Bankruptcy isn’t as popular an option as it used to be for dealing with debt. While it may not be the first resort, however, it’s still a necessary alternative for many, and credit card debt is often a driving factor for considering this serious step in finance management.

Before you consider bankruptcy as a viable option for overwhelming debt or crippling payments, it’s wise to understand how the process will affect your credit card obligations, specifically.

Here are five things to know about your credit accounts in bankruptcy:

1. The type of bankruptcy is important

Whether you file Chapter 7 or Chapter 13 bankruptcy will have the biggest effect on how your credit cards are handled.

Most individuals file for chapter 7 or 13 bankruptcy (unless you’re a fisherman or farmer).

In Chapter 7, your debts are completely dismissed after your assets are sold off to pay what you can. Anything not covered by your asset sale is discharged permanently.

In chapter 13, you will work with your creditors to pay back what you can on a structured plan that lasts three to five years. Debt that is left over (including credit card balances) after the plan is discharged.

Both types of bankruptcy have their unique advantages and disadvantages, so it’s best to consult a bankruptcy attorney before embarking on either as a solution to overwhelming credit card demands.

2. Bankruptcy typically discharges most or all of credit card debt

For most of the Chapter 7 bankruptcies seen in courts today, either the consumer doesn’t have any assets to liquidate (often referred to as a “no asset case”) or their debt is paid in order of “priority.”

Debts such as mortgages or car loans (which are secured by the actual property being paid for by the loan) are considered “secured” and get paid first by any money left after selling assets.

Credit cards, on the other hand, are at a low priority, and rarely get paid off in their entirety.

In Chapter 13 cases where the debtor sets up a repayment plan, the secured and priority debts will be paid first. If you still have time left in your plan and the money to do so, you will be asked to pay some or all of the remaining unsecured debts.

3. Secured credit card debt is an exception

Most of the credit cards consumers use today are considered “unsecured” debt. This simply means you obtained your credit line without having to come up with collateral, or your own physical assets, to use as insurance against non-payment.

In the rare case that you took out a secured line of credit, however, both types of bankruptcy will attempt to pay those debts.

Thinking about getting a secured card? Check out our favorites here.

4. Your taxes may be affected by your bankruptcy

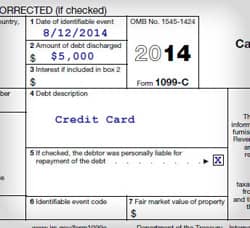

If you thought that a finalized bankruptcy was the end of your liability, you may be wrong. In fact, if you had any debts discharged or forgiven without payment, you’ll see a new tax form in the mail along with the W-2’s from your employer.

Labeled 1099-C, this form shows the value of the debt that was written off as a form of income. Taxes are generally owed on this income, and it may affect any refund you were expecting and can even cause you to owe a tax payment come April 15th.

Before you panic, however, understand that you may be eligible for a little-used exemption to this new tax burden. If you can show that you were insolvent (or that you owed more than you were worth) at the time of your bankruptcy, you will only owe taxes on a portion of the debt you were forgiven as it relates to your net worth (which for many people, can be very little.)

Use this IRS guide to walk you through calculating your asset values, and use form 982 to file with your 1099 to claim this exclusion.

5. Co-signers may be responsible for your unpaid debt

One common bankruptcy myth is that the proceeding spares everyone listed on a credit card account from having to pay the total bill.

If you file a Chapter 7 Bankruptcy, however, anyone who helped vouch for your creditworthiness by putting their name down as responsible for the debt will be called upon to pay anything not paid in full during the bankruptcy proceedings. Most co-signers are protected from being pursued for additional payments after a Chapter 13 proceeding.

While bankruptcy is never desirable, it can be a legitimate tool to surviving major financial devastation and starting the path back to becoming financially stable. As with any major financial decision, it’s best to seek wise counsel in these matters and explore all the options to find the solution best suited to your individual financial situation.

Photo creidts: enlightenme.com, myfavoritewebdesigns.com, irs.gov

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Credit Cards After Bankruptcy Discharge ([updated_month_year]) 9 Best Credit Cards After Bankruptcy Discharge ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/01/after-bankruptcy.png?width=158&height=120&fit=crop)

![7 Unsecured Credit Cards After Bankruptcy ([updated_month_year]) 7 Unsecured Credit Cards After Bankruptcy ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Unsecured-Credit-Cards-After-Bankruptcy.jpg?width=158&height=120&fit=crop)

![12 Best Post-Bankruptcy Credit Cards ([updated_month_year]) 12 Best Post-Bankruptcy Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_421700602.jpg?width=158&height=120&fit=crop)