Lots of good things are free just for asking, and some good things may be free even without asking. One such example is an increase in your credit limit for one or more of your credit cards.

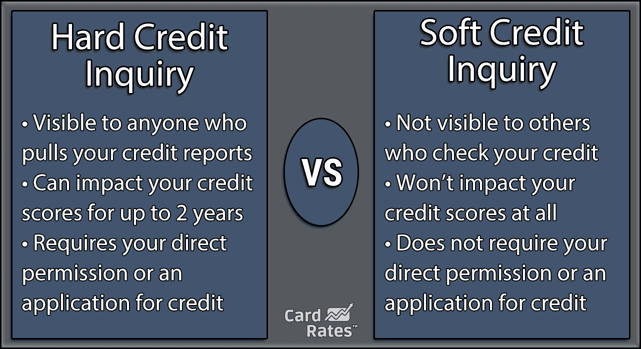

The advantage of getting a credit limit increase (CLI) without asking is that if you request a CLI, the issuer likely will use a hard pull to review your credit scores. A hard pull can knock a few points off your score. If you’re given an automatic CLI, or auto-CLI, there’s a better chance your issuer will use a soft pull (or soft inquiry), which shouldn’t affect your credit scores.

If you ask one card company for a CLI, the impact of a few shaved-off points may be minor. If you ask several companies, however, the impact on your credit score could be significant. What’s more, asking for a CLI could imply that you need more credit due to financial difficulties. In either case, asking for a CLI could hurt your chances of getting one.

So, how can you get a CLI without asking? Card companies have their own proprietary criteria for auto-CLIs, which they rarely disclose. Given the elusive nature of this information, your best approach may be a combination of strategy, patience, and luck.

Here are three steps you could take that may help.

1. Update Your Income

Your income isn’t the only factor card issuers may consider when they review your account for an auto-CLI, but it may be one of the more important. To understand why, it’s helpful to review how your income factors into card approval.

To get approved for a card, you’ll have to have at least some regular income. It could come from:

- A full-time or part-time job

- Self-employment

- Gig-economy hustle

- Investments

- Social Security or pension benefits

- Student financial aid

- Public assistance

- Your spouse

- Other sources

Card issuers expect you to have a verifiable income source so you can make at least the minimum payment each month if you use your card for new purchases or carry a balance. If you don’t have a steady income, you may be able to get approved for a card with a cosigner, if he or she has good credit and is willing to be equally responsible for your card payment.

Your income will be an important factor in your initial credit limit upon approval. The more you earn, the higher that limit will likely be.

If your income increases, you may receive a CLI. Your income could increase if you:

- Work more hours

- Get a raise

- Earn a minimum wage that’s increased by law

- Get married

- Graduate and get your first full-time job

- Other reasons

Keep in mind that card issuers don’t look at your income only as a raw number. They also consider how much of your income you have to use every month to make your minimum payments for your cards and other debt obligations.

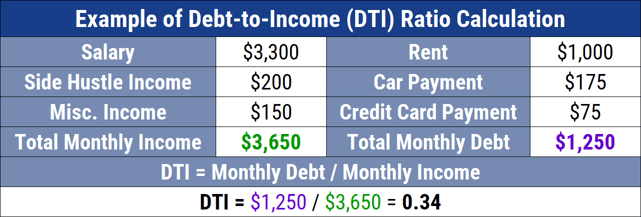

This percentage is known as your debt-to-income ratio, or DTI. Your DTI shows how well you’re able to manage the debt you have with the income you earn.

If your income increases and you don’t borrow or charge more, your DTI will improve because you’ll have more income to make your minimum payments. If your income increases and you do borrow or charge more, your DTI may not improve. The implication is that if your income increases, but you also add more debt, you may not see the auto-CLI you hoped for.

You don’t have to tell your card issuers you’re earning more but updating your income could encourage them to review your card accounts and raise your limits even if you don’t request a higher limit.

You may be able to update your income online. A phone call should work as well if your card issuer doesn’t offer that option.

2. Use Your Card Responsibly

Card issuers generally like customers who:

- Have good credit habits

- Have higher than average credit scores

- Make at least the minimum payment every month

- Pay on time (or early) every month

- Keep their account open for at least six months or preferably much longer

- Carry a balance

- Don’t max out their card

- Don’t try to charge more than their card’s limit

- Pay off other debt

- Don’t apply for more credit elsewhere

- Use their mobile apps

While it’s impossible to know for sure which, if any, of these behaviors will trigger an auto-CLI, it’s reasonable to assume that companies generally like to reward their customers’ good credit behavior. This suggests that any of these behaviors may — and we must emphasize may — help you get an auto-CLI.

3. Wait

It may seem odd that doing nothing could help you get an auto-CLI, but sometimes, as the saying goes, good things come to those who wait.

Card issuers generally review their customers’ income, payment history, and credit scores on a regular basis, so you may receive a CLI just because you’ve handled the credit you have well over time. To improve your chances, you may want to:

- Make your minimum payments on time every month

- Keep your existing credit accounts open

- Use a variety of different types of credit

- Avoid maxing out any of your credit cards

If your credit history and credit scores look good when your card issuers review your accounts, you may be rewarded with auto-CLIs for that reason.

Issuers with Automatic Credit Limit Increases

Below we’ll evaluate the credit card issuers that are known to provide automatic credit limit increases and their top card offers.

Capital One | Discover | Chase | Bank of America | Citi

Capital One

Capital One doesn’t disclose its parameters for automatic credit limit increases on its website, but it does state that if you have a Capital One card, you can request a credit limit increase. To make the request, you’ll have to share some information, such as your:

- Income

- Employment status (e.g., employed, self-employed, unemployed, retired or student)

- Monthly rent or mortgage payment

To improve your chances, you should:

- Make your card payment on time every month

- Pay more than the minimum

- Monitor your credit score

- Keep all your credit accounts in good standing (i.e., no delinquencies or defaults)

- Keep your income and employment status up to date

Your request may be approved if:

- Your account has been open at least three months

- Your card isn’t secured

- Your credit limit hasn’t changed in the previous six months

Approval may be immediate, or the decision could take a few days. The company will approve you for the highest limit it can allow. If you prefer a lower limit, you can choose that instead.

Capital One also has what’s known as the Credit Steps program, which reviews certain cardholder accounts for CLIs after five consecutive on-time payments. Below are select Capital One cards that may be eligible to receive an auto-CLI.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

“Over time, when you use your credit card responsibly, your credit score may begin to climb, and your credit limit can increase,” Capital One says.

Discover

Discover doesn’t disclose its criteria for CLIs on its website, but it does offer some general information about how card issuers determine card limits. Factors that, Discover says, may matter include your:

- Payment history

- Overall credit utilization ratio

- Credit utilization ratio for individual credit accounts

- Length of credit history

- Income

- Housing costs

- Recent credit inquiries

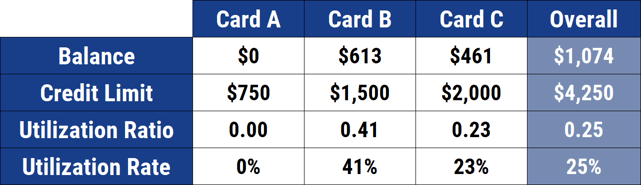

Your credit utilization ratio is the percentage of your available credit that you use. It’s normally tracked for each of your credit cards individually and all of your credit cards collectively.

You may be more likely to be approved for a CLI if:

- Your utilization ratio is low

- Your credit history is long

- Your rent or mortgage payment is low relative to your income

- You haven’t applied for a lot of new credit within a short period of time

Below are the best Discover cards they may be eligible to receive auto-CLIs.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

“The best way to increase your odds of a high credit limit is to make sure all the components that affect your credit score are in good standing,” according to Discover.

Chase

As with other credit-card issuers, Chase doesn’t mention auto-CLIs on its website. It does offer a smidgen of information about how to request a Chase credit limit increase.

“You may request an increase to your credit line by calling the number on the back of your credit card; you cannot submit a request online at this time. Your request for an increase to your credit limit is subject to the approval of Chase,” Chase states.

If you decide to call and ask, you’ll have to wait and see what response you’ll get, but here are some tips for approval.

Below are the best Chase cards that may be eligible to receive an auto-CLI.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The criteria Chase uses to approve or deny CLI requests aren’t disclosed.

Bank of America

Bank of America doesn’t discuss CLIs on its website, except to state that if you’re going on a trip, you can request a credit limit increase online or by phone.

To make a request online, sign in to Bank of America’s online banking, choose your credit card account, select Information & Services, choose “Manage your account” and then click on “Credit line increase.” If you don’t see that option, your account isn’t eligible for you to request a CLI.

To make a request by phone, call the toll-free number on the back of your Bank of America credit card.

Below are the top Bank of America cards that may be eligible to receive an auto-CLI.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don't expire as long as your account remains open.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% - 27.24% Variable APR on purchases and balance transfers

|

$95

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Bank of America generally requires account holders to wait a minimum of three to six months from account opening or their last increase before requesting a CLI.

Citi

Citi says on its website “There is no one-size-fits-all answer” to inquiries about CLIs. The company doesn’t disclose its criteria, but says you may be able to request a credit card limit increase “if you maintain timely payments and use your card in line with the terms and conditions of your card issuer.”

Citi says a higher limit may be useful if you’re planning to make large purchases and you can pay off your balance in full every month, but it’s important to think about your spending and whether you can responsibly manage a higher limit.

“Whether this is an option for you or not depends on several factors, including your credit history,” Citi says.

Below are the top Citibank cards that may be eligible to receive an auto-CLI.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024. - Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou® Points are redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% (Variable)

|

$95

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

How Do Credit Limit Increases Affect Your Credit Score?

Changes to your credit limits may affect your credit scores primarily in two ways:

Inquiries – When you request a CLI, your card issuer usually will review, or “pull,” your credit history and one or more of your credit scores. This is known as an inquiry or a pull. A hard pull indicates that you proactively requested additional credit; consequently, it may chop a few points off your scores. A soft pull normally won’t affect your scores. You typically don’t get to choose which type of pull your issuer uses when you request a CLI.

Utilization – A CLI will, by its very nature, increase the amount of credit you have available. If you continue to use the same amount of credit as you previously did, the CLI will lower your utilization ratio. If you start to use more credit, your utilization ratio may be lower, the same, or higher after you receive a CLI. A lower ratio may increase your credit scores, a higher ratio could lower your scores.

“Any time you make a change to your credit history, you may see a temporary dip in credit scores,” says credit bureau Experian. “However, increasing your credit limits on your credit cards will not likely hurt, and can help, your credit scores in the long run.”

Can Banks Increase Your Limit without Your Permission?

Yes, your card companies can increase or decrease your credit limits without asking for your permission, and they may have good reasons to do so.

Card companies are highly competitive, and they have a profit motive to attract and retain the best customers. If you’ve demonstrated that you’re a good credit risk, your card company may want to encourage you to use your card more and carry a higher balance.

A higher limit with the opportunity to boost your credit score and earn more card rewards may make you more loyal to that card. Maybe you’ll even stop using another card that you also like, or you’ll transfer a balance from another card to the one that gave you a new higher limit. Using your card more is what your card company wants you to do.

If you receive a credit limit increase, it may be just 10 or 15% of your previous limit or it could be as much as 30% or more. If you receive a higher limit that you don’t want, perhaps because you have a habit of overspending, you can contact your card company and ask to have your limit lowered.

How Often Do Credit Card Companies Increase Your Limit?

There’s no real discernible or predictable pattern to CLIs. Rather, the timing depends on your card issuer’s proprietary guidelines and your individual circumstances.

Over time, your card company may:

- Increase your limit repeatedly

- Give you a one-time bump

- Offer you a temporary increase as part of a balance transfer offer

- Never increase your limit at all

- Increase your limit only if you proactively request an increase

- Decrease your limit

Which of those actions occurs depends on a variety of factors, which may include:

- Your card companies’ guidelines

- The types of cards you have

- Your income and DTI

- Your card usage and payment history

- Your credit utilization ratios

- Your credit scores

- Other factors

It’s important to understand that card companies also increase or decrease card limits in response to economic trends and business developments.

For example, during the 2007-2009 economic recession, card companies noticed a rise in credit card delinquencies and defaults. To try to protect themselves from those losses, they lowered many consumers’ credit card limits. The possibility that your limit may be lowered even if you don’t carry a balance and make your payment on time every month is a good reason not to max out your cards.

Should You Always Accept a Credit Limit Increase?

For most people, the answer is probably yes. Higher credit limits enable you to charge high-dollar purchases without maxing out your cards or having your transaction declined.

Higher limits also give you the opportunity to earn more card rewards and become better prepared for financial emergencies that could tap out your savings. Another benefit is that your credit scores may go up, particularly if you receive a CLI, but don’t use a bigger percentage of your available credit.

“From the standpoint of increasing your credit scores,” says credit bureau Experian, “You can’t have too much available credit. Having a very low credit utilization ratio, such as one that’s under 10%, can only help your credit scores.”

Increasing your credit limit on one or more cards can lower your utilization rate and improve your credit score.

With higher scores, you may receive better offers for other loans, such as a mortgage or auto loan.

All that said, there’s one important caveat of CLIs, which is that higher limits could enable you to charge more than you can afford. If you’ve had trouble using credit responsibly in the past or you feel you may overspend in the future, a CLI may be a “no” for you.

Earn More Spending Power with a Limit Increase

Auto-CLIs can be unpredictable and even surprising since card companies usually don’t disclose how, when, or why they increase or decrease credit limits.

If you’re eligible for a CLI, you can request one. If you’d prefer to wait and see, you may receive an auto-CLI — or you may not.

If you’re ready for more credit, a better approach may be to shop for a new card rather than hope your current card companies will grant your wishes.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Tips: How to Increase Citi Credit Limit ([updated_month_year]) 6 Tips: How to Increase Citi Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/02/Citi-Credit-Limit-2.jpg?width=158&height=120&fit=crop)

![6 Tips to Increase Your Credit Limit Today ([updated_month_year]) 6 Tips to Increase Your Credit Limit Today ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Credit-Limit-Increase-4.jpg?width=158&height=120&fit=crop)

![6 Tips: How to Increase Chase Credit Limit ([updated_month_year]) 6 Tips: How to Increase Chase Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Chase-Credit-Limit-2.jpg?width=158&height=120&fit=crop)

![6 Tips: Increase Your Capital One Credit Limit ([updated_month_year]) 6 Tips: Increase Your Capital One Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Capital-One-Credit-Limit-2--1.jpg?width=158&height=120&fit=crop)

![6 Tips: How to Increase Discover Credit Limit ([updated_month_year]) 6 Tips: How to Increase Discover Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/09/DiscoverCreditLimit--1.jpg?width=158&height=120&fit=crop)

![9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year]) 9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-No-Limit_High-Limit-Prepaid-Debit-Cards--1.jpg?width=158&height=120&fit=crop)

![9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year]) 9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/without2.png?width=158&height=120&fit=crop)

![7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year]) 7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-5--1.jpg?width=158&height=120&fit=crop)