In the sports world, a head start may be against the rules — but in the financial world, the best credit cards for young adults are a great way to lay the foundation for a successful future.

With these cards, you can start to build a credit score, while proving to banks that you’re responsible with your bills and monthly budget. That is a great advantage to have when you’re ready to make a big purchase — such as a home or a car — in the future.

And since most of these cards start out with lower credit limits, you don’t have to worry about making costly mistakes that put you deep into debt for the foreseeable future. Instead, you can learn as you go and eventually graduate to bigger and better credit cards.

Unsecured Cards | Secured Cards | Student Cards

Best Unsecured Credit Cards For Young Adults

An unsecured card requires no collateral or security deposit for approval. Instead, these traditional credit cards come with a preset spending limit from the bank that issues your card. In some cases, you may have the ability to earn cash back or other rewards for every dollar you charge to the card.

You may earn a credit line increase at no extra charge as you prove to be a responsible borrower over time. Even better, you may qualify for an upgrade to a more lucrative credit card through the same issuing bank.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

Capital One QuicksilverOne Cash Rewards Credit Card charges a small annual fee in exchange for access to a flat and unlimited cash back rewards rate that you earn on eligible purchases you charge to the card. Depending on how much you spend — and how quickly you pay off the debt — you could use your rewards to make money using this card.

This card is part of Capital One’s Automatic Credit Limit Increase program that monitors all accounts and considers new cardholders for a no-charge credit limit increase after your first six months with the card.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Platinum Credit Card is the Virginia bank’s starter credit card. While you won’t earn rewards with this card, you also won’t pay an annual fee or other hidden charges that some cards tack on to increase their profits.

Your low balance and on-time payments will also help you quickly establish your first credit score, as Capital One reports your payment and balance history to all three major credit bureaus.

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

The Milestone® Mastercard® is another great card for those new to credit and looking to build. Your account history will be reported to all three major credit bureaus, and you can access your account at any time on your mobile app.

This card has a slightly lower variable APR than the cards above it, but you can avoid any finance charges altogether by paying your balance in full each month. Instead, this card has a variable annual fee that can make it quite pricey if you have bad credit.

- Earn 1% cash back rewards on payments made to your Total Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair, Bad Credit

|

You can apply online for the Total Visa® Card and receive a credit decision within seconds. If you qualify, you’ll get your new card in the mail within seven to 10 business days.

This card assesses a program fee that is deducted from your initial credit line when you activate your account. Late and returned payments also trigger fees. Because the initial credit limit is low, you should find your monthly payment requirement easy to manage.

Best Secured Credit Cards For Young Adults

A secured credit card is a great way to teach credit responsibility without the risk of racking up personal debt.

These cards require a refundable security deposit that typically matches your credit limit. For example, a $300 deposit will net you a card with a $300 spending limit. The credit card company will refund your deposit in full when you close your account — as long as your card has no outstanding balance.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

The Capital One Platinum Secured Credit Card has long been our favorite secured card for several reasons. The main reason is that the bank determines your security deposit requirement based on your credit score. Some applicants may qualify for an account with a deposit that’s only a fraction of their credit limit.

And since this card is issued by Capital One, you’ll get your foot in the door with one of the largest credit card issuers in the world. When the time’s right, you can upgrade to an unsecured rewards card and better fees.

6. Bank of America® Customized Cash Rewards Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Bank of America® Customized Cash Rewards Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Bank of America® Customized Cash Rewards Secured Credit Card is a rare secured card that offers cash rewards for eligible purchases. All cardholders also receive free monthly FICO score updates with no annual fee for membership.

And just like the Capital One card above, you can leverage your responsible financial behaviors to eventually graduate to one of Bank of America’s many unsecured card offerings.

- Better than Prepaid...Go with a Secured Card! Load One Time - Keep On Using

- Absolutely No Credit Check or Minimum Credit Score Required

- Automatic Reporting to All Three National Credit Bureaus

- 9.99% Low Fixed APR - Your Rate Won’t Go Up Even if You Are Late

- Activate Today with a $200 Minimum Deposit - Maximum $1,000.

- Increase Your Credit Limit up to $5,000 by Adding Additional Deposits Anytime

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

9.99% Fixed

|

$48

|

Poor/Fair/Limited/Damaged

|

The Applied Bank® Secured Visa® Gold Preferred® Credit Card was our 2020 Editor’s Choice Award for top secured credit card for its low ongoing interest rate and flexible deposit requirements.

Another perk of this card that sets it apart from many other secured offerings is its ability to accept future deposits after you open your account to increase your spending limit. Some cards will lock you into your current limit after you make your initial deposit.

8. Citi® Secured Mastercard®

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Citi® Secured Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Citi® Secured Mastercard® is a great way to get in on the ground floor with Citibank. This card helps you build your credit history — which you can track through your free monthly FICO score updates.

This card also has one of the lowest minimum deposit requirements on this list — which makes it a great way to get started in the credit world without major upfront costs and credit requirements.

Best Student Credit Cards For Young Adults

A student credit card isn’t just a great way to pay for late-night pizza runs and extra notebooks for your chem class. These cards also help you build your credit history, which is a great way to prepare for the real world after graduation.

And student cards also feature perks that matter to young consumers. These can include cellphone insurance, statement credits for approved referrals, and rebates for charging your subscription fees for certain online streaming services.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Cash Back not only pays out a higher-than-average cash back rate when compared with some consumer cash back rewards card offerings, but it also enrolls you in Discover’s popular Cashback Match program. With this, you’ll earn a complete match of all the cash back you earn during your first year with the card.

This card also piles on the rewards with a statement credit for referring a friend if they’re approved and may include a new cardholder bonus with interest-free financing for your first several months with the card. All of this — and there’s no annual fee for membership.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

Much like its Student Cash Back sibling, the Discover it® Student Chrome lets cardholders earn cash back and matches all of the cash back earned during their first year with the card.

After graduation, cardholders can call Discover to update their personal information and income, which may make them eligible for a credit line increase.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

If you have an itch to see the world, the Bank of America® Travel Rewards credit card for Students can help you earn travel rewards that you can redeem for discounts on airfare, rental cars, hotel stays, and other travel necessities.

And since you redeem your points to erase all or part of previous travel expenses, you don’t have to worry about blackout dates, carrier restrictions, or other pesky hurdles that some travel credit cards place in front of cardholders.

How Old Do You Have to Be to Get a Credit Card?

You must be at least 18 years old to apply for a credit card. In the past, a predatory credit card issuer would pounce on a young consumer to get them into credit card debt as soon as they turned 18, but the Credit CARD Act of 2009 created restrictions that made it harder for applicants between the ages of 18 and 20 to qualify for credit.

That doesn’t mean you can’t get a credit card when you’re 18. But if you want one, you must show proof that you can repay what you borrow. This may include proof of employment and proof of income.

Just remember that income doesn’t always have to come from regular employment. Many banks will also accept regularly occurring income from government benefits, student aid, an annuity, inheritance, or another form of recurring income.

You can also attempt to add a cosigner to your card account to qualify for a credit card in your name. In this scenario, the cosigner is someone who has a better credit rating than you and is willing to sign on to guarantee the repayment of any credit card debt you accrue.

This is a tricky situation. If you default on your account or miss a payment, you and the cosigner will take the credit score hit. That’s caused the end of many friendships, relationships, and ruined plenty of family gatherings.

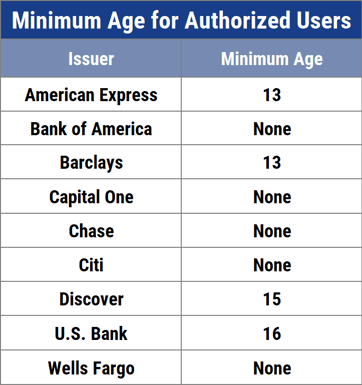

If you’re under the age of 18, you can also begin building credit by becoming an authorized user on an existing credit card account.

If you’re under the age of 18, you can also begin building credit by becoming an authorized user on an existing credit card account.

As an authorized user, you’ll receive a credit card with your name on it that gives you access to all or part of the primary user’s credit limit. When you make a charge to the card, that amount will be deducted from the primary credit account and will appear on that person’s monthly bill.

But just as with a cosigner, being an authorized user can have its drawbacks. You could end up charging more to the card than you can afford and leave the primary cardholder stuck paying your bill. Or, maybe worse, the primary cardholder could miss a payment — which will hurt both of your credit scores.

Developing a good credit score early is a great way to get a head start on adulthood. It will allow you to prove your responsibility at a young age, while also teaching you financial lessons that you won’t learn in school.

Just make sure you’re ready to take on the responsibility that comes with a credit card. After all, a single mistake can leave you in debt — or put you in a credit score hole that takes years to crawl out of.

What is a Good First Credit Card For a College Student?

Choosing a student credit card is a lot like choosing a college. Just as how the name on your diploma can open up doors in the professional world, the name on the front of your credit card can pave smooth paths in your financial life.

The best card for a college student is one issued by a major bank. Our top-rated student card is the Discover it® Student Cash Back. Not only does this card offer cash back rewards for every purchase you make, but it also matches all of the cash back you earn during your first year with the card.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

But perhaps the most important thing you’ll have access to with this card is the bank itself. Discover maintains a large portfolio of unsecured credit card products — each with great rewards, fair interest rates, and no annual fee.

By starting your credit-building journey with a bank as large as Discover, you set yourself up for the opportunity to eventually earn a card upgrade after graduation. That’s a great way to qualify for a more lucrative card with a larger spending limit.

That’s why you should always stick to major banks for your first credit card. Some card issuers only offer starter credit cards or cards for bad credit. So once you earn a good credit score, your only option is to move on from that card and start a relationship with another bank.

But if you start with a big bank that offers a path to the credit cards you want, you can continue building credit without having to jump ship — or banks. That’s why our top-rated student credit cards come from Discover, Capital One, and Bank of America, among other large banks.

Can a College Student Get a Credit Card With No Job?

There are several ways for college students to get a credit card in their name without having regular employment.

In most cases, the student is limited to student credit cards — as they’re designed specifically for young consumers with minimal income and limited credit. But despite the low entry point for these cards, most still offer solid rewards, a good interest rate, and extra perks that put them on par with some mid-level consumer credit cards.

If you’re an unemployed student who is currently enrolled at least part-time in school, here are some options you can consider when applying for a credit card:

- Consider all income sources: When a credit card application asks about your income, it’s not just asking about the money you make from full-time employment. A bank will also consider any recurring income from government benefits checks, disability payments, student aid, or other forms of regular income. If you have additional income streams, you could qualify for a credit card without being employed.

- Add a cosigner: This can get tricky because you’re asking someone to take a big plunge in guaranteeing your debt. If you stop making payments, your cosigner is on the hook for the debt. If you miss a payment, you both take the credit score ding. Don’t take on that responsibility unless you’re completely ready for it.

- Become an authorized user: Ask your parents or a significant other to let you become an authorized user on their credit card account. You’ll get a card in your name that shares all or part of the credit line extended to the primary cardholder. You can also improve your credit as an authorized user if the account balance remains low and you make timely payments.

- Apply for a secured credit card: Many secured credit cards don’t require a credit check or income verification for approval. Instead, the card issuer requires you to place a refundable security deposit that serves as collateral against default. The amount of your deposit will often equal your card’s credit limit.

Adding a credit card to your wallet is a big responsibility. If you add a cosigner or become an authorized user on an existing card, that responsibility multiplies. Consider all your options before you take the credit card plunge.

Can You Build Credit as an Authorized User?

An authorized user can build his or her credit score by being added to a pre-existing credit card account.

To make this happen, the primary cardholder has to contact the card issuer and request to add you to the account as an authorized user. The card issuer will then print a card with your name on it and send it to you in the mail. You should receive it within seven to 10 business days.

Your new card will have your name on it and give you access to the primary cardholder’s credit line. Some cards allow the primary account holder to limit how much credit you have access to, but others may give every cardholder equal access to the full credit line.

When you make a purchase using the card, that amount will be deducted from the account’s available credit. The primary account holder receives a statement each month with all the charges made on the account and must make at least the minimum payment to keep the account active.

If the account has no late payments reported to the major credit bureaus and the account’s balance remains low, you will reap all the same credit score benefits as the primary account holder.

On the other hand, a late payment or large balance can weigh down your score.

Before you become an authorized user, make sure you’re ready for that responsibility — and also be certain that the primary account holder is responsible enough to help you build your credit.

How Do I Choose a Credit Card?

In today’s financial world, there are nearly as many credit card choices as there are entrées at an all-you-can-eat buffet in Vegas. But if you don’t know what you’re looking for — or what you need — from a credit card, you could end up with much more than an upset stomach.

Whether you’re looking for your first credit card or your 50th, the rules pretty much remain the same.

- Stay within your means: While a card with a massive spending limit, a flashy metal frame, or top-shelf perks may seem tempting, they’ll only get you into trouble if you can’t afford to repay your debt. Be realistic with what you can afford to repay each month. Then find a card that can provide for your needs and budget.

- Calculate Risk vs. Rewards: Rewards credit cards are all the rage. Everyone seems to want a piece of the cash back pie — but that’s not always the smartest move. Many rewards cards come with a higher interest rate or an annual fee to offset the cost of paying out those rewards. If you carry a balance from month to month, you’ll pay far more in interest than you’ll make in rewards. If you rarely use your rewards credit card, the annual fee may cost you more than your rewards yield. Consider a card with a $95 annual fee and a 1.5% cash back rewards rate. With this card, you have to charge approximately $6,334 per year (or $528 per month) just to make up the annual fee — and that’s if you avoid all interest charges. If you don’t plan to spend that much using your card, you may be better off with a non-rewards credit card that has a low interest rate.

- Think long term: You typically aren’t thinking about your second credit card when you apply for your first credit card, but maybe you should. If you start your credit building mission with a card issuer that only issues cards for bad credit, you’ll have no room to grow once you improve your credit score. But if you choose a bank that has several credit card offerings — like Discover, Capital One, Chase, Citi, and Bank of America — you can scaffold your financial framework and incrementally upgrade to better cards until you land the card of your dreams.

Before you hit the submit button on your credit application, think about all of the points above. If you’re unsure about any of them, you may want to sleep on your decision. After all, it’s easier to wait a few days to decide than it is to undo a financial mistake.

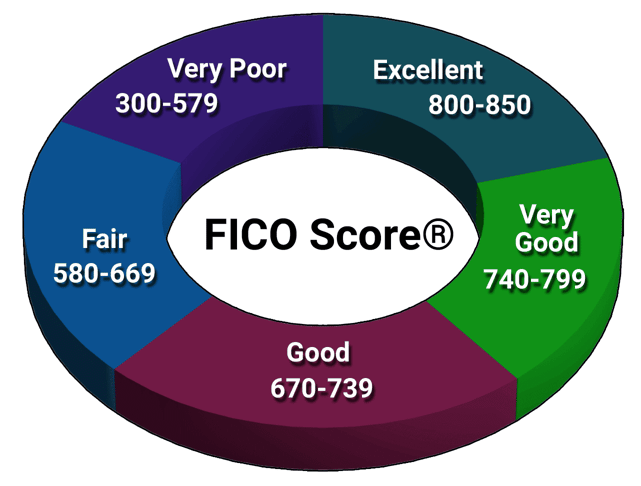

What Credit Score Do You Start With?

Until you establish credit, you have no credit score. But once you open your first credit card or take out your first loan, you’ll establish your first score within three to six months.

Many people believe you start with a credit score of zero. That’s both untrue and impossible.

Your FICO score ranges between 300 and 850 — with 850 the equivalent of perfect credit. If you’re new to credit, you have no credit score at all — otherwise known as being credit invisible. This means you don’t have enough information on your credit report to generate a reliable credit score.

Once you add a personal loan, credit card, or other debt-based financial product to your credit history, you’ll start to accumulate a credit history. You will develop your first credit score in three to six months.

There’s no way to tell exactly what that score will be, but if you make timely payments and keep your credit balance low, you’ll likely start out in the mid-600s. If you have a late payment or a large revolving balance, your score could be in the 500s, which is not good.

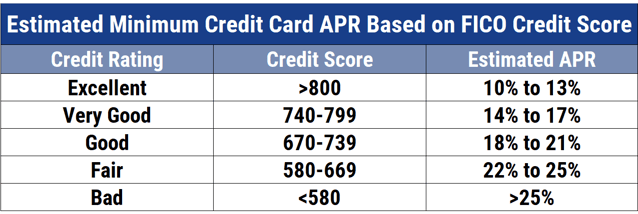

What is a Good APR For a Credit Card?

Your APR is the annual percentage rate of interest a credit card charges you for carrying a balance from month to month. You’ll often see this displayed as a percentage on your credit card statement. How much interest a bank charges you is determined by a borrower’s default risk — the likelihood you’ll default on the payments.

If you have excellent credit and the bank feels confident that you’ll repay your balance on time each month, you’ll likely have a low interest rate. But if you’re just starting out or if you have little credit history, the bank may charge you a higher interest rate to offset the risk it takes in issuing credit to you.

That’s why it’s hard to answer a question like this. A good APR for one person may be horrible for another.

If you’re a credit newcomer, you can expect unsecured card offerings to charge a variable APR of between 22% and 35%. Try to choose the card with the lowest APR offered if you don’t expect to pay your full balance every billing cycle.

Since a secured card has your security deposit as collateral, there’s less risk involved. As a result, you may find some secured credit cards with an interest rate below 10%.

Can I Keep a Student Credit Card After I Graduate?

As long as your account is in good standing, you can keep using your student credit card after you graduate. You may choose to do this if you like the card’s issuing bank or prefer the rewards or perks the card offers.

In some cases, you may have to contact the card issuer to let them know you’ve graduated. This won’t cancel your account. Instead, the bank will likely reclassify your account to reflect the change in your student status but keep your current card account active.

Other times, the bank may transition you into a non-student card with the same rates, rewards, and perks you’re enjoying with your student card. Banks need customers to stay in business. They can’t do that if they take away the products you want.

But keep in mind that many of the best rewards credit cards may have greater rewards, lower rates, and more perks than your student card. Depending on your employment and income status, you may qualify for an even better card than what you currently have.

What is a Perfect Credit Score?

A perfect FICO score is a score of 850 — which only 1.2% of Americans currently have. The truth is, banks consider any FICO score above 800 as excellent.

Once you hit the elusive 800s with each credit bureau, you’ll have access to a wide range of financial products and services for consumers with excellent credit. There isn’t a specific card or club open only to those who have an 850 credit score. So while it’s a noble goal to shoot for an 850, don’t feel like a failure if you end up in the 800s.

What Fees Do Credit Cards Charge?

The fees and charges added to a credit card are completely up to the bank that issues the card. Some laws may limit how much a bank can charge for certain fees, and credit card issuers must inform consumers of specific fees or charges.

Some fees you may find on your card will include:

- Annual fee: Some cards don’t charge an annual fee, but you may find that a starter credit card will likely include some sort of membership fee or a higher interest rate to make up for the risk associated with the card.

- Late payment fee: You’ll be hard-pressed to find a card that doesn’t charge a late payment fee. Expect some sort of penalty if you submit your payment after the due date.

- Balance transfer fee: If you move an existing credit card balance from an old card to a new card, you’ll likely encounter a balance transfer fee. Banks typically charge a percentage (2% – 5%) of the transferred amount to initiate the request. This is a smart idea if you are moving a balance to a card with a lower interest rate or a card that has a balance transfer promotional rate or intro APR deal.

- Cash advance fee: You’ll see a host of fees when you use your credit card like a debit card to withdraw cash from an ATM machine or at a bank teller’s window. This is also known as a cash advance. The amount of your fee will vary depending on your card issuer. A cash advance also has a higher interest rate than a regular purchase and has no grace period — which means you start accruing interest charges as soon as you receive your cash.

- Over-limit fee: Many credit cards will decline any transaction that brings your balance over your stated credit limit. This is typically a set amount. You’ll also immediately owe the amount you charged over your spending limit.

- Returned payment fee: If your bank declined your payment — because of insufficient funds in your checking account — you should expect a fee.

- Foreign transaction fee: You may incur a foreign transaction fee if you initiate a transaction in a currency other than your own. This fee typically equals a percentage of the transaction total.

Your bank may charge all these fees or just some of them. It’s highly unlikely that your card will feature none of these fees. Check your cardholder agreement to get a better idea of what fees your card can charge.

Should I Cancel My Credit Card Account If I Stop Using the Card?

In most cases, you shouldn’t cancel old credit card accounts — even if you don’t need the card. A lone exception may be if your account charges an annual fee that you can’t afford or don’t want to pay.

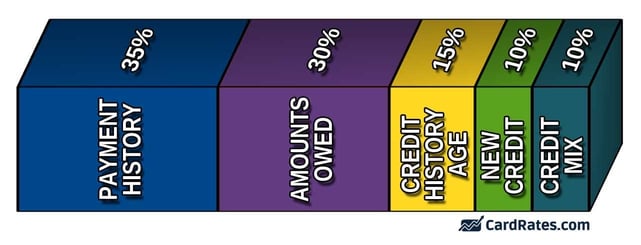

The reason you want to avoid canceling old credit card accounts is because 30% of your FICO credit score depends on the current amounts you owe and your credit utilization ratio.

Your credit utilization ratio shows how much of your available credit you’re using. If you’re using a lot of your available credit, lenders may shy away from extending you more credit. But if you’re managing your credit well and not using a majority of what’s available, a lender may see you as responsible and creditworthy.

You can calculate your credit utilization ratio by dividing your current credit card balances by the total amount of credit available to you. For example, a credit card with a $1,000 credit limit and a $400 balance has a 40% credit utilization ratio. In other words, you’re utilizing 40% of your available credit.

Lenders like to see a credit utilization ratio below 30% from applicants. If you cancel a credit account, you eliminate some of your available credit and could drastically increase your credit utilization ratio.

Let’s say you have two credit cards. One has a $3,000 credit limit and a $900 balance, and the other card has a $4,000 limit and a balance that you just paid off.

When combined, you have $7,000 in available credit and $900 in credit card debt — equalling a solid 12.8% credit utilization ratio.

If you decide to cancel the card you just paid off, you’ll erase that $4,000 from your available credit, which would increase your credit utilization ratio to 30%.

Instead of canceling a card account, consider locking the card away where you won’t be tempted to use it. Every six months, take it out and make a small purchase to keep the account active. By doing this, you’ll keep your credit utilization ratio high and help your credit score climb the charts.

Find the Best Credit Cards For Young Adults Online

A head start may get you labeled as a cheater on the playground — but in the adult world, a head start makes you smart.

That’s why it’s never too early to start thinking about your credit report. Learning about credit at a young age is a great way to prepare for adulthood, and may help you limit the mistakes that so many young adults make when they get their first credit cards.

Plus, the earlier you start, the better your credit score will be when you need it most — such as when it’s time to buy a house, purchase a car, or finance a large purchase.

With the best credit cards for young adults, you can get the head start you need to come out as a winner when it counts.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Credit Cards For Young Adults ([updated_month_year]) 12 Best Credit Cards For Young Adults ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Best-Credit-Cards-For-Young-Adults.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Young Professionals ([updated_month_year]) 7 Best Credit Cards for Young Professionals ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-Credit-Cards-for-Young-Professionals-Feat-1.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for Young Travelers ([updated_month_year]) 12 Best Credit Cards for Young Travelers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-Credit-Cards-for-Young-Travelers-Feat.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards For 18-Year-Olds ([updated_month_year]) 5 Best Credit Cards For 18-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/18.png?width=158&height=120&fit=crop)

![8 Best Credit Cards for 20- to 30-Year-Olds ([updated_month_year]) 8 Best Credit Cards for 20- to 30-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-20-to-30-Year-Olds-Feat.jpg?width=158&height=120&fit=crop)

![Understanding Credit Cards: A Beginner’s Guide ([updated_month_year]) Understanding Credit Cards: A Beginner’s Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Understanding-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![8 Low Interest Credit Cards For Beginners ([updated_month_year]) 8 Low Interest Credit Cards For Beginners ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Low-Interest-Credit-Cards-For-Beginners.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For 16- & 17-Year-Olds ([updated_month_year]) 9 Best Credit Cards For 16- & 17-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-Credit-Cards-For-16-17-Year-Olds.jpg?width=158&height=120&fit=crop)