Twenty-three percent of millennials don’t have a credit card, according to TD Bank’s 2019 Annual Consumer Spending Index, which means they’re missing out on benefits that can enhance their lives. So, should you pick a card, any card, and be done with it? Oh no.

If you’re an emerging career-driven consumer, getting the account that best suits you requires some consideration. After all, you wouldn’t buy a new laptop without first investigating the advantages and prices of the different types that are available. A credit card is no different.

There are hundreds of credit card options on the market today and sifting through all of them would take a tremendous amount of time. Each has its own set of benefits, and some may be more appealing to you than others. To make it easy, here are 10 great credit cards that will suit you as a young professional, based on the different features you may desire.

Signup Bonus | Points | Cash Back | No Annual Fee | Ride-Sharing | Travel | Flexibility | Dining | Entertainment | 0% APR

Best Sign-Up Bonus for Young Professionals

Some credit cards will give you a one-time bonus just to get their card, and the value of that bonus can be huge. With the Chase Sapphire Preferred® Card, you’ll earn bonus points after meeting the minimum spending requirement within the first three months of opening it.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

Points are worth 25% more when you redeem them for travel through Chase Travel.

Best Points Card for Young Professionals

Many credit cards allow you to earn rewards each time you buy something, but some programs are more generous than others. We like the Bank of America® Premium Rewards® credit card for its redemption options.

- Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don't expire as long as your account remains open.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% - 27.24% Variable APR on purchases and balance transfers

|

$95

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

More specifically, you can redeem rewards right into your Bank of America bank account or eligible investment account to increase your bottom line, and the airline statement credit makes up for the annual fee.

Best Cash Back Card for Young Professionals

One of the most attractive credit card features is being able to earn money as you use the card. The Citi Custom Cash® Card earns you the most cash back on whatever you bought most in certain eligible spending categories every billing cycle.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

This card does away with rotating and tiered spending categories to making earning cash back easy.

Best No Annual Fee Card for Young Professionals

Annual fees are fine when you get more out of the card because of all the valuable benefits, but the Discover it® Cash Back card still comes with cool features.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

This card is a great option for young professionals who want valuable features such as free access to their FICO credit score and top-notch customer service.

Best Rideshare Rewards Card for Young Professionals

As you may already know, Lyft and Uber are convenient ways to get around, but the bills can add up fast. If you use these companies frequently, the Blue Cash Preferred® Card can make a big difference in reducing those expenses.

Cardholders also receive fraud protection, extended warranties, and cellphone protection of up to $1,000 per claim when you use your Amex card to pay your phone bill.

Best Travel Rewards Card for Young Professionals

In addition to the impressive signup bonus you’ll get after charging a certain amount in the first three months of card activation, the Capital One Venture Rewards Credit Card offers two times the miles on every purchase you make. This could mean serious travel miles rewards if you meet the criteria.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

You can use your miles to fly on any airline or stay at any hotel with no blackout dates. There are no foreign transaction fees.

Best Payment Flexibility for Young Professionals

If you’re the type of person who needs more flexibility in your account management schedule, the Citi Simplicity® Card may be right up your alley. You’ll never be charged a fee for paying late (and the issuer won’t jack up your interest rate if you do), and you can set up your own personal bill payment schedule.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

This card charges no late fees, no penalty rates, and no annual fee, making it a great starter option for anyone new to credit.

Best Restaurant Rewards Card for Young Professionals

Is your fridge keeping a handful of expired food items cool, or do you rely on others to make or deliver meals for you? The American Express® Gold Card deserves a spot in your wallet.

The annual dining credit only covers about half the cost of the annual fee, but you’ll also receive a $100 annual airline fee credit. If you use both, this card may be worth having in your wallet.

Best Entertainment Rewards Card for Young Professionals

Aside from the cash back you’ll enjoy on dining and entertainment purchases, the Capital One SavorOne Cash Rewards Credit Card will also help you have an especially good and swanky time. As a cardholder, you’ll gain access to premium experience packages, including special sporting events and concerts.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

You’ll receive early ticket access to select sporting events, music festivals, and premier food and wine festivals (among other events), plus exclusive discounts — all without paying an annual fee.

Best Interest-Free Card for Young Professionals

This is a smart card to use if you know you’ll be buying some expensive items but don’t have all the money to pay for them at once. The BankAmericard® credit card offers a promotional 0% introductory APR on new purchases and balance transfers and charges no annual fee for the convenience.

10. BankAmericard® credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to BankAmericard® credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

You may also receive a relatively low variable APR once the intro period ends.

How Do I Choose a Credit Card for the First Time?

If this is your starter account, be aware that every credit card issuer will expect you to meet certain qualification requirements. So not only should the account have the best terms and fit the demands of your unique lifestyle, you have to be an attractive applicant to the credit card issuer. It’s like dating — you both have to like each other enough to move forward with the relationship.

Your first step will be determining what you most want out of a credit card. Let your needs and desires lead the way. For example, if you really want to travel, a credit card that helps you earn miles for free flights and hotels will be where you want to focus your attention, but it won’t make sense if you’ll be sticking close to home for a while. And a sign-up bonus is wonderful, but not if you can’t meet the minimum spend.

When you’re clear on what motivates you, take a close look at the credit requirements for the card. Having a steady job will be an important qualification factor, but so will your credit history. Pull your credit reports from annualcreditreport.com (a free and safe site) to see what’s on your reports.

You can get free copies of your credit reports — one from each bureau — on annualcreditreport.com.

If you took out student loans and have never missed a payment, that’s working in your favor. Perhaps you’re a cosigner on a car loan and that too is showing up on your file in a positive way. Pulling your credit reports is also an opportunity to clear up any errors you may spot by disputing them with the credit reporting bureaus.

Mistakes and fraud can hurt your ability to qualify for a credit card because high debt and collection accounts make it seem like you’re a poor credit risk.

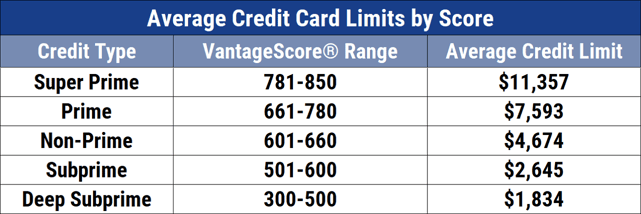

Then check your credit scores to see where you stand numerically. FICO and VantageScore are the two most common credit scoring models, and their scores range from 300 to 850. Having higher scores is preferable since they are a predictor of lower credit risk.

Although credit cards are available to just about anybody, including people whose scores are at the bottom of the scale, scores in the 700 and above range will give you access to far greater account options.

What is the Best Credit Card for Someone Just Starting Out?

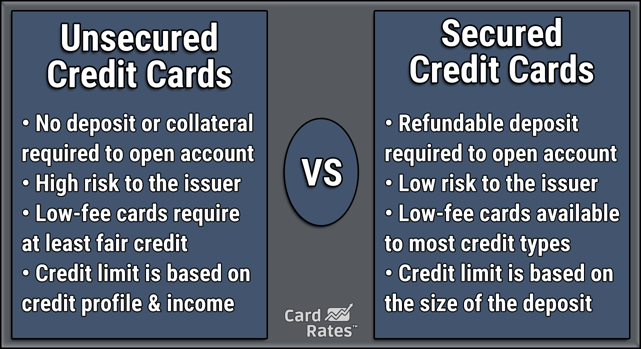

In the event you have no credit report because you have no loan associated with your name — or you do but your credit scores are very low — you may want to start out with a secured credit card. These products are much easier to qualify for than their unsecured cousins.

With secured cards, you make a cash deposit that will guarantee the credit line. That sum is typically the same as the amount you’re allowed to charge. Therefore, if the security deposit is $1,000, that will also be your credit limit. The issuer assumes very little risk because if you don’t satisfy a debt you acquire on the card, the issuer will take the funds held in deposit.

Secured cards function the same as unsecured credit cards but the majority of them come without the bells and whistles you may want. Use one responsibly by paying on time and in full, however, and it won’t be long before you create a strong credit score. It takes about six months to develop a FICO score and a couple of months to produce a VantageScore, so the sooner you start charging responsibly, the better.

Some secured cards even transition into unsecured cards after a specific number of months of responsible use. Just make sure the issuer sends your account information to the three credit reporting agencies — Experian, Equifax, and TransUnion — as not all do.

A final bit of good news regarding secured cards: You’ll always know that you have money set aside as savings. You can close the secured card any time your balance is at zero to reclaim the deposit. It’s comforting to know the cash is there should you need it.

After your credit scores are in the good to excellent range, you will probably be eligible for credit cards with a number of perks.

How Many Credit Cards Should One Person Have?

There is no specific number of credit cards you should have to create and maintain a high credit score. If you have a few cards you keep active with positive borrowing and repaying habits, you will certainly populate your credit reports with great information.

Begin with one credit card. Keep it in good standing by paying on time and in full each month and then add others that appeal to you when you’re ready to reap more benefits. But be prudent with the applications — your credit score will be impacted each time you apply and with every new account you get. Apply for a bunch all at once and your scores will decline, making it tougher to qualify for the account you want.

You’ll also want to review every account you have to check for accuracy and track spending. You should pull up the account information online on a weekly basis, read over what you’ve spent and where, and stop charging when the balance is getting too high for ease of payment.

You can become overwhelmed and give up on this process when you have several credit cards in use. Not keeping track of your card charges can quickly build into unmanageable debt. You’ll also want to stay on top of the points and cash you’re racking up and know when certain categories are offering increased reward accumulation. In short, don’t have so many cards that managing them becomes laborious or confusing.

What you want is enough of a cumulative credit line to cover your projected spending. A single credit card that has a small limit may be insufficient, so adding one or two more with a higher credit limit to your wallet may be a wise idea. Below is a chart of the average credit limit available based on one’s VantageScore.

Many people have a credit card in reserve for emergencies, so think about the various expenses that could conceivably come up in your life and how you would pay for them on the fly. There’s a chance you’ll come up short. According to a recent LendingTree survey, only 40% of millennials can cover a $1,000 emergency expense with cash in the bank.

A credit card that allows you to charge something like an expensive car repair bill so you can continue to drive to work can act as a crucial safety net. Because you don’t want that charge to hurt your credit utilization ratio, which will bring down your credit scores, the credit limit should be high enough to cover an emergency expense but not add a balance you can’t pay off.

Be Realistic with Your Spending and Expectations

Remember, shopping for a credit card is like shopping for any other important product — you’ve got to be realistic. A pre-owned vehicle may be within your financial means now, but a tricked-out Tesla isn’t. That doesn’t mean it won’t be in the future. You just have to build up to it. So start with the credit card you’re eligible for and that best suits your needs, then add to your plastic portfolio when you’re prepared to handle a few more like a seasoned credit pro.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Credit Cards For Young Adults ([updated_month_year]) 12 Best Credit Cards For Young Adults ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Best-Credit-Cards-For-Young-Adults.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for Young Travelers ([updated_month_year]) 12 Best Credit Cards for Young Travelers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-Credit-Cards-for-Young-Travelers-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards For Young Adults ([updated_month_year]) 7 Best Credit Cards For Young Adults ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Best-Credit-Cards-For-Young-Adults.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards For 18-Year-Olds ([updated_month_year]) 5 Best Credit Cards For 18-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/18.png?width=158&height=120&fit=crop)

![8 Best Credit Cards for 20- to 30-Year-Olds ([updated_month_year]) 8 Best Credit Cards for 20- to 30-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-20-to-30-Year-Olds-Feat.jpg?width=158&height=120&fit=crop)

![Understanding Credit Cards: A Beginner’s Guide ([updated_month_year]) Understanding Credit Cards: A Beginner’s Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Understanding-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![8 Low Interest Credit Cards For Beginners ([updated_month_year]) 8 Low Interest Credit Cards For Beginners ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Low-Interest-Credit-Cards-For-Beginners.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For 16- & 17-Year-Olds ([updated_month_year]) 9 Best Credit Cards For 16- & 17-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-Credit-Cards-For-16-17-Year-Olds.jpg?width=158&height=120&fit=crop)