If you’re old enough, you may remember the commercial for Certs breath mints and its catchphrase: “Two, two, two mints in one!” Today, many people enjoy other products that combine features — like credit cards that offer cash back rewards and 0% intro APR promotions.

These two-in-one cards save you money by offering cash back on eligible purchases and waiving interest charges on unpaid balances. Our article reviews the best double-duty cards for individuals and businesses and explains how the cards work. So pop a Certs into your mouth and keep reading!

-

Navigate This Article:

Best Personal Cash Back Cards With 0% APRs

These cash back cards offer 0% APRs for purchases and/or balance transfers to individuals when they sign up. If you’re looking for your next credit card, one of these is a solid option.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

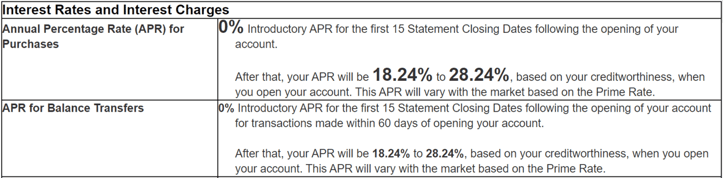

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card will interest consumers who want to choose where they earn rewards. You can select from top-tier cash back categories, including travel, drug stores, online shopping, gas, dining, and home furnishings. We judge this as the best credit card for new cardmembers seeking a signup bonus and 0% APR promotions for purchases and balance transfers.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card delivers generous perks. It provides bonus cash back on quarterly rotating categories such as grocery stores, restaurants, gas stations, and other merchants. You must activate the new category each quarter to earn the bonus rate. New cardmembers also get a 0% intro APR on balance transfers and eligible purchases, as well as a Cashback Match at the end of the first year.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® card is a popular card thanks to its excellent introductory promotions, and elevated cash back rewards rate on several common spending categories. You can earn a signup bonus rate for the first year and a 0% APR on purchases and balance transfers.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card lets you earn cash back on every purchase, every day. There is no limit on the amount of cash back you can collect. You can redeem cash back in many ways, including a statement credit, gift card, or check. The 0% intro APR extends to eligible purchases and balance transfers.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

Owners of the Citi Custom Cash® Card can choose their cash back bonus categories. The card features a signup bonus, no annual fee, and introductory 0% APR promotions for purchases and balance transfers. The card’s app can send you alerts for payment due dates, low balance levels, and attempts to spend beyond your credit limit.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card structures its cash back rewards to favor cardmembers who enjoy travel, dining, and entertainment. If you frequently entertain clients or enjoy nights out on the town, this card’s cash rewards can really add up. New cardholders qualify for a signup bonus and an intro 0% APR for balance transfers and eligible purchases.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Unlimited Cash Rewards credit card provides straightforward cash back while charging no annual fee. The flat rate increases when you become a Preferred Rewards member. New cardmembers can earn a signup bonus and a 0% APR on purchases and balance transfers. As with all Bank of America cards, you want to avoid overdue payments, or the bank will terminate your 0% APR and impose penalty interest and fees.

- Earn $200 back in the form of a statement credit after you spend $2,000 in purchases on your new card in your first 6 months

- Unlimited 1.5% cash back on every purchase

- 0% intro APR on purchases and balance transfers for 15 months from the date of account opening, then a variable APR applies

- Rental car loss and damage insurance when you use your eligible card to reserve and pay for the entire rental and decline the collision waiver at the rental company counter

- Find out if you prequalify for the Cash Magnet® Card or other offers in as little as 30 seconds.

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.24% – 29.99% Variable

|

$0

|

Good/Excellent

|

The Cash Magnet® Card from American Express lets you earn a flat cash back rate that’s easy to redeem through the card’s website or mobile app. New cardholders receive the customary benefits expected from an American Express card, including a signup bonus and introductory 0% APR for purchases and balance transfers. This card is an attractive introduction to the American Express card portfolio.

- Earn $250 back in the form of a statement credit after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year on purchases (then 1%). Also earn 6% cash back on select U.S. streaming subscriptions.

- Earn 3% cash back on transit, including U.S. gas stations, taxis/rideshare, parking, tolls, trains, buses, and more. All other purchases earn 1% cash back.

- $120 Equinox Credit – Use your Blue Cash Preferred Card to pay for Equinox+ at equinoxplus.com and receive $10 in monthly statement credits. Enrollment required.

- 0% intro APR for 12 months from the date of account opening, then a variable APR applies

- $0 intro annual fee for the first year, then $95

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

19.24% – 29.99% Variable

|

$0 intro annual fee for the first year, then $95

|

Excellent Credit

|

If you don’t mind paying a deferred annual fee, you may favor the Blue Cash Preferred® Card. It is the undisputed leader for cash back at US grocery stores, offering the highest rate on purchases. It provides a signup bonus, but its 0% intro APR applies only to eligible purchases, not balance transfers.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Chrome provides bonus cash back rewards for purchases at restaurants and gas stations. You don’t need to sign up to activate your bonus rewards, but they have quarterly limits. The card provides new cardmembers a 0% introductory APR on eligible purchases and balance transfers and offers a Cashback Match on all cash back posted during the first year. After the introductory promotion ends, the regular APR will apply.

- Earn $250 back in the form of a statement credit after you spend $2,000 in purchases on your new Card within the first 6 months of Card Membership

- 3% cash back on groceries from U.S. supermarkets (on up to $6,000 per year in purchases, then 1%)

- 3% cash back on U.S. online retail purchases (on up to $6,000 per year in purchases, then 1%)

- 3% cash back at U.S. gas stations, 1% back on other purchases

- Introductory 0% APR for 15 months on purchases and balance transfers, then a variable rate applies

- Find out if you Pre-Qualify for the Blue Cash Everyday® Card or other offers in as little as 30 seconds

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.24% – 29.99% Variable

|

$0

|

Good

|

The Blue Cash Everyday® Card from American Express offers its best cash back bonuses for gas, grocery, and online purchases. The card doesn’t charge an annual fee, but provides a signup bonus and a 0% APR promotion for purchases and balance transfers. Beware of the card’s hefty penalty APR, late fee, and promotion cancellation if you miss a payment.

Best Business Credit Cards With Cash Back and 0% APRs

Some credit cards for business owners offer larger bonuses than personal cards. The following business credit cards offer cash back rewards and introductory 0% APR promotions.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Cash® Credit Card offers tiered rewards for several business expense categories. The signup bonus, introductory 0% APR on purchases, and high Chase Ultimate Rewards help pay for spending at office supply stores, gas stations, communications, utilities, and restaurants. The card has no annual fee, and Chase Bank monitors your transactions for signs of fraudulent activity. It ranks as the best credit card in this group for owners of small businesses.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Unlimited® Credit Card pays Chase Ultimate Rewards points on all eligible purchases. The bank designed the card to appeal to small business owners who want a simple, low-cost credit card. The card has no annual fee, and you can authorize employee cards at no additional cost. It also provides several travel and consumer protections and can integrate into your accounting software.

- Earn a $250 statement credit after you spend $3,000 in purchases on your Card in your first 3 months.

- Earn 2% cash back on all eligible purchases on up to $50,000 per calendar year, then 1%. Cash back earned is automatically credited to your statement.

- Buy above your credit limit with Expanded Buying Power. Make business purchases over your credit limit with no penalty or enrollments, and still earn cash back on those purchases. Terms apply.

- 0% introductory APR on purchases for 12 months from the date of account opening, then a variable APR applies

- Get an application decision in as little as 30 seconds

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

18.49% – 26.49% Variable

|

$0

|

Good/Excellent

|

The Blue Business Cash™ Card from American Express pays a high, flat rewards rate up to a set yearly limit — and a lower rate afterward. This no-annual-fee business card offers a modest signup bonus, and its short 0% APR promotion applies only to purchases, not balance transfers. The card lets you spend beyond your credit limit without penalty.

- 0% Intro APR for the first 12 months; 21.24% – 29.24% variable APR after that

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won’t expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

21.24% – 29.24% (Variable)

|

$0

|

Good

|

The Capital One Spark Cash Select for Good Credit is a solid flat-rate card with unlimited rewards for eligible purchases. You can qualify for a signup bonus if you spend the required amount within the first three months of opening the account. The card offers new cardmembers a short 0% APR promotion on purchases. This Spark card also lets you pick your monthly payment date and set spending limits on free employee cards.

What Is a Cash Back Credit Card?

A cash back credit card is a traditional credit card that pays cash rewards to cardholders by returning a percentage of each purchase. Most cash back cards deliver rewards of up to 5% on purchases, although some offer even more on selected purchases.

This type of card rebates a specified percentage of each eligible purchase. The cash back structure may be flat, tiered, or rotating:

- Flat rate: These cards offer a flat cash back rate (typically 1% or 2%) on all purchases. Some cards place an annual cap on the spending eligible for a high rate and then pay a lower, unlimited rate on the remainder.

- Tiered rates: These cards offer different bonus rates for spending on various merchant categories (e.g., restaurants, gas stations, office stores, etc.) The card may limit the purchase amounts entitled to the bonus rates. All other eligible spending receives the default rate, typically 1%.

- Rotating categories: The card specifies a new merchant category for each quarter’s top bonus rate. You must activate your enrollment every quarter to receive these rewards. Issuers often cap the quarterly spending eligible for the high bonus rate. These cards may also include tiered bonuses for secondary spending categories.

Other features of cash back credit cards include the following:

- Introductory promotions: Many cash back cards let you earn a cash bonus when you spend a set amount on eligible purchases during the initial period (typically two to six months after account opening). We discuss 0% APR promotions below.

- Costs: Issuers specify each card’s APR and fees. Different interest rates may apply to purchases, balance transfers, and cash advances. The issuer may impose a penalty APR (typically 29.9%) and a fee if your payment is late. You should also know the card’s annual and foreign transaction fees.

- Benefits: The best cash back cards may offer additional consumer benefits, including price protection, travel insurance, purchase protection, and free FICO scores, among others.

- Credit limits: Issuers assign credit limits on unsecured cash back cards. Your card’s spending limit depends on your credit score, income, debt, and housing costs. Your cash deposit sets the initial credit limit for secured cash back cards.

Consumers frequently choose cash back cards with the highest rewards for their favorite categories, such as groceries or dining. CardRates.com publishes dozens of informative articles to help you select your next credit card.

What Is a 0% APR Credit Card?

New cardmembers may receive an intro 0% APR promotion on purchases and balance transfers for a set period (typically six to 21 months) after account opening. Many cards for consumers with good credit offer this promotion, regardless of whether the card also pays rewards in cash back, points, or miles.

The promotion allows cardowners to stretch their payments for purchases over multiple billing cycles without accruing interest. Many consumers seek out 0% APR cards in anticipation of one or more big-ticket purchases. Doing so can save money on interest and may qualify the new cardholder for a signup bonus.

A 0% APR on balance transfers offer lets you move outstanding credit card balances to a new card and avoid interest charges until the promotional period expires. You can use this feature to consolidate your credit card debts and repay the combined balance without the drag of interest.

How Do I Qualify For a Card With No Interest and Cash Back?

You will need a good good FICO score to get a card with 0% interest. Cash back cards are available to consumers with at least fair credit, but you need good credit to get a card with high cash back rates and zero-percent APRs.

The issuer typically provides a quick answer when you apply online. As a note, formally applying for a credit card may impact your credit score, regardless of whether you are approved. Card issuers do a hard pull of your credit file when you apply for a credit card or loan.

The major credit bureaus (Experian, Equifax, and TransUnion) track the hard inquiries you receive. Only you can approve hard inquiries, which occur when you attempt to increase your access to credit (i.e., by applying for a credit card, a higher credit limit, or a loan).

Hard inquiries typically have a negligible impact on your FICO score, but several of them in a short period may harm your credit. Creditors view multiple hard inquiries within a brief period as an indication of financial distress. Hard inquiries remain on your credit report for two years but impact scores only for the first year.

Soft inquiries result from credit checks that do not involve new accounts. Employers, landlords, utilities, and even dating partners may be interested in your credit history and lodge soft inquiries. And remember, self-inquiries are always soft.

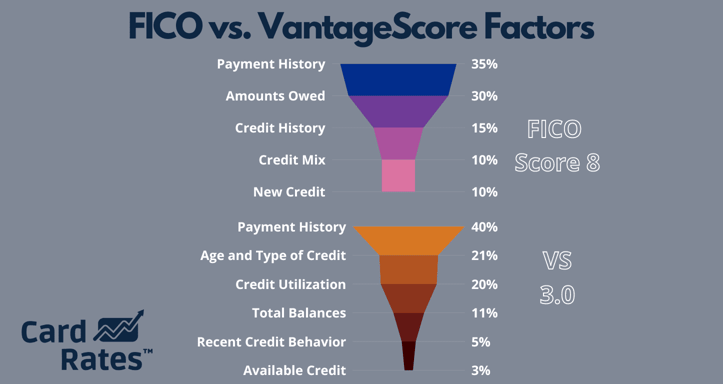

If you want to improve your odds of qualifying for a cash back card with a 0% intro APR, it helps to boost your credit score. The most effective way to raise your score is to pay your bills on time every month. Your payment history accounts for 35% of your FICO score — the most significant factor determining your overall score.

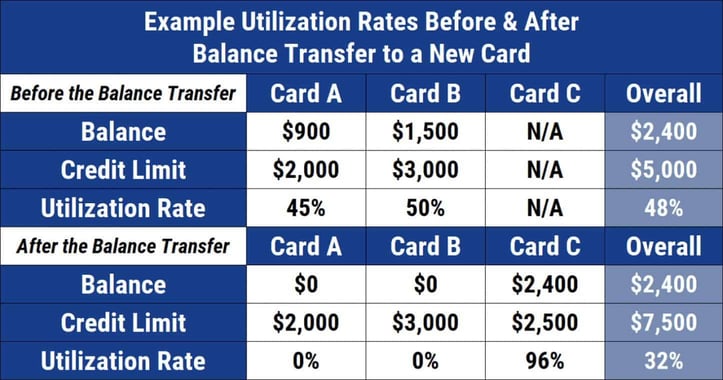

Your debt levels account for another 30% of your FICO score. One important metric is your credit utilization ratio (CUR), which is the amount of credit you currently use divided by the amount of credit available. Your CUR should always be below 30% for good credit scores.

Your debt-to-income ratio is another measure of your creditworthiness. Typically, creditors get nervous when they see DTI ratios above 35%, although the critical threshold may be higher for certain types of secured debts.

You can also improve your credit by removing inaccurate, obsolete, and unverifiable data from your credit reports. Start by getting a free copy of each report from AnnualCreditReport.com. You can dispute incorrect data by contacting the credit bureaus online, by mail, or over the phone.

If you win your dispute, the credit bureau must delete or correct the offending item, recalculate your credit score, and inform recent report recipients of the change. If you aren’t the DIY type, you can hire a legitimate credit repair company to help clean up your reports.

Your credit should improve whenever a credit bureau removes derogatory information from your report. Know that credit repair companies cannot guarantee a higher score. Expect to pay between $50 and $150 monthly to subscribe to a credit repair company, but you can terminate or extend your subscription if needed.

Some credit cards allow cosigners. By recruiting a cosigner with good credit, you may qualify for a cash back, 0% APR credit card even if you have poor credit.

Is it Better to Have a 0% APR or Pay No Annual Fee?

A 0% APR card can save you hundreds in interest, especially if you are contemplating big-ticket purchases. A card with a 0% APR on balance transfers can save significant interest costs when you use it to consolidate and repay your credit card debt.

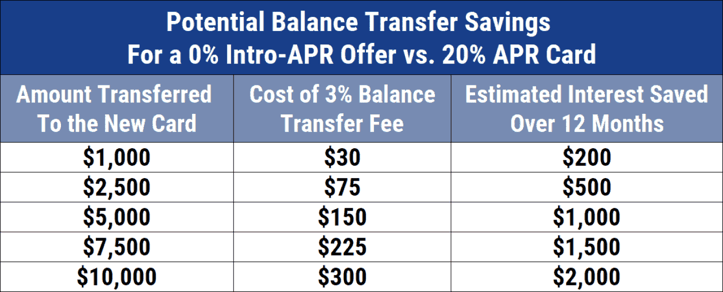

But a 0% APR promotion is a temporary benefit. When it expires, you’ll face a much higher rate on carried balances. Remember that you’ll pay a 3% to 5% fee on each balance transfer.

Paying no annual fee is a permanent benefit. Cards with annual fees ranging from $29 to more than $600 may pack more perks, but a no-annual-fee card can be adequate for any lifestyle.

Cardmembers who always pay their entire monthly balance will be indifferent to the 0% APR and may prefer a card with no annual fee. But if you frequently carry a balance across multiple billing cycles, a 0% APR will save you money (at least temporarily).

You may also prefer a 0% APR on balance transfers to reduce your credit card debt.

The most straightforward answer is: Try to get a credit card that offers a 0% promotion without charging an annual fee. You’ll have your cake, eat it too, and won’t put on any weight.

How Do 0% APRs Affect My Credit Score?

A 0% APR offer doesn’t directly affect your credit score, but how you use the card does. You increase your available credit when you receive a new credit card, which reduces your credit utilization ratio and potentially raises your credit score.

You can reduce your CUR further by using a 0% APR to consolidate and pay off your outstanding credit card balances.

But if you use your new card to finance a shopping spree, you may raise your CUR and harm your credit score. Your behavior will dictate the ultimate impact on your CUR.

If you have a large unpaid balance when the 0% promotion expires, your credit will suffer if your debt is so high that you can’t afford the minimum payments. You’ll also feel the impact if your minimum payment is more than 30 days late.

Applying for several cards in a brief period can also drive down your credit score because of the multiple hard inquiries on your credit reports. It’s best to wait about six months before applying for another credit card.

What Are the Pros and Cons of a 0% APR For Purchases?

A 0% APR for purchases on a credit card offers various advantages and disadvantages. Here are some of them:

Pros

- Interest-free financing: You can make purchases without interest for a set period. This promotion can be particularly useful for purchasing big-ticket items, including appliances, furniture, or electronics, allowing you to stretch your payments over multiple billing cycles without additional cost.

- Flexibility: The 0% APR makes financial planning more flexible. For example, you can use the card interest-free (during the promotional period) if you suddenly need money for a holiday sale or medical emergency.

- Credit score benefits: Making timely payments on your 0% APR card can help raise your credit score.

- Promotional Rewards: Credit cards offering a 0% APR frequently provide signup bonuses and rewards in the form of cash back, points, or miles.

These are powerful reasons to get a 0% APR credit card.

Cons

Cards with a 0% APR promotion on purchases have a few potential drawbacks:

- Temporary benefit: The 0% APR is a promotional offer that will expire after a certain period (usually six to 21 months). Once the promotional period ends, you’ll pay a much higher interest rate on any remaining balance.

- Potential for overspending: The allure of 0% interest can tempt you into overspending, leaving you with a balance that you can’t pay off before the promotional period ends.

- High post-promotional APR: After the promotional period expires, the regular APR may be higher than average, especially if your credit is only fair.

- Impact on your credit utilization ratio: You risk increasing your credit utilization ratio if you use your new card to go on a shopping spree. A high CUR can harm your credit score. The damage worsens if you can’t pay off a big balance before the 0% APR period ends.

- Complex terms and conditions: Some 0% APR offers come with obscure gotchas. For example, you may forfeit the 0% rate if you miss a payment, which could result in costs higher than anticipated. The impact is worse if the card imposes a high penalty fee.

On balance, a 0% APR on purchases is an excellent promotion if you manage it responsibly.

What Are 0% APR Pros and Cons for Balance Transfers?

Balance transfers allow you to consolidate debt. Cards with 0% APRs for balance transfers can do good or harm, depending on how you use them.

Pros

Let’s start by accentuating the positives:

- Interest savings: The primary benefit of a 0% APR for balance transfers is that it can help you pay down debt without incurring interest for a specific period, usually between six and 21 months. That time can result in significant savings if used prudently.

- Simplified payments: Transferring multiple credit card balances to a single 0% APR card can simplify your financial life because you won’t have to remember different due dates and minimum payments. You’ll have just one credit card payment to track each month.

- Financial flexibility: The interest-free period gives you some breathing room should you suddenly need money for emergencies.

- Credit score: A balance transfer can lower your credit utilization ratio and raise your credit score if you don’t rack up new balances on your old credit cards.

With the right attitude, you can use balance transfer cards to your advantage.

Cons

A balance transfer card is not without potential downsides:

- Balance transfer fees: Most credit cards charge a balance transfer fee, typically between 3% and 5% of the transferred amount. This fee will offset some amount of interest savings, depending on the size of the balance you’re moving,

- High Post-Promotional APR: As with the 0% APR for purchases, the regular APR on the remaining balance can be quite high once the promotional period ends. This high APR may eliminate some of your interest savings if you don’t pay the entire balance before the promotion expires.

- Potential for increasing debt: Having a card with a zero balance after the transfer might tempt you into creating more debt, worsening your financial situation.

- Credit score impact: Opening a new account and transferring balances will result in a hard inquiry for your credit report, which may impact your credit score. Additionally, the new account will reduce the average age of your credit accounts, another factor that could lower your score.

- Limited time to qualify: Many cards require you to complete the balance transfer within a certain period (e.g., within 60 days of account opening) to be eligible for the 0% APR offer. Missing this deadline means losing out on the benefit.

Consider these possible pitfalls before transferring your credit card balances.

Get a Credit Card With Cash Back and 0% Interest

Individual and business owners looking for a cash back credit card have many options. We’ve given you more than a dozen cards to consider, all offering a 0% introductory APR on purchases and/or balance transfers. Each card has a unique mix of benefits and costs, so one or more may perfectly match your requirements.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year]) What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/what-is-apr.jpg?width=158&height=120&fit=crop)

![What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year]) What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/good-apr2.png?width=158&height=120&fit=crop)

![7 Low APR Credit Cards For Bad Credit ([updated_month_year]) 7 Low APR Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_615601223-4.jpg?width=158&height=120&fit=crop)

![7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year]) 7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/low.png?width=158&height=120&fit=crop)

![4 Best Student Credit Cards With 0% APR ([updated_month_year]) 4 Best Student Credit Cards With 0% APR ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Student-Credit-Cards-with-0-APR.jpg?width=158&height=120&fit=crop)

![7 Best 0% APR Travel & Air Miles Credit Cards ([updated_month_year]) 7 Best 0% APR Travel & Air Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-0-APR-Travel-Air-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![11 Best High-Limit 0% APR Credit Cards ([current_year]) 11 Best High-Limit 0% APR Credit Cards ([current_year])](https://www.cardrates.com/images/uploads/2023/03/Best-High-Limit-0-APR-Credit-Cards.jpg?width=158&height=120&fit=crop)