When the problem is too much credit card debt, the solution may be one of the credit cards with the best 0% balance transfers for 18+ months. These cards not only allow you to consolidate your credit card debt, but they also can save you a ton of money in interest expenses.

And if you’re going to pay the fee to transfer balances anyway, you may as well get 18 months or more of no-interest payments. Keep reading to see which cards offer this money-saving benefit that can help simplify your monthly payments calendar.

Balance Transfer Cards With 0% APR For 18+ Months

These five cards constitute an elite group offering a super-long balance transfer promotional period. Most balance transfer credit cards give new cardmembers 0% APR for 15 or fewer months. If you have a significant amount of credit card debt, these cards provide extra time to pay it off interest-free.

The lowest available balance transfer fee is either 3% of the amount of each transfer or $5 minimum, whichever is greater. Some cards charge more — the greater of 5% or $10 — for no apparent reason other than greed, assuming the cost of managing a balance transfer transaction is pretty much the same for all credit card providers.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

The introductory APR on balance transfers offered by the Citi Simplicity® Card is one of the most impressive in the balance transfer arena. You must complete eligible balance transfers within four months of account opening to avoid paying the regular APR, which is based on your creditworthiness. This card certainly earns its name with its truly “simple” structure.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

It’s no surprise that the Citi® Diamond Preferred® Card offers yet another impressive introductory APR period on balance transfers completed in the first four months after you open the account like its sibling cards previously mentioned. A balance transfer fee applies, and the regular APR that takes effect afterward is based on your creditworthiness.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The 0% introductory APR on balance transfers offered by the Discover it® Balance Transfer applies to transactions completed within the specified time after account opening. The card has the lowest regular variable APR in this group. Keep in mind, a balance transfer fee will apply. Be sure to review the card’s terms prior to making a transfer.

- For a limited time, get a special 0% introductory APR on purchases and balance transfers for 21 billing cycles. After that, the APR is variable.

- Enjoy Cellphone Protection Coverage of up to $600 annually when you pay your monthly cellphone bill with your card

- View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use, and free to U.S. Bank customers.

- Fraud Protection detects and notifies you of any unusual card activity to help prevent fraud

- Choose your payment due date

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 21 billing cycles

|

0% for 21 billing cycles

|

18.74% - 29.74% (Variable)

|

$0

|

Excellent Credit

|

Additional Disclosure: The information related to this card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this product.

The U.S. Bank Visa® Platinum Card is currently offering a whopping APR of 0% for 21 billing cycles on balance transfers, after which the regular variable APR activates. The offer applies to balances transferred within 60 days from account opening. The credit card balance transfer transaction fee is low, and its grace period for purchase is 24 to 30 days after the close of each billing cycle — balance transfers have no grace periods.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

Nothing shabby about the introductory APR period on balance transfers offered by the Citi Double Cash® Card. The offer applies to balance transfers completed within four months of account opening, after which the regular variable APR kicks in. Please keep in mind, a balance transfer fee will apply, and balance transfers do not earn cash back.

What Is a Balance Transfer?

A balance transfer is a service offered by some credit cards that allows you to transfer the existing balances of your credit cards to a new credit card with a lower — or 0% — interest rate.

In this way, you can consolidate your credit card balances all in one place, with one monthly payment that’s easy to manage. By consolidating your credit card balances, you no longer have to contend with the payment schedules and interest rates of your other cards. You will also have only one minimum payment to make, meaning that more of your money is available to pay down your balances.

Many cards support balance transfers, and a subset of cards offer a special 0% introductory APR for balance transfers, allowing you to pay down your credit card debt interest-free for the life of the introductory period.

Your ability to get the most from your interest-free balance transfer card depends on the size of your credit line. It makes sense to comparison-shop the credit limits you’re offered on competing cards and to get a card with a large enough limit to accommodate your consolidation plans.

Some cards limit the amount you can transfer. For example, Chase caps balance transfers at $15,000 within a 30-day period. If you have some large existing credit card balances you want to transfer, be aware of any issuer-imposed limits that may interfere with your plans.

A balance transfer card may offer other benefits not found on your current cards, such as better rewards, an introductory offer for purchases, and no annual fee.

A nifty little trick regarding balance transfers is that you can increase the participating types of debt beyond credit card balances, thanks to the courtesy checks you can order for your credit card account.

Credit card checks, which function as cash advances, can be used to pay other debts. You then transfer the cash advance balances, just as you would purchase balances. And if the transfer is to a card offering a 0% introductory APR on balance transfers, you won’t have to pay interest on the cash advances.

How Do Balance Transfers Work?

You can accomplish a balance transfer in five easy steps:

- Investigate the best balance transfer credit cards that someone with your credit score can obtain, starting with the five cards featured in this review.

- Submit an application for the card you prefer. Be sure you’ve evaluated important parameters, such as fees and regular interest rates.

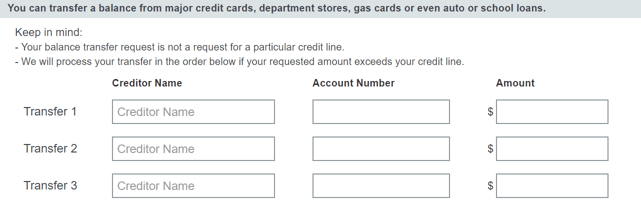

- Request transfers from each participating card, over the phone, or online. You’ll need to provide the account number and balance for each card. You can request balance transfers at account opening or at a later time, but be sure to observe any deadlines for the 0% APR promotions.

- Continue to pay the minimum payments on each participating card until you receive confirmation that the transfer has been completed.

- Order cash advance checks for your new credit card and transfer non-credit-card balances to the card.

The card issuer handles all the arrangements to transfer your existing balances, including contacting the issuers of your current cards (such as banks and credit unions like Navy Federal) and paying off your remaining balances. If you transfer only a partial balance, you’ll have to make monthly payments to both the old and new cards until you pay off your balances.

The following illustration is a typical online screen for transferring balances:

Remember that each balance transaction will trigger a one-time transaction fee of between 3% and 5%. For a $1,000 transfer, the fee will usually range from $30 to $50.

Although most credit cards support online balance transfers, you can call a customer service rep if you prefer.

In either case, figure a period of up to two weeks or more before the transaction completes. The following processing periods are typical:

- American Express: 5 to 7 business days

- Barclays: Up to three weeks

- Capital One: Between 3 and 14 business days

- Chase: Between 7 and 21 business days

- Citi: Between 2 and 21 business days

- Discover: Between 4 and 14 business days

Continue to make minimum payments to your old credit card until the balance is transferred, as failure to do so can result in late fees and damaged credit scores. Don’t worry if you overpay your old card because of an in-process transfer — the issuer will refund you the excess once the transfer completes.

In other respects, a balance transfer credit card is like any other credit card, allowing you to charge purchases and (where supported) take cash advances. A card’s APRs for qualifying purchases, balance transfers, and cash advances may differ, with cash advances usually having the highest interest rate.

Cards that offer 0% introductory APRs on balance transfers frequently have a similar offer on purchases, but less so for the reverse, as 0% promotions appear to be more popular for purchases than for balance transfers.

Kudos to Citigroup, home of the Citi Flex Plan, for dominating this review with three entries. Looks like Citi’s serious about attracting new cardholders seeking the best deals on balance transfers.

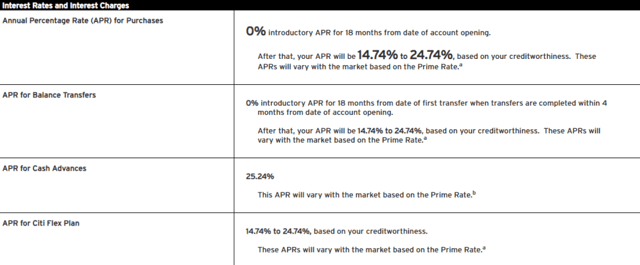

What Happens After the Balance Transfer Period Is Over?

Once the promotional balance transfer offer expires, the credit card will charge the regular purchase APR for balance transfers. You’ll pay the regular APR on any remaining transferred balance once the promotion period ends.

For example, suppose you transferred $6,000 to your new card with a 0% introductory APR on balance transfers. After the period expires, you still have a $3,000 balance that will incur daily interest at the regular purchase APR.

As mentioned earlier, balance transfers not covered by a 0% APR promotion do not provide an interest-free grace period. In other words, interest accrues daily on these balance transfers starting with the transaction date, either because the promotional period is over or was never offered.

Make sure you understand the deadline for completing balance transfers that you want to include in a 0% APR promotion. While the card’s headline may advertise an 18-month promotion, the fine print may reveal that you have only two or four months to execute the transfers that qualify for 0% interest.

How Long Do Balance Transfer Promos Typically Last?

Federal regulations require that 0% introductory APR promotions for both qualifying purchases and balance transfers last at least six months. After that, it’s up to the issuer to decide how long its promotions will run.

The promotion periods seem to run in three-month multiples — 6, 9, 12, 15, 18, and 21 months. However, any period is possible, as long as it isn’t shorter than six months. The U.S. Bank Visa® Platinum Card is unusual in that it is currently offering 0% Intro APR Period 21 months on Balance Transfers on balance transfers, although this appears to be available for only a limited time.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

Generally, 12- and 15-month balance transfer promotions dominate the current credit card landscape. As with most features, credit card providers are free to change their promotions without notice.

What Credit Score Do I Need to Qualify for a Balance Transfer Card?

Most balance transfer credit cards are reserved for consumers with FICO scores of 700 and above. However, a few of the balance transfer credit cards above accept applicants who have fair credit scores as low as 651. Several of these are student credit cards that do not require a credit history.

One standout balance transfer offer for consumers with less-than-excellent credit is the Discover it® Secured Credit Card, which offers an introductory APR of 10.99% Intro APR (6 months) on balance transfers, after which the regular 28.24% Variable APR kicks in. Because it is a secured card, you can get it without regard to your credit score as long as you make the required deposit.

If your low score precludes you from getting an unsecured balance transfer card, consider actions to increase your score, such as paying down your debt and making all payments on time.

Paying Down Your Debt

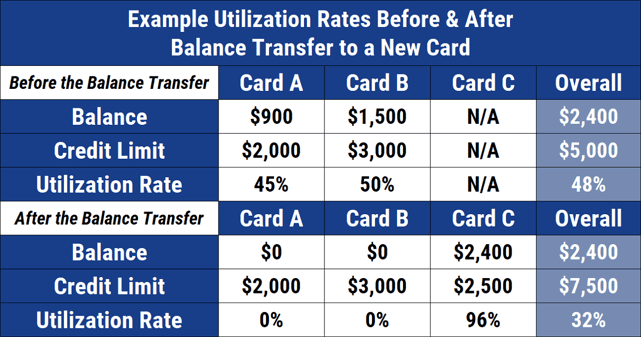

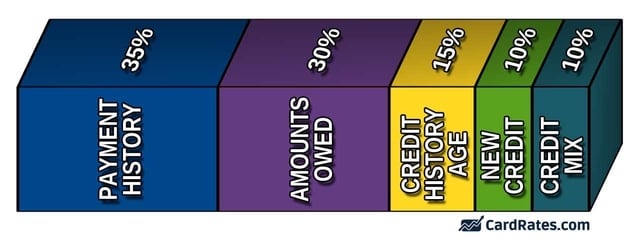

The problem with having a relatively high debt level (i.e., a debt-to-income ratio above 28%) is that it spooks creditors, who may conclude that you are in financial distress. The amounts you owe, as measured by your credit utilization ratio (CUR), represent 30% of your credit score.

CUR can be calculated using the formula (100 x credit card balance / credit limit), where the factor of 100 is to convert the ratio to a percentage rate. Creditors and lenders want to see your CUR fall below 30% as a sign of financial health.

For example, if you have a $500 balance on a card with a $2,000 credit limit, your CUR is 100 x $500 / $2,000 = 25%. This is the individual CUR for the card. However, the credit bureaus calculate your overall CUR, which uses the sum of all your card balances and limits.

The following chart illustrates overall CUR:

You won’t see your CUR published on your credit card statements, but you can calculate it yourself by pooling the information you need from your statements and/or credit reports. You can order your reports at no cost at AnnualCreditReport.com, the sole source of federally authorized credit reports.

It’s something of a catch-22 that you use balance transfers to reduce your credit balances and thus raise your credit score, but you can’t get a balance transfer credit card if your score is too low.

If you are caught up in this paradox, consider recruiting a cosigner to help you obtain a qualifying balance transfer credit card. A cosigner pledges to pay any bills that you fail to, thereby reducing the risk that the account will go into default.

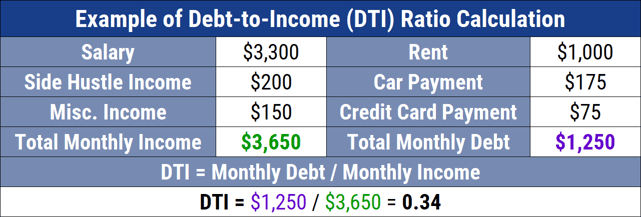

Another indicator that your debt is too high is the debt-to-income (DTI) ratio. Your DTI ratio is the sum of your monthly debt payments divided by your gross monthly income, as illustrated in the next figure:

Naturally, a high DTI, usually considered to be at least 28%, will make potential creditors uneasy, although the ratio isn’t formally used to calculate your FICO score.

Note that DTI does not cover expenses other than debts, such as food and transportation. In other words, calculating your DTI will reveal the money you have to live on after paying your debts each month. If your income is insufficient, your request for a new credit card will likely be rejected.

In sum, reducing your debt is one of the surest ways to improve your credit profile and break down the barriers preventing you from acquiring a good credit card — one that provides a 0% introductory APR for balance transfers and purchases.

Paying Bills on Time

Thirty-five percent of your credit score reflects your credit history. Many possible credit problems can ensue from late or missed payments to the credit card company. These include late fees, penalty APRs, collections, write-offs, repossessions, foreclosures, and bankruptcies.

Here again is a paradox: You are more likely to pay bills on time (and improve your credit score) if you have fewer bills, something that credit card consolidation achieves via balance transfers. Yet you need good credit to get a qualifying balance transfer credit card in the first place.

To help ensure you don’t miss payments, take actions like creating a prioritized budget, setting up automatic payments, and tracking your budget using personal financial software like Quicken or Moneydance. If your problem is that you simply cannot afford to pay all your bills, consider tightening your budget and/or using a debt settlement company to reduce your debt.

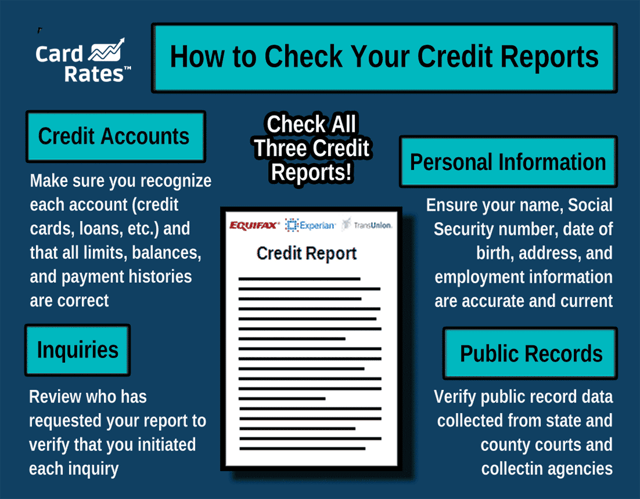

Fixing Your Credit Reports

Your credit score may be needlessly depressed due to mistaken and incomplete information on your credit reports from TransUnion, Experian, and Equifax.

You have the option to fix up your credit reports by yourself or you can hire a credit repair agency to handle the problem for you.

If you are taking the DIY route, you can begin by ordering copies of your credit reports at no cost from AnnualCreditReport.com. You can then review them for problems like unknown accounts, unexpected balances, and unauthorized inquiries.

If you detect any problems, you can ask the appropriate credit bureau to correct or remove the derogatory information via an online request or mailed letter. You will have to include identification data as well as information backing your claims.

The credit bureau normally takes about a month to respond to your challenge. If successful, you should see the disputed item removed from your reports within the next month or two, along with an increase in your credit score.

Several software packages or software as a service (SaaS) offerings can assist in your DIY efforts, including Credit Versio, a package costing $19.95/month that uses AI to help you identify and dispute errors on your credit reports from all three credit bureaus.

The DIY method costs the least but can require a good amount of time devoted to the process. If you can’t or don’t want to take the time to do it yourself, you can hire a credit repair agency to do the work for you.

The best credit repair companies charge a monthly subscription amount between $50 and $150 in exchange for a set minimum number of disputes it will lodge on your behalf. The usual subscription period is six months, but you can cancel at any time.

Lexington Law is a top-rated credit repair company that may help you raise your credit score by 100 points or more. Priced at just $99.95 per month, it’s a relatively affordable service considering all that is offered.

Another well-regarded credit repair service is CreditRepair.com, while Sky Blue Credit Repair’s service is simple, guaranteed, and inexpensive.

What Is a Balance Transfer Fee?

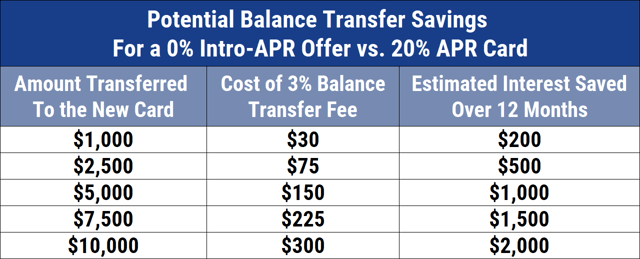

Cards that offer a 0% balance transfer promotion usually charge a fee for each transaction. The fee is usually the greater of $5 to $15 and 3% to 5% of the transferred amount. The following chart shows how much you can save, despite the fee, by executing a balance transfer at 0%:

If you want to transfer a modest balance, you may want to compute the cost versus the savings. You can use an online balance transfer calculator to determine your potential savings.

Are There Any Cards With No Balance Transfer Fee?

There are indeed credit cards that charge no balance transfer fee, but this freebie is usually available only when there is no zero-interest balance transfer promotion, either because the card doesn’t offer it or the introductory period has expired.

For example, Capital One isn’t currently charging its cardmembers a balance transfer fee — but it also isn’t offering a 0% promotion.

However, some cards offer a 0% balance transfer promotion and charge no balance transfer fees. The combination of the two features can save new cardmembers some serious coin. But these offers are not very common, and usually only run for a limited time.

At the time of writing, we don’t know of any issuers offering both a $0 transfer fee and a 0% APR.

Do 0% Balance Transfers Affect Your Credit Score?

The impact of a 0% balance transfer upon your credit score is not so clear-cut, as it depends on a variety of factors, starting with everyone’s unique financial history.

That being said, balance transfers usually help your credit score to the extent you use them to reduce your overall credit utilization ratio. Your indebtedness drives 30% of your FICO score, meaning your score should improve when you pay down debt.

If you perform balance transfers and then rack up new balances on your old cards, you will plunge your credit score deeper into the depths. You’ll also hurt your score if you cancel your old cards after you transfer out their balances, as this will raise your credit utilization ratio.

The message: Only you can control the outcome after you transfer balances.

Balance transfers may hurt your credit score in a couple of ways:

- Hard inquiries: Your credit files will have to endure a hard inquiry whenever you apply for a new unsecured credit card, such as when obtaining a new 0% balance transfer card. However, the damage is slight — only five to 10 points — and it dissipates after one year.

- Age of accounts: A new credit card will reduce the average age of your credit accounts. This will have a slight negative impact on your FICO score. The more accounts you already have, the smaller the new account’s impact.

After accounting for all these factors, it’s clear that you can exploit balance transfers to improve your credit — as long as you use them to pay down debt.

Can I Keep Transferring Credit Card Balances?

You are within your rights to transfer balances multiple times. The question is whether it’s a wise move. It can make good sense if you are aggressively paying down your debt. But, surprisingly, it also makes sense when you make minimum payments.

Usually, the only reason to transfer a balance more than once is that the introductory period for a 0% APR promotion is about to expire. Let’s focus on how this would work.

Imagine you have three 20% APR credit cards, with a combined balance of $10,000. You transfer all three balances to a new credit card with a 15-month 0% balance transfer promotion.

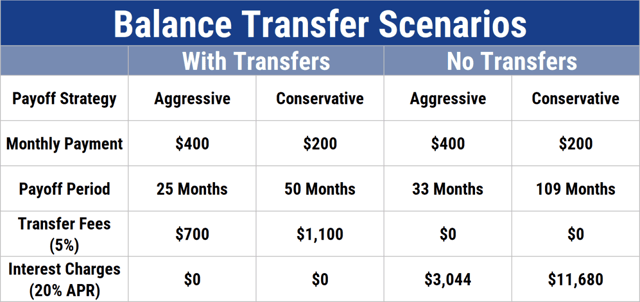

Aggressive Repayment Case

It is your intention to pay down the balance at the rate of $400/month. After 15 months, you still have a balance of $4,000. You transfer this balance to yet another new card with its own 0% balance transfer promotion and pay off the remaining balance over the next 10 months.

If both new cards charge a 5% balance transfer fee, your cost for this 25-month strategy is (0.05 x ($10,000 + $4,000)), or $700, and your interest charge is $0.

Compare this with a strategy of simply paying down your cards (each of which has a purchase APR of 20%) at the rate of $400 per month. An online payoff calculator reveals that you would spend $3,044 in interest and it would take 33 months to complete the process.

With this no-transfer process, you save the $700 balance transfer fee but end up paying an extra ($3,044 – $700), or $2,344, by not performing the multiple balance transfers. In this case, it makes total sense to perform multiple balance transfers.

Conservative Repayment Case

Now, what would happen if you paid a minimal amount each month, say $200?

First, the no-transfer scenario: The online payoff calculator informs you that, without the transfers, it would take 109 payments to pay off the balance, costing you $11,680 in interest.

In other words, 46% of your payments would reduce the principal, and 54% would pay interest. No money would go toward fees.

Compare to the balance transfer scenario: You pay no interest, so you save $11,680.

During each 15-month introductory period, you will pay off $3,000 (i.e., $200 x 15 months) in debt, so your balance transfer amounts will be $10,000, $7,000, $4,000, and $1,000. The 5% fees on these transfers are $500, $350, $200, and $50, respectively, for a total of $1,100 in balance transfer fees.

The $1,100 total cost for this balance transfer scenario is $10,580 less than the no-transfer scenario’s cost.

The Bottom Line

The following chart summarizes the results:

The balance transfer scenarios for the aggressive and conservative payoff strategies save $2,344 (i.e., $3,044 – $700) and $10,580 (i.e., $11,680 – $1,100), respectively, compared to the no-transfer scenarios. These results indicate that multiple balance transfers can save you money versus paying interest, whether you adopt an aggressive or conservative repayment schedule.

Now for the reality check.

The balance transfer scenario with conservative payments requires four transfers, hence four new credit cards offering a minimum introductory period of at least 10 to 15 months for their 0% introductory APR promotions on balance transfers. This strategy has several challenges, including:

- Anti-churning rules: Many credit card companies limit the number of new credit cards they will issue to the same consumer. This may require you to cancel your balance transfer cards when the introductory periods end, which can hurt your credit score.

- Annual fees: Our examples ignored annual fees, something you may not be able to do.

- Different values for variables: Results will differ if you plug in different APRs, monthly payments, and/or transfer fees. For example, a significantly lower APR will reduce the advantage of the balance transfer scenarios.

- Credit limits: The example assumes that the credit limits on your balance transfer cards will be large enough for the strategy to work, but the assumption may be wrong.

- Credit score requirements: It is difficult to obtain a suitable 0% APR balance transfer credit card if your credit score is bad. But having a large unpaid balance may cause your score to be low, making it impossible to carry out the balance transfer strategy.

- Discipline: The examples assume that you are not creating new balances on your credit cards, perhaps by switching to making your purchases with a debit card. Adding more debt will increase your costs and could hurt your credit score as your credit utilization ratio increases. Moreover, lack of spending discipline (such as failure to use a debit card) may have put you in this financial pickle to begin with, and you would simply be propagating bad financial habits.

Given these challenges, you may want to consider adopting an aggressive payoff strategy to minimize the number of cards required and the fees you’ll have to pay.

Are 0% Balance Transfers Worth It?

Having worked through various scenarios, we think there is no doubt that 0% balance transfers are worth it.

The pros for 0% balance transfers are:

- They can save you tidy sums of cash compared with paying interest, even after you figure in the fees.

- They can facilitate an orderly process of debt consolidation and repayment.

- They replace multiple monthly payments with a single one that is easier to schedule.

- They may reduce the amount spent on minimum payments.

- When used properly, they can boost your credit score by improving your credit utilization ratio.

The cons for 0% balance transfers are:

- May reinforce bad habits that can lead to deeper debt if you continue to accumulate new balances.

- You may not have a high enough credit score to qualify for a 0% balance transfer card.

- You may be locked out of signup bonus promotions if you churn cards from the same issuer.

- They may hurt your credit score by increasing the number of hard credit inquiries and decreasing the average age of your credit accounts.

In our opinion, the ayes have it, but only on the proviso that you do not use balance transfers as a way to go deeper into debt.

Can You Earn Cash Rewards on Balance Transfers?

We are not aware of any credit card that lets you earn miles, points, or cash rewards on balance transfers. If you read the disclosures accompanying every credit card offer (and you should!), you’ll see language that limits rewards to eligible purchases, ruling out balance transfers and cash advances.

The balance transfer amount does not earn rewards and it doesn’t satisfy the purchase requirements for signup offers. Moreover, interest begins accruing immediately on balance transfer transactions not covered by a 0% introductory APR.

Lest you judge the balance transfer cards too harshly, remember that you probably earned rewards when you first purchased the items that contributed to the credit card balance you want to transfer.

Another important factoid: Payments made to reduce the transferred balance do not count toward the month’s minimum payment, assuming one is required. Normally, the minimum payment amount is 1% to 4% of your purchase balance, independent of your transfer balance.

When you send a credit card payment, it’s important to know how the money will be applied. First, it pays for the minimum amount due, after which it pays your balances in descending order of APR. For example, cash advances usually have the highest regular APR, followed by balance transfers and purchases, and then by any 0% APR promotions.

This payment allocation scheme is to your benefit, as it applies your payments toward the most expensive debt first. You can explicitly override the default order of payments by attaching a note to your payment.

Beware of how balance transfers affect your grace period on purchases. If you don’t pay off your balance transfer balance by the due date, you may lose your interest-free grace period on new purchases.

What is the Worst Mistake You Can Make With a 0% Balance Transfer APR?

The Big Daddy of mistakes regarding your 0% intro APR promotion is to miss the payment due date by 60 days or more. Most likely, the issuer will revoke the promotion and saddle your balance transfers with the regular purchase APR, or if they really lack compassion, they may hit you a penalty APR (frequently around 30%).

This rule, shared on the website of the Consumer Financial Protection Bureau, makes it clear that your 0% intro APR offer, whether for purchases or balance transfers, must run for at least six months unless your payment is 60 days late. Note that your regular APRs, if variable, can change during the introductory period (or anytime else).

Compare the Best 0% Balance Transfers For 18+ Months

Our exploration of the best 0% balance transfers for 18 months or more has uncovered five cards that can help you consolidate your debt and save you money. You can get more details about each card by clicking the APPLY NOW button that will transfer you to the card’s official website.

Remember to read the fine print, as there may be conditions and deadlines that impact the way you plan to use these 0% balance transfer strategies.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How Do Balance Transfers Work? + 5 Top Offers ([updated_month_year]) How Do Balance Transfers Work? + 5 Top Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/04/complete-guide-to-balance-transfers.jpg?width=158&height=120&fit=crop)

![0% For 21 Months: Balance Transfer Cards ([current_year]) 0% For 21 Months: Balance Transfer Cards ([current_year])](https://www.cardrates.com/images/uploads/2023/04/0-Percent-Blance-Transfer-For-21-Months-Credit-Cards.png?width=158&height=120&fit=crop)

![0% For 24 Months Balance Transfer Cards ([updated_month_year]) 0% For 24 Months Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/0-Percent-For-24-Months-Balance-Transfer-Cards.jpg?width=158&height=120&fit=crop)

![0% For 12+ Months: Balance Transfer Cards ([updated_month_year]) 0% For 12+ Months: Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/0-percent-for-12-months-balance-transfer-cards.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards: No Interest for 12+ Months ([updated_month_year]) 7 Best Credit Cards: No Interest for 12+ Months ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/Best-Credit-Cards-with-No-Interest-for-12-Months-Feat.jpg?width=158&height=120&fit=crop)

![6 Best No-Interest Credit Cards for 18+ Months ([updated_month_year]) 6 Best No-Interest Credit Cards for 18+ Months ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-No-Interest-Credit-Cards-for-18-Months-Feat.png?width=158&height=120&fit=crop)

![What is a Credit Card Balance? Transfer to 0% ([updated_month_year]) What is a Credit Card Balance? Transfer to 0% ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/what-is-a-credit-card-balance.jpg?width=158&height=120&fit=crop)

![9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year]) 9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/btandrewards.png?width=158&height=120&fit=crop)