You (or your parents) have worked hard and done well, so why not celebrate by applying for a few luxury credit cards? For this article, we’re only covering cards with an annual fee of at least $199.

Truth be told, many good credit cards cost less. We’ve drawn the line at a price point that buys you multiple premium benefits and card membership rewards.

Luxury credit cards provide perks you can’t get with (most) everyday credit cards. But different cards have different strengths, and some offer a better cost-benefit balance than others. This review makes sense of it all and should help you decide which cards deserve your consideration.

-

Navigate This Article:

Best Overall Luxury Credit Card

There can be only one best credit card. In this case, it’s not the most expensive premium card or the hardest to get. Chase Sapphire Reserve® doesn’t come cheap, but travelers will find it pays for itself and then some.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Although Chase Sapphire Reserve® has a steep price tag, it offers generous rewards, travel rebates, annual credits, and extensive protections and conveniences. Furthermore, this card’s Chase Ultimate Reward points gain 50% in value when you redeem them in the Chase Travel portal.

You also receive access to select airport lounges and exclusive hotel property benefits. The card offers the best travel insurance coverage in the industry, including primary collision damage waiver on rental cars.

Best Luxury Cards For Flights & Airport Lounge Access

A luxury card should make travel easier and more pleasant. These cards succeed by offering lounge access, free flights and seat upgrades, generous travel rewards, and various credits, significantly reducing their net cost.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$395

|

Excellent

|

The Capital One Venture X Rewards Credit Card provides a signup bonus and better card membership rewards than those offered by many of its competitors. You and a guest can access the exclusive Capital One Lounge network and more than 1,300 partner lounges, including the Priority Pass™ and Plaza Premium networks.

You earn generous bonus miles on the flights you book through Capital One Travel and even more for hotel and rental car bookings. Venture X provides an anniversary credit and a yearly reimbursement on bookings made through its travel portal. You can transfer the points from this Visa Infinite card to more than a dozen travel partner programs.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Chase Sapphire Reserve® card is your invitation to the bank’s growing lounge network, Chase Sapphire Lounge by The Club. New lounges are going up in New York, Boston, San Diego, Phoenix, and Hong Kong, among other as yet unannounced locations.

Each Sapphire Reserve cardholder can bring two guests at no charge. The card also provides complimentary access to more than 1,300 Priority Pass lounge locations worldwide.

4. Citi® / AAdvantage® Executive World Elite Mastercard®

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Citi® / AAdvantage® Executive World Elite Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Citi® / AAdvantage® Executive World Elite Mastercard® gives you a free American Airlines Admirals Club membership. The card provides you and two guests complimentary access to more than 50 lounges across the globe.

Cardmembers get priority check-in and screening (where available), as well as early boarding when flying on American. You also get free baggage check, TSA Precheck reimbursement, and no foreign transaction fees on purchases.

- Earn 80,000 Membership Rewards® points after you use your new card to make $6,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% – 27.49% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® provides complimentary access for you and two guests to more than 1,400 members of the Amex Global Lounge Collection. The collection includes American Express Centurion, Delta Sky Club, and Lufthansa lounge locations.

In addition, you get an annual airline credit from the American Express Platinum Card when you charge incidental travel fees on one qualifying airline. The Amex Platinum card reimburses the membership cost of CLEAR, which provides touchless ID for faster passage through airport security.

- Earn 90,000 Bonus Miles after you spend $6,000 in purchases on your new card in your first 6 months of ownership

- Earn 15,000 Medallion Qualification Miles after you spend $30,000 in purchases on your card, up to 4 times/year

- Earn 3X miles on Delta purchases made directly with Delta — all other purchases earn 1 mile per $1

- Complimentary access to The Centurion Lounge and the Delta Sky Club® plus two Delta Sky Club One-Time Guest Passes each year

- Receive a domestic First Class, Delta Comfort+®, or Main Cabin round-trip companion certificate each year upon renewal of your Delta SkyMiles Reserve American Express card

- As a benefit of Card Membership, you can check your first bag free on Delta flights booked with your card. You can save up to $60 on a round-trip Delta flight per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% – 29.24% (Variable)

|

$550

|

Excellent

|

The Delta SkyMiles® Reserve American Express Card provides complimentary Delta Sky Club access. Cardowners receive two complimentary one-time Sky Club guest passes each year.

You also get complimentary access to the American Express Centurion Lounge Network when you book a Delta flight with the Reserve Card. In addition, you receive an annual companion certificate for one complimentary round-trip Delta flight in an upgraded class.

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1.5% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $100 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Black Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Black PVD-Coated Metal Card: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $495 ($195 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$495 ($195 for each Authorized User added to the account)

|

Excellent

|

The Mastercard® Black Card™ provides complimentary admission to more than 1,300 airport lounges, mini-suites, and airport restaurants with Priority Pass Select. Access includes unlimited visits for you and your guests.

Luxury Card Concierge can arrange entry to the best five-star restaurants and spa services anywhere you travel. You also receive an annual airline credit, reimbursement for TSA Precheck and Global Entry charges, and several travel protections.

Best Luxury Cards For Hotel Benefits

You can’t enjoy a luxury experience at a fleabag hotel. These cards ensure a better fate by offering premium hotel benefits that should please discerning travelers.

- Earn 80,000 Membership Rewards® points after you use your new card to make $6,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% – 27.49% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® treats you to an annual credit when you book and prepay reservations through Amex Travel for more than 1,200 properties that belong to Fine Hotels + Resorts or The Hotel Collection (minimum two-night stay).

All prepaid hotel bookings earn high bonus points when you use Amex Travel. You can also enroll to receive Marriott Bonvoy and Hilton Honors Gold Elite Status, which entitles you to upgraded rooms and late check-out times (based on availability), among other benefits.

- Earn 150,000 Hilton Honors Bonus Points after you spend $4,000 in purchases on the card within your first 3 months of Card Membership

- Earn 14X points on hotels and resorts in the Hilton portfolio

- Earn 7X points on select travel, including flights booked directly with airlines or AmexTravel.com and car rentals booked directly with select car rental companies, and at US restaurants, including takeout and delivery. Earn 3X points on other eligible purchases.

- Enjoy complimentary Hilton Honors Diamond status with your Hilton Honors Aspire Card

- Enjoy one weekend night reward with your new Hilton Honors American Express Aspire Card and every year after renewal. Plus, earn an additional night after you spend $60,000 on purchases on your card in a calendar year.

- $450 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% – 29.24% (variable)

|

$450

|

Good/Excellent

|

The Hilton Honors American Express Aspire Card is your passport to elevated travel, starting with an especially lucrative signup bonus. You also earn generous rewards for eligible purchases at hotels and resorts in the Hilton portfolio.

Cardmembers earn complimentary Hilton Honors Diamond status with the Hilton Honors Aspire Card. You also get an annual statement credit and weekend night rewards for eligible purchases at Hilton resorts.

Best Luxury Cards For Dining & Entertainment

These cards give you a luxurious alternative on those occasions when you want something better than greasy fast food. Cardholders will savor the opportunities these cards provide for fine dining and sparkling entertainment.

- Earn 60,000 Membership Rewards® points after you spend $4,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the Gold Card at Grubhub, Seamless, Boxed and other participating partners. This can be an annual savings of up to $120. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. A minimum 2-night stay is required.

- $250 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% – 28.49% Pay Over Time

|

$250

|

Excellent

|

The American Express® Gold Card ranks on top due to its high reward rate for restaurant dining, including takeout and delivery. And to support home dining, the card offers the same reward rate for grocery shopping and a special Uber Cash deal.

Cardmembers get exclusive access to ticket presales and events, including Broadway shows and concert tours. With Preferred Seating, you can get premium seats for select cultural and sporting events based on availability.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Chase Sapphire Reserve® offers generous rewards on Chase Dining purchases when you make prepaid restaurant reservations, order takeout, or join virtual cooking events through Chase Ultimate Rewards. You also earn high rewards on any other dining purchases worldwide.

The card gives you a free DashPass membership for at least 12 months, a handy money-saver when you order food delivery. And you’ll earn bonus points for Lyft rides, which is a safe alternative after a night of celebrating. You also get a special Uber Cash credit.

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1.5% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $100 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Black Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Black PVD-Coated Metal Card: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $495 ($195 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$495 ($195 for each Authorized User added to the account)

|

Excellent

|

The Mastercard® Black Card™ offers a concierge service that can help you book a dining or entertainment experience worldwide. The service will allow you access to exclusive concert and event tickets any time, day or night. The card is less expensive than the Mastercard® Gold Card™ but provides most of the same benefits.

You also can have the concierge service plan sightseeing and hiking trips for you and your family. Beyond making dinner reservations, the service can help you sift through restaurants to meet your dietary restrictions.

Best Business Luxury Cards

Those who think you can’t mix business with pleasure should think again. These cards prove that the two mix quite well. If you own or run a business, you deserve nothing less.

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Use Membership Rewards® Pay with Points for all or part of an eligible fare and get 35% of those points back, up to 1,000,000 points back per calendar year

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.74% – 26.74% Pay Over Time

|

$695

|

Excellent

|

The Business Platinum Card® from American Express provides lavish reward points for flights and prepaid hotels you book through Amex Travel. You earn annual statement credits for the money you spend recruiting new hires on Indeed and purchasing high-tech products from Dell Technologies.

With this Platinum American Express card, you can use employee cards to stay on top of your expenses. Employees can buy what they need (within the limits you set) as authorized users. You’ll earn rewards on each eligible purchase they make and receive real-time alerts to help you control their spending.

- 60,000 Bonus Points after you spend $5,000 on purchases in your first 3 months from account opening

- 9 points total per $1 spent at Hyatt – 4 Bonus Points per $1 when you use your card at Hyatt hotels & 5 Base Points per $1 from Hyatt as a World of Hyatt member

- 2 Bonus Points per $1 spent in your top three spend categories each quarter through 12/31/24, then your top two categories each quarter.

- 2 Bonus Points per $1 spent on fitness club and gym memberships

- 1 Bonus Point per $1 spent on all other purchases.

- Up to $100 in Hyatt statement credits – spend $50 or more at any Hyatt property and earn $50 statement credits up to two times each anniversary year.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49% – 28.49% variable

|

$199

|

Good/Excellent

|

The World of Hyatt Business Credit Card offers a healthy signup bonus when you spend the required amount in the first three months. Naturally, you earn the highest reward point rate for your stays at Hyatt and affiliated properties.

The Hyatt Leverage program can save you hundreds yearly through discounts on standard room rates. You’ll reach Explorist and Globalist status even faster by issuing employee cards.

- Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening.

- 9,000 bonus points after your Cardmember anniversary.

- Earn 4X pts on Southwest® purchases.

- Earn 3X points on Rapid Rewards® hotel and car rental partners.

- Earn 2X points on rideshare.

- Earn 2X points on social media and search engine advertising, internet, cable, and phone services and 1X points on all other purchases.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49% – 28.49% Variable

|

$199

|

Good/Excellent

|

The Southwest® Rapid Rewards® Performance Business Credit Card is a no-brainer for business people who fly on Southwest. You get a set number of upgraded boardings, reward point transfer credits, and bonus points each year, plus reimbursement for your TSA PreCheck and Global Entry fees.

Each Southwest Airlines eligible purchase earns you tier-qualifying points toward A-List status. You can get employee cards at no additional cost and earn points on employee spending. Southwest flyers get free baggage check and don’t have to pay change fees.

What Is Considered a Luxury Credit Card?

The typical luxury credit card costs a lot but returns even more. In this article, we arbitrarily set $199 as the minimum annual fee for inclusion.

That leaves several good credit cards out of the running, including Chase Sapphire Preferred® Card, Capital One Venture Rewards Credit Card, and the Blue Cash Preferred® Card.

Luxury credit cards offer exclusive benefits, including generous signup bonuses, ongoing premium rewards, airport lounge access, travel insurance, and many other benefits. These cards also come with a premium price tag, with several charging $550 or more annually to bring you all their luxury perks.

These credit cards are often status symbols because they’re geared primarily toward big spenders with excellent credit.

Here’s a partial list of the types of perks you can expect from a luxury credit card:

- A large signup bonus worth $500 or more

- Generous rewards (often 5x membership rewards or more)

- Cards are often metal construction

- Annual credits, usually for travel

- Exclusive deals

- Airport lounge access

- Consumer protections

- Travel and rental car insurance

- Low introductory purchase and balance transfer APRs

- High credit limits

Naturally, not every luxury credit card offers all these features, but a few do. These cards usually focus on travel, dining, and entertainment benefits, the types of activities that appeal to many affluent cardowners with high credit scores.

We consider Chase Sapphire Reserve® to be the quintessential luxury credit card, the one we measure other cards against. To be a top-rated luxury card, the issuer must provide good value.

Cardowners who fork over several hundred dollars a year want to know that the value of their benefits will exceed their annual fees. Luxury cards that don’t satisfy this trade off will have trouble competing for customers.

What Credit Score Do You Need For a Luxury Card?

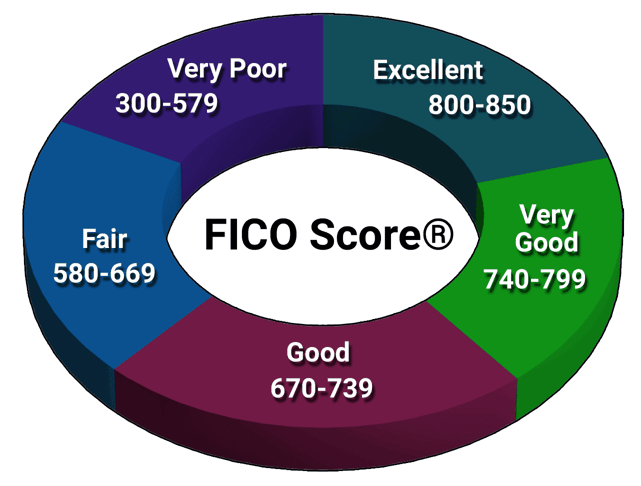

You typically need very good to excellent credit to get a luxury card. On the FICO scale, that translates to a minimum score of 740.

Truthfully, you can probably get most of the reviewed cards with a score of 700, as issuers often look beyond the number. They may consider your credit report, income, and debts when deciding whether to approve your application.

A card issuer must send you an Adverse Action Notice (AAN) if it declines your application. The notice explains the reasons for the rejection and the information sources on which it relied.

Typical justifications include low credit scores, a troubling credit report, insufficient income, and the inability to confirm your identity. It’s a good idea to treat an AAN as a helpful resource indicating what you must fix before reapplying.

What Is the Most Exclusive Luxury Card?

The American Express Centurion Card, or Black Card, is likely the world’s most exclusive credit card. It is notoriously expensive, costing $10,000 in the first year and requiring six-digit spending habits.

The card, a favorite among celebrities and the super-wealthy, is available by invitation only. It’s unclear how Amex decides who to invite, but it probably doesn’t hurt to have a long-standing relationship with the issuer. And lots of money.

The card is loaded with top-tier benefits, as you’d expect. Mere mortals can also get black credit cards, but not the one from American Express.

For example, the Visa Black Card became the Mastercard® Black Card™ in 2016. RBC Bank offers a black card, and the Marriott Bonvoy Brilliant® American Express® Card is a black-colored luxury card. You need no invitations for these look-alikes.

Are Luxury Credit Cards Worth It?

As with many of today’s great questions, the answer is a resounding “It depends.” Almost all luxury cards provide good value, but only if you take advantage of their benefits. If you prefer to stay home, there may be little point in shelling out several hundred dollars for a fancy travel card.

Moreover, excellent cards providing many desirable perks are available for less than $200 a year. For example, the Chase Sapphire Preferred® Card card offers impressive rewards and benefits for less than $100 a year.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

But a luxury card is the way to go if you want the best credit card privileges, such as access to airport lounges and exclusive venues.

Get a Credit Card That Matches Your Lifestyle

Luxury credit cards make sense when you can take advantage of their benefits. If you like to travel, dine out, and attend events, you may find that a premium card is well worth a steep annual fee.

The cards reviewed in this article have a high pamper quotient, each offering one or more benefits that may fit your lifestyle well. Best of all, you’re free to change your mind if you’re unhappy with a card’s tradeoffs. Always read the fine print so you’re aware of all the perks you’ll be getting for your money.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Luxury Card: Review & 3 Better Cards ([updated_month_year]) Luxury Card: Review & 3 Better Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/07/Luxury-Card-Review.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='29774' field_choice='title' link_type='none'] vs. The Luxury Card ([updated_month_year]) [card_field card_choice='29774' field_choice='title' link_type='none'] vs. The Luxury Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Chase-Sapphire-Reserve-vs.-Luxury-Card.jpg?width=158&height=120&fit=crop)

![6 Best Credit Cards for PPC & Google Adwords ([updated_month_year]) 6 Best Credit Cards for PPC & Google Adwords ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/PPC-Credit-Cards.png?width=158&height=120&fit=crop)

![7+ Best “2% Cash Back” Credit Cards ([updated_month_year]) 7+ Best “2% Cash Back” Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/2-percent.png?width=158&height=120&fit=crop)

![14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year]) 14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Rewards-Credit-Cards-with-No-Annual-Fee-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Cash Back & Travel ([updated_month_year]) 7 Best Credit Cards for Cash Back & Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Best-Credit-Cards-for-Cash-Back-Travel.jpg?width=158&height=120&fit=crop)

![12 Best “2% to 5%” Cash Back Credit Cards ([updated_month_year]) 12 Best “2% to 5%” Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-2-to-5-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Secured Credit Cards With Cash Back Bonus ([updated_month_year]) 5 Secured Credit Cards With Cash Back Bonus ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Secured-Credit-Cards-With-Cash-Back-Bonus.jpg?width=158&height=120&fit=crop)