If your credit card spending has gotten out of hand and it’s time to pump the brakes, you’ve come to the right place — keep reading for the best ways to pay off credit card debt.

The convenience and rewards offered by credit cards have made them one of America’s favorite ways to pay. But a significant thing happens if you start to mistake that little piece of plastic for free money: you end up with a big ole heap of credit card debt. Swiping a card is quick and easy, and for many consumers, it doesn’t feel as impactful as forking over real cash.

That’s what happened to Beverly Harzog many years ago, when the first of her many cards was canceled and she had to face her debt reality. “That was my rock-bottom moment,” Beverly described. “From that moment on, I vowed I would get myself back in financial shape.”

By making key changes in the way she handled her finances, Beverly was able to pay off her credit card debt in just two years. Since then, she’s worked to share her hard-won wisdom with the masses, including in several successful books and a popular blog. She was also kind enough to share with us her top tips for paying off credit card debt. We’ll look at these tips in-depth below, including sections on how to own your own debt, prioritizing, balance transfers, budgeting, consolidation loans, learning from your mistakes, downsizing, and more.

Own Your Debt | Prioritize | Balance Transfers | Budgeting | Consolidation Loans |

Learn From Your Mistakes | Downsizing | It’s Only Temporary | Get Support

1. Stare Down Your Debt So You Own It

As the old saying goes, “Denial ain’t just a river in Egypt.” Many of us tend to live in denial about the extent of our debt, but existing in a state of voluntary ignorance does little good. Indeed, that ignorance can actively impair your ability to effectively get yourself out of debt. Therefore, confronting your debt head-on is the first step toward doing something about it.

Beverly Harzog became a debt expert to battle her own credit card debt, paying down more than $20,000 in just two years.

“The very first thing that someone needs to do is stare at your debt and make sure you know what your balances are. This is particularity important when you have credit card debt on multiple cards,” said Beverly. “You need to write down your balances and take a good, hard look at them. I call this ‘Staring down your debt so you own it.'”

She suggests making a list of each credit card and its current balance, as well as the APR being charged. How much you owe and how much it’s costing you to owe it will factor into how you prioritize your debt.

Beverly believes that facing your debt is vital to taking control of it. The point is to put aside any excuses and finally accept that the debt exists — and to determine the extent of the problem.

“It’s easy to feel like a victim or to avoid responsibility,” Beverly said. “But you need to accept that it’s your debt and you have to pay it off. And that starts by recognizing how much debt you have to pay off — and owning it.”

2. Prioritize Your Debt: Snowball, Avalanche, or Blizzard?

Once you’ve got the whole kit and caboodle in black and white before you, it’s time to start developing a plan. In general, the most effective method is to focus on one card at a time, putting all of your extra funds toward paying off that card, then moving to the next card on the priority list.

Beverly described three methods of prioritizing your debts, recommending that each individual select the method (or combination of methods) that best suits his or her own needs. The first, the snowball method, prioritizes each debt based on the size of the balance owed.

The snowball method prioritizes your debts by balance, starting with the smallest balance first.

“The snowball method is where you order your cards from smallest balance to largest balance, and pay off the smallest balance first, then the next smallest, and so on,” explained Beverly. “You pay more interest this way, but a lot of people love this method because they can pay off one of their balances quickly. They often get a burst of energy and motivation from that.”

As Beverly points out, the snowball method can cost you more money in the long run, as the cards with the highest APRs will charge you the most to carry a balance.

At the same time, studies have shown the snowball method can be effective at paying down debt due to the increased motivation from the small victories obtained in the initial stage.

The avalanche method prioritizes your debts by interest rate, starting with the highest APR first.

The second method of prioritizing your debt is typically called the avalanche method. Using the avalanche method, you prioritize your debts by the APR, paying down the debt with the highest interest rate first, and the lowest rate last.

This method saves you more money overall, as you pay fewer and fewer interest fees with time as your high-interest debts are paid off.

“When I was in debt many years ago, this is the method I used to prioritize,” explained Beverly. “You save the most money — and saving money is what motivates me!”

One thing to remember, if you have balances from different types of transactions, such as balance transfers versus new purchases, they may be charged different APRs even on the same card. Be sure you know the APR each part of your balance is being charged.

In Beverly’s blizzard method, you pay off the smallest balance first, then prioritize based on APR.

Beverly also mentions a third method, coined the blizzard method, which she created herself and describes in her books. “With the blizzard method, you pay off the smallest debt first, to get that psychological boost, then you switch to the avalanche method to save more money.”

No matter which method — or combination of methods — you choose, you’ll still need to pay at least the minimum amount on all of your other cards (plus any other bills). Missing payments not only sticks you with late fees, but you’ll likely end up damaging your credit, as well.

“The most important thing is to pay everything on time,” Beverly stressed. “I’ve seen some people get so consumed with their debts that they get sloppy on some of their payments. Payment history is 35% of your FICO score, so you want to pay close attention to all of your finances, not just the debt.”

3. Use Balance Transfer Offers (If You Qualify)

A somewhat unique thing about credit cards is that you can have pretty significant credit card debt while still maintaining decent credit, especially when you have high-limit cards. For those with good to excellent credit, Beverly suggests opting for a balance transfer credit card with a nice 0% APR introductory offer.

Basically exactly what it sounds like, a balance transfer is when you transfer your balance from one credit card to another card with a lower APR. An array of cards with balance transfer offers are out there for those who qualify, typically with introductory terms extending 12 months or more. Our favorite balance transfer cards, for example, provide up to 18 months interest-free.

Additional Disclosure: Citi is a CardRates advertiser. Additional Disclosure: Citi is a CardRates advertiser.

+See More Balance Transfer Cards

“If you have excellent credit, you can probably get approved for one of these cards fairly easily, and transfer your balance,” said Beverly. “Let’s say it’s 18 months; that gives you 18 months to pay off your balance without paying any interest.”

Of course, most things come with caveats, and balance transfers are among those things. In particular, most credit cards will charge a balance transfer fee for the service, which usually ranges between 3% and 5% of the transferred balance.

Another thing to keep in mind is that your introductory APR will only be good for the length of the intro period; once that period expires, your remaining balance will be charged the default balance transfer APR. The best way to make the most of your balance transfer is to ensure you can pay off your balance before the end of the term.

“Let’s say you have 18 months no interest,” Beverly described. “You add up your balance — including any balance transfer fee — and you divide it by 18 to figure out what you have to pay, per month. But even if it’s too much to pay off, if you can pay off a chunk of it without interest, that’s still a good deal.”

4. Track Your Spending & Make a Budget

Some advice is given so frequently that you may find yourself rolling your eyes each time it’s given anew. But, at the end of the day, if it weren’t good advice, people would stop giving it. It might also be repeated less if more people actually listened.

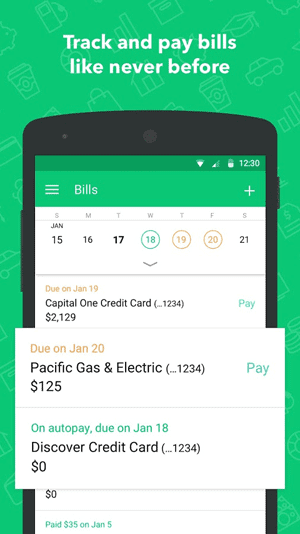

A variety of digital tools are available to make it easier to build and track your budget, including Mint.com’s website and mobile app.

And that’s how budgeting fits into the finance world. Although most Americans fail to keep a detailed budget, nearly every financial expert — Beverly among them — will tell you that budgets are absolutely necessary to effectively corral your frolicking finances. She also emphasizes the need to consistently track your spending to make sure you stick to that budget.

“If you don’t have a budget, you need to get one; you should put together a budget and track your spending. This is the only way you’re going to be able to stay out of debt, as well as start to save for the goals you have, like a special trip or purchasing a home,” she explained.

“And tracking your spending is especially important. A lot of people don’t track their credit card spending or include a line in their budget for their credit cards. That’s a huge mistake.”

While Beverly recognizes the myriad ways of tracking your finances and maintaining a budget — which include everything from mobile apps to spreadsheets to good old-fashioned pen and paper — she personally uses, and recommends, Mint.com, particularly for those who enjoy seeing their information visually, such as in bar graphs and pie charts. But, she added, there’s no one-size-fits-all method of handling your finances.

“I don’t think there’s one solution for any of this. You should do a little bit of research and think about how you like to manage your money, then pick whatever is right for you.”

5. Consider Consolidation Loans

Although the right combination of balance transfers and winter-themed payment methods can help many through the worst of their credit card debt, others simply can’t obtain a good balance transfer deal. And more still may not be capable of keeping up with a variety of payments across multiple credit cards each month. For these consumers, a consolidation loan may be the best option.

Consolidating with a personal loan involves taking out a single, large loan to pay off several smaller debts, such as multiple credit card balances. Ideally, the interest rate you pay on your loan will be less than the APR charged on any of your credit cards, thus reducing the amount of interest you pay and lowering your monthly payments. Online lending networks, such as our top-rated picks, can provide quotes from multiple lenders at once.

- Loan amounts range from $1,000 to $35,000

- All credit types welcome to apply

- Lending partners in all 50 states

- Loans can be used for any purpose

- Fast online approval

- Funding in as few as 24 hours

- Loan amounts range from $500 to $10,000

- Compare quotes from a network of lenders

- Flexible credit requirements

- Easy online application & 5-minute approval

- Funding in as few as 24 hours

- Loan amounts range from $1,000 to $35,000

- Flexible credit requirements

- Loans can be used for anything

- Five minute application

- Funding possible in as few as 24 hours

- Large lending network with multiple partners

Since the key to a consolidation loan is the lower interest rate — that’s what is responsible for reducing your monthly payments — it will be helpful to consult your list of balances and APRs while rate shopping. If the rate you receive on your loan is higher than the APR for a particular card, don’t include that card in the consolidation loan; you won’t actually save any money by consolidating it.

Additionally, carefully consider how long you’ll need to repay your consolidation loan. The longer you take to repay the loan, the more interest payments you’ll need to make, and the more expensive that loan becomes. Instead, focus on finding the right balance between affordable monthly payments and a cost-effective loan.

6. Figure Out How You Got Into Debt

According to Beverly, another key step to dealing with your debt over the long term is to determine how you got into all that debt to begin with. As they say, those who don’t learn from history are often doomed to repeat it.

Beverly’s first book describes how she spent her way into credit card debt — and how she managed to pull herself back out.

“I think that figuring out why you got into debt is an important part of working on your debt strategy,” she explained. “You need to take a look at why this happened in the first place; if you don’t, it’s likely to happen again. Something like impulse purchasing, those shopaholic tendencies — they can really kill your budget.”

And Beverly knows all about the impact of those particular tendencies. Shopping is part of how she got into trouble herself, fueling her purchasing with multiple credit cards. For Beverly, those shopping habits were a big part of what she had to exclude from her budget as she dragged herself out of credit card debt.

“This isn’t the kind of problem you’re going to solve in a day, but, if you know what the problem is, you can at least start working on it,” said Beverly. “And if you find that the problem is that you simply don’t have enough money to pay your bills, so you rely on credit cards, that’s a red flag right there because the situation is only going to get worse for you. That’s why it’s important to identify the problem and start tackling it.”

7. Downsize Your Expenses

With your debts laid out, your balance transfers made, and your debts prioritized and/or consolidated, it’s time to get your proverbial ducks in a row. Here’s where you take that budget and give it a squeeze, finding the places you can get a little extra monetary juice to funnel to your debts. For Beverly, this step in her own debt repayment process involved modifying the food budget and downsizing her more frivolous expenses.

“To help get myself out of debt, I ate a lot of peanut butter and jelly sandwiches every night,” she said. “I rarely went out with friends, and when I did, I took advantage of two-for-ones and other deals.”

That’s not to say you should get rid of everything that makes you happy or healthy, of course. Beverly suggests looking for ways to downsize expenses you’d rather not eliminate altogether.

“I had bought a gym membership at this extravagant health club that I really didn’t need. Since I didn’t want to stop exercising, I simply downsized it; I went with a local gym, which worked out well. Not only was it less expensive, but because it was closer, I ended up saving money on gas, too,” Beverly described. “If you look closely at your budget, there’s likely somewhere you can save. You can downsize an expense without giving up everything you love”

8. Remember That It’s Temporary

By the time you’ve stared your debts in the face, manhandled your budget into submission, and downsized your different expenses, chances are you’re feeling a little downsized yourself. It’s at this point, says Beverly, that you need to remember one important thing:

“These changes don’t have to be permanent. This is a temporary situation and it won’t last forever.”

For Beverly, outing-free nights cuddled with up her PB&J sandwiches wasn’t what she’d call a fun way to spend her time, but those sacrifices helped her pay off all of her credit card debt in just two years. Overall, it was worth it to her to have her finances back in order and her debts paid as quickly as possible.

So, while you may cringe at the idea of missing the latest hit show when you cancel your cable subscription or not keeping up with the latest viral videos because you downgraded your data plan, remember that it won’t be forever. Much like the pop culture for which you pine, your current problems are temporary.

9. Get Help & Support When You Need It

At the end of the day, battling crippling credit card debt is exactly that: a battle. It requires strength and dedication to effectively fight your debt, especially when that debt comes with high interest rates, fees, and potential credit damage. What’s more difficult, each individual has to find his or her own way to fight the battle since no two situations are exactly alike.

“You have to work with what your situation is,” Beverly said. “It took two years for me, and that sounds fast, but I really, really put myself on a strict budget. Additionally, since it was just me, it was much easier to keep that budget than if I were trying to manage a family and get out of that kind of debt.”

Of course, while we all need to fight our own battles, none of us has to fight them alone. It’s important to know when to seek out help, whether that’s the help of a financial professional, such as a financial advisor, or simply a sympathetic ear. The visitors to Beverly’s popular blog, for example, frequently share their own trials and tips, offering support and understanding to others who are also fighting the good fight.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![6 Ways to Pay Student Loans With a Credit Card ([updated_month_year]) 6 Ways to Pay Student Loans With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Pay-Student-Loans-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)

![9 Ways to Refinance Credit Card Debt ([updated_month_year]) 9 Ways to Refinance Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Ways-to-Refinance-Credit-Card-Debt.jpg?width=158&height=120&fit=crop)

![7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year]) 7 Ways to Manage Credit Card Debt When Rates Rise ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Ways-to-Manage-Credit-Card-Debt-When-Interest-Rates-Rise.jpg?width=158&height=120&fit=crop)

![6 Best Loans to Pay Off Credit Card Debt ([updated_month_year]) 6 Best Loans to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/loans.png?width=158&height=120&fit=crop)

![How to Pay Off Credit Card Debt ([updated_month_year]) How to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/02/How-to-Pay-Off-Credit-Card-Debt.jpg?width=158&height=120&fit=crop)

![11 Best Credit Cards to Pay Off Debt ([updated_month_year]) 11 Best Credit Cards to Pay Off Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-Credit-Cards-to-Pay-Off-Debt-Feat.png?width=158&height=120&fit=crop)

![5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year]) 5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/loans2.jpg?width=158&height=120&fit=crop)