Secured credit cards with low deposits are one of the easiest — and most affordable — ways to build or rebuild your credit score.

A secured credit card requires a refundable security deposit for approval. But these cards work just like a traditional credit card. That means you can shop online or in person and pay bills while enjoying the convenience of credit.

And since your security deposit backs your account, you may not have to worry about a lender running a credit check and turning you down because of your bad credit score.

Lowest Deposit | More Secured Cards | FAQs

The Secured Card With the Lowest Deposit Minimum

The Capital One Platinum Secured Credit Card is one of the few secured card products that may not require you to make a full security deposit that matches your credit limit. Instead, you may qualify for an account that requires a deposit of as low as $49 to secure your credit line, depending on your creditworthiness.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

Capital One will monitor your account every six months to see if you qualify for a credit limit increase that will not require additional deposit funds. Furthermore, Capital One may switch you over to an unsecured account and return your security deposit to you as a statement credit if you are deemed eligible.

More Secured Cards With $200-$300 Deposits

The following credit cards make your credit limit equal to the amount of your security deposit. So, for example, a $300 deposit will yield a $300 credit limit. Most secured cards charge a minimum of $200, but a few outliers require $300.

The card issuer will report your payment history to the major credit bureaus so you can build credit with on-time payments. Your security deposit is completely refundable upon account closure or graduation to an unsecured card.

The Capital One Quicksilver Secured Cash Rewards Credit Card offers the same cash back rewards as its unsecured counterpart. You won’t be charged an annual fee, either.

This card competes well with the Capital One card above, with comparable APRs and fees. The only difference is this card doesn’t offer partial deposits, instead opting to offer cash back.

We like the Discover it® Secured Credit Card for many reasons. You’ll get cash back rewards, automatic account reviews for possible upgrades, and access to your FICO Score for free so you can track your credit progress.

Discover is known for its highly-ranked customer service and infamous Cashback Match that will automatically match all the cash back you’ve earned at the end of your first year.

The OpenSky® Secured Visa® Credit Card does not require a credit check for approval and provides an online application that takes a matter of minutes to complete and activate your new account.

Once you begin using your account, OpenSky will report your monthly payment history to each credit bureau. Responsible behavior helps you build your credit score faster and replace previous negative items on your credit history with positive data.

- Better than Prepaid...Go with a Secured Card! Load One Time - Keep On Using

- Absolutely No Credit Check or Minimum Credit Score Required

- Automatic Reporting to All Three National Credit Bureaus

- 9.99% Low Fixed APR - Your Rate Won’t Go Up Even if You Are Late

- Activate Today with a $200 Minimum Deposit - Maximum $1,000.

- Increase Your Credit Limit up to $5,000 by Adding Additional Deposits Anytime

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

9.99% Fixed

|

$48

|

Poor/Fair/Limited/Damaged

|

The Applied Bank® Secured Visa® Gold Preferred® Credit Card doesn’t require a credit check and has no minimum credit score requirements for approval. You can apply on the bank’s website and supply a low refundable security deposit to open an account with a low ongoing interest rate.

One caveat, however, is that while the APR is low, it does not provide a grace period for new purchases, so that’s something to be aware of before committing to this card.

- Choose your own credit line based on how much money you want to put down as a security deposit.

- Initial deposits can be from $200 to $3,000. You can increase your credit line at any time by adding additional money to your security deposit, up to $3,000.

- After 9 months, we review your account for a credit line increase. No additional deposit required!

- Secured Credit Cards are great for people looking to build or rebuild credit and are available to people with all kinds of credit backgrounds.

- Unlike a debit card or a pre-paid card, it helps build your credit history. We report your payment history to all three major credit-reporting agencies.

- Get your FICO® Credit Score for free each month.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.70% Variable

|

$36 for first year. Billed $3 per month thereafter

|

See website for Details*

|

The Merrick Bank Secured Credit Card reports to each credit bureau to help you rebuild your credit faster. The bank’s low minimum deposit requirement will give you access to a free set of online account management tools and $0 fraud liability for unauthorized charges.

To qualify, applicants must be at least 18 years old with a valid Social Security number and physical U.S. home address. Applicants must also pass the bank’s income assessment and identity verification requirements and have no pending bankruptcy or other outstanding federal, state, or local tax obligations.

The First Progress Platinum Prestige Mastercard® Secured Credit Card has a slightly higher-than-average annual fee, but its low variable interest rate can offset that cost if you tend to carry a balance from month to month.

First Progress claims that it often approves applicants who struggle to find approval elsewhere.

First Progress Platinum Elite Mastercard® Secured Credit Card has a lower annual fee than its Platinum Prestige sibling — but the card also charges a slightly higher interest rate. That said, this card offers credit-building opportunities similar to those of the other cards on the list, but the cost of credit places this card lower in the rankings.

The First Progress Platinum Select Mastercard® Secured Credit Card doesn’t require credit history to approve your application. You can use the card to build or rebuild your credit, and it charges a low competitive APR for purchases.

The annual fee will be deducted from your available credit line upon card activation. First Progress may increase your credit limit without requiring you to add to your deposit account. Any increases in your credit limit are subject to credit approval

What is a Secured Credit Card?

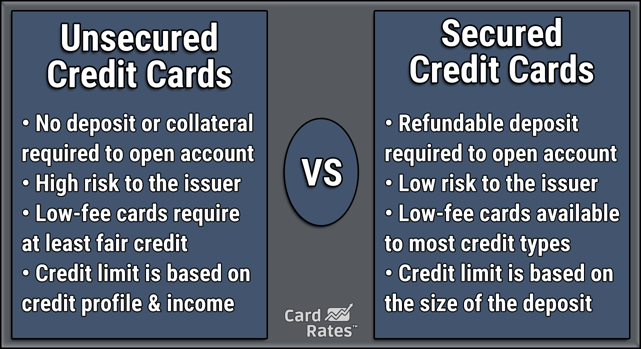

A secured credit card functions similarly to any traditional credit card on the market. The only difference is that it requires a refundable security deposit to get approved for the card.

These cards rarely require a credit check for approval and are designed to help the cardholder build — or rebuild — his or her credit history. Since most secured card members have fair credit or poor credit, the banks require the deposit to back the account in case the cardholder fails to pay the credit card bill.

Think of this as you would renting an apartment. Before you move in, the landlord requires a security deposit to cover any damages you may make to the dwelling. If you move out without trashing the place, you get your money back. If you damage the apartment, the money you paid upon moving in will cover the repairs.

The same goes for a secured credit card. If you eventually cancel your account with no outstanding debts, the bank will return your deposit. If you stop making payments or default on your account altogether, the bank will use your deposit to cover your debt.

That is why most secured credit cards match your available credit limit to the amount of your security deposit.

Once approved, your secured credit card functions the same as an unsecured credit card. You can shop online or in person, pay bills, or pay for services rendered. A few secured credit cards even offer cash back rewards options.

The real reason to use a secured credit card is for its credit-building capabilities. Each month, your credit card company will report your payment history to one or all of the three major credit bureaus. These are the businesses that collect your credit history and calculate your credit scores.

If you make on-time payments and maintain a low balance on your card, you can begin to build a positive history that will increase your credit score over time.

Doing so could help you qualify for an unsecured credit card that will not require a security deposit. Certain secured cards, including the BankAmericard® Secured Credit Card, will routinely monitor your account and refund your deposit if you show continued responsible behavior with your account.

Larger banks that offer secured credit cards, such as Capital One, Citi, and Discover, can eventually graduate your account from a secured to an unsecured card. If this happens, the bank will issue you a new card and refund your security deposit.

How Can You Improve Your Credit Score with a Secured Credit Card?

Any good secured credit card will report your payment history and current balance each month to at least one credit bureau. Positive reports will increase your credit score over time.

There are three main credit bureaus that generate credit scores under your name — Experian, Equifax, and TransUnion. Each bureau depends on lenders and banks to submit monthly updates on your accounts to keep your credit score up-to-date and accurate.

If you have bad credit because of previous financial mistakes, you can improve your credit score by adding new, positive information that gradually pushes old data further down your personal credit report. You can do this by keeping a low balance on your secured credit card and making on-time payments each month.

Like most things in the financial world, your most recent data is the most important part of your credit history. As items get older, they lose their impact on your score.

In time, older items will age off your report and be gone forever. This typically takes up to seven years for most items.

During that time, the negative items will become less and less important as they get older, and positive items take their place at the top of your credit file.

But you can continue to damage your credit score if you make mistakes with your secured credit card. One 30-day late payment can take as many as 100 points off your credit score.

Other important credit scores, such as your FICO score, factor your total debt into the credit score equation. In this case, 30% of your credit score depends on your current balance. If you keep your balance low and make prompt payments, you will see a positive change in your credit score.

Which Secured Credit Card Has the Lowest Deposit?

The Capital One Platinum Secured Credit Card requires the lowest possible deposit of any secured card.

Capital One currently has a tiered system that uses your credit score to determine the amount of deposit you are required to make. While all new cardholders start with the same credit limit, your cash deposit may be just a fraction of how much you have available to spend.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

Capital One monitors accounts every six months and could increase your credit limit if you maintain a clean account record. If this happens, the bank will not require a further deposit from you.

At publication, more than half of the credit cards listed above require a minimum cash deposit of $200. Some cards may have a slightly higher minimum of $300. Few cards have higher minimums.

Banks regularly change their credit card terms and conditions. This means that a secured credit card issuer could change their minimum and maximum security deposits at any time. Thankfully, if you already have an account when these changes take place, you will not have to add more to your deposit if you fall below the new minimum.

Is a Secured Credit Card the Same as a Prepaid Card?

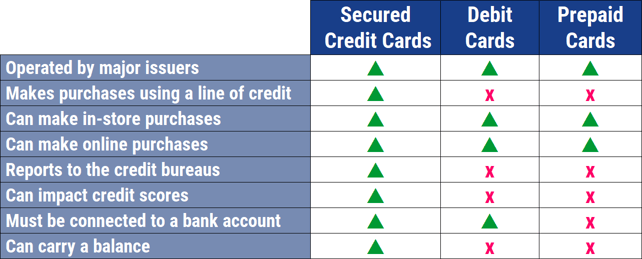

A secured credit card and prepaid card are two very different things. Not only do they function differently at the register, but only a secured credit card can help you build your credit score.

A secured credit card functions in many of the same ways as a traditional credit card. You use it to make purchases against a line of credit. Although you back your card account with a security deposit, you still have to make monthly payments for any credit card charges you accrue.

A prepaid card is similar to a debit card. You put money into your prepaid card account and use your card to make purchases with that money, so you can only spend the amount of money you have in your account.

You do not need to make monthly payments, but you will need to reload your card with more money whenever you spend the money already in the account.

Since prepaid cards do not include a line of credit, the credit card company will not report your payment history to any credit bureau. As a result, this card cannot help you rebuild or establish a credit history.

On the other hand, a secured credit card does draw from a revolving credit line. That means on-time payments and low balances can help you build your credit history.

Do All Secured Credit Cards Require a Deposit?

Yes. All secured credit cards will require some type of refundable security deposit for approval.

Banks typically design these cards for consumers who have poor credit or previous financial mistakes on their credit histories. Because of those mistakes, lenders tend to consider these consumers a greater risk than someone who has good credit or excellent personal credit. That often means these people have a much harder time qualifying for a traditional unsecured credit card that does not require a deposit.

After all, if those old mistakes happen again — and the cardholder stops paying on his or her debt — the bank loses a substantial amount of money.

To help these consumers create a path toward rebuilding their credit, banks created secured credit cards. For a low deposit — typically anywhere between $49 and $300 — a secured credit card can help consumers open the door to a revolving line of credit and a better credit score.

This is similar to the scenario consumers face when they rent a car. At the time you pick up the vehicle, the rental agency will charge the cost of the rental plus a security deposit to cover the cost of any potential damage you do to the car.

If you return the car in the same condition you received it in, you get your money back. If there is damage, your security deposit covers the repairs.

The same goes for your secured credit card. As long as you close your account in good standing, you will receive your money back.

If a bank provided a secured credit card without a deposit, it would not be a secured card. It would instead be an unsecured credit card, which means there is nothing to secure the account against potential default.

What is the Easiest Secured Credit Card to Get?

Two of the cards listed above clearly state that no credit check is required. They are the Applied Bank® Secured Visa® Gold Preferred® Credit Card and the OpenSky® Secured Visa® Credit Card. You can qualify for these cards as long as you can provide the necessary security deposit for approval.

- Better than Prepaid...Go with a Secured Card! Load One Time - Keep On Using

- Absolutely No Credit Check or Minimum Credit Score Required

- Automatic Reporting to All Three National Credit Bureaus

- 9.99% Low Fixed APR - Your Rate Won’t Go Up Even if You Are Late

- Activate Today with a $200 Minimum Deposit - Maximum $1,000.

- Increase Your Credit Limit up to $5,000 by Adding Additional Deposits Anytime

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

9.99% Fixed

|

$48

|

Poor/Fair/Limited/Damaged

|

While these two secured card products don’t require a credit check, other secured card issuers may want a peek at your credit report before printing a card in your name.

The need for a credit check is not always to judge your credit score. Instead, many banks will not approve a secured credit card application for someone who has a pending bankruptcy case or has active tax liabilities or collections accounts.

A credit check will show if any of these negative items appear in your name. If they do, the bank will reject your credit application. If they do not, you stand a very good chance at approval — even with a bad credit score.

Banks understand that most consumers who apply for a secured credit card do so to build, or rebuild, their credit. That means they do not expect every applicant to have a sterling credit history.

With that in mind, consumers who have good credit can opt for a secured credit card because it helps keep them disciplined with a card that has a small credit limit and little temptation to spend.

In short, if you do not have an active bankruptcy, tax liability or lien, or an account in collections — and you can afford at least the minimum required security deposit — you should find that just about any secured credit card on the market is attainable.

Can You Increase a Secured Card’s Credit Limit?

This depends on the card you have and the rules surrounding deposits.

Most secured credit card issuers allow you to increase your credit limit by adding to your security deposit. In many cases, this will come with a processing fee that can range between $9 and $49.

Other card issuers may allow you to increase your credit limit during a short window. Capital One, for instance, will allow you to add to your deposit to increase your credit limit during your first 80 days after card activation.

Some secured card products, such as the Capital One Platinum Secured Credit Card, offer periodic credit limit increases at no additional charge.

Every Capital One cardholder — secured or unsecured — gains automatic enrollment in the bank’s automatic credit limit increase monitoring program. The bank will monitor your account once every six months to see if you qualify for a higher credit line.

If you do, Capital One will immediately initiate the increase. For secured cardholders, this comes at no additional cost.

Over time, you may also qualify for an account upgrade to an unsecured credit card. If that happens, Capital One will refund your deposit as a statement credit.

How Fast Will a Secured Card Build Credit?

Most consumers will see a positive change to their credit score after six months of on-time payments and maintaining a low balance. If you have a very poor credit score, it could take much longer.

The time it takes to build your credit score will depend greatly on the type of items currently on your credit report. For example, one late payment can begin to lose its impact if you replace it with consecutive on-time payments. A recent bankruptcy, on the other hand, could take several years to overcome.

Whatever your mission, a steady flow of on-time payments will help push whatever negatives you have further down your credit profile. In time, the older items will lose their impact on your score, so long as they are replaced with positive items.

In addition to making on-time payments, maintaining a low balance on your credit cards during your credit rebuilding journey is equally important.

In addition to making on-time payments, maintaining a low balance on your credit cards during your credit rebuilding journey is equally important.

Approximately 30% of your credit score is based on your credit utilization rate. You can calculate your credit utilization by dividing your overall credit limit by your card’s current balance.

For example, a credit card with a $1,000 credit limit and a $500 current balance has a 50% credit utilization ratio. In other words, the consumer is using 50% of his or her total available credit.

Banks like to see no more than a 30% credit utilization ratio on a credit application. Anything above that may make you look like you are over your head in debt and seeking more money.

This can get especially tricky if you have a secured card with a low credit limit.

Most of the secured credit cards with low deposits allow for a security deposit as low as $200. In most cases, this will yield a credit limit of $200.

If you maintain no more than a 30% credit utilization rate, you can have no more than $60 in debt on your card at the end of every billing cycle. This is why it is so important to pay as much as you can each month to eliminate your debt.

Doing so will not only keep your credit utilization ratio down, but it will also minimize interest charges and other fees that you may have to pay to your card issuer.

Do I Get My Deposit Back from a Secured Credit Card?

As long as you close your account in good standing or are upgraded to an unsecured account, you will receive a full refund for your security deposit.

You will not receive a refund if you close your account with outstanding debts or charges due. Instead, the bank will use your deposit to cover any money you owe. If there is money left after satisfying those debts, the bank will return it to you.

Your refund will typically come via a paper check from your credit card’s issuing bank. The check usually arrives within seven to 10 business days after you close your account.

In some cases, the bank could refund your deposit to a linked checking account or savings account at a bank account or credit union. In those cases, you could receive your refund within two to three business days.

How Much Should I Put Down on a Secured Credit Card?

The amount you’re comfortable putting down is up to you, but banks impose minimum and maximum deposit amounts for secured cards. As we’ve shown, the lowest deposit available is $49 from Capital One, but some secured cards will let you deposit as much as $5,000.

The beauty of secured credit cards is that they allow you to essentially create your own credit limit. The amount you put down as a security deposit on a secured credit card will be your credit limit.

But remember that your security deposit does not count as payment. If you pay the bank $500 as a deposit and then get your card two weeks later and immediately charge $500 to it, you will have to repay the full $500 to the bank.

Can You Be Denied a Secured Credit Card?

Like any financial product, a bank could deny your application for credit if you do not meet its standards for lending.

Those standards are typically much lower for a secured credit card, though, because your security deposit eliminates much of the risk a bank would carry by lending money to someone who potentially has bad credit.

But there are still times where a bank will think you are too much of a risk — even with a security deposit. This can include:

- A pending bankruptcy case: During an active bankruptcy proceeding, a judge could lump all of your debts — including your new credit card — into the pending discharge. That could leave your new card issuer holding the bag on any outstanding debt you charge to the card.

- Outstanding tax liabilities or liens: This could be federal, state, or county taxes. A tax lien could cause automatic payroll deductions that make it harder for you to pay your monthly bill.

- An account in collections: If you recently defaulted on a loan, most lenders will shy away from extending you more credit. The way they see it is if you did it once, you will do it again.

- You do not meet the bank’s income requirements: A bank will only extend credit to someone who has the means to repay it. If you are unemployed — or underemployed — a bank may reject your application for credit until you can boost your income.

Secured credit cards are not your typical credit card product. While an unsecured card will rely on your credit score for approval, secured cards will look more at your potential than your previous history.

This includes your income and any outstanding liabilities that could affect your ability to maintain your account in the future. If you meet the bank’s requirements, you will likely qualify for the secured card of your choice.

How Long Does it Take for a Secured Credit Card to Become Unsecured?

Banks that offer both secured and unsecured cards will typically consider you for an upgrade to an unsecured card every six months. That does not mean you will move from a secured to an unsecured card in just six months, though.

The time you will need to upgrade will depend on your credit score and the factors that are holding it down. You can quickly overcome certain negative items on your credit history, such as a few late payments or too many hard inquiries. Other negative items take more time.

If you have defaults, collection accounts, or a previous bankruptcy, a bank will want to see a much longer pattern of responsible behavior before extending unsecured credit to you. Depending on the severity of your past mistakes, it could take several years. If you have less severe transgressions on your credit report, you could graduate to a new card in a year or less.

Although issuers like Capital One and Discover monitor accounts every few months to see if you qualify for a deposit refund, higher credit limit, or card upgrade, you can still request an account change at any time.

To contact Capital One about moving to an unsecured card, call 1-800-227-4825. Discover cardholders can call 1-800-347-2683.

While an upgrade is never guaranteed, it won’t hurt to ask. Just remember that if you call and request an account change too often, you could hurt your chances of getting what you want.

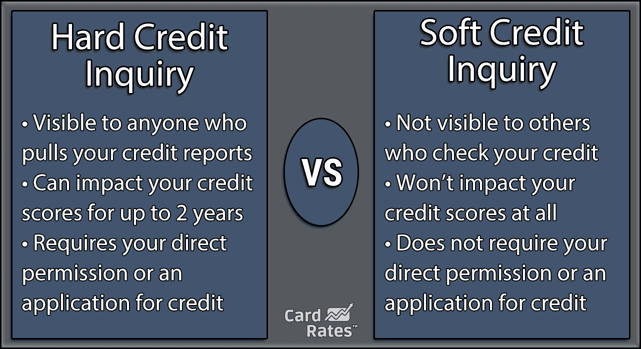

Does Applying for a Secured Credit Card Count as a Hard Inquiry?

Some secured credit card issuers do not require a credit check for approval, which means you won’t accrue a hard inquiry. If the issuing bank does require a credit check, it will add an inquiry to your credit history.

Any time you apply for credit, the lender or bank will need your permission to access your credit history and conduct a credit check. No lender can access this information without your permission.

An inquiry is essentially a notation placed on your credit history that shows that a bank accessed your credit report during an application process. It does not state whether you were approved or denied credit.

Inquiries work twofold. On one hand, they let consumers know who has accessed their credit history. If you see inquiries on your credit report that you did not approve, someone else may have access to your Social Security number or other identifying information.

On the other hand, banks want to know how often you apply for credit. The number of inquiries on your credit report show whether you are applying too often for loans or credit cards.

A few inquiries are expected on everyone’s credit report. But too many inquiries can make you look desperate for money. Inquiries live on your credit report for two years and can minimally affect your scores for up to one year.

A general rule of thumb is that one to three inquiries within a six-month period are okay. More than that, and you could see a dip in your credit score until older inquiries age off your reports.

Compare Secured Credit Cards with Low Deposits Online

You may want to find secured credit cards with low deposits for several reasons. Maybe you want to build credit for the first time or rebuild credit from previous mistakes. Whatever your reason, a secured credit card can help you reach your goals while setting your own credit limit. This flexibility allows you to be the author of the next chapter of your credit-building journey.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![11 Credit Cards For Bad Credit: Deposits Needed ([updated_month_year]) 11 Credit Cards For Bad Credit: Deposits Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Credit-Cards-For-Bad-Credit-With-Deposit.jpg?width=158&height=120&fit=crop)

![13 Best Credit Cards with Refundable Deposits ([updated_month_year]) 13 Best Credit Cards with Refundable Deposits ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_247620232.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![7 Low APR Credit Cards For Bad Credit ([updated_month_year]) 7 Low APR Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_615601223-4.jpg?width=158&height=120&fit=crop)

![15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year]) 15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/cheap.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Low-Income Earners ([updated_month_year]) 12 Best Credit Cards for Low-Income Earners ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/low-income2.jpg?width=158&height=120&fit=crop)

![7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year]) 7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/low.png?width=158&height=120&fit=crop)

![11+ Best Low-Interest Credit Cards ([updated_month_year]) 11+ Best Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/low-int-1.png?width=158&height=120&fit=crop)