Every credit card comes with terms, including the annual percentage rate, otherwise known as the APR. Several APRs may be attached to the card, and among them is the regular purchase APR.

This rate is important because it represents how much the finance fees will be on items and services you charge to the card if not paid off each month. Here’s everything you need to know about regular purchase APRs.

Regular Purchase APR Versus Other APRs

Credit card issuers can charge several different APRs to a single account. The purchase APR is the one you will be charged for the things you buy at physical and online locations.

For example, when you use your card at a restaurant, gas station, or order an item online, the purchase APR will be calculated on the portion of the bill that you do not pay in full by the due date. It is considered a regular APR when an introductory or balance transfer APR is not in effect:

- Introductory APR – Some credit cards come with a temporary interest rate referred to as promotional or introductory APRs. These short-term rates can be as low as 0% and usually last between six and 18 months from when you first open the account. After that time frame, the regular purchase APR will go into effect.

- Balance Transfer APR – The balance transfer APR is the rate a new credit card issuer will give you for moving debt from another card to the new account. In exchange, you’ll get an extraordinarily low APR, oftentimes 0%. As with the introductory APR, that low rate eventually expires and reverts to the regular purchase APR.

Two other APRs to know are:

- Penalty APR – This is the APR that you will be charged if you miss a payment or don’t pay on time. If the payment becomes 60 days past due, the regular interest rate can rise to a higher penalty rate. Paying credit cards with introductory or balance transfer APRs late will usually cause those special rates to end prematurely, too.

- Cash Advance – If you withdraw cash from your credit card’s credit line, the amount you take out will be hit with the cash advance APR. It’s typically a little higher than the regular purchase APR, and there is no interest-free grace period. That means interest starts to accrue as soon as you take the money out. Two different APRs can apply to your debt: the regular purchase APR on things you buy and the cash advance APR on the money you withdraw.

All of the different APRs associated with any credit account can be found in the card’s terms and conditions.

A Regular Purchase APR Can Be Fixed or Variable

Your credit card’s regular purchase APR may be a fixed or variable rate. Variable APRs are far more common.

Here are the differences between the two:

- Fixed – If your credit card has a fixed APR (typically issued by credit unions), the issuer can’t increase the rate in the first year after you open the account. After that, the issuer must send you a 45-day advance notice that warns you of an upcoming interest rate hike. At that stage, you may choose to opt out and repay your balance (should you have one) at the original interest rate. The other instance when a fixed APR may change is if the account becomes delinquent.

- Variable – Most credit cards have variable rates. This APR can change without the issuer notifying you or without you missing any payments. That’s because the variable rate is connected to an index rate (such as the Federal prime rate) that rises and falls. The regular purchase APR will be a specific number of percentage points more than the index rate, called the margin. If the prime rate is 12% and the margin is 2%, the variable APR will be 14%, but if the prime rate rises to 12.75%, your variable APR will be 14.75%. However, the issuer will have to notify you if it increases the margin. At that point, you may choose to opt out the same as you would with a fixed-rate card.

Fixed APRs aren’t very common, but if you tend to keep a balance on your credit card, obtaining a fixed low APR can help keep your finance charges low.

How to Get a Good Regular Purchase APR

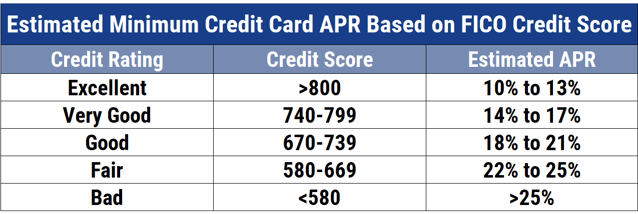

When applying for a credit card, the better your credit rating, the lower your regular purchase APR will be. Each credit card issuer offers a range of APRs based on an applicant’s creditworthiness. Just a few examples:

Capital One® Savor® Cash Rewards Credit Card: (Information for this card not reviewed by or provided by Capital One.)

Chase Freedom Flex℠:

Ink Business Preferred® Credit Card: 21.24%-26.24% Variable

To establish a high credit score, do the following:

- Send payments on other credit products on time. Payment history is the most important credit scoring factor. Skipping an entire billing cycle will create a late payment notice on your credit report that may severely damage your credit score and remain on your report for seven years. Conversely, sending payments on time for all accounts that appear on your credit report will result in a great payment history, so your scores will rise.

- Keep revolving debt down. The less you owe on your credit cards — both on individual accounts and as a whole — the better for your credit scores. The general advice is to keep revolving balances lower than 30% of your credit limit, but paying in full is preferable.

- Use credit products early and mix it up. Your credit scores will benefit from a long and varied credit history. Use several different types of credit cards and loans responsibly and over many years.

- Apply for credit products judiciously. Submitting a large number of credit card and loan applications within a short span of time can drive your credit scores down. Only pursue the credit products that you need, will qualify for, and are sure to manage well.

Do all the above and your credit scores will be attractive to credit card issuers and your regular purchase APR will be preferable.

How to Keep Your Regular Purchase APR Low

If you have an introductory or balance transfer APR that is soon transitioning to the regular purchase APR, make sure to manage the account to your advantage.

- Ask the issuer to reduce the APR. It never hurts to pick up the phone and pitch your case for a better APR. You’ll be especially compelling if you’ve managed the account well.

- Keep the account in good standing. Yes, that means paying on time so that the rate doesn’t go even higher with the penalty APR. Consider enrolling in automatic bill pay so you never forget about a bill.

- Alert your issuer if there will be problems. It’s possible to offset an APR hike by letting the company know that you’re experiencing financial difficulties. Do it before you pay late, and they may agree to keep the lower rate.

In the end, the regular purchase APR will not be an issue if you do not carry over any debt from one month to the next. By only charging the amount you can and will repay in 30 days, you won’t be assessed any finance fees, no matter what the rate is.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Purchase APR Credit Cards ([updated_month_year]) 7 Best Purchase APR Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Purchase-APR-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year]) What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/what-is-apr.jpg?width=158&height=120&fit=crop)

![What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year]) What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/good-apr2.png?width=158&height=120&fit=crop)

![7 Best Credit Cards For Purchase Protection ([updated_month_year]) 7 Best Credit Cards For Purchase Protection ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Best-Credit-Cards-For-Purchase-Protection.jpg?width=158&height=120&fit=crop)

![7 Options When Your Credit Card APR Rises ([updated_month_year]) 7 Options When Your Credit Card APR Rises ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/shutterstock_591898394-edit1.jpg?width=158&height=120&fit=crop)

![How to Calculate APR on a Credit Card ([updated_month_year]) How to Calculate APR on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/CalculateAPR-1--1.png?width=158&height=120&fit=crop)

![9 Best Fixed-APR Credit Cards & Alternatives ([updated_month_year]) 9 Best Fixed-APR Credit Cards & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Best-Fixed-APR-Credit-Cards.jpg?width=158&height=120&fit=crop)