Many people choose a credit card for its great rewards program or signup bonus. But what they often forget to consider is its customer service.

By opting for credit cards with the best customer service, you can get your issues or questions addressed right away. You can also ensure you’re making the most out of their rewards program and taking full advantage of their benefits.

Credit cards that make good customer service a priority will take good care of you so you remain a customer. Let’s dive deeper into the credit cards with the best customer service.

Discover | Amex | Capital One | Chase

Discover Tops the Customer Service Rankings

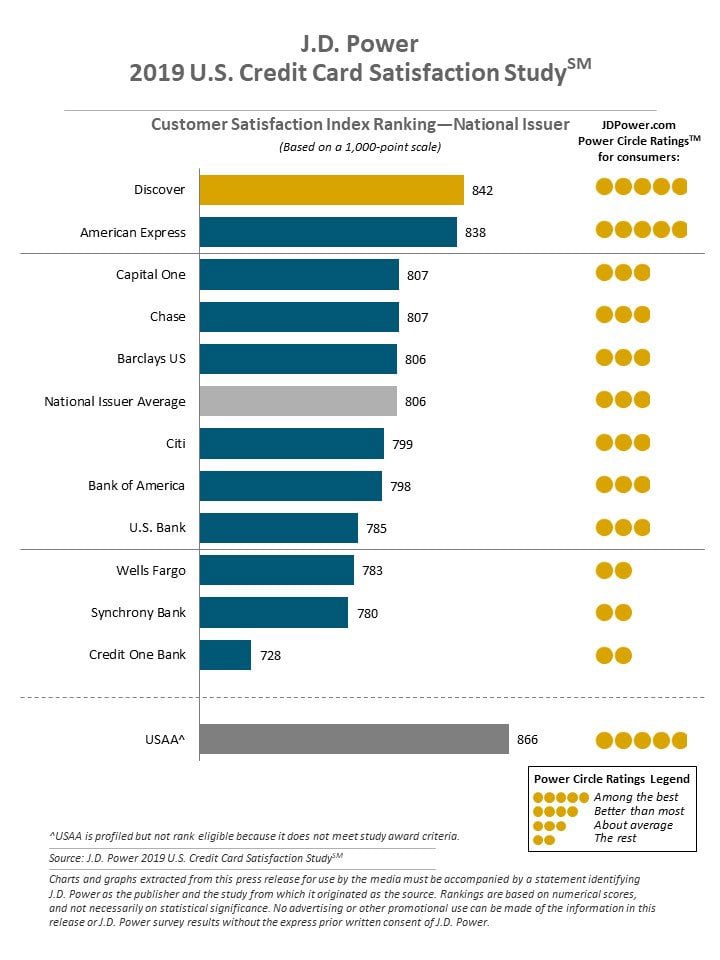

Discover leads the way in customer service, according to J.D. Power’s 2019 U.S. Credit Card Satisfaction Study. The study surveyed 28,236 credit card owners between September 2018 and June 2019.

Discover and the other credit card issuers in the study were ranked by their customer satisfaction scores, which were based on a 100-point scale. Discover’s customer satisfaction score was 842 — the highest among issuers for the fifth time in six years.

Discover’s CEO, Robert Hochschild, states that the key to Discover’s exceptional customer service is the technology the company continues to invest in. If you have a Discover credit card, you can reach out to customer service by phone or email 24 hours a day, seven days a week.

Discover also offers a Credit Resource Center you can use to learn more about Discover’s rewards and cardholder benefits. In addition, the Credit Resource Center offers a breakdown of the credit card types available so you can choose the right one.

Best Discover Cards

Some Discover cards are ideal for cash back rewards while others are intended for balance transfers and air miles. No matter which card you choose, you can expect unparalleled customer service.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Discover it® Cash Back offers a variety of benefits. Since it’s a bonus category card, you can earn bonus cash back on purchases in various categories. The bonus spending categories must be activated each quarter, and rewards are subject to spending maximums. Rewards don’t expire so you can redeem them whenever you’d like.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

With the Discover it® Balance Transfer card, you will enjoy an introductory APR on all transfers for a long promotional period. You’ll also earn bonus cash back on select quarterly categories that you activate, up to the quarterly maximum.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Miles card will give you miles rewards for every $1 you spend. You can use the miles to pay for airfare, lodging, rental cars, and other travel purchases.

See more Discover credit cards.

American Express Comes in a Close Second

American Express ranked second for customer satisfaction with 838 points, just behind Discover.

American Express offers a Help Center that provides answers to common questions on topics like account management, benefits and rewards, and security and fraud. Its Help Center also includes how-to videos to show you how to make a payment, how to replace a lost or stolen card, and how to use rewards points.

If you don’t find what you’re looking for in the Help Center, you can contact American Express via phone, email, or chat.

Best American Express Cards

In addition to great customer service, American Express cards come with some noteworthy cash back rewards and travel benefits. Consider your unique lifestyle and spending habits before choosing one.

- Earn $250 back in the form of a statement credit after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year on purchases (then 1%). Also earn 6% cash back on select U.S. streaming subscriptions.

- Earn 3% cash back on transit, including U.S. gas stations, taxis/rideshare, parking, tolls, trains, buses, and more. All other purchases earn 1% cash back.

- $120 Equinox Credit - Use your Blue Cash Preferred Card to pay for Equinox+ at equinoxplus.com and receive $10 in monthly statement credits. Enrollment required.

- 0% intro APR for 12 months from the date of account opening, then a variable APR applies

- $0 intro annual fee for the first year, then $95

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

19.24% - 29.99% Variable

|

$0 intro annual fee for the first year, then $95

|

Excellent Credit

|

While the card charges an annual fee, it’s worth it if you tend to spend a lot of money on groceries each month. In addition to its generous cash back rewards, the Blue Cash Preferred® Card comes with a 0% intro APR on purchases and balance transfers for 12 months.

Known as a leading travel rewards card, The Platinum Card® pays 5X Membership Rewards® points for every $1 you spend on flights and hotels. It also grants you Elite status with Marriott and Hilton hotels so you can enjoy late checkouts, free Wi-Fi, and more.

You can also access more than 1,000 airport lounges, including Amex Centurion Lounges. While the card charges a hefty $550 annual fee, the perks it offers make it well worth it for frequent travelers.

The Amex EveryDay® Preferred Credit Card shines with its category spending bonuses. You can earn 3 points per $1 spent at grocery stores and 2 points per $1 spent at gas stations. You’ll get 1 point per $1 on all other purchases.

If you use the Amex EveryDay® Preferred Card to make at least 30 purchases in a billing period, you’ll enjoy 50% extra points on all of them. Therefore, your rewards rates will significantly increase if you meet the transaction threshold each month.

Followed by Capital One and Chase, Respectively

Capital One and Chase both tied for third place in J.D. Power’s survey, earning 807 points each.

The Support Center on Capital One’s website offers a search function and plenty of articles on topics that include reporting fraud and redeeming credit card rewards.

Chase offers a Credit Card Resource Center with tools to help you manage your Chase credit cards. The resource center contains answers to frequently asked questions, a glossary of common terms, and a self-service toolkit.

You can use the self-service toolkit to do things such as set up automatic payments or manage account alerts. If you don’t find what you’re looking for in the resource center, you can call its customer service phone number 24/7/365.

Best Capital One Cards

Several Capital One cards reward you with cash back and miles for everyday purchases. Fortunately, all these cards come with unlimited access to the Capital One Support Center and customer service line.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card offers a generous signup bonus that can be used toward travel purchases. All you must do is spend a certain amount within a set time frame from the day you open your account.

You can also score 2X miles on every purchase and use them to pay for airfare, hotels, and other travel expenses. There’s no limit to how many miles you can earn, and they won’t expire as long as you remain an account holder in good standing.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One VentureOne Rewards Credit Card doesn’t charge an annual fee and offers 1.25X miles on all purchases. If you’d like, you can transfer your miles to over 12 of the top travel loyalty programs.

In addition, the Capital One VentureOne Rewards Credit Card comes with a 0% APR on all purchases for a promotional period. There’s also a one-time bonus offer and no foreign transaction fees.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

If you’d like to earn an unlimited 1.5% cash back on every purchase, the Capital One Quicksilver Cash Rewards Credit Card fits the bill. It’s a simple card because there are no rotating categories or activations required.

Aside from its simplicity, the Capital One Quicksilver Cash Rewards Credit Card offers a promotional 0% APR offer on purchases. There’s no annual fee, and you can earn a one-time bonus if you spend a certain amount within three months of opening your account.

See more Capital One credit cards.

Best Chase Cards

Chase credit cards are designed to meet the needs of all types of customers. Whether you’re an avid traveler or looking for some extra cash, there’s a Chase card for you. Each Chase card is backed by superior customer service.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

With the Chase Freedom Unlimited®, you’ll get cash back rewards on all purchases. The card also offers a 0% intro APR on purchases for new cardholders.

If balance transfer options are what you’re seeking, look no further. Keep in mind, balance transfer fees may apply. The cash back rewards you earn will never expire as long as you keep your account open, and there’s no annual fee.

11. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

The Chase Freedom Flex℠ gives you bonus cash back on up to a set amount in combined bonus category purchases every quarter you activate.

You don’t have to pay an annual fee and can earn a cash bonus if you meet a certain spending threshold within your first three months from opening your account. The Chase Freedom Flex℠ also comes with a 0% intro APR terms.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Known as Chase’s premium travel card, the Chase Sapphire Reserve® offers 3X points for travel and restaurant purchases. You’ll get 1X points for all other purchases.

The Chase Sapphire Reserve® also gives a $300 annual travel credit and up to $100 every four years for TSA PreCheck® or Global Entry fee reimbursement. In addition, you can access a network of airport lounges with free food and drinks as soon as you activate the card.

A Variety of Cards Offer Excellent Customer Service

Even though customer service may not be the first thing you consider when shopping for a credit card, it’s important. You want a credit card that’s backed by a company that’ll be there for you any time you have a question or concern.

By choosing one of these credit cards with the best customer service, you can enjoy the peace of mind of knowing your credit card issuer values you. They’ll go above and beyond to help you and resolve issues if your account is compromised.

As you can see, a variety of credit cards offer excellent customer service, and you’re sure to find one that meets your lifestyle and preferences.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Best Wells Fargo Credit Cards ([updated_month_year]) 6 Best Wells Fargo Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/wellsfargo.png?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![7 Best First Credit Cards, No Credit Needed ([updated_month_year]) 7 Best First Credit Cards, No Credit Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/firstcard.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Building Credit ([updated_month_year]) 12 Best Credit Cards for Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/BUILD.jpg?width=158&height=120&fit=crop)

![7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year]) 7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/fair-credit-limits-art.jpg?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Secured Credit Cards: No Credit Check ([updated_month_year]) 7 Best Secured Credit Cards: No Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/Best-Secured-Credit-Cards-with-No-Credit-Check.jpg?width=158&height=120&fit=crop)