With the best no limit/high limit prepaid debit cards, you can create a realistic monthly budget without worrying about a card’s low spending limit.

A prepaid debit card isn’t a credit card. Instead of relying on a line of credit, these cards act much like a debit card and only allow you to spend whatever money you have loaded onto the card. So instead of incurring debt, these cards make it easy to complete online and in-person purchases without the risk of carrying cash.

The Best No Limit/High Limit Prepaid Debit Cards

We’ve spent a lot of time researching the best prepaid debit cards on the market to make sure our rankings reflect all of the things that matter to you, including ease of use, low costs, and high spending limits.

The best prepaid debit card options below all meet that criteria. Just remember that a prepaid debit card is not a credit card — so using one will not help you build or rebuild your credit score.

Brinks has helped secure money for more than a century, which makes the financial institution a no-brainer for storing your money for use with a prepaid debit card. You can use your Brinks prepaid account to store up to $15,000.

PayPal is well known as the most popular way to virtually send and receive money online, but the company also offers a prepaid Mastercard that is among the best in the industry and allows you to load up to $15,000 onto your account.

The PayPal Prepaid Mastercard® connects to your PayPal account and allows you to move money to and from your account quickly while earning a cash back bonus for using your card. You can receive your paychecks faster by having them automatically deposited into your Paypal account through direct deposit.

This card allows you to spend up to $5,000 per day — which is much higher than most cards in this space. The ATM withdrawal limit is $940 per day.

The NetSpend® Visa® Prepaid Card has long been among our favorite prepaid cards because it is flexible and charges lower fees than most cards in the space. The Netspend Prepaid Visa Card also allows you to maintain a balance of up to $15,000 on your account at any time.

Aside from its low costs, every NetSpend cardholder also receives overdraft protection that allows you to spend up to $10 more than your account balance without incurring an overdraft fee. That’s an important perk if you tend to overspend from time to time.

The daily spending limit for the Netspend Prepaid Visa is $4,999, and the daily ATM withdrawal limit is $940. Plus, you can load up to $7,500 in cash in a day.

The Brink’s Armored™ Account comes with a mobile application that allows you to view your account balance, deposit money electronically, review past transactions, and stay updated on offers from Brinks’ partners.

The NetSpend® Visa® Prepaid Card works like its sibling card that’s ranked at No. 2 on this list. The main difference between the two is that this card has a flat monthly maintenance fee that does not change. Both cards allow you to deposit up to $15,000.

The other card can feature a lower fee if you meet certain deposit and spending requirements. If you don’t meet those requirements, though, the fee on that card can exceed what you’d normally pay for this card. Consider this option if you aren’t a heavy spender or may not take advantage of the direct deposit feature.

The daily spending limit for the NetSpend® Visa® Prepaid Card is $4,999, and the daily ATM limit is $940. Plus, you can load up to $7,500 in cash in a day.

The Serve® American Express® Prepaid Debit Account is more than just a prepaid debit card with a $15,000 deposit limit. This full account allows you to safely store your savings and gives you access to direct deposit options that gets you paid faster.

American Express Serve card members also have access to a large network of free ATM machines throughout the U.S., as well as a robust mobile application that gives you several tools to manage your card account. This card caps monthly spending at $15,000 and allows a cash withdrawal limit of $750 each day through an ATM. You can load up to $2,500 in cash each day.

The Bluebird® American Express® Prepaid Debit Account is a rare prepaid account that doesn’t charge monthly maintenance fees or a transaction fee. This affordable account gives you access to free Moneypass ATM locations, and you can deposit up to $15,000 into your high limit account.

Just realize that this card has fees that can quickly offset the lack of monthly maintenance charges. You’ll have to pay a hefty ATM fee for out-of-network withdrawals and as much as a 5% fee to have same-day check clearing. Typical clearing time without a fee can take up to 10 business days to give you access to your money. Instead of daily spending limits, this card places a monthly spending limit of $15,000 on all cardholders.

The Mango Prepaid Mastercard® has no hidden fees that can pop up and surprise you — but that doesn’t mean the card doesn’t charge cardholders for common activities. Although this convenient and secure card is a good option for new prepaid debit card users, it’s not the most affordable card on this list.

You can expect to pay a monthly maintenance fee with this card if you have less than $800 in monthly direct deposits. If your card is inactive for more than 90 days, your maintenance fee will nearly double. You’ll also see an ATM fee on top of whatever fee the ATM operator charges. Prepare also to pay up to $1 each time you check your balance through an ATM machine. That said, Mango maintains a mobile application that allows you to check your balance for free.

The maximum daily spending limit for the card is $2,500, and the daily ATM limit is $500.

The ACE Elite™ Visa® Prepaid Debit Card is a convenient and affordable way to maintain a prepaid debit card — as long as you reside near an ACE Credit Express location. From there, you can load and withdraw money from your account without a fee. At other locations, you’ll have to pay a fee for either type of transaction.

This card has a high spending limit with a cash withdrawal limit of up to $940 per day from ATMs and up to $5,000 each day at a bank counter.

Additional Disclosure: Walmart MoneyCard® is a debit card offer.

*Please see site for full terms and conditions.

The Walmart MoneyCard®, issued by Green Dot Bank, is an ideal choice for anyone who shops at Walmart. You can earn cash back rewards of up to 3% on eligible purchases.

This card allows you to deposit $3,000 a day, up to a maximum balance of $10,000. However, the card’s account terms say that, “…we may, in our sole discretion, allow your Account balance to exceed this limit.”

What is a Prepaid Debit Card?

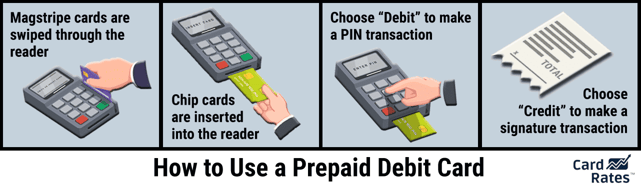

A prepaid debit card acts the same as a traditional bank or credit union debit card, but it does not require a bank account, checking account, or savings account for activation. Instead, you’ll create a secure card account with the card issuer where your money is stored until you spend it through your prepaid debit card.

Whereas a bank card would allow you to deposit money by visiting the financial institution, you can add money to your prepaid account by visiting a cash reload station — which varies by the card issuer.

For example, you can perform cash reloads on your ACE Elite™ Visa® Prepaid Debit Card at one of more than 950 ACE Cash Express locations throughout the U.S. The NetSpend® Visa® Prepaid Card provides cardholders with more than 130,000 cash reload locations in the U.S., including select grocery stores, convenience stores, and check cashers.

The PayPal Prepaid Mastercard®, links directly to your PayPal account and allows you to accept and send money and reload your account from several different sources.

Keep in mind that you may incur a reload fee when adding money to your account. The amount of your fee will depend on the card issuer.

You can also use any of the prepaid cards ranked above to accept direct deposits from your paycheck or other government benefits checks. This helps you get paid up to two days earlier than you would if you were to receive a paper check in the mail. Your card issuer may also allow you to access a mobile check deposit feature through its mobile application that lets you deposit a paper check virtually.

Prepaid debit cards operate on a credit card network. This means that your transactions will process through the Visa, Mastercard, or American Express network. This allows you to pay for items online or at the register while also paying bills or conducting other debit-based transactions.

But the presence of a credit card network logo does not make this a credit card. Since your prepaid debit card does not come with an associated line of credit, your card activity will not be reported to any of the three major credit bureaus. That means that you cannot build or rebuild your credit score with a prepaid debit card.

And your reloadable prepaid card will not have a credit limit since there’s no credit attached to the account. Instead, your card may carry a daily or monthly spending limit that allows you to spend up to a certain amount of your deposited money via purchase transactions or ATM withdrawals.

Despite that limitation, a prepaid card is a great way to stick to a budget and avoid the risk of carrying large amounts of cash.

How Do I Get a Prepaid Debit Card?

A prepaid debit card is easier to obtain than a credit card because it doesn’t require a credit check or access to your credit score.

Many prepaid cards are sold over the counter at grocery stores and convenience stores, where you can purchase your card and deposit money into your card account right away at the register. You can also apply for many of the top prepaid cards online.

A prepaid card is similar to a gift card in that they allow you to load — and reload — money onto the card and spend up to your total balance to make purchases wherever you choose. You will need to provide the card issuer with some personal information when creating your account, which may include:

- Your name

- Your address (physical and email)

- Your phone number

- Your Social Security Number (though some cards don’t require a SSN)

The card issuer uses this information to verify your identity and create an account under your name. You will use this account like you would a bank account — to deposit or withdraw money and accept direct deposits and cash paper checks.

If you apply for a prepaid debit card online, the card issuer will create your card as soon as it approves your account. You will receive it in the mail within seven to 10 business days, and you can begin using your card account as soon as it arrives in the mail.

Which Prepaid Card Has the Highest Limit?

A drawback of some prepaid debit cards is that they place different types of limits on cardholder activity. This may be a limit on how much money you can deposit into your account or a limit on how much money you can spend or withdraw from an ATM in one day.

Just as in the credit card world, you want to find a prepaid debit card with high limits that won’t restrict your financial transactions.

For example, a card with a lower balance limit may prevent you from receiving your direct deposit paycheck. This may also be a problem if you’re good at saving money and want to build a nest egg for a rainy day.

All of the cards ranked above cap your balance at $15,000.

The ACE Elite™ Visa® Prepaid Debit Card spending account has the highest limits on this list when considering withdrawal power. With this card, you can withdraw $940 per day from ATMs and up to $5,000 each day at an ACE Cash Express counter.

- Manage and control your money on one convenient reloadable prepaid card

- Get paid up to 2 days faster with direct deposit

- No-fee cash withdrawals of up to $100 at ACE with regular Direct Deposits

- When you use your card for everyday purchases, you can earn offers to redeem for cash back rewards at select retailers.

- Choose from 3 card designs

- As a cardholder, you can open a Tiered Optional Savings Account. Balances up to $1,000.00 currently earn up to 5.00% annual percentage yield. No minimum balance required.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

The NetSpend® Visa® Prepaid Card spending account allows cardholders to spend up to $4,999 each day using their available balance.

Although a high spending and deposit limit is a very important aspect to consider when selecting the prepaid card that’s best for you, be sure that you understand all of the other details of the card before submitting an application.

Some cards that have very high limits also come with very high fees that can quickly eat away at your savings and make it difficult to take advantage of those high limits.

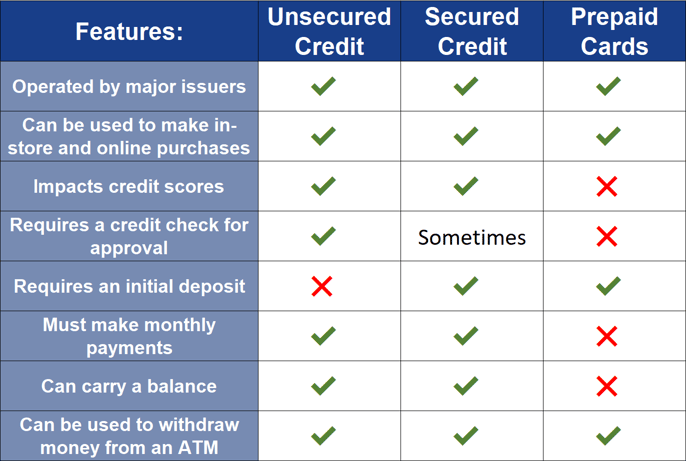

Can a Prepaid Card Help Me Build Credit?

A prepaid debit card does not come with an associated line of credit, so your card activity will not be reported to a credit bureau and can’t help you build credit. To build credit, consider a secured credit card that requires a refundable security deposit for approval and activation. A secured card is sometimes referred to as a prepaid credit card.

In most cases, you can qualify for a secured card without a credit check. Most of these credit cards will base your credit limit on the amount of your security deposit. For example, a deposit of $500 will yield a card with a $500 credit limit.

You can use a secured credit card as you would a traditional unsecured credit card — to make online and in-store purchases, to pay bills, or to rent a car or hotel room. Your card issuer will also report your payment and balance history to at least one credit bureau, which will help you build or rebuild your credit score over time with responsible behavior.

Your deposit will not serve as a payment for your secured card account. Instead, the card issuer will hold your deposit in a savings account and use it as a backing in case you fail to repay your credit card debt.

This is like a security deposit when you rent an apartment. If the home is in good condition when you move out, the landlord will refund your deposit. If you trash the place, the landlord will keep the deposit to cover the cost of repairing the damages.

You must make a monthly payment to cover whatever charges you make with your secured credit card. Any unpaid balance will incur interest charges. When you close your account, the card issuer will refund your deposit, minus any remaining balance or fees due on your card account.

This is a great way to build credit. And since you can essentially choose your credit limit, you can use your secured credit card as a budgeting tool that won’t entice you to take on too much debt that can quickly lead to financial troubles.

And if you choose a secured card issuer that also provides unsecured credit card options, you could eventually qualify for a better credit card — potentially one with cash rewards — that won’t require a deposit. If that happens, the card issuer will upgrade your card and refund your security deposit automatically.

What Credit Score Do I Need to Get a Prepaid Card?

Your credit score does not matter when you apply for a prepaid debit card. That’s because a prepaid card is not a credit card and doesn’t rely on your credit history for approval.

Instead, you must deposit cash into your reloadable prepaid card account to use your card. Your purchase power is limited to the amount of money you have in your account. There is no associated revolving line of credit with a prepaid card account.

In most cases, you can apply for and receive a prepaid debit card by filling out a short online form that includes your name, address, phone number, and Social Security number.

You can visit one of your card’s reload stations (often a grocery or convenience store) to add money to your account. You can also mail in a paper check or initiate an electronic funds transfer from an existing bank account.

What Fees do Prepaid Debit Cards Charge?

Although prepaid debit cards provide easy access to a reloadable prepaid card and account, many cards charge several fees that can eat away at your savings.

Here are some examples of the fees that your card issuer may charge. Study your card disclosure document before applying to make sure you understand just how much your card will cost you.

- Maintenance fee: This is a monthly fee that the card issuer may charge for maintaining your account. Fees vary by card type, but you could qualify for a reduced or waived monthly fee if you maintain a certain balance in your account or receive direct deposits into your card account.

- Transaction fee: You can conduct several types of transactions with your prepaid debit card, and all may come with a fee. This may include a fee when you make a purchase or withdraw money from an ATM operator. It may also include a fee for checking your balance through an ATM machine or even a fee when you add money to your account.

- Overdraft fee: Most prepaid cards will not allow you to spend more than the amount deposited into your account. The cards that do allow you to exceed your balance may charge an overdraft fee if you go past your account balance. You may also qualify for an overdraft protection program that reduces the fee if you go over your balance.

- Deposit and withdrawal fees: You may incur charges, such as as an ATM withdrawal fee, if you attempt to withdraw money from your account through an ATM or at a reload location. A similar reload fee may apply when you deposit money into your account via cash or mobile check deposit.

- New card fee: You may have to pay a fee when the card issuer creates your first card or sends you a replacement card. This is similar to when you purchase a prepaid Visa card or a Visa debit card in a storefront and have to pay a fee for the card itself.

The fees you pay, and the amount the card issuer charges you, will vary depending on the card you add to your wallet. The possible fees listed above aren’t the only fees you may encounter but are an example of the most common fees that prepaid cards charge.

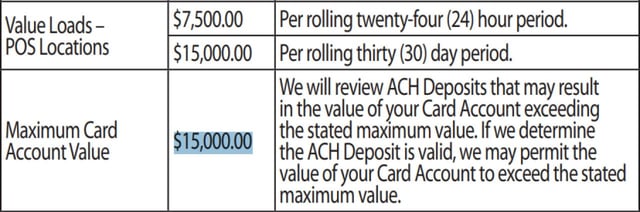

What is the Maximum Amount You Can Load Onto a NetSpend Card?

NetSpend has several prepaid cards within its portfolio, and they all have the same limits that allows a NetSpend cardholder to load as much as $15,000 into their card account.

Netspend will allow you to have up to $15,000 in your account at any time. You cannot deposit more than $15,000 within a 30-day period.

When using your card, you can spend up to $4,999 each day without restrictions.

Is There a Maximum Amount You Can Load Onto a Visa Prepaid Card?

Most Visa prepaid card options will allow you to load up to $15,000 into the card account. If you’re accessing a reloadable prepaid card, you can continue to add money to your account when you spend some of your current balance.

In either scenario, though, you cannot surpass the $15,000 account balance limit.

How Can I Withdraw More Than My Card’s Daily Limit?

Some card issuers will allow you to temporarily surpass your card’s daily spending limit if you call the issuer’s customer service number located on the back of your card.

When speaking to a customer service rep, you can request a temporary spending limit increase that will allow you to complete a large transaction within a 24-hour period.

Research the Best No Limit/High Limit Prepaid Debit Cards Online

Many consumers turn to prepaid debit cards to help them securely store and save their money. These cards are great for setting a budget or helping you make online purchases where cash isn’t a payment option.

But not every prepaid debit card is the same. Some may severely limit your spending power by capping how much money you can load into your account or how much you can spend using your card each day. But with the best no limit/high limit prepaid debit cards listed above, you can build your nest egg savings and make larger purchases without worrying about a merchant declining your card.

Just remember that a prepaid card won’t help you build credit. If you want to work on improving your credit score so you can eventually qualify for a personal loan, auto loan, or mortgage, consider a secured credit card that will report your account activity and provide an affordable entry-level experience in the credit card world.

A secured card won’t disqualify you solely based on your credit score and will potentially give you a path toward qualifying for a better unsecured credit card over time.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year]) 7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/fair-credit-limits-art.jpg?width=158&height=120&fit=crop)

![16 High Limit Credit Cards for Excellent Credit ([updated_month_year]) 16 High Limit Credit Cards for Excellent Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/highlimitcover.jpg?width=158&height=120&fit=crop)

![11 Best High-Limit 0% APR Credit Cards ([current_year]) 11 Best High-Limit 0% APR Credit Cards ([current_year])](https://www.cardrates.com/images/uploads/2023/03/Best-High-Limit-0-APR-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 High-Limit Secured Credit Cards ([updated_month_year]) 5 High-Limit Secured Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/05/High-Limit-Secured-Credit-Cards.jpg?width=158&height=120&fit=crop)

![9 High-Limit Business Credit Cards ([updated_month_year]) 9 High-Limit Business Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/06/High-Limit-Business-Credit-Cards.png?width=158&height=120&fit=crop)

![6 Best Prepaid Debit Cards with No Fees ([updated_month_year]) 6 Best Prepaid Debit Cards with No Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/prepaid--1.png?width=158&height=120&fit=crop)

![9 Best Prepaid Debit Cards For Minors ([updated_month_year]) 9 Best Prepaid Debit Cards For Minors ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Prepaid-Debit-Cards-For-Minors.jpg?width=158&height=120&fit=crop)

![6 Custom Prepaid Debit Cards ([updated_month_year]) 6 Custom Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Custom-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)