There’s no shortage of credit cards for fair credit with no annual fee, but they usually lack many of the bells and whistles associated with cards pegged to higher scores. That means you’re unlikely to encounter big signup bonuses, although some cards in this group offer cash back rewards and a few other goodies.

All of the cards reviewed below may charge no annual fee and are useful to folks with a scant or blemished credit history. Timely payments and low balances can help keep your interest charges in check and demonstrate your creditworthiness. This may help you increase your credit score over time.

Read on for some of our experts’ top selections — we’ll dive into the overall best cards, cash back cards, student cards, business cards, and retail cards.

Overall | Cash Back | Students | Retail

Best Overall Cards For Fair Credit With No Annual Fee

We’ve judged these three cards to offer the best overall mix of benefits. All three are unsecured and should be available to those with fair credit scores. These cards may be useful for improving your credit without necessarily shelling out annual fees.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Platinum Credit Card is highly rated because it may provide access to higher credit limits when you make your first five months of payments on time. It takes only a few minutes to pre-qualify for this card and doing so won’t hurt your credit score. The card offers tools to monitor your credit, $0 fraud liability, automatic monthly payments, provision for adding authorized users, and several travel and retail services.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Chrome offers a limited bonus cash back rate on select purchases and an unlimited regular cash back rate on all others. Students receive a statement credit if they refer a friend and they’re approved. The card provides free alerts when it spots new accounts on your credit report or detects your Social Security number on the dark web.

3. Indigo® Unsecured Mastercard®

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Indigo® Unsecured Mastercard® is offered with an annual fee as low as $0. The card is designed for those with less-than-perfect credit. You can select from several card designs at no additional fee. Indigo will pre-qualify your application without a hard pull of your credit history, which means your credit score won’t be impacted. It promises a 60-second pre-qualification decision and offers 24/7 mobile account access.

Best Cash Back Cards For Fair Credit With No Annual Fee

These cards provide cash back rewards, charge no annual fee, and are obtainable by people with fair credit. That’s valuable because many cards for a fair credit score don’t offer rewards. Avoiding annual fees leaves you more money to pay your card balance.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

The Fortiva® Mastercard® Credit Card may charge or waive annual fees, depending on your credit history. But it will approve an applicant with a fair credit score and offers cash back on select purchases. You’ll also get automatic reviews for opportunities to increase your credit line, $0 fraud liability, and a free Equifax credit score.

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

The Discover it® Secured Credit Card requires a refundable security deposit up to your approved credit limit. If you use the card responsibly for a probationary period, Discover will evaluate whether to return your deposit. The card offers cash back on all purchases with a limited bonus cash back rate on select purchases.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

The Aspire® Cash Back Reward Card offers cash back on select purchases but may charge an annual fee, depending on your credit score. You can see whether you prequalify for this cash back credit card before applying, which may also show you whether you’ll be charged a fee before you officially apply.

Best Student Cards For Fair Credit With No Annual Fee

Student cards can be helpful for folks with limited credit experience. They usually offer features that can help students and other credit newbies manage their credit and monitor the card’s security.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Cash Back card uses a quarterly rotating merchant system to offer a bonus cash back rate. You must activate the card each quarter to earn the bonus rate. All other purchases earn the regular cash back rate.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Chrome offers a bonus cash back rate on limited selected purchases and an unlimited regular cash back rate on all other purchases. Other benefits include fraud liability protection, free credit scores, an instant on/off switch to freeze your account, and 24/7 live customer support.

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Quicksilver Student Cash Rewards Credit Card is a newer student offer, paying unlimited flat-rate cash back on all purchases. The APR is a bit high, so you must pay your balance off each month to reap any real rewards.

Moreover, you can earn a higher credit line by making timely payments for the first six months. The card lets you access credit monitoring tools, provides $0 fraud liability, and supports virtual card numbers for online purchases. You also get instant card lock and various types of security alerts.

Best Store Cards For Fair Credit With No Annual Fee

Store cards allow you to make purchases online or at brick-and-mortar store locations. The following three approve applicants with fair credit scores, and two of them offer alternatives to those who may have trouble qualifying for a card.

- Easy application! Get a credit decision in seconds.

- Build your credit history – Fingerhut reports to all 3 major credit bureaus

- Use your line of credit to shop thousands of items from great brands like Samsung, KitchenAid, and DeWalt

- Not an access card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See Issuers Website

|

$0

|

Poor Credit

|

The Fingerhut Credit Account is for charging online purchases from this merchant. The account helps you build credit by reporting your transactions to TransUnion, Experian, and Equifax, the three major credit bureaus.

You automatically apply for the Fingerhut Fresh Start Installment Loan at the same time you apply for the credit account, and Fingerhut will let you know which one you qualify for. The account offers promotions that allow you to skip a payment or two, although interest will continue to accrue. The maximum liability for unauthorized use of your account is $50.

11. Amazon Store Card

Amazon.com offers multiple credit card products, the Amazon.com Store Card being the one marketed to consumers with fair credit scores. It offers promotional financing and will help increase your credit score with responsible use.

- 6-, 12- or 24-month 0% financing on select purchases

- Start shopping on Amazon.com instantly upon approval

- Access to free credit score monitoring

- No annual fee

For those with lower credit scores, there is also the secured Amazon.com Credit Builder Card. Your application for the Amazon Store Card automatically includes this offer if you don’t qualify for the Store Card. The Credit Builder Card requires you to put down a security deposit of at least $100, which acts as your credit limit.

12. Target RedCard

The Target RedCard can be used to charge purchases at Target stores and Target.com. The card offers several rewards, including a fixed 5% discount on all purchases.

- 5% discount on all Target and Target.com purchases, including in-store Starbucks locations

- Extended returns when you pay with your RedCard

- Free 2-day shipping on qualifying items from Target.com

You can combine the 5% discount with savings from Target Circle™ Rewards and Target Subscription offers. You also get early access to special products, exclusive extras, and a 10% coupon to use in-store on your account anniversary.

What Is the Easiest Credit Card to Get With Fair Credit?

Typically, secured credit cards are the easiest to obtain, since they are backed by your deposited cash. In this group, the secured credit cards are the Amazon.com Credit Builder Card, and the Discover it® Secured Credit Card. The Amazon card’s minimum deposit is lower than that of the Discover card, which may make the Amazon card somewhat easier to get.

In both cases, the issuer automatically re-evaluates your use of the secured card and will reward responsible usage with an upgrade to an unsecured account. However, only the Discover it® Secured Credit Card also offers cash back on purchases.

Although the Amazon card may be the easiest to get, it’s not necessarily the easiest to understand. That’s because Amazon offers at least six different credit cards:

- Credit Builder Card

- Prime Credit Builder Card

- Store Card

- Prime Store Card

- Amazon Rewards Visa Signature Card

- Amazon Prime Rewards Visa Signature Card

The last two are for those with good or excellent credit. For those with fair credit, the Prime versions of the first four cards offer better benefits — including cash back — than the non-Prime counterparts.

While none charge an annual fee, it costs $119/year to join Amazon Prime. Of course, you get many benefits with Prime membership beyond cash back on the cards.

Store cards are known to be easy to acquire, although they could offer tight credit limits. Therefore, if you prefer a non-secured card, the Target REDcard and the Fingerhut Credit Account may be easy to obtain with fair credit.

Which Credit Cards Are Best For Building Credit?

The basic rule for building credit from credit card usage is for the issuer to report your payment activity to one or more of the major credit bureaus, Experian, TransUnion, and Equifax.

All of the cards in this review report payment activity, although not necessarily to all three bureaus. A business credit card may instead, or additionally, report account activity to business credit bureaus.

To help build credit, you should make your payments on time and remit at least the minimum payment due each month. This approach can help pay off the balance quickly, as it demonstrates that you haven’t overused your credit.

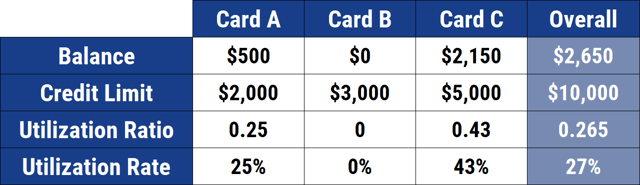

Credit scoring models like to see a credit utilization rate below 30%, meaning your total balances are no more than 30% of your available credit. A low utilization rate indicates you have leeway to respond to a sudden need for credit, such as a medical emergency.

This chart shows examples of utilization rates across three different cards.

Another important point for building credit is to avoid canceling a card, even if you have stopped using it. That’s because the credit limit on the card contributes to your overall available credit. Closing the card will reduce your available credit and therefore increase your credit utilization ratio, which is a negative factor for your credit score.

As indicated earlier, secured cards are a good way to build or establish credit. The secured card in this review is the Discover it® Secured Credit Card. If you have bad or scant credit, you may find it easier to get a secured card first, and possibly replace it with an unsecured card later.

Does Getting Approved For a Credit Card Raise Your Score?

Getting a new credit card can have both positive and negative implications for your credit score. On the positive side, the credit limit on the new card increases your available credit. All things being equal, this will reduce your credit utilization ratio, which should help your credit score.

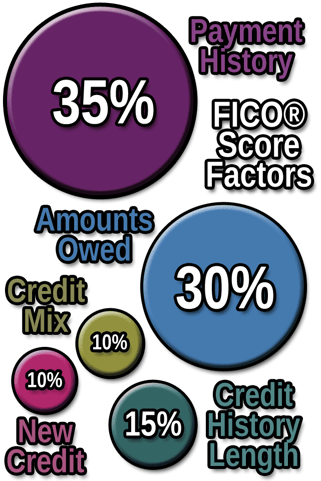

However, that benefit could quickly disappear if you make a big-ticket purchase when you open the card. That could reduce your overall credit utilization ratio to a figure lower than the one you had before you got the new card, which could weaken your credit score. Credit utilization counts as 30% of your FICO score.

There are a couple of other ways a new credit card could hurt your credit score. The first is that a new credit score lowers your average credit age. Credit scores like FICO consider the age of your credit accounts and rewards older credit histories.

In fact, 15% of your credit score is determined by the age of your credit history. The second negative effect is that accepting a new credit card requires the card issuer to place a hard inquiry on your credit report. That’s true even if you decline the offer. Credit inquiries have a small negative impact, composing 10% of your credit score.

It may not seem significant to lose a few points from an inquiry, but if you are barely in the “fair” range, an inquiry could tip you into “poor” territory.

You may have important reasons to apply for a new card even if it negatively impacts your score. For example, you may want to take advantage of a card’s introductory offers for a cash back bonus or 0% APR on purchases and balance transfers. Or perhaps you’ve improved your score enough to qualify for a card with a significantly lower APR or better rewards.

Compare Offers to Find the Best Rates and Terms

All the cards reviewed here should be obtainable by people with fair credit, and some may be available to those whose credit is poor or nonexistent. We’ve categorized some of the cards (i.e., student, business, store, secured) to help you focus on the ones that best meet your individual needs.

By concentrating on cards with no annual fees, you keep your expenses down and have more money to repay your card balances. Responsible use of these cards may help boost your score and possibly open a whole new universe of card choices.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year]) 7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1092414950-1.jpg?width=158&height=120&fit=crop)

![5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year]) 5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Credit-Cards-For-Bad-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![8 Best No Annual Fee Credit Cards ([updated_month_year]) 8 Best No Annual Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/annualfee.png?width=158&height=120&fit=crop)

![14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year]) 14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Rewards-Credit-Cards-with-No-Annual-Fee-Feat.jpg?width=158&height=120&fit=crop)

![7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year]) 7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/No-Annual-Fee-Credit-Cards-with-Rewards.jpg?width=158&height=120&fit=crop)

![7 Secured Credit Cards With No Annual Fee ([updated_month_year]) 7 Secured Credit Cards With No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_29251765.jpg?width=158&height=120&fit=crop)

![7 Best Student Credit Cards With No Annual Fee ([updated_month_year]) 7 Best Student Credit Cards With No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Student-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![7 Best No-Annual-Fee Cards For Excellent Credit ([updated_month_year]) 7 Best No-Annual-Fee Cards For Excellent Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Best-Credit-Cards-For-Excellent-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)