Searching for credit cards for a high debt-to-income ratio may seem like an impossible task. Fortunately, some banks will consider your application for credit despite your current debt load.

These credit cards can give you some spending power to cover an emergency or to pay your bills, but you can expect to pay higher interest rates for the privilege.

The card options listed below are all unsecured credit cards, meaning you won’t need a security deposit for approval, but some do charge an annual fee that is taken from your available credit upon activation.

Best Credit Cards For a High Debt-to-Income Ratio

Below are our top credit cards for consumers who have a high debt-to-income ratio. Each card is designed specifically for consumers who have a low credit score, which means your current debt won’t automatically disqualify your application.

And since most credit cards allow you to apply for a new account online, you may also be able to prequalify for one of the cards below before you officially apply. This can give you some indication of your approval odds without placing a potentially harmful hard inquiry on your credit history.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 - $125

|

See website for Details*

|

The Surge® Platinum Mastercard® offers qualified applicants one of the largest credit limits on this list thanks to its generous credit standards and forgiving approval criteria. While not every applicant will receive a large credit limit, this card has a history of providing more spending power than the average credit card for bad credit.

Just keep in mind that the card also has one of the highest potential interest rate offerings on this list. If you plan to carry a balance from month to month, the larger credit limit could end up costing you more over the long haul.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% APR (Variable)

|

$75 - $125

|

Bad, Fair, or No Credit

|

The Reflex® Platinum Mastercard® may look past your credit score and debt-to-income ratio and still provide you with access to a credit card. But you should expect to pay some pretty hefty fees for that access.

The card’s charges will include a higher-than-average interest rate and one of the largest annual fees of any card on this list. After your first year with the card, Reflex will add a monthly maintenance fee to the annual fee, which makes the card even pricier. Note that Continental Finance will waive your monthly fee if you maintain a credit limit of $750 or more.

3. Arro Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Arro Card charges no annual fee and a low APR, much lower than that of other unsecured subprime credit cards. Its initial credit limit is low, but you don’t need to put down a deposit to get this card, and there’s no credit check involved, making your high DTI ratio irrelevant.

You can manage your account completely through the Arro App, and paying your bill on time each month can help you build credit over time.

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

The Milestone® Mastercard® accepts applicants with high debt to income ratios, causing poor credit. The annual fee and APR are lower than that of some competitors, and there’s no monthly maintenance charge. Your account history will be reported to all three credit bureaus.

Cash advances are expensive, and a foreign transaction fee applies to international purchases. But cardholders receive all the benefits of Mastercard, including the Mastercard Global Service program, which is available 24 hours a day, 365 days a year.

- Earn 1% cash back rewards on payments made to your Total Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair, Bad Credit

|

The Total Visa® Card requires applicants to pay a program fee before they open the account. The first annual fee will also charge to your account upon activation. After your first year with the card, you’ll also start incurring monthly maintenance fees on top of the annual fee.

For all of those charges, you’ll likely receive a low credit limit with a higher-than-average interest rate that can make this one of the more expensive cards on the list. But if you’re in a pinch and need access to credit, Total has forgiving acceptance standards and offers fast approvals for new applicants.

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99%

|

$99

|

Fair/Poor/Bad

|

The FIT™ Platinum Mastercard® charges a one-time program fee before you open your account and adds an annual fee to your account balance when you activate your card. After 12 months, in addition to the annual fee, you will also start incurring monthly maintenance fees.

All new cardholders start with the same credit limit. Just make sure that you pay your credit card debt in full each month to avoid the card’s hefty interest rate.

- Earn 1% cash back rewards on payments made to your First Access Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Bad Credit

|

If you’re approved for the First Access Visa® Card, you’ll have to pay a program fee before the bank will send you the card. When you activate the card, the bank will deduct the annual fee from your available credit. While the annual fee you are charged goes down starting in your second year, the addition of a monthly maintenance fee makes the card more expensive.

And since this card offers fairly low starting credit limits, you can likely find a less expensive credit option if you look a little higher on this list.

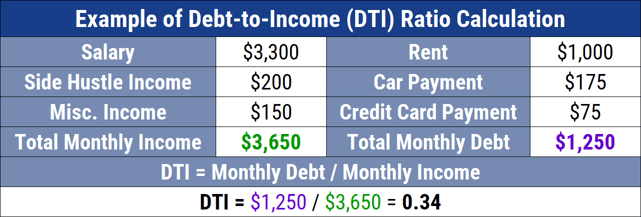

What is a Debt-to-Income Ratio?

Your debt-to-income (DTI) ratio is all of your monthly debt payments divided by your gross monthly income. This is different from your credit utilization ratio, which calculates how much of your available credit you’re using.

Lenders use existing debt and income to calculate your DTI ratio and gauge your ability to afford any new monthly debt obligations.

To understand this better, let’s look at an example. Let’s say a consumer has several debts that require a monthly payment. She has a $400 car loan payment, a $1,500 rent payment, a $300 credit card minimum monthly payment, and a $200 student loan payment. Altogether, that equals $2,400.

This same consumer has a job that pays her a salary of $3,000 per month. She wants to take out another personal loan that will add another $300 monthly payment to her debt.

While her monthly gross income of $3,000 is more than her new monthly debt of $2,700, a lender would likely reject her loan application because of a high debt-to-income ratio. Even though she technically makes enough money to afford those debts, your DTI does not consider other expenses you incur each month. This includes food, transportation (public transportation or gas and/or tolls for your own vehicle), and other bills.

It’s highly unlikely that the $300 left over from this consumer’s salary will cover all of her living expenses. As a result, a lender is unlikely to approve a loan that a borrower is unlikely to afford.

Credit card issuers also use DTI to assess your ability to take on new debt. Using the example above, you can substitute the new $300 personal loan for a credit card with a $300 limit. Even if this borrower doesn’t max out her card every month, the bank still has to assess whether she can afford the debt repayment if she maxes it out.

That means another likely rejection.

What Debt-to-Income Ratio is Considered Too High?

Different types of lenders have varying definitions of a high debt-to-income ratio. A mortgage lender has perhaps the strictest definition, as they typically abide by the unwritten 43% rule, which states that you will automatically be rejected if your DTI is above 43% with your new mortgage loan debt payment factored in.

This means that your total monthly debt payments must not exceed 43% of your gross income. For example, total monthly debt obligations of $3,000 will require a gross monthly income of approximately $7,000 for consideration. This rule is true for a VA loan, FHA loan, and another qualified mortgage home loan.

Other lenders may want a potential borrower to have a DTI ratio of around 36%. Wells Fargo, for example, lists DTI tiers on its website. It states that a DTI ratio of 35% is good and provides manageable debt in relation to the consumer’s income.

Someone with a DTI ratio of 36% to 49% is adequately managing debt but has room for improvement. A DTI ratio of 50% or more requires action, as this person may have limited funds to save or spend.

Keep in mind that couples can use their household DTI ratio when applying jointly for a credit card or loan. This allows you to add both of your incomes, but you must also include everyone’s total debt.

Depending on your combined debt and annual income figures, this can improve or decrease your DTI.

Lenders may also allow you to exceed the average DTI requirements for a debt consolidation loan. This is because consolidating all of your debts into one payment can actually save you money by lowering your monthly debt payment.

Can I Get a Credit Card With a High Debt-to-Income Ratio?

Most banks avoid risk by rejecting applications from borrowers who may not make enough money to afford the minimum monthly loan payment. But some banks work specifically with consumers who have bad credit to give them access to credit cards despite having a high DTI ratio.

Just be aware that these cards often come with higher fees to offset the bank’s risk. This may mean a program fee before the bank sends you your card, an annual fee deducted from your available credit balance, and high APRs. Some issuers of credit cards for bad credit also add monthly maintenance fees beginning in your second year with the card.

Let’s say you qualify for a card with a $300 limit. You may have to pay a program fee of around $80 to $90 to get access to your card. The bank may also charge an annual fee of around $75 to your account as soon as you activate the card. That automatically lowers your available credit to $225 and adds $75 to your overall debt load.

After your first year with the card, the bank may charge another $75 annual fee to your account while also adding a monthly maintenance fee that typically runs between $6 and $7. With the annual fee and monthly fees combined, you may end up paying as much as $159 in fees each year for access to $300 in credit.

Determine whether you really need another credit card before applying for this type of card. Use the card responsibly to improve your credit score so you can cancel the account and upgrade to a better, more affordable card in the future.

How Do Credit Cards Affect Debt-to-Income Ratio?

As with any other debt, your credit card will add to your total monthly debt and will increase your debt-to-income ratio if you carry a balance.

But since credit cards have different credit limits and a balance that changes regularly, you must use a slightly different calculation to gauge your card’s impact on your DTI ratio. While your car payment or personal loan payment will likely be the same each month, your credit card payment will vary based on the amount of credit card debt you have.

Your DTI ratio will fluctuate as your credit card balances and minimum payments change.

To account for that potential shift, you should factor your minimum monthly credit card payment into your DTI ratio. Even if you have a $5,000 credit card balance, your minimum payment due is all you need to factor into your debt ratio.

As you lower your credit card balance, you’ll also lower your minimum monthly payment. That decrease can improve your DTI ratio and get you closer to qualifying for the loan or credit card you want.

How Can I Lower My Debt-to-Income Ratio Quickly?

The obvious answer here is that you can lower your DTI ratio by making more money or paying off your debts — but those options are not always possible. If you want to decrease your DTI ratio without risking your job by demanding a raise, you have options available to you.

- Strategically pay off your debts: Paying off debt always helps your DTI ratio — but paying certain debts can help more than others. Let’s say you have two credit cards: one with a $500 balance and a $50 minimum monthly payment and another with a $300 balance and a $75 minimum monthly payment. If you pay off your $300 balance first, you’ll wipe $75 from your DTI calculation. If you paid off the $500 balance first, you’d only eliminate $50 from your debt ratio. Make sure you calculate your bill-to-balance ratio to pay off the debts that will help you the most.

- Use a balance transfer credit card to lower your interest rate: Many credit cards offer balance transfer deals that let you move debt from one credit card to another. This is a great way to potentially lower your monthly payment if the new card has a lower interest rate than the old card. Some cards have promotional offers that waive finance charges on your transferred debt for a set length of time after you activate your new card.

- Take Advantage of a debt consolidation loan: This type of loan allows you to roll all — or some — of your current debts into one new loan with a lower interest rate. This can also lower your monthly loan payment, and your DTI, by consolidating several monthly loan payments into one.

- Make some extra money with a side hustle: Whether you’re tapping into a talent or interest or just performing some labor for a few hours on the weekend, a side hustle is a great way to earn a few extra dollars to put toward your current monthly debt obligations. Just make sure you factor in any taxes you may have to pay on that extra income.

All the above options can help lower your DTI ratio and make your application more attractive to credit card issuers or other lenders. Just be sure to keep your new debt to a minimum so you don’t undo all of the hard work you put into lowering your DTI ratio.

Which Bills Are Considered in Debt-to-Income Ratio?

Your debt-to-income ratio factors in all of your monthly debt payments — including your rent or mortgage payment, auto loan payment, credit card payment, and any personal loans, payday loans, or student loan debt payments you may have.

Your DTI ratio does not consider recurring monthly payments such as your cable bill, streaming subscriptions, utility payments, or other bills that are not debt-based and can be canceled at any time.

Only money you borrowed that must be repaid counts toward your DTI ratio — not monthly recurring bills such as streaming services that can be canceled at any time.

In short, if you can’t cancel the account or payment and end your debt obligation, you should factor it into your DTI ratio.

Compare Credit Cards for High Debt-to-Income Ratio Online

Your debt-to-income ratio may seem like just a number — but those digits can add up to a lot more than a simple percentage. A good DTI can unlock top credit card and loan options that aren’t available to those who have a high DTI ratio.

But even if you’re currently managing a high debt load, consider the credit cards for high debt-to-income ratio listed above as a way to access the credit you need without paying an upfront deposit or taking on other unnecessary expenses.

These cards can also help you lower your overall DTI ratio and credit utilization ratio, and improve your credit score if you pay your balances on time and in full each month.

After all, credit is a great responsibility. And you don’t want to overextend your responsibilities to the point where they get out of control. But once you grab hold of your debt load and make a plan to eliminate it, you regain the power over your financial future.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Credit Cards for Students With No Income ([updated_month_year]) 9 Best Credit Cards for Students With No Income ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/noincome.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Low-Income Earners ([updated_month_year]) 12 Best Credit Cards for Low-Income Earners ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/low-income2.jpg?width=158&height=120&fit=crop)

![15 FAQs: Annual Income on Credit Card Applications ([updated_month_year]) 15 FAQs: Annual Income on Credit Card Applications ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_394244284.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for High Spenders ([updated_month_year]) 12 Best Credit Cards for High Spenders ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Spenders-Feat.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year]) 7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/fair-credit-limits-art.jpg?width=158&height=120&fit=crop)