Building credit is all about being smart with your money — and researching no annual fee credit cards for fair credit is a smart move.

Instead of paying a hefty fee each year for card membership, you can gain access to a revolving line of credit for no cost at all. Even better, these cards report your payment and balance history to each credit bureau, which helps you build your credit history over time.

And the cards listed below aren’t just basic credit starter kits. With many, you will find cash back rewards, purchase protection, and other perks that make them a great addition to your wallet.

Best Overall | Best of the Rest | FAQs

Best Overall Card for Fair Credit with No Annual Fee

The Capital One Platinum Credit Card tops our list because of its ability to help you now and in the future. This is Capital One’s top starter credit card that offers a competitive interest rate, reliable service, and regularly offers credit limit increases if you display responsible financial behaviors.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

This card also packs some nice perks under the hood. Every cardmember receives complete fraud coverage if a card is lost or stolen, as well as access to the award-winning Capital One mobile application that makes it easy to manage your account, make a payment, and monitor your transactions and balance.

But perhaps the most attractive feature of this card is its long-term value to your wallet. Since Capital One maintains many credit cards in its portfolio, you can eventually graduate to a better card over time without having to cancel your account and apply for membership with a new bank.

More Cards for Fair Credit with No Annual Fee

The following cards are designed for fair-credit applicants and charge no annual fees. Some of the cards listed are for students and come with student-centric perks and rewards found on most cards for good or better credit.

The Capital One Quicksilver Student Cash Rewards Credit Card is a solid cash back card for anyone enrolled in school. There is no annual fee or foreign transaction fees. This card is identical to its non-student sibling, the Capital One Quicksilver Cash Rewards Credit Card, which requires good credit to qualify for.

Most student cards are real bargains, providing similar benefits to cards for better credit scores, and this card is no exception.

The DCU Visa® Platinum Credit Card offers no annual fee for qualified applicants. The card’s website says it is available for consumers with average credit, which is generally synonymous with fair credit.

In addition to no annual fee, it comes with a super-low interest rate in lieu of purchase rewards. Although Digital Credit Union does provide a Platinum Rewards alternative with a slightly higher interest rate.

The Deserve® EDU Mastercard is a great offering for international students because it does not require a Social Security number, charges no annual fee, and has no foreign transaction fee. But don’t think this card is only for international students.

Every cardmember receives cash back for everyday purchases, a competitive variable APR, and a free Amazon Prime Student membership (a $59 value) after spending $500 within your first three billing cycles.

If you have military affiliation, the More Rewards American Express® Credit Card may be a viable option. It’s another card that says it approves “average to excellent” credit (average generally meaning fair), but you can see whether you prequalify for the card before you apply.

Navy Federal is a credit union that requires membership before you can prequalify and apply. ”

To become a member, “You or one of your family or household members must have ties to the armed forces, DoD or National Guard,” and you’ll need to deposit $5 into a membership savings account, according to the Navy Federal website.

This card is currently not available.6. Indigo® Unsecured Mastercard®

The Indigo® Unsecured Mastercard® has a tiered annual fee structure that’s based on your creditworthiness and can charge anywhere between $0 and $99 each year for card membership. You can attempt to prequalify on the bank’s website to see which tier you fall in with no damage to your credit score.

This card should only have a place in your wallet if you do not have to pay an annual fee. Otherwise, it offers a very low starting credit limit and a high interest rate that makes this a less-than-ideal choice for someone with better options.

Can I Get a Credit Card With a Fair Credit Score?

Credit card issuers love consumers with fair credit — otherwise known as average credit — because they fall within a gray area between bad credit and good credit. This means that these cardholders don’t pose the same risks as someone who has bad credit, but they also incur slightly higher fees than someone who has good credit.

For most banks, that’s the best of both worlds.

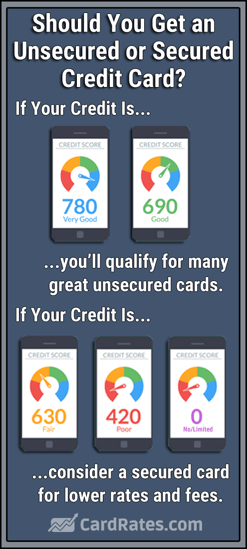

But if you fall within the fair credit range — which typically means a FICO score of between 580 and 669 — you can also find some very good credit cards that can help you get that extra boost you need to get into good credit territory.

Your best bet is to find a credit card company that offers several credit cards for consumers with different types of credit. That means a portfolio of cards for fair credit, good credit, and even excellent credit.

A bank like this offers you a clear path on your credit building journey. As you prove to be a responsible borrower and your credit score improves over time, you can request upgrades and credit limit increases.

If you start with a bank that specializes in cards for average credit only, you’ll be stuck with that one card until you’re ready to upgrade. When that happens, you may have to cancel your current account and apply for a card with another bank. Starting your credit journey with an established bank helps cut out the middle man.

Banks — including Capital One and Wells Fargo are already considered some of the top financial institutions in the country. Thankfully, they also offer credit cards for just about every credit score tier.

And since most of these cards don’t charge an annual fee, you can increase your spending power without paying for the privilege.

What is a Credit Card Annual Fee?

Credit cards are issued by banks. Each bank sets the terms, credit limits, and fee structures for every card it offers to the public.

That means it’s totally up to the bank whether it charges an annual fee for card membership. Some banks choose to charge a fee to cover the costs of managing the card, and others choose to skip the fee and make up the cost in other areas, such as by charging cardholders a higher interest rate or monthly maintenance fees.

A bank may charge an annual fee for several reasons:

- To cover operating costs: Banks are in business to make money. Credit cards cost money to operate. Instead of eating that expense, a bank may choose to pass it on to its cardholders in the form of an annual fee. This helps pay for the infrastructure, software, hardware, and staffing needed to keep credit cards operational.

- To offset rewards payouts: The ability to earn cash back or other rewards incentivizes consumers to use their credit cards more often. That means banks earn more transaction fees from merchants. Still, paying out all of those rewards gets expensive. Adding an annual fee to a credit card helps cover some of those costs.

- To pay for other perks: A credit card isn’t just for making purchases. Some cards on the market offer tremendous perks, including annual airline credits, access to luxury airport lounges, free meals, and other pricey benefits. The cost of those top-shelf perks is sometimes added to a card’s annual fee.

- To offset risk: Credit cards designed for consumers who have bad credit come with an inherent risk to the card issuer. An unsecured credit card does not require a deposit for approval. If the cardholder stops making payments, the bank has no way to recoup its lost money. To offset those risks, some banks may charge an annual fee.

A general rule of thumb is that any card that offers lots of rewards and perks will often have either an annual fee or an elevated variable APR that adjusts with the prime rate to offset the cost of those benefits.

But that doesn’t mean you can’t find a good credit card that adds exceptional value to your wallet without charging an annual fee. Several cash back rewards card options are listed above. You can also find cards that skip the cash back and instead offer a low interest rate to help you pay off credit card debt faster and with less expense.

Some cards charge new cardholders no annual fee and offer them a promotional period that may include a temporary 0% APR on new purchases or a balance transfer deal that allows them to move existing credit card debt from an old card to a new card that has a lower APR.

What is Considered Fair Credit?

There are literally hundreds of credit scores, but the industry standard is the FICO credit score, which is used in 90% of lending decisions. FICO says a fair credit score is a score of between 580 and 669.

FICO breaks its credit scores into ranges, between 300 and 850, each with its own designation. For example, a credit score of between 800 and 850 is considered exceptional, or excellent credit.

A good credit score falls between 670 and 739. A score between 580 and 669 is considered fair credit, or average credit. A poor credit is any score below 579.

According to the credit bureau Experian, approximately 17% of Americans have a fair credit score.

While fair credit is still considered subprime, the credit cards offered to these consumers often have better terms and fewer fees than the cards designed for applicants who have bad credit.

Your fee structure will also likely depend on where you fall within the fair credit range. A consumer with a credit score closer to good credit will have more lucrative credit card offers than one with a credit score trending closer to poor credit.

Does Every Credit Card Have an Annual Fee?

Many credit cards do not charge an annual fee. Although these cards do not require annual payments, most still offer very good benefits that include good interest rates, fraud protection, and potential cash back or bonus point rewards on all eligible net purchases.

Fees and charges are completely at the discretion of the bank that issues the credit card. As a result, some cards may charge for membership and others may not.

Some cards offer a tiered annual fee structure that depends on your creditworthiness to determine how much, if anything, you’ll pay.

For instance, a card may have annual fee tiers of $0, $39, $59, $79, and $99. When the bank runs your credit check during the application process, it will put you into one of these tiers that may require an annual fee when you activate your credit card.

That fee will remain the same throughout the life of your credit account. The bank will deduct that amount from your available credit every year on your account anniversary and will not recheck your credit to see whether you fall within a new tier structure.

In some cases, you can attempt to prequalify for a card through the issuer’s website. This short form allows the bank to perform a soft credit check that does not harm your credit history. Doing this allows the bank to see whether you will qualify for the card if you decide to formally apply. It will also let you know which annual fee tier you may qualify for.

Is it Worth Paying an Annual Fee For a Credit Card?

Regardless of where you fall on the credit score spectrum, whether it’s bad credit or excellent credit, an annual fee may be worth your time, money, and effort.

An annual fee may be the only choice for consumers who have bad credit and want an unsecured credit card. Few unsecured credit cards for bad credit allow free membership. The annual fee works to offset the risk that any bank takes when issuing these cards.

If you have bad credit and want to avoid an annual fee, your best bet may be to consider a secured credit card that requires a refundable security deposit for approval. The beauty of a secured card is that it allows you to choose your own credit limit based on the amount of your deposit.

On the other end of the credit universe are those who have excellent credit. While these consumers have very little risk associated with their credit history, they can easily rack up hefty annual fees on their credit cards.

But instead of paying to offset risk, these fees help to provide unbeatable perks. Fees for cards for people with excellent credit can fall between $95 and reach several thousand dollars depending on the card. For that kind of money, you can earn annual airline travel credits, free membership in exclusive travel clubs, high cash back rewards rates, bonus points, and other high-end perks.

But despite the annual fee, you can actually make money off these offerings if you play your cards right.

If you fall in the middle somewhere between fair and good credit, you may not find much use for a card with an annual fee. Several credit cards in this range offer good interest rates, solid rewards potential, and other handy benefits at no extra charge. Check out the list above to see all the solid choices you can add to your wallet for free if you have an average credit score.

What Type of Credit Cards Typically Charge Annual Fees?

Annual fees typically apply to credit cards that have very lucrative rewards or cards that have more risk attached to them than the average credit card. For example, a bank may add an annual fee to credit cards for bad credit consumers because those cards carry more risk.

As you improve your credit score and move up to a card for fair credit, you may not be charged that annual fee any longer.

Banks also typically add annual fees to cards that have many perks. The Chase Sapphire Reserve®, for example, sports a hefty $550 fee but provides benefits that can outweigh that cost.

What you’ll find with annual fees for excellent credit consumers is that the fee is often indicative of the rewards offered. While you can find great rewards options with no annual fee, you can step up your rewards game if you’re willing to pay.

Can I Negotiate My Credit Card Annual Fee?

Some banks may be willing to listen to your negotiations to waive your annual fee — but you’ll likely only get their attention if you’re a long-standing customer with very few blemishes on your credit report.

Banks make money off long-term customers. The longer you stick around, the more important you are to a bank. That becomes even more obvious if you pay at least your minimum credit card payment on time each billing cycle and give the bank little reason to worry about your reliability.

To keep these customers happy, a bank may consider waiving your annual fee if it feels that it may lose your business otherwise. After all, it costs more to attract new customers than it does to keep current customers happy.

Before you contact your credit card issuer to request an annual fee waiver, make sure you have a few negotiation tools ready. These include:

- Your full history with the bank: How long have you been a customer and how prompt have you been with your payments? Don’t estimate or offer generalities — such as “I’ve been a customer for a long time.” Know your exact time frame and use it to your advantage. Showing that you’re prepared is a great way to get the bank’s attention.

- Understand the value of the card: If the card doesn’t offer enough value to offset the annual fee, let the customer service rep know that you’re not fully pleased with the card.

- Know the competition: The only thing worse for a bank than losing a customer is losing a customer to the competition. Does another bank have a similar card with no, or a lesser, annual fee? Bring that up as well. Let the bank know that you’re researching other cards and aren’t against the idea of switching banks.

It may come down to you suggesting that you’re considering canceling your account instead of paying the next year’s annual fee. In many cases, the customer service representative may look for ways to either waive your annual fee or move you into a card with similar perks and no annual fee.

You may also have to escalate your negotiations by requesting to speak to a manager on duty. In some cases, banks do not give customer service reps the ability to waive or reduce annual fees. That’s a power that’s reserved for a supervisor.

Instead of wasting time pleading your case to someone who can’t help you, jump to the top of the food chain from the outset and give it your best shot.

How Can I Get a Credit Card With No Annual Fee?

Credit card issuers can choose whether they want to add an annual fee to the cards they offer. Thankfully, you can also choose which credit cards you want to apply for.

The easiest way to get a credit card without an annual fee is to limit your search only to cards that don’t charge for card membership.

Lots of no annual fee credit cards for fair credit are on the market — and the number seems to grow every day as competition expands. That competition means that banks now offer more affordable and lucrative credit cards than ever before.

If you want to join in on that action, you can create a list of the cards that you’re interested in that have no annual fee. From that list, you should whittle the candidates down to those that offer prequalifying. Taking this step may limit potential damage to your credit score.

Whenever you apply for credit or a loan, the lender conducts a credit check under your name that leaves a hard inquiry on your credit report. This inquiry will live on your credit history for two years and let future lenders know how often (as long as it’s within two years) you’ve applied for credit.

A few inquiries are no big deal. But once you start to accumulate four or more over a two-year span, lenders may view you as someone who is a greater risk and in desperate need of more credit. That can lead to application rejection. Too many inquiries can also lower your credit score.

But when you attempt to prequalify for a credit card, the bank will use a soft credit pull to gain access to a limited version of your credit report. This type of credit check will not reflect on your credit report and won’t damage your credit score.

Just remember that prequalifying for a credit card does not guarantee that you’ll receive the card when you officially apply. At times, there may be a negative item that appears on your full credit history that was not obvious on your limited credit report. If that happens, a bank can rescind its prequalifying status and reject your application.

Still, prequalifying for a card is a strong indicator of future success if you apply for the card. Keep in mind that any official application will require a full credit check, which leaves behind a hard inquiry. That shouldn’t concern you, though, if you already have the peace of mind knowing you’re prequalified.

Once you’ve narrowed your list to the best cards without an annual fee, you can attempt to prequalify for your favorites and see which card provides the best interest rate, credit limit, and benefits. That card should be the one you officially apply for.

What Other Fees Do Credit Cards Charge?

An annual fee is just one way that banks make a little money or offset risk when issuing credit cards to consumers. You may see several other charges on your credit card statement — which is why it’s important to understand those potential fees before taking the leap and opening an account.

Besides an annual fee, the other most common credit card fees include:

- Interest Rate Fee: Banks make money with credit cards by charging interest on all the money they lend out. Interest is calculated as a daily percentage of your card’s balance that is not paid within the card’s purchase grace period.

- Late Fee: Most cards add a late fee if your monthly payment arrives within a certain time frame after the due date. The fee amount will vary by the bank or card issuer. Some banks also initiate a penalty APR that can temporarily or permanently increase your interest rate following a late payment.

- Balance Transfer Fee: Some cards charge a balance transfer fee when you transfer an existing balance from one card to another. The fee may be worth it if your new card has a lower interest rate than your old card. This fee is usually 3% to 5% of the amount of debt you transfer.

- Over-Limit Fee: Some banks will simply decline any transaction that attempts a charge that puts you over your available credit limit. Other cards provide a purchase cushion that lets you exceed your spending limit by a set amount — typically between $10 and $100. If you do this, though, you can expect an added fee on your next statement.

- Cash Advance Fee: Your credit card may allow you to withdraw a set amount of money from your card account at an ATM or bank teller window. This is known as a cash advance. Banks typically charge approximately 3% of the amount withdrawn from your credit line as a cash advance fee. You will also have no grace period for this type of transaction and will immediately begin accruing interest charges on the amount you withdraw. Most credit cards also charge a higher interest rate for cash advances than they do purchases.

- Foreign Transaction Fee: If you make a purchase in a foreign country — or one that requires payment in a currency other than your native currency — your issuing bank may charge a foreign transaction fee to convert the amount spent. This is usually a small percentage of the total transaction.

- Returned Payment Fee: If you send in a check or submit an online bank transfer for a payment that bounces due to insufficient funds, you will likely encounter a returned payment fee of $25 or more.

- Card Replacement Fee: If you lose your credit card, the bank will need to freeze your account and print and send you a new card. You may be charged a fee that varies based on the card issuer, but most banks replace cards for free. Some cards allow you to freeze your account in real time from a mobile application at no added charge.

Fees are nothing new in the banking world. Although you may find promotional periods that waive certain fees or charges for a limited amount of time — such as a 0% introductory APR offer or 0% balance transfer deal — there’s no way to avoid all credit card fees altogether.

If a bank charged no credit card fees at all, it wouldn’t make money, and would quickly go out of business.

Can I Cancel a Credit Card Before the Annual Fee is Due?

You can cancel a credit card at any time and for any reason. But you may still have to pay an annual fee after canceling your card.

That’s because a bank may charge your annual fee if you still have an outstanding balance on your account. This is because even if your card is no longer active, your account will remain open while you pay down your balance.

Technically, your annual fee is to maintain your account and not just the card, which makes you still liable for the fee. Some banks may opt to eliminate your fee if you close your account and are making regular payments toward your active balance.

If you cancel your credit card account with no balance, you will not incur an annual fee. This is because your account is no longer active, and you do not require the services that the fee covers.

What is the Easiest Credit Card to Get With Fair Credit?

There are two main types of credit cards: Unsecured cards and secured cards. A secured credit card will require a refundable security deposit to activate your account. Since that deposit acts as collateral for your account, many banks will bypass a credit check and issue a card regardless of the applicant’s credit history.

As a result, a secured credit card is the easiest credit card to get for any credit score.

As a result, a secured credit card is the easiest credit card to get for any credit score.

Most secured cards allow you to set your spending limit based on your deposit amount. This means a deposit of $500 will net a card with a $500 credit limit.

Your secured card will work in all the same ways that an unsecured card works. You can use it to pay bills, pay for car rentals or hotel rooms, or to make purchases online or in-store.

Your deposit doesn’t count as a payment, and you will still have to pay off all charges — with interest — that you place on the card.

If you don’t want the upfront costs of a security deposit, consider an unsecured credit card that does not require a deposit. These cards may offer lower credit limits and higher interest rates, but that may be worth it if you want to avoid a deposit.

As the top-rated card on our list, the Capital One Platinum Credit Card may also be one of the easiest cards to qualify for. This card accepts applications from consumers who have fair and limited credit and has relaxed approval standards for new cardholders.

And while the card does not come with very high initial credit limits, Capital One regularly monitors accounts and may automatically increase your credit limit whenever you qualify for a boost.

In time, you may also qualify for an upgrade to a card with greater benefits and more lucrative rewards.

What Kind of Rewards Can I Get With Fair Credit?

Rewards cards for fair credit applicants typically offer cash back as the main reward. You don’t usually see bonus points or travel miles rewards until you get into the good credit category.

With fair credit, most cards offer a flat rate of unlimited cash back that can range between 1% and 1.5%. So, for every eligible purchase you make, you will receive a rebate for that percent of the total amount charged.

You can typically redeem your cash back for a statement credit that erases all or part of your credit card balance. Some card issuers will also send you a check for your earned rewards or electronically deposit them into a linked checking account or savings account.

In some cases, the credit card issuer may add an annual fee to offset the cost of the rewards it pays out. This can make these cards far less valuable.

Consider an average fair credit card that has a $300 credit limit, a $95 annual fee, and a 1% cash back rewards rate.

With that level of cash back, you would need to charge $9,500 to your card each year just to break even. And, with a low $300 credit limit, you would have to max out your card 32 times — or once every 11.5 days — just to recoup your annual fee.

This is why cash back rewards — or any rewards for that matter — should not be the deciding factor in which card you want to apply for. If you have fair credit, your goal is to attain a good credit score and, eventually, an excellent credit score. Instead of focusing on rewards and perks, look for a card that will get you to your goal both efficiently and cheaply.

Do I Have to Pay an Annual Fee For Credit Card Rewards?

As stated above, banks can dictate the fee structure for any credit card they offer to the public. That means that some cards will come with an annual fee and others will not.

Many rewards cards on the market do not charge an annual fee. You typically start to see annual fees with cards that offer larger rewards, including annual travel credits, TSA Precheck credits, and airport lounge access.

But if you’re looking for basic cash back, air miles, or bonus points, you can often find a very good rewards credit card with no annual fee.

If you have fair credit, you may find some rewards cards that have a tiered annual fee structure that’s based on your creditworthiness. If you’re on the high end of fair credit and closing in on good credit, you may not incur an annual fee for card membership. But if you’re just crossing over from bad credit into fair credit, you may only qualify for an account that charges an annual fee.

What is the Fastest Way to Build Credit?

Several factors make up your credit score. Some take time and patience and others may allow a quick fix with a little financial flexibility. Things to consider when looking to build credit include:

- Your payment history accounts for 35% of your credit score. This doesn’t factor in how large your payments are — only that they were submitted on time. If you have late payments on your credit report, you can lessen their impact by making all of your future payments on time.

- Your outstanding debt accounts for 30% of your credit score. This factors in your credit utilization and how much money you owe overall. You can make a quick impact on this category by paying down existing debts.

- Your length of credit history accounts for 15% of your credit score. Banks like applicants who have a long and successful credit history. Seven years is considered a good length of credit history. There’s no way to rush this.

- Your new credit accounts for 10% of your credit score. Opening too many credit accounts in a short time frame is a red flag for banks. Don’t open any new accounts unless it’s absolutely necessary.

- Your credit mix accounts for 10% of your credit score. Aside from credit cards, lenders like to see consumers who have successfully managed other types of debt — including auto loans, home loans, personal loans, or student loans.

You should approach your credit building journey as a marathon and not a sprint. Although you can pay down debt to quickly improve your credit score, the other factors that determine your rating take time and patience.

Is Fair Credit the Same as Bad Credit?

Fair credit and bad credit are very different, though both are considered subprime.

A bad credit score is a FICO score that falls between 300 and 579. This is typically indicative of someone who has several recent negative items on his or her credit report. This consumer will likely only qualify for credit cards and loans that have higher interest rates and other fees.

Fair credit — also considered average credit — is a step above bad credit and typically falls in the FICO range of 580 to 669. This person may have a mistake or two in his or her financial past, but time and recent positive items have worked to lessen the impact of the previous slips.

Someone with fair credit may also be fairly new to credit and does not have enough data on his or her credit report to generate a better credit score. Lenders see these borrowers as less of a risk and may provide better credit card offers with no annual fee and small rewards.

How Many Credit Cards Is Too Many?

There is no limit to how many credit cards a person can have — though some banks limit how many cards they will issue to a consumer. For example, one person can’t have more than two Capital One credit cards. The Chase 5/24 rule limits how often you can apply for credit through the bank.

Besides those limitations, a person can have as many credit cards as they can qualify for. Many people sign up for new cards simply to take advantage of introductory offers. Others limit their card applications only to when they truly need more credit.

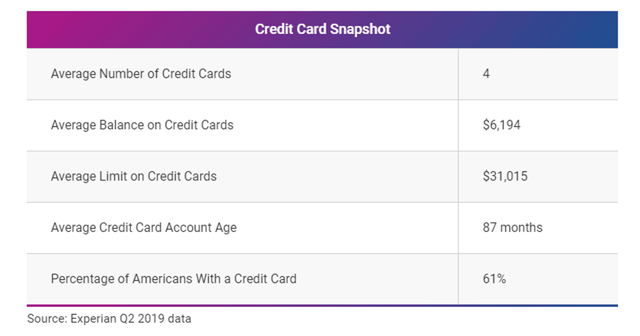

The average consumer has four credit cards.

Experian found that Americans have an average of four credit cards, according to Q2 2019 data.

If all the cards in your wallet charge annual fees, adding to your portfolio could get expensive. Also, if you carry a balance on several cards at once, you could rack up finance charges fast while spreading your monthly budget thin with multiple monthly payments.

A good rule of thumb is to only keep as many credit cards as you can realistically afford. Added credit brings added temptation to spend. If you think you may succumb to that temptation, you’re better off limiting the number of cards in your wallet — or keeping some of your cards at home.

Only Settle For the Best No Annual Fee Credit Cards For Fair Credit

Research is the key to finding the best no annual fee credit card for fair credit — and if you’ve made it this far, you’ve mastered the course.

Remember that to build credit, you must stick to credit cards that are both efficient and cost-effective. Never pay an annual fee unless the perks are worth the cost — or you have no other choice. And, if you have fair credit, you definitely have a choice.

Choose a card issuer that can help you grow by offering card upgrades as you improve your credit score. By doing that, you can scale your credit-building mission without having to search for new cards every step of the way.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year]) 5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Credit-Cards-For-Bad-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![8 Best No Annual Fee Credit Cards ([updated_month_year]) 8 Best No Annual Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/annualfee.png?width=158&height=120&fit=crop)

![13 Best No-Annual-Fee Credit Cards ([updated_month_year]) 13 Best No-Annual-Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/03/best-no-annual-fee-credit-cards.jpg?width=158&height=120&fit=crop)

![14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year]) 14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Rewards-Credit-Cards-with-No-Annual-Fee-Feat.jpg?width=158&height=120&fit=crop)

![7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year]) 7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/No-Annual-Fee-Credit-Cards-with-Rewards.jpg?width=158&height=120&fit=crop)

![7 Secured Credit Cards With No Annual Fee ([updated_month_year]) 7 Secured Credit Cards With No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_29251765.jpg?width=158&height=120&fit=crop)

![7 Best Student Credit Cards With No Annual Fee ([updated_month_year]) 7 Best Student Credit Cards With No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Student-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)