The coronavirus lockdown has flipped our world upside down. In addition to the health threat this virus poses, people are also suffering financially with millions losing their jobs or experiencing reduced hours and cut wages.

In fact, a recent online poll from Fortune and SurveyMonkey found that 63% of U.S. consumers are worried they won’t have enough money to pay their monthly bills.

Managing your budget in the wake of this pandemic comes down to planning. Mapping out which bills to pay now, which to postpone, and how to lower expenses can alleviate some of the financial pressure and anxiety you may be feeling right about now.

Follow this step-by-step guide to get your monthly bill payment plan in order.

1. Make a Bill Prioritization Plan

The first step to managing your bills during this economic downturn is to understand your options. Some banks and service providers are allowing customers to defer or reduce payments, so get on the phone to find out:

- who is offering what

- how long you can defer payments

- payment plan options

- if any fees or interest will be applied to your account

- how deferred payments will be reported to credit bureaus

List out all your monthly expenses and make a note next to each bill, highlighting their terms and conditions for payments during this time. From there, you can prioritize which bills to pay.

Keep in mind that some lenders may continue to charge interest during a deferment, and these fees may be added to your loan balance. The downside here is that you will end up owing more on a balance in the end.

This is why it’s important to understand all the terms and conditions of postponing payments and prioritize paying those bills that will continue accruing interest, so you don’t waste more money in the long run.

For example, federal student loans will not accrue interest until September 2020, or possibly longer, so this is a bill you can confidently defer. On the flip side, private student loans will accrue interest even when you defer, so pay this bill ahead of others.

2. Analyze Recurring Expenses

Take time to go through your credit card and bank statements to pinpoint your monthly, quarterly, and annual recurring expenses to determine which ones you actually need and use, and which ones can go.

This process may help you uncover a subscription you forgot you signed up for that is costing you a few bucks each month. Even if it’s not a lot of money, it’s still a waste to spend it on something you don’t need and aren’t using.

For all those nonessential services you love, like that beauty sample box delivery, now is the time to say goodbye. Just remember, the farewell doesn’t have to be forever — you can always sign back up for that subscription or membership you enjoy once you become financially stable again. This mindset can help ease the process of canceling.

3. Negotiate Rates on Monthly Services

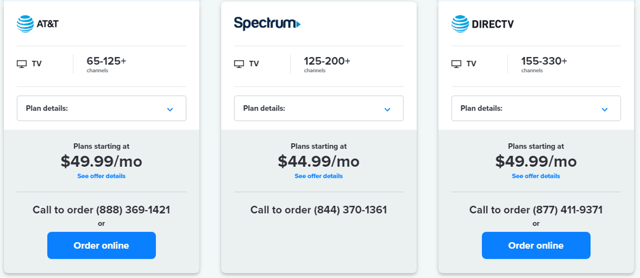

Nothing bad can come from trying to negotiate your bills, so you may as well give it a try. For the best chance of securing a lower rate, run a quick online search to see what competitors in your area are offering, and use that information as leverage in your negotiating.

If the first person you get on the phone isn’t able to help, politely ask to speak with a supervisor or manager who may have more authority to adjust prices. If your negotiations still are not getting very far, consider switching providers if their rates are truly better.

You can use sites like Allconnect.com to compare rates on services, such as TV and internet. You can then use this pricing information to negotiate a better rate with your current service provider.

Threatening to cancel will often send you to the retention team who will work harder to keep you!

4. Shop Around for Insurance

You may have scored a great rate on your homeowners and auto insurance when you first bought your home or car, but if you haven’t touched the policy since, you may have noticed small increases to your premium over time. Now is the time to shop around to see if you can snag a better rate from a competitor.

Begin by quickly comparing insurance quotes through sites like PolicyGenius.com and Insurance.com. Just make sure you read the fine print so you’re getting the coverage you need and want.

Another trick to lowering your monthly payment is to increase your deductible. Depending on how much you increase this payment, you could significantly reduce your annual premium.

Raising your deductible means you assume more risk upfront. Be proactive and put those premium savings in a separate savings account until you reach your deductible. That way, you have the money to pay out-of-pocket costs if you have to file a claim. And, considering you aren’t driving as much right now, your chances of getting into a car accident are very low, so increasing your auto insurance deductible can squeeze some additional savings out of your monthly budget.

5. Opt for a Lower-Tiered Data Plan

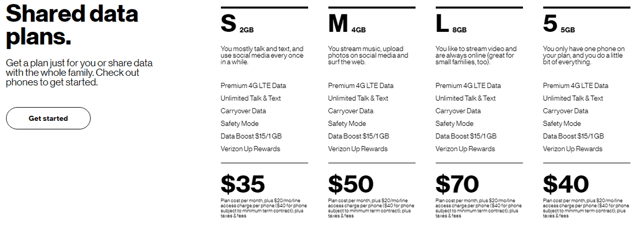

If most of your time is spent at home these days because your workplace has transitioned to remote operation, chances are you really aren’t using much data. If you are using your home WiFi, why not lower your monthly plan?

Most cell service providers, such as Verizon pictured here, offer tiered data plans that can help you save money.

Some mobile carriers allow customers to make changes to their monthly plans online. If you have to call a customer service agent to make the changes, just don’t take their bait in trying to get you to keep your current plan by offering you some bonus deals. Your ultimate goal is to lower your monthly charges, so stick to that.

6. Look for Free Service Alternatives

Families have turned to video streaming services to stay entertained during the stay-at-home orders. However, you don’t have to pay more money on new subscriptions if you’re looking for new content.

Many people don’t realize that libraries offer digital access to borrow streaming content such as movies, TV shows, documentaries, audio and ebooks — all without leaving your home. If you don’t have a library card, you can usually apply right online to gain access quickly.

Otherwise, look into your mobile carrier deals. Some offer access to video streaming services with your plan. For example, Sprint provides members with a free subscription to Hulu, and T-Mobile offers a free Netflix subscription. You can view the full list of deals at whistleout.com.

7. Look for a New Credit Card

The average credit card debt per household hovers around $5,700, according to the U.S. Federal Reserve. With such a high balance, those who can’t afford to pay more than the minimum due are wasting money on interest and will struggle to dig themselves out of debt.

Now is a great time to look into new credit cards that may be offering 0% interest on balance transfers for a set time, which could be for anywhere from 12 to as much as 21 months. Here is our top-rated balance transfer card:

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

A balance transfer buys you more time to make payments toward the actual balance without accruing additional interest and gives you more flexibility in your payments. Just make sure you read the fine print and can pay down the balance in full before the promotional date is up to avoid potential retroactive interest charges.

8. Refinance Your Mortgage

If your monthly mortgage payment isn’t giving you much flexibility in your budget to afford other expenses, look into refinancing your loan. The benchmark mortgage rates are near record lows and you could be looking at saving a whole percentage point on your interest rate.

Not only will this lower your monthly bill, but it could save you thousands of dollars in interest. When shopping around for lenders, make sure you are comparing rates and fees, and ask for a breakdown of your new payment amount plus all the loan closing costs so there are no surprises.

Credit unions typically offer better rates and lower fees, and are a good place to start looking.

9. Cash in On Clutter

Now that you’re bunkered down at home, there’s no better time than now to tackle those decluttering projects. Go through your closets, drawers, kid’s playroom, pantry, garage, and attic space to see which items you can get rid of and what you can sell.

From unworn clothing to gently used baby items and toys to video games and other unwanted gadgets, you could be sitting on hundreds of dollars’ worth of items that you could easily sell online.

Whether you prefer to sell the items yourself through auction sites or want cash quickly upfront, several sites make the process of cashing in on your unwanted items easy. Plus, the money you make from selling your stuff could help cover your bills over the next few months.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![11 Ways to Lower Your Monthly Bill Payments ([updated_month_year]) 11 Ways to Lower Your Monthly Bill Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Ways-to-Lower-Your-Monthly-Bill-Payments.jpg?width=158&height=120&fit=crop)

![6 Credit Strategies to Help You Financially Prepare for the Holidays ([current_year]) 6 Credit Strategies to Help You Financially Prepare for the Holidays ([current_year])](https://www.cardrates.com/images/uploads/2019/10/Holiday-Credit-Strategies-Feat.jpg?width=158&height=120&fit=crop)

![How to Pay Your Credit Card Bill in [current_year] How to Pay Your Credit Card Bill in [current_year]](https://www.cardrates.com/images/uploads/2021/11/How-to-Pay-Your-Credit-Card-Bill.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Tax Payments ([updated_month_year]) 7 Best Credit Cards for Tax Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-for-Tax-Payments.jpg?width=158&height=120&fit=crop)