Credit cards with purchase rewards are a great way to get a little something back for the things you already buy. And of all the different reward card types, cash back cards offer the easiest way to use your rewards. To take full advantage, you need to know where to find the highest cash back credit cards, and which one belongs in your wallet.

Whether you use a card for business expenses, dining, entertaining, or just everyday purchases, choosing the right cash back card is essential. Here are the cards we’ve identified as having the highest cash back for some of the most common card uses.

Highest Overall

Flat-Rate | Rotating | Tiered | Business | Student | Fair Credit | FAQs

Highest Cash Back Card Overall

A typical cash back credit card lets you earn back a percentage of what you spend as a reward, often with higher cash back earnings in different spending categories. Some of these categories rotate each quarter, while others offer higher fixed rewards for certain types of spending, such as gas, dining, groceries, etc.

If you plan to use your card for a variety of purchases, or if you’re looking for a single card to do it all, here’s our choice for an ideal “utility” cash back card.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® is one of the most popular reward cards thanks to its signup bonus, elevated cash rewards rate on several common spending categories, and industry-leading introductory terms.

Highest Cash Back Cards With Flat-Rate Rewards

Cash back cards that offer flat-rate rewards are great for everyday spending and for folks who use their card for a variety of purchases. That’s because these cards offer the same cash back percentage on all purchases made with the card.

No more monitoring categories or juggling cards, however, the flat-rate amount is usually less than what you could earn if you maximized the bonus categories on rotating cash back cards.

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card offers cash back once when you buy and again when you pay, totaling 2% back on every purchase.

Cash back is actually awarded as Citi ThankYou points that can be redeemed for cash back as a statement credit, direct deposit, or a mailed check. They can also be redeemed for gift cards and travel or to shop with points at Amazon and other eCommerce sites.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card lets you earn cash back on every purchase, every day. There is no annual fee, and no limit to the amount of cash back you can earn.

Cash back can be redeemed at any time and for any amount. Rewards can be used in a variety of ways, including a statement credit, to cover a purchase, redeemed for gift cards, or, of course, as cash in the form of a check sent directly to you.

Highest Cash Back Cards With Rotating Categories

If you want to earn the maximum amount of cash back on your purchases and are willing to do a little work, a card with rotating categories may be right for you. Cards with rotating categories offer cash back rates as high as 5% at certain places each quarter, including gas stations, restaurants, grocery and home improvement stores, even wholesale clubs and department stores, like Walmart and Target.

You can maximize your rewards by keeping an eye on the 5% cash back calendar. Just remember you have to register and activate your bonus categories each quarter.

4. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

The Chase Freedom Flex℠ card lets you earn bonus cash back in rotating spending categories. The places you can earn these bonus cash back rewards include grocery stores, gas stations, restaurants, pharmacy chains, and more.

The bonus category spending is capped each quarter, but you’ll automatically earn 1% cash back after you reach the cap and on all other purchases. There’s no annual fee for this card, and the cash back rewards never expire.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

As far as cash back rewards go, it’s hard to beat the rewards you earn from the Discover it® Cash Back card. The rotating bonus cash back categories include grocery stores and restaurants, gas stations, warehouse stores, and Walmart and Target.

Cash back can be redeemed at any time and in any amount. Rotating categories must be activated each quarter.

Highest Cash Back Cards With Tiered Rewards

Sometimes, a credit card is used for a specific purpose, but you still want to earn the most cash back from it. Cards with tiered rewards are great for this.

Tiered rewards cards give you higher cash back earnings on specific categories of spending, and the categories don’t change. For example, if you use your card primarily for dining out, you can choose one that maximizes cash back for dining and entertainment purchases while still providing smaller rewards for all other purchases.

- Earn $250 back in the form of a statement credit after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year on purchases (then 1%). Also earn 6% cash back on select U.S. streaming subscriptions.

- Earn 3% cash back on transit, including U.S. gas stations, taxis/rideshare, parking, tolls, trains, buses, and more. All other purchases earn 1% cash back.

- $120 Equinox Credit - Use your Blue Cash Preferred Card to pay for Equinox+ at equinoxplus.com and receive $10 in monthly statement credits. Enrollment required.

- 0% intro APR for 12 months from the date of account opening, then a variable APR applies

- $0 intro annual fee for the first year, then $95

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

19.24% - 29.99% Variable

|

$0 intro annual fee for the first year, then $95

|

Excellent Credit

|

The Blue Cash Preferred® Card is the undisputed leader when it comes to grocery rewards, offering the highest rate we know of on purchases at US supermarkets.

Put it this way: The average US household spends $4,942 per year on groceries, according to the US Bureau of Labor Statistics. 6% of that amount comes to $296.52 you could earn just from using this card to buy your groceries. Deduct the annual fee and you’re still up about $200 a year, and that doesn’t include additional rewards earned in other categories.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card is ideal for people who spend a lot on dining and entertainment each month.

For example, if you frequently entertain clients or simply enjoy dinner and a show on a regular basis, the SavorOne card’s cash back can really add up.

Highest Cash Back Cards For Businesses

If you’re going to use a credit card for business purchases, you may as well earn some cash back for it. Cards designed specifically for businesses include features like maximum cash back rewards for purchases made on office supplies and business services.

Many of these cash back business cards also include an option for employee cards at no extra cost. Using a cash back card for necessary expenses is a great way to grow a business while saving a little extra cash.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Unlimited® Credit Card is a versatile and generous card designed for businesses of all sizes. With its unlimited cash back on spending for business and non-business expenses, this card can quickly add to your bottom line.

There’s no annual fee, so it’s easy to try it out and see if this is the right card for you. Cash back rewards can be requested at any time and in any amount, and they never expire. You can also get free employee cards, and those purchases also earn the same cash back rewards.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Cash® Credit Card from Chase is a great cash back card for small business owners. Cardholders earn bonus cash back on the first $25,000 in combined purchases at office supply stores — as well as on services such as internet, cable, and phone — annually on the account anniversary.

You’ll also earn elevated cash back on the first $25,000 in combined purchases at gas stations and restaurants, plus 1% cash back on all other purchases with no limits. Employee cards are available at no extra cost.

Highest Cash Back Cards For Students

If any group of cardholders could use some extra cash back, it’s college students. Cash back credit cards for students are designed to reward responsible credit usage, while also offering up to 5% cash back on purchases at gas stations, grocery stores, and other places students use their cards.

Everyone knows school is expensive, so why not get a little help in the form of cash back on those expenses.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

As with Discover’s consumer-focused cash back card, the Discover it® Student Cash Back card offers bonus cash back in a rotating group of categories, up to the quarterly maximum. You can earn bonus rewards at gas stations, restaurants, grocery stores, and many more merchants.

You must activate each category to receive your bonus cash back and you’ll earn a lesser reward rate on all other purchases.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

With the Discover it® Student Chrome card, students can earn a higher cash back rate at two of the places they’re most likely to use their card — gas stations and restaurants. No need to worry about rotating categories. All other purchases earn a lesser reward rate.

Highest Cash Back Cards For Fair Credit

Card issuers love to reward applicants who have good credit. Cash back rewards for these folks are easy to come by. But what if your credit score is less than exemplary?

Believe it or not, you can still qualify for cash back cards with a fair credit rating. While these cards may not offer the highest cash back rewards, they’re still a great way to save a little extra cash while you work on improving your credit score.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

For consumers with average credit scores who still want to earn cash back, there’s the Capital One QuicksilverOne Cash Rewards Credit Card. This easy-to-use card gets you unlimited flat-rate cash back on everything you buy, every day.

Rewards never expire, and you can redeem them in any amount at any time. You’ll also be able to access a higher credit line with Capital One’s Credit Steps after making your first five payments on time. The QuicksilverOne does come with an annual fee, so take that into consideration when deciding if this card is right for you.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

The Fortiva® Mastercard® Credit Card is a cash back rewards card that offers up to 3% back on select purchases. You’ll be charged an annual fee and a high APR, so make sure you 1) spend enough to offset the annual fee and 2) pay your balance in full to avoid hefty interest charges.

Once you achieve a higher credit score with responsible use, you can consider one of the better cards for good credit.

What Is the Best Cash Back Credit Card?

Choosing the best cash back credit card for you depends on how you answer a few questions:

- How and where do you use your card?

- Do you carry a balance or pay in full each month?

- Is this a primary card or will it supplement others?

- What is the average amount you charge each month?

All these factors must be considered before you can decide which card is best for you.

Generally speaking, cash back credit cards are best for people who don’t carry a balance each month. That’s because the interest rate tends to be higher for cash back cards than for a standard card with limited rewards. The interest you pay on a balance can easily outweigh any cash back rewards you may accrue.

Consider a cash back card that earns 5% cash back. If you have an APR of 17%, you’ll be in the hole for 12% on any amount you carry forward as a balance each month.

Hence, the real value of a cash back card comes when you pay your balance in full. If that’s not you, consider a card with a lower monthly APR.

The type of cash back card you choose also makes a big difference. If you use your card mainly for dining and entertainment, choose a card like the Capital One SavorOne Cash Rewards Credit Card that maximizes those expenses. If you’re a small business owner who regularly charges things like office supplies, the Ink Business Cash® Credit Card might be best.

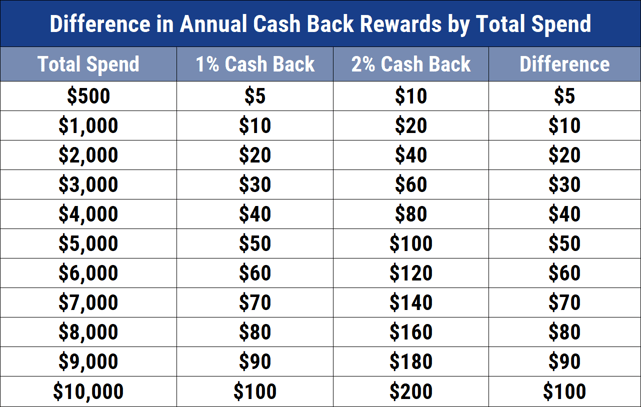

Another consideration is whether the card has an annual fee. If it does, how much will you need to spend to offset the fee? For example, even a nominal $50 annual fee on a 2% cash back card means you need to spend $2,500 before you start benefiting from your cash back rewards.

The Citi Double Cash Card offers 2% cash back and doesn’t charge an annual fee, making it a natural leader in the cash back space.

Finally, if you don’t mind spending time tracking and activating reward categories, some of the rotating category 5% cards can actually be quite lucrative. Of course, this means curtailing purchases that aren’t in the quarterly bonus category or putting them on another card. Yes, it can get a little tricky.

Is there a Limit on Cash Back?

Many of the highest cash back cards come with a quarterly spending cap that limits the amount you can earn in the maximum reward categories.

For example, the Chase Freedom Flex℠ card lets you earn bonus cash back in rotating categories, but limits that to a set amount in purchases each quarter. After that, you earn a tiered cash back rate on travel, dining, and drugstore purchases, then a flat 1% on all other purchases. The same is true for some other cards on this list.

The Ink Business Cash® Credit Card has a higher cutoff limit of $25,000 annually in combined office store purchases for its 5% cash back card. Contrast that with the Capital One Spark Cash for Business card that comes with 2% cash back on all purchases, with no limit. Spending anything more than $60,000 annually makes the Capital One Spark card the better choice. (Information for this card not reviewed by or provided by Capital One.)

Depending on how much you spend and in what categories, a fixed-rate card with a lower cash back percentage but no limits may be the way to go. If you can’t find a card that maximizes rewards in categories you’ll regularly use or otherwise restricts your regular spending patterns, go with a flat-rate 2% cash back card.

Is 2% Cash Back a Good Rate?

Yes, a flat 2% back on everything with no earning caps is good. But if your card limits what you earn 2% back on and caps your earnings, not so much.

The Citi Double Cash® Card is probably the best 2% cash back rewards card around.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

Another consideration is whether you’re paying an annual fee for that 2%. As we explained above, even a $50 annual fee on a 2% cash back card means you need to spend $2,500 before you start benefiting from your rewards.

Which is Better, Points, or Cash Back?

How do you spend, and what do you want to earn? That’s the question you need to ask yourself when considering whether a points card or a cash back card is best for you.

Cash back cards offer simplicity when redeeming your rewards, but points cards offer more flexibility in what you redeem your rewards for, and usually let you earn more for each dollar you spend. It’s all in how you use your cards and the rewards they offer.

Some points cards require you to know where and on what types of purchases you’ll earn the most points. If that’s not where you want to spend your energy, then a cash back card can remove much of the complexity of knowing when to use which card.

Cash back cards — especially flat-rate cards — let you earn a percentage of your spending back on every purchase you make, generally between 1% and 2%. Those rewards are then returned to you as cash via a statement credit or a mailed check, among other options specific to each issuer.

Points cards require you to redeem your rewards for specific benefits. These may include travel accommodations like flights and hotels, merchandise, gift cards, or even redeemed for cash back, though they’ll likely be worth less as cash back than if you redeem them for one of the other reward types.

While cash back may be simpler, cards that offer reward points can often have more value if used in conjunction with special offers and bonus point multiplier or loyalty programs.

Swipe Your Way to Free Money

In today’s vast credit card landscape, cash back cards are among the most popular and diverse offerings. And if you follow a few of the common-sense rules we’ve laid out in this guide, like not carrying a balance, they can be quite beneficial. Using a cash back card can be like rewarding yourself for having good spending habits.

Of course, you’ll need to choose the right card for your needs, and, hopefully, after reading this guide, you’ll be equipped to do so. Also, be sure to choose from among the highest cash back credit cards that support your spending patterns.

More than just a convenience, a cash back credit card can help you earn a little back from the spending you would be doing already. Just remember to never spend more than you’ve budgeted for, and never put something on a card simply for the cash back.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Highest-Limit Cash Back Credit Cards ([updated_month_year]) 9 Highest-Limit Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)

![11 Highest-Limit Cards for Bad Credit ([updated_month_year]) 11 Highest-Limit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/highlimit.png?width=158&height=120&fit=crop)

![7 Highest-Limit Travel Credit Cards ([updated_month_year]) 7 Highest-Limit Travel Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Travel-Credit-Cards.jpg?width=158&height=120&fit=crop)

![11 Highest-Limit Air Miles Credit Cards ([updated_month_year]) 11 Highest-Limit Air Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Air-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![6 Highest-Limit Chase Credit Cards ([updated_month_year]) 6 Highest-Limit Chase Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Chase-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Highest-Limit Citi Credit Cards ([updated_month_year]) 5 Highest-Limit Citi Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Citi-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Highest-Limit Student Credit Cards ([updated_month_year]) 7 Highest-Limit Student Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Highest-Limit-Student-Credit-Cards.jpg?width=158&height=120&fit=crop)

![19 Highest Credit Card Limits by Category ([updated_month_year]) 19 Highest Credit Card Limits by Category ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_370788551.jpg?width=158&height=120&fit=crop)