Traveling is one of the greatest joys in life. There’s nothing like seeing new things, experiencing different cultures, and creating memories that will last a lifetime. Perhaps that’s why young adults are traveling more than any generation before them.

If you’re the type who doesn’t like to stay in one place for too long, or if the travel bug recently bit you, welcome to the club. Thankfully, there are many credit card options that can net you rewards that make traveling easier, more convenient, and less expensive — which only opens up room in your budget for more trips!

Overall | Points | Hotels | Miles | Ride-Sharing | FAQs

Best Overall Cards for Young Travelers

Having a good travel credit card in your wallet is almost as important as having a trustworthy GPS signal in an unfamiliar land. With the right card, like our top options listed below, you can earn rewards, discounts, and avoid those pesky foreign transaction fees that can make overseas trips a lot more expensive than you think.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Miles card allows you to accrue miles for every dollar spent on the card. Many cardholders save their miles throughout the year — since they never expire — and combine them with the first-year signup offer to take one big trip.

Capital One Venture Rewards Credit Card members earn 2x miles on every dollar spent using the card, and the signup bonuses offered by Capital One can shift your miles earnings into second gear. On top of the miles, cardholders also receive up to a $100 credit for Global Entry or TSA PreCheck®. You can also redeem your miles with no blackout dates or hotel and airline restrictions, or you can transfer your earned miles to more than 12 leading loyalty programs to further maximize their value.

Best Points Cards for Young Travelers

While many rewards cards on the market today return a percentage of your purchase in cash back, many travel cards focus on points or miles to get you on your way to your next trip. You typically earn points at a flat rate and can redeem them for a host of travel perks that make exploring even more rewarding.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

No two travelers are alike. While some like to travel by car and explore the areas around them, others may look to go far away when they have the time. The Capital One Venture Rewards Credit Card works for both but really rewards the latter. With big points earning potential and up to a $100 credit for Global Entry or TSA PreCheck®, you could be in the friendly skies in no time — without the hassle of long airport security lines.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The beauty in the Chase Sapphire Preferred® Card is its flexible redemption options. Your points can be worth as much as 25% more when used on airfare, hotels, car rentals, and cruises through the stellar Chase program. And if you’re traveling abroad, you’ll have the peace of mind in knowing you won’t be charged foreign transaction fees every time you use your card.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Travelers who add the Bank of America® Travel Rewards credit card to their wallets can use their card to make purchases with any airline, hotel, or travel provider they choose, then use their accumulated rewards for a statement credit toward those purchases. That means you can take advantage of sales or other deals through the travel provider while still using your earned rewards to sweeten the deal.

Best Hotel Rewards Cards for Young Travelers

Anyone who says the journey is more important than the destination has never stayed at a nice hotel. After a long day of adventures and exploring, it’s great to have a comfortable, safe place to return to. And since your hotel is one of the most expensive parts of any trip, you’ll be well served by considering a good hotel rewards credit card, like those below, to lower that bill.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One VentureOne Rewards Credit Card charges no annual or foreign transaction fees and regularly offers signup bonuses to let you earn bonus miles when you reach certain spending thresholds. What’s more, you may be able to increase the value of your rewards by transferring them to one of Capital One’s travel partners, which includes hotel operators.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card offers a host of redemption options through Chase to meet any traveler’s needs. This includes discounts and elite status at several partnered hotel chains throughout the world.

Best Air Miles Cards for Young Travelers

There’s an old saying “Youth is wasted on the young.” Since you’re only young once, why waste it cooped up in the same place, day after day? If you want to get out and see more of the world while you still have the time and energy, consider adding a miles travel card, like those below, to keep your trips from impacting your budget.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Miles card is a top choice for anyone who has a big trip planned. That’s because you’ll earn miles for every dollar you spend using the card and can combine them with Discover’s year-end offer for new cardmembers — that’s a lot of miles to get you wherever you want to go.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

Whether you’re an experienced traveler or a newbie to airports and rental car counters, chances are you still have your preferred travel brands when you’re on the road. The Capital One VentureOne Rewards Credit Card understands this and lets you choose how you redeem your points — with no restrictions on hotel, airline, or rental car brands.

10. JetBlue Card

New account holders of the JetBlue Card can earn bonus points after meeting the required spending on purchases in the first 90 days of card ownership. That gets you closer to your next flight in those comfy seats with free DirecTV. You can redeem your points for any seat at any time on JetBlue-operated flights with no blackout dates. Rewards accrue over time and never expire.

Best Ride-Sharing Cards for Young Travelers

Anyone who has visited a big city knows how hard it can be to get around. Public transportation is convenient at times, but it can also be a hassle when you have to make train connections or walk several blocks because the bus doesn’t stop by your destination. Instead of fighting traffic in the tunnels or on the roads, a good ride-sharing credit card helps you get to your destination faster and more affordably.

The Capital One Quicksilver Student Cash Rewards Credit Card provides extra cash back on purchases made through Uber, making it a sound choice for anyone who uses ride-share services to get around. This is a student card, meaning you’ll need to be enrolled in school to qualify for this card offer.

But you don’t need good credit to get a student card; You may be approved with no credit history at all. And you’ll never be charged an annual fee or be responsible for fraudulent purchases.

- Earn $250 back in the form of a statement credit after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year on purchases (then 1%). Also earn 6% cash back on select U.S. streaming subscriptions.

- Earn 3% cash back on transit, including U.S. gas stations, taxis/rideshare, parking, tolls, trains, buses, and more. All other purchases earn 1% cash back.

- $120 Equinox Credit - Use your Blue Cash Preferred Card to pay for Equinox+ at equinoxplus.com and receive $10 in monthly statement credits. Enrollment required.

- 0% intro APR for 12 months from the date of account opening, then a variable APR applies

- $0 intro annual fee for the first year, then $95

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

18.49% - 29.49% Variable

|

$0 intro annual fee for the first year, then $95

|

Excellent Credit

|

The Blue Cash Preferred® Card from American Express cardholders can rack up 3% cash back on all transit purchases, including ride-sharing services. Other bonus tiers provide as much as 6% cash back on U.S. streaming subscriptions and U.S. supermarket purchases (up to $6,000 per year in purchases). That’s a lot of cash back.

While this card charges an annual fee, you can easily make up for that charge through the excellent cash back options. Simply spending $133 each month on groceries alone will more than pay for the annual fee — and that’s not including the other cash back you’ll earn for your other purchases.

What is a Good Credit Card for Young Adults?

No matter what your age, everyone has different goals and financial abilities. That’s why you should always consider your own unique situation when deciding which travel credit card is best for you.

But one thing is for sure — many Americans carry a revolving balance on their cards. If you’re part of that group, the best card for you should include an introductory period with 0% interest on new charges and transfers.

This bonus allows you to carry over and stretch out current debt for as much as 18 months without paying interest. That means you can pay the debt off faster than you would on a similar interest-charging card.

As if that wasn’t enough, many of these cards also come with rich rewards that can give you points, miles, or cash back for your new purchases using the card. Just keep in mind that cards rarely give rewards for balance transfers and many cards will charge you a fee — usually a small percentage of the total amount transferred — to complete a balance transfer.

But a world of rewards is open to you if you don’t carry a balance on your credit cards and you’re in the habit of paying your cards in full each month.

Take the Discover it® Miles card, for example. With miles earned on every dollar spent and an impressive year-end bonus for new cardholders, you can earn quite a haul toward your next trip.

Or, you can look at a card that offers a massive signup bonus for spending a certain amount of money within a set period of time. If you reach those thresholds, some cards offer instant, one-time rewards that can equal a round-trip flight or multiple-night stay in a luxury hotel.

Which Credit Cards Give the Best Travel Rewards?

As stated above, the best travel rewards will depend upon your goals and needs. If you’re looking for a general-use travel rewards card that lets you choose how you redeem your points or miles — be it on airfare, hotels, or rental cars — then you may appreciate the slow-and-steady building of the Discover it® Miles or the quick-earning bonus potential of the Capital One Venture Rewards Credit Card.

But if you have a specific need from your rewards, you may find more potential from a hotel- or airline-branded credit card. That’s because a specific brand can give richer rewards when you purchase directly through the company than if you shop for deals through a third-party.

By pinpointing your favorite airline or hotel, you can quickly earn free flights or nights for purchases you’re already making. And if you’re a regular traveler, you’ll often find that branded credit cards offer cardholders added perks, such as room or seating upgrades or elevated loyalty program levels.

The major downfall of these cards, though, is that you can only use the rewards with the specific brand. But that’s not much of a drawback if you’re already spending money with that company. To maximize your rewards, you should remain focused on whichever card you add to your wallet.

Far too often, travelers fall for fancy promotions or specific goals and accumulate multiple credit cards that give different reward types. The problem with this thinking is that these consumers tend to spread their spending across multiple cards and never really maximize their rewards potential on any of them.

When you focus on one card with a rewards structure that best matches your spending, you can get the most benefit from your purchasing power and meet your travel goals much faster.

What are the Best Credit Cards for First-Time Users?

Being a rookie isn’t necessarily a bad thing. As a first-time credit card user, you likely won’t come into the game with accumulated debt or a damaged credit profile.

Your newness opens the door to several options that can make your first experience with a credit card both rewarding and exciting while increasing your purchasing power and getting you to your next trip that much faster.

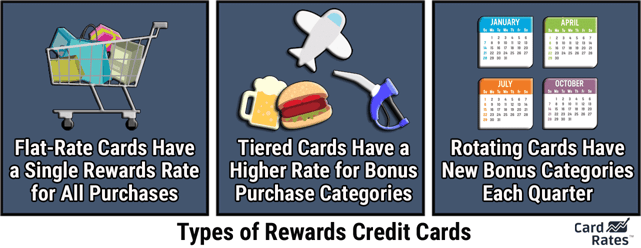

Since you’re new to credit, you may want to start off by keeping things simple. A lot of great cards out there offer tiered rewards structures depending on your spending habits and brand loyalty.

Some may offer 4% cash back on certain purchase categories and only 2% on others. Some categories remain stable while others rotate quarterly.

Some even require you to choose your desired rewards categories each quarter — and if you don’t choose in time, you lose the option.

In short, credit cards can be confusing and take up a lot of your time and energy. Once you get some experience, that may be the route you want to take. But, in the meantime, you’re likely best served by choosing a single rewards structure that’s most appealing to you: cash back, miles, or points.

We’ll discuss the main differences among the three in the next section, but just know for now that choosing the structure and a flat-rate rewards card means you won’t have to worry about rotating categories or tiered bonuses.

With a flat-rate bonus card, such as the Discover it® Miles for miles or the Capital One Quicksilver Cash Rewards Credit Card for cash back, you’ll earn a flat rate for every purchase, no matter the category or cost. Both cards allow unlimited rewards earnings and fairly flexible redemption options that don’t require jumping through hoops, creating new accounts, or calling customer service.

In fact, both of these cards allow you to redeem your earnings with a couple of taps within the card’s mobile app. Sometimes, simple is best.

What’s the Difference Between Points and Air Miles?

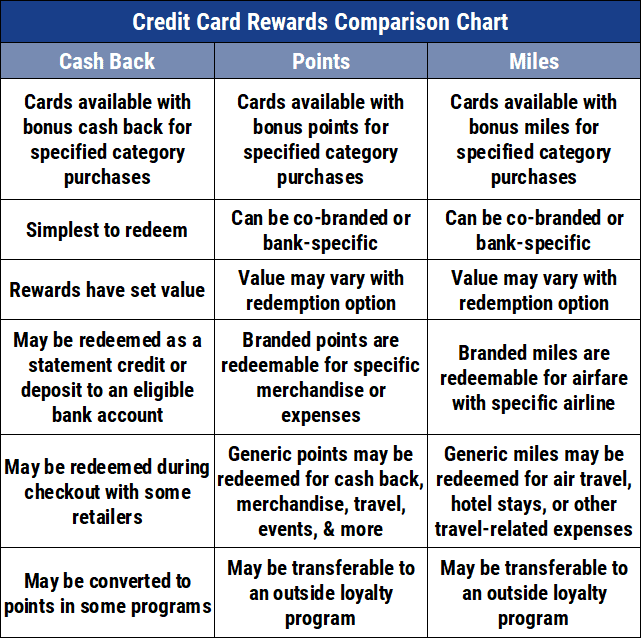

There are three main types of credit card rewards: cash back, miles, and points.

Possibly the most popular reward is cash back. That’s where a credit card issuer refunds a set percentage of every purchase in the form of a check, direct deposit to your bank account, or a statement credit. This remains the most flexible type of reward because nothing beats cash.

But cash back may not be the most valuable reward you can find in a credit card. Points and miles can give tremendous value to a cardholder, and both act essentially the same way.

You can usually spot the main difference between the two when looking at your redemption options. You typically find miles associated with travel cards, which means most of the rewards deal with hotels, airfare, car rentals, or other travel-related expenses.

Since these cards and their rewards focus solely on travel, you’ll often find the best travel deals with them.

On the other hand, points can provide a broader range of redemption options. Since they aren’t geared only toward travel, you can often find value through gift cards, merchandise, or experience-based rewards. You’ll still find travel perks here, but they may not be as rich as through a travel-based card.

Some cards, such as the Chase Sapphire Preferred® Card, offers their heralded rewards program, which can increase the value of your points by as much as 25% when you use them to purchase merchandise, travel, or other perks through the portal.

You should consider your goals and regular spending habits when deciding which perk works best for you. If you’re saving up for a big trip, you may be best served by finding a travel-focused card with a large signup bonus that can get you to your goal faster.

But if you’re only an occasional traveler, you may find great benefit from a points-based card that gives you great flexibility whenever and however you decide to redeem your earnings.

Let Your Card Be Your Travel Guide

You won’t find many people who regret traveling and seeing the world. The experiences you accumulate and memories you cultivate while traveling are worth far more than any trinket you can buy and stick on a shelf.

When the travel bug bites, it can be hard to shake off the desire to plan your next trip. But before you start packing your bags, make sure you have a good travel rewards credit card in your wallet to guide you, financially, through the adventures ahead.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Credit Cards For Young Adults ([updated_month_year]) 12 Best Credit Cards For Young Adults ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Best-Credit-Cards-For-Young-Adults.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Young Professionals ([updated_month_year]) 7 Best Credit Cards for Young Professionals ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-Credit-Cards-for-Young-Professionals-Feat-1.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards For Young Adults ([updated_month_year]) 7 Best Credit Cards For Young Adults ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Best-Credit-Cards-For-Young-Adults.jpg?width=158&height=120&fit=crop)

![5 Travel Credit Cards For Bad Credit ([updated_month_year]) 5 Travel Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Travel-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Travel Rewards Credit Cards ([updated_month_year]) 7 Best Travel Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/07/best-travel-credit-cards.png?width=158&height=120&fit=crop)

![7 Best Hotel Rewards Credit Cards ([updated_month_year]) 7 Best Hotel Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/01/hotels.png?width=158&height=120&fit=crop)

![8 Best Travel Credit Cards for Students ([updated_month_year]) 8 Best Travel Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Best-Travel-Credit-Cards-for-Students-1.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards For 18-Year-Olds ([updated_month_year]) 5 Best Credit Cards For 18-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/18.png?width=158&height=120&fit=crop)