I still have my first credit card, despite it not currently residing in my wallet. While I began my credit card journey with a mere $300 limit, over the years, my little Capital One card has undergone several credit limit increases and upgrades to better iterations.

But I don’t use it. Instead, I prefer to stay up with the latest cards to reap their benefits.

There are so many credit card offers that tear me from my typical brand loyalty — between large cash-back percentages, signing bonuses, and other rewards, it hardly makes sense to limit yourself to a single issuer, brand, or type of credit card.

Here we’ve rounded up the best available credit card offers and organized them into specific categories to help you find the next piece of plastic to reside in your wallet. Use the navigation below to skip ahead to the credit card offer that best suits your needs.

2. Best “0% Balance Transfer” Offer

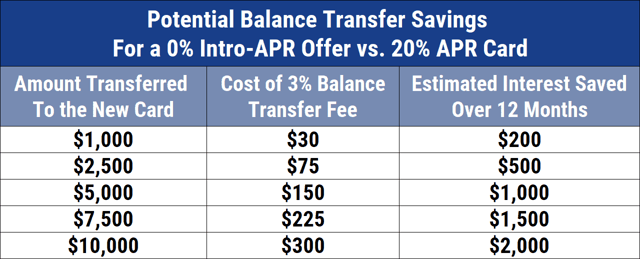

Generally speaking, balance transfer offers are only extended to individuals with good to excellent credit. These types of credit cards are awesome for helping you pay off debt because they allow you to move a balance from a higher interest card to a lower or 0% interest card. This way, you can pay off the balance without paying extra in interest during the promotional period.

However, be aware that most cards charge balance transfer fees, which are typically charged as a small percentage (usually 3% to 5%) of the balance being transferred. Just be sure to read the small print to know what the offer entails, including the interest-free time period and the transfer fee. A card like this one offers a superb introductory period, while keeping fees to a minimum:

Additional Disclosure: Citi is a CardRates advertiser.

+See more balance transfer offers

3. Best “0% Intro APR” Offer

An introductory offer of 0% APR is a great option for big purchases (though it is also limited to individuals with good to excellent credit). For example, if you are moving into a new place and need to purchase furniture, a 0% intro APR offer would be a great way to cover the costs of a new living room set without paying interest.

Similar to balance transfer cards, the introductory 0% APR is for a limited period of time, so be sure to read the offer fully to know when to pay the balance off before interest hits. Below is our favorite 0% introductory APR offer:

Additional Disclosure: Bank of America is a CardRates advertiser.

+ See more 0% intro APR offers

4. Best “Cash Back” Offer

The offers I always find myself gravitating toward more than any other are whichever the best cash back credit cards happen to be at the time. Most programs have purchasing categories such as gas stations, grocery stores, and specific retailers that earn a higher cash-back percentage on purchases, while offering a standard percentage for all other purchases.

It’s important to note that higher percentage cash-back earnings can get capped, so read the offer completely before committing. Only you will know what the best cash back credit card for your spending style is.

Luckily, many issuers have made redeeming cash back so easy that you can do it right online where you view your account activity. However, you may have to rack up a certain amount before you can redeem it. I generally just take my cash back as a statement credit, which is standard, but some issuers will send you a check for your cash-back earnings.

Be sure to pay attention to the interest rates for cash back offers as they tend to be rather high (it’s how the credit card company hopes to make its money back). Below is our best cash back credit card offer:

Additional Disclosure: Bank of America is a CardRates advertiser.

5. Best “Points & Rewards” Offer

While I tend to favor cash back rewards, often points-based rewards programs offer hefty benefits, including signing bonuses that end up equating to a few hundred bucks toward travel or merchandise. These types of rewards cards give you a specific amount of points per purchase, but be sure to know the rate at which the points accumulate because some programs are more rewarding than others.

Redeeming points for rewards can be done online or over the phone, though you’ll want to be aware of any travel blackout dates or other redemption restrictions. Because of the headache this used to cause for consumers, many cards have eased up on rewards limitations. The card below offers an amazing program for earning points rewards:

Additional Disclosure: Bank of America is a CardRates advertiser.

+ See more points & rewards offers

6. Best “Business” Offer

Business credit cards offer tempting benefits from larger credit limits to more rewards points when purchases are made for the business. While some issuers are more lenient as to what constitutes a business (for example, a self-employed entrepreneur can often use their Social Security number on a business credit card application rather than the business’s Federal Tax ID number), others have strict rules governing who can apply.

It’s important to read thoroughly all the business card’s terms and conditions, which can vary among issuers as business cards are not protected under the Credit CARD Act of 2009. Our favorite business card offer includes many sought-after business benefits:

+ See more business credit card offers

7. Best “Student” Offer

Student credit cards are for those currently enrolled in a higher education institution and some offer additional perks for maintaining good grades. Because the best student credit cards know their applicant demographic, they are willing to accept the limited credit history of most college students.

Most student cards don’t charge annual fees, but their benefits vary, so you’ll want to shop around for the best APR available given your credit rating. The application process for our favorite student credit card is pretty painless:

+ See more credit card offers for students

8. Best “Secured” Offer

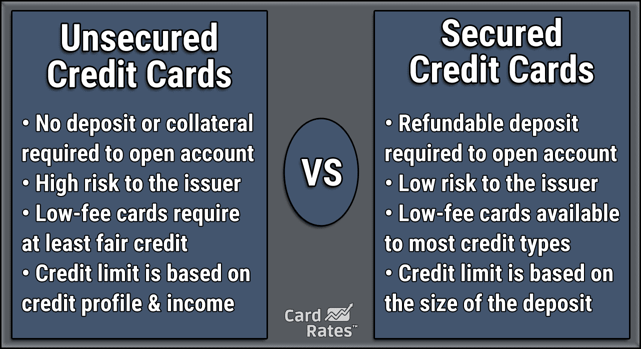

Consider a secured credit card if your credit prohibits you from being approved for other credit card offers. A secured card is similar to a prepaid credit card — you give the credit card company a deposit upfront and they issue you a line of credit for that amount, the key difference being that a secured card is still a line of credit rather than requiring you to reload it. If you consistently make payments you can often get your deposit refunded to you.

Plus, almost all secured cards report to the credit bureaus. Just read the terms and conditions of any offer to confirm reporting before you apply because if the issuer doesn’t report your activity, it can’t help build your credit. Here is the offer we suggest to those looking for a secured credit card that reports to all three major credit bureaus:

+ See more secured credit card offers

9. Best Offer for “Good Credit”

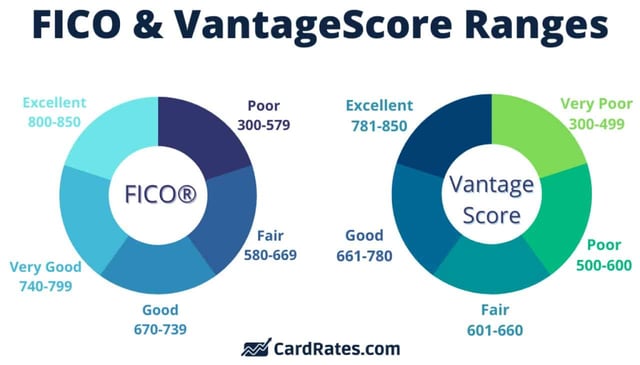

With a good credit score of 700+, you have access to some of the best credit card offers out there, including those that have handsome rewards and cash back programs as well as those offering a hefty signing bonus.

To ensure your rating remains in tact, be sure to keep your credit utilization ratio below 30% even as you apply for and open new credit accounts. This is our card of choice to reward those with good credit with good perks:

+ See more credit card offers for good credit

10. Best Offer for “Fair Credit”

Fair credit, defined as a FICO score between 580 and 670, may seem limiting, but there are still many options for fair credit borrowers. Because lower scores typically represent a more risky applicant to the credit card company, some cards will have a higher APR or even charge an annual fee, so you’ll want to compare your options apples-to-apples.

However, many of the choices still come with nice rewards programs like cash back. Our highest-rated credit card offer for fair credit is below:

+ See more credit card offers for fair credit

11. Best Offer for “Bad Credit”

Credit cards for people with bad credit are specifically geared toward helping you qualify, even with a credit score below 600. You can use these credit cards to help build credit, but there will likely be higher fees and APRs if you are late or miss making a payment. Payment history accounts for 35% of your FICO credit score, so if you aren’t sure you can pay the bill on time, you might want to look into a prepaid card instead.

If you decide to go with an unsecured card, this card is a great option for you. It’s our top choice for those with bad credit, and it does not require you to secure the credit line with a large deposit:

+ See more credit card offers for bad credit

12. Best Offer for “No Credit History”

Building your credit history can be done easily with a credit card for limited credit. Qualifying for no credit credit cards may require a little more information from you than a typical credit card application because there isn’t as much data in your credit report.

There will likely be higher fees and APRs, but as long as you stay on top of your payments and keep your credit utilization low, an unsecured credit card for limited credit can help you build your history so you may qualify for better cards in the future. We recommend the following offer to help you build your credit:

+ See more credit card offers for limited credit

Pros and Cons of Different Credit Card Offers

We’ve listed a dozen different credit card offers, but the reasons for choosing a particular credit card considerably exceed that number. Knowing the advantages and disadvantages of each offer can help you decide which to pursue.

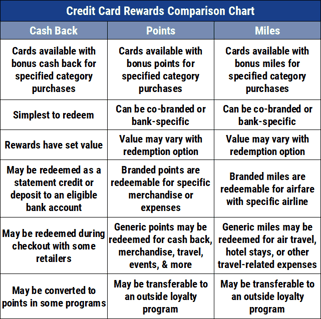

Air Miles

You can redeem air miles for flights and/or seat upgrades. Depending on the type of credit card, you can use the miles on any carrier, or you may have to settle for the co-branded airline. For example, the miles you earn with a Delta credit card can only be used with Delta and its partners.

The cards offering general miles are the most versatile, as you can use them on any flight. You know their dollar value in advance, which you apply directly to the flight’s cost (or seat upgrade). You can also redeem your miles for cash and other rewards.

While flexible, these cards may not be as valuable as the frequent flyer miles you earn from credit cards offered by specific airlines. Cards co-branded with airlines provide miles directly tied to airline loyalty programs. This may give you more bang for the buck, but it depends on how many miles the carrier requires for your flight or upgrade, which varies from one airline to the next, and can change at any time with no advance notice.

Owning a co-branded rewards card makes sense if you regularly fly that airline. But you can’t transfer the miles to non-affiliated airlines, nor can you redeem the miles for cash.

Some cards offer extra value when you book flights or redeem miles through the issuer’s travel portal. Look for cards that also provide bonus rewards for hotel stays, car rentals, and cruises, among other perks.

When choosing the best rewards credit card for air miles, consider the benefits that may appeal to you, including airport lounge access, travel insurance, and expense reimbursement.

Cards with the most benefits tend to charge the highest annual fees. But high-fee cards may offer enough value to make them worthwhile, so don’t automatically dismiss them.

Cash Back

Everyone loves cash back. It’s so versatile! Issuers offer it in three ways that can beef up your savings account:

- Flat rate: These cards offer 1% to 2% cash back on all eligible purchases. No muss, no fuss.

- Tiered rates: These cards pay different rates, usually 2% to 5%, for different merchant types (e.g., restaurants, gas stations, office stores, etc.), while all other purchases earn 1%.

- Rotating categories: The card names new merchant categories each quarter that will receive the top earnings rate, usually 5%. You must enroll each quarter to receive these rewards. These cards often include tiered rates for other purchases and the standard 1% back on everything else.

Many cash back cards allow you to redeem your rewards for gift cards, statement credits, travel purchases, or at checkout with retailers like Amazon, among other options.

On the downside, many cash back cards limit your earnings in the quarter (or the year). For example, a card may pay you 5% cash back on the first $1,500 of grocery spending per quarter and 1% after that.

Points

Points are almost as versatile as cash. You can redeem them for statement credits, gift cards, travel purchases, and more. You may also be able to transfer your points to airline or hotel loyalty programs.

The cards quote the point reward rates with an X rather than a %. For example, a 5X rate means you earn five points for each dollar you spend on eligible purchases.

A few credit cards increase the value of points when you redeem them through the issuer’s online travel agency. The Ultimate Rewards points from Chase Sapphire cards are an example. They inflate point values by 25% (Chase Sapphire Preferred® Card) or 50% (Chase Sapphire Reserve®). If you own a Sapphire card and another Chase Bank credit card, you can transfer points to the Sapphire card in your online account to get the higher point values.

As with cash back, be alert to any limitations on the bonus reward rates for point cards. The points on a few cards may expire if you don’t redeem them by a set time.

0% Intro APR

Card issuers recruit new cardholders with special signup deals, such as a 0% intro APR. This promotion allows you to stretch payments on purchases interest-free for at least six months. The best of these deals lasts for 18 to 21 months.

You can get this special rate upon opening a new account, or the issuer may send existing customers in good standing a promotional rate for a shorter duration. Card issuers may withhold the promotion if you previously owned the card or if you are upgrading from another one of its cards.

The promotion is especially valuable if you plan to finance big-ticket purchases like appliances or a fancy vacation. It can also come in handy for financing an upcoming wedding or bar mitzvah.

The only downside occurs when the promotional period ends. Any existing balance will now be subject to the card’s regular interest rates if not repaid by the next due date. It’s an excellent time to evaluate whether to keep the card or find another with a signup promotion. A switch may be tempting if the card’s other benefits and rewards are less attractive than those of the competition or if you are planning more large purchases.

0% Balance Transfers

This is another signup promotion geared toward consumers who want to consolidate their credit card debt. You can transfer the balances from other credit cards and pay no interest for a set period (typically six to 21 months). The idea is to pay off all your old credit card debt before the promotion expires.

As with the 0% intro APR offer, this one is available only to new cardholders (and existing cardholders in good standing, at the issuer’s discretion), and a late payment can cause its cancellation. Each transfer triggers a fee, typically 3% to 5%.

The usefulness of this promotion depends on the card’s credit limit versus how much you owe to other credit cards. If the card doesn’t cover all your other balances, you’ll have to pay multiple cards each month, defeating some of the benefits of debt consolidation.

Watch out for tricky conditions on 0% balance transfer promotions. For example, the card may advertise a 15-month period, but only for balances you transfer during the first 60 or 90 days after account opening.

Signup Bonuses

Many cards offer signup bonuses to new cardmembers who spend the required amount on purchases during a set period (typically three months) after account opening. These cards sometimes combine signup bonuses with 0% intro APRs and rewards, making them an excellent choice for consumers about to go on a spending spree.

Discover credit cards offer a Cashback Match to new cardmembers instead of the typical signup bonus. This is a one-time bonus equal to all the cash back posted during the first 12 months of card membership, and there is no limit to the amount you can earn. Accordingly, the Discover it® Cash Back card is always in the running for the best cash back credit card.

The only downside to signup bonuses is that they encourage you to spend more to receive the bonus, and you should never spend more on a credit card than you can afford to repay due to their high interest rates.

Business

Business credit cards can help small business owners separate their personal and business expenses, which can help them prepare their tax returns. The cards frequently offer bonus rewards for business-related purchases, such as supplies and furniture from an office supply store or internet, phone, and wifi expenses.

Business cards usually allow you to add employees as authorized users for free. You can limit each user’s spending while collecting the user’s rewards on purchases.

The cardmember agreements for business credit cards usually require cardowners to guarantee their personal wealth to pay card balances. This requirement may disqualify applicants with poor credit.

Student

Student credit cards may offer the best deals in the industry. Undergraduates can get them if they attend an eligible school at least half time, even if they have no previous credit history.

The cards usually offer bonus cash back or point rewards on the types of purchases students are likely to make, such as groceries, gas, subscriptions, and dining. Typically, there are no annual fees, APRs are modest, and a few cards provide credits for academic achievement.

On the downside, these cards have low credit limits, and the issuer may close or transfer the account when you stop attending school.

Secured

Secured credit cards are available to consumers with no, limited, or bad credit who would have difficulty getting an unsecured card. They require you to deposit cash collateral equal to the card’s credit limit, which can vary widely (i.e., from $300 to $10,000).

The deposit is refundable, and the issuer will only use it if you miss a payment.

Most secured card issuers promote creditworthy cardmembers to an unsecured card within a year. The best secured cards offer rewards and benefits, charge low fees, and have reasonable interest rates. Secured cards typically report your payments to all three credit bureaus, helping you rebuild your credit when you pay on time each month.

Good Credit

Cards for consumers with good to excellent credit offer the best rewards and benefits. Most travel credit cards are available only to consumers with good credit. These cards, such as American Express, Visa Signature cards, and Mastercard World Elite cards, will likely offer signup promotions, large credit limits, and luxurious perks.

While many cards for good credit are available with annual fees below $100, several of the best charge about $400 to $700 or more each year. In return, these expensive cards usually have the best perks, including airport lounge access and annual travel credits, that more than make up for the annual fee.

Fair Credit

Cards for fair credit (i.e., FICO scores between 580 and 669) provide limited benefits. Some offer relatively modest rewards. Look for higher fees and interest rates than those available from better credit cards, although several of these cards charge no annual fee. Typical credit limits are low to moderate.

Cards in this category frequently serve as a way station for consumers rebuilding poor credit. While not particularly exciting, the best cards for fair credit, including the Capital One Platinum Card, offer a decent tradeoff between costs and benefits.

Bad Credit

As mentioned, secured cards are an excellent choice for consumers with bad credit. Unsecured cards in this group are not nearly as attractive. Their best feature is easy approval — they may approve applicants with poor, limited, or no credit.

Bad credit unsecured cards charge high fees and APRs. Many issuers impose extra costs, such as fees for signup and monthly maintenance. Virtually no unsecured cards for bad credit offer rewards, their credit limits are low, and their benefits are meager.

You may be stuck with a card of this type if your credit score is below 580 and you don’t want to make a security deposit.

No Credit History

If you have no credit history and are a student, then a student credit card is your best bet. Otherwise, there are options for credit newbies that don’t charge annual fees or the highest APRs. Don’t settle for unsecured cards for bad credit — you can do better.

A secured card is also a great option because your security deposit is refundable and your APR will be lower than that of unsecured cards, a particularly nice feature if you know you’ll carry revolving debt.

In all cases, make sure the card reports your payments to all three credit bureaus so you can build a credit history.

How to Apply For a Credit Card

The online procedure to apply will require you to submit your name, address, citizenship, income, housing costs, employment data, and other personal information. You should get an immediate verdict and receive the credit card in about a week to 10 days if approved. Some banks can expedite shipping, possibly for a fee.

How Your Credit Score Affects Your Card Offers

The higher your credit score, the better your chances of getting good credit card offers. Almost all credit card issuers look at your credit score and credit history when you apply for a card.

Your FICO and VantageScore credit scores used for card approvals range from 300 to 850, as depicted in this pie chart:

If you want access to the best credit card offers, you must build and maintain good credit. You can do so by paying your bills on time, keeping your credit utilization ratio (i.e., credit spent compared with credit available) below 30%, and disputing mistakes from your credit reports.

Typical Credit Card Fees

Credit cards charge interest and fees. APRs range from about 15% to 36% and generally vary for purchases, balance transfers, and cash advances. Annual fees can range from $0 to $1,000 or more.

Cards usually charge 3% to 5% for cash advances and balance transfer transactions and may impose fees on foreign transactions (typically 3%) and late payments (up to $41).

Cards for bad credit may also tack on extra fees. Some charge up to $150 to sign up, and many impose a monthly maintenance fee of up to $10 starting in Year Two of card ownership. Miscellaneous fees can include those for expedited card shipping, duplicate cards, and custom designs.

Is It Worth Paying an Annual Fee?

You can often get a good-quality card without paying an annual fee. Most cards charge less than $100/year, but you can get many good perks for free. Be on the lookout for credit cards that delay the annual fee until the second year.

Premium cards with triple-digit annual fees usually offer extraordinary benefits that make these cards worthwhile for well-heeled consumers. Prudence dictates that you carefully evaluate the costs and benefits of a card before applying.

Which Type of Reward (Points, Miles, or Cash Back) Is Best?

Cash and points are the most versatile. They are about equally valuable to most consumers since you can readily cash in points.

Points and miles are best for frequent travelers. They are the ideal way to save money on flights and seat upgrades. General-purpose miles are similar to points, and you can use them on any airline.

But you can use the miles from co-branded cards only on the associated carrier and its partners. Moreover, you can’t cash in these frequent flyer miles unless you sell them in the secondary market. Also, be careful to use your miles before they expire.

Which Cards Offer Signup Bonuses?

Signup bonuses are available only from cards for good to excellent credit. As described earlier, these bonuses allow new cardmembers to earn extra rewards when they spend a set amount on purchases during the first few months after account opening.

You can find signup bonuses on cash back, points, and miles cards. The dollar value can vary from about $200 to more than $2,000. Cards with signup bonuses frequently offer $0 intro APR promotions as well. This pair of incentives can be beneficial when making expensive purchases.

How Many Credit Cards Are Too Many?

Many folks get by on one credit card, though the average American has four credit cards. But that doesn’t mean owning five (or 25) is too many. The most important consideration is how much you’ll pay in annual fees and minimum monthly payments.

One of the benefits of owning many credit cards is that you can enjoy a very low credit utilization ratio, but only if you don’t let your balances build up. A low CUR will help boost your credit scores.

Another benefit is the ability to get the best rewards on all types of purchases. But too many cards may dilute the value of your rewards since you can’t combine them across different issuers. And they can cause a whole mess of trouble if they entice you to overspend. In the end, only you know how many credit cards are right for you.

So Which is the Right Offer for You?

When I was searching for my first “starter” line of credit as a college student, I didn’t have such a comprehensive list to refer to, nor was I able to receive any offers by mail. Instead, I had to do all of my own research separately on what I could qualify for with my limited credit history. But lucky for you, we’ve done all the research for you — and we’ll keep this guide updated regularly.

These days, there is no shortage of credit cards to apply for, no matter if you’re just starting your credit journey, rebuilding credit, or you’re credit score is fantastic — there’s something for just about everybody.

So opt out of those old-school junk-mail offers and check back with us anytime you’re looking for a new credit card. And don’t be discouraged if you’re starting out with a poor or limited credit history — once you’re responsibly using your new card, you may find, as I did, that in just a few years, you’ll be able to move up from a secured or student card and qualify for one of the best credit card offers out there!

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![15 Credit Card Tips & Tricks from Experts ([updated_month_year]) 15 Credit Card Tips & Tricks from Experts ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Credit-Card-Tips.jpg?width=158&height=120&fit=crop)

![5 Best Starter Credit Cards by Experts ([updated_month_year]) 5 Best Starter Credit Cards by Experts ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/What-Is-the-Best-Starter-Credit-Card.jpg?width=158&height=120&fit=crop)

![13 Category Winners: Best Credit Card Offers ([updated_month_year]) 13 Category Winners: Best Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-4.jpg?width=158&height=120&fit=crop)

![7 Longest 0% APR Credit Card Offers ([updated_month_year]) 7 Longest 0% APR Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Longest-0-APR-Credit-Card-Offers-Feat.png?width=158&height=120&fit=crop)

![12 Best Credit Card Signup Bonus Offers ([updated_month_year]) 12 Best Credit Card Signup Bonus Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/credit-card-signup-bonus-offers.jpg?width=158&height=120&fit=crop)

![How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year] How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year]](https://www.cardrates.com/images/uploads/2017/06/how-to-transfer-credit-card-balance.jpg?width=158&height=120&fit=crop)

![7 Best Credit Card Offers Right Now ([updated_month_year]) 7 Best Credit Card Offers Right Now ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Best-Credit-Card-Offers-Right-Now.jpg?width=158&height=120&fit=crop)