While credit cards are popular among consumers for their perks and convenience, it’s easy to forget that credit cards aren’t only popular with consumers; the card issuers and banks love them too — but for different reasons. For instance, credit cards are a consistent (and abundant) source of income.

In fact, according to the Federal Reserve, credit card interest fees account for nearly 10% of the income of credit card banks, and almost 3% of the income for the average commercial bank.

With so much money on the line, consumers, quite rightly, often look to get the lowest APR they can. But what is a good credit card APR — or a really bad one? As with many things in life, the answer to that question is: It’s relative.

APRs Explained | Best APR Deals

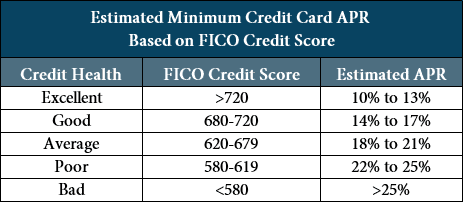

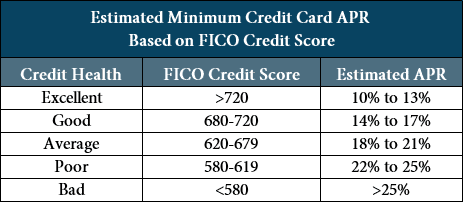

For the most part, the quality of a particular APR will depend more on your credit history than any hard-and-fast numbers. That said, a few generalizations can be made, starting with the fact that a lower APR is always better — and a zero APR is the best. On the other end of the range, double-digit APRs are common for credit cards, but an APR over 30% is always bad.

Outside those broad lines, whether a specific APR is a good APR will depend on both the card and your personal creditworthiness. Nearly all open-loop credit cards will have a range of possible APRs (e.g., 14.99% – 19.99%), typically spanning five to 10 percentage points. This range is determined by issuers based on their risk tolerance and the potential risk of the card’s intended audience.

The APR you are offered when you apply for a particular credit card will come from the predetermined range, but the exact number will depend on your individual creditworthiness. Lower-risk applicants — those with well-established credit profiles and high credit scores — will be offered an APR from the lower end of the range. Higher-risk applicants with lower credit scores will receive an APR from the higher end of the range.

Along these lines, a specific interest rate can be good for one card and applicant, but poor for another. For example, consider two credit cards, Card A and Card B, with APR ranges of 11% to 16% and 15% to 20%, respectively. Suppose Hypothetical Henry applies for both cards and is offered a 15% interest rate by both issuers. Relative to the possible rates for Card A, Henry’s 15% APR isn’t very good. For Card B, however, the 15% APR is the best possible rate.

In general, the only effective way to influence the APR you receive when you are approved for a particular credit card — other than improving your credit — is to be discerning during the card selection process. If you choose to apply for a credit card with a low APR range, then you are essentially guaranteed to get a low APR if you are approved.

Of course, it’s important to apply for a card for which you are actually likely to be approved, no matter how tempting the APR range of out-of-reach cards. If you have poor credit, for instance, you are likely to be rejected for a prime credit card with a low APR range and may need to settle for a card with a higher APR. Since each application will result in a hard credit inquiry, don’t apply for cards well outside your credit score’s reach.

Low Ongoing APR | 0% New Purchases | 0% Balance Transfers | Fair Credit | Bad Credit

Best Cards with “Low Ongoing” APRs

Although most of us know it’s best to avoid carrying a credit card balance because of the fees, sometimes — life happens. With a credit card that always has a low APR, you can avoid paying an arm and a leg — or any other body part — to your credit card issuer and ensure that life’s little problems don’t turn into big expenses. Our top-rated picks for low ongoing APRs offer rates as low as 11.99% to qualified applicants.

- Get a 0% intro APR for 15 months on Balance Transfers and Convenience Checks that post to your account within 90 days of account opening. After this time, the Variable Regular APR will apply to your balance.

- Our lowest-rate card: Pay less in interest if you carry a balance from month to month

- Travel benefits include Auto Rental Coverage, Travel Accident Insurance, Baggage Delay and Reimbursement, and Trip Cancellation and Interruption Coverage

- No annual fee or foreign transaction fees

- This offer is only open to members of military-affiliated groups and their families

|

|

|

|

|

|

N/A

|

0% for 15 Months

|

9.15% - 26.15% (Variable)

|

$0

|

Good to Excellent

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

+See more Low Ongoing APR Cards

If you have made significant credit score improvements since you obtained your current card, you may be able to request an APR reduction from your issuer. Few issuers will grant decreases outside the advertised APR range, so check your card’s range to get an idea of what rate to ask for based on your credit profile.

Best Cards for “New Purchase” Intro 0% APR

Credit cards are an amazingly convenient way to make all kinds of purchases, especially large purchases that would be a hassle to make with cash. At the same time, the typical double-digit APR can make that purchase a whole lot less convenient.

Cards offering an introductory 0% APR deal are great for financing large purchases you may need a little time to pay off. The best cards, including our favorites, provide introductory periods of 12 months or more. Look for a card with bonus rewards for your purchase category to maximize your potential savings.

0% INTRO APR RATING

★★★★★

4.8

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

0% INTRO APR RATING

★★★★★

4.8

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

0% INTRO APR RATING

★★★★★

4.8

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

+See More New Purchase Intro APR Cards

When taking advantage of introductory APR deals, remember that introductory basically means temporary in this case. After your intro period ends, you’ll be charged the default purchase APR on your remaining balance and new purchases. To avoid sudden interest fees, be sure to pay off your balance before your terms expire.

Best Cards for “Balance Transfer” Intro 0% APR

It’s all well and good to get a new credit card with a low (or 0%) APR for new purchases, but what about the balance you’re already being charged double-digit interest on? That’s where the balance transfer card offer comes in. These introductory credit card offers provide 0% APR on transferred balances and more than 12 months to pay them off. The balance transfer options on our list won’t even charge an annual fee.

0% BALANCE TRANSFER RATING

★★★★★

4.8

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

|

|

|

|

|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

0% BALANCE TRANSFER RATING

★★★★★

4.8

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

0% BALANCE TRANSFER RATING

★★★★★

4.8

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

|

|

|

|

|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

+See More Balance Transfer Intro APR Cards

Before transferring your balance, check to see if your new card charges a balance transfer fee (hint: most cards do). Typically 3% to 5% of the transferred balance, these fees are often worth the cost to those currently being charged a 20%-plus APR.

Best Low-APR Cards for “Fair” Credit

Although the exact credit score range will vary by model, those with scores in the mid-600s tend to be described as having “fair” credit. These consumers are often building (or rebuilding) their credit, which equates to a fairly substantial credit risk to an issuer — and, thus, relatively high APRs.

Overall, fair-credit consumers will generally be offered an APR at the high end of the range for prime cards, but may qualify for the low end of the range with a subprime card. On the plus side, those with fair credit can still find quality cards, even some that offer purchase rewards, such as some of our expert-rated options below.

10. Credit One Bank® Visa® Credit Card with Cash Back Rewards

This card is currently not available.

Fair Credit Rating

★★★★★

N/A

FAIR CREDIT RATING

★★★★★

4.4

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

FAIR CREDIT RATING

★★★★★

4.8

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

+See More Cards for Fair Credit

A good way to ensure your new card helps build your credit profile in a positive way is to pay your balance on time every month, perhaps by setting up automatic payments. Since your payment history is 35% of your FICO score calculation, late or missed payments can sabotage any progress you’ve made on your rebuilding journey.

Best Low-APR Cards for “Bad” Credit

If there’s anything that scares a prime credit card issuer, it’s a bad credit score (typically defined as a FICO score below 580). As a result, these high-risk consumers instead need to focus on secured credit cards — which require a deposit — or unsecured subprime credit cards. Our list of bad-credit card options includes both secured and unsecured cards to get your search started off right.

BAD CREDIT RATING

★★★★★

4.9

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

|

|

|

|

|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

BAD CREDIT RATING

★★★★★

4.3

- Now with higher credit limits

- Increase your access to available credit

- Higher limit than before, still no security deposit required!

- Greater access to credit than before

- Less than perfect credit is okay

- Mobile account access at any time

|

|

|

|

|

|

N/A

|

N/A

|

35.9%

|

$175 - $199

|

Bad, Poor Credit

|

BAD CREDIT RATING

★★★★★

4.7

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

|

|

|

|

|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

+See More Cards for Bad Credit

Many consumers avoid secured credit cards because of the initial deposit, but they may be more affordable than most people think. Not only can you add to your deposit over time if you can’t afford a large deposit upfront, but that deposit is completely refundable. Many unsecured credit cards require several hundred dollars worth of fees just to open the account, making unsecured cards more costly for some consumers.

Every year, large credit card companies and commercial banks rake in hundreds of millions of dollars’ worth of interest fees from cardholders around the world. Consumers can do their part to fight back against interest fees by keeping their credit card balances paid off every month and using low-interest credit card deals. Paying off your balance each month is also an important factor in maintaining a healthy credit score because this is one of the main areas credit bureaus look at when determining your score.

If you’re not happy with the high APRs you’re currently being charged, the best solution is to improve your credit. Overall, the higher your credit score rises, the lower the APRs you’ll be charged for credit cards — or any other credit product. With a little research and some diligent credit building, nearly anyone can reduce or eliminate interest fees, keeping their hard-earned money out of the banks’ voracious vaults and in their own pockets.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year]) What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/what-is-apr.jpg?width=158&height=120&fit=crop)

![7 Low APR Credit Cards For Bad Credit ([updated_month_year]) 7 Low APR Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_615601223-4.jpg?width=158&height=120&fit=crop)

![7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year]) 7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/low.png?width=158&height=120&fit=crop)

![How to Calculate APR on a Credit Card ([updated_month_year]) How to Calculate APR on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/CalculateAPR-1--1.png?width=158&height=120&fit=crop)

![7 Options When Your Credit Card APR Rises ([updated_month_year]) 7 Options When Your Credit Card APR Rises ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/shutterstock_591898394-edit1.jpg?width=158&height=120&fit=crop)

![7 Longest 0% APR Credit Card Offers ([updated_month_year]) 7 Longest 0% APR Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Longest-0-APR-Credit-Card-Offers-Feat.png?width=158&height=120&fit=crop)

![11 Best High-Limit 0% APR Credit Cards ([current_year]) 11 Best High-Limit 0% APR Credit Cards ([current_year])](https://www.cardrates.com/images/uploads/2023/03/Best-High-Limit-0-APR-Credit-Cards.jpg?width=158&height=120&fit=crop)