Similar to your first job, car or apartment, your first credit card is an important milestone on your journey from youth into adulthood. To do adulting right, you’ll want at least one card in your own name.

While you can manage your personal finances without any cards, you’ll find life in the grownup world is much easier with them. Cards can help you shop online, rent a car, book an airline ticket, reserve a hotel room, set up cellphone service, and more.

Cards for beginners usually come with at least a few basic perks. Level up and you may be eligible for rewards, such as points, miles, or cash back for your card purchases. You may also get a higher credit limit, which allows you to spend more on the card and potentially earn more rewards.

Interest | APR | Fees | Payments | Statements | Rewards | Debt | Beginner Cards

Understanding How Credit Card Interest Works

Credit cards come with responsibilities as well as benefits.

One responsibility is that when you make purchases with your card, you’ll have to pay the amounts you spend to your card company. The total amount that you owe is your balance.

If you pay your balance in full every month on or before the due date or within the grace period, you won’t owe more than you charged. If you don’t pay your entire balance, however, the unpaid amount is carried over to the next month — and the next and the next and so on — until you pay it in full. Each month you carry a balance, you’ll be charged interest for that amount and any new purchases you charge.

Interest is a fee that’s calculated as a percentage of the amount you carry over.

Credit cards typically charge high interest rates compared to most auto loans or home mortgages, or the interest that banks and credit unions pay for savings and interest-bearing checking accounts.

If you make only the minimum payment on your card or any other partial payment that’s less than the interest you owe on your previous balance — plus your new purchases — the interest will also carry over, and you’ll owe interest on interest in subsequent months. The minimum payment usually isn’t enough to avoid this scenario.

You may also be charged a late payment fee, higher penalty interest rate, or both if you make a payment after the grace period ends.

Understanding Your Credit Card’s APR

Your card issuer will charge you interest for every day you carry a balance. Although the amount accumulates daily, it’s typically expressed as an annualized percentage rate (APR).

Many people who have credit cards find APRs and how they’re calculated to be a complicated subject. It doesn’t have to be.

To calculate your card’s APR, multiply your Average Daily Periodic Rate (ADPR) for your card by 365. Your ADPR should be printed on your monthly statement. Multiply by 365 because three of every four calendar years have 365 days. (The extra day in a leap year isn’t material for this calculation.) Here’s an example:

ADPR: 0.04654

Days in a year: 365

APR: 0.04654 x 365 = 16.987%

The APR printed on your statement is typically rounded, so 16.987% would be shown as 16.99%

If your card’s ADPR times 365 doesn’t equal your card’s APR, it may be because your card issuer uses 360 days instead of 365 days for its calculations. Most issuers use 365 days, but some may use 360.

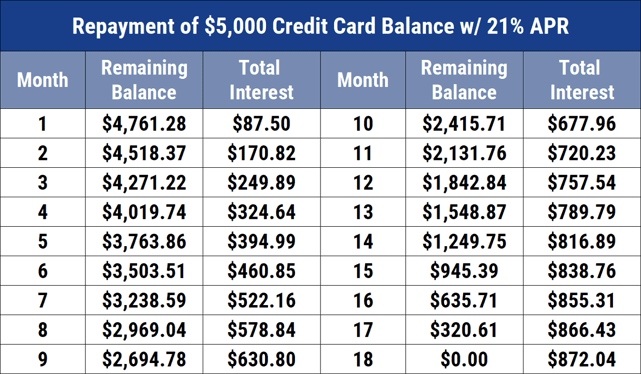

The chart below shows how your credit card’s APR affects the total interest you’ll pay over time.

If you’re carrying a balance on a card with a high APR, you may want to transfer some or all of your balance to a new card that has a 0% APR balance transfer offer. You may be charged a fee for a balance transfer, but you’ll usually get to carry your balance interest-free for at least six months, maybe a lot longer. Some balance transfer offers give you a 0% APR for 12, 15, or even 18 months.

The APR should be an important factor when you apply for a card if you plan to carry a balance. If you don’t plan to carry a balance, the APR may not be important.

Understanding Credit Card Fees

Interest isn’t the only fee you may be charged to use your card.

- Annual fee: Your card issuer may charge you this fee every year to keep your card active. Annual fees range from as little as $25 to as much as $550 or more. A fee of $95 is common. Cards that charge a higher annual fee usually offer more perks and better rewards, however, many good cards have no annual fee. Some card issuers will waive an annual fee for the first year to encourage you to apply for that card.

- Foreign transaction fee: This type of fee may be added to your transactions when you use your card in a foreign country. The fee is separate from the currency exchange rate that converts your foreign purchase into U.S. dollars. Fees of 3% are common, but many cards don’t charge foreign transaction fees.

- Processing fees: Restaurants, hotels, and other merchants pay processing fees to your card company when you use your card to pay for purchases. Though you don’t pay these fees directly, they are built into the prices of most goods and services.

- Cash advance fee: You’ll typically have to pay a cash advance fee if you use your card to get cash other than as a cash back reward. Cash advance fees of $10 or 3% of the amount, whichever is higher, are common.

- Late payment fee: You may be charged this fee if you don’t make your payment until after your grace period ends. Late payment fees range from about $28 to $39. This fee may be charged in addition to a higher APR. If you normally pay on time but make one late payment, it’s worth calling your card issuer to ask to have this fee reversed. The issuer may say yes to keep you as a satisfied customer.

It’s smart to shop around for a credit card because some have a lot of fees and others have very few. All the fees you may be charged will be disclosed in your cardholder agreement. You should read it before you use your card.

Understanding Credit Card Payments

If you carry a balance or use your card to make new purchases, you will have to make at least the minimum payment every month. That’s true even if you have a card with a promotional 0% interest rate. No interest doesn’t mean no payment.

Your minimum payment isn’t a fixed amount. Rather, it may vary from month to month, depending on your balance.

Card issuers use slightly different methods to calculate minimum payments. However it’s calculated, your minimum payment should be printed on your monthly statement.

Card companies frequently refer to a month as a payment cycle because their payment due dates don’t necessarily align with the first or last day of the month.

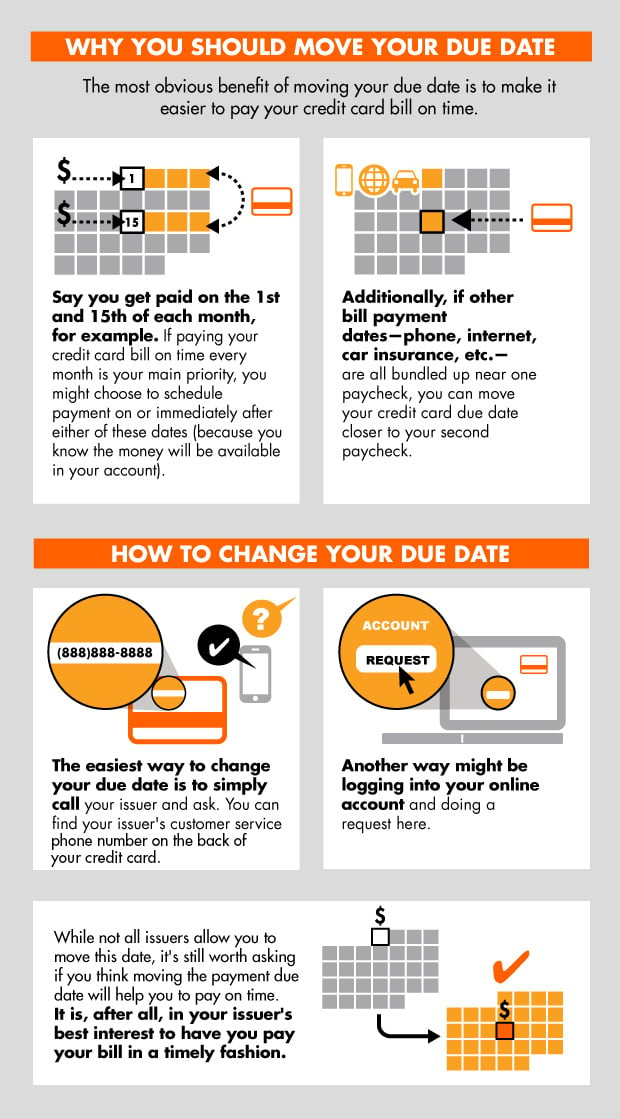

Some card issuers let you choose which day each month you want to make your payment. That can be helpful if you want to pay multiple bills on the same day, separate your bill payment dates, or schedule your payment date after you receive your paycheck.

The following infographic from Discover helps further explain the advantage of choosing your own due date.

The most important thing you should know about your card payments is that the minimum amount due may not be enough to pay off your debt in a reasonable time. In fact, your required minimum may not even be enough to pay the interest you owe for that payment cycle.

If you pay only the minimum due, the amount you owe will increase over time, perhaps dramatically. You’ll usually have to pay more than the minimum due every month to pay it off.

Understanding a Credit Card Statement

Your monthly card statement is a summary of your card activity for one payment cycle. The most important information in your statement is:

- Your balance

- Your minimum payment

- Your payment due date

Card statements aren’t all alike, but most also show:

- Payments you made

- Purchases you made

- Credits you received (e.g., for purchases you returned)

- Fees you were charged

- Interest you were charged

- Rewards you earned, including any cash back

- Cash advances you received

- Balance transfers you made

If your rewards program involves categories with different levels of rewards, you may see a category-by-category summary of the rewards you earned as well as a total. Categories may include travel, gasoline, or restaurants, for example.

Your card statement should also disclose:

- How long it will take to pay off your balance if you make only minimum payments

- How much you’d have to pay each month to pay off your balance, including interest charges, in three years

- The fee and penalty APR you may be charged if you make a late payment

- Your credit limit

You should receive a statement once a month. Typically, you can choose whether to receive a paper statement or an electronic one. Most card issuers also let you access your statements on their website.

Card issuers sometimes print important information on the back of your statement, so that’s a good place to look if you need more information. If you have questions about your statement or you need help from your card issuer, there should be a customer service phone number on your statement, too.

Understanding Credit Card Rewards

Rewards are one of the biggest perks of using credit cards. Every time you use a card to make a purchase, you may receive points, airline miles, gasoline rebates, or even cash back. The types of rewards you earn depends on your card’s rewards program.

Some cards are “co-branded,” which means your card issuer has partnered with a non-credit-card company to offer rewards that are specific to that company. Companies that offer co-branded cards include Amazon, American Airlines, Delta, Hilton, Hyatt, JetBlue, Marriott, Ritz-Carlton, Southwest Airlines, Uber, and United Airlines, among many others.

To collect and redeem rewards, you’ll have to become familiar with the rules of your card’s rewards program, which may be different for each card you have.

Different cards have different rewards values for different levels of spending. In other words, a dollar charged with one card may earn more or fewer rewards than the same dollar charged with another card.

You’ll have to read the rules and do some research to maximize your rewards. Premium cards tend to have greater rewards, but also higher annual fees.

Some cards offer bonus rewards for certain categories of spending, such as 4% for gasoline purchases, 3% for restaurant meals, 2% for travel, and 1% for everything else. The categories may be fixed or they may change from month to month.

If your card’s bonus categories change, you may have to activate (i.e., enroll or select) a category online to qualify for the bonus rewards.

Understanding Credit Card Debt

Your card balance is a debt you owe to your credit card company. If you pay your balance in full every month, you won’t be charged interest, though you may still have to pay an annual fee or other fees associated with your card use.

If you don’t pay your balance in full, your debt will be carried over to the next month and you’ll be charged interest for your balance and any new purchases you make with your card.

Carrying a balance can become quite costly. You could end up paying double, triple, or more than what your purchases would have cost if you’d paid cash or paid off your balance every month to avoid interest.

Financial experts recommend two approaches to pay off card debt:

- Pay off your lowest balances first. This approach gives you smaller, but easier and faster wins to help you get started and stay motivated.

- Pay off your highest APR balances first. This approach could help you pay less interest over the long run while you pay off your debt.

If you carry a balance and your card has a high APR, you may want to transfer all or part of your balance to a balance transfer card, which offers an introductory 0% APR for a certain time period. You may have to pay a balance transfer fee.

A balance transfer can give you an opportunity to reduce your card debt if you restrain yourself from making more purchases. You may also want to contact a credit counseling service if your debt feels burdensome.

The Best Cards for Credit Beginners

As a credit card newbie, you probably won’t be eligible for the premium cards that offer the most enticing rewards right away. Fortunately, there are plenty of good cards for beginners, and many of them come with nice packages of perks, benefits, and rewards, even for newbies.

Three types of cards to consider are:

1. Starter Cards for No/Limited Credit

Cards for beginners are often categorized with cards for people who have bad credit, but there are important differences between the two groups. Bad credit results from late and missed payments and other financial mistakes. No credit or limited credit results from inexperience.

Limited credit is sometimes called “thin credit,” which used to refer to paper files of credit documents that were literally slim. Credit beginners are also sometimes called “credit invisible” when they don’t have enough data in their credit history to generate a credit score.

Some card companies offer good starter cards, especially for thin credit and credit-invisible consumers alike. Below are our top picks.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

+ See More Cards for No/Limited Credit

2. Student Cards

Student cards are designed for college students who may need credit and have good future income potential, but don’t yet have much credit experience. Look for a student credit card with no annual fee.

Other factors to consider include the APR, signup offer, and rewards or perks, such as a statement credit for good grades. Below are our favorite student card offers.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

3. Secured Cards

If your credit history is short or you’ve had some problems with credit, you may want to consider a secured credit card. You’ll have to make a cash deposit — usually of a few hundred dollars — to get a secured card.

The deposit isn’t an amount you can spend like cash loaded onto a prepaid card. Instead, it’s collateral for your card balance. If you miss a required payment, your card issuer can use your deposit to cover the amount, plus any fees you may owe.

A secured card can be a good way to build or improve your credit. Some secured cards offer perks and rewards. Others can be converted into an unsecured card after you demonstrate that you’ve used the card responsibly. Below are our top recommended secured cards.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

Use Credit Wisely to Build Positive Credit History

A key benefit of getting your first credit card (or cards) is that your card issuer typically will report your payments to the major credit bureaus — Equifax, Experian, and TransUnion. These companies compile your credit card and other debt payments into your credit history, or credit report, which is used to calculate your credit scores.

Making your card payments on time and in full every month shows that you can use credit responsibly and should help increase your credit scores over time.

A good credit score may help you get approved for more cards, including many that offer lower APRs, more perks, or more enticing rewards. You may also be eligible for higher credit limits for your cards.

With a higher credit score, you may also be offered lower rates and better terms for other types of loans, such as personal loans, auto loans, or home mortgages. A good credit score can save you a lot of money throughout your lifetime.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What’s the Minimum Age for a Credit Card? 9 Best Beginner Cards ([updated_month_year]) What’s the Minimum Age for a Credit Card? 9 Best Beginner Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/04/minimum-age-credit-card-1.jpg?width=158&height=120&fit=crop)

![8 Best Beginner Credit Cards: No Annual Fee ([updated_month_year]) 8 Best Beginner Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Best-Credit-Cards-For-Beginners-With-No-Annual-Fee-1.jpg?width=158&height=120&fit=crop)

![11 Best Credit Cards for Beginners ([updated_month_year] Guide) 11 Best Credit Cards for Beginners ([updated_month_year] Guide)](https://www.cardrates.com/images/uploads/2019/03/credit-cards-for-beginners-feature.jpg?width=158&height=120&fit=crop)

![How Do Credit Cards Work? Expert’s Guide ([updated_month_year]) How Do Credit Cards Work? Expert’s Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/04/how-do-credit-cards-work.jpg?width=158&height=120&fit=crop)

![How to Sign Up For a Credit Card: Expert Guide ([updated_month_year]) How to Sign Up For a Credit Card: Expert Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/signup2.png?width=158&height=120&fit=crop)

![What Credit Card is Best for Me? Expert Guide ([updated_month_year]) What Credit Card is Best for Me? Expert Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/me.png?width=158&height=120&fit=crop)

![9 Best Airline Rewards Programs: Expert Guide ([updated_month_year]) 9 Best Airline Rewards Programs: Expert Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/airline.png?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)