If traveling is your thing, one or more double miles credit cards might belong in your wallet.

As Indiana Jones famously observed, “It’s not the years, it’s the miles.” These cards double those miles, making travel more affordable and a nicer experience.

Buckle up and keep reading for a crash introduction to double miles.

Best Overall | More Miles Cards | FAQs

Best Double Miles Credit Card

The Capital One Venture Rewards Credit Card earns top honors among double miles cards. Every purchase earns you unlimited miles that won’t expire for as long as you keep the account open.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

This card offers a signup bonus in which you can earn bonus miles by spending the required amount on purchases in the first three months after account opening. You’ll also receive limited reimbursement for Global Entry or TSA Precheck expenses, and you won’t be charged a fee for foreign transactions.

You can redeem your miles on all sorts of travel-related expenses at any website or mobile app or convert them to cash in the form of a check, statement credit, or gift card. You can also transfer your miles to any of 10+ airline and hotel loyalty programs or use them instantly at Amazon.com checkout.

You’ll enjoy the peace of mind knowing that the card provides $0 liability protection, instant card lock/unlock, instant purchase notifications, and suspicious activity alerts. This card is marketed to folks with excellent FICO scores (in the 800 – 850 range) but is certainly obtainable by many consumers with good credit scores.

The variable APR you receive is tied to the Federal Reserve’s prime rate and is based on your creditworthiness.

More Double Miles Credit Cards to Consider

Doubling your miles doubles your fun, which is probably why there is strong demand for several double miles credit cards that compete with each other for space in your wallet. These offer some sort of double miles rewards scheme, and one even earns you triple rewards (but only for the first year).

- Earn 10,000 bonus miles after spending $1,000 in purchases on your new card in your first 6 months of card membership

- Earn 2X miles at restaurants (including takeout and delivery) and 2X miles for every dollar spent on eligible purchases made directly with Delta. Earn 1X miles on all other purchases.

- Receive a 20% savings in the form of a statement credit after you use your card on eligible Delta in-flight purchases of food, beverages, and audio headsets

- Take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com

- No foreign transaction fees

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.99% - 29.99% Variable

|

$0

|

Good

|

If you’re a fan of Delta Airlines, check out the Delta SkyMiles® Blue American Express Card. You earn miles on eligible purchases made directly with Delta and at restaurants for dining, delivery, or takeout. This no-annual-fee card offers bonus miles when you spend the required amount on purchases during the first three months after signup.

You can redeem your miles for discounts on airline tickets that you book at Delta. Once aboard your flight, use the card to get a partial rebate on your statement for in-flight purchases. Other benefits include car rental insurance, purchase and extended warranty protection, special access to entertainment events, and no foreign transaction fees.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$395

|

Excellent

|

The Capital One Venture X Rewards Credit Card pays 2X miles on most purchases, but select purchases booked through Capital One Travel earn even more. This card also pays a sizable signup bonus when you meet the minimum spending requirement.

As a premium travel card, it comes with a bevy of perks, including primary rental car insurance, travel credits, and much more. You can transfer your Venture X miles to select loyalty programs to possibly earn even more value from your miles.

- Earn 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

- Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants

- Earn 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases

- Earn a $125 American Airlines Flight Discount after you spend $20,000 or more in purchases during your cardmembership year and renew your card

- No foreign transaction fees

- First checked bag is free on domestic American Airlines itineraries for you and up to four companions traveling with you on the same reservation

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.99% (Variable)

|

$99, waived for first 12 months

|

Excellent, Good

|

Additional Disclosure: (The information related to Citi® / AAdvantage® Platinum Select® World Elite Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® lets you earn double AAdvantage® miles at restaurants, gas stations, and on eligible American Airlines purchases. There are bonuses galore: A signup bonus when you spend the required amount in the first three months, and you also can earn an anniversary bonus each card membership year by spending the required amount and renewing your card.

The card can ease your travel by giving your preferred boarding, your first checked bag for free, and savings on eligible in-flight purchases of food and beverages. Through Citi Entertainment®, you get special access to purchase tickets for thousands of events. The card works well with digital wallets and the chipped card enables contactless pay.

- Earn 75,000 American Airlines AAdvantage® bonus miles after spending 5,000 within 5 months of account opening

- Earn 2 AAdvantage® miles for every $1 spent at telecommunications merchants, cable and satellite providers, car rental merchants, at gas stations and eligible American Airlines purchases — all other purchases earn 1X points

- First checked bag free on domestic American Airlines itineraries for you and up to 4 travel companions

- 25% savings on American Airlines inflight WiFi, food, and beverage purchases when you use your card

- Earn an American Airlines Companion Certificate for domestic travel after $30,000 in purchases each card membership year and card membership is renewed. Fees apply.

- $0 intro annual fee, then $99

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.99% (Variable)

|

$99, waived first 12 months

|

Excellent, Good

|

Additional Disclosure: (The information related to CitiBusiness® / AAdvantage® Platinum Select® Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

The Citi® / AAdvantage Business™ World Elite Mastercard® lets you earn double AAdvantage® miles on eligible purchase from American Airlines and an array of selected merchant categories. Travelers get their first bag checked for free, preferred boarding, savings of 25% on in-flight Wi-Fi, and a companion certificate each anniversary year when you purchase the required amount and renew your membership (fees apply).

The card offers business perks that include employee cards, access to a personal business assistant, and online account summaries. As with other Citi cards, this one carries an electronic chip that facilitates contactless pay, and you can use the card for shopping with your digital wallet.

- Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

- $0 introductory annual fee for the first year, then $99.

- Receive a 5,000-mile "better together" bonus each anniversary when you have both the United℠ Business Card and a personal Chase United® credit card.

- Earn 2 miles per $1 spent on United® purchases, dining including eligible delivery services, at gas stations, office supply stores, and on local transit and commuting.

- Earn 1 mile per $1 spent on all other purchases. Plus, employee cards at no additional cost - miles earned from their purchases accrue in your account so you can earn rewards faster.

- Enjoy a free first checked bag - a savings of up to $140 per roundtrip (terms apply), 2 United Club℠ one-time passes per year, and priority boarding privileges.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.99% - 28.99% Variable

|

$99

|

Good/Excellent

|

The United℠ Business Card from Chase earns you double United miles on purchases from United as well as several other common day-to-day spending categories, while all other purchases earn single miles. If you also have a personal United credit card, you’ll earn bonus miles on each card anniversary.

The card provides priority boarding, your first checked bag for free, and two United Club one-time passes on account opening and on each anniversary. You also get a United travel credit each anniversary year after you make the required number of ticket purchases, and you get money back on United in-flight purchases. There are no foreign transaction fees, and the annual fee is minimal.

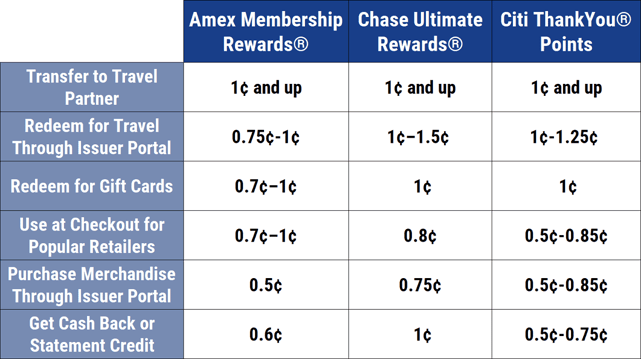

What is a Double Miles Credit Card?

Double miles cards are targeted at consumers who want to save money on travel. These cards share three attributes:

- You can use the card just as you would any other credit card to make purchases, take out cash advances, and, if allowed, perform a balance transfer.

- The card offers frequent flyer mile rewards. The miles may be redeemable for travel at a single airline, or they may be transferable to a multitude of airlines. You may also be able to redeem the miles for other items, including hotel stays, car rentals, or even cash.

- You earn 2X miles on purchases, meaning two miles for each dollar spent. In some cases, the 2X purchases are limited to selected categories of merchants, while other cards offer unlimited 2X miles on all purchases.

Note that some double mile cards are not one-trick ponies — they may give you 2X miles on non-travel purchases at restaurants, gas stations, network providers, and other merchant classes.

If you want to book a flight but don’t have enough miles, you can usually buy the remaining miles at a standard rate. You may also be allowed to use your miles for travel perks including seat upgrades or priority boarding.

How Does a Double Miles Card Work?

The standard operating procedure for this class of credit cards is to reward you with miles when you make purchases. The reward rate for a double miles card is two miles per dollar spent on eligible purchases.

Flat-rate double miles cards offer 2X miles on all purchases, whereas tiered double miles cards offer 2X miles on select merchant categories that always include airline travel.

Card issuers determine which merchant categories beyond airlines will earn 2X miles. Popular choices include restaurant dining, gas stations, and network providers. Issuers also determine the redemption value of the miles, which has a large influence on how worthwhile it is to own the card.

Several of these cards offer signup bonuses that let new cardmembers quickly accumulate a bunch of miles. As you accumulate miles, you can redeem them for airline tickets and perhaps other travel-related purchases such as car rentals and hotel stays. You can usually purchase additional miles if you don’t have quite enough to fully pay for an airline ticket.

Some cards, like our top-rated Capital One Venture Rewards Credit Card, let you apply your miles retroactively after the travel expense has occurred.

Other cards only allow you to redeem miles for tickets before the travel date. All cards in this review give you the option of trading in your miles for cold hard cash, although the miles may be worth more for travel.

One big decision you’ll have to make is whether to get a mileage card co-branded with a particular airline, such as American, United, Spirit, or Delta. Co-branded cards make sense if you happen to fly only a particular carrier. If that’s not you, then a general mileage card like Capital One Venture Rewards Credit Card may be a better choice.

How Do I Get a Double Miles Credit Card?

The first order of business is to decide which double miles card to get. We humbly submit this review to help you choose the card that is the best fit for your needs.

You can narrow down your choices to one or more candidates before seeking further information — always read a card’s rates and terms disclosure (available on the card’s website) before applying so you know exactly what to expect.

The application process for a double miles credit card is no different from that for any other rewards card. You can conveniently click on the “Apply Now” button to be redirected to the card’s online application form, which you should be able to complete in just a couple of minutes.

The issuer may collect additional information before performing a hard inquiry. Federal law requires that you divulge certain identifying information, including your name, address, date of birth, citizenship, contact information, and other information (i.e., your Social Security number, a copy of your driver’s license, and/or other documents).

You’ll also be asked to disclose financial information such as your current job, annual earnings, bank and other financial accounts, and monthly housing costs (rent or mortgage payments).

The double miles cards in this review are unsecured, meaning you don’t have to put up collateral to get them. As such, issuers evaluate your creditworthiness before approving your application, which is why they perform a hard inquiry on your credit report. You should expect a nearly instant decision on your application, although sometimes the issuer may require more time before informing you via mail or email.

Sometimes, your credit score may be too low, or you may have too many other credit cards (not necessarily from the same issuer) to receive approval.

For example, the United℠ Business Card is a co-branded card from Chase, and is therefore subject to the Chase 5/24 Rule. The rule states that Chase won’t approve a card application if you’ve opened five or more credit accounts (they need not be with Chase) in the previous 24 months.

Citi uses its 8/65/95 Rule to restrict new cards through the following provisions:

- You have to wait eight days after applying for a Citi card before applying for another one.

- You have to wait 65 days before applying for a third Citi card.

- You have to wait 95 days before applying for a second Citi business card.

The Citi 8/65/95 Rule applies only to Citi accounts.

Discover lets you own no more than two of its cards at any one time. You must have owned the first card for a year before applying for the second card.

American Express created its 4/4 Rule to limit you to four Amex credit cards and four Amex charge cards. Capital One lets you own no more than two Capital One credit cards. However, some co-branded Capital One cards may be exempt from this rule.

Other issuers may have their own rules limiting the approval of new cards.

If approved, you should receive the card within seven to 10 days, although Discover always expedites shipping for arrival in three to five days. Some cards may allow you to begin making card-not-present purchases as soon as your card is approved. This may involve the use of temporary account numbers or mobile wallets so you can start making purchases right away.

Normally, you’ll have to activate the card by notifying the issuer that you’ve received it. You can do so online or via a phone call. You can then peel off the card’s sticker, sign the back, and go shopping at your favorite stores and online sites.

Which Credit Card Gives You the Most Miles?

Of the cards included in this review, the Capital One Venture Rewards Credit Card gives you the most miles on an ongoing basis.

The reason is that while all purchases earn at least 2X miles, certain purchases from Capital One Travel — usually rental cars and hotel stays — give you even more miles. That’s good enough for the card to rank first for generosity.

Which Airline Credit Card is the Best?

The “best” airline credit card is the one that’s best for you, and that depends on your individual circumstances. One of the double miles cards reviewed here may be your perfect choice, but don’t forget that many other airline miles credit cards are available to you.

Before making a final decision on which credit card to get, consider these factors:

- Breadth of rewards: Some airline credit cards narrowly focus their rewards on travel-related purchases. That’s fine if you are a frequent traveler, but not everyone is. You may prefer a card that also offers double miles for other types of purchases. Our top pick, the Capital One Venture Rewards Credit Card, offers double miles on all purchases, making it a great choice if you spend a lot on non-travel expenses. But keep in mind that all the cards reviewed here offer rewards on several merchant categories, such as dining or hotel stays. One strategy is to own multiple credit cards so that you earn high rewards on all your purchases.

- Brand loyalty: This operates in two dimensions — loyalty to a particular airline and loyalty to a particular card issuer. If you prefer to fly with a particular airline, you may want an appropriately co-branded double miles card. In this review, we cover co-branded cards for Delta, United, American, and Spirit. On the other hand, you may have no airline brand loyalties, which makes the Capital One Venture Rewards Credit Card a suitable choice. Your choice may be further guided by the card issuer. Now, don’t laugh, but there are definitely Discover devotees, Capital One champions, etc., and that may play a role in the card you choose.

- Costs: You may love a card but hate its annual fees. Those fees dilute the value of the rewards you earn, so you need to do some back-of-the-envelope math to see if a card is worth it. If you travel internationally, you may also want a card that charges no foreign transaction fees. Bear in mind that cards that charge annual fees typically offer richer rewards than cards that don’t.

- Benefits: Beyond miles, you may be drawn to cards that offer specific benefits, such as free access to airport lounges, free checked bags, travel insurance, and car rental insurance. You also may want to consider any signup bonus offers, new card first-year miles matching, and 0% introductory APR offers. Business owners who have significant travel expenses may want a business travel credit card that fits their spending profiles.

are a great place to quickly compare credit cards so you can zoom in on the ones that fit your lifestyle best.

Are Miles Credit Cards Worth it?

Miles cards are great for frequent travelers or if you want to save up miles for a vacation. Otherwise, you probably will be drawn to a cash back or points card that better complements your spending habits.

Having said that, many miles cards have no annual fees, making them easy to own without a lot of worry about their cost/benefit ratios.

If you do want a miles card, what makes some worth more than others? Consider these benefits when deciding:

- Value of miles: Two cards may both offer double miles for travel, but for different airlines. The true value of the card comes down to how many miles you need to get a free ticket, free upgrade, or some other flight perk.

- Value of travel-related benefits: If you like to frequent airport lounges, you may be willing to pay the high annual fee on a premium travel credit card that provides free lounge access. Other benefits, such as free baggage check, priority seating, and trip interruption insurance, may be available from cards with smaller or no annual fees.

- Miles vs cash back vs points: Before selecting a miles card, consider the alternatives. Many cards offer up to 5X points or miles on select purchases. You may find the amount of rewards you earn from these cards let you obtain flight tickets with cash or points for less spending than required by a double miles card. For example, the Chase Sapphire Reserve® card offers points on purchases that are worth more when redeemed for travel via the Chase Ultimate Reward program, although you’ll have to pay a hefty annual fee.

If the tradeoffs make your head spin, relax. Many consumers own multiple credit cards to ensure they earn the best rewards from different merchant categories.

We may be biased at CardRates.com, but we think it’s fun to find the best credit cards for just about any purpose and any consumer.

How Many Miles Do You Need to Get a Free Flight?

The miles required for a free flight depend on several parameters, including the airline on which you fly, your departure and arrival locations, and cabin type. Given the different variations on these parameters, it’s not surprising that the value of miles differs widely.

A survey from ValuePenguin found that a free, one-way domestic flight in economy class required 14,165 miles, whereas international flights needed 36,800 miles, on average. The surveyed range for a free ticket was 5,000 to 147,000 miles.

Airlines have different ways of setting the mileage price of a ticket. For example, American Airlines sets prices by broad destination regions, such as the continental United States.

Delta keeps its award arrangements on the down low, preferring to charge miles case by case.

The survey looked at the price of a pre-booked flight from New York City to Los Angeles and found typical mile requirements between 5,000 miles and 30,000 miles. Of the big carriers, United Airlines had the best deal — $12,500 for all seats in economy class. Other carriers had a range of prices starting below United’s price but exceeding it on the high end.

One interesting finding was that you get a greater dollar-to-mile ratio if you fly business or first class, even though it takes more miles to get a free ticket. For example, American Airlines charged 85,000 miles for a first-class ticket on the example NYC to LAX flight. That worked out to a value per mile of $0.015 vs only $0.007 for economy class.

In other words, if you’ve got plenty of miles, go ahead and splurge on a luxurious cabin ticket — you’ll get more bang for your buck.

How Much Are Miles Worth in Dollars?

The default value for a credit card mile is one cent when applied toward travel purchases. That means you need 100 times the ticket price to get a free flight.

However, if you want to cash in those miles, their value depends on the rate offered by the credit card, and those rates are not necessarily one cent per mile. In fact, for many credit cards, the cash rate is $0.005 per mile, i.e., 50 cents for 100 miles.

Unfortunately, not all credit cards are forthcoming with the cash-in rate for miles. For example, Capital One states:

“Rates for [cash] redemption options vary and are subject to change without notice.”

Once you own the card, you can visit the online servicing webpage to view the current redemption offers.

For co-branded cards, you will need to consult the loyalty program to see if you can exchange your miles for cash and if so, at what rate.

Do Credit Card Miles Expire?

Generally, credit card miles don’t expire as long as you keep the account open. That means you want to cash in your miles before cutting up your credit card.

Other cards can be a little more forgiving. For example, if you cancel the account or don’t use the card for a period of time, some card issuers will refund you the cash value of your miles.

The Free Spirit® Travel More World Elite Mastercard® is strict when it comes miles. You lose your Free Spirit miles if you close the account or if you don’t earn or redeem miles for three months in a row.

You earn AAdvantage miles from the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® and the Citi® / AAdvantage Business™ World Elite Mastercard®. To keep these miles from expiring, you must keep the account open and earn or redeem miles at least once every 18 months. The 18-month requirement is waived if you are under 21 years old.

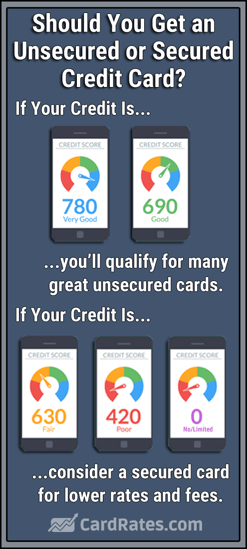

Can You Get an Airline Credit Card with Bad Credit?

Airline credit cards are, by definition, rewards cards, which means they are geared to consumers with average or better credit.

If you have middling credit, don’t assume your airline card application will be declined.

If your credit score is poor or you have no credit history, consider getting a secured card. With this kind of card, you deposit cash into a locked account maintained by the issuing bank or credit union. The deposit collateralizes your credit line and protects the credit card company from losses if you miss a payment or spend above your credit limit.

If your credit score is poor or you have no credit history, consider getting a secured card. With this kind of card, you deposit cash into a locked account maintained by the issuing bank or credit union. The deposit collateralizes your credit line and protects the credit card company from losses if you miss a payment or spend above your credit limit.

You can usually get a secured card even if you have terrible credit, short of a history of fraud or other financial felonies. Typically, these cards do not offer rewards other than $0 liability protection. One exception is the Bank of America® Customized Cash Rewards Secured Credit Card, which offers cash back rewards on purchases from a selected merchant bonus category.

The Capital One Platinum Secured Credit Card, Citi® Secured Mastercard®, and several other secured cards are good choices, although they don’t offer any rewards.

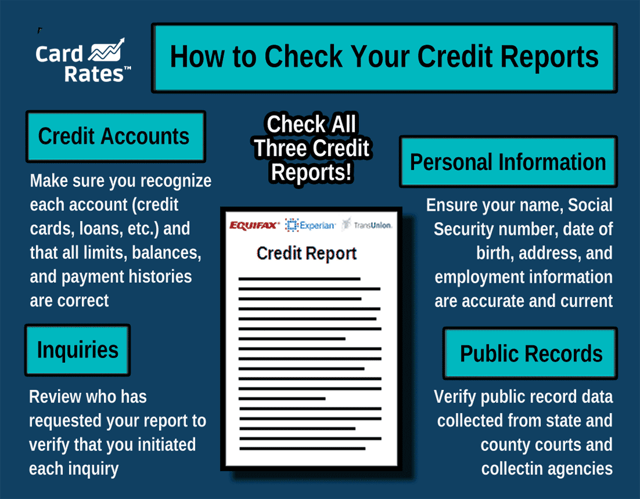

If obtaining a miles credit card is on your to-do list despite your bad credit, it’s time for you to improve your credit score. You can do a few things to help you boost your score and make you more eligible for a travel rewards credit card:

- Pay your bills on time: Missed payments more than 30 days past due will show up on your credit reports and remain there for seven years. Delinquency can drop your score by dozens of points, and it gets even worse if you go into collection or file for bankruptcy.

- Pay down your debt: Reducing your credit utilization ratio (i.e., credit card balances divided by your total credit available) below 30% should be positive for your credit score. If you have loans, you will benefit by reducing your debt-to-income ratio below 36%.

- Fix your credit reports: Removing negative inaccuracies from your credit report can raise your score quickly. You can get copies of all three credit reports from annualcreditreport.com. You can dispute mistakes by communicating with the credit bureaus, or you can hire a credit repair company to do the job for you.

- Do not get new cards: Every time you apply for credit creates a record of a hard inquiry on your credit report. Those inquiries can cause your score to drop by five to 10 points for up to a year. Conversely, do not close old credit card accounts because that reduces your average account age and that hurts your score.

Finally, a shortcut to owning a miles card is to enlist a cosigner with good credit. You and the cosigner are equally responsible for paying your monthly bill on time. Issuers will usually base their approval decision on the cosigner with the better credit profile.

What is the Easiest Airline Credit Card to Get?

Generally, co-branded airline cards are easier to obtain than are general airline cards. Furthermore, airline cards that are both co-branded and secured are without a doubt the easiest to get. In addition, travel cards aimed at students usually don’t have credit score requirements, making them perfect for enrolled students.

Here is a short list of airline cards that are worth getting if you have bad or scant credit:

- Aeromexico Visa® Secured Card: A great choice if you like flying into Mexico for free. The card offers double miles on select purchases and single miles on the rest. You can secure the card with deposits of $300 to $5,000. This card charges a small annual fee.

- SKYPASS Visa Secured Card: Korea and other international destinations are yours for free if you accumulate enough SKYPASS miles. The card provides single miles on eligible purchases, signup and renewal bonuses, and mile redemptions on Korean Air and its partners.

- LATAM Visa Secured Card: Your gateway to free flights to Latin America, this card provides one rewards point per dollar for eligible purchases and a discount on your first yearly purchase from LATAM Airlines, up to the limit amount. You receive a bonus upon the card’s first use. The small annual fee is waived for the first year.

- Bank of America® Travel Rewards credit card for Students: If you’re a student with wanderlust, this card will let you earn unlimited miles on all purchases. You can use the miles for any airline or hotel, with no annual fee, blackout dates, nor foreign transaction fees. The card also offers a signup bonus.

The cards featured in this review are geared toward consumers with good to excellent credit, so they are not necessarily an appropriate choice for consumers with bad credit.

How Do I Choose a Miles Credit Card?

The chief reason to choose a miles card is that you want to save money on airline tickets and/or hotel stays. The card you choose depends on what you need and what the card offers. Here are some factors to consider:

- Brand promiscuity: If you don’t care much about which airline you fly on, choose a card that offers miles that aren’t tied to any one carrier. The card of this type reviewed here is the Capital One Venture Rewards Credit Card. On the other hand, if your loyalty to a particular airline runs deep, you may want to own a co-branded card. In this review, we cover cards for aficionados of American, Delta, and United. These cards give you frequent flyer mile rewards that you can use directly to pay for flights and related purchases.

- Fees and interest rates: We all hate fees, but some cards offer enhanced benefits that make fees more palatable. Annual fees range from $0 to more than $500, so when you select a high-fee card, you want to feel you are getting value for your money. On the other hand, your needs may be modest, and a no-annual-fee card seems just right. If you travel abroad, you probably will want a card that charges no foreign transaction fees. You should also look at how currency translation costs are priced since these can vary from card to card. Other fees are not specific to travel cards, including those for cash advances, late payments, and returned payments. Cards that offer a 0% introductory APR for a balance transfer typically charge a transfer fee of 3% or more. The other important cost component is a card’s APR. For consumers with good to excellent credit, APRs should be available in the mid-teens. Naturally, you’ll save on interest costs if your card offers a 0% introductory APR for a set period after account opening. Note that some cards charge higher rates for cash advances, and some cards assign you a penalty APR if you’re ever late making a payment.

- Reward rate: This review concentrates on double miles cards, that is, cards that let you earn two miles for each dollar you spend on eligible purchases. Some cards offer 2X miles on all purchases, while others reserve that rate for spending at select merchants. Other miles cards offer different rewards schemes, and some offer rewards in a rewards point form that you can convert into miles. When choosing a card, consider whether you want a simple reward scheme where you earn the same rate on all purchases. For some, tiered cards with different rates for different merchant classes make the most sense.

- Redemption value: Not all miles are equal. When you get a co-branded card, you earn loyalty program miles whose value depends on the airline’s rewards structure. Generally, co-branded card miles should be the most valuable, since they can be used only on a single airline brand (plus its travel partners, if any). General mileage cards offer miles that you can use on any airline. The value of these card miles depends on the exchange ratio to the frequent flyer miles of each airline. In some cases, the miles pack an extra punch if you use them to purchase travel through the card’s rewards facility. For example, the rewards you earn with the Chase Sapphire Reserve® card are worth 50% more in ultimate rewards points when you redeem them for travel via the Chase Ultimate Reward program.

- Mile expiration: You may be accustomed to the formulation that you keep your miles for as long as the account remains open. It’s a little more complicated with some co-branded travel cards. For example, you can lose your Free Spirit® Travel More World Elite Mastercard® miles if you don’t earn or redeem miles for three consecutive months. Some other co-branded cards have similar rules, albeit for longer periods.

- Bonuses: Many mileage cards offer signup bonuses. Out of these, most require you to spend a set amount on purchases during the first three months after account opening. Some pay a bonus after the first purchase, whereas some offer more than one reward period during the first year. There are also some miles cards that offer a bonus every year.

- 0% introductory APR: Some travel cards, such as the Wells Fargo Propel American Express® Card, offer new cardmembers a 0% introductory APR on purchases for a set number of months after account opening. This type of card is a smart choice if you are planning an expensive vacation that involves airline flights because it allows you to stretch out the payments over at least six months.

- Travel-related perks: When you evaluate different miles cards, look for perks like free access to airport lounges, free baggage check, free travel insurance, priority seating, discounts on inflight purchases, rideshares, free hotel stays, free car rental insurance, and more. Some cards, such as the Capital One Venture Rewards Credit Card, offer limited reimbursement for Global Entry or TSA Precheck.

Sometimes, other considerations may influence your card choice. Be sure to take your time when reviewing card options and pick the one that works best for you and your travel needs.

Do Airline Credit Cards Allow Balance Transfers?

Most credit cards, including airline credit cards, offer balance transfers. This is a process in which you use your card to pay off another one, thereby transferring the balance. What’s rarer is an airline card that offers a 0% intro APR for balance transfers.

This kind of offer gives you an extended grace period (at least six months) in which you don’t pay interest on transferred balances. The Wells Fargo Propel American Express® Card offers an APR of for balance transfers, although fees apply for each transfer.

This kind of card is useful when you want to consolidate credit card debt, as the interest you save should more than compensate for the transfer fee.

Keep a few things in mind if you choose to take advantage of a 0% intro APR for balance transfers. The first is whether you plan to repay the full transferred amount before the introductory period expires. If not, check the card’s regular APR, which will add to the cost of the consolidation.

The second factor is that some cards set a short deadline for transfers that qualify for the 0% APR. For example, a card may offer an 18-month period of 0% APR but only for balance transfers that you execute in the first six weeks after opening the account.

What Credit Score is Needed for a Travel Card?

We’ve been saying that travel cards are primarily aimed at consumers with good to excellent credit. But what does that mean?

The primary scoring system used in the United States is FICO, from the Fair Isaac Corporation. The scores range from 300 (worst) to 850 (best). The higher your score, the easier it becomes to qualify for the best credit cards and to be granted a higher credit limit/lower APR.

A higher FICO score also means you are more likely to be approved for a loan with a relatively low interest rate. A high score also helps when you apply for a job, a rental apartment, a utility account, an insurance policy, and other situations.

Bear in mind that it is up to creditors to interpret your FICO score, and some may be stricter or more lenient. In particular, each credit card company decides the minimum acceptable FICO score for each of its cards. Issuers also use FICO scores to determine your annual fees (if any), your credit limit, and your APR.

Card issuers retrieve your FICO score and your credit history from one or more of the three credit bureaus (also known as credit reporting agencies). These bureaus — Experian, TransUnion, and Equifax — keep records on more than 200 million people.

Given that credit cards in this review are all marketed to consumers with good credit or better, it would seem that you need a FICO score of 670 or higher to receive one. But as you may have guessed, that assumption needs some qualification.

Applications from folks with scores above 670 are sometimes denied, while applicants with lower scores are sometimes approved.

The reasons why a 670 FICO score isn’t necessarily determinative include:

- There are many travel credit cards offered from hundreds of credit card companies, banks, credit unions, and other financial institutions. Each issuer sets its own policies that may lean toward creditors above or below a 670 score.

- You may have items on your credit report that influence an issuer’s decision. For example, if you filed for bankruptcy nine years ago, some issuers may immediately strike you off while others may concentrate on your more recent credit history.

- Many issuers set quotas for how many credit cards you already own. Some apply the quota only to credit cards they issue, but others, such as Chase, look at how many new credit accounts you’ve opened in the last 24 months, whether from Chase or elsewhere. Issuer quotas trump credit scores, which can sink your application even if you have excellent credit.

- Issuance of secured and student credit cards does not hinge on your credit score. Secured credit cards are collateralized by cash you deposit with the issuer, greatly reducing default risk to the issuer. Issuers understand that many college students have little credit experience, so they are willing to approve their applications in the hopes of building brand loyalty that will endure after graduation.

- You can overcome a low credit score by applying with a cosigner who has an acceptable credit score. Both you and your cosigner are responsible for making card payments. That may be a good deal for a low-score consumer but bear in mind that your relationship with your cosigner may sour if you don’t fulfill your payment responsibilities.

No matter what factors loom large in a card issuer’s decision, you need to know your credit score so you have a realistic idea of your chances for acceptance. The Fair Credit Reporting Act (FCRA) gives you the right to receive your credit reports annually from the three credit reporting agencies. You can get them from AnnualCreditReport.com, the only source authorized by federal law.

The FCRA does not entitle you to get your FICO score for free. You can pay a credit bureau to receive your FICO score, usually on a monthly basis.

Many credit cards give you free access to your credit score, but be aware that these offers may involve non-FICO scores that are useful only as a general indication of your perceived creditworthiness.

The average FICO score as of 2019 was 706, a good score. This implies that the average consumer has a better-than-even chance of qualifying for a travel card.

If your application is declined, you are entitled to receive a written explanation, called an adverse action report, that provides up to five reasons why you were turned down. The report also discloses the source and value of your credit score, which can serve as the starting point for figuring out how to improve your score.

What Are Some Benefits of Miles Credit Cards?

There seems to be a credit card for almost every consumer. Miles cards exist to help you save money on travel. You can use the card for your everyday purchases to accumulate miles that you then redeem for free or reduced-cost travel.

Many miles cards offer higher rewards on travel purchase transactions, such as airplane tickets and hotel stays, but several of the cards in this review pay double miles on all purchases. The money you save when you redeem your miles for travel can mean a longer, more exotic, or more luxurious trip. Your miles may enable you to visit destinations that would otherwise be unaffordable.

Miles cards can also make your travel experience more pleasant. You may be able to secure perks like priority seating, airport lounge access, cabin or seat upgrades, and discounts on in-flight purchases. Additionally, you can travel with less risk if your card provides travel insurance, worldwide travel assistance, and free baggage check/baggage insurance, among other perks.

Some cards also provide travel credits and/or reimbursement for Global Entry or TSA Precheck expenses.

These benefits are specialties of travel cards, but travel cards can offer many other benefits that are not specifically travel-related, including signup bonus points or miles, no annual fees, no foreign transaction fees, and enhanced security and purchase protections. Our credit card reviews are a great place to narrow your search for your next card, but always read each card’s fine print to ensure you’re getting the benefits you want.

What Are Some Disadvantages of Miles Credit Cards?

With apologies to Marc Antony, we’ve come to praise miles credit cards, not to bury them. Nonetheless, we must point out why miles cards are not everyone’s perfect choice.

The most serious drawback is that you may not travel enough to make these cards worthwhile. For example, you may prefer to receive double cash back rewards that you can use to help pay your monthly bills. Frequently, miles are worth more for travel than the money you would receive by cashing in the miles, which means miles cards are not always efficient substitutes for cash back cards.

Co-branded travel cards can be problematic because your miles are limited to one airline’s (and its partners’) flights and destinations. If your preferred airline doesn’t fly to your next destination, you’ll have to use other resources to pay for your flight. If this concerns you, consider instead a general travel card where the miles or points can be used with any airline.

Some credit cards offer higher cash back rewards for travel than do miles cards. For example, Chase Freedom Unlimited® and Chase Freedom Flex℠ offer elevated cash back rates on travel purchased through Chase.

Because travel miles are a valuable reward, don’t be surprised that many miles cards charge an annual fee. The double miles cards in this review charge annual fees from $0 to $99, but premium travel cards may charge $500 or more.

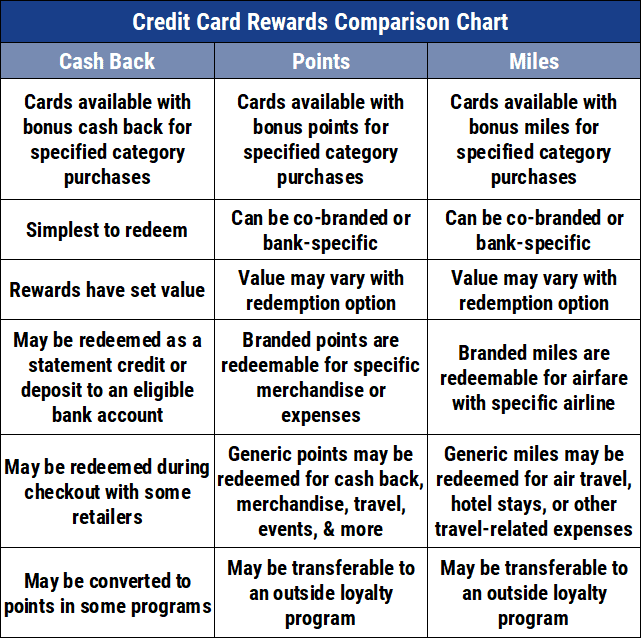

Are Points the Same as Miles?

You may notice that some travel cards offer rewards in the form of points rather than miles. Essentially, points and miles are the same, in that they both can be used to pay for airline tickets and other travel costs. Additionally, travel cards allow you to redeem miles and points for cash, statement credits, or gift cards.

One distinction between points and miles involves co-branded cards, which usually reward you with the frequent flyer miles from the issuing airline. Travel cards not tied to a particular airline are more likely to reward you in points rather than miles, both of which are worth a penny apiece.

Naturally, points are more versatile than frequent flyer miles since you can use them on any airline as well as for other purchases.

Non-co-branded travel cards from Chase and American Express are more likely to reward you with points. For example, the Chase Sapphire Reserve® card rewards you with points you can redeem for travel via Chase Ultimate Rewards where they are worth 50% more.

The Delta SkyMiles® Blue American Express Card reviewed above is co-branded and rewards you in Delta SkyMiles. Contrast this with The Platinum Card® from American Express, which is not co-branded and denominates Membership Reward points.

When you compare miles and points cards, read the fine print to see how far your rewards will go. Additionally, look closely at the rules for rewards expiration, as some travel cards cancel rewards if you don’t earn or redeem rewards within a specified period.

How Do You Earn a Signup Bonus with an Airlines Miles Credit Card?

A signup (or welcome) bonus

can add a lot of appeal to a miles card. Often, the bonus will pay for your first free airline ticket.

Some miles cards pay you a bonus after your first purchase, while others require you to meet a spending goal for an introductory period (typically three months).

Bonus points or miles help you maximize your earnings during the first year of card ownership. Some cards offer bonus miles, others don’t. You should expect cards with higher annual fees to offer more generous signup bonuses.

The spending goal may require purchases costing several thousand dollars. Naturally, there’s a correlation between the required spending amount and the size of the bonus.

While the signup bonus can seem like a shiny prize, it’s counterproductive to live beyond your means to earn it. Conversely, if you are planning a big-ticket purchase, a card with a signup bonus will reduce the net cost of the purchased item.

So, if you are planning a wedding or home renovation, check out cards with the highest signup bonuses.

Apply for Double Miles Credit Cards Online

Our review of double miles credit cards is a great place to start your search for the best travel card for you. We’ve provided links to each card’s webpage so you can delve into the details that distinguish one card from another.

Simply click on the link, review the rates and terms, and then fill out the online application if you like what you see.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Citi Double Cash Credit Score Requirements ([updated_month_year]) Citi Double Cash Credit Score Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Double-Cash-Credit-Score.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for Points & Miles ([updated_month_year]) 8 Best Credit Cards for Points & Miles ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/points.png?width=158&height=120&fit=crop)

![8 Credit Cards With Miles That Don’t Expire ([updated_month_year]) 8 Credit Cards With Miles That Don’t Expire ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Miles-That-Dont-Expire.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards With Air Miles & Cash Back ([updated_month_year]) 5 Best Credit Cards With Air Miles & Cash Back ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Credit-Cards-With-Air-Miles-Cash-Back.jpg?width=158&height=120&fit=crop)

![12 Best Flight Miles Credit Cards ([updated_month_year]) 12 Best Flight Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Flight-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![Miles vs. Cash Back: 5 Best Cards For Each ([updated_month_year]) Miles vs. Cash Back: 5 Best Cards For Each ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Miles-vs.-Cash-Back.jpg?width=158&height=120&fit=crop)

![9 Best Air Miles Credit Cards for Business ([updated_month_year]) 9 Best Air Miles Credit Cards for Business ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_1054148699.jpg?width=158&height=120&fit=crop)

![5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year]) 5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Air-Miles-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)