For frequent travelers, air mile rewards are a no-brainer. But these premium travel cards aren’t just for people who are constantly up in the air. They’re also a great choice for people who have modest travel plans or aspirational travel goals.

If you collect enough miles, you can score free or heavily discounted flights, hotel stays, or other desirable travel perks. Air miles can also be converted into other types of rewards, cashed out, gifted to family and friends, or donated to worthy charitable organizations.

If you’ve thought about earning travel rewards but aren’t sure how these programs work, you may be happily surprised to learn that today’s air mile rewards programs are highly flexible and surprisingly easy to use.

-

Navigate This Article:

What Are Air Miles?

Simply stated, air miles are a form of currency, which means they have an economic value and can be exchanged for goods or services. Unlike other currencies, including dollars, euros, or cryptocurrency, air miles can’t be used for the entire world of purchases. Rather, they’re tied specifically to travel, though there are also other ways to use them.

Air miles are sometimes called frequent flyer miles, points, or airline miles. The concept is the same regardless of which term is used.

You generally don’t have to be a frequent flyer or a member of an elite frequent-flyer program to earn air miles even if a rewards program uses the term frequent flyer to refer to its rewards.

How to Earn Air Miles With a Credit Card

The easiest way to earn air miles is to use an airline-branded card to make purchases. Many domestic and international airlines offer rewards cards, so you should be able to find at least a few that may be a good fit for you.

The more you use your air miles credit card for purchases, the more air miles you’ll earn.

Another way to earn miles is to use a general-purpose travel card that features air miles as a rewards category. With this type of card, you may be able to transfer your miles to a dozen or more different airlines when you’re ready to use them.

While some rules and restrictions typically apply, the basic idea of a general-purpose travel card is that you can earn rewards, shop for flights or hotel stays, then transfer your miles from your card to that airline or hotel online, and you’re good to go.

Co-branded and general-purpose travel rewards cards also offer partner programs that let you earn bonus air miles for purchases from those companies. Partners can include a wide variety of travel and non-travel goods and services.

Best Air Miles Cards

When you’re ready to shop for an air miles card, it may be a natural inclination to check out the cards of your favorite airlines first. But you don’t have to limit your search to those cards. You may find an air miles credit card with another airline or a general travel card that you like and want for other reasons.

The first feature you may want to look for is an attractive signup or “welcome” bonus, which typically gives you tens of thousands of bonus miles or bonus points — possibly enough to qualify for a free flight — all at once. Welcome offers are usually a reward for a minimum amount of spending with your new card in the first few months after you receive it.

Below are a few of our favorite travel cards with air miles or points that can be redeemed for flights or transferred to airline partners:

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$95

|

Excellent, Good

|

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers – only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% – 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

Citi® / AAdvantage® Executive World Elite Mastercard®

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Citi® / AAdvantage® Executive World Elite Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

- Earn 10,000 bonus miles after spending $1,000 in purchases on your new card in your first 6 months of card membership

- Earn 2X miles at restaurants (including takeout and delivery) and 2X miles for every dollar spent on eligible purchases made directly with Delta. Earn 1X miles on all other purchases.

- Receive a 20% savings in the form of a statement credit after you use your card on eligible Delta in-flight purchases of food, beverages, and audio headsets

- Take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com

- No foreign transaction fees

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.99% – 29.99% Variable

|

$0

|

Good

|

- Earn 10,000 bonus points after spending $1,000 on purchases in the first 90 days

- Earn 3X points on eligible JetBlue purchases, 2X points at restaurants and grocery stores, and 1X points on all other purchases

- Enjoy 50% inflight savings on cocktails and food purchases

- 0% introductory APR for the first 12 billing cycles following each balance transfer that posts to your account within 45 days of account opening (transfer fee applies), then a variable APR applies

- No foreign transaction fees, no blackout dates, and points never expire

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% for 12 billing cycles

|

20.49%, 24.49%, or 29.49%, based on credit

|

$0

|

Good

|

Other features to consider include the card’s partner programs and the transferability of the miles you earn.

Some good travel cards don’t charge annual fees. Others do. Higher fees tend to be associated with more valuable benefits and perks.

Some travel cards are designed to appeal to business travelers or students who travel. If you own a small business, you’re an independent contractor, or you’re a student, you may want to consider these types of cards.

Many travel cards also offer other enticing travel-related features, such as:

- 24-hour access to an emergency replacement card and cash advance if you lose your card or it’s stolen.

- Travel accident insurance at no extra cost when you purchase travel services with your card.

- A collision damage waiver at no extra cost when you use your card to rent a vehicle.

- No foreign transaction fees.

- A statement credit for Global Entry or TSA Pre✓ fees.

- One or more free checked bags when you fly.

- Access to airport lounges with comfortable seating, exclusive snack and beverage offerings, and other perks.

To get a travel rewards card, you’ll typically need a good or excellent credit score. If your credit score is only fair or poor, you can take steps to get back on track, boost your credit scores, and hopefully get approved for these types of cards.

Before you apply for any type of card, you should read the disclosures and make sure you understand any rules, restrictions, or fees that can affect how you plan to use your card.

How to Earn Air Miles Without a Credit Card

There are also ways to earn air miles without a travel card. One way is to enroll in an airline’s frequent flyer program and collect miles when you fly with that airline or one of its partners.

Another way is to transfer points from a credit card with a points-based rewards program, such as Chase Ultimate Rewards or American Express Membership Rewards, to an airline loyalty program if the points-based program and the airline allow that type of transfer.

A third way is to purchase air miles for cash. This option may be appealing if, for example, you want to redeem miles you’ve earned for a specific flight, hotel stay, or other rewards, but you’re a few miles short. By purchasing miles, you can top up your account to try to get the reward you want. Buying miles is also an option if you want to gift miles to someone else.

If you’re not a frequent flyer or you don’t want to shop with a travel card, accumulating enough miles to earn free flights or other pricey rewards could take a long time. Take advantage of multiple ways to earn air miles, and your total can quickly add up.

How to Redeem Air Miles

When you’re ready to redeem your air miles for travel, you can search for and book flights and hotel stays online at airline and hotel websites just as you would if you planned to pay with a card. (When you search, look for a checkbox or search option labeled “Redeem miles,” “Use points,” or similar language.)

Be sure to read all the disclosures before you commit to your purchase in case your travel plans change.

You can transfer, convert, gift, or donate your miles on the credit card issuer’s website. Read your card agreement or contact your card company for more information.

Some airlines and hotels have a minimum number of miles or points that you must contribute to make a donation. Some will match your donation with an equal number of additional miles or points, doubling the value of your gift to the charity you choose.

How Much Are Air Miles Worth?

Air miles are worth about $0.01 apiece and up, depending on the airline and the methodology used to analyze the cash value.

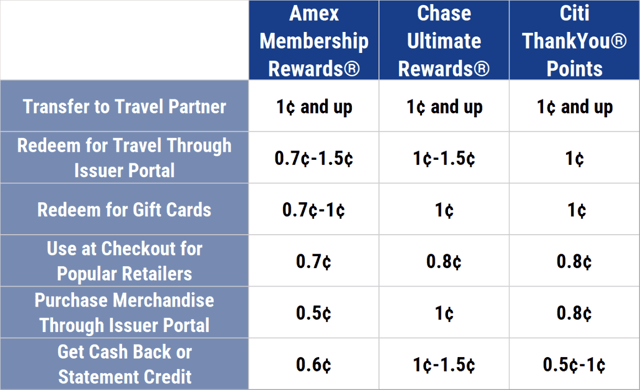

Air miles and credit card points can be transferred to partner programs or converted into other types of rewards that tend to be more valuable than air miles that can be used only for flights on a specific airline.

Air miles also tend to be worth more if you use them to book business-class flights, which tend to be more expensive than coach-class tickets. Air miles and rewards points from a travel card are sometimes less valuable when redeemed for non-travel purchases.

The Points Guy provides an in-depth guide updated monthly with valuations across brands.

Not Just Miles, But Memories

The true value of air miles may involve more than their cold-hard cash value. Miles tied to an airline you love or travel perks you value may be worth more to you than other rewards.

Miles may also have a psychological value since they can be used for exotic adventures, relaxing vacations, or enjoyable family visits that you could miss out on if you opt for other types of card rewards.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year]) 5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Air-Miles-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![7 Best 0% APR Travel & Air Miles Credit Cards ([updated_month_year]) 7 Best 0% APR Travel & Air Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-0-APR-Travel-Air-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards With Air Miles & Cash Back ([updated_month_year]) 5 Best Credit Cards With Air Miles & Cash Back ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Credit-Cards-With-Air-Miles-Cash-Back.jpg?width=158&height=120&fit=crop)

![9 Best Air Miles Credit Cards for Business ([updated_month_year]) 9 Best Air Miles Credit Cards for Business ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_1054148699.jpg?width=158&height=120&fit=crop)

![11 Highest-Limit Air Miles Credit Cards ([updated_month_year]) 11 Highest-Limit Air Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Air-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![How Do Balance Transfers Work? + 5 Top Offers ([updated_month_year]) How Do Balance Transfers Work? + 5 Top Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/04/complete-guide-to-balance-transfers.jpg?width=158&height=120&fit=crop)

![How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year] How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year]](https://www.cardrates.com/images/uploads/2016/10/how-does-a-secured-credit-card-work.jpg?width=158&height=120&fit=crop)

![How Does a Prepaid Credit Card Work? ([updated_month_year]) How Does a Prepaid Credit Card Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/How-Does-a-Prepaid-Credit-Card-Work.jpg?width=158&height=120&fit=crop)