Here is our roundup of credit cards with instant approval by category. It turns out that most credit cards can give you an instant approval decision when you apply online.

Sometimes, they will tell you that they need more information and will send a decision soon — in a matter of hours or days. Of course, sometimes the issuer will decline your application, but may offer an alternative card that better suits you.

Bad Credit | Fair Credit | Cash Back | Miles | Balance Transfer | Students | Business

FAQs & Ranking Methodology

Credit Cards for Bad Credit with Instant Approval

In general, a bad FICO credit score is below 580 on a range of 300 to 850. About 16% of applicants fall into this category.

You can still get a credit card while having bad credit, but your choices are limited. The cards listed below are geared toward consumers who have bad credit.

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

- PREMIER Bankcard credit cards are for building credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- Credit Limit Increase Eligible after 12 months of consistent responsible account management.

- We report monthly to the Consumer Reporting Agencies to help you build your credit.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See Provider Website

|

See Provider Website

|

Fair/Poor

|

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

The credit limits on these cards are low, and you can expect higher-than-average APRs. You may also face hefty fees, which can include annual, application, cash advance, and management fees.

Nonetheless, these cards can help you build your credit score so that eventually you may qualify for a less expensive card with a higher credit limit.

Credit Cards for Fair Credit with Instant Approval

The FICO range for fair credit is generally considered to be 580 to 669. About 17% of applicants fall into this subprime category.

As you can see below, the universe of credit cards expands when you go from having bad to fair credit.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

Relative to the cards for bad credit consumers, these tend to have higher credit limits, lower costs, and some even provide rewards. All the cards listed here will give you an instant decision when you apply online.

You should ascertain your credit score before applying so you apply for a card in the right category.

Cash Back Cards with Instant Approval

Cash back cards are popular because, well, who doesn’t love cash? These cards generally have a base reward level of $1 to $1.50 for each dollar spent on purchases.

Below are our top three choices of cash back cards.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

Some also offer higher reward levels for purchases at specific types of merchants. The schemes for higher rewards generally fall into two types.

The first is tiered rewards, with one or more elevated reward levels permanently linked to specific merchant types. The second uses a quarterly rotating set of favored merchants that provide high rewards as long as you activate the category each quarter. Cards often limit the cash back on the higher reward levels to a specific amount of purchases per quarter.

Air Miles Cards with Instant Approval

If you are a frequent flyer, air miles cards may be just the ticket. Instead of cash back, they offer air miles you can use to book your next flight, or your next hotel stay.

The better cards allow you to use your miles to book flights with no blackout dates. See our favorites below.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

These cards often provide signup bonuses in which you can earn a mother lode of miles when you spend the specified amount on purchases during the first three months after opening the account. Some allow you to transfer your miles to their travel partners’ reward programs on a 1:1 basis.

Generally, you can also redeem your miles for reduced-rate or free stays at selected hotels.

Balance Transfer Cards with Instant Approval

A balance transfer is a way to consolidate your credit card debt to one card. The cards reviewed here all provide a period after account opening in which you will be charged 0% interest on balance transfers for a specified number of months.

A one-time fee may apply, generally around 3% for each transfer.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

15. Chase Slate Edge℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

By transferring your balances to one card, you simplify your monthly payment schedule and perhaps reduce your monthly minimum payments. The period of introductory 0% interest is your opportunity to eliminate balances on your other cards.

However, do not close these other credit card accounts because doing so will reduce the age of your credit history and thereby hurt your credit score.

Student Cards with Instant Approval

Students are singled out for a credit card category because they frequently lack credit history. For many students, these cards will be the first cards they own.

That’s an important audience for issuers, who would like to build brand loyalty starting at an early age. The hope is that after the students enter the workforce, they will apply for a fancier credit card from the same issuer.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The perks on these cards vary. Some offer items like good-grade rewards, Cashback Match, and/or elevated reward levels on merchant categories favored by students, such as gas stations and restaurants.

You’ll also notice that many offer reasonable APRs given that students often have thin credit reports.

Business Cards with Instant Approval

If you’re a business owner, these credit cards allow you to build rewards from your own purchases and the purchases of employees. Most issuers will provide free cards to employees who earn rewards for the owner.

This can be especially lucrative when you have employees who frequently travel and therefore rack up rewards for flights, hotel stays, restaurant dining, and car rentals.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

- 0% Intro APR for the first 12 months; 21.24% - 29.24% variable APR after that

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won't expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

21.24% - 29.24% (Variable)

|

$0

|

Good

|

Business credit cards may offer elevated tiered or quarterly rewards in addition to their base reward level. Their benefits are usually geared to business expenses, such as supplies, travel, travel insurance, and dining.

Some cards single out business-to-business services, such as phone, internet, and cable, for higher rewards. Business cards often offer rewards in the form of miles or points.

Which Credit Cards Have Instant Approval?

The 21 credit cards in this review all offer an instant approval decision for a wide range of consumers, including the credit-challenged, students, frequent travelers, consolidators, and businesses.

Each bureau assigns you a credit score, so you should know all three.

Your credit score is one of the key determinants as to whether you will receive instant approval. That means you should know your credit scores from the three major credit bureaus — Experian, TransUnion, and Equifax.

You need all three because each credit bureau independently assigns you a score, and those scores can differ based on the unique information available to each bureau.

As we show, there are instant-approval credit cards for each credit type, from poor to exceptional. To increase the chances of approval, you can first research to find which of the three bureaus your credit card issuer uses in your state.

For example, you’ll find that Discover favors Equifax, Capital One pulls credit reports from all three bureaus, and Chase prefers Experian (although in some states it favors TransUnion).

Knowing which credit bureau your card uses is useful because it allows you to focus on cleaning up your credit report from that bureau first. By “clean up,” we mean remove errors that hurt your score.

You can attempt this yourself or hire a credit repair company to do the work for you. Several credit repair services can offer expert help for a reasonable fee.

Can I Use a Credit Card Immediately After Approval?

We recently reviewed 27 credit cards that offer same-day use. These cards allow you to use your account even before you receive the physical card.

Until the card arrives, you’re limited to card-not-present (CNP) purchases, either over the phone or online. This is usually implemented using virtual account numbers.

A virtual account number is cooked up by the credit card issuer and bears no relationship to your actual number. Most are one-time use only, but some can be reused.

Typically, you go online to a merchant and enter the virtual card number as you would the actual number. Single-use virtual cards limit the damage fraudsters can inflict if they happen to steal the virtual number.

Some issuers offer virtual account numbers on all their cards. For example, you can use the Eno® feature to generate virtual Capital One card numbers.

Some issuers offer virtual account numbers on all their cards. For example, you can use the Eno® feature to generate virtual Capital One card numbers.

Another issuer of virtual cards is Citibank, which offers this service on select Citi® cards. In addition, American Express offers its vPayment virtual card service, but only on business cards. Bank of America recently discontinued its ShopSafe® program that provided virtual cards.

Another alternative is to use a third-party service, such as Privacy, that issues virtual card numbers. You can limit a virtual number to a specific merchant, for specific dates, with pre-set spending caps. This keeps your card from being exposed to fraud at a different merchant and limits the damage the fraudster can do.

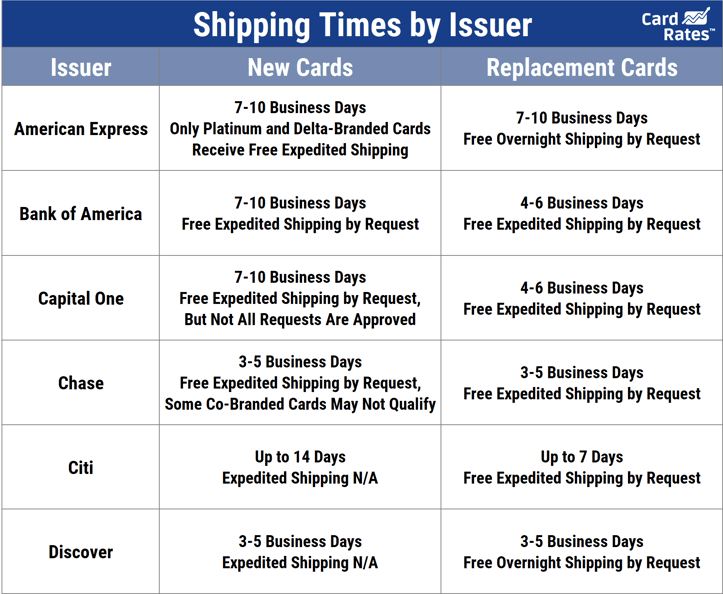

How Long Does It Take to Get a Credit Card in the Mail?

Typically, it will take seven to 10 days after approval to receive a credit card in your mailbox. That length of time is necessary to create the card, mail it, and wait for delivery. The issuers save money by using standard mail instead of one of the expedited services.

The major credit card issuers have created extremely efficient operations, which means that they can usually print your card and get it in the mail by the next business day. Some exceptions may take longer.

For example, some issuers offer heavy credit cards made of metal and other non-plastic materials. It may require more time to create one of these heavyweight cards.

Discover is an issuer that has semi-expedited its card mailing service by using Priority Mail. You can expect to receive your Discover Card in three to five business days after approval.

This is an automatic feature that applies to all cards issued by Discover. In addition, the issuer will replace lost or stolen cards using overnight shipping.

Some other credit card issuers offer overnight shipping for lost, stolen, or damaged cards. They may offer the service for free or may charge a fee.

One example is Chase, which offers free overnight shipping if you ask for it. You can then expect the card to arrive in one to two days.

Capital One sometimes will provide expedited shipping, but it may require you to plead your case.

Ranking Methodology

Our rankings of the best credit cards with instant approval are categorized by credit score requirements, rewards offered, and special qualifying criteria, such as being a student or owning a business. We evaluated each card’s likelihood of approval for poor credit applicants, the ability to rebuild credit with responsible use, APRs and annual fees, 0% promotional periods, and other criteria relevant to this article.

CardRates’ reviews undergo a thorough editorial integrity process to ensure that content is not compromised by advertiser influence.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Instant-Approval Credit Cards with Instant Use ([current_year]) 8 Instant-Approval Credit Cards with Instant Use ([current_year])](https://www.cardrates.com/images/uploads/2021/07/Instant-Approval-Credit-Cards-With-Instant-Use.jpg?width=158&height=120&fit=crop)

![7 No-Credit Credit Cards with Instant Approval ([updated_month_year]) 7 No-Credit Credit Cards with Instant Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/No-Credit-Credit-Cards-With-Instant-Approval.jpg?width=158&height=120&fit=crop)

![12 Best Instant-Approval Credit Cards ([updated_month_year]) 12 Best Instant-Approval Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Instant-Approval-Credit-Cards--1.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: Instant Approval ([updated_month_year]) 7 Credit Cards for Fair Credit: Instant Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Credit-Cards-For-Fair-Credit-With-Instant-Approval.jpg?width=158&height=120&fit=crop)

![9 Best Instant Approval Credit Cards With No Deposit ([updated_month_year]) 9 Best Instant Approval Credit Cards With No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/best-instant-approval-credit-cards-with-no-deposit.jpg?width=158&height=120&fit=crop)

![5+ Instant Approval Auto Loans For Bad Credit ([updated_month_year]) 5+ Instant Approval Auto Loans For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Instant-Approval-Auto-Loans-For-Bad-Credit--1.jpg?width=158&height=120&fit=crop)

![8 Instant-Approval Bad Credit Personal Loans ([updated_month_year]) 8 Instant-Approval Bad Credit Personal Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/06/Instant-Approval-Bad-Credit-Personal-Loans.jpg?width=158&height=120&fit=crop)

![7 Best Instant-Approval Personal Loans ([updated_month_year]) 7 Best Instant-Approval Personal Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/05/Best-Instant-Approval-Personal-Loans.jpg?width=158&height=120&fit=crop)