With the best 0% balance transfer credit cards, you can tackle existing credit card debt or make a large purchase without taking on the burden of high finance charges and fees. This is one of the most popular promotional offers in the credit card industry because it allows consumers to save money and achieve certain financial goals at the same time.

If you have a large purchase in your future or you currently have credit card debt that is stuck on a credit card with a high interest rate, consider applying for one of the cards listed below. You could save thousands in finance charges over the life of your debt with a 0% balance transfer card.

Best 0% Balance Transfer Credit Cards

Credit card issuers offer intro APR rates and other limited-time offers as a way of enticing consumers to apply for their credit cards. History has shown that this tactic works.

Banks change their promotional offers regularly, based on the competition and current financial environment. If you find an offer that you really like, you may want to consider jumping on it as soon as you are ready. Below are our top-rated 0% balance transfer cards:

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

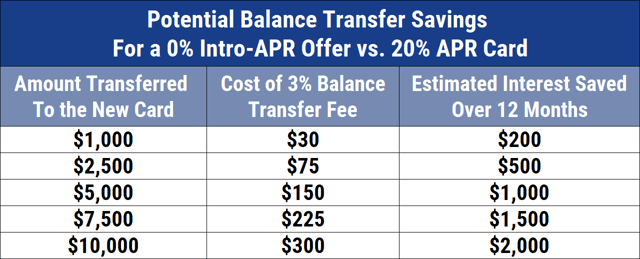

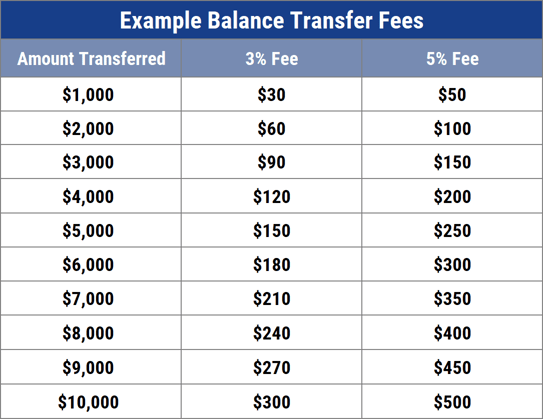

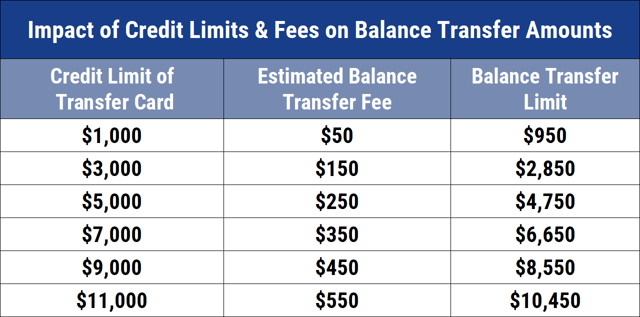

In your review of the best 0% balance transfer credit cards, consider the balance transfer fee you may have to pay to initiate the move. This typically equates to a percentage of the total amount of money you are moving to the new card.

The average balance transfer fee is approximately 3% to 5% of the transferred funds. While that may sound steep, it is actually very little when compared with how much you can save when you do not pay interest of 17% or more over the life of your promotional offer.

What is a 0% Balance Transfer Credit Card?

A 0% balance transfer credit card is a traditional credit card that has a promotional offer for new customers who apply for the card.

This promotional offer typically consists of interest-free financing on balance transfers for between six and 18 months. Some cards pair this with 0% financing on new purchases as well. Each bank has a unique offer, so the terms and length of the promotion will vary depending on the card you qualify for.

With this type of promotion, you can transfer the balance from an existing credit card — up to the limit that your new credit card provides — and pay the balance down over the length of the promotional period without paying interest or finance charges on the balance.

This is especially handy if your current balance is sitting on a credit card with a high interest rate. In this case, a large percentage of your monthly payment will go toward interest fees. But with a 0% balance transfer credit card, your payments will go toward your principal balance and pay your debt down faster.

Many credit cards with this promotional period also allow you to transfer the balances from multiple credit cards onto your new card — so long as you do not surpass your card’s credit limit. This form of consolidating debt is very popular among consumers who would rather not pay multiple monthly credit card bills.

Aside from your promotional period, a balance transfer credit card will work the same as any other unsecured credit card. You can use it to make online purchases, pay in-person charges, and carry a balance from one month to the next.

And while you will not have to pay an interest charge for the life of your promotion, this great deal will eventually end, and you will immediately begin accruing interest on the remaining balance you carry. That’s why it’s important to use your promotional period time wisely and pay off as much of the debt as you can.

Depending on your card, you may also have to pay an annual fee. Be sure to read your card’s terms and conditions carefully before you apply so you understand the rules regarding your promotional period. Doing so can eliminate any surprises down the road.

How Do I Get a Balance Transfer Credit Card?

Just as with any other credit card, you have to apply to be approved. Just about every credit card in the marketplace allows consumers to apply online and receive a near-instant credit decision. By clicking the links to each card above, you can find the online application for the card you choose.

The application typically takes less than five minutes to complete. It will ask for your basic identifying information — including your name, address, phone number, email address, and Social Security number. It will also require verifiable income information so the bank can verify that you can afford to repay any debt you accrue with the credit card.

Once you submit your application, the bank will run a credit check to see your credit score and full credit history. Thanks to automated underwriting systems, this process takes a matter of seconds. In most cases, the bank will update your application page with a decision very quickly.

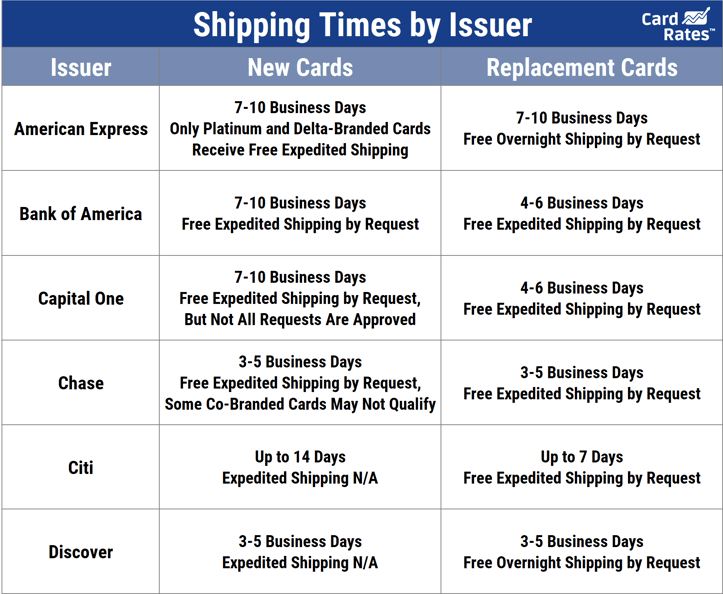

The bank will immediately tell you your new card’s credit limit upon approval. The card should arrive in the mail within seven to 10 business days. Your new card issuer may give you access to your new credit account right away via a temporary credit card number. If not, you will have to wait to receive your card and activate it to begin using it.

If the bank denies your application, you will receive an adverse action letter in the mail within seven to 10 business days. Banks are required by law to send these letters to consumers who have their applications rejected.

The letter will detail the reasons why the bank did not accept your application. In some cases, the letter will also provide tips on ways to improve your credit standing so you have a better chance at approval down the road.

In some cases, the automated underwriting system will not be able to make a quick application decision. This could happen if there are misspellings or inconsistencies on your application. The bank may also require more information from you to make a final decision.

If this happens, the bank will place your application on hold for 30 days and give you a list of the documentation it needs to finalize its decision. If you do not provide the information within the 30-day window, your application will be voided and you will have to start a new application all over again at a later date.

Something to keep in mind when you are applying for credit cards is the number of inquiries you have on your credit report.

The lender will run a credit check every time you formally apply for a= credit card or any other type of loan. To access your credit history, the lender places a hard inquiry on your credit report. This inquiry lives on your credit file for two years.

A few inquiries are fine, but when you start to accumulate several inquiries within a short period, lenders may see you as desperate for money and be less likely to approve your application. You could also see a slight dip in your credit score if you acquire too many inquiries.

The general rule of thumb is that three inquiries are acceptable. Beyond that, you may start to get into a gray area that lenders do not like.

Do Balance Transfers Affect Your Credit Score?

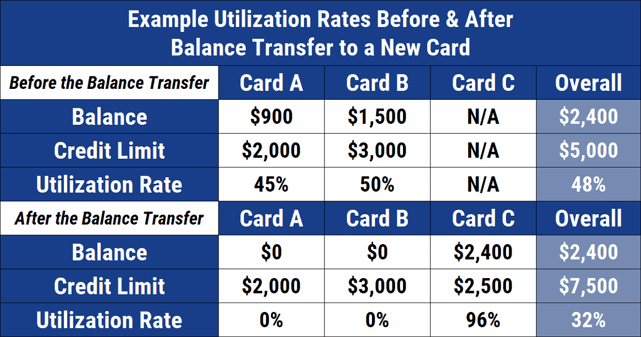

Balance transfers can have both a short-term and long-term positive effect on your credit score. The impact occurs for multiple reasons.

Opening a new credit card means you have more available credit at your disposal. This improves your credit utilization rate — so long as you do not accrue a large balance right away.

You can calculate your credit utilization rate by dividing your current credit card balances by the total amount of credit made available to you by credit card issuers.

So, for example, if you have a credit card with a $2,000 credit limit, and you have a $1,000 balance on that card, you have a credit utilization rate of 50% — meaning that you are using 50% of your available credit.

If you add a new credit card — in this case, a balance transfer credit card — with a $1,000 limit, you increase your available credit to $3,000. In this case, your credit utilization rate will decrease from 50% to 33%.

The amount you owe accounts for 30% of your FICO credit score. The lower your utilization rate — or the amount of debt you have — the better your credit score.

This all depends on you not adding new debt to your overall balances, though. Otherwise, you will see an increase in your credit utilization rate and a decrease in your credit score.

You can also see a positive impact on your credit score if you take advantage of your balance transfer offer window to eliminate your existing debt. Doing so will decrease the amounts you owe and can drastically improve your credit score.

And, since you won’t pay finance charges during the promotion, you can eliminate the debt faster and get your credit score back on track in a more orderly fashion. The key to maximizing your credit score benefits from a balance transfer is to avoid the temptation to spend because of the interest-free period.

When you transfer a balance from an old credit card to a new card, you may feel an urge to charge something to the recently paid off credit card. But this only continues the cycle that put you in debt in the first place.

On the other hand, you may be tempted to cancel the credit card that you just paid off through the balance transfer. When you close a credit card, you decrease your total available credit — thus increasing your credit utilization rate. You may also lower the average age of your credit accounts — a factor that makes up 15% of your credit score.

Unless you are paying an egregious annual fee on the old card, you are probably better served by locking it away and forgetting about it for a while. You may have to charge something to the card at least once every six months to a year to keep the account active.

Pay the charge as soon as it posts to your account and lock the card back up. Your credit score will thank you for it.

Are 0% Balance Transfers a Good Idea?

A 0% balance transfer credit card can be a very good idea — when used properly.

When you transfer your existing credit debt from a high-interest credit card to a new credit card with a 0% balance transfer offer, you give yourself time in which you can pay the debt down with no finance charges. This can save you a tremendous amount of money.

Let’s look at an example to understand how much you can save. Say you have $5,000 in existing credit card debt that is sitting on a card with a 17.8% interest rate.

You transfer that balance to a card that has an 18-month, 0% balance transfer offer. To pay that card balance in full during your promotion, you have to make 18 monthly payments of $277.78.

On your interest-bearing credit card, you would need to make 22 payments of $277.78 and pay $859.86 in interest charges. In this case, the promotion saved you nearly $1,000 and four months’ worth of payments.

Many balance transfer credit cards charge a balance transfer fee to move money from one card to another. This fee typically equates to between 3% and 5% of your total amount transferred.

Even with this fee, you will still save a substantial amount of money — your $5,000 balance will equate to a fee of between $150 and $250. That is far less than the $859.86 you save in finance charges.

A balance transfer is only a good idea if you maintain discipline with your new credit card. Far too often, people put off paying down their balances until the end of the promotion. Even worse, they succumb to the temptation to place new charges onto their old credit cards that were paid off during the balance transfer.

The point of taking on a 0% balance transfer credit card is to eliminate debt. If you end your promotional period with more debt, all you did was make your financial situation more difficult to fix.

And with that added debt, you will decrease your chances of qualifying for a new balance transfer credit card to move the added debt to. That means you will be stuck with interest charges while you pay down the debt.

Can You Pay Off a Balance Transfer Card Early?

Balance transfer credit cards usually have no early payment penalty or other charges for paying off your balance early. You typically have between six and 18 months without interest charges to pay off new purchases or balance transfers. What you do with that window of opportunity is up to you.

Many consumers decide to spread the debt out into equal payments over the course of the promotion so they can eliminate the debt before the intro APR rate expires. Others may pay as much as they can each month with the hope of satisfying the debt early, while others may not be able to pay off the debt before the 0% rate expires.

Since some balance transfer cards provide interest-free financing for new purchases as well, you can continue to enjoy the lack of finance charges on new purchases for the remainder of the promotion — even if you pay off your balance transfer early.

The only catch is that most qualifying balance transfer promotions only apply to transfers initiated during a short window after you activate your card, usually up to 90 days after account opening. After that window expires, you will not be able to transfer money to the card and receive the 0% offer.

If your plan is to pay off a qualifying balance transfer early, be sure to research your chosen credit card offer before you apply.

Under the CARD Act, the minimum time a card issuer can extend a 0% financing promotion is six months, though some offers extend as long as 18 months. We’ve seen 0% offers go for as long as 21 months.

Card issuers change their promotions monthly, so keep looking if you don’t see the right deal for you. Make sure you get as much bang for your buck as possible and apply for the card with the longest promotional period. That way, you can pay off your balance transfer early and enjoy the rest of the intro APR period on new purchases.

Is There a Downside to Balance Transfers?

Balance transfer credit cards have few downsides. That said, you should consider a few things before you apply for one:

- Length of the promotional period: If you cannot pay the debt off in time, you will have to pay interest on the unpaid portion of the balance. A shorter promotional window may not leave you with much time to work with.

- The ongoing APR after the 0% rate expires: All good things must come to an end — and this includes promotional offers. Once your promo expires, your card will transition to the ongoing variable APR for as long as you maintain the account. If the card has a high interest rate, you may find yourself paying more than you should for any balance you carry over. Plus, if the new card has a higher interest rate than your old card, you could wind up in worse shape if you do not pay the transferred balance off on time.

- Other fees charged by the bank: Aside from a balance transfer fee that usually equates to 3% to 5% of your transferred amount, you may have to pay an annual fee or other maintenance charges for your new credit card. Take this into consideration, as annual fees will continue long after your promotional period expires.

- Deferred interest: This is a biggie. Your balance transfer credit card may charge two types of interest, one of which could cost you a lot more than the other. Deferred interest means that the card issuer will freeze interest on the debt during the promotional period. If you do not pay the debt off within the promo period, you will be charged all of the interest accrued during that period. So, if you transfer $5,000 to a new card and pay off $4,999 during the promotional period, you will still have to pay interest on the full $5,000 because you did not eliminate all of the debt in time. The more common form of interest will only charge you finance charges on the portion of the balance you did not pay off in time — though you may have a higher balance transfer APR than your variable APR for new purchases. While you should always try to pay off all of your debt before the end of the promotional period, it is far more advisable to pay interest on the unpaid portion of your balance transfer than on the whole amount.

Do not let the potential downfalls of a balance transfer keep you from applying for one of the best 0% balance transfer credit cards. With these cards, you can eliminate your debt faster and find financial freedom much sooner than if you pay interest on your balances.

How Long Does a Balance Transfer Take?

Most balance transfers will take up to three weeks to complete, but this depends on the bank issuing your new card and the bank that receives the funds from the balance transfer.

When you initiate a balance transfer, the bank that issues your new credit card sends transferred money to your old credit card to pay all, or part, of your balance. This takes time to complete. Once the bank that issues your old card receives the funds, it can take a few more days for the bank to reflect the payments on your account.

Each bank handles balance transfers and payments differently and at different speeds. Here’s a breakdown of how long the major credit card issuing banks say they need to complete a balance transfer, according to their websites:

- American Express: A minimum of five to seven business days and a maximum of six weeks

- Barclays: Up to four weeks

- Bank of America: Up to two weeks

- Capital One: Between three and 14 days

- Chase: Between one and three weeks

- Citi: Up to two weeks

- Discover: Between one and two weeks

- U.S. Bank: Up to two weeks

- Wells Fargo: Between one and five business days

These time frames are only estimates, and some banks may be able to process your balance much faster. Some reviews report transfers being completed in just a few business days.

No matter how long your balance transfer takes, make sure that you continue to make your on-time monthly minimum payment during the process.

Your old credit account will still require payment until your balance reflects as $0. If you do not make your monthly minimum payment during the balance transfer process, you will be subject to a late fee and the negative credit score reporting that comes from a late payment.

If the payment you make, combined with your balance transfer, results in you paying more than you owe, your credit card issuer will send you a refund for the overage.

To avoid this potential issue, you can consider scheduling your balance transfer at the beginning of a billing cycle in hopes that you can clear your balance before the next bill is due.

Just keep in mind that most card balance transfer offers only work for balances transferred within a short window after you activate your card. This means that you may get as many as 18 months of interest-free financing, but only on balances transferred within six months of your card’s activation.

The length of your promotion will depend on the card you apply for. Check with the card issuer before applying to get a clearer idea of how long you have to transfer your balance and still enjoy the promotional rate.

How Can I Get a Balance Transfer Fee Waived?

You have to consider a balance transfer fee when calculating the savings you would gain when taking advantage of a 0% balance credit card transfer offer.

While the lack of interest charges can save you thousands — depending on the amount of your current credit card balances — you may still have to pay hundreds of dollars to transfer the balances to your new card.

A balance transfer fee typically equates to approximately 3% of 5% of the total amount of money you transfer. While that is substantially lower than the interest rate you will likely pay if you keep the balance on your current card, it is still an expense that you may not want to pay.

In some instances, you can negotiate with your new credit card issuer to have the fee reduced or eliminated. Here are a few tips that may help you find success when negotiating:

- Call the card issuer and ask the representative if the bank has any current offers or deals that may eliminate your balance transfer fee. If the bank does not, ask to be transferred to a supervisor. Most call center representatives do not have the authority to waive fees. Speaking directly with a supervisor who can will increase your odds of success.

- Leverage your credit history in negotiations. Banks like as little risk as possible when lending money. If you have good credit or excellent credit, you may be able to use that to your advantage if you say that the credit card balance transfer fee is a dealbreaker in your applying for the card.

- Research the competition. If you see a competing bank offering free or reduced balance transfer fees, mention that to the supervisor on the phone. In many cases, these employees have the authority to match a competitor’s promotion.

- Negotiate in person. If the bank that issues your credit card has a local branch near you, head down there and speak to a loan officer. Many consumers do not realize that a loan officer has the authority to reduce or erase fees as well. Sometimes, putting a face to a voice can help you in negotiations.

If all else fails, you can either decide to apply for a different credit card, pay the balance transfer fee with your card of choice, or consider another option for eliminating your debt. This could include a consolidation loan or personal loan that rolls all of your debts — credit card or otherwise — into one loan.

Just remember these loans charge interest from the day you sign for the loan. That makes them a more expensive option than paying a credit card balance transfer fee for access to a 0% balance transfer credit card.

Are All Balance Transfer Offers the Same?

Every credit card company creates its own promotions based on current marketplace trends. Those offers tend to change every few months to reflect the competition.

The length of your introductory APR offer will vary depending on your credit card. By law, a card issuer has to provide at least six months of 0% APR during an interest free promotion.

The exception to this is if the cardholder is more than 30 days late on a payment. In that case, the credit card company can cancel the offer altogether.

Some card issuers will extend the introductory APR promotion for as long as 18 months. On a few rare occasions, some banks may even offer up to 24 months of interest-free financing.

But the length of your promotion is not the only potential difference between different offers. You may also find:

- Your 0% APR may not be for everything. Oftentimes, the promotion applies to new purchases and qualifying balance transfer transactions. The offer will rarely apply to any cash advances and you likely will not accrue any rewards for funds you transfer.

- Your 0% APR offer could be canceled. Banks treat late payments differently. Some may cancel your promotional offer if you are late by 30 days or more with a payment. Other banks may allow you to continue with the promo, but impose a hefty fee for the late payment.

- You may not be able to transfer all of your balances over. Different cards will offer different credit limits — and some banks will also limit the amount you can move in a balance transfer. Just because a credit card gives you a $10,000 credit limit does not mean you can transfer over $10,000 in balances from other cards. You may find that your balance transfer limit is substantially less than your new purchase credit limit.

- Your interest charges will vary after the promotion expires: Some banks only offer deferred interest. This means that you will pay interest on all of the money you transfer over if you do not pay the debt in full during the promotional time frame. So if you transfer $10,000 over and pay all but a dollar of it off during the promotion, you will still have to pay interest on the entire $10,000. Other banks may only charge you for the amount of debt you did not pay off in time.

Never make assumptions when dealing with finances. Banks have different methods of making money, but each views you as a customer — not an individual.

With that in mind, you should protect yourself by carefully researching any credit card you consider applying for. Do not assume that the rates and terms are the same across the board. That type of mistake only brings on more debt and even more regrets.

Can I Keep Transferring Credit Card Balances?

There is no rule that states you can not transfer your unpaid balance to a new credit card after your current balance transfer offer expires.

If you have a large balance currently sitting on a high-interest credit card, you may need more than six to 18 months to eliminate the debt. If that’s the case, you may want to maximize your time frame by utilizing a balance transfer credit card and paying down as much of the debt as possible during your promotion.

If you have remaining debt once the promotion expires, you can either begin paying interest on that amount while you pay it down or move it over to a new balance transfer credit card that offers a fresh promotional window. Just remember that to transfer your existing balance to a new balance transfer credit card, you have to qualify for that new credit card.

If you regularly open credit cards or maintain high balances on the cards you already have in your name, you could find it difficult to qualify for a new card when you need it. You may also fail to qualify for a balance transfer promotion under certain terms.

Capital One, for instance, does not allow you to transfer balances from one Capital One card to another card issued by the same bank. Plus, Capital One only allows you to have two of its cards active at one time. If you already have two Capital One cards, the bank will reject your application for a third — no matter how great your credit.

Other banks may also limit how often you can take advantage of new customer promotions.

Wells Fargo has, perhaps, the vaguest of all balance transfer rules. According to the bank:

“You may not be eligible for introductory annual percentage rates, fees, and/or bonus rewards offers if you opened a Wells Fargo Credit card within the last 15 months from the date of this application and you received introductory APR(s), fees, and/or bonus rewards offers, even if that account is closed and has a $0 balance.”

So, in short, you can definitely keep transferring a balance to new cards until you satisfy the debt. Just make sure that you qualify for the promotion — and the card — before you delay paying the debt off by the end of your current promotional window.

What Happens if You Don’t Pay Off a Balance Transfer?

In most cases, you will start accruing interest on the remaining part of the balance at the rate of your regular purchase APR. Your first interest charges will appear on the first statement you receive following the end of your promotion period.

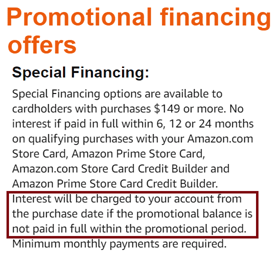

However, some credit cards charge a trickier form of interest that can cost you a lot of money if you are not prepared for it. Deferred interest is somewhat rare, but not impossible to find when looking at credit balance transfer promotional offers.

Avoid cards that charge deferred interest if you’re not sure you can pay the balance before the special financing period ends.

In essence, deferred interest freezes your interest charges, but continues to calculate them in the background. If you pay off the entirety of your balance transfer debt during the promotional period, the bank will waive all of the interest charges. If you do not pay it all off — even if it is just a few cents left unpaid — the bank will add all of the interest charges that accrued in the background to your remaining balance. That means you never saved any money at all.

Many consumers go into a balance transfer promotional period without fully understanding what type of interest the card issuer is charging them. Near the end of the promotion, they may not be able to pay off all of the debt and think they will only have to pay interest on what’s left.

Imagine their surprise when they see a charge for hundreds of dollars in interest that racked up during their interest-free financing period.

Before you apply for a balance transfer credit card, make certain that you understand the terms of the interest you are charged by the bank. Also, ask the bank what will happen if you do not pay the debt off during the promotional window.

Use a balance transfer calculator to determine the minimum payment you must make each month to pay the debt off during the promotion. If you cannot afford that payment, you may want to consider a different option for consolidating your debt. If you can afford it, make sure you stick to the plan and remain diligent in your payments.

Do You Pay Interest on Balance Transfers?

You will not pay interest on the funds you transfer during the promotional period if you have a 0% balance transfer credit card. That window can range from six to as many as 18 months or longer. The length of your promotion will depend on the card you apply for.

If you do not have a 0% APR promotion for balance transfers, you will begin accruing interest charges as soon as the funds are transferred to your new account.

Remember that some credit cards charge a different interest rate for new purchases than they do for balance transfers. Without a promotional period, you could pay a higher APR for your balance transfer than you would for everyday purchases, though this isn’t very common. And if that’s the case, a balance transfer may not be worth it — especially when you factor in the balance transfer fee.

Although you may like the thought of making one monthly payment instead of multiple payments to different credit card issuers, the convenience could cost you a lot more if the balance transfer interest rate on your new card is higher than the ongoing variable APR on your current card.

As we mentioned in the question above, your bank could charge you two different forms of interest once your 0% APR promotion expires. One form is a traditional ongoing APR that charges you for any portion of the transferred funds you did not pay off during the promo period. Deferred interest will charge you interest for your entire balance transfer amount — including the portion you paid off.

Your best bet is to pay off your entire debt during your 0% APR promotional period. That way, you will not have to worry about interest charges or other hidden fees.

How Much Can You Move to a Balance Transfer Credit Card?

Every credit card issuer sets unique rules regarding balance transfers and how much money you can transfer from existing cards to your new card.

In some cases, you can transfer as much as your credit limit will allow — minus the balance transfer fee. So, a card with a $5,000 credit limit and a 3% balance transfer fee will allow you to transfer roughly $4,850 to the card.

Other cards may set your balance transfer limit well below your credit limit. Part of the reasoning for this rule is that the bank cannot make any money off a customer if they max the new card out with an interest-free balance transfer.

The hope is that you will transfer your balances over and continue to make new purchases on the card. Even if you also have a 0% promotional period for new purchases, the bank can still make money on your charges via transaction fees. There are no such fees when you transfer a balance — aside from the initial balance transfer fee.

Even if you are not given enough room on your new credit card to transfer all of your existing credit card debt, you can still transfer a portion of it over to the new card to receive interest-free financing. The remaining balance will still earn interest on your old card, but you will accrue less interest with a smaller balance.

What Happens if I Transfer More Than I Owe?

If you happen to pay more than you owe during a balance transfer, the bank that issues the newly paid-off credit card will send you a refund for the overage. This can happen for many reasons.

You could accidentally initiate a transfer for more than what you owe. You could also put a transfer through without considering any rewards you have available to you that would lower your account balance.

The most common reason why people end up paying more than they owe is that a balance transfer can take up to three weeks to complete. During that time, you are still liable for any payments due.

If you miss a payment, you could find yourself with a late payment fee and a drop in your credit score. So, instead of risking that, many people choose to submit at least the minimum payment due. Once the balance transfer arrives, they have overpaid the amount of the minimum payment that was due.

If that happens, you can take one of two courses of action. You can allow the bank to keep the money, and you will have a credit for that amount on your account, or you can request that the bank send you a check for the overage.

You will typically receive the check within seven to 10 business days. In some cases, the bank can transfer the overage back to your linked checking account.

Can You Cancel a Balance Transfer?

You have a short window after initiating a balance transfer in which you can cancel the transaction. According to HelpWithMyBank.gov:

“Generally, you have at least 10 days after the bank sent the account-opening disclosures (not the day you received them) to call the bank and stop the balance transfer.”

This window can vary depending on your bank. Some banks, including Wells Fargo, process balance transfer requests within four to seven business days. A bank like Capital One could process it in as little as three days.

If your transfer request is approved and the money is disbursed to your old credit card, it is too late to cancel the transaction.

Please note that some credit card issuers may still charge you a balance transfer fee or cancellation fee if you void your transaction while it is processing.

What Happens to a Credit Card When You Transfer the Balance?

A balance transfer essentially means your new credit card company is sending money to your old credit card issuer to pay off some, or all, of your balance. You will then pay the new bank off in installments.

Two things happen to your credit cards when you transfer a balance: The new card gains the debt and the old card loses it. If you have a $3,000 balance on your existing card and do a $3,000 balance transfer to a new card, the new card will have a balance of $3,000 (plus any balance transfer fees) and your old card will have a balance of $0.

If you have that same $3,000 card and only initiate a balance transfer for $2,000, your new card will have a balance of $2,000 (plus any balance transfer fees) and your old card will retain a balance of $1,000.

Even if you completely pay the old card off through your balance transfer, the account will remain open and the card will stay active.

Many people think that this is a good time to close the account, since it is paid off and no longer necessary. That is among the biggest mistakes you can make following a balance transfer.

Approximately 30% of your credit score is based on the amount of money you owe in relation to the total amount of credit issued to you. This is also called your credit utilization rate. When you cancel a paid-off credit card, you lower the amount of credit available to you. This instantly increases your credit utilization rate and can drastically lower your credit score.

Instead of canceling the account, lock the card up in a lockbox, and keep the account open. Taking it out of your wallet will limit your temptation to spend, but keeping the account active will still give you positive credit score benefits.

Just remember that most credit card issuers can cancel an account that has no activity on it within a six- or 12-month period. You can keep your account active by placing a small charge on it every six months and paying it off as soon as the charge posts to your account.

That may seem like a hassle to remember, but the small bit of work is worth the benefits you will receive on your credit report.

Research the Best 0% Balance Transfer Credit Cards

You may not be able to change your entire financial profile by adding one of the best 0% balance transfer credit cards to your wallet — but you can come close to it.

With one of the cards listed above, you can move your debt from an existing high interest credit card over to a card that provides interest-free financing for a limited time. You can eliminate all or part of your credit card debt without paying the hefty finance charges that keep people in a continuous debt cycle.

Even a $5,000 balance transfer paid off over 18 months could save you nearly $900 in finance charges. That’s money you can put toward other debts — or a congratulatory treat for yourself. Vacation, anyone?

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year]) 9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/btandrewards.png?width=158&height=120&fit=crop)

![7 Balance Transfer Cards With High Limits ([updated_month_year]) 7 Balance Transfer Cards With High Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Balance-Transfer-Cards-With-High-Limits.jpg?width=158&height=120&fit=crop)

![Are Balance Transfer Cards a Good Idea? ([updated_month_year]) Are Balance Transfer Cards a Good Idea? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Are-Balance-Transfer-Cards-a-Good-Idea.jpg?width=158&height=120&fit=crop)

![0% For 21 Months: Balance Transfer Cards ([updated_month_year]) 0% For 21 Months: Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/0-Percent-Blance-Transfer-For-21-Months-Credit-Cards.png?width=158&height=120&fit=crop)

![7 Easiest Balance Transfer Cards to Get ([updated_month_year]) 7 Easiest Balance Transfer Cards to Get ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Easiest-Balance-Transfer-Cards-to-Get.jpg?width=158&height=120&fit=crop)

![0% For 24 Months Balance Transfer Cards ([updated_month_year]) 0% For 24 Months Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/0-Percent-For-24-Months-Balance-Transfer-Cards.jpg?width=158&height=120&fit=crop)

![0% For 12+ Months: Balance Transfer Cards ([updated_month_year]) 0% For 12+ Months: Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/0-percent-for-12-months-balance-transfer-cards.jpg?width=158&height=120&fit=crop)