Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

According to the Small Business Administration (SBA), there are more than 33 million small businesses in the United States, and I’m proud to own and operate one of them. One of the things that many, if not most, small businesses must deal with is securing the funding necessary to open their doors for business.

Most small business owners likely had to decide whether they were willing to sign personal guarantees on credit applications when starting their businesses. Here are six important questions to consider when deciding whether a card with a personal guarantee is right for you.

1. What is a Personal Guarantee?

A personal guarantee, in a credit and borrowing context, is language that is likely in the agreements with your commercial lenders that obligate you to be financially liable for your company’s debt. A personal guarantee essentially makes you as liable for payment of business debt as you would be for your personal credit cards, auto loans, or mortgage obligations.

The reason most business lenders require business owners to sign a personal guarantee is that every one of those 33+ million small businesses started with no products, no revenue, no customers, and no commercial credit history. When you lack these things, the lender is going to ask you to stand in place of your company if your business credit card or loan goes into default. It’s their way of mitigating the risk of your business failing.

While some may view personal guarantees as punitive, they do serve a valuable purpose, which is to act as a catalyst for the availability of funds for unproven businesses.

If banks and other commercial lenders had to roll the dice and take a chance on a fledgling business being successful, funding options would be more limited and more expensive. Simply put, the personal guarantee unlocks funds for new businesses.

2. Should I Use a Personal Credit Card to Fund My Business?

You have other options if you’re not interested in signing a personal guarantee or you don’t want to take out any business credit to fund your operations. Using an existing or newly opened personal credit card in lieu of applying for business credit is a viable option.

In fact, there is no shortage of stories about highly successful businesses starting out on a shoestring budget built off personal credit card debt, loans from family members and friends, and other sources of funds that don’t come from traditional commercial lenders.

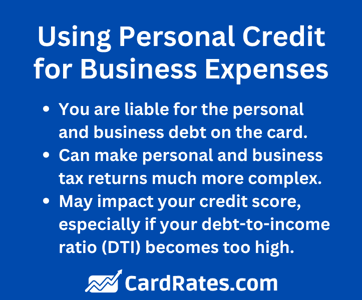

Keep in mind, however, that if you’re using personal credit cards instead of business credit cards, you’re still personally liable for the debt. And, if you depend on those same credit cards for personal use, using a portion of the credit limit for business purposes is going to limit your card’s capacity for personal usage.

Now, whether you should use personal credit cards to fund a business is a different topic. If your accountant is like my accountant, then they’re going to tell you to quickly segregate personal from business credit and expenses to keep accounting and tax returns as straightforward as possible.

But that’s not the only reason you shouldn’t depend on personal credit cards longer than absolutely necessary. You should also be concerned with your credit reports and credit scores.

3. How Do Cards With Personal Guarantees Affect My Credit Scores?

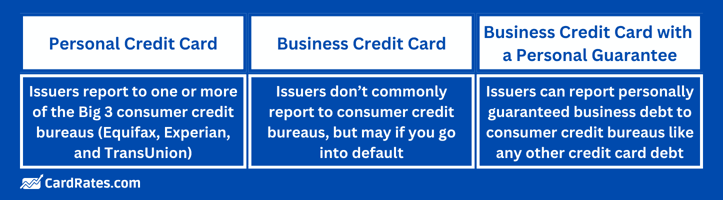

Almost every consumer credit card issued by a financial services company in the United States is reported to one or more of the national credit reporting agencies, Equifax, Experian, and TransUnion. And, of course, the credit cards on your credit reports are going to influence your credit scores.

If you’re using your credit cards responsibly, they’re going to help your credit scores. But if you’re abusing your credit cards by missing payments and maxing out the card’s limit, your credit reports are going to harm your credit scores.

But business credit cards are not commonly reported to consumer credit reporting agencies, except under certain conditions. What I’ve found to be the most common practice is business card issuers, with some exceptions, report your accounts to the credit bureaus only if you go into default.

There are, however, a small number of issuers that do report personally guaranteed business credit cards to the consumer credit bureaus even if they’re in good standing.

If you are able to find a business lender willing to offer you a business credit card and not require you to sign a personal guarantee, the account will not be added to your personal credit reports because you’re not incurring consumer debt. But if you did sign a personal guarantee, then the lender can report the account to the credit bureaus just like any other consumer credit card account.

There is no difference between personally guaranteed consumer debt and personally guaranteed business debt when it comes to their impact on your credit scores. That means missing payments on business credit cards is going to have the same impact as missing payments on consumer credit cards. And maxing out business credit cards is going to have the same impact on your credit as maxing out consumer credit cards.

4. Are Business Credit Cards Hard to Open?

Commercial lenders, many of whom are also personal lenders, are in the business of lending money. That means they would like to extend as much credit to borrowers as possible. That makes opening a business credit card fairly simple and pain-free.

You are going to be asked for information about your business, so the lender knows there’s a real entity operating as the business. And, as we’ve already covered, you’re going to be asked to agree to a cardholder agreement, which will likely include a personal guarantee.

As part of the personal guarantee, the lender is going to collect your personal information and then pull one or more of your personal credit reports and credit scores, as it would if you were applying for a consumer credit card.

You’ll likely be approved if your credit reports and credit scores are good enough, i.e., meet the issuer’s approval criteria. A few days or weeks later, a card with your company’s name embossed across the front will show up, and you can start using the card after it has been activated. This process is nearly identical to opening a consumer credit card.

5. Can My Personal Guarantee Be Removed Someday?

If your small business is successful, you can leverage that success in a variety of ways. That includes no longer having to sign personal guarantees for new business credit. This is because the company’s revenue, credit reputation, and business credit scores justify the elimination of the personal guarantee requirement.

You can ask your business lenders to rework your contracts to eliminate existing personal guarantees. But there’s no requirement for them to do so. You may be asked or required to open new accounts, with new underwriting, to eliminate your personal liability.

6. Do Business Cards Appear on My Credit Reports?

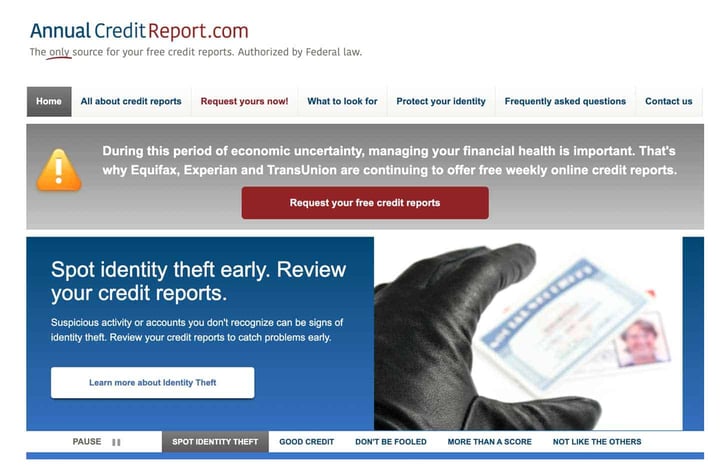

Those of you who use business credit cards and/or business loans to fund your small business may not know whether those accounts are on your personal credit reports. The good news is you can check your credit reports for business accounts just like you can check your credit reports for your consumer accounts on AnnualCreditReport.com.

If you don’t see your business credit on your personal credit reports, that indicates you either do not have personal guarantees on those accounts or your lenders, as a matter of policy, do not report to the consumer credit bureaus unless the accounts have gone into default.

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)

![7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year]) 7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-5--1.jpg?width=158&height=120&fit=crop)

![12 Best Personal Cards For Business Expenses ([updated_month_year]) 12 Best Personal Cards For Business Expenses ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/BusinessPersonaCard1.jpg?width=158&height=120&fit=crop)

![7 Best Personal Credit Cards ([updated_month_year]) 7 Best Personal Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/personal-cover.jpg?width=158&height=120&fit=crop)

![5 Best Online Personal Loans for Bad Credit ([updated_month_year]) 5 Best Online Personal Loans for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/loan.png?width=158&height=120&fit=crop)

![7 Cash Advance & Personal Loans For No Credit ([updated_month_year]) 7 Cash Advance & Personal Loans For No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Cash-Advance-Personal-Loans-For-No-Credit.jpg?width=158&height=120&fit=crop)