Fierce competition among credit card companies motivates them to appeal to the masses in several ways. One of their most potent marketing ploys is to offer no-interest borrowing and balance transfers for new cardmembers.

Our experts have identified the best credit cards with no interest for at least one year. This can be especially useful if you want to charge a big-ticket item or consolidate your credit card balances. Read on to learn which cards give you the best interest-free introductions.

0% APR on Purchases | 0% APR on Balance Transfers | FAQs

Cards with 0% Interest on New Purchases for 12+ Months

These cards let new cardmembers stretch out interest-free payments on new purchases for a year or longer. Depending on your credit limit, an introductory offer could save you hundreds of dollars in interest charges.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® card offers new cardmembers interest-free purchases for a promotional period. This no-annual-fee card provides zero liability protection, 120-day new-purchase protection, a year extension on eligible warranties, and free unlimited access to your credit score.

2. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

The 0% intro APR from the Chase Freedom Flex℠ card is for more than a year after account opening. The card also lets you earn a bonus cash back reward when you spend the specified amount on purchases in the first three months. You can earn bonus cash back on rotating categories you activate each quarter and unlimited flat-rate cash back rewards on all other purchases.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card markets to new cardmembers by offering over a year of 0% APR on purchases. This no-annual-fee card offers unlimited cash back rewards on all purchases and a one-time cash bonus when you spend a set amount in the first three months from account opening.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card offers new cardmembers a 0% APR on promotional purchases. It has three tiers of unlimited cash back rewards and a one-time cash bonus when you spend the required amount on purchases during the first three months. The card charges no annual fee.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Cash Rewards Credit Card allows cardholders to choose a category that will yield them an elevated 3% cash back. These categories include online shopping, which provides even more money back for purchases you’re already making. Who doesn’t love free money?

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card offers an extended introductory APR for new customers. When activated, quarterly bonus categories offer high cash back rates (up to the quarterly maximum) and cash back at a reduced standard rate on all other purchases.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Miles card offers a lengthy introductory period on new purchases. You also earn miles rewards on all purchases with no blackout dates and free Social Security number alerts. Other benefits include a free FICO score and instant account freeze/unfreeze.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One VentureOne Rewards Credit Card gives new cardmembers an initial 0% APR on purchases. This $0-annual-fee card offers a mileage reward on every dollar you spend on purchases. Furthermore, you get bonus miles when you purchase the required amount in the first three months. Your miles never expire as long as the account remains open.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Simplicity® Card not only provides an introductory APR offer on purchases, but it also offers new cardmembers one of the longest introductory 0% interest periods on balance transfers on the market. The card charges no annual fee, no late fees, and no penalty rates. You also get $0 liability protection and fast alerts if Citi detects any suspicious activity on your account.

Cards With 0% Interest on Balance Transfers For 12+ Months

These cards give you a period of at least 12 months to avoid interest on balances transferred from other credit cards. Most charge a one-time fee for each transfer, even in the introductory period. Also, some require you to complete your transfers in the first several months after account opening to get the promotional rate.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Balance Transfer offers the longest introductory period on balance transfers of all Discover cards. You earn bonus cash back, up to a spending cap, on quarterly rotating categories that you activate, plus regular flat-rate cash back on all other purchases. Transferred balances do not earn rewards.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card charges an introductory 0% APR on balance transfers you complete within four months of account opening. Transfers must be made within four months of opening the account to qualify for the intro rate, and a fee applies to each transfer.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Simplicity® Card is another card currently offering a long introductory 0% interest rate on balance transfers, but a balance transfer fee applies. The card charges no annual fee, no late fees, and no penalty rates. Cardholders also get zero liability protection and fast alerts if Citi detects any suspicious activity on their account.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

You get an introductory 0% rate for balance transfers and purchases with the Capital One Quicksilver Cash Rewards Credit Card. Balance transfers incur a fee and earn no cash back. Purchases earn unlimited cash back, and you get a one-time cash bonus by spending the required amount during the first three months after opening the account. The card charges no annual fee.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card is a tiered rewards card with varying rates of cash back on different purchase categories. You must pay a fee for each balance transfer during the introductory period. Transfers earn no cash back, and the annual fee is $0.

What Does 0% APR for 12+ Months Mean?

The annual percentage rate, or APR, is the interest rate a credit card charges on unpaid balances. Normally, if you pay your entire card balance by the next due date, you will not face interest charges.

An introductory 0% APR for 12+ months means you won’t have to pay interest on the balance during a promotional period of at least 12 months from account opening. Credit cards sometimes make separate 0% introductory offers for purchases and for balance transfers.

For example, the Citi Simplicity® Card currently offers different promotional periods for balance transfers and purchases.

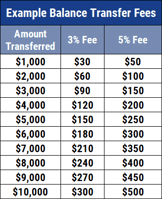

Many cards charge a balance transfer fee that is the larger of a fixed percentage or cash amount. For example, you may see a fee of 3% of the transferred amount or $5, whichever is greater. None of the cards in this review charge retroactive interest on transferred balances that are not fully paid by the end of the introductory period. However, if you pick a card that is outside of this group, check the fine print before applying.

What is the Best 0% Interest Credit Card?

The best card with introductory 0% interest on purchases is the Chase Freedom Unlimited® (0% Intro APR on Purchases 15 months), and it offers a highly competitive cash back rewards program with no annual fee. When you earn rewards on a card with intro APR offers or just pay your balance in full each month, you’re quite literally earning free money just for using the card.

For balance transfers, the winner is the Citi Simplicity® Card. This card currently has one of the longest introductory interest-free balance transfer periods on the market followed by a competitive ongoing APR thereafter. Balance transfer amounts do not qualify for rewards, however, and a balance transfer fee may apply.

Be sure to review the regular APR for each card that kicks in after the introductory period is over. It’s wise to choose the card with the lowest APR possible, even if you lose a month or two of 0% financing.

What Credit Card Has the Longest Interest-Free Period?

In the category of cards with the longest introductory interest-free period for purchases, the winner is the Capital One Quicksilver Cash Rewards Credit Card.

Three cards currently offering long 0% introductory APRs on balance transfers: Discover it® Balance Transfer, Citi Double Cash® Card, and Citi Simplicity® Card.

If you like the idea of earning double cash back on purchases, you could consider the Citi Double Cash® Card. Although the card offers no introductory APR on purchases, its double rewards may be the clincher for you.

How Can I Avoid Paying Interest on My Card?

One way to avoid interest charges is to always use a card that offers a 0% APR to new cardmembers. This involves switching to a new credit card when the introductory period on your current card expires. With so many cards offering a year or more of no interest, there is no shortage of cards from which to choose when the time comes.

If you pick a new card that offers no interest on both purchases and balance transfers, you can move your remaining balance on your old card to the new one. This will extend your 0% APR from the old card, but you will have to pay a fee for the maneuver. Typical transfer fees range from 3% to 5%.

The downside of this strategy is that you will accumulate credit cards over time, cards that you likely won’t use once the introductory period expires. That’s not necessarily a bad thing because your available credit will rise with each new card, thereby lowering your credit utilization ratio and pleasing the credit bureaus.

However, if your available credit grows too large for your income, you may have trouble getting the credit limit you require on your next card. You can close an old account to work around this problem, but that will reduce your average account age, a negative for your credit score.

The other method of avoiding credit card interest is simply to pay your full balance every month. Use the credit card as a convenient alternative to cash and checks, not as a way of financing your lifestyle. You’ll avoid interest charges throughout the year and won’t have to worry about replacing your credit card or transferring balances when the introductory period expires.

Finance a Purchase or Get Out of Debt With a 0% Card

You have plenty of choices if you want to avoid paying credit card interest. The cards that offer up to 18 months of interest-free purchases are perfect for financing a big-ticket item.

On the other hand, if the interest on your credit card balances is eating you alive, you can use a card that offers no interest on balance transfers to start climbing out of debt. These cards allow you to apply 100% of your monthly payment to reducing your balance. The only cost is a one-time transfer fee.

Whatever your motivation for seeking an interest-free card, compare all features, including bonuses and rewards, when considering your options.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Best No-Interest Credit Cards for 18+ Months ([updated_month_year]) 6 Best No-Interest Credit Cards for 18+ Months ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-No-Interest-Credit-Cards-for-18-Months-Feat.png?width=158&height=120&fit=crop)

![0% For 21 Months: Balance Transfer Cards ([current_year]) 0% For 21 Months: Balance Transfer Cards ([current_year])](https://www.cardrates.com/images/uploads/2023/04/0-Percent-Blance-Transfer-For-21-Months-Credit-Cards.png?width=158&height=120&fit=crop)

![0% For 24 Months Balance Transfer Cards ([updated_month_year]) 0% For 24 Months Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/0-Percent-For-24-Months-Balance-Transfer-Cards.jpg?width=158&height=120&fit=crop)

![0% For 12+ Months: Balance Transfer Cards ([updated_month_year]) 0% For 12+ Months: Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/0-percent-for-12-months-balance-transfer-cards.jpg?width=158&height=120&fit=crop)

![5 Best 0% Balance Transfers For 18+ Months ([updated_month_year]) 5 Best 0% Balance Transfers For 18+ Months ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Best-0-Balance-Transfers-For-18-Months.jpg?width=158&height=120&fit=crop)

![8 Best Low-Interest Credit Cards with 0% Intro ([updated_month_year]) 8 Best Low-Interest Credit Cards with 0% Intro ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/low-interest.png?width=158&height=120&fit=crop)

![If I Cancel My Credit Card, Will The Interest Stop? ([updated_month_year]) If I Cancel My Credit Card, Will The Interest Stop? ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Cancel-Credit-Card.jpg?width=158&height=120&fit=crop)

![3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year]) 3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/lowerinterest.png?width=158&height=120&fit=crop)