Credit cards are super convenient. But, if not used properly, they can also be very expensive. The longer you take to pay off your balance, the more money you spend on interest and fees — unless you snag one of the longest 0% APR credit card offers.

These cards offer extended promotional periods for new cardholders that allow you to pay no interest charges for a set period on all your new purchases and initial balance transfers. These offers can help you knock debt out faster by applying your full payment toward your balance to eat away at your principal instead of munching on interest charges.

New Purchases | Balance Transfers | FAQs

Longest 0% APR Offers on New Purchases

Not every 0% APR offer is the same. Some cards offer other rewards on top of the interest-free promotional period.

You could earn cash back, travel miles, or rewards points for your purchases. Cards that don’t offer rewards typically provide a longer 0% APR period for new cardholders.

With Rewards | Without Rewards

Longest 0% APR on New Purchases with Rewards

The only thing better than paying no interest for your new purchases is paying no interest and getting rewarded for using your card.

With the cards below, you can have your cake and eat it, too. Just make sure you pay your balance off before the end of your promotional period, so you don’t risk negating those rewards with added finance charges.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

Not only can new Chase Freedom Unlimited® cardholders take advantage of intro 0% interest, but they’ll also earn cash back on all purchases. To sweeten the pot even further, if you spend enough on purchases in your first few months with the card, Chase will provide a signup cash bonus.

2. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

As a new cardholder of the Chase Freedom Flex℠, you’ll enjoy a lengthy 0% APR introductory period. Perhaps the best deal is the top cash back on up to a set limit in combined purchases in quarterly rotating bonus categories each quarter. Just remember to activate your bonus category each quarter to take advantage of the extra cash back.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card is one of the bank’s most popular credit cards. Not only does the offering charge no annual fee, but you’ll also get 15 months of interest-free purchases while earning an unlimited 1.5% cash back on those purchases. Cash back never expires, and you can redeem your rewards for a check or statement credit.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card is a foodie’s best friend. Whether you eat at home or at your favorite restaurant, you’ll earn elevated cash back on dining and entertainment purchases made with the card.

5. Citi Rewards+® Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Citi Rewards+® Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Citi Rewards+® Card provides a very appealing introductory offer package for its new cardholders on purchases and balance transfers as well as a hefty signup bonus when spending criteria is met within the first few months of account opening. Paired with its tiered points reward structure and lack of annual fee, this card is hard to pass up for those in the good to excellent credit range.

Longest 0% APR on New Purchases without Rewards

Credit card issuers can’t give everything away for free. Oftentimes, banks shorten introductory APR periods to make up for the rewards they offer on their cards.

If you’re willing to forego the rewards, you can buy even more time to knock your debt out.

- For a limited time, get a special 0% introductory APR on purchases and balance transfers for 18 billing cycles. After that, the APR is variable.

- Enjoy Cellphone Protection Coverage of up to $600 annually when you pay your monthly cellphone bill with your card

- View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use, and free to U.S. Bank customers.

- Fraud Protection detects and notifies you of any unusual card activity to help prevent fraud

- Choose your payment due date

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 18 billing cycles

|

0% for 18 billing cycles

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent Credit

|

The U.S. Bank Visa® Platinum Card offers one of the longest introductory periods in the credit card space — 20 months with no interest charges on new purchases or balance transfers. And since you won’t pay an annual fee, you can essentially access free credit for a year and a half.

You must initiate your balance transfer within 60 days after opening your account to take advantage of the introductory period. After that, your transfers will immediately begin accruing interest at an APR that is based on your credit history.

7. Wells Fargo Platinum card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Wells Fargo Platinum card lets you pay down existing debt on high-interest credit cards by offering an 18-month introductory period without interest charges. The card never applies an annual fee and includes balance transfers made within your first 120 days with the card on the intro offer.

Cardholders can also access the free Wells Fargo Online® desktop interface or mobile application. There, they can view their account information and also receive regular updates on any changes to their FICO® credit score.

(The information related to Wells Fargo Platinum card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Longest 0% APR Offers on Balance Transfers

If you currently carry debt on a high-interest credit card, you may find yourself spending most of your monthly payment on finance charges. That’s not a great way to pay down your balance and become debt-free.

But with a good balance transfer card, you can knock your principal down faster and get a little closer each month to eliminating your debt. Some banks offset their introductory periods and rewards by tacking on a balance transfer fee, usually 3% to 5% of the amount of debt you’re moving over to the card.

While these charges aren’t optimal, they’re often far less than the amount of interest you’d pay by keeping the debt on your existing high-interest credit card.

- For a limited time, get a special 0% introductory APR on purchases and balance transfers for 18 billing cycles. After that, the APR is variable.

- Enjoy Cellphone Protection Coverage of up to $600 annually when you pay your monthly cellphone bill with your card

- View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use, and free to U.S. Bank customers.

- Fraud Protection detects and notifies you of any unusual card activity to help prevent fraud

- Choose your payment due date

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 18 billing cycles

|

0% for 18 billing cycles

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent Credit

|

The U.S. Bank Visa® Platinum Card offers a 0% introductory balance transfer APR as well as purchase APR. While you won’t get rewards, you’ll enjoy cellphone protection coverage, fraud protection, access to your free credit score, and no annual fee.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Simplicity® Card offers one of the longest introductory 0% APR periods in the credit card space on all balance transfers made within four months of opening your card. Please keep in mind, a balance transfer fee will apply, but if you need time to pay off your debt, the fee may be worth it.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card also charges a balance transfer fee like its sibling card above. But for that fee, you’ll enjoy a lengthy introductory 0% APR period on that transfer as well as a two-step cash back system that pays up to 2% on every purchase. You start by earning 1% when you buy and then you earn another 1% as you pay for your purchases.

Which Credit Card Has the Longest Interest-Free Period?

The longest 0% period currently available is 20 billing cycles on both new purchases and balance transfers, offered by the U.S. Bank Visa® Platinum Card. The card also offers a competitive interest rate once the promotional rate expires, making it an attractive offer for anyone looking to add a new card to their wallet.

Note that you will be charged a 3% balance transfer fee, so, for example, if you transfer $5,000 to your new card, you can expect $150 to be added to your balance shortly after the transfer is complete.

What is the Best 0% APR Credit Card?

The best introductory offer is one that offers a long period of interest-free financing without charging you annual fees or balance transfer fees along the way. After all, the point of taking advantage of a 0% APR introductory offer is to eliminate debt and not add more to it in the form of fees.

To truly maximize your interest-free period, you may have to forego cash back and other rewards. That’s because credit card issuers tend to shorten introductory offers on cards that offer rewards.

Our list above mentions several cards that could easily vie for the title of “best 0% APR credit card,” depending on your needs. Most don’t charge an annual fee, and many will net you as many as 18 months without interest charges.

Just remember that every card has different rules on how they treat balance transfers. Many issuers will include transfers from other credit cards on the interest-free period, but each bank requires you to initiate your transfer within a certain amount of time.

If you’re planning on using your introductory period to knock out pre-existing debt, make sure you know for certain how soon you have to initiate your balance transfer, and if your new bank will charge you a fee to move your debt over to the new card.

Does a 0% APR Affect Your Credit Score?

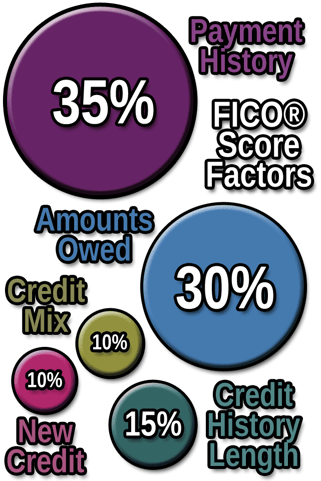

Taking advantage of an introductory 0% APR offer can help your credit score — if you stick to a budget and decrease your debt instead of adding to it. That’s because a good portion — 30% — of your FICO credit score focuses on how much debt you currently have.

When your debt lives on a high interest credit card, you dedicate a portion of your payment every month to interest and finance charges. That means it takes more time and money to eliminate that debt — which can slow your credit score growth.

But when you leverage an extended interest-free introductory period, all your payments go toward your current principal, which quickly lowers the amount of money you owe and increases your credit rating.

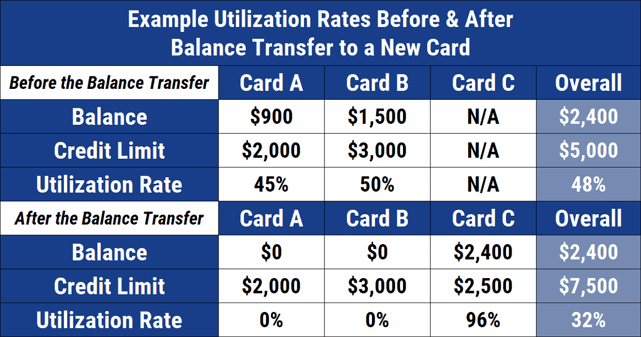

You also immediately affect your credit utilization rate, or ratio, when you add a new credit card to your wallet. Your utilization shows how much of your available credit is currently used. You can calculate your utilization by dividing your current balance by your overall credit limit.

For example, a card with a $1,000 credit limit and a $250 balance has a 25% utilization.

By opening a new credit card, you’re increasing your total available credit. As long as you don’t go charge-crazy on your new plastic, you’ll lower your credit utilization and could see an immediate increase in your credit score.

Lenders like to see low utilization. Banks see applicants who use too much of their credit, and then apply for new credit, as being over their head and perhaps desperate for more money. A high utilization rate can result in your application for a new card being declined even if you have a history of on-time payments.

As you continue to pay down your debt, you’ll see your utilization ratio continue to improve. The same benefits should apply to your credit rating.

Just be certain that you don’t fall into a common trap that many cardholders face with introductory APR offers. The lack of fees can increase the temptation to spend more. That can get very expensive if you don’t pay off your entire balance before the end of the introductory period — when the regular ongoing APR kicks in.

All Credit Cards Have an Interest-Free Grace Period

Thanks to the Federal Credit Card Accountability, Responsibility, and Disclosure Act of 2009 (CARD Act), credit card issuers must give you an interest-free grace period of at least 21 days from the date of purchase to pay your bill before you start accumulating finance charges.

So, every purchase you make using your credit card won’t accrue interest until 22 days after you complete the sale. If you pay it off before then, you’ll only pay the amount you charge to the card.

If you need more than 22 days to pay your bill, using one of the longest 0% APR credit card offers allows you to take advantage of the convenience credit cards provide without paying heavy finance charges.

When used responsibly, they can be a great way to eliminate debt and improve your credit score.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Longest 0% APR Balance Transfer Cards ([updated_month_year]) 6 Longest 0% APR Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/09/Longest-0-APR-Balance-Transfer-Cards.jpg?width=158&height=120&fit=crop)

![What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year]) What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/what-is-apr.jpg?width=158&height=120&fit=crop)

![What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year]) What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/good-apr2.png?width=158&height=120&fit=crop)

![7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year]) 7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/low.png?width=158&height=120&fit=crop)

![7 Best Purchase APR Credit Cards ([updated_month_year]) 7 Best Purchase APR Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Purchase-APR-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![How to Calculate APR on a Credit Card ([updated_month_year]) How to Calculate APR on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/CalculateAPR-1--1.png?width=158&height=120&fit=crop)

![7 Options When Your Credit Card APR Rises ([updated_month_year]) 7 Options When Your Credit Card APR Rises ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/shutterstock_591898394-edit1.jpg?width=158&height=120&fit=crop)