Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

One of the cardinal rules of having a credit card is to always pay your bill on time, if not earlier than the due date. If you miss your due date by even a single day, bad things can start to happen. And they get worse the later your card issuer receives your payment.

But there are also some misconceptions about how missing a credit card payment may impact your credit history and credit scores. In truth, there’s a small window after the due date that gives you the opportunity to bring your account current without harming your credit scores. This is the little-known grace period built into the credit reporting system.

Here’s a look at what happens behind the scenes if you miss a credit card payment. And while it’s always better to pay your credit card bill on time — or early, if possible — understanding the details below can be helpful if you ever overlook making your credit card minimum payment.

-

Navigate This Article:

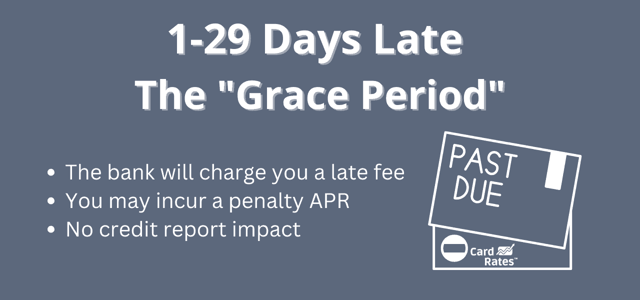

What Happens If You’re 1 to 29 Days Late

When you miss the due date on your credit card bill by even a single day, your credit card issuer will consider your account to be late and past due. At that point, it’s common for your card issuer to assess a late fee.

According to the Consumer Financial Protection Bureau (CFPB), a late fee can cost as much as $41. Card issuers may charge $30 for an initial late payment and $41 for repeat offenses. As you can see, it can become expensive to pay your bills late.

Another potential negative consequence of paying late is that your credit card issuer may decide to increase your Annual Percentage Rate (APR) on future purchases. If your account includes a penalty APR, and most do, that rate could be significantly higher than the regular purchase APR to which you’re accustomed.

This is another punitive measure designed to punish cardholders who don’t pay their bills on time.

On a positive note, until you become at least 30 days past the due date, your card issuer will not report you as late to the major credit bureaus (Experian, TransUnion, and Equifax). In fact, no lender is allowed to report late payments to the bureaus until a consumer is a full 30 days past the due date on their account, according to credit reporting guidelines.

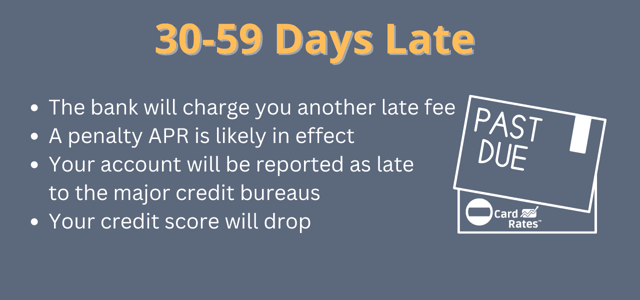

What Happens If You’re 30 to 59 Days Late

Once your payment is 30 to 59 days late, the credit reporting grace period is over. At this point, a credit card issuer can inform the credit bureaus that you’re 30 days late on your credit card payment if it wishes to do so. This will result in a late payment appearing on your credit reports.

Remember, credit reporting is voluntary. There’s nothing in the Fair Credit Reporting Act that requires card issuers to report late payments, or anything else. Most credit card companies will choose to inform the credit bureaus if you pay your bill 30 days late, or worse.

If a late payment shows up on your credit reports, it could be a problem for quite some time. There are a few circumstances where you may be able to change missed payments on your credit reports.

But, in general, legitimate late payments can remain on your credit report for up to seven years from the date of their occurrence.

When late payments appear on your credit reports, those blemishes may also damage your credit scores. Your payment history, and the presence or absence of derogatory information, accounts for 35% of the points in your FICO® Score. So it’s important to avoid having any negative payment history appear on your credit reports whenever possible.

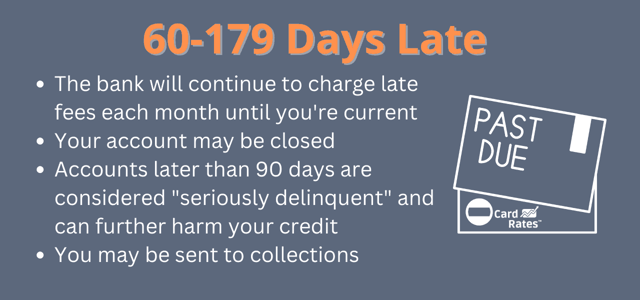

What Happens If You’re 60 to 179 Days Late

Falling further behind on a credit card bill opens the door to more serious consequences from your credit card issuer. If your account is 90 days past due, your card issuer may close your account, report you as being delinquent, and send you to collections.

Being at least 90 days late could also have a more serious impact on your credit scores compared to being 30 days late. Credit scoring models consider anything 90 or more days late to be severe whereas anything less than 90 is considered to be a minor derogatory event.

Likewise, multiple late payments or recent late payments are more problematic than an isolated 30-day late payment that happened several years ago.

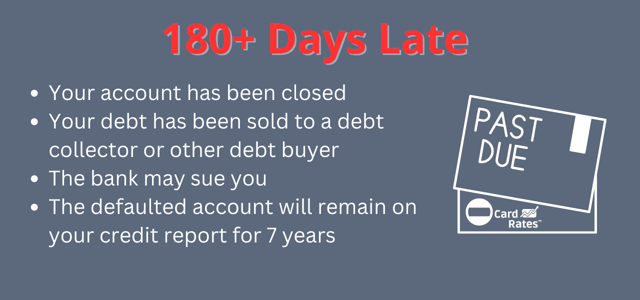

What Happens If You’re 180+ Days Late

By now, your card issuer has likely designated your account as being in default and has charged off the balance as a loss. It has also likely either outsourced the collection of the balance to a third-party debt collector or sold the debt to a debt buyer.

Your card account was closed several months ago. And depending on the size of the balance, the issuer is likely considering whether to sue you.

Third-party collection accounts can stay on your credit reports for up to seven years from the date of the delinquency with the originating creditor. While it’s often misreported, collection accounts don’t actually remain on your credit reports for seven years because the seven-year clock begins ticking before the account is sent to a collection agency.

NOTE: The credit reporting agencies allow lenders to report you as being current, 30-59 days late, 60-79 days late, 80-119 days late, 120-149 days late, 150-179 days late, and 180 days late or greater.

Talk to Your Card Issuer ASAP

If you’re worried that your credit card payments are becoming unmanageable, it’s better to take action early and speak with your card issuer sooner rather than later. Ignoring the problem will only make it worse and waiting until you’re past due will limit your options.

Instead, avoid continued overspending on your credit cards, and do your best to avoid facing the problems above before it’s too late.

![5 Bad Credit Auto Loans With No Down Payment ([updated_month_year]) 5 Bad Credit Auto Loans With No Down Payment ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/06/Bad-Credit-Auto-Loans-With-No-Down-Payment.jpg?width=158&height=120&fit=crop)