No matter how much you love your job — because we all do, of course — often one of the best parts of a great vacation is that your destination is far, far (far) away from the stress and bustle of your everyday life. Unfortunately, as soon as you start adding airfare and hotel rooms to your vacation expenses, those happy little palm trees can turn into mean little dollar signs right before your eyes.

Designed for those who spend more time in the air than on the ground, frequent flyer programs can be a treasure trove of savings for jet-setters who know their pilots by name. But what about the rest of us, those yearning for sandy beaches, fruity drinks, and happy trees?

Well, as it turns out, you, too, can enjoy the benefits and bargains of frequent flyer programs — all without stepping foot on a single plane. Read on to learn how to get frequent flyer miles without flying. We’ll explore using travel rewards, cash back rewards, miles received as gifts, combining rewards with miles, and more. We’ll also take a look at some of our top credit card picks that can help get you in the air for cheaper.

1. You Can Use Travel Rewards Cards to Earn Miles

Credit card travel rewards are a simple, straightforward way to earn points and miles to cover expenses for your next trip. Really, what’s easier than spending money you were already going to spend anyway? In fact, pair a solid per-dollar earning rate with a juicy signup bonus, and you could be poolside sipping from a coconut in no time. Plus, you can use your travel rewards card to pay for those tropical treats to get a jump start on your next trip.

If you’re devoted to your favorite airline, then a branded rewards card, such as the Gold Delta SkyMiles® Credit Card from American Express, is a good choice as the miles you earn can be added to your existing frequent flyer account. Those who would rather have more flexibility in where — and with what carrier — they fly should check out our top-rated travel rewards cards. These programs have no brand restrictions or blackout dates to limit your travel options.

+See More Travel Rewards Cards

In your search for the perfect rewards card, don’t forget to investigate the associated rates and fees to ensure you get a good financial deal in addition to awesome travel perks. An important — yet often over-looked — cost to be wary of in a travel card is that due to foreign transaction fees. When charged, these fees will apply to any purchase you make that involves a conversion between US and foreign currencies.

Many travel credit cards will come without foreign transaction fees — but not all. When present, foreign transaction fees are typically 3% to 5% of the total transaction amount. You can check the terms of your credit card offer or cardholder agreement to find out the details of your card’s fees.

2. You Can Use Cash Back Rewards to Purchase Miles

Although unknown to many, one way to add to your stash of frequent flyer miles (without dealing with airplane food) is to simply purchase them from the airline. While this method won’t always provide the greatest value — per-mile costs can be prohibitive to some free-flight aficionados — it’s a good way to pad your points if you come up a little short when it’s time to redeem.

Additionally, many programs regularly offer discounts on miles purchases that can increase the value. Of course, the best way to get great value is to buy those miles with free money — like cash back rewards from your everyday credit card. With a great cash back card, such as our top picks, you can earn rewards on everything you buy, including gas and groceries, then redeem your cash back for a statement credit to cover your miles purchases.

Additional Disclosure: Bank of America is a CardRates advertiser.

To maximize the amount of cash back you can earn — and, thus, put toward your temporary ticket out of the rat race — you should seek out the cash back program that will make the most of your spending. If you make purchases just about everywhere, a simple, flat-rate unlimited program may be best. However, if the bulk of your buys fall into a variety of common categories, you can often bag bonus cash back rewards.

Categories rewards will typically come in two types: those that rotate quarterly, and those that remain the same all year long. Rotating categories can be great for those whose spending changes with the season, typically offering bonuses on gas or groceries during the summer and popular shopping brands during the holiday months. However, if your spending is as regular as a German train, then set categories might give you the most robust rewards.

3. You Can Use Miles Gifted to You From Family & Friends

Another way to accrue frequent flyer miles without actually flying frequently (or at all) is to take advantage of the airplane addicts in your network of family and friends. The simplest option is to have them order a ticket for you, as most, if not all, airlines will allow you to designate a ticket purchased through your account to be used by a family member.

Another option is to receive a transfer of miles directly. The majority of major airlines and travel rewards programs will allow you to gift or share points and miles between accounts. Among the things to keep in mind when considering transferring points (or receiving them) is that some airlines will charge a per-mile fee to gift miles, sometimes as much as several cents per point, which can easily eliminate any value from the transaction.

I have had friends who asked for frequent flier miles in lieu of wedding gifts, to help reduce the cost of their honeymoon. It’s a great way to get something you actually want and need for your wedding instead of can openers and assorted bowls.

Your frequent flyer or travel rewards account may also have a cap on the number of points or miles you can send or receive on an annual basis. Points transferred over the cap may be unavailable to use until the next year, or lost altogether, so be aware of any limitations before you initiate a transfer.

Stack the Savings by Combining Rewards and Miles

Few things are as good for the body, mind, and soul as a great vacation. Even the simple act of getting away (far, far away) from the daily grind can be enough to help you relax and rejuvenate.

You can transfer some travel rewards to your existing frequent flyer account to save even more.

At the same time, it’s hard to enjoy the food, fun, and fruity drinks when you’re focused on how long it’ll take you to pay for it all.

While frequent flyer miles and travel rewards can both be effective ways to pay for your much-needed getaway, unless you’re in the air more than a migratory bird, it can feel like forever to collect the points you need. That said, saving in the skies can be as simple as saving in the grocery aisles if you know how to properly stack your points and miles.

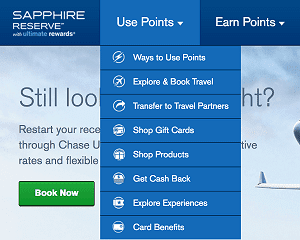

For example, you can use the generous Ultimate Rewards signup bonus from your new Chase Sapphire Preferred® credit card directly, redeeming them through the Chase portal to cover travel expenses. Or you can transfer your Ultimate Rewards to any of Chase’s popular airline partners, turning those points into branded frequent flyer miles and adding to your vacation-ready hoard.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Capital One Pre-Approval: 5 Secrets to Prequalify ([updated_month_year]) Capital One Pre-Approval: 5 Secrets to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/capital-one-pre-qualify-1.png?width=158&height=120&fit=crop)

![9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year]) 9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/without2.png?width=158&height=120&fit=crop)

![7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year]) 7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-5--1.jpg?width=158&height=120&fit=crop)

![3 Tips: Credit Card Limit Increases Without Asking ([updated_month_year]) 3 Tips: Credit Card Limit Increases Without Asking ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Limit-Increase-without-Asking-Feat--1.jpg?width=158&height=120&fit=crop)

![3 Prepaid Cards Without SSN Requirements ([updated_month_year]) 3 Prepaid Cards Without SSN Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/Prepaid-Cards-Without-SSN-Requirements.jpg?width=158&height=120&fit=crop)