Imagine this scenario: You own five credit cards with a combined unpaid balance of $10,000. Right now, you’re paying more than $200 per month in interest charges. Wouldn’t you like to pocket that $200 instead, perhaps using it to help pay down your debt?

If your answer is “Of course!”, this article is for you. It will tell you all about consolidating your credit card debt and avoiding interest charges for at least one year. In my book, that’s a darn good deal.

21-Month 0% Balance Transfer Cards

The following cards offer the longest 0% balance transfer promotions currently available from a major bank. You’ll have almost two years to pay down your existing card debt without spending a penny on interest (although transfer fees apply).

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% – 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee – our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% – 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi® Diamond Preferred® Card provides a remarkable introductory period for 0% APR balance transfers. The card offers reasonably high credit limits — yours will depend on your credit profile.

You can also sign up for automatic account alerts by email or text and choose any payment due date within the month. This contactless, chip-enabled card lets you tap a card reader to shop safely. It is our top choice among balance transfer cards.

- No Late Fees, No Penalty Rate, and No Annual Fee… Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% – 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% – 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Simplicity® Card has much to offer, starting with its 21-month balance transfer promotion. It also provides automatic account alerts, 24/7 customer service, flexible payment due dates, contactless pay, and digital wallet compatibility.

But the card’s lack of a rewards program is a definite downer for cardholders. On the plus side, you receive extensive protection against unauthorized charges, and Citi Identity Theft Solutions can help you resolve problems arising from lost or stolen cards.

18-Month 0% Balance Transfer Cards

While the 0% APR promotions on the following cards aren’t the longest available, 18 months is still a good chunk of time to pay off your transferred balances.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Balance Transfer card isn’t known for high credit limits, which may limit the usefulness of a credit card balance transfer. But you may get a larger spending limit if you have excellent credit.

This card charges a small fee for each balance transfer transaction – see card terms for details. But that fee is far less than the amount you’d spend on interest charges from a high-APR credit card. You can take advantage of this card’s lack of a foreign transaction fee when you travel abroad.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card is an excellent choice among credit cards with 0% balance transfers because of its potentially high credit limit and cash back on every eligible purchase. You can redeem your cash rewards as a statement credit, points, a direct deposit into a bank or credit union account, or a mailed check. Transferred balances do not earn rewards.

Only the balance transfers you complete within four months of account opening qualify for the 0% APR. The Citi Double Cash® Card is a World Elite Mastercard, providing valuable benefits, including access to premium experiences and 24/7 concierge service.

5. Chase Slate Edge℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Chase Slate Edge℠ is a unique card offer thanks to the opportunity cardholders have to earn a lower APR over time. While you’ll still get the promotional 0% balance transfer offer upon account opening, you can lower your interest rate by 2% every year.

There are no rewards, but if you tend to carry a balance month to month, a low-rate card such as this one can help you save money in the long run.

15-Month 0% Balance Transfer Cards

The cards in this group currently provide at least 15-month balance transfer periods. Bear in mind that credit card companies can change or withdraw their introductory promotions at any time.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card has a 0% intro APR on purchases and balance transfers, after which the regular APR kicks in. The balance transfer offer applies only to transactions you make within 60 days of account opening.

The card features no annual fee and your choice of a bonus merchant category. International travelers take note: This card charges a foreign transaction fee on purchases you make in a foreign currency.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don’t expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want – you’re not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Bank of America® Travel Rewards credit card may offer an initial spending limit of $10,000 or more to creditworthy applicants. The card’s 0% APR introductory promotion currently applies to purchases and balance transfers. The card also provides a signup bonus and unlimited rewards.

This no-annual-fee card is an obvious choice for travelers with Bank of America accounts. The value of your reward points increases if you are a member of the bank’s Preferred Rewards program.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card offers the simplicity of a flat cash back rate with the convenience of a promotional interest-free balance transfer period. Consumers receive the customary protections that all Bank of America credit cardholders currently enjoy.

These safeguards include Balance Connect® for overdraft protection, fraud protection on all unauthorized purchases, and digital wallet and contactless chip technology.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® is the second offering from Chase Bank on this list. This Visa Signature card provides an initial credit limit of at least $5,000, but cardholders with excellent credit may receive a substantially higher credit line.

This card offers a signup bonus and a higher rewards rate on the travel purchases you arrange through Chase Travel. All eligible purchases earn points redeemable for travel, cash, gift cards, and other items.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers – only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% – 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Miles is another offer from Discover, albeit with a slightly shorter 0% intro APR period than its balance-transfer sibling. This card is for those who prefer to earn travel miles over cash back. Cardmembers earn an unlimited Miles-for-Miles match on all rewards posted during the first year of card ownership.

You’ll receive your matched miles a month or two after the first year ends. You can redeem your miles anytime for cash or purchases made through PayPal and Amazon.com.

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1.5% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $100 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Black Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Black PVD-Coated Metal Card: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $495 ($195 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$495 ($195 for each Authorized User added to the account)

|

Excellent

|

The Mastercard® Black Card™ offers a good flat rate on airfare redemptions but charges a hefty annual fee. Its 0% APR promotion for balance transfers only applies to transfers you post within 45 days of account opening.

The card features no foreign transaction fees and a concierge service that will book the best spas and five-star restaurants at your request. Note that you’ll pay a stout authorized user fee to share your account with your significant other.

What Is a 0% Balance Transfer Card?

A 0% balance transfer credit card is a traditional credit card that offers interest-free financing on balance transfers for at least six months. The longest introductory period currently available is 21 months, but numerous cards provide 15- or 18-month promotions.

Some cards offer 0% financing on new purchases, with or without an accompanying balance transfer promotion. The introductory periods for dual-promotion cards need not be the same. Each issuer’s offer is unique, so the length and terms of these promotions vary with the card you choose.

A 0% balance transfer promotion lets you transfer the balances from your other credit cards up to the dollar limit your new credit card specifies. You can repay the balance over the promotional period without incurring interest or finance charges.

Paying down the balance is up to you — the promotion doesn’t compel it. But the credit card will begin charging interest on the unpaid balance when the promotion expires, so it’s a good idea to repay the entire balance before the promotional period ends.

The promotion is especially valuable if you owe money to one or more high-interest credit cards whose interest fees absorb a large proportion of your monthly payment. With a 0% balance transfer credit card, your payments go toward your principal balance exclusively, allowing you to pay down your debt faster.

Balance transfer fees apply — typically 3% to 5% for each transaction. Sometimes, cards charge a smaller transfer fee during the promotional period and then raise it once the promotion ends.

Your balance transfer card may also charge an annual fee. Be sure to read your card’s terms and conditions before you apply so you understand the rules regarding the promotional period. Doing so can eliminate nasty surprises down the road.

For example, many cards terminate their 0% APR promotions if you miss a payment. Should this happen, your unpaid balance will start accruing interest immediately.

You should also check the regular APR that will go into effect once the promotional period ends. That’s the interest you’ll pay on any remaining balance after the promotion expires.

Some balance transfer promotions impose short deadlines (i.e., 45 to 120 days) for transfers to qualify for the 0% interest. Only transfers you request within the deadline will receive the 0% APR. Balance transfer promotions from Discover and Chase do not impose early deadlines.

Consolidating multiple debts through a 0% balance transfer offer is very popular among consumers who would rather not pay multiple monthly credit card bills.

Aside from the promotion, a 0% balance transfer credit card works the same as any other unsecured credit card. You can make online, in-store, and in-app purchases, pay bills, take cash advances, and carry a balance over multiple billing cycles.

How Do I Apply for a 0% Balance Transfer Credit Card?

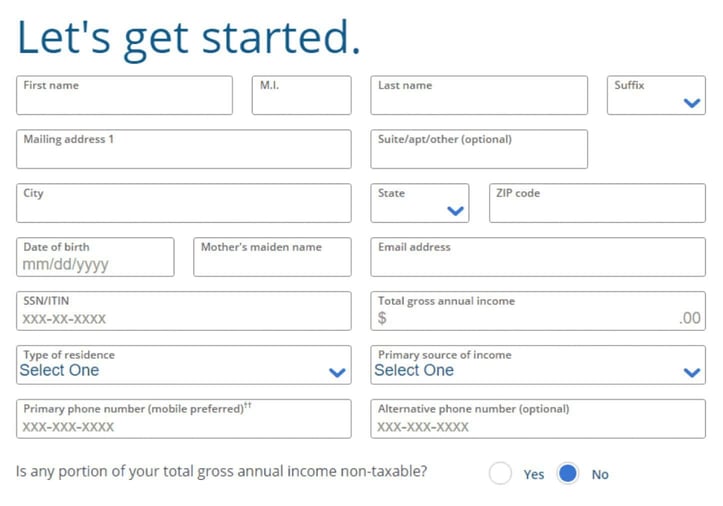

You can apply online for a 0% balance transfer card just as you would with any other credit card. You’ll find the online applications for the reviewed cards by clicking the links above.

An application will ask for your primary identifying data, including your name, address, email address, phone number, and Social Security number. It may require details about your income, employment, housing costs, and debts so the issuer can verify your ability to repay any balance you accrue on the new credit card. This information also helps the credit card issuer set your credit line and regular APR.

Once you submit your application, the bank will run a hard credit check to see your credit score and history. This process takes a matter of seconds, thanks to automated underwriting systems. The issuer will usually give you a decision soon after you submit your application.

Upon final approval, the issuer will immediately disclose your new card’s credit limit and APR. You can e-sign the card agreement after reading and agreeing to the card’s terms and conditions.

The card should arrive in the mail within three to 10 business days. The issuer may immediately give you access to your new credit account via a temporary credit card number. Otherwise, you must wait to receive and activate your card to begin using it.

If the credit card issuer denies your application, you should receive an Adverse Action Notice (AAN) in the mail within seven to 10 business days. The Fair Credit Reporting Act requires issuers to send these notices to rejected applicants. The AAN can help you fix deficiencies in your credit profile by providing the following information:

- The reasons for your rejection

- The information sources (typically, a major credit bureau) upon which the creditor relied, including your credit scores and reports

- Instructions on how to get a free copy of your credit reports

- Information on disputing credit report items you feel to be in error

Sometimes, the automated underwriting system can’t give you a quick decision. A delay may occur if your application has misspellings, inconsistencies, or unverifiable data. The issuer may require more information from you to make a final decision.

If the credit card company needs extra time to decide, it will place your application on hold for up to 30 days and specify the documentation it needs to finalize its decision. The issuer will cancel your application, and you will have to reapply later if you do not provide the additional information within the 30-day window.

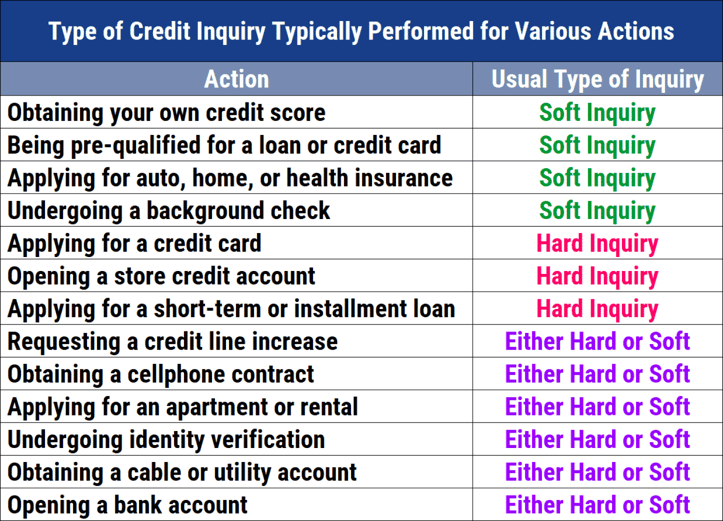

Something to keep in mind when applying for credit cards is the number of hard inquiries on your credit report. Creditors run hard credit checks to access your credit history whenever you formally apply for a credit card or loan. This inquiry remains on your credit file for two years but impacts your credit score for only one year.

A few inquiries will have little effect on your credit score. Still, when you accumulate several inquiries within a short period, lenders may think you are in financial distress and are less likely to approve your application. You may also see a change in your credit score if you trigger too many hard inquiries.

The general rule is that up to three inquiries within six months are OK. Beyond that, you enter a gray area that makes creditors uncomfortable.

It would help to let six months pass before reapplying for the same or a different credit card. Waiting gives you time to take remedial actions and protects your credit score from too many credit applications within a short period.

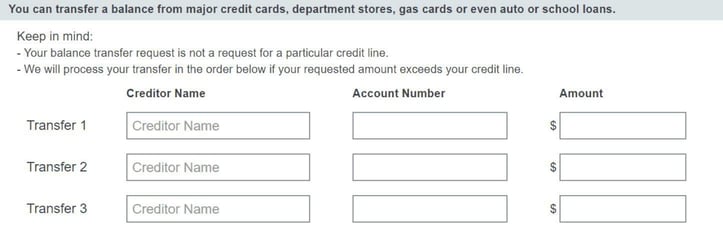

How Do I Transfer My Balances?

You can transfer balances online, in person at a bank or credit union branch, or by phone with your credit card’s customer service department. Several issuers let you request balance transfers when you apply for a new card online.

Regardless of your chosen method, you’ll need the account numbers and balances of the credit cards from which you will transfer debts. You’ll also need the account number of the card that will receive the transferred balances.

The exact procedure for transferring your balance online varies by issuer. For example, Chase online banking customers can select the “Transfer Balance” option adjacent to the “Available Credit” listing on their credit card summary page.

Discover cardholders can find balance transfer selections under the “Credit Options” menu. The Discover it Balance Transfer Card allows you to include up to three balance transfer requests on the application form.

Keep in mind that the balances you can transfer are subject to your card’s credit limit. You can contact your issuer for assistance if you have trouble completing the process online.

Transferring your balances may take at least seven to 10 days to complete and up to 30 days to fully process. You must continue to make all your minimum payments until the transfers are complete. Missing a payment can negatively impact your credit, so it’s best to play it safe and pay on time.

A credit card will refund any overpayments at your request. Refunds may be a statement credit, a check mailed to you, or a deposit to your bank account.

You may decide to cancel a credit card after you’ve transferred away its balance. Before you do, we advise you to read “Is it Bad to Cancel a Credit Card?” for all the pros and cons.

What Are the Advantages and Disadvantages of Balance Transfers?

Consider these advantages and disadvantages before deciding whether to proceed if you’re on the fence regarding balance transfers.

Advantages

Here are some compelling reasons to transfer balances:

- Save money: Transferring your balances to a credit card with a 0% APR promotion can save you hundreds of dollars in interest. According to the Federal Reserve, the average credit card interest rate is 15.13% as of the second quarter of 2023. Credit card interest rates are much higher for consumers with less than good credit. The savings potential from a balance transfer card can be significant if you obtain a 0% introductory APR and pay down your debt within the promotional period.

- Reduce debt: A 0% intro APR on a balance transfer card will help you pay off your debt faster. More of your payment goes toward your principal balance when you pay less interest per month, even if you make the same monthly payments. A 0% balance transfer card is most effective if you can put extra money toward paying off your debt each month.

- Consolidate debt. A balance transfer card lets you move outstanding debt from several credit cards to a single new account. Consolidating your debt reduces the number of creditors you must pay each month, making your budget more manageable. And if you’re concerned about forgetting to make a payment, a single monthly payment is easier to remember than several payments throughout the month.

- Build credit: A new balance transfer card may help your credit scores — as long as you don’t close your pre-existing credit card accounts. FICO and VantageScore measure your credit utilization ratio (i.e., your credit balances as a percentage of your credit limits). Adding a new credit card to your credit report should increase your total credit limit and, in turn, reduce your credit utilization ratios. But this strategy only works if you don’t go on a new spending spree and drive up your credit balances. Reducing your debt-to-income (DTI) ratio can also help you improve your credit score.

These advantages only accrue if you practice discipline after you transfer balance. To get the most value from a 0% balance transfer card, pay down your debt aggressively and refrain from creating new debt. Your budget and your credit score will thank you.

Disadvantages

You’ll want to take a moment to consider the potential disadvantages of balance transfer cards before you begin filling out applications.

- Balance transfer fees: These fees typically run around 3% to 5% of the total amount you transfer. For example, a 5% fee on a $10,000 transfer will cost you $500. The fee usually isn’t a concern because your potential savings easily offsets the cost. You can use a balance transfer calculator to ensure the math works in your favor.

- Credit requirements: Most balance transfer cards — especially those with the longest promotional periods — require you to have a good to excellent credit rating to qualify for the card. An issuer may reject your application for a 0% balance transfer card if you’re struggling with poor credit.

- Late payments: Read the cardholder agreement and look for language regarding the penalty for late payments. Many cards will void your promotion if you miss a payment, and you will suddenly start accruing interest on your remaining transferred balance. Consider setting up an automatic payment arrangement on your credit card to avoid this scenario.

- Resumption of regular APRs: Any transferred balance remaining after the promotional period ends will incur interest at the card’s regular APR. Failure to aggressively pay down your debt before the promotion expires may cost you more money than you’ve saved.

- The temptation to overspend. The most responsible way to manage a credit card is to pay on time and pay your entire statement balance each month. It’s dangerous to obtain a new balance transfer card, move all your debts to it, and then build new balances on your original accounts. Moreover, these actions can cost you any savings in interest charges and damage your credit scores.

For these reasons, you should only apply for a new balance transfer credit card if you’re confident you can avoid overspending.

How Much Can I Save With a 0% Balance Transfer?

The amount you save through 0% balance transfers depends on the amount you transfer, the APRs on your current credit cards, and your ability to repay the transferred balances before the promotion expires. Let’s run the numbers for a hypothetical 21-month balance transfer scenario.

The savings from a 21-month balance transfer could be in the hundreds or thousands, even after accounting for the 3% to 5% fee for each balance transfer.

For example, suppose Card A has an APR of 20% and a balance of $1,000. The annual interest cost would be approximately $200 (i.e., 0.20 x $1,000) and $350 for 21 months (i.e., $200 x 21 months/12 months).

Suppose the card charges a 3% transfer fee, equal to $30 (i.e., $1,000 x 0.03). Your net savings would be $350 minus the $30 transfer fee, or $320, by transferring balances to Card B with its 0% APR promotion.

The following table shows the potential savings of a 0% intro-APR offer versus a credit card with a 20% APR:

| Amount Transferred to the New Card | Cost of 3% Balance Transfer Fee | Estimated Savings Over 21 Months |

|---|---|---|

| $1,000 | $30 | $320 |

| $2,500 | $75 | $800 |

| $5,000 | $150 | $1,600 |

| $7,500 | $225 | $2,400 |

| $10,000 | $300 | $3,200 |

As the table shows, the higher your balance, the more you can save. These numbers are approximate because they don’t account for the amount on Card A you would have paid off during the 21-month period had you not transferred the balance to Card B. The scenario also doesn’t include any monthly fluctuations in the Card A balance.

What Other Ways Can I Pay Off My Credit Card Balances?

Although they are convenient, 0% balance transfer cards are but one way to repay your credit card balances. Here are a few more:

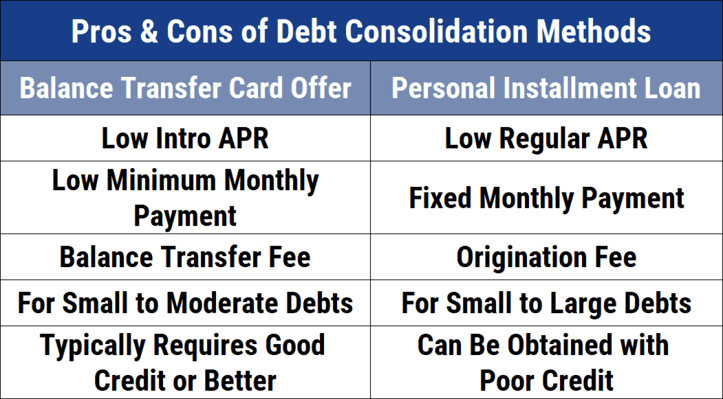

1. Debt Consolidation Loans

Consider using a personal loan to consolidate your debt if you’re carrying balances on multiple credit card accounts. When taking a debt consolidation loan, you borrow a lump sum that will cover your credit card balances.

The lender will most likely pay your card balances directly, leaving you responsible for just one monthly payment at a fixed interest rate. You should save a considerable amount of money on credit card interest since personal loans usually charge lower interest rates than credit cards.

Credit card consolidation helps with budget management because one monthly payment is easier to remember than multiple due dates. Reducing your chances of forgetting payments makes you less likely to trigger late payment fees and penalty APRs.

2. Snowball Method

The Snowball Method is a debt repayment strategy in which you pay down your smallest balance as quickly as possible while only paying the minimum due on your other credit cards. This method allows you to experience quick early success that may help you feel more motivated as you work toward freedom from debt.

Once the first credit card balance is gone, you move on to the credit card with the next-highest balance and repay it as quickly as possible. The strategy creates a snowball effect that allows you to pay more toward each succeeding debt. This method can help you gain the confidence you’ll reach your goal.

3. Avalanche Method

Some people find the small wins from the Snowball Method less motivating than the prospect of saving the most money on interest, in which case the Debt Avalanche Method is a better choice.

Using the Avalanche Method, you first repay the credit card balance with the highest interest rate. While this strategy may require more time to repay your debt, you will save more money in the long run. You can use an app such as Debt Payoff to help you decide which debt repayment strategy will work best for you.

4. Debt Settlement

If the amount you owe is too much to handle right now, you may be interested in pursuing debt settlement. Qualifying for this course of action usually requires you to owe at least $10,000 in unsecured credit card debt. You may first have to undergo credit counseling, and your credit score will suffer.

Debt settlement involves negotiations between a debt counselor and your card issuers to determine a payoff amount for less than you owe. You withhold payments to your credit cards and divert the money into an escrow account. Your debt counselor uses your escrowed money to repay your creditors after they agree to forgive some of your debt.

If the negotiations succeed, your credit card issuers will cancel your cards, and you’ll agree to a schedule to pay off the negotiated amount. Debt settlement can be risky and expensive.

5. Bankruptcy

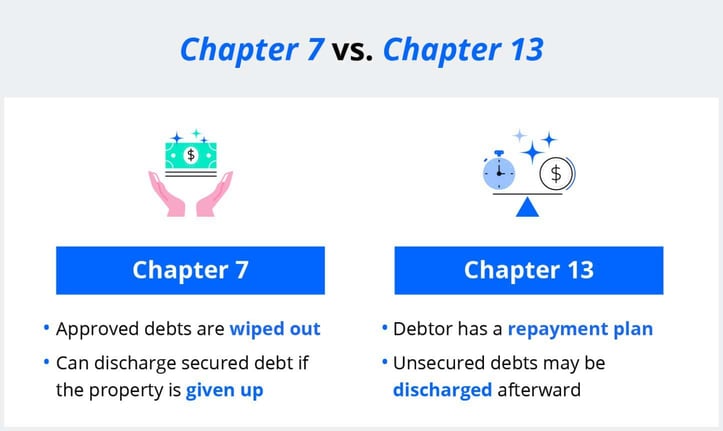

Bankruptcy is the ultimate solution to debt problems. The court works out an arrangement that forgives or restructures your debt. Bankruptcy does further damage to an already suffering credit score.

Chapter 7 bankruptcy results in the court discharging your unsecured credit card debt. You must have few or no assets to qualify for Chapter 7. This type of bankruptcy rids you of unsecured debt but doesn’t affect mortgages, car loans, secured credit cards, and other collateralized debt.

Chapter 13 bankruptcy restructures your debt, giving you three to five years to repay all or most of the amounts you owe. This alternative plan discharges (i.e., forgives) any debt remaining after the plan period ends.

Chapter 7 bankruptcy remains on your credit reports for 10 years, but Chapter 13 lingers for only seven years.

Whip Your Finances Into Shape With a 0% Balance Transfer

Our review of 0% balance transfer cards shows you how to consolidate your debt and rebuild your credit relatively inexpensively. Choose a card based on the length of the 0% promotion, the likely credit limit you’ll receive, the annual fee, and the post-promotion APR rates.

Balance transfer credit cards are powerful tools that can help you address your credit situation, but you must exercise discipline to extract their maximum benefits.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![0% For 21 Months: Balance Transfer Cards ([current_year]) 0% For 21 Months: Balance Transfer Cards ([current_year])](https://www.cardrates.com/images/uploads/2023/04/0-Percent-Blance-Transfer-For-21-Months-Credit-Cards.png?width=158&height=120&fit=crop)

![0% For 24 Months Balance Transfer Cards ([updated_month_year]) 0% For 24 Months Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/0-Percent-For-24-Months-Balance-Transfer-Cards.jpg?width=158&height=120&fit=crop)

![5 Best 0% Balance Transfers For 18+ Months ([updated_month_year]) 5 Best 0% Balance Transfers For 18+ Months ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Best-0-Balance-Transfers-For-18-Months.jpg?width=158&height=120&fit=crop)

![9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year]) 9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/btandrewards.png?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![9 Best 0% Balance Transfer Credit Cards ([current_year]) 9 Best 0% Balance Transfer Credit Cards ([current_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_1495481012.jpg?width=158&height=120&fit=crop)

![7 Balance Transfer Cards With High Limits ([updated_month_year]) 7 Balance Transfer Cards With High Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Balance-Transfer-Cards-With-High-Limits.jpg?width=158&height=120&fit=crop)

![Are Balance Transfer Cards a Good Idea? ([updated_month_year]) Are Balance Transfer Cards a Good Idea? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Are-Balance-Transfer-Cards-a-Good-Idea.jpg?width=158&height=120&fit=crop)