The Consumer Financial Protection Bureau recently found that credit card limits are rising for most groups after stagnating during the pandemic. In 2022, credit card delinquencies neared a 10-year low.

These trends — more income, lower credit utilization rates, lower debt-to-income ratios, and fewer delinquencies — allow credit card issuers to offer higher credit limits.

Hey, big spenders, spend a little time with us as we show you how to earn more cash back. We review several cash back cards with high credit limits and explain ways to increase your credit lines. After all, you’d like more credit, wouldn’t you?

Cash Back Cards With High Credit Limits

We chose these credit cards for more than just their high credit limits. They are all excellent cash back cards worth owning regardless of the credit limit.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card is our candidate for the best credit card in this review. It is frequently reported that Bank of America has a maximum credit limit of $99,900 for its credit cards.

Though that won’t be your initial credit limit, by any means, Bank of America may increase your credit limit automatically after you’ve managed the card responsibly for a while. The bank may not officially notify you of an increase, so check your statements periodically to see if your limit is higher.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Another forum contributor claims a $99,900 credit limit on their Bank of America® Unlimited Cash Rewards credit card. Consumers uninterested in rotating or tiered categories will appreciate the card’s flat reward structure. The unlimited cash back rewards don’t expire while the account remains open.

Most Bank of America credit cards, including this one, are eligible for the bank’s Preferred Rewards program, which boosts your reward rates by as much as 75%.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

A myFICO Forum contributor claims a $52,000 credit limit on the Discover it® Cash Back card, a limit probably near the maximum available. The card offers rotating bonus cash back in select purchase categories that typically change every year, though some of the more popular ones, such as grocery purchases, stick around.

You must activate the bonus rotating category each quarter to get the high membership rewards rate. You can redeem your cash back at any time and in any amount. The Discover Cashback Match lets new cardholders double their cash back during the first year following account opening, and there’s no limit on the rewards matched.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

One Redditor claims a $50,000 credit limit on the Citi Double Cash® Card. The card rewards you with ThankYou Points you can quickly redeem for cash via a direct deposit, statement credit, or check. You can also use your points for gift cards, travel, and shopping at select merchants.

The card’s benefits include special access to entertainment events, 24/7 customer support, contactless pay, and compatibility with digital wallets. You also receive $0 liability for unauthorized charges, 24/7 fraud protection through Citi Identity Theft Solutions, and access to the Citi Lost Wallet Service.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® provides a starting credit limit of at least $5,000. A Reddit contributor boasted an initial card limit of $25,000 upon approval. All eligible purchases earn Chase Ultimate Rewards points redeemable for cash back, gift cards, and travel.

This Visa credit card offers an introductory 0% APR for several months following account opening. Other first-year promotions include higher bonus cash back on travel purchases and a signup offer.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

Redditor blitzkrieg_94 claims to have a $16,3000 credit limit on their Capital One Quicksilver Cash Rewards Credit Card. In addition to cash back rewards, the card’s intro 0% APR promotion for purchases and balance transfers runs longer than one year.

The card has a signup bonus for new cardmembers, a flat cash back rate on all eligible purchases, and no annual or foreign transaction fees. Book your hotel stays and rental cars through Capital One Travel for extra rewards.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Custom Cash® Card is one of Citi’s newer cards. A forum contributor claims an initial $15,500 credit limit on the card. You can choose which merchant category will receive the highest membership rewards rate, and you don’t have to contend with rotating categories. It’s easy to configure your account to automatically alert you to low balance levels, upcoming payment dates, and attempts to exceed your credit limit.

The Citi Mobile App lets you select your monthly payment due date. You can use the app to make payments and view basic information, including your available credit, current balance, and a spending summary.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

You may be surprised by a forum report of a credit limit of $30,000 for the Capital One SavorOne Cash Rewards Credit Card. That’s not bad for a no-annual-fee card from Capital One.

This card offers a welcome bonus, unlimited rewards, and a low intro APR. You’ll also receive cardholder-exclusive travel and entertainment benefits.

- Earn $250 back in the form of a statement credit after you spend $2,000 in purchases on your new Card within the first 6 months of Card Membership

- 3% cash back on groceries from U.S. supermarkets (on up to $6,000 per year in purchases, then 1%)

- 3% cash back on U.S. online retail purchases (on up to $6,000 per year in purchases, then 1%)

- 3% cash back at U.S. gas stations, 1% back on other purchases

- Introductory 0% APR for 15 months on purchases and balance transfers, then a variable rate applies

- Find out if you Pre-Qualify for the Blue Cash Everyday® Card or other offers in as little as 30 seconds

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.24% – 29.99% Variable

|

$0

|

Good

|

The Blue Cash Everyday® Card from American Express is an excellent choice for online, gas, and grocery shoppers, with limited bonus cash back on eligible purchases. The card doesn’t charge an annual fee.

This card’s initial limit reportedly can exceed $15,000, but higher limits may be available. Our senior editor has a $30,000 limit on this card (increased over time). It offers attractive introductory offers but imposes a hefty penalty APR if you miss a payment.

What Is a Cash Back Credit Card?

A cash back credit card gives cardmembers cash rewards by refunding a percentage of each eligible purchase. Most cash back cards offer rewards of 1% to 5%, but some may offer higher rates for special promotions or selected merchants.

Each time you use your card to pay for an eligible purchase, the card returns a percentage of the transaction as cash back (or points you can easily convert into cash). You can accumulate your rewards or redeem them in several ways.

Cash back cards can use any of these three reward schemes:

- Flat rate: The card applies a fixed percentage to each purchase, usually between 1% and 2%. These cards don’t limit the cash back you can earn. Consumers who want a straightforward rewards scheme favor flat-rate cards.

- Tiered: This type of card has two or more reward rates. Typically, the tiers with higher rates apply to selected merchant categories and may have quarterly or annual limits. These cards always have a catch-all rate, typically 1% to 1.5%, that applies to all eligible transactions that don’t qualify for a higher tier. You may prefer cards with tiers that align with your predominant spending patterns (e.g., purchases at supermarkets, gas stations, restaurants, etc.).

- Rotating: A card with a rotating scheme applies its top reward rate to a single merchant category that changes quarterly. You must activate the new category each quarter to receive the maximum rate. The cards place a quarterly cap on the amount you can earn at the top rate. Some cards combine rotating and tiered schemes, but all include a flat catch-all rate, usually 1%. You may prefer this card type to earn maximum rewards in several categories during the year.

Many consumers own multiple credit cards with various favored categories that synergistically earn bonus cash back on almost all purchases. Careful planning can help you maximize your credit card rewards.

How Do Credit Limits Work?

When you apply for a credit card, the issuer will tell you how much you can charge to the account. This maximum spending cap is your credit limit.

For example, if your initial spending limit is $1,000, the card will reject transactions that cause your balance to exceed the limit. Some cards approve transactions that put you over the limit by a small amount but may charge you an over-limit fee.

At any given time, the amount available for new purchases equals your credit limit minus the unpaid balance. The amount available fluctuates with your payments and spending. Some cards impose a lower cap on cash advances than on purchases.

For secured credit cards, your initial credit limit equals your security deposit. Secured cards usually have limits between $200 and $5,000, which may be subject to additional deposits after account opening.

What Is the Highest Credit Limit You Can Get?

Credit card limits generally relate to cardmember credit scores. Consumers with bad credit may have initial limits as low as $300. At the other end of the spectrum, luxury credit cards may offer six-or-seven-digit credit limits.

The Chase Sapphire cards reportedly offer limits as high as $500,000. But for the highest spending limit, you can’t beat the Centurion Card from American Express, better known as the “Black Card.”

As with several American Express cards, the Black Card has no preset spending limit (NPSL), which means you can charge a maximum amount that varies over time. The amount you can spend may change from transaction to transaction based on your account history and other factors.

How Do I Increase My Credit Limit?

You can ask your card issuer for a credit limit increase, but you must be able to justify the request. Alternatively, you can wait for an automatic increase or reallocate credit from another card.

These are the three common methods for getting a credit limit increase:

1. Wait For an Increase

Credit card companies usually review your credit limit every six months or so. They may raise your credit limit spontaneously without any request from you. To qualify, you must continue to be a good customer by paying on time and, when possible, the entire monthly bill. It helps to report income increases to your credit card company.

Cards for subprime borrowers often promise to evaluate your credit limit after six months of on-time payments. Secured cards may promote you to an unsecured version of the card and possibly increase your limit simultaneously.

2. Request a Higher Credit Limit

Credit card companies usually base your credit limit on income, debts, and credit history. When you request a higher limit, the issuer will usually make a hard credit inquiry, which may have a small impact on your score.

Over time, issuers want a rising credit score, a decreasing debt-to-income ratio, and a clean payment history. Your chances for an increase diminish if you miss a payment date, your credit score falls, your salary stagnates, or you owe more money.

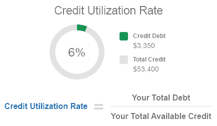

To raise your credit score, you must pay your bills on time and reduce your credit utilization ratio (i.e., your unpaid credit card balances divided by your total available credit). FICO sets the optimal CUR target at 1%, whereas VantageScore prefers a CUR below 30%.

Card issuers also look at your income and DTI ratio, which ideally will have improved since the last time the issuer evaluated your credit limit. Before raising your credit limit, issuers want reassurance that you can pay your bills on time.

A long and loyal relationship with a credit card issuer helps, to a certain extent, but only if you never miss a payment. It also helps to pay your balances in full each month (or at least pay more than the minimum amount due). It would be best if you didn’t ask for an increase more than once every six months; never ask before you hit the six-month mark.

When speaking to a customer representative about a higher limit, be patient, kind, and not overly greedy — these traits are important for success. Asking for an increase greater than 25% may raise a red flag, suggesting to the issuer that you are in financial distress.

3. Reallocate Credit

Some card companies allow you to redistribute your credit limits if you own multiple cards from the same issuer. For example, if your limits are $10,000 on Card A and $20,000 on Card B (both from the same card issuer), you can reallocate your limits to $5,000 on A and $25,000 on B.

This scenario may appeal to you if, for instance, Card B offers higher travel rewards and you’re about to take a trip.

Chase offers a sweet deal. If you reallocate your Chase Ultimate Rewards points from an eligible card (such as Chase Freedom Unlimited®) to a Sapphire card, the transferred points are worth 25% to 50% more when you redeem them for travel through Chase.

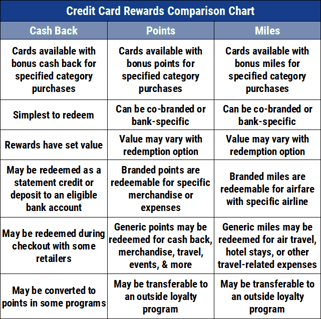

Is Cash Back Better Than Points and Miles?

The best credit card rewards for you depend on your needs and preferences. Issuers offer many excellent cards with rewards in the form of cash back, points, or miles. The following chart compares your options:

Cash back is a post-purchase cash rebate on the items you buy. Depending on the card, you can receive your cash back as a check, a deposit to your bank account, a statement credit, or a gift card.

In addition, many cards let you redeem your cash back directly from select merchants and/or online rewards portals, such as Chase Ultimate Rewards.

For frequent travelers, a credit card that dispenses rewards in points or miles can be advantageous. You typically earn one point/mile for each dollar you spend (i.e., 1X), but bonus reward rates, up to 5X or more, are often available on purchases from select merchants.

The redemption value of your non-cash rewards depends on several factors, including what you redeem them for and the nature of the rewards. Points are flexible because you can cash or transfer them to participating airline and hotel loyalty programs.

Miles are less flexible and come in two types:

- Airline cards that are co-branded, which means they reward you with an airline’s frequent flyer miles. You can’t cash in these miles or transfer them to competing airlines (although you can use them for flights on partner airlines).

- Other credit cards issue general-purpose miles that you can use to purchase flights from any airline.

Co-branded miles can sometimes be a better choice than cash back, but we recommend getting a point or cash back card in most situations. That’s because redeemed miles are often worth less than the nominal rate of one cent per point, and you cannot exchange these miles for cash.

Cash back cards are easy to understand because their cash value is explicit — there’s no guesswork involved. That’s why we recommend cash back cards, but there is a solid case for owning multiple cards with different rewards.

You may maximize your rewards using your miles/points cards for travel redemptions and your cash back card for everything else.

What Are the Pros and Cons of a High Credit Limit?

You’d think a high credit limit is intrinsically a good thing. But prudence suggests you consider both sides of the argument before you decide to get a high-limit card (or ask for an increase).

Pros of High Credit Limit

A high credit limit or credit limit increase confers several advantages, including the following:

- Purchasing power: A high credit limit allows you to make big-ticket purchases without using multiple credit cards or paying in cash.

- Credit utilization ratio: A credit limit increase can lower your CUR, but only if you don’t go on a spending spree. A lower CUR helps to improve your credit score.

- Your creditworthiness: A high credit limit testifies to your creditworthiness and makes you a more trustworthy borrower.

- Rewards and benefits: Premium credit cards offer better perks for cardmembers with high credit limits. For example, these cards may offer more generous rewards and a greater variety of valuable benefits (although they may charge a stout annual fee).

- Emergency funds: A higher credit limit can be a backup if you face an unexpected financial situation or emergency expenses.

Please don’t consider a high credit limit as a license to spend more than you can afford to pay back. Staying within your budget and avoiding high-interest debt are responsible ways to manage your credit.

Cons of a High Credit Limit

While a high credit limit delivers several advantages, be mindful of the following possible disadvantages:

- Potential overspending: A high credit limit may tempt you to overspend, thereby accumulating debt that may be difficult to repay.

- Interest charges: A high credit limit means you can carry a higher unpaid balance, which can result in interest charges on the amount you don’t repay each month.

- Credit score impact: Asking for a higher credit limit usually results in a hard pull of your credit, which can impact your credit score (although the effect is small).

- Overreliance on credit: Although a high credit limit provides more purchasing power, remember that a credit line is not a substitute for saving and investing. Relying too heavily on credit can lead to financial challenges should an unexpected expense arise.

Whatever your current credit limit, please weigh the pros and cons of a credit limit increase. We recommend you request a boost only if you have a real need and can handle it responsibly.

Compare Cash Back Cards With High Limits

OK, dear reader, we’ve given you a wealth of information about cash back credit cards with high spending limits. We even described the downsides of a credit limit that’s too high.

Now the decision is yours. We recommend you compare the costs and benefits of the cards we’ve reviewed in this article. When you’ve selected the winner, enjoy the card’s benefits but do so responsibly.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![11 Highest-Limit Cards for Bad Credit ([updated_month_year]) 11 Highest-Limit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/highlimit.png?width=158&height=120&fit=crop)

![7 Highest-Limit Travel Credit Cards ([updated_month_year]) 7 Highest-Limit Travel Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Travel-Credit-Cards.jpg?width=158&height=120&fit=crop)

![11 Highest-Limit Air Miles Credit Cards ([updated_month_year]) 11 Highest-Limit Air Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Air-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![6 Highest-Limit Chase Credit Cards ([updated_month_year]) 6 Highest-Limit Chase Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Chase-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Highest-Limit Citi Credit Cards ([updated_month_year]) 5 Highest-Limit Citi Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Citi-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Highest-Limit Student Credit Cards ([updated_month_year]) 7 Highest-Limit Student Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Highest-Limit-Student-Credit-Cards.jpg?width=158&height=120&fit=crop)

![13 Highest Cash Back Credit Cards ([updated_month_year]) 13 Highest Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Highest-Cash-Back-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year]) 9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-No-Limit_High-Limit-Prepaid-Debit-Cards--1.jpg?width=158&height=120&fit=crop)