or you can buy a prepaid card from a retailer. Most prepaid cards charge $3 to $10 for in-store purchases but waive the fee when you request the card online.

- Card activation: You activate your card by funding it the first time (i.e., the initial load). You can do so with cash, check, direct deposit, or electronic transfer. To activate the card, you must set a personal identification number (PIN). Some funding methods, such as cash load/reload at a retail location, may incur fees, whereas others (direct deposits, standard mobile check loads, and account-to-account transfers at the card’s website) are usually free of charge.

- Card registration: Federal law requires prepaid card issuers to verify your identity, a process called registration. Depending on the issuer, you can register the card at the time of purchase or when you receive the card after buying it online.

You can’t use the card at all until you activate it. Unless you register it, the card will not cover you for damages due to its loss or theft. The issuer may also restrict you from using an unregistered card for in-store purchases, ATM withdrawals, account-to-account transfers, additional loads, and international transactions.

Some prepaid card issuers assess a monthly fee for card inactivity (usually about $5 to $10) if you fail to activate and/or register your card by a set deadline, typically 90 days.

How to Use a Prepaid Debit Card

You can do many things with a prepaid debit card, including:

- Accept direct deposits

- Earn rewards on select cards

- Reload funds

- Make purchases online and in-store

- Transfer funds to other accounts

- Withdraw money at ATMs and get cash back at checkout lines

Let’s take a close look at these activities:

Reloading a Card

Prepaid cards are debit cards, meaning they draw from deposited funds — in this case, in a bank account administered by the card issuer. If you exhaust your funds, you can’t use your card until you reload money, although some cards offer overdraft protection.

You can reload your card in several ways:

- Depositing cash (or equivalent) at in-network reload centers and retail locations. For example, Netspend has an extensive, nationwide network of reload centers, and you can replenish the Walmart MoneyCard®, a prepaid debit Mastercard, at any Walmart store. Generally, you can refill a card at the place you bought it. Most cards charge a reload fee, although a few waive it.

- Arranging direct deposits of government and payroll checks. Debit cards don’t charge for a direct deposit.

- Check capture using the camera and app on your mobile phone. You scan both sides of the check and transmit the images via the card’s mobile app. This service is usually free, but you may have to pay a fee for an expedited check load. Ingo Money provides this service for most prepaid cards and online banking apps.

- Adding money from a linked checking or savings account.

You can’t fund a prepaid debit card from a credit card, but you can use a credit card cash advance to make a cash deposit if you really need to. It’s not a very good idea, however, due to the high interest rates credit cards charge for cash advances.

Making Purchases

The primary reason to own a prepaid debit card is to purchase goods and services at a physical store, online, and in-app without using cash or a credit card.

Prepaid cards may charge you a flat monthly fee in the $5 to $10 range to cover your purchase activity. Alternatively, you can sign up for pay-as-you-go pricing, in which you pay a small fee (typically $1.50) for each transaction.

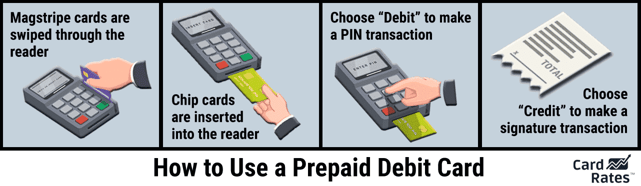

You can use a prepaid debit card at a store in two ways.

If your prepaid card is among the few equipped with an EMV chip, you can make a debit transaction by entering your PIN. This alternative is safer because you don’t transmit card account information, just a unique number for each transaction.

The alternative is a credit transaction (which is misnamed, as it doesn’t involve the use of credit), in which you sign your name instead of supplying a PIN. If your card lacks a chip, you’re stuck with this purchase method, which is less secure because the card carries and transmits your account information.

You can also use your prepaid card for online and in-app purchases by providing the cardowner’s name, account number, and security code on the back of the card. Online purchases are safer if the website uses encrypted communications.

Some of the reviewed debit cards offer payback rewards on eligible purchases. These rewards reduce the cost of owning these debit cards.

Several cards provide a purchase cushion (typically $10) to allow you to complete a purchase even if it results in a small negative account balance. The cushion usually doesn’t apply to ATM withdrawals. Issuers expect to bring your account out of negative territory as soon as possible.

Usually, this service has an overdraft fee if you don’t immediately replenish the funds, and the card may limit the number of overdrafts per month. You may have to satisfy a card’s direct deposit requirements to have access to a purchase cushion.

Sometimes, credit card owners going on international trips take a debit card instead of a travel card. This option reduces the worry about financial damage from the theft of a travel card.

Withdrawals and Transfers

You can withdraw cash from your prepaid card balance at ATMs, financial institutions, and reload locations. Fees usually apply for any cash withdrawal. ATMs may also charge a small fee for balance inquiries, but you can get the information free online or by calling the card’s customer service department.

The website and mobile app usually charge nothing to transfer money to other cardholders. You can also transfer money from your checking account to your debit card for free but expect a charge if you receive assistance from a customer service agent. A fee may apply to transfers from your card to another account, and many cards charge to accept money order transfers.

Be aware that debit cards often carry miscellaneous charges, such as a custom card fee or statement printing fee, that add to their cost.

Prepaid Cards Provide an Alternative to a Bank Account

Are you ready to apply for a prepaid card? We’ve given you the information you need to get started. If you think you’d benefit from owning a prepaid reloadable card, read the cardholder agreement and compare the fees closely, as some are more expensive than others.

If you are among the unbanked masses or have bad credit, it’s good to know you have an alternative that doesn’t require you to step into a bank branch or wield a credit card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Virtual Prepaid Card Options ([updated_month_year]) 7 Virtual Prepaid Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Virtual-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards with Free Reload Options ([updated_month_year]) 8 Prepaid Debit Cards with Free Reload Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Prepaid-Debit-Cards-With-Free-Reload.jpg?width=158&height=120&fit=crop)

![How to Apply for a Credit Card Online: 4 Easy Steps ([updated_month_year]) How to Apply for a Credit Card Online: 4 Easy Steps ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/07/How-to-Apply-for-a-Credit-Card-Online--1.jpg?width=158&height=120&fit=crop)

![7 Credit Card Requirements & Minimums to Apply ([updated_month_year]) 7 Credit Card Requirements & Minimums to Apply ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/req.png?width=158&height=120&fit=crop)

![5 Steps to Apply for a Business Credit Card ([updated_month_year]) 5 Steps to Apply for a Business Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/How-to-Apply-for-a-Business-Credit-Card.jpg?width=158&height=120&fit=crop)

![How to Apply For a Credit Card With Bad Credit ([updated_month_year]) How to Apply For a Credit Card With Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/How-to-Apply-For-a-Credit-Card-With-Bad-Credit.jpg?width=158&height=120&fit=crop)

![Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year]) Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Is-It-Bad-to-Apply-For-Multiple-Credit-Cards-At-The-Same-Time.jpg?width=158&height=120&fit=crop)

![7 Options to Get Cashback on a Credit Card ([updated_month_year]) 7 Options to Get Cashback on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Cashback-Credit-Card.png?width=158&height=120&fit=crop)