No matter how great it may seem at the outset, everything in life has its downsides. Delicious pizza tends to come with a lot of calories, fast-and-fun sports cars have terrible gas mileage — and rewards credit cards have high interest rates.

Happily, there are ways to have your pie and enjoy it, too. Light-cheese veggie pizzas are almost healthy, sports cars can come with electric engines, and low-interest credit card deals can offer interest-free financing.

Indeed, a variety of low-interest rate credit cards are available to consumers and businesses alike, offering both introductory APR offers as well as low ongoing rates for long-term interest savings. In this article, we’ll explore the best low-interest rate credit cards around. We feature our top picks for each category in this section or you can scroll down for the full list.

- Best Overall: Discover it® Cash Back

- Best for Intro APR: Discover it® Cash Back

- Best for Balance Transfers: Discover it® Balance Transfer

- Best with Rewards: Discover it® Cash Back

- Best for Businesses: Ink Business Cash® Credit Card

- Best for Students: Discover it® Student Cash Back

- Best for Fair Credit: Aspire Platinum

- Best for Bad Credit: First Progress Platinum Prestige Mastercard® Secured Credit Card

Need more options? We’ve select three of the best low-interest card options for each category to help you narrow the field based on your specific needs.

Overall | 0% Intro APR | Balance Transfers | Rewards | Fixed Interest | Businesses | Students | Fair Credit | Bad Credit

Best Overall Low-Interest Rate Cards

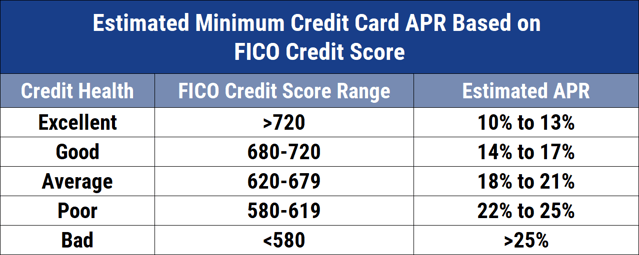

Given that the exact interest rate you’re offered for any given credit card will depend almost entirely on your credit risk, there’s no single best low-rate credit card for everyone. Even consumers with the same exact credit score can be offered different rates based on the specifics of their credit profiles.

The best overall low-interest rate credit cards are ones that tend to offer solid intro APR offers and low ongoing rates to consumers with average credit or better (typically a credit score of 670 or higher). These picks should be available to the majority of applicants since the national average FICO Score is over 700.

Discover is all about offering affordable cards, as this card can certainly attest. In addition to a competitive APR, cardholders can earn cash back on every purchase that never expires and can be redeemed at any time with no redemption minimums.

New cardholders enjoy industry-leading 0% introductory APR offers with this no-annual-fee card along with $0 liability and purchase protection. The Chase Freedom Unlimited® card also has a great cash back program, offering unlimited cash back rewards on everything you buy.

3. Alliant Cashback Visa® Signature Credit Card

The Alliant Cashback Visa® Signature Credit Card offers a very low regular APR range of 11.99% up to 14.99%, with your specific APR based on your creditworthiness. Cardholders can also earn 2.5% cash back on every purchase up to $10,000 spent each billing cycle.

- Earn 2.5% cash back on every purchase up to $10,000 each billing cycle

- Pay no foreign transaction fees

- Pay $0 annual fee the first year, then $99

Once approved, you are eligible to be a member of Alliant Credit Union if you work for a Qualifying Company, live or work in a Qualifying Chicagoland Community, are a member of a Qualifying Organization, or donate to become a member of Foster Care to Success.

Best Low-Interest Rate Cards with a 0% Intro APR

If you’re looking for a credit card with a low interest rate, chances are good you see some upcoming purchases on the horizon that may take a few months to repay. An introductory APR offer from a credit card can be a great way to enjoy interest-free financing on your card purchases while being able to make payments over time.

When looking for a great 0% APR offer, stick with open-loop credit cards that don’t charge deferred interest if you fail to pay your full balance during the promotional period. Our top picks for this category all offer at least 14 months of 0% interest on new purchases and balance transfers alike (balance transfer fees may apply).

This card’s regular APR is pretty competitive on its own, but it gets even better with friendly introductory terms. It’s attractive to those who want the benefits of a robust rewards program without breaking the bank on interest payments.

This card’s regular 19.99% - 29.99% (Variable) APR is lower than the rate offered by many of its competitors, and the long 0% APR deal on new purchases means plenty of time to enjoy interest-free financing. Unlimited cash back rewards and no annual fee can help users make the most of their cards.

This card is currently not available.6. Chase Slate Edge℠

The Chase Slate Edge℠ is a solid option for saving on interest thanks to its feature that helps you lower your interest rate over time with consistent on-time payments.

In addition to a competitive introductory offer, this card comes with a number of Chase and Visa benefits, including free FICO credit scores and $0 liability protection.

Best Low-Interest Rate Cards for Balance Transfers

As helpful as 0% APR offers can be for avoiding interest on your purchases, they all inevitably expire at some point. Any existing debt then starts to accrue interest at the regular rate — a rate that is likely quite high.

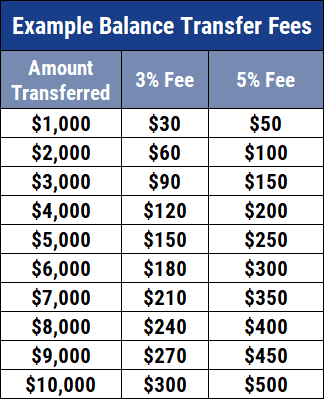

Thankfully, you can obtain 0% APR offers that will apply to balance transfers, giving you a year or more interest-free to pay down your balances. Of course, you’ll need to watch out for balance transfer fees, which can wind up costing you 3% to 5% of your total transferred balance.

The best low-interest cards for balance transfers will offer long promotional periods on balance transfers and low or no balance transfer fees. They should be free from annual fees, too.

Transferring a balance can save you a lot of money, and this card is one great option to accomplish that. After the introductory period expires, the ongoing APR is low enough to keep the account open for purchases thereafter. Not to mention the fantastic rewards you’ll earn.

Additional Disclosure: Citi is a CardRates advertiser.

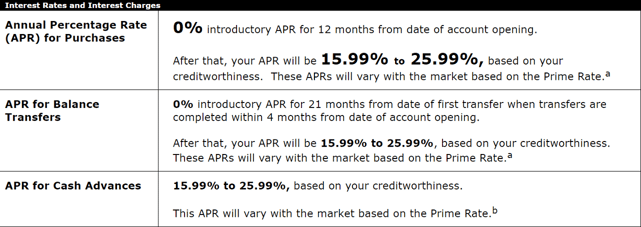

This card offers one of the longest promotional APRs available, after which your regular APR will kick in. Balance transfers need to be made within the first four months of account opening to qualify for the intro APR offer.

Additional Disclosure: Citi is a CardRates advertiser.

Obviously designed for balance transfers, this card offers a remarkable 0% APR introductory period for balance transfers. A transfer fees will apply, and its regular 19.24% - 29.99% (Variable) APR applies after the promotional period expires.

Best Low-Interest Rate Cards with Purchase Rewards

Perhaps one of the best things about 0% APR offers is that you can still earn credit card rewards on your purchases while skipping the interest through a good introductory deal. (Of course, balance transfers rarely earn rewards or qualify for signup bonus spending requirements.)

Although the top-tier travel rewards and points cards don’t usually offer introductory rates, you can find a slew of great cash back rewards cards that not only have intro APR offers and competitive ongoing APRs, but they also come with unlimited purchase rewards and no annual fee.

This card isn’t your average bonus rewards credit card. Instead of the typical bonus categories, this card offers higher cash back on purchases in select bonus categories that rotate each quarter. If you don’t mind staying on top of the calendar, you can really maximize your cash back earnings.

A good option for consumers who like a night on the town, this card offers 3% cash back on dining — including dine in and takeout — as well as 3% cash back on select entertainment like concerts and sporting events. Plus, earn 3% cash back at grocery stores and 1% cash back on everything else.

12. Alliant Cashback Visa® Signature Credit Card

The Alliant Cashback Visa® Signature Credit Card not only offers a very low regular APR range with rates as low as 11.99%, but it also offers 2.5% cash back on every purchase, up to $10,000 each billing cycle.

- Earn 2.5% cash back on every purchase, up to $10,000 spent each billing cycle

- Pay no foreign transaction fees

- Pay $0 annual fee the first year, then $59

Once approved, you are eligible to be a member of Alliant Credit Union if you work for a Qualifying Company, live or work in a Qualifying Chicagoland Community, are a member of a Qualifying Organization, or donate to become a member of Foster Care to Success.

Best Low-Interest Rate Cards with Fixed Interest

When it comes to credit cards, there are two main types of interest: variable and fixed. Variable interest rates tend to vary, or change, depending on outside factors (usually the U.S. Prime Rate). Conversely, fixed interest rates typically remain the same as long as the account remains open.

While variable interest rates can technically work in your favor — if the U.S. Prime Rate drops, APRs often follow suit — it can also mean your rates can increase at any time. Unfortunately, the number of fixed-rate credit cards available these days is very limited, with most being offered by credit unions rather than major banks.

13. Purdue FCU Cash Rewards Visa Traditional Rewards

The Purdue Federal Credit Union Cash Rewards Visa Traditional Rewards is a solid low-fee option, offering an intro APR deal good on new purchases, balance transfers, and cash advances, as well as a low fixed regular APR range. All with no annual fee.

- 1.9% introductory APR on new purchases, balance transfers, and cash advances for 12 months from date of account opening

- Regular 11.5% to 17.5% fixed APR

- Pay $0 annual fee

As with most credit unions, you’ll need to join Purdue Federal Credit Union as a member to be eligible for most of its products. There are many ways to become a member, including living, working, or going to school in an eligible area, or by being a member of a qualifying partner organization.

14. Hughes Federal Credit Union Visa® Classic Card

The Hughes Federal Credit Union Visa® Classic Card is a solid start credit card that offers manageable credit limits and a low, fixed 12.50% APR (based on creditworthiness).

- Design your own credit card by choosing from available designs or uploading your own photo

- Fixed 12.50% APR for qualified applicants

- Pay $0 annual fee

You’ll need to join Hughes Federal Credit Union to qualify. You can become a member by being an active or retired employee of a sponsor company, by living, working, worshiping, or attending school in Tucson, or by becoming a paid member of the Friend of the Library organization for the Oro Valley, Green Valley, or Pima County.

Best Low-Interest Rate Cards for Businesses

While still not as robust as its consumer counterpart, the business credit card marketplace has made leaps and bounds over the last decade or so, and it is now home to dozens of options, including some top-tier travel and rewards picks as well as affordable no-annual-fee selections.

Additionally, business owners can find a number of business credit cards that come with introductory APR deals (though not as many as in the consumer market). Our top picks not only offer interest-free financing for new purchases, but the deals also apply to balance transfers.

One of the best business credit cards available, this card offers 12 months of 0% APR followed by an ongoing 18.49% - 24.49% Variable APR. But while the APR deal is nice, users will want to keep this card around long after the promotional period thanks to its broad bonus rewards categories that include everything from office supplies to restaurants.

Similar to its category-offering cousin above, this card has a long 12-month 0% intro APR offer with a regular 18.49% - 24.49% Variable APR. Where it differs is in its rewards; rather than bonus categories, this card has the same unlimited 1.5% cash back on every purchase, regardless of category.

17. U.S. Bank Business Edge™ Platinum Card

The U.S. Bank Business Edge™ Platinum Card has a solid 12-month 0% APR offer, plus a low APR range that tops out below 20%, making it one of the better cards for low interest in the business realm.

- 0% introductory APR on new purchases and balance transfers for the first 12 months

- Regular APR as low as 11.99% for qualified applicants

- Pay $0 annual fee

This card also comes with the standard Visa Business benefits, as well as a range of perks from U.S. Bank. These include $0 fraud liability, free employee cards, and a full suite of spending control and tracking tools.

Best Low-Interest Rate Cards for Students

Although carrying a balance from month to month should be the last thing you consider as a student trying to build credit, grants and scholarships aren’t always the most regular sources of income, which can make carrying a balance an occasional necessity while you wait on funds to arrive.

Given that most students will have limited credit history, the typical APR on a student credit card will be less-than-desirable. Our top picks for this category include some solid 0% intro APR credit cards as well as some of the lowest regular APRs of the bunch.

This card can help you get through a tough semester with minimal interest fees, thanks to its intro APR. Even better, you’ll earn cash back rewards on your purchases.

19. Bank of America® Cash Rewards for Students

The Bank of America® Cash Rewards for Students has a good 12-month introductory offer for 0% on new purchases and balance transfers made within the first 60 days of account opening.

- Earn 3% cash back on gas, plus 2% cash back at grocery stores and wholesale clubs

- Receive $200 when you spend $500 in first 90 days

- Pay no annual fee

Cardholders can also earn unlimited 1% cash back rewards on every purchase, 2% cash back at wholesale clubs and grocery stores, and 3% cash back on gas purchases. Bonus rewards are limited to the first $2,500 in combined category purchases each quarter.

20. Wells Fargo Cash Back College℠ Card

The Wells Fargo Cash Back College℠ Card provides 0% APR on new purchases and balance transfers for the first six months, with a regular ongoing APR as low as 13.15% for qualified applicants.

- Earn 3% cash back on gas, grocery, and drugstore purchases for the first 6 months

- Earn unlimited 1% cash back on other purchases

- Pay no annual fee

In addition to a low APR, this card offers cash back rewards on every purchase. Cardholders can choose to have cash back rewards automatically redeemed to their account in $25 increments as a credit card statement credit.

(The information related to the Wells Fargo Cash Back College℠ Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Best Low-Interest Rate Cards for Fair Credit

Being a consumer with fair credit can often feel like being stuck in limbo, with your credit good enough that you don’t want to settle for a subprime card — but not so good that you can easily qualify for the top cards.

At this stage, one option is to spend a few months building credit before looking into a prime card with a good APR deal. Depending on the specifics of your credit profile, it’s possible to go from fair credit to good credit in a period of three to six months.

Alternatively, fair-credit consumers can often find good deals by turning to a credit union or small community bank. These organizations often have flexible credit requirements and lower fees than are offered by major banks.

21. Aspire Platinum

The Aspire Platinum offers six months of 0% APR on both new purchases and balance transfers, plus a low regular APR range that varies based on your individual credit profile.

- 0% introductory APR on new purchases and balance transfers for the first 6 months

- Standard 10.15% to 18% APR, depending on creditworthiness

- Pay no annual fee

You’ll need to become a member of Aspire Credit Union when you apply for its credit cards, but you can become eligible for membership if you work for a Select Employer Group or by joining the American Consumer Council.

22. Alliant Visa® Platinum Card

The Alliant Visa® Platinum Card has a year-long intro APR deal that offers 0% interest on new purchases and balance transfers. The regular APR range offers a rate as low as 10.99% to qualified applicants.

- As low as 0% introductory rate for 12 months on purchases and balance transfers

- Balance transfer fee of 2% of the amount transferred

- Pay no annual fee

Once approved, you are eligible to be a member of Alliant Credit Union if you work for a Qualifying Company, live or work in a Qualifying Chicagoland Community, are a member of a Qualifying Organization, or donate to become a member of Foster Care to Success.

Best Low-Interest Rate Cards for Bad Credit

While you really shouldn’t carry a balance on your credit cards from month to month while trying to rebuild credit (or, ideally, at all), that’s not always an option. With bad credit, finding a card with a low APR isn’t always easy, as that higher APR is often how issuers make up for the higher risk of their cardholders.

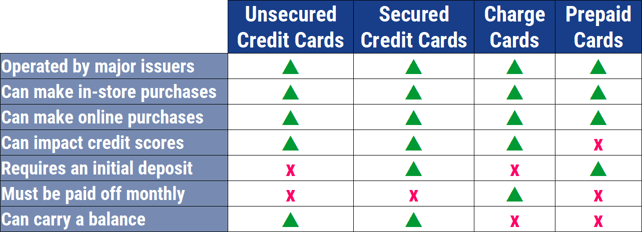

In general, most low-APR bad-credit options will be secured credit cards that require a deposit kept in a secured savings account, though some banks may allow you to use an existing savings account as collateral.

Additionally, the majority of subprime credit cards that offer low APRs will often charge higher-than-average annual fees, though some credit union options may be more affordable. Be sure to do the math to determine if the higher annual fee is worth any potential interest fee savings.

This secured credit card trades a lower interest for a higher annual fee, offering a low 15.24% (V) regular APR to all approved applicants in exchange for the $49 annual fee. Cardholders can put down as little as $200 or as much as $2,000, with the credit limit equal to the size of the deposit, which is refundable so long as your account is closed in good standing.

24. SDFCU Savings Secured Visa Platinum Card

The SDFCU Savings Secured Visa Platinum Card is a no-fee secured card with a minimum deposit requirement of $250. While there’s no intro APR deal, the regular APR is a low 13.99% (variable).

- Minimum security deposit of $250; your credit line is equal to your deposit

- Regular APR as low as 13.99% for qualified applicants

- Pay $0 annual fee

To become a member of the State Department Federal Credit Union, you’ll need to be a US Department of State employee, employed or affiliated with an eligible organization, be an immediate family of a member, or be a paid member of the American Consumer Council (ACC).

What is Credit Card Interest?

While people may assume there is little difference between a debit card and a credit card, the two are vastly dissimilar. With a debit card, the money for each transaction you make is deducted directly from your checking account at the time (or shortly after) you make a purchase.

Credit card purchases, on the other hand, are funded by the issuing bank when you make your purchase. These purchases add up over the course of a statement period. Then, at the end of the statement period, you pay the credit card bill to reimburse the bank for the money you borrowed to make purchases.

With most credit cards, if you pay off the entire balance by the due date for that statement period, you won’t pay any interest on the purchases. The time you have to pay your balance without interest is called the grace period, and it typically ranges from 21 to 27 days.

If you don’t pay your full billed amount before the due date, you’ll then be charged interest on that balance, which will show up on your next bill. You’ll generally continue to be charged interest until you pay off your full balance.

It’s important to note that not all credit cards offer a grace period on interest fees; subprime credit cards are a common culprit. Without a grace period, interest will start accruing on your purchases as soon as the transaction posts to your account.

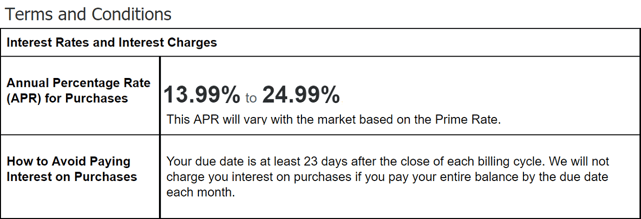

Your credit card’s grace period can be found in your cardholder agreement or terms and conditions documentation.

You can see if your credit card has a grace period for purchases by reading your cardholder agreement or terms and conditions documentation. The pages that list your card’s interest rates and fees should include a section that tells you how long you have before interest starts accruing on your balance.

The amount of interest you pay is based on your APR, or annual percentage rate. The majority of credit cards will have a set interest rate range that is based on the designated market for the card and the issuer’s tolerance for credit risk.

You likely won’t know your specific APR until you are approved for a card and receive your cardholder agreement. The exact APR you are offered at the time of approval will be based on your specific credit profile and perceived risk.

For example, a credit card may have a published APR range of 13.5% to 19.5%. An approved applicant with great credit will likely be offered an APR around the 13.5% end of the range, while an applicant who is seen as higher risk will likely be given an APR toward the 19.5% part of the range.

How is Credit Card Interest Calculated?

The interest fees that appear on your monthly credit card bill are determined by the credit card company based on your credit card balance and your interest rate. The higher your interest rate, the more you’ll typically pay in interest fees.

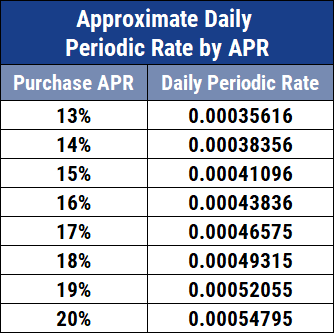

Credit card interest is generally compounded on a daily basis, which means your interest fees will be calculated based on your ending balance for each day during the statement period using what’s known as your daily periodic rate.

But here’s where it gets a little complicated. Interest rates are displayed as the APR, which is short for annual percentage rate. As the name implies, the annual percentage rate is your, well, annual rate; it’s a general estimate of what percentage of interest you’ll pay over the course of a year.

To get your daily periodic rate from the APR printed on your cardholder agreement, you’ll need to divide the APR by 365. For example, if your credit card’s APR is 20%, the daily periodic rate is: 0.20 / 365 = 0.00054795, or around 0.055%.

You can use your daily periodic rate to get an estimate of your monthly interest fees by multiplying it with your average daily balance.

Consider Cardholder Carla, for instance. If Carla has a credit card with an APR of 20% on which she carried a $500 each day of the statement period, she can estimate her interest payment by multiplying the 0.055% daily periodic rate by $500 by the 30 days of the statement period. So, 0.00054795 * $500 * 30 = $8.22.

How Do You Find Your Credit Card APR?

Given that your interest fees will be based on your credit card’s APR, it’s important to know what that APR actually is — or, at the very least, how to find it in case you need it.

Or, should we say, in case you need them? That’s right, most credit cards will have more than one APR, with the specific APR varying by the type of transaction.

New purchases will typically have their own APR, which may or may not be the same as the APR charged on the balance from a balance transfer. And a cash advance will usually have a different APR from other transactions (often much higher than the APR for either new purchases or balance transfers).

Credit cards may have multiple APRs depending on the type of transaction. APRs are listed in your cardholder agreement.

What’s more, if you make a late payment, many cards will charge you what’s known as a penalty APR. The penalty APR can be significantly higher than your regular purchase APR — 29.99% is a common penalty APR — and while many issuers cap penalty APRs at six months, they can technically remain in effect indefinitely.

All of your credit card’s APRs should be clearly laid out in the cardholder agreement, which should be sent along with the terms and conditions when your card first arrives in the mail. The cardholder agreement should also state any applicable penalty APR, as well as listing the terms of the penalty APR.

If you don’t have your cardholder agreement for some reason, you should be able to access a digital copy through your credit card issuer’s online banking portal or mobile banking app.

What is a Variable APR?

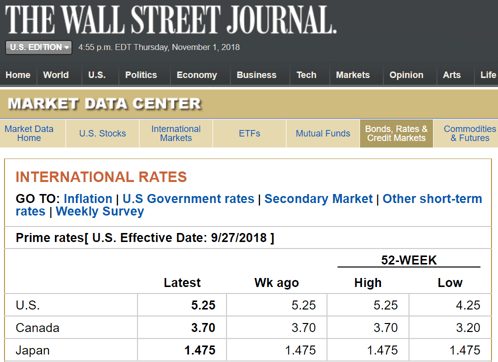

Yet another thing that adds to the confusion surrounded credit card interest is the fact that most cards charge variable interest. A variable APR is one that can change at any given time, typically based on the U.S. Prime Rate.

The U.S. Prime Rate is mostly based on the federal funds rate, which is set by the Federal Reserve’s Federal Open Market Committee (FOMC). When the economy is doing well, FOMC increases interest rates, and the market and the banks follow suit. Similarly, if the economy is doing poorly, rates go down across the board.

As a result, variable APR credit cards can be a double-edged sword; when rates go down, you’ll pay less interest. But when rates go up, you’ll pay more.

The opposite of a variable APR credit card is one with a fixed rate. These cards generally have the same APR so long as the account remains open and in good standing. Fixed-rate cards have less ambiguity — you’ll always know what your rate will be — but that also means no chance of a lower rate over time.

In any case, fixed APR credit cards are a rarity in the big-bank arena, though you may have better luck with small community banks, online banks, or local credit unions.

Can You Avoid Paying Credit Card Interest?

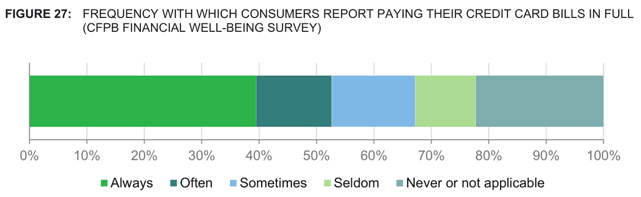

Although credit card interest can feel inevitable, there are a number of ways to avoid paying credit card interest entirely — several of which won’t require you switch to a different payment method.

The simplest and most long-term solution is to use a credit card with a grace period. The term grace period typically refers to the time between when your statement closes and your due date; if you pay off your full balance during this time, you won’t be charged interest on that balance.

The easiest way to avoid paying credit card interest is to use a card with a grace period and pay in full every month.

If you fail to pay off the full balance, however, you will be charged interest based on your average daily balance and APR. That interest charge will usually show up on the following bill.

The Consumer Financial Protection Bureau (CFPB) survey shows less than 40% of consumers always pay credit card balances in full.

Even if you can’t pay your full balance, remember to make at least the minimum required payment. Late payments not only mean late fees, but they will also often trigger a penalty APR that is significantly higher than your regular APR.

Introductory APR offers are another way to avoid credit card interest, and they can be particularly helpful if you need longer than the grace period allows to pay off your full balance, as the best offers can last 12 months or more.

While 0% APR offers can be good tools, you’ll typically need at least good credit to qualify for a 0% APR offer. Many 0% APR offers will apply to both new purchases and balance transfers, though the length of the promotional period may vary for each transaction type.

Late payments are also a big no-no when enjoying the perks of a 0% APR offer, as many credit card issuers have a clause that voids an intro APR offer if a late payment is made. That means you could go from having six months left at 0% APR to being charged your regular APR in the blink of a single late payment.

Of course, if you’d rather avoid any potential interest whatsoever, then you can choose to use a charge card or a prepaid debit card for your purchases. Charge cards will require you to pay your balance in full each month, removing the temptation to carry a balance.

In contrast, prepaid debit cards are debit cards that aren’t directly a part of your checking or savings account. Prepaid cards are loaded with funds and used to make purchases, then reloaded when the funds run out. Since there’s no credit line, there are no interest fees.

A key thing to keep in mind about prepaid debit cards — and debit cards in general — is that they can’t generally be used to establish or build your credit profile. Credit cards and charge cards, on the other hand, can and will report to your payment history to the three major credit bureaus.

What Credit Score Guarantees the Lowest Interest Rate?

Most credit cards have a set APR range from which individual applicant APRs are assigned. For example, a typical rewards credit card might have a published APR range of 14.99% to 18.99%, with individual cardholders assigned a single APR from that range.

The specific APR you are offered for a given card will depend on both the card’s APR range and your individual creditworthiness. Approved applicants with good credit will generally receive a lower APR, while applicants with less-than-good credit will receive a higher APR.

Although a higher credit score is more likely to net you a lower APR, there’s no set credit score number that will always ensure you get the lowest rates. That’s because your actual credit history and profile will be important, not just your credit score.

But, while an excellent credit score won’t guarantee you the lowest interest rate — finance has no real guarantees — consumers with excellent credit (a FICO credit score of 750+) will have the best chance of qualifying for most low-rate credit cards and intro APR offers.

What is Deferred Interest?

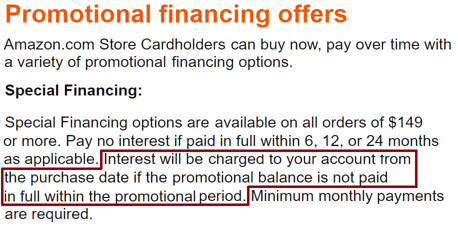

One of the best ways to avoid paying interest on your credit card purchases is to take advantage of 0% APR offers that give you interest-free financing on your purchases. But not all 0% APR offers are the same.

In particular, it’s important to watch out for special financing or interest rate deals that come with deferred interest — say, for example, like the kind offered by most store credit cards. That’s because deferred interest financing deals have a major catch.

These “special financing” offers promise 0% APR on your financed purchase for some set period of time, often at least a year, when you use the store credit card or open a store credit line.

Watch out for deferred interest, which is charged by many store cards, including the Amazon.com Store Card.

But what these special financing deals hide in the fine print is that you’ll need to pay off every last financed penny before the deal expires. If any of the financed amount remains after the promotional period ends, you’ll have to pay interest on the entire amount, regardless of how much is unpaid when the deal expires.

The 0% APR offers provided by most open-loop cards, on the other hand, typically don’t charge deferred interest. With these deals, you’ll enjoy 0% interest while the promotion lasts, then your APR will revert to the standard purchase APR. Any remaining balance will start accruing interest at the standard rate, but you won’t need to pay any back interest at all.

Do Intro APR Offers Apply to Balance Transfers?

Introductory APR deals can be a good way to finance new purchases when you need a few months to pay them off, but they aren’t all that helpful when it comes to your existing credit card debt — or are they?

Happily, many cards that come with intro APR offers extend those offers to both new purchases and balance transfers. In fact, applicants with good credit can find 0% APR offers for up to 21 months on balance transfers with a little research (like the kind you can do by, say, reading a helpful article on low-interest credit cards).

It’s not all roses, of course. There are some restrictions to intro APR balance transfer offers — and to balance transfers in general. Starting with the fact that most intro APR offers don’t include a balance transfer fee waiver, so you’ll still need to factor a 3% to 5% balance transfer fee into your calculations.

Additionally, you can typically only transfer balances between different credit card companies, not within the same company.

For example, you can’t transfer a balance from one Chase credit card to another Chase card, but you can usually transfer a balance from a Chase card to a Citi card.

The amount you can transfer is also limited, as you can only transfer an amount up to the credit limit of the card to which you’re making the transfer. This amount is less any balance transfer fees, however, so make sure your card’s limit can handle both the fees and your balance.

As with intro APR deals that are solely for new purchases, some offers may only apply to balance transfers. These offers will exclude new purchases as well as any transaction classified as a cash advance or cash-equivalent transaction.

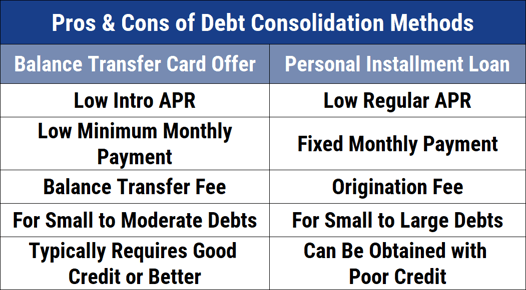

Are Low-Interest Credit Cards or Loans Better for Debt?

Most people interested in a low-interest credit card or an intro APR offer are likely anticipating a large purchase or looking to reduce the interest they’re paying on existing credit card debt. In either case, one important consideration should be whether you should use a credit card or loan for your financing needs.

In general, credit card companies don’t design their products for long-term financing; by nature, revolving credit lines are intended to be paid off and reused regularly, rather than carry a sustained debt for months or years at a time.

While intro APR offers can be an exception to this rule — some offer nearly two years of 0% APR on certain transactions — even the best intro APR offer will eventually expire.

Installment loans, on the other hand, are specifically designed for long-term debt. Personal installment loans can have a term length of up to six years, giving you a significant amount of time to pay off your debt.

So, if you need more time than a credit card can give you, a loan may be the better option. At the same time, the longer you take to repay the loan, the more interest you’ll end up paying, so make sure to balance affordability with interest fees when selecting a loan.

Furthermore, personal loans tend to offer much lower interest rates than credit cards, particularly if you have average to good credit. This can make loans a better deal than credit cards, especially if you can’t qualify for a good 0% APR credit card.

Don’t Let Interest Fees Weigh You Down

In life, you have to take the good with the bad. If you want delicious pizza, you’ve got to make peace with a few extra calories. If you want awesome travel rewards, you’re going to have to also take the high interest rate.

But while you can’t avoid the caloric consequences of your pizza — though you can hustle them along with some exercise — you can avoid paying high interest fees with responsible card use and the right card in your wallet.

Indeed, whether your want a low-interest rewards card or a great balance transfer deal, the options are nearly limitless for cards that can help you save on interest fees. Just remember to always make your payments on time.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year]) 7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/low.png?width=158&height=120&fit=crop)

![8 Best Low-Interest Credit Cards with 0% Intro ([updated_month_year]) 8 Best Low-Interest Credit Cards with 0% Intro ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/low-interest.png?width=158&height=120&fit=crop)

![15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year]) 15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/cheap.png?width=158&height=120&fit=crop)

![8 Low Interest Credit Cards For Beginners ([updated_month_year]) 8 Low Interest Credit Cards For Beginners ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Low-Interest-Credit-Cards-For-Beginners.jpg?width=158&height=120&fit=crop)

![5 Best Low-Interest Personal Loans ([updated_month_year]) 5 Best Low-Interest Personal Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Low-Interest-Personal-Loans.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![7 Low APR Credit Cards For Bad Credit ([updated_month_year]) 7 Low APR Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_615601223-4.jpg?width=158&height=120&fit=crop)

![9 Secured Credit Cards with Low Deposits ([updated_month_year]) 9 Secured Credit Cards with Low Deposits ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_740578252.jpg?width=158&height=120&fit=crop)