You’ll need to find the right balance transfer cards with high limits if you want to affordably consolidate credit card debt. After all, a low limit will keep you from really getting to work on those existing balances.

With the cards listed below, you can transfer your existing debt to the new account and take advantage of a promotional period with no interest on the amount you owe. The length of your balance transfer offer will depend on the card you qualify for.

During this promotional period, you can work to pay off your balance without worrying about large interest charges or other fees that eat away at your monthly payment. Many consumers use these offers to quickly eliminate expensive credit card debt.

Best Balance Transfer Cards With High Limits

The following cards all come from big-name banks you know and trust — many of which can approve you for a credit limit that will support your balance transfer. Remember that balance transfer cards require a good to excellent credit score for approval, generally considered to be a score of 670 or higher.

1. BankAmericard® credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to BankAmericard® credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

The BankAmericard® credit card offers a very competitive interest rate for new cardholders and, according to WalletHub reviewers, provides an initial average credit limit that can range between $1,000 and $10,000.

This high limit credit card doesn’t require a Bank of America account for approval, but you will need good credit or excellent credit to qualify. Qualifying balance transfers will be charged a balance transfer fee of 3% of each transaction ($10 minimum).

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Simplicity® Card tends to offer lower credit limits to new cardholders, but you can quickly boost your spending power with a credit limit increase. CreditKarma reviewers report an initial credit line that ranges between $500 and $2,000, with a credit limit increase occurring around three months after activation.

Your credit limit will depend on your credit history, but this card seems to have an average initial credit limit of approximately $800. You can call Citi upon approval and request a high credit limit by explaining that you intend to perform a balance transfer.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

If you haven’t noticed by now, Citi is a great credit card company for transferring balances and eliminating expensive debt. The Citi® Diamond Preferred® Card is a solid option that, according to cardholders, offers starting credit limits of between $500 and $10,000.

This card also offers tremendous perks for all cardholders — including an introductory promotional period during which you can avoid interest on your transferred balances. Just keep in mind that this credit card is designed for consumers who have good credit or excellent credit.

The average Discover it® Balance Transfer cardholder receives an initial credit limit of $1,000 to $3,000, though your limit may reach as high as $20,000 over several years with responsible use.

This card charges a balance transfer fee, so be sure to review the card’s terms before transferring. But that fee will fall well short of what you’d pay in interest charges on a high-interest credit card. Be sure to avoid this card’s foreign transaction fee if you’re traveling abroad.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card’s initial credit limit will depend on your credit score and existing card accounts, but cardholders report spending limits that range between $500 and $11,000. A quick credit limit increase isn’t uncommon, as one WalletHub user claims to have received a boost from $11,000 to $19,5000 right after card activation.

The Citi Double Cash® Card is a great tool for eliminating debt because of its potentially high credit limit and cash back on every eligible purchase. Your cash back can be redeemed as a statement credit, direct deposit into a bank account, a mailed check, or converted to points.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card offers a minimum initial spending limit of $5,000, which is substantially more than the initial limit on Citi cards on this list. Some cardholders report receiving a starting credit line of $10,000.

This card has stellar rewards, a sizable welcome bonus, a good variable APR, and charges no annual fee.

- For a limited time, get a special 0% introductory APR on purchases and balance transfers for 21 billing cycles. After that, the APR is variable.

- Enjoy Cellphone Protection Coverage of up to $600 annually when you pay your monthly cellphone bill with your card

- View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use, and free to U.S. Bank customers.

- Fraud Protection detects and notifies you of any unusual card activity to help prevent fraud

- Choose your payment due date

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 21 billing cycles

|

0% for 21 billing cycles

|

18.74% - 29.74% (Variable)

|

$0

|

Excellent Credit

|

Additional Disclosure: The information related to this card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this product.

The U.S. Bank Visa® Platinum Card offers generous starting credit limits and is reported to be even more giving when it comes to granting a credit limit increase. One cardholder on myFICO Forums received an unsolicited $19,500 credit limit increase only months after opening their account.

This card doesn’t offer rewards, which is pretty common for cards designed specifically for balance transfers. Promotional financing offers change regularly, so be sure you’re maximizing your debt-payoff power and getting the best offer possible.

What is a Balance Transfer Credit Card?

A balance transfer credit card is a traditional credit card with an added promotion for new cardholders that makes it more affordable to pay down existing credit card debt.

You can use a balance transfer card the same way you would any other credit card to make in-store and online purchases, pay bills, cover the cost of services rendered, rent a hotel or vehicle, or conduct any other credit-based transaction. Your card issuer may also provide rewards for qualifying purchases or other perks that make the card more attractive.

The key to a good balance transfer card is its 0% balance transfer promotion. During this promotion, new cardholders can transfer the balance from an existing credit card to their new card and pay no interest on the transferred debt for the duration of the promotion.

The length of your credit card balance transfer offer will vary by card. These offers can run for as short as six months (the legal minimum) or as long as 24 months. During that time, you won’t pay interest on the debt you transferred to the new card.

You may also qualify for 0% financing on new purchases, though some cards only offer interest-free financing for balance transfers or new purchases.

You will likely have to pay a balance transfer fee that equals a percentage of the total debt you move over to the new card. Although this one-time charge may look steep, it’s typically far less than what you’d pay in interest while working to pay down the debt. Once the promotion ends, your regular purchase APR will kick in for any remaining unpaid debt you have.

A secured card, a prepaid card, and a business credit card are examples of cards that do not typically support balance transfers, though some outliers exist.

How Do Balance Transfers Work?

A balance transfer is very similar to transferring money from your savings account to your checking account. The main difference is that the money moves from one credit card company to another.

If you have an existing balance on a credit card that has a higher interest rate than your new card, you can attempt to transfer that balance to the new card and pay less money to satisfy the debt.

When you initiate this transfer, the new card issuer will send money to your existing card’s issuer to pay off the debt. You’ll then owe that money to the new card issuer.

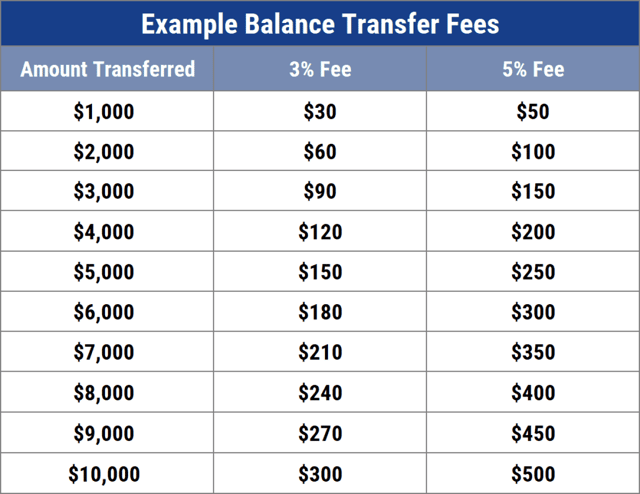

You can initiate a balance transfer request through your bank’s website. The entire process may take two to four weeks to complete. Balance transfers usually charge a fee of around 3% to 5% of the amount transferred.

Be sure to make any payments due to your credit card company during this time. If you don’t, you may be subject to late payment fees and credit history damage. If your payment and the money sent from your new card issuer equals more than you owe on the card, you’ll receive a refund for the overage after the balance transfer is completed.

Once your old card has a $0 balance, you can choose to keep the card account open or close it — but beware that closing your old account can hurt your credit utilization ratio and, ultimately, your credit score.

Which Balance Transfer Card Gives the Highest Limit?

As with any other credit card, a balance transfer credit card will base your credit limit on your credit score and other information on your credit report. Every bank has different standards for approval, and one card may offer you a higher credit limit than another card.

Unlike a secured credit card that uses your deposit to determine your credit limit, you’ll have very little say in your new card’s credit line. No credit card company publicizes its maximum credit limits, which means there’s no way to tell exactly how much credit a bank will extend to you.

But by looking at cardholder reviews, you can get an idea of what the average credit line may be for a particular card. For example, online reviews show that most of the cards on this list offer up to $10,000 in credit to qualified applicants.

While your credit line is important if you’re looking to transfer over a large balance, don’t base your credit card search solely on which bank will offer you the most credit. A high limit card may charge expensive fees that offset your savings. That’s because the highest credit limits are generally reserved for premium rewards cards, such as the Chase Sapphire Reserve®.

These fees can range from a high annual fee, a high variable APR, or an exorbitant balance transfer fee — all of which can increase your credit card debt quickly. Keep these fees in mind when shopping for the best balance transfer cards with high limits.

What’s the Benefit of Using a Balance Transfer?

On the surface, it may seem like a balance transfer only shifts your debt from one bank to another. But the true advantage of any balance transfer offer comes from the cost to eliminate that debt.

You should only consider a balance transfer if the card you’re moving the debt to has a lower interest rate than the card the debt is currently on. Moving your debt to a card with a higher interest rate will only increase your cost to satisfy the debt.

A lower interest rate reduces your overall cost — especially if your new card has a promotional period with 0% interest for balance transfers.

To understand this better, consider a consumer with $10,000 in credit card debt. If this consumer qualifies for a balance transfer credit card with a 0% APR for 18 months, he or she can eliminate that debt with 18 monthly payments of $555.

Now let’s say this person decides to keep that $10,000 debt on their existing card with a 22% interest rate. It would require 23 months of $555 payments to satisfy the debt — including $2,250 in interest charges.

Even if the balance transfer credit card charges a standard 3% balance transfer fee, the charge would only amount to $300 — which is a small price to save $1,950.

Some cards may limit how much money you can transfer to the new card. Be sure to understand the card issuer’s rules and limitations before you apply for a card.

Some of the best balance transfer credit cards include rewards for every eligible purchase. This can net you cash back, a statement credit, travel discounts, gift card offers, or merchandise.

These cards have far more utility in your wallet than an average bank or credit union debit card. Even if you’re a credit newcomer, you can work your way toward a higher credit limit by proving your creditworthiness over time.

How Much Does a Balance Transfer Cost?

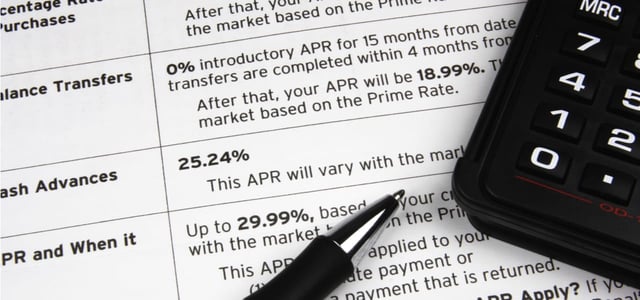

Every credit card company sets its own price for balance transfers. Check the credit card disclosure before applying for any card to make sure you understand the charges associated with transferring a balance.

In the meantime, some common balance transfer fees you may encounter include:

- Balance Transfer Fee: As we’ve discussed, this fee is typically a set percentage of the amount you’re transferring. For example, a card with a 3% balance transfer fee will charge $150 to transfer $5,000 in debt from one card to another. Some cards will periodically waive this fee to entice new cardholders.

- Interest Rate: Some cards have a different interest rate for balance transfers than for purchases. Other cards charge the same interest rate for either type of transaction. A card with a 0% APR balance transfer promotion will temporarily waive all interest charges on balance transfers for new cardholders.

- Transaction Fee: This is rare to find, but some card issuers may tell you that they won’t charge a balance transfer fee, instead charging a “transaction fee” to transfer the money to the bank that holds your existing debt.

If you play your cards right, you may find a card that lets you transfer your balance for free and offers an interest-free period to eliminate your debt. This is pretty much the best balance transfer deal you can find, but issuers don’t commonly offer free balance transfers.

But don’t shy away from paying a balance transfer fee if it means you’ll get a long promotional period without interest. That fee will be small compared with the amount you’ll save by reducing or eliminating your APR.

Do Balance Transfer Cards Have Higher Limits?

Typically, balance transfer cards do not have different credit limits than any other unsecured credit card. But some cards limit how much of your available credit card balance you can dedicate to balance transfers.

For example, a credit card may offer you a $10,000 credit line, but only allow up to 80% of your credit limit for balance transfers. Some banks use this tactic to limit how much interest-free debt you can add to your card, and prevent you from maxing out your credit limit.

Your balance transfer credit card offer will lay out all the rules regarding your credit line as well as how you can use the money. Be sure to research all of the fees and stipulations regarding your account to make sure you understand your advantages and limitations.

Your credit limit will depend on several factors that have nothing to do with your balance transfers. These include:

- Your credit score

- Your current debt load

- Your recent payment history

- Your length of credit history

- Your card’s issuing bank

The last point is important to consider because every bank — and each individual card offered by that bank — has different minimum and maximum credit limits available that could affect how much credit you’re offered.

Although some banks may promote their minimum credit line available, very few will advertise the maximums.

Is it Bad to Do Multiple Balance Transfers?

It depends on how you manage your debt after you open a new credit card. Many people opt to transfer a balance multiple times if they’re unable to repay the debt during the new card’s promotional window. There’s no rule that says you can’t continue to move balances around — though a balance transfer does not take the place of a monthly payment.

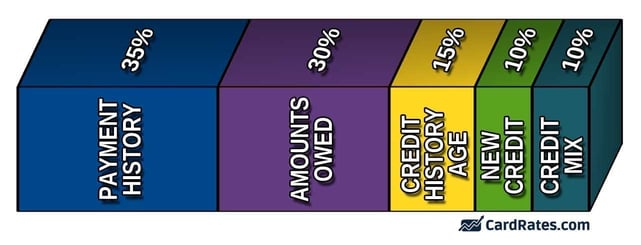

But certain credit report factors will come into play that affect your credit score every time you open a new credit card. For one, opening a new card will increase your available credit — this is a positive for your credit scores because it lowers your credit utilization rate (or ratio).

Your credit utilization rate is part of the “amounts owed” component of your credit score and accounts for 30% of your FICO credit score.

However, if you cancel your old credit card, you won’t reap the benefits of a lower credit utilization ratio. That’s one reason it’s smart to keep old accounts open. But be careful not to rack up more debt on the card.

Secondly, every time you apply for financing — be it a credit card, a personal loan, an auto loan, or any other loan — the lender will place a hard inquiry on your credit report to gain access to your credit history.

A hard inquiry will live on your credit report for two years but will only minimally affect your credit score for up to one year. Several recent inquiries are negative for your credit score.

But other than that, balance transfers are a smart way to consolidate your credit cards and pay off expensive debt. If you still owe money when your promotional period expires and you can qualify for another balance transfer credit card, there’s really no reason not to do multiple balance transfers.

Is There a Limit on How Much Debt I Can Transfer to a New Card?

Your card’s issuing bank may limit how much money you can transfer to your new card. But if that’s not the case, you can initiate a balance transfer up to the amount of your available credit provided by the bank.

Your credit card may set a balance transfer limit to maximize its profit potential. Every time you swipe, tap, or insert your credit card to make a purchase, the card’s issuer collects a transaction fee from the merchant that accepts your payment. Those fees add up quickly and profit the bank.

When you initiate a balance transfer, the bank may charge a balance transfer fee. But if you have a 0% balance transfer promotion, that’s the only money the bank will collect on your account.

To collect more transaction fees, a bank may limit your balance transfer capabilities. That gives you more available credit to conduct regular purchases — which is more profitable for the bank. Read the credit card’s disclosure carefully before you sign up to make sure you’ll have enough available credit to transfer as much as you need.

How Can I Get a Higher Credit Limit?

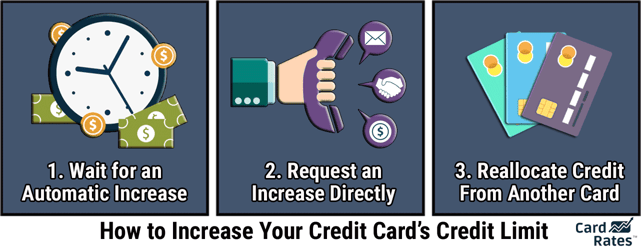

You can request a credit limit increase through your card’s issuing bank in several ways.

Just about every bank offers a short form on its website or mobile application that allows you to submit a credit limit increase request. This form usually requires you to provide your name, address, Social Security number, and income information. Some banks allow you to request a specific increase amount, though this amount isn’t guaranteed.

Once you submit the request, the bank should offer a near-instant decision. If you’re approved, the new credit line will appear immediately. If you’re denied, the bank will send an adverse action notice in the mail outlining the reasons for its decision. You should receive this letter within seven to 10 business days.

You can also call your bank directly and request a credit limit increase from a customer service representative. This method is the most personal and can help your cause if your credit score is not up to par.

Some customer reps — or a supervisor — can override decisions and approve a credit limit increase if the bank’s automated system rejects you. You may be able to negotiate a larger increase over the phone as well — as automated services will assign you a set increase and offer no chance to change that number.

A few banks — namely Capital One and Discover — regularly monitor credit accounts to see whether you qualify for an automatic credit limit increase. If you do, you will get a boost to your spending power without having to do anything.

Just remember that this can go both ways. Irresponsible credit behavior can also result in a credit limit decrease.

Banks typically limit you to one credit limit increase every six months — though it’s completely up to the bank as to how often you can request and/or receive an increase to your credit line.

Should I Close My Card After I Transfer a Balance?

You should only close a credit account if the account comes with an annual fee you don’t want to pay anymore. Otherwise, it’s smart to keep all of your credit card accounts open — even if you don’t use the card. This is mainly because of your credit utilization ratio that we’ve already discussed.

Banks typically like to see a utilization rate below 30%. If you have no credit card debt at all, you won’t see a change in your utilization ratio by canceling a card. But if you carry a balance, you may see your credit score drop due to the removal of that available credit from your credit history.

To find your utilization rate, add all your current credit card balances and divide the total by the sum of your credit limits. For example, a card with a $1,000 credit limit and a $500 balance has a 50% utilization rate — meaning you’re using 50% of your available credit.

The lower your utilization rate, the better your credit score. When you cancel an open credit account with a $0 balance, you automatically increase your utilization rate.

Let’s say you have three credit cards, each with a $2,000 credit limit. Between the three, you have $800 in total credit card debt. With $6,000 in available credit and an $800 balance, you have a 13.3% utilization rate. Not bad.

But let’s say you cancel one of those three cards because you rarely use it. That instantly lowers your available credit to $4,000, but your balance remains at $800. Just like that, your utilization rate jumped to 20%. Still not terrible, but again — the lower your credit utilization ratio, the better your credit scores.

How Long Does It Take For a Balance Transfer to Be Completed?

Most balance transfers are completed within four to six weeks after you receive the initial approval. This gives the bank time to process your transaction, send the money to the other bank, and add the transferred debt to your credit card account.

Some banks conduct these transfers much faster. For example, Citi can complete a balance transfer within two to 21 days.

During this time, you’ll still have to pay any monthly payments due to the old credit card company. Otherwise, you may be subject to late payment fees and credit score damage.

If your monthly payments and the balance transfer equals more than you owe on your account, your old credit card issuer will issue a refund for the extra amount you pay.

What Happens to My Balance After My Balance Transfer Offer Ends?

If you still have a balance on your credit card after your balance transfer promotional offer ends, you’ll begin accruing interest on the remaining balance. You won’t have to pay interest on any amount you paid off during the promotion — unless you choose a card with deferred interest.

You won’t be able to extend your promotional period or start a new promotion, as these are intended only for new customers. You may want to consider applying for a new balance transfer credit card.

Get Approved For the Best Balance Transfer Cards With High Limits Online

A few decades ago, you had to fill out pamphlets or mailers and send them to a bank to apply for a credit card. This process would take weeks to put a new card in your wallet.

Thankfully, banks now offer online applications that take minutes to complete and only seconds to receive a credit decision.

This is especially important if you’re looking to transfer a large balance from an existing card to a new card. Interest charges add up quickly, and the faster you can move your balance to a card with a 0% APR promotional offer, the more money you’ll save.

The balance transfer cards with high limits listed above let you apply and get a quick approval decision. Some card issuers allow you to initiate your balance transfer as part of your application process. This can help you jump-start your debt payoff mission.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Credit Cards to Transfer High Balances ([updated_month_year]) 12 Best Credit Cards to Transfer High Balances ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/best-credit-cards-for-transferring-high-balances-feat.jpg?width=158&height=120&fit=crop)

![9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year]) 9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/btandrewards.png?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![9 Best 0% Balance Transfer Credit Cards ([current_year]) 9 Best 0% Balance Transfer Credit Cards ([current_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_1495481012.jpg?width=158&height=120&fit=crop)

![Are Balance Transfer Cards a Good Idea? ([updated_month_year]) Are Balance Transfer Cards a Good Idea? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Are-Balance-Transfer-Cards-a-Good-Idea.jpg?width=158&height=120&fit=crop)

![0% For 21 Months: Balance Transfer Cards ([current_year]) 0% For 21 Months: Balance Transfer Cards ([current_year])](https://www.cardrates.com/images/uploads/2023/04/0-Percent-Blance-Transfer-For-21-Months-Credit-Cards.png?width=158&height=120&fit=crop)

![7 Easiest Balance Transfer Cards to Get ([updated_month_year]) 7 Easiest Balance Transfer Cards to Get ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Easiest-Balance-Transfer-Cards-to-Get.jpg?width=158&height=120&fit=crop)

![0% For 24 Months Balance Transfer Cards ([updated_month_year]) 0% For 24 Months Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/0-Percent-For-24-Months-Balance-Transfer-Cards.jpg?width=158&height=120&fit=crop)