Credit cards with miles that don’t expire are like savings accounts for your next big trip. Instead of redeeming cash back and points rewards when they post to your account, you can build up your miles over time to pay for all or part of your next flight.

And if you don’t have enough to cover the cost of your flight, you can still use your banked miles to pay for a seat upgrade, checked bag, or in-flight purchase.

With the cards below, you won’t have to worry about losing your earned credit card rewards if you don’t redeem them quickly. That’s important because the only thing more annoying than expired miles are the people who get up and clog the exit aisles as soon as the plane lands.

Best Cards With Miles That Never Expire

Below is our list of the best credit cards with air miles that don’t expire. Some are co-branded credit card options and others allow you to use your earned miles with any airline — or to cover other travel-related expenses.

That means you can also redeem your miles to pay for hotel stays, rental cars, ride-sharing services, or even meals on the road.

The Capital One Venture Rewards Credit Card is a top travel rewards credit card because it allows you to redeem your earned miles to cover the cost of previous travel-related expenses. And since you’re paying for expenses that you’ve already charged, you don’t have to worry about blackout dates or carrier restrictions.

If that weren’t enough, this card also regularly provides a chance to earn bonus miles through a sign up bonus for new cardholders. And you can receive a statement credit for Global Entry or TSA PreCheck® — all while earning a flat and unlimited miles reward on all eligible purchases.

With the Discover it® Miles card, you can earn unlimited miles on all eligible purchases — not just travel purchases — and receive a match of your entire earnings amount at the end of your first year with the card. That’s the same as earning double miles on every purchase for an entire year.

You can redeem your miles to cover the cost of previous travel expenses — which means you’ll face no blackout dates or carrier restrictions. Discover defines travel expenses broadly, which allows you to cover the cost of everything from airfare to ride-shares.

The Capital One VentureOne Rewards Credit Card may not have all of the bells and whistles of its top-ranked Venture Rewards sibling, but the lack of an annual fee may make this card more attractive to some, and they’ll still earn a generous sign up bonus.

There’s no limit to the number of miles you can earn, and your miles will never expire. And if you’re traveling abroad, you won’t pay a foreign transactions fee for any purchase made outside of the U.S.

The Capital One Venture X Rewards Credit Card is a Capital One premium card offering with huge signup bonus potential and miles that never expire. While it charges a hefty annual fee, the card easily pays for itself when you use the annual travel credit and bonus miles you receive each card anniversary.

This card also comes with several other travel benefits that make it a worthy addition to your wallet.

Delta calls itself “The World’s Most Trusted Airline,” and its co-branded credit card tries to live up to that slogan. With the Delta SkyMiles® Reserve Business Card, you can earn Delta SkyMiles to charge your everyday purchases. The more you charge, the higher your credit card rewards rate climbs.

Cardholders can also earn complimentary access to The Centurion® Lounge and a Domestic First Class, Delta Comfort+®, or Main Cabin round-trip companion certificate each year upon account renewal. Those two perks alone just about cover the cost of the card’s annual fee.

If your business keeps you on the move, the Capital One Spark Miles for Business card can get you where you’re going for less. That’s because this card regularly offers a sign up bonus that pays out a generous amount of bonus miles in addition to valuable cardholder benefits. These benefits include unlimited miles that don’t expire and the ability to transfer those miles to earn free flights, elite status, or frequent flyer points with many of the top loyalty program options in the airline industry.

A cardholder may also qualify for a waived annual fee during their first year and a statement credit that covers the cost of their TSA PreCheck® or Global Entry application fee.

If Delta miles are your thing, the Delta SkyMiles® Blue American Express Card can help you rack up rewards quickly with a potentially hefty sign up bonus and a large miles rewards point rate for your everyday purchases.

You can also earn savings on in-flight purchases when you use your card and enjoy discounted airfare and other services — all with no annual fee.

Delta is well represented on this list for a reason. Although the Delta SkyMiles® Platinum Business Card is the third-ranked Delta co-branded airline credit card on this list, it’s still one of the best airline cards in the industry. Cardholders receive priority boarding on Delta flights and early access to overhead compartment space.

This card features a very attainable sign up bonus that pays out a large sum of Delta miles. Everyday purchases, as well as spending through Delta, can pile on even more miles. A free checked bag on every flight is another way to make this card work for you and your business.

Do Credit Card Miles Expire?

Every travel rewards card and airline credit card has its own set of rules regarding how soon you must redeem your miles. While the cards ranked above have no expiration date on your rewards program earnings, other cards may force you to use your rewards balance within a certain time frame.

Even if you don’t have to worry about miles or points expiration, you may find that your rewards program may institute blackout dates or carrier restrictions that limit how and when you can use your miles.

This annoying hurdle is why we ranked the Capital One Venture Rewards Credit Card, Discover it® Miles, and Capital One VentureOne Rewards Credit Card as our top-three rewards card options.

These cards allow you to redeem your miles to cover the cost of previous travel expenses. That means you can book a trip without restrictions and use your miles to pay for all or part of the charge.

And your miles will never expire, as long as you keep your credit card account open and in good standing. That’s more convenient than the conditions on some airline cards, which will only allow you to use your earned frequent flyer miles with the branded airline during non-peak times.

How Do I Earn Credit Card Miles?

If you have a travel rewards credit card that pays out miles, you can earn miles on every purchase you make — not just travel purchases.

Just as with a cash back credit card, you can earn a set number of miles for every dollar you charge to your card. For example, a card that pays out 2X miles will give you two miles for every dollar you spend.

Some cards allow you to earn bonus miles when you make purchases or book flights through a specific airline or booking agency, or use your card at specific merchants, like restaurants or gas stations. These types of transactions all help you increase your reward point potential.

Your miles will continue to accrue in your account until you redeem them. You don’t have to worry about expired miles or credit card points going to waste with any of the cards listed above — as long as your account remains open and in good standing.

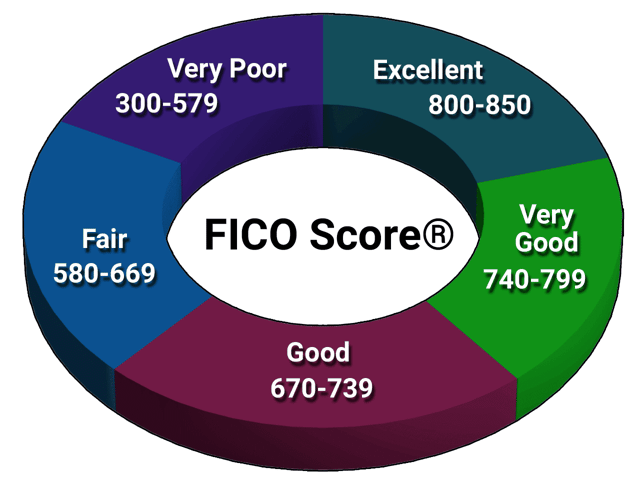

What Credit Score is Needed to Get an Airline Miles Card?

A card issuer rarely lists a minimum credit score requirement. Instead, you’ll often find a score range the card issuer considers acceptable. You’re not guaranteed approval if your score falls within that range, but it’s a good indicator of success if you formally apply.

Most travel rewards credit cards will consider applications from consumers who have good credit or better. In general terms, that means a FICO score of 670 or greater.

If you’re concerned that your credit score may keep you from getting the travel rewards card you want, you can look for a card that allows you to prequalify without a hard inquiry on your credit report that may harm your credit score. Although prequalifying isn’t a guarantee that you’ll receive the card, it can give you peace of mind before you apply.

What Happens If I Don’t Use My Miles?

Some cards have a use-it-or-lose-it policy — if you don’t redeem your rewards by a certain time, they’re deleted from your account and gone forever. But with the cards listed above, you don’t have to worry about expired miles.

But don’t forget to redeem your miles or credit card points if you plan to close your account. They won’t be there after the account is closed, and you will lose them.

What Perks Can You Redeem Miles Rewards For?

You can use your earned travel rewards for a host of options. Some cards allow you to use your miles to cover the cost of previous travel-related expenses — including airfare, rental cars, hotel points, ride-sharing, and other charges. Or you can transfer them to frequent flyer miles.

Miles cards usually provide more redemption options than just paying for flights.

Co-branded airline mile cards allow you to use your miles to pay for flights, seat upgrades, in-flight purchases, and checked bags. Some may also offer free access to airport lounges, elite status with the airline’s loyalty program, gift card options, priority boarding, and other perks.

Find the Best Credit Cards With Miles That Don’t Expire

You are likely to find plenty of travel rewards cards available whether you want all-inclusive travel miles, AAdvantage Miles, Chase Sapphire Ultimate Rewards points, Citi ThankYou Points, or perks through another rewards program.

But before you hit submit on your online application, be sure that your earned rewards won’t expire if you don’t use them quickly. After all, saving up your rewards for a dream vacation is part of the fun of having a travel rewards credit card.

With the cards above, you can save for as long as you’d like — and enjoy the fruits of your labor when the time is right.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Best Credit Cards for Points & Miles ([updated_month_year]) 8 Best Credit Cards for Points & Miles ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/points.png?width=158&height=120&fit=crop)

![6 Best Double-Miles Credit Cards ([updated_month_year]) 6 Best Double-Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_581280244.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards With Air Miles & Cash Back ([updated_month_year]) 5 Best Credit Cards With Air Miles & Cash Back ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Credit-Cards-With-Air-Miles-Cash-Back.jpg?width=158&height=120&fit=crop)

![12 Best Flight Miles Credit Cards ([updated_month_year]) 12 Best Flight Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Flight-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![Miles vs. Cash Back: 5 Best Cards For Each ([updated_month_year]) Miles vs. Cash Back: 5 Best Cards For Each ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Miles-vs.-Cash-Back.jpg?width=158&height=120&fit=crop)

![9 Best Air Miles Credit Cards for Business ([updated_month_year]) 9 Best Air Miles Credit Cards for Business ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_1054148699.jpg?width=158&height=120&fit=crop)

![5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year]) 5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Air-Miles-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)