Although a few exceptions may exist, the true value of most great deals or offers will be entirely contextual. For example, the best credit card offers for travel rewards are only actually valuable to those who, well, travel.

As with many other things, finding a great credit card offer will start first with identifying what you want out of your card — and your offer. The modern card market allows for extreme personalization in your credit card portfolio, making it easy to maximize rewards on most types of purchases.

Once you know what type of card you’re after, then you can narrow it down to finding the one with the best deal. And, whether you want cash back, airline miles, or business rewards — a lot of great card offers are just waiting to be found. Below, we’ll explore the best offers available today across 13 different popular categories including options for students and those with fair or bad credit. We’ll also look at some of the most common questions people have about credit card offers.

Overall | Cash Back | Travel | Signup Bonus | Points | Intro APR

Balance Transfer | Airline Miles | Hotels | Student | Business | Fair Credit | Bad Credit | FAQs

1. Best Overall Card Offers

While finding the absolute best deal for you will depend a lot on your needs and wants, some card offers are so good — or so flexible — that they can appeal to a wide variety of cardholders. Cash back rewards, in particular, are almost always easy to redeem as a statement credit on your card account, which allows them to be used toward any purchase.

In general, most consumers (understandably) think of sweet signup bonuses when they start looking for good credit card offers. However, while our top overall cards all have lucrative signup bonuses, they can also be valuable cards to have in your wallet well after the signup bonus is gone.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

So far as credit card deals go, this card delivers on multiple fronts. The signup bonus is fairly easy to obtain, and you’ll earn the most cash back for whatever spending category you spent the most in each billing cycle. This card makes it easy to earn top dollar without an annual fee.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

This card is a hot deal on several levels, starting with the high-rate bonus rewards. Cardholders earn bonus cash back in rotating quarterly categories that can really help maximize rewards. There’s also a unique signup offer for new cardmembers after the first year of membership.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

This card provides cash back rewards on all purchases and a modest signup bonus for new cardmembers. Pair this card with one that earns Ultimate Rewards® points to get even more value out of the deal.

2. Best “Cash Back” Card Offers

Cash back rewards were the original form of mass-marketed credit card rewards, introduced by what would eventually become Discover. Once points and miles hit the market, however, cash back was left behind by many of the most ardent card aficionados. Well, no more.

Today, cash back cards are making a comeback. These cards fill in gaps left by travel-focused points cards and offer more affordable alternatives rewards cards with three-digit usage fees. Our favorite cash back offers include attainable signup bonuses, useful rewards categories, and freedom from annual fees.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

This card provides cash back rewards on all purchases and a modest signup bonus for new cardmembers. The card also has an intro-APR offer on new purchases, charges no annual fee, and comes with the standard collection of Chase cardholder benefits.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The little sibling of the Savor card above, this card has the same cash back categories — albeit at a low rate — and no annual fee. New cardholders also earn a competitive signup bonus and enjoy an introductory 0% APR deal with a long promotional period.

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card is one of the few cards available to offer a flat 2% cash back reward rate on every purchase — 1% when you buy, 1% when you pay.

In addition to rewards, new cardholders receive an introductory 0% APR on balance transfers and a solid slew of benefits, like access to Citi Entertainment®. Plus, users never pay an annual fee.

3. Best “Travel” Card Offers

Although cash back is popular for its ease of use, travel rewards are, unquestionably, the most sought-after type of rewards by consumers looking to maximize value. That’s because most travel rewards can be redeemed in a variety of ways, including, in many cases, through a transfer to an existing hotel or airline loyalty account.

When redeemed wisely, some of the best credit card offers can be worth hundreds — if not thousands — of dollars. Even when rewards are redeemed through their respective issuers, most travel rewards cards provide a lot of value through purchase rewards and secondary benefits. Our top picks include several of the most popular travel rewards programs on the market.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

Travelers who don’t want to be bothered tracking categories can get some good value out of this card, which offers unlimited 2X miles per dollar on every purchase on top of a good-sized signup bonus and no foreign transaction fees. Miles can be redeemed for statement credit toward travel purchases, or they can be transferred to partner airline frequent flyer programs.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

A card high on nearly every list of top travel credit cards, this option has a host of perks and benefits that appeal to a variety of travelers, including Ultimate Rewards® points on every purchase. Cardholders also receive airport lounge access, an annual travel credit, and a hefty signup bonus.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® from American Express is a traveler’s card, offering the most Membership Rewards® points per dollar on flights and hotels, as well as elite status with Hilton and Marriott and access to over 1,000 airport lounges, including the prestigious Amex Centurion Lounges.

The Membership Rewards® points earned by cardholders can be transferred to many hotel and airline loyalty programs. This card has a standard signup bonus of points, but targeted offers of up to 100,000 points are not uncommon. (Amex cards have variable signup bonuses that can change based on the link you use, so you may need to apply via an incognito browser or referral link for the highest offer.)

4. Best “Signup Bonus” Card Offers

Even a brief search of consumer credit cards will unveil literally hundreds of options — and all of those issuers are vying for wallet space. Enter: the signup bonus. The best signup bonuses offer big pools of cash back, points, or miles that can easily be worth hundreds of dollars.

Most of the best signup bonus offers will come from cards designed for consumers with good credit or better. Typical bonuses will require the cardholder to spend a certain amount on the card within a given time period to earn the bonus, but be careful not to spend more than you can repay just to earn a bonus.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

If you’re looking for a big pool of transferable points, look no further than this popular travel rewards card. The signup bonus is one of the most valuable on the market, especially considering it consists of the highly coveted Ultimate Rewards® points. The spending requirement is fairly steep, but it should be manageable for most cardholders with a little planning.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The signup bonus for this card is large enough that almost anyone can get serious value. As is typical, the large signup bonus has an equally large spending requirement, so budgeting may be needed to avoid paying interest just to earn the bonus.

Capital One® Savor® Cash Rewards Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

With a signup bonus more than double that of the average cash back card, this pick easily makes the list. The spending requirement is downright affordable compared to the cards above, and the annual fee is waived the first year. Rewards are easily redeemed as statement credit, making it simple to get full value from the bonus.

5. Best “Rewards Points” Card Offers

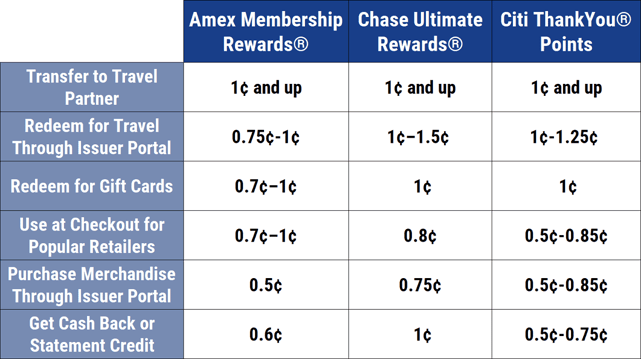

Credit card rewards points are often lauded as the most versatile type of rewards, as they can typically be redeemed for a variety of products. For instance, most points programs allow redemption for cash back, gift cards, and travel through the issuer. The most popular programs also allow points to be transferred to partner hotel or airline loyalty programs.

The downside of this is that the per-point value will depend on how the points are redeemed. Cash back will generally offer the lowest per-point value, while travel and/or transfer will offer the best value. Of course, as in other things, the best redemption option for any given cardholder will vary based on their individual needs.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

A top-tier travel rewards card, this option shows that an annual fee can be worth paying for the right combination of rewards and perks. Users earn triple points on travel and dining purchases, and points can be used directly for travel through Chase or transferred to over a dozen hotel and airline loyalty programs with the potential to unlock even more value. The annual travel credit, airport lounge access, and big signup bonus all help offset the large annual fee.

Wells Fargo Propel American Express® Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

This card is worth considering if you’re in the market for a points card but don’t want the hassle of trying to make up for a huge annual fee. Cardholders earn triple points on dining, travel — including gas — and select streaming services, all useful everyday categories for many people. The signup bonus isn’t huge for a points card, but it is competitive for a card with no annual fee.

While this card operates on the American Express network, as its name implies, the card is issued by Wells Fargo. This means that the card is accepted anywhere that accepts American Express, but you’ll actually deal with Wells Fargo and log into your Wells Fargo account to pay your bill, use your rewards, and track your purchases.

- Earn 90,000 Membership Rewards® points after you spend $6,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. Minimum 2-night stay is required.

- $250 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$250

|

Excellent

|

The American Express® Gold Card may come with a pricey annual fee, but it also comes with annual and monthly credits for things like airline fees and select dining purchases. New cardholders can also get a valuable signup bonus. Keep in mind that this is a charge card and will need to be paid in full each billing cycle.

6. Best “Intro APR” Card Offers

While most cardholders know that the best way to avoid credit card interest is simply to pay in full during the grace period, this isn’t always an option. That’s where 0% APR offers can be an important tool.

The best introductory 0% APR credit card offers provide a year or more without interest fees on carried balances (provided you make at least the minimum payment each billing cycle). Many rewards credit cards also offer introductory interest rate deals, but the cards with the longest promotional periods won’t have rewards.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® is a solid option for saving on interest thanks to its long 0% APR introductory offer good on both new purchases and balance transfers. In addition to a competitive introductory offer, this card comes with a number benefits, including tiered cash back rewards as well as free FICO credit scores and $0 liability protection.

- Earn $200 back in the form of a statement credit after you spend $2,000 in purchases on your new card in your first 6 months

- Unlimited 1.5% cash back on every purchase

- 0% intro APR on purchases and balance transfers for 15 months from the date of account opening, then a variable APR applies

- Rental car loss and damage insurance when you use your eligible card to reserve and pay for the entire rental and decline the collision waiver at the rental company counter

- Find out if you prequalify for the Cash Magnet® Card or other offers in as little as 30 seconds.

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.24% - 29.99% Variable

|

$0

|

Good/Excellent

|

Consumers who prefer American Express may prefer this choice, which offers the same long introductory interest rate deal and no annual fee. The promotional rate applies to new purchases only, with the regular APR dependent on your creditworthiness. Cardholders also get access to the full stable of Amex benefits.

- For a limited time, get a special 0% introductory APR on purchases and balance transfers for 21 billing cycles. After that, the APR is variable.

- Enjoy Cellphone Protection Coverage of up to $600 annually when you pay your monthly cellphone bill with your card

- View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use, and free to U.S. Bank customers.

- Fraud Protection detects and notifies you of any unusual card activity to help prevent fraud

- Choose your payment due date

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 21 billing cycles

|

0% for 21 billing cycles

|

18.74% - 29.74% (Variable)

|

$0

|

Excellent Credit

|

Additional Disclosure: The information related to this card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this product.

The U.S. Bank Visa® Platinum Card is a no-nonsense card obviously designed for consumers who want to save on interest rather than earn rewards. This card has one of the longest promotional periods available from a major bank, with new cardholders enjoying up to 20 months of 0% APR on new purchases and balance transfers.

Although the card does have a balance transfer fee, it charges no annual fee. And, while the 0% APR offer can be ideal for financing large purchases, think twice before using it for purchases abroad, as the card comes with a 3% foreign transaction fee.

7. Best “Balance Transfer” Card Offers

A credit card balance transfer is the only way to move debt from one credit card account to another account. Most transfers are performed as a way to reduce the interest fees charged for a given balance by moving it to a card with a lower APR.

Similar to the 0% APR deals for new purchases, some credit cards will offer 0% APR on transferred balances for the duration of a promotional period. The best balance transfer offers last for a year or more, and some of these offers even waive the balance transfer fee for qualifying transfers.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Simplicity® Card offers one of the longest introductory 0% balance transfer offers currently available. This can be a boon to consumers who need to pay off higher-interest debt, but the card does require good to excellent credit for approval, and your transferred amount will be subject to a balance transfer fee.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

Yet another card from Citi, the Citi® Diamond Preferred® Card is nearly identical to the Citi Simplicity® Card above. Just note that there is a balance transfer fee for each transfer you make.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The third and final card in this category, the Discover it® Balance Transfer offers a longer period for balance transfers than it does for purchases. But that’s okay because you’ll also earn valuable cash back rewards, unlike the cards above. Add this card to your wallet if you want generous rewards and a long 0% APR period to pay off debt.

8. Best “Airline Miles” Card Offers

Frequent flyer programs are offered by most airlines as a way to reward brand-loyal travelers. When they started, the only way to earn airline miles was to, well, fly with that airline. Today, however, co-branded airline credit cards make it easier than ever to earn frequent flyer miles, all without needing to ever step on a plane.

Between the purchase rewards and signup bonuses for these cards, even the casual traveler can find a lot of value. In addition to earning miles, most co-branded airline cards also offer extra travel perks, like free checked bags and priority boarding, that can save both time and money.

- Earn 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

- Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants

- Earn 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases

- Earn a $125 American Airlines Flight Discount after you spend $20,000 or more in purchases during your cardmembership year and renew your card

- No foreign transaction fees

- First checked bag is free on domestic American Airlines itineraries for you and up to four companions traveling with you on the same reservation

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.99% (Variable)

|

$99, waived for first 12 months

|

Excellent, Good

|

Additional Disclosure: (The information related to Citi® / AAdvantage® Platinum Select® World Elite Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a great choice for regular American Airlines flyers — and not just for the ability to earn AAdvantage miles on every purchase. Cardholders will also receive airline perks like free checked bags and preferred boarding.

New cardholders, in particular, can get a ton of value out of the card thanks to a solid signup bonus large enough to get you flying for free in no time. Plus, the first year’s annual fee is waived.

Alaska Airlines Visa® Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Alaska Airlines Visa® Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Alaska Airlines Visa Signature® card is a popular co-branded option thanks, in part, to its much-touted Companion Fare that can be used to purchase a companion ticket for just $99, plus fees.

Of course, cardholders can also earn Alaska Mileage Plan miles on every purchase, and, as with many co-branded cards, users get their first checked bag free on Alaska flights. The signup bonus is pretty competitive, and it has a reasonable spending requirement.

- Earn 10,000 bonus points after spending $1,000 on purchases in the first 90 days

- Earn 3X points on eligible JetBlue purchases, 2X points at restaurants and grocery stores, and 1X points on all other purchases

- Enjoy 50% inflight savings on cocktails and food purchases

- 0% introductory APR for the first 12 billing cycles following each balance transfer that posts to your account within 45 days of account opening (transfer fee applies), then a variable APR applies

- No foreign transaction fees, no blackout dates, and points never expire

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% for 12 billing cycles

|

21.24% - 29.99%

|

$0

|

Good

|

The JetBlue Card offers some good value to JetBlue flyers, starting with 6X points per dollar on JetBlue purchases, as well as double points on restaurant and grocery store purchases. It also offers a competitive signup bonus with a really manageable spending requirement.

Although this card has an annual fee, it also has a few ways to make up for that fee even beyond the typical purchase rewards. This includes a very generous 50% in-flight discount, as well as an anniversary bonus of 5,000 points every year after you pay your annual fee.

9. Best “Hotel” Card Offers

Similar to the way airlines offer frequent flyer programs to reward loyal guests, so, too, do hotels offer a range of brand loyalty programs. Achieving elite status with a hotel can unlock all kinds of perks, from free breakfast to room upgrades to premium internet access.

Hotel co-branded credit cards are tied to a hotel’s loyalty program, offering cardholders a way to earn hotel points and, often, to gain elite status with the program. Some of the best offers come with huge signup bonuses that can be redeemed for free nights as soon as they’re earned.

Hilton Honors Ascend Card

The Hilton Honors Ascend Card has a lot of bells and whistles that will likely appeal to Hilton loyalists and casual visitors alike, including a huge 12X points per dollar on Hilton purchases and 6X points at US restaurants, supermarkets, and gas stations.

- Earn 12X Hilton Honors™ points per dollar for Hilton purchases

- Earn 6X points for purchases at US restaurants, supermarkets, and gas stations

- Pay $95 annual fee

The card comes with a lot more than high-rate purchase rewards, too. For instance, cardholders get complimentary Gold status, the second-highest loyalty tier that unlocks free breakfast at hundreds of Hilton properties. New cardholders can enjoy a hefty signup bonus, and spending $15,000 on the card in one year earns a free Weekend Night Reward.

IHG® Rewards Club Premier Credit Card

The IHG® Rewards Club Premier Credit Card is a solid pick for IHG fans, offering an easy way to earn loyalty points with everyday spending. Cardholders also get a boost redeeming those points with the fourth night free perk.

- Earn 10X points per $1 on IHG® hotel purchases made directly with IHG®

- Earn 2X points per $1 on gas, groceries, and dining

- Pay $89 annual fee

Several of the card’s additional benefits can be quite valuable, including the Platinum Elite status that unlocks free room upgrades and extended check-out. Plus, cardholders can easily recoup their annual fee with the annual free night awarded after each account anniversary.

(Non-Monetized. The information related to IHG® Rewards Club Premier Credit Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

Radisson Rewards Premier Visa Signature® Card

The Radisson Rewards Premier Visa Signature® Card is packed full of perks for Radisson visitors, starting with the 10X points per dollar on Radisson purchases and 5X points on everything else. And that’s without the big pile of points you can earn with the sizeable signup bonus.

- Earn 10X Gold Points per $1 on qualified Radisson Hotel Group purchases

- Earn 5X points per dollar on everything else

- Pay $75 annual fee

Cardholders receive Gold status, which is high enough up the loyalty ladder to unlock free room upgrades and 72-hour room availability guarantee. The card has a comparatively affordable annual fee for a hotel co-branded card, and it’s easy to make up that fee with the free 40,000 rewards points you receive each year when you renew your card.

10. Best “Student” Card Offers

Your years as a college student are an ideal time to explore and try new things — like establishing your consumer credit profile. In fact, given the wealth of high-quality student credit cards available, it could be argued that the best time to get your first credit card is while you’re in college.

Given that students aren’t expected to have much — if any — credit history, most student credit cards won’t have minimum credit requirements. The best card offers will also be free from annual fees and many waive some late fees. Some of our favorite student cards even offer purchase rewards and small signup bonuses.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

This is one of the best student cards on the market for a number of reasons, with the card’s high-rate rewards being the most obvious. Students can access a free FICO credit score and build a relationship with the top-rated issuer in terms of customer service to start their credit-building journey.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card for Students is a solid student card with useful rewards, including 3% cash back in a category you select from a list that includes gas, online shopping, dining, travel, drug stores, or home improvement/furnishings.

You can select a new 3% category each month. Bonus rewards are capped at $2,500 in combined bonus category purchases each quarter. Plus, users never pay an annual fee.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Travel Rewards credit card for Students is for students who love to travel, and, let’s be honest — who doesn’t? This card offers generous travel rewards on every eligible purchase made with the card.

Rewards are then redeemed as statement credits toward past eligible travel purchases such as flights, hotels, cruises, rental cars, and baggage fees, among other purchases. There are no blackout dates or restrictions and points do not expire.

11. Best “Business” Card Offers

According to the Small Business Administration, the U.S. is home to more than 30 million small businesses (PDF link) — and they make up more than 99% of all U.S. businesses. And, from merchants to freelancers to side hustlers, most of those small business owners are eligible for a business credit card.

While not quite as robust as the consumer market, the small business credit card market is full of options, with many great deals and offers to be had. The best offer for your business will be the one that complements your company’s spending habits and needs, but our picks below are a good place to start.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

With a one-two punch of high rewards rates and versatile points, this card is one of the most popular business cards on the market. The card earns triple points on travel, shipping, communications services, and select advertising (up to $150,000 in combined bonus category purchases each year). And they’re not just any points — they’re the versatile rewards that can be transferred to many hotel and airline loyalty programs.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

This card is ideal for small businesses and freelancers — and not just because it doesn’t have an annual fee. Users earn up to 5% cash back in several bonus categories useful to a range of businesses, including office supplies and communications services. The signup bonus is very competitive, though the spending requirement is a little on the large side for smaller businesses.

This card is an ideal business card for companies with expenses that don’t fit neatly into common bonus categories, providing 2X miles on every dollar spent, with no limits or category restrictions. This card also offers a generous signup bonus when you meet the minimum spending requirements.

12. Best Card Offers for Fair Credit

Given that no one starts with a perfect credit score, we’ll all likely experience fair credit at least once on our credit journey. Consumers with fair credit will either be building credit for the first time or rebuilding after a problem, and the nature of your fair credit will influence your credit card options.

If you’re looking for a good starter card and are a college student, check out the student cards above. Otherwise, the unsecured cards below are decent cards for credit builders, and the secured option is good for both builders and re-builders alike.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

This card is the picture of a starter credit card, offering an unsecured credit line that can be used anywhere Mastercard is accepted. Paying on time for the first five months can unlock a higher credit line, and users never pay an annual fee. The APR is a little on the high side, however, so pay in full each statement period to avoid interest fees.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

Having fair credit can definitely limit your credit card options, but it doesn’t rule out rewards altogether, as evidenced by this unsecured card that offers unlimited 1.5% cash back on every purchase. Since the card does come with an annual fee, it’s important to do the math before you apply to make sure you’ll earn enough in rewards to make up for the fee.

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

One of the best ways to get a card with bells and whistles when your credit is less than ideal is to go with a secured card. This option has cash back rewards and the ability to get upgraded to an unsecured card over time. Cardholders can also receive free FICO credit scores and an automatic bonus that kicks in at the end of your first year.

13. Best Card Offers for Bad Credit

In many ways, bad credit is in the eye of the beholder — or the lender — as minimum credit score requirements vary by product and provider. However, bad credit is, in general, considered to be any score below 580 on the FICO credit score scale of 300 to 850.

With bad credit, the credit card “deals” are going to be few and far between, especially if you’re looking for an unsecured card (but you can try your local credit union). Instead, most of the deals to be found will be with secured credit cards, like our picks below.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

This card is one of the few with the potential to be partially secured, offering both a variable minimum deposit requirement — depending on your qualifications — as well as the opportunity to unlock a higher credit line by making the first five payments on time. The card charges no annual fee, but it does have a high APR, so it’s not ideal for carrying a balance.

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

A low minimum deposit requirement makes this card accessible, but it’s the rest of the card’s features that make it a good deal. Cardholders can earn a flat cash back rate on set categories, including gas station and restaurant purchases each quarter up to a purchase limit. All other purchases earn a reduced standard cash back rate. What’s more, the card is upgradeable for eligible users.

BankAmericard® Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to BankAmericard® Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The BankAmericard® Secured Credit Card is a no-frills secured card with a $300 minimum deposit requirement. The max deposit for qualified applicants is $4,900 for a credit limit of the same size.

Although this card doesn’t offer purchase rewards or a signup bonus, it does have the ability to be upgraded to an unsecured credit card. Bank of America will periodically check your account and automatically upgrade your account when you become eligible, returning your deposit.

What Credit Card Offers the Most Rewards?

In general, there are two ways to look at the question of which card offers the most rewards. One is from a signup bonus standpoint — which card has the biggest bonus? The other consideration is which card earns purchase rewards at the highest rate.

Both answers are, unfortunately, somewhat complicated.

So far as signup bonuses are concerned, it’s hard to select any one card as having the largest bonus, in part because signup bonuses change so frequently. In fact, you could see multiple signup bonus offers for the same card on the same day based entirely on the web browser you use or the link you click.

Even if that were not the case, however, size alone is not all that matters when it comes to credit card rewards. Sure, if you have a cash back card, it’s easy enough; if one card has a $300 bonus and a second card offers a bonus of $500, it’s pretty simple math to tell that the $500 bonus is better.

The challenge comes from points and miles cards. One card’s 50,000-point offer may be more valuable than another card’s offer of the same size — or it could even out-value a larger offer due to having a higher per-point value at redemption.

And this applies to the card’s purchase rewards as much as it does to the signup bonus. Two cards may both earn 3X points per dollar on travel, for instance, but one rewards program may net you 2¢ per point at redemption, while the points from the other program are only worth 1¢ apiece when redeemed.

Additionally, when it comes to purchase rewards, the highest rewards rates will typically be reserved for bonus categories, rather than all purchases. For example, a card might offer 5X points per dollar on dining, but one point per dollar on other purchase types. This makes it hard to point out any single card as earning the most rewards without looking at specific categories.

All of this having been said, in general, the cards that offer the most rewards will be the cards with the largest annual fees. The top-earning card in any given category will likely have an annual fee of at least $95, but may charge a fee as high as $550.

The American Express Platinum® Card, for example, is well-known for earning a remarkable 5X points per dollar on hotel stays and for frequently offering 100,000-point signup bonuses — but it’s also notorious for its $550 annual fee.

The main exceptions to this rule will be for somewhat fringe categories not offered by many cards. The U.S. Bank Cash+ Visa Signature® Card, for instance, is a no-annual-fee card that offers 5% cash back in user-selected categories, and the card leads the pack in several of those category choices, including home utilities and fitness centers.

So, long story short, to determine which card offers the most rewards, you really need to determine the type of rewards with which you’re concerned, then go from there. Looking at credit card rewards from a sheerly numerical perspective can leave a lot of value potential on the table.

Which Cards are the Most Prestigious or Exclusive?

Once upon a time, pulling out a shiny metal credit card at the restaurant signified your elite status and elicited “oohs” and “aahs” from the diners around you. These days, however, many card issuers offer sturdy (and sparkly) metal credit cards that can be obtained by almost anyone.

So, in a world where credit cards are less a status symbol than a prosaic, workaday tool, are there any prestigious, exclusive cards after which the elite can lust?

As it turns out, yes — and they’re just as expensive as one could hope. Here are a few credit cards sure to make your server take notice:

Centurion® Card from American Express

The Centurion® Card — better known to the world as The Black Card — has long been the go-to standard for exclusive credit cards thanks to its invitation-only application policy that reportedly requires an annual American Express credit card spend of at least $450,000.

If you’re spendy enough to make it into the cardholder club, you’ll get to — surprise, surprise — hand over even more money. The one-time initiation fee is supposed to be a whopping $7,500, a figure that (almost) makes the $2,500 annual fee seem reasonable in comparison.

And don’t expect monster purchase rewards for all that cash. The card offers a measly 1X point per dollar on most purchases and 1.5X points per dollar on purchases of $5,000 or more. Indeed, this card is said to be more about the perks — a long list of offerings that includes elite status with a number of hotel and airline brands, airport lounge access, and special event invites.

Dubai First Royale Card

The Dubai First Royale Card is a card that oozes prestige, starting with its royal look. This high-brow credit card is trimmed in gold on both sides, and the stylized logo on the front of the card is accented by a real 0.235-carat diamond.

As you might guess, this gem-encrusted card requires an invitation to apply, and some sources say you need to be a resident of the UAE to receive an invite. Even if you score an invite, however, don’t expect to get the card for free — the card reportedly requires users to pay an annual fee of around $2,000.

The rewards and perks of the Dubai First Royale Card aren’t advertised, but it’s been suggested that it earns cash back. As with many of the most exclusive cards, the real draw seems to be in the perks, and each cardholder has a dedicated relationship manager as well as a lifestyle manager (read: concierge).

J.P. Morgan Reserve Card

The J.P. Morgan Reserve Card, previously called the Palladium Card, is yet another invitation-only credit card, this one exclusive to the high-net-worth folks who are Chase Private Bank clients. The main thing that sets this card apart from its peers is its composition — the card is made out of palladium, a rare chemical element typically used in catalytic converters. (Take that, you cheesy gold and platinum cards!)

From a rewards perspective, the J.P. Morgan Reserve Card — issued by J.P. Morgan Chase Bank — is suspiciously similar to the Chase Sapphire Reserve®, also from Chase. This includes the same triple points on travel and dining purchases, the same annual travel credit, and the same cardholder benefits like rental car insurance.

But, while the Chase Sapphire Reserve® charges an annual fee of just $550, the J.P. Morgan Reserve Card charges $595 for most of the same perks and rewards. So, in essence, users are essentially paying a $145 surcharge for a palladium composition — and, perhaps the most important factor for some, exclusivity.

(Non-Monetized. The information related to J.P. Morgan Reserve® was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

Are Credit Cards with Annual Fees Worth It?

Given that many of the top credit card offers will come with big annual fees, one of the most common questions you’ll need to ask yourself when you’re evaluating potential deals is whether a given card or offer is worth paying the annual fee.

However, as with most aspects of choosing a new card, the answer to that question will depend entirely on you — and math.

The simplest way to get a rough estimate of a card’s value is to determine how much you’ll earn in rewards with that card in a year. For points and miles cards, you’ll also need to designate a set value to those rewards (or use the valuations from a third party).

For example, if you know you generally spend $2,500 on travel in a year, then you know a card that earns 3X points per dollar on travel will net you 7,500 points. If those points are worth 1.5¢ each in your estimation, then those points are worth around $112.

While it can be tempting to assume that a higher rewards rate is always worth paying an annual fee, this may not always be the case, as it will really depend on how much spend you put on the card. So, a card that earns 3% cash back on certain purchases but charges no annual fee may end up the better value than a card that earns 4% back but charges an annual fee.

While most of your value will probably come from credit card rewards, it’s important to look at a card’s secondary benefits, as well. A card that offers you airport lounge access, for instance, may be well worth its annual fee if you travel enough to make the perk worthwhile. Similarly, you may be more than happy to pay extra for a higher-tier co-branded card to unlock elite status and free breakfast.

And, of course, don’t forget the signup bonus. You probably don’t want a card that charges more in annual fees than you can earn in the signup bonus — at least, not unless the card’s perks more than make up the difference. But, if you’re choosing between a card with a $69 annual fee and one with a $99 annual fee, and the latter offers a bonus worth twice as much, it may be worth paying the larger fee.

How Many Credit Cards Should You Have?

Nearly every aspect of finding a new credit card will require you to know at least a little bit about your spending habits, your individual consumer credit profile, and your specific needs.

In other words, picking out a credit card or spotting the best offer is a personal experience that will vary for each cardholder. The best credit card offer for you may not be the best for your neighbor, and no single credit card offer will be the best for everyone.

Even something as simple as figuring out how many credit cards you should have in general isn’t something with a one-size-fits-all answer. If you’re someone who has trouble using credit cards responsibly, then the answer may actually be zero. For most folks, the answer will likely be somewhere between one and a dozen.

You should probably have at least one credit card — that you use at least semi-regularly and pay in full each time — for the sake of your credit; those payments can help you maintain an ongoing positive payment history and the card will add to your credit diversity.

Whether you should have more than one credit card will depend on your needs and wants — and credit scores. Consumers with low scores who need to build credit should apply for cards carefully, and only apply for cards necessary to help build credit. Rewards churning and signup bonus collecting are card hobbies best left to consumers with good credit.

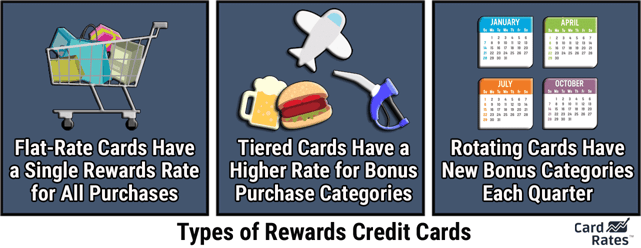

However, if your credit is solid and you like the idea of maximizing your rewards, there can be a lot of value in holding several cards with complementary bonus rewards categories and cardholder benefits. Most consumers will have expenses that fall into the most common bonus categories — like travel, dining, and gas — making it easy to find cards to earn high rewards rates for their most frequent purchases.

And don’t forget the purchases that seem to inevitably crop up that won’t fit into those common bonus categories. You can keep a good flat-rate, unlimited rewards credit card in the rotation so you can maximize your non-bonus spend. Overall, a few cards that offer high rates for your top expenses, paired with a solid flat-rate card for non-category expenses, can make for a good strategy.

Of course, if you’re going to play the rewards game, make sure you actually redeem those rewards. A surprising number of cardholders allow their rewards to expire or otherwise lie fallow, which obviously negates any potential value they may have held.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Credit Card Reviews: 5 Best Cards by Category ([updated_month_year]) Credit Card Reviews: 5 Best Cards by Category ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Expert-Reviews_-5-Best-Cards-by-Category.jpg?width=158&height=120&fit=crop)

![12 Easy-Approval Credit Cards by Category ([updated_month_year]) 12 Easy-Approval Credit Cards by Category ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/easy-approval-credit-cards-feat.jpg?width=158&height=120&fit=crop)

![19 Highest Credit Card Limits by Category ([updated_month_year]) 19 Highest Credit Card Limits by Category ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_370788551.jpg?width=158&height=120&fit=crop)