If you run a business that requires frequent travel, you’ll want to read this review of the best air miles credit cards for business owners. Not only will these cards help you reduce your travel expenses, but they’ll also reward you for other purchases your business requires.

And by adding key employees to your card, you can earn rewards much faster than going it alone. After sifting through reams of information, we’ve identified the following card as our top choice.

Best Overall

More Cards | FAQs

Best Overall Business Air Miles Card

Strictly speaking, the Ink Business Preferred® Credit Card is not an air miles card, but points can be redeemed for travel at 25% more value through Chase Travel℠, making it a top travel card. Those points can also be transferred at 1:1 value to Chase’s travel partners.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

You can authorize employees to use your account and receive employee cards at no extra cost. This rewards credit card is loaded with liability, purchase, cellphone, and travel protections, including trip cancellation/interruption insurance and auto rental collision damage waiver.

More Top-Rated Air Miles & Travel Cards for Business

The remaining cards are also good choices for business people on the go. Most of these are co-branded with a particular airline, which may make a lot of sense if it matches your travel preferences.

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Use Membership Rewards® Pay with Points for all or part of an eligible fare and get 35% of those points back, up to 1,000,000 points back per calendar year

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.74% - 26.74% Pay Over Time

|

$695

|

Excellent

|

Business Platinum Card® from American Express offers bonus points for flights, hotel stays, and large purchases. Travel benefits include access to airport lounges, annual credits for eligible expenses at your chosen airline, and point rebates for airline fares paid with points.

This high-annual-fee card offers a variety of business-related benefits beyond those for travel, including statement credits for purchases from Dell Technologies, employee cards, account manager designation, year-end summaries, and account alerts. You can use the American Express Business App to manage receipts and the optional Vendor Pay feature to pay bills while earning extra points. You also get benefits like extended warranties, purchase protection, and dispute resolution.

- Earn 100,000 bonus miles after you spend $6,000 in purchases on your new card in your first 3 months of card membership

- Earn 3 Miles on every dollar spent on eligible purchases made directly with Delta, all other purchases earn 1 Mile per dollar spent

- After you spend $150,000 in purchases on your card in a calendar year, you can earn 1.5 miles per dollar on eligible purchases for the rest of the calendar year

- Enjoy complimentary access to Delta Sky Clubs plus complimentary access to The Centurion® Lounge when you book your Delta flight with your Reserve Card

- Enjoy a Domestic First Class, Delta Comfort+® or Main Cabin round-trip companion certificate each year upon renewal of your Delta SkyMiles Reserve Business Card

- Enjoy early boarding on Delta flights as a benefit of Card Membership. You can board your flight when Main Cabin 1 priority boarding is called so you can find room for your carry-on bag and settle into your seat sooner.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% - 29.24% Variable

|

$550

|

N/A

|

The Delta SkyMiles® Reserve Business Card is a premium miles card with an annual fee to match. You earn bonus miles on direct purchases from Delta that you can redeem for flights, upgrades, merchandise, gift cards, and car rentals, among other options. Travel benefits include free or discounted access to participating airport lounges, a free annual companion certificate, priority seating, free upgrades, and a free checked bag.

You also get a fee credit for Global Entry or TSA Precheck, baggage insurance, trip insurance, around the clock Reserve Concierge, and car rental loss and damage insurance. Your business benefits from several expense management tools, including free employee cards, Vendor Pay, online and year-end statements, the American Express Business App, and various account and purchase protections.

- Earn 60,000 bonus points after spending $2,000 on purchases in the first 90 days. Plus, earn an additional 10,000 bonus points when a purchase is made on an employee card.

- Earn 6X points on eligible JetBlue purchases, plus 2X points at restaurants and office supply stores, 1X points on all other purchases

- Earn 5,000 bonus points every year after your account anniversary

- Receive a 50% savings on eligible inflight purchases of cocktails and food on JetBlue-operated flights

- Enjoy an annual $100 statement credit after purchasing a JetBlue Vacations package with your card

- Free first checked bag for you and up to 3 companions on the same reservation when you use your card to book JetBlue-operated flights.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% or 29.49% (Variable)

|

$99

|

N/A

|

The JetBlue Business Card from Barclays offers bonus points on eligible purchases from JetBlue, restaurants, and office supply stores. Travel perks include free baggage check, discounts on inflight food and beverages, Mosaic membership, and an annual statement credit after purchasing a JetBlue Vacations package.

You also get points rebates for flights purchased with rewards, earn annual bonus points after your account anniversary, and pay no foreign transaction fees. Points Pooling lets you accumulate points with friends and family. Your employees can get their own copies of your card at no extra cost, and you can control spending limits on employee cards.

- Earn 95,000 Bonus Miles after spending $4,000 in purchases on your new card in your first 3 months of card membership

- With Status Boost®, get closer to Medallion® Status by earning 10,000 Medallion® Qualification Miles (MQMs) after you spend $25,000 in purchases on your Card in a calendar year, up to 2 times per year

- Earn 3 Miles on every dollar spent on eligible purchases made directly with Delta and purchases made directly with hotels

- Earn 1.5 Miles on single eligible purchases over $5,000, up to 50,000 additional miles per calendar year, and 1 Mile on every eligible dollar spent on purchases

- You can check your first bag for free and save up to $60 on a round-trip Delta flight, plus enjoy early boarding on Delta flights

- Enjoy early boarding on Delta flights as a benefit of card membership. You can board your flight when Main Cabin 1 priority boarding is called so you can find room for your carry-on bag and settle into your seat sooner.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% - 29.24% variable

|

$250

|

N/A

|

The Delta SkyMiles® Platinum Business Card offers rebates on in-flight purchases, preferred seating, and a Delta Platinum companion certificate each year upon renewal of your card. You can shop with your miles at the Delta SkyMiles Marketplace.

Other benefits of this American Express card include free employee cards, free checked bags, reimbursed TSA Precheck or Global Entry fees, and guaranteed lowest hotel rates upon booking. You’ll also get travel protections that include baggage insurance, car rental loss and damage insurance, and 24/7 access to medical, legal, financial, or other select emergency coordination and assistance services.

- Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening.

- 9,000 bonus points after your Cardmember anniversary.

- Earn 4X pts on Southwest® purchases.

- Earn 3X points on Rapid Rewards® hotel and car rental partners.

- Earn 2X points on rideshare.

- Earn 2X points on social media and search engine advertising, internet, cable, and phone services and 1X points on all other purchases.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49% - 28.49% Variable

|

$199

|

Good/Excellent

|

In return for a moderately high annual fee, the Southwest® Rapid Rewards® Performance Business Credit Card offers bonus points for Southwest Airline purchases, plus upgraded boardings and inflight WiFi credits.

The card reimburses you for Global Entry or TSA PreCheck® fees, your first two bags fly for free, and you are insured against luggage loss or delay. You can order employee cards at no extra cost and take advantage of travel and emergency assistance services. Other benefits include auto rental collision damage waiver, roadside dispatch, purchase protection, travel accident insurance, and extended warranty protection.

- Earn 65,000 American Airlines AAdvantage® bonus miles after spending 4,000 within 4 months of account opening

- Earn 2X miles for every $1 spent on American Airlines purchases and at cable and internet providers, gas stations, select telecommunications merchants, and car rental services — all other purchases earn 1X points

- First checked bag free on domestic American Airlines itineraries for you and up to 4 travel companions

- 25% savings on American Airlines inflight WiFi, food, and beverage purchases when you use your card

- Earn an American Airlines Companion Certificate for domestic travel after $30,000 in purchases each card membership year and card membership is renewed. Fees apply.

- $0 intro annual fee, then $99

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% - 29.49% (Variable)

|

$99, waived first 12 months

|

Excellent, Good

|

Additional Disclosure: (The information related to CitiBusiness® / AAdvantage® Platinum Select® Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

If you are an American Airlines fan, you’ll be interested in owning the CitiBusiness® / AAdvantage® Platinum Select® World Elite Mastercard®. The card charges no foreign transaction fees and offers a hefty signup bonus for new cardholders if requirements are met.

Travel perks include the first bag checked for free, discounts on inflight purchases, preferred boarding, and more. Plus, your business will benefit from access to a personal business assistant and online account summaries. You also get the convenience of contactless pay and digital wallet features.

- Earn 60,000 points after you spend $3,000 on purchases in the first 3 months your account is open.

- 6,000 bonus points after your Cardmember anniversary.

- Earn 3X points on Southwest Airlines® purchases.

- Earn 2X points on Rapid Rewards® hotel and car rental partners.

- Earn 2X points on rideshare.

- 1 point per $1 spent on all other purchases.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49% - 28.49% Variable

|

$99

|

Good/Excellent

|

If you are looking for a Southwest Airlines card with a moderate annual fee, the Southwest® Rapid Rewards® Premier Business Credit Card may be a perfect choice. You get bonus miles for purchases from Southwest Airlines and hotel and car rental partners. The card offers free checking of your first two bags and no fees for ticket changes.

Your bags are insured against loss and delayed arrival, and the items you buy are covered by eligible purchase protection and extended warranties. The card gives you access to reward seating on more than 100 destinations in the Western Hemisphere with no blackout dates. If you’re in a hurry, just tap to pay with this contactless card.

- Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

- $0 introductory annual fee for the first year, then $99.

- Receive a 5,000-mile "better together" bonus each anniversary when you have both the United℠ Business Card and a personal Chase United® credit card.

- Earn 2 miles per $1 spent on United® purchases, dining including eligible delivery services, at gas stations, office supply stores, and on local transit and commuting.

- Earn 1 mile per $1 spent on all other purchases. Plus, employee cards at no additional cost - miles earned from their purchases accrue in your account so you can earn rewards faster.

- Enjoy a free first checked bag - a savings of up to $140 per roundtrip (terms apply), 2 United Club℠ one-time passes per year, and priority boarding privileges.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.99% - 28.99% Variable

|

$99

|

Good/Excellent

|

If you prefer to fly United, check out the United℠ Business Card. For a moderate annual fee, you get free passes to United Club, free employee cards, and priority boarding. You’ll also like the fact that there are no foreign transaction fees or blackout dates.

You get annual travel credits, rebates on United inflight purchases, your first bag is checked for free — which can save you up to $140 per round trip — and your bags are covered against loss or delay. You also get trip delay/cancellation/interruption insurance, auto rental collision damage waiver, extended warranties, and eligible purchase protection against damage or theft.

How Does an Air Miles Business Card Work?

Accumulating travel rewards for your business is the chief reason to own an air miles business credit card. These rewards, in the form of miles or points, defray some of your travel costs, and the best cards also provide an array of benefits for other business activities. Every dollar you spend with an air miles card earns you one or more miles that can eventually pay for a flight, travel upgrades, or another travel-related purchase.

Most air miles business cards work in a similar fashion. You apply for the card in the name of your business, creating an account separate from your personal financial accounts. Your miles or points accumulate as you use the cards for your business purchases, and some of those purchases may earn bonus miles that speed your progress toward free or discounted flights.

You can log on to your air miles credit card online site or mobile app at any time to review your mileage totals and consider your options for redeeming your miles. Your choices are shaped by the nature of the card — whether it is a general-purpose card that accumulates miles that can be used on a variety of airlines or a co-branded card with a particular carrier.

Your card will likely offer you other redemptions besides airline tickets, including cash, gift certificates, purchases from select merchants, hotel stays, and car rentals, among other options.

The Ink Business Preferred® Credit Card from Chase and Business Platinum Card® from American Express from American Express exemplify the general travel card category. Both cards let you earn points you can redeem for tickets on any airline, and the Chase card lets you transfer your points 1:1 to leading frequent flyer programs.

To redeem your points for tickets, you must use the sites provided by the card issuers, Chase Ultimate Rewards or American Express Travel, respectively.

The remaining cards in this review are co-branded with specific airlines. You can use your accumulated miles for travel purchases directly from the co-branding airlines and their partners. Or you can use your miles to partially pay for a ticket or other travel purchase and make up the difference with cash (or a charge on your air miles credit card).

Because these are business credit cards, most offer bonus rewards for common business purchases, such as those from office supply stores, phone, cable, and cellphone network operators, and social network advertising providers, among others. Some of these cards also include hotel and dining expenses among the bonus categories, and most offer special account management tools such as yearly summaries and free employee cards.

Business credit cards usually offer a larger sign up bonus than do regular cards. For instance, the Ink Business Preferred® Credit Card offers a sizable bonus when new cardholders meet the minimum spending threshold on new purchases during the first three months after opening the account. Most of the co-branded cards offer a welcome bonus for 60,000 miles or more.

Each card’s fine print will tell you all you need to know about how the card works, and as a good business owner, you owe it to yourself to read it. You should understand any limitations on your rewards and benefits, as well as your rights under arbitration.

The card’s important interest rates and fees are summarized in the Schumer box so you aren’t surprised by extra charges tacked onto your monthly bill.

How Do I Apply for a Business Credit Card?

You shouldn’t be surprised that the credit card companies make it as easy as possible to apply for a business credit card. The starting point is to identify the card you want, which you can do by perusing online reviews such as this one.

When you make a choice, simply click the “Apply Now” button, and you’ll be directed to the card’s application page.

Business credit card applications ask for data items not used when you apply for a consumer card. The most significant difference is that you need to supply an Employer Identification Number, available from the IRS to uniquely identify your business. The EIN takes the place of a Social Security number for all businesses other than a sole proprietorship, where it is optional.

You’ll be asked several other questions about your business, such as its name, phone, and address, how it is organized, the number of employees, the annual business income, years in business, and your industry classification. From there, you’ll enter the usual personal information you find on consumer credit cards. You may be asked whether a portion of your annual gross income is non-taxable.

Read the certifications before you submit your application, as it describes a number of facts to which you agree, including:

- The account is strictly for business purposes.

- As the authorizing officer, you are personally and jointly liable with the business to make your payments.

- You’ve read all the relevant terms and conditions, and all the information you’re submitting is accurate and complete.

- You will notify the issuer if the ownership of the business changes or if you leave the business.

- You are responsible for all redemptions, and the redemption will be used only for business purposes.

- You will receive all cards, statements, and notifications sent by the issuer.

- You are responsible for authorizing employees to receive copies of the credit card, and authorized employees have access to the card’s full credit line unless you set specific limits.

- You may not be eligible for an introductory and sign up bonus if you’ve received one from the card issuer during a specified previous period.

- You understand that interest rates and fees may change.

If you agree to all these points, you can check the “read and agree” box and hit the submit button. If your credit is good enough, you should receive an approval immediately. An approval will be accompanied by key information including APR and credit limit.

However, expect to wait longer if the credit scores for the business or yourself are lower than the issuer’s requirements or some other obstacle appears. If you are denied, the bank is legally required to mail you an adverse action notice informing you of its decision and the reason for denial.

Upon approval, you can request employee cards, which in many cases are available for free, or at least free for a set number of employees. Take the opportunity to set any purchase and cash advance limits for each employee card. Cards that charge annual fees may simply add the fee to your balance rather than requiring up-front payment.

Expect to receive the card in one to two weeks unless you arrange expedited shipment. Some cards may offer immediate access to a virtual credit card number that allows you to make card-not-present purchases until the physical card arrives.

What is the Best Business Credit Card for Airline Miles?

Our top pick is the Ink Business Preferred® Credit Card from Chase, even though it is technically a points card. Since you can convert the points to miles, we’ve got no problem including it with the cards in this group. We like the card’s generous welcome bonus, its high reward rate with a high annual cap, and the different merchant categories qualifying for the high rate.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The annual fee is reasonable considering the card’s benefits and rewards. There is a long list of benefits that should satisfy any owner of a small business. The ability to use your points for travel on any airline makes the card very flexible.

As a Chase points card, it qualifies for a higher redemption value (125% of regular value) when you use your points to purchase airline tickets through Chase Travel℠. As with most cards in this category, it offers no 0% introductory APR promotion for purchases or each balance transfer.

Among the co-branded mile cards, we especially like the CitiBusiness® / AAdvantage® Platinum Select® World Elite Mastercard®. If you like to fly on American Airlines, you’ll appreciate the card’s signup offer that gives you a bit longer than the usual industry offering to meet its spending requirement. It provides generous features including miles earned on every purchase, free baggage check, and discounts on inflight purchases.

We also like that the Citi card waives its moderate annual fee for the first year and doesn’t charge foreign transaction fees. The card packs features including online account summaries, free employee cards, and personal business assistance that should warm the weary heart of any business owner.

Your choice for the best business air miles card depends on your unique preferences. It, therefore, makes sense for you to consider all the cards in this review before making a final choice. Factors to consider include:

- Cost: Even if you select a card with no annual fee, you still are subject to the card’s other fees and its APR. Often, cards are advertised with a range of APRs and the rate you are offered will reflect your creditworthiness. Be sure to check the card’s terms and conditions for a rundown of all the fees that may apply. While you may prefer a cheap credit card, an annual fee should not automatically disqualify a card from your considerations. It really depends on what benefits the card provides and how much those benefits are worth to you. For example, you may decide to get a card that offers free baggage check and airport lounge access, even if the annual fee is more than $100.

- Flying preferences: If you habitually fly with one particular airline, you would probably do best with a travel credit card that is co-branded with that airline. That’s usually the most efficient way to accumulate miles you can use to get free tickets and other travel perks. Conversely, you may enjoy the freedom of selecting flights from a variety of airlines. Of course, you’ll have a much bigger selection if you live near an international airport rather than a small regional facility. If having options is important to you, it’s best to stick to one of the travel points cards that work with all airlines.

- Spending preferences: Some cards may be a better fit for your spending habits. For example, some cards may offer a higher membership reward rate for purchases at grocery stores, restaurants, or gas stations. Ideally, you’d like a card to offer you bonus rewards for shopping at merchant types that you frequent. The cards reviewed here all have a basic rewards rate of 1X (i.e., one point or mile per dollar) that applies to all purchases that aren’t eligible for higher rewards rates. You should consider not only which purchases earn higher rewards rates, but also any caps on the amounts of purchases that qualify for the higher rewards rate within a specified period. For instance, you may prefer a card that lets you earn unlimited 3X miles on travel, hotels, and restaurants rather than a card that offers 5X miles only on travel and capped at $1,500 in eligible purchases per quarter.

- Signup bonuses: It can be pretty enticing when a card offers a boatload of miles or points to new cardmembers who spend a set amount on purchases during an initial period following account opening. In some cases, cards also offer an annual bonus paid each year on the anniversary of the account start date. But don’t be seduced by huge signup bonuses if you aren’t likely to spend the target amount before the deadline, or if you know you’ll overspend just to achieve bonus rewards.

You may have additional factors that influence your choice of credit card, such as brand loyalty or the cards you already own. The perfect new card is the one that’s perfect for you.

What is the Best Airline Rewards Credit Card Program?

If we combine the business and consumer credit card categories, our top choice is the Capital One Venture Rewards Credit Card. It charges a moderate annual fee while earning you double miles on every purchase. You can transfer your miles to more than 10 loyalty programs or redeem them for travel, vacation rentals, car rentals, and more.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

A very close runner up (and my personal card) is the Chase Sapphire Preferred® Card. The signup bonus isn’t quite as generous as that offered by the Capital One card, but the card’s reward points are worth 1.25X more when redeemed for travel via Chase Travel. The card offers bonus rewards on travel and dining plus special promotions that widen the variety of merchant types where purchases earn bonus points.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Preferred card’s annual fee is only 20% of that for its big brother, the Chase Sapphire Reserve®, yet it offers about 80% of the value. That’s an exceptionally good tradeoff unless you need premium features like access to airport lounges or an annual travel credit. The Reserve card’s points are worth 1.5X when redeemed through Chase for travel.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Perhaps you’d prefer a co-branded airline card, not necessarily for business. We are fond of the United℠ Explorer Card, which waives its moderate annual fee for the first year and pays you bonus miles for purchases from hotels, restaurants, and United Airlines. The card offers limited free baggage check and reimburses you up to $100 for Global Entry or TSA PreCheck®.

Another likeable choice is the Delta SkyMiles® Reserve American Express Card. This is a premium co-branded card with a high annual fee that delivers a goodly number of perks, including free baggage check, free access to Delta Sky Club, and many other benefits comparable to those available from the Delta SkyMiles® Reserve Business Card featured in this review.

When evaluating the best airline miles program, factor in these important considerations:

- Signup bonus: All things being equal, you’ll like a bigger sign up bonus, but not so big that it requires an untenable amount spent on purchases during the promotion period. Periods longer than three months give you extra time to fulfill the purchase requirement.

- Value of miles: This is a function of the number of miles you receive through purchases and bonuses and the number of miles required to get a free ticket or upgraded seat. A card that pays you a signup bonus of 100,000 miles may be worth less than another card with a smaller signup bonus but boasting more valuable miles.

- Reward type: Some air mile cards offer a flat rewards rate on all purchases, while others may provide tiered or even quarterly rotating rewards. Variations in bonus rewards can range from 1.5X to 5X miles or more. There are also variations in the types of merchants where purchases earn bonus rewards that impact how quickly you accumulate miles.

- General or co-branded: A general air travel card gives you points or miles you can spend at a variety of airlines. This is a good choice if you need flexibility, but it’s usually not as rewarding as a credit card designed to be used for one airline. Co-branded cards lack the flexibility of general air miles cards, but they also may offer more valuable rewards from the co-branded airline.

- Annual fees: Many cards in this category charge an annual fee of $95. You can pay more to get additional benefits, but first, make sure that those benefits are worth it. For example, if you prefer carry-on luggage, a free baggage check won’t be that useful to you.

Other factors may apply, depending on your personal preferences. For example, do you often stay at a particular hotel brand when traveling? You may like a card that is affiliated with that brand and earns you bonus miles when you stay at one of its properties.

Similarly, you may be a traveler that regularly rents a car at the airport. Not only would you like to earn bonus miles for those rentals, but you’ll also appreciate getting free collision damage waiver coverage and free road assistance.

If you travel abroad, you probably want a card that doesn’t charge a foreign transaction fee or currency translation fee. You’d also probably benefit from travel accident insurance that will come in handy when something goes wrong in a foreign country.

If you like to lubricate long flights with a parade of those little liquor bottles, check out cards that offer you discounts or rebates on in-flight purchases. The bottom line is that you should take a few minutes to consider your own preferences before deciding on an airline credit card.

What is the Best Credit Card for Business Travel?

Business travel requires a business travel credit card, one that understands you aren’t necessarily traveling for pleasure and would appreciate a reasonable quota of comfort and valued features. In other words, you may find the higher annual fee charged by a premium travel card to be worthwhile if it makes your travel easier.

In that vein, we think you’ll really like Business Platinum Card® from American Express, especially if you plan to authorize cards for employees to use. The reason is that the generous signup bonus requires a significant amount of spending on eligible purchases, a goal that’s much easier to achieve if you collect miles from employee purchases.

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Use Membership Rewards® Pay with Points for all or part of an eligible fare and get 35% of those points back, up to 1,000,000 points back per calendar year

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.74% - 26.74% Pay Over Time

|

$695

|

Excellent

|

The card offers a high bonus rate on flights and hotel stays booked through American Express Travel. You get an annual statement credit each year that in itself pays you about a third of the annual fee. Combine that with free airport lounge access and the Pay with Points feature that rebates 35% of points on eligible fares, and you can see why we give this card a high rating.

But wait, there’s more! You can get a Dell Technologies rebate annually on eligible purchases. There is also the Fine Hotels + Resorts® Program — book your stay through American Express Travel and receive hundreds of dollars in perks at over 1,100 properties worldwide.

Your free access to airport lounges covers more than 1,300 properties in 140+ countries, including names like Centurion® Lounge, the International American Express lounges, Priority Pass Select lounges, the Delta Sky Club, and other members of the American Express Global Lounge Collection. Once you arrive, take advantage of free upgrades and other perks you’re entitled to thanks to your Marriott Bonvoy™ Gold Elite and Hilton Honors Gold status, all because you own Business Platinum Card® from American Express.

Long flights can really build up an appetite, but you’re welcome to exclusive access to the restaurants in the Global Dining Collection. The collection includes some of the world’s best restaurants with renowned chefs famous for creating unique dining experiences. You can use the Business Platinum Card Concierge to make all the arrangements plus help you procure concert tickets, book ground transportation, and any other items on your to-do list.

Interruptions to your business travel can be costly, but the card doesn’t leave you twisting in the wind, thanks to the free trip delay, cancellation, and interruption insurance. In addition, you’ll be eligible for preferred seating, baggage insurance, and car rental loss and damage insurance.

How Many Miles Do You Need to Get a Free Flight?

Human flight has been a dream of mankind since the first cave dweller observed a bird on the wing. Airplane flight became a reality in the early 20th century thanks to the Wright Brothers. Now, free airplane flight is in the reach of consumers who redeem frequent flyer miles and/or credit card miles and points.

The question then becomes one of knowing how many miles you’ll need to fly for free. The answer is slightly different for co-branded and general-purpose travel cards.

Reward Ratios

A travel card’s reward ratio is the amount you have to spend on eligible purchases to earn a point or mile. The basic rewards rate, known as 1X, is one point or mile per dollar spent.

However, many credit cards offer either a flat higher rate (i.e., ranging from 1.25X to 2X) on all purchases, while others offer higher reward tiers (1.5X to 5X or higher) on selected purchases (perhaps subject to a dollar cap) and the basic rewards rate on all other purchases.

In this review, the two general-purpose travel cards offer from 3X to 5X reward points on travel purchases, whereas the co-branded cards offer 2X to 6X frequent flyer points/miles on travel.

The cards’ reward ratios don’t tell you how many points or miles you need to get a free ticket. Rather, the ratios indicate how much you’ll have to spend to get the requisite number of points/miles.

Co-Branded Travel Cards

The points or miles you earn from these cards are directly usable in the co-branding airline’s frequent flyer program. You can’t use those miles on a different airline unless it is a partner of the co-branding one.

The points/miles you earn on these cards can indeed pay for a free flight, but note that you’ll have to reach into your own pocket to pay for fuel surcharges and international taxes. Since you already know which airline you’ll be flying, you can quickly check its award chart to know how many miles you’ll need to redeem.

General-Purpose Travel Cards

These cards let you accumulate card reward points that you can use on any number of different airlines. This makes general-purpose cards more versatile than co-branded ones, but are they as efficient?

Efficiency in obtaining free flights depends on the value of each card reward point and the ticket price for the flight you want. The value of each point is usually $0.01, meaning you need 100 points for each dollar of airfare.

However, credit cards may enhance the value of points used to purchase flights. That’s the case for the Ink Business Preferred® Credit Card, where each point is worth $0.0125 when redeemed for travel via Chase Ultimate Rewards.

Similarly, Business Platinum Card® from American Express rebates 35% of the points you redeem for travel through its Pay with Points program with the Business Platinum Travel Service, raising the effective value of those points to $0.0135 each.

You can peruse the current ticket prices of the flights you are considering to see how many points you’ll have to redeem for a free ticket. One nice feature of the general-purpose travel cards is that you can use them to pay any additional fees, such as those for fuel use or international taxes.

As to how many points or miles you’ll need to directly book a free flight using a general-purpose travel card at the issuer’s travel service, you simply divide the ticket price (including fees) by the effective value of the point. For example, a $500 ticket purchased via Chase Ultimate Rewards using points earned with the Ink Business Preferred® Credit Card would require ($500 / 0.0125 points per $), or 40,000 points.

If the redemption value of the card’s reward points or miles is 1X, you can calculate the points required by multiplying the ticket price by 100. In our example, a $500 ticket obtained using 1X reward points from a general-purpose travel card would require ($500 x 100 points/$), or 50,000 points.

Transferring General-Purpose Travel Card Points

General-purpose travel cards allow you to directly transfer points to individual frequent flyer programs at participating airlines. The value of each point then depends on the conversion ratio of points to miles, but it’s usually 1:1. After the conversion, you treat the transferred miles the same as if you earned them from a co-branded card.

If you want to transfer your Business Platinum Card reward points to a participating frequent flyer program, American Express will charge you a fee of $0.0006 per point, with a maximum fee of $99. You can use your points to pay this fee.

To know how many frequent flyer points or miles you need to cover the cost of a ticket, you must review the airline’s award chart. A recent survey found the following frequent flyer point/mile requirements to buy one month in advance a one-way economy ticket from New York City to Los Angeles:

| Air Canada | 7,500 – 12,500 |

| Alaska Airline | 5,000 – 23,000 |

| American Airlines | 12,500 – 30,000 |

| Delta Air Lines | 15,000 |

| JetBlue | 10,000 – 20,000 |

| Southwest Airlines | 15,000 |

| United Airlines | 12,500 |

| Virgin America | 8,000 – 13,000 |

As you can see, the number of frequent flyer points/miles needed can vary significantly among the different airlines. Naturally, more expensive seats require additional points/miles. For example, it may cost you up to 147,000 miles to get a free first-class ticket on JetBlue.

There are several important things to remember when obtaining airline tickets:

- The cheapest priced seat may not be the one that requires the fewest frequent flyer miles to book.

- International flights require more miles to get a free ticket than do domestic flights.

- Award charts and online travel search engines do not usually reflect dynamic pricing, in which the cost of seats varies in real time according to supply and demand. However, online tools such as Escape allow consumers to find the up-to-the-second dynamic prices for airline tickets, albeit only for cash purchases, not frequent flyer redemptions.

- Upscale seats (i.e., business and first-class) require more points than do economy seats, but they also offer a greater dollar-to-point ratio. In other words, you get more value for fewer points when redeemed for upscale seats.

- A travel rewards card may let you use your points retroactively to pay for a trip you’ve already purchased. You simply use your travel rewards card to pay for your tickets (including all taxes and fees) and then use your accumulated points/miles as a statement credit.

While you can certainly use your credit card points/miles on short notice, by planning in advance you give yourself enough time to suss out the best available deals.

How Much are 25,000 American Airlines Miles Worth?

The general consensus is that American Airlines miles have a baseline value of a penny each. On that basis, 25,000 miles would be worth $250.

However, the dollar price isn’t the only way to evaluate miles. You could instead answer the question by stating what you can get for 25,000 American Airlines miles. With a little digging, you may be able to optimize the value of your AA miles well above the baseline.

The first thing to know is that American Airlines uses regional price charts for its AAdvantage frequent flyer program. That means you redeem the same number of miles for any destinations within the same region. Three programs are available to redeem your AA miles:

- MileSAAver awards: These provide heavily discounted seats, requiring as few as 7,500 miles for a free ticket. Only selected routes will offer these tickets, and the routes can change quickly. Naturally, these tickets go fast, so it takes a little luck to snag one.

- AAnytime awards: Generally available for all flights, these seats will require more (sometimes, several times more) miles than MileSAAver awards.

- Web Special awards: Getting one of these is akin to winning the lottery, with selected seats and dates requiring as few as 5,000 frequent flyer miles. They show up during the booking process but remember that these tickets do not allow any changes.

Referencing the redemption chart above, the AAnytime award for an economy one-way trip from New York City to Los Angeles requires a minimum of 12,500 miles. If you could grab a MileSAAver ticket on the same flight for 7,500 miles, you’d save 5,000 miles — not bad!

You can use your AA frequent flyer miles on partner airline flights. Generally, the cost in miles is comparable, but beware of exorbitant fees some partner airlines (I’m looking at you, British Airways) tack on. More than 20 airlines will allow you to book your flight using AA miles.

AA miles can also be used to upgrade your seat. You’ll need to pony up 5,000 to 25,000 miles for the upgrade, plus pay a cash fee of up to $550. This isn’t the most efficient way to use your AA miles, but the opportunity may be cost-effective if you have an Elite Status AAdvantage account.

Other ways to redeem your AA miles include:

- Car rentals

- Hotel stays

- Vacation packages

- Admirals Club membership

- Merchandise and gift card purchases

- Charitable donations

Note that you receive less value when you redeem your miles for these options.

Can You Use a Business Credit Card for Personal Use?

You won’t go to jail if you mistakenly use your business card for a personal purchase — it’s not considered illegal. However, a business credit card’s terms and conditions usually prohibit this practice, so misusing your card is a violation of the account agreement. That can have serious repercussions, so you are advised to keep your business and personal expenses separate.

The first problem with mixing the two types of expenses is that it jumbles your accounting. Whether you do your tax filing yourself or hire an accountant, it requires time to tease apart and correct misplaced expenses, assuming you find them all. In addition, spending business funds on personal expenses reduces the amount of money you have available to grow your business.

It’s all there in the card’s terms and conditions, as in this excerpt:

“By becoming a Visa Business Card cardmember, you agree that the card is being used only for business purposes…”

If the credit card company gets wind of the fact that you’ve cross-circuited your spending, they may close your business credit card account.

You may have set your business up as a separate entity, such as a limited liability company or corporation, to shield you from personal liability for your business debt. However, if you use your business rewards card for personal expenses, you risk that courts will pierce the so-called corporate veil if creditors sue your business and hold you personally liable for those debts.

Moreover, most issuers include in the account agreement a guarantee holding you personally liable for debts on your business credit card.

Another reason to avoid misusing your business credit card is that these cards lack many of the consumer protections afforded to personal credit cards by the CARD Act, including rules against:

- Raising interest rates on existing balances

- Raising interest rates without prior notice

- Charging interest on balances paid on time

- Failing to apply payments to the charges with the highest interest rate first

Perhaps one day these protections will be extended to business credit cards, but right now this is only a hope. Misusing your business card makes it harder to dispute charges you disagree with. You also forego certain protections from debt collectors that apply to personal credit cards.

If you’re trying to improve your credit score, making personal purchases on your business card represents a lost opportunity. That’s because your business card payments may be reported to business credit bureaus rather than the big three commercial bureaus (Equifax, TransUnion, and Experian).

Even worse, your personal credit score may suffer if you fail to pay a personal expense charged on your business rewards card due to the personal guarantee in the account agreement.

Beware that business credit cards typically charge higher fees and interest rates than do consumer cards. The card issuers can get away with this because businesses (but not consumers) can deduct these costs when filing income tax returns.

This not only costs you money but it also further tangles your bookkeeping chores and makes it harder to evaluate your business’ financial condition or apply for loans.

Mistakes sometimes happen, so if you use your business card for personal expenses, make sure to flag the transaction so you don’t include it in your company’s bookkeeping. Pay off the charge as quickly as possible and, if necessary, figure out how to inform interested external parties about the error.

Do Business Credit Cards Affect Personal Credit?

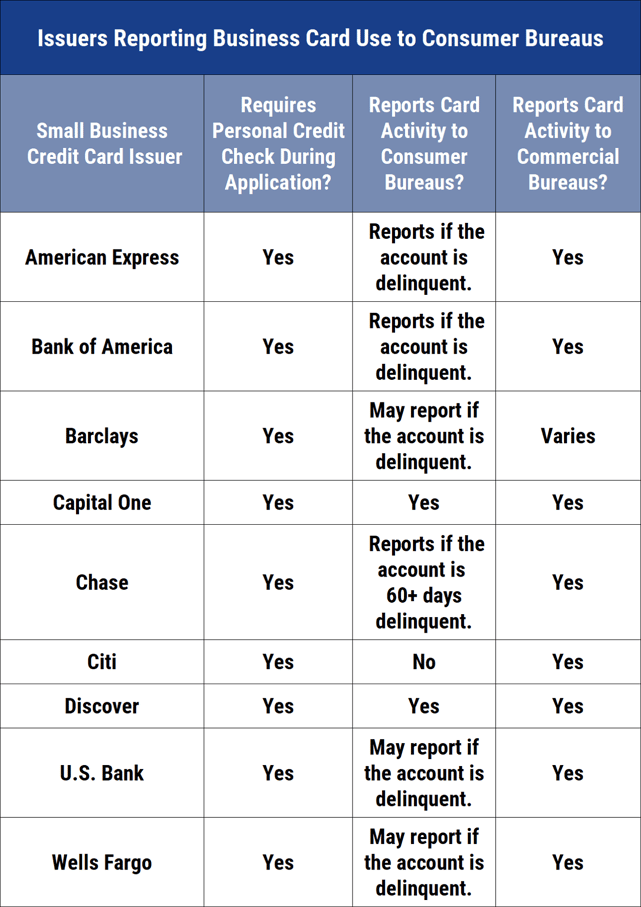

The credit card industry is divided: Some card issuers report business credit card payments to both business and commercial credit bureaus, while others report payments to business bureaus only.

For example, American Express is a dual reporter, but only of negative information. That means your Amex business payment activity can hurt, but not help, your personal credit.

Discover, U.S. Bank, Chase, and Capital One also perform dual reporting under certain circumstances. The personal liability clause of your business credit card agreement prompts this cross-reporting and, therefore, exposes your credit score to business card activity.

Note that only the business owner’s credit is at risk — the reported activity is not recorded on the credit reports of employees authorized to use the company’s credit card.

If your business card falls into the dual-reporting category, you should expect that creditworthy behavior (i.e., timely payments and low credit balances) will help both your business and personal credit. The flip side is that failure to use your business card responsibly will damage your personal score.

If you are worried about the link between your business and personal credit, you could limit your universe of business credit cards to those that explicitly do not report your activity to the consumer credit bureaus. The downside of this strategy is that you won’t necessarily obtain the business credit card with the best rewards and benefits.

Generally, unless you find it hard to use your business card only for business expenses, you should simply choose the business credit card that offers you the most value.

Is It Worth Having a Business Credit Card?

Business credit cards provide several important advantages:

- They provide short-term, tax-deductible financing for business expenses. Both interest and fees are deductible for businesses but not consumers.

- They help build your business credit, thereby making it easier to get a loan.

- They help you separate your business expenses from your personal ones, which facilitates clean bookkeeping and tax return preparation.

- They may offer rewards not available with consumer credit cards, such as oversized signup bonuses, business management tools, and free employee cards.

Our business credit card reviews are a great place to identify which cards will suit you best.

Review the Best Air Miles Credit Cards for Business

This review of air miles credit cards for business owners identifies the best candidates for general-purpose and co-branded cards.

General-purpose cards offer you flexibility by letting you choose from among multiple airlines to use your miles or points for free flights or seat upgrades. Co-branded cards offer the best rewards if you usually fly the co-branding airline (or one of its partners).

We’ve concentrated on travel credit cards for businesses, specifically cards that offer miles (or points convertible to miles). If traveling isn’t a business priority, you may prefer one of our top-rated cash back business cards. Cash back can help you recover some of the money your business spends on everyday expenses as well as big-ticket purchases, such as computers and communications equipment.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year]) 5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Air-Miles-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![7 Best 0% APR Travel & Air Miles Credit Cards ([updated_month_year]) 7 Best 0% APR Travel & Air Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-0-APR-Travel-Air-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![11 Highest-Limit Air Miles Credit Cards ([updated_month_year]) 11 Highest-Limit Air Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Air-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards With Air Miles & Cash Back ([updated_month_year]) 5 Best Credit Cards With Air Miles & Cash Back ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Credit-Cards-With-Air-Miles-Cash-Back.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for Points & Miles ([updated_month_year]) 8 Best Credit Cards for Points & Miles ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/points.png?width=158&height=120&fit=crop)

![6 Best Double-Miles Credit Cards ([updated_month_year]) 6 Best Double-Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_581280244.jpg?width=158&height=120&fit=crop)

![12 Best Flight Miles Credit Cards ([updated_month_year]) 12 Best Flight Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Flight-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)