The best credit cards with refundable deposits are a great way to build — or rebuild — your credit score. A secured credit card allows you to set your own credit limit, which can help you stick to a budget and improve your credit score along the way.

Meanwhile, your refundable security deposit acts as a nest egg that you can crack into if there’s an emergency or you need some extra cash. And since your deposit serves as collateral for your account, you can often qualify for a secured credit card despite having bad (or even very bad) credit.

Best Overall | More Cards | FAQs

Best Overall Credit Card with a Refundable Deposit

The Capital One Platinum Secured Credit Card tops our list, in part, because it is one of the only secured credit cards that may require a deposit that is less than your credit limit, otherwise known as a partially secured card. Capital One determines your required deposit amount based on your creditworthiness.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

And since Capital One maintains a large portfolio of unsecured credit cards, you may qualify for a card upgrade over time. If you’re eligible to upgrade, Capital One will transition you to a new unsecured account and will return your security deposit to you as a statement credit.

More Top-Rated Secured Cards to Consider

The secured credit cards below all require refundable security deposits for approval. You choose the amount of your deposit, and that amount will be equal to your credit card’s spending limit.

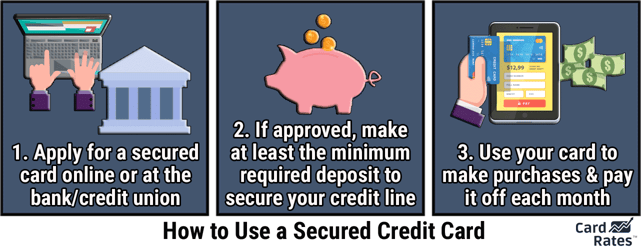

You can use a secured credit card just as you would a traditional unsecured card. That means you can make online or in-store purchases, pay bills, or pay for a rental car or hotel stay. You will pay off your charged debts, as well as any accrued interest charges, through monthly payments.

The Applied Bank® Secured Visa® Gold Preferred® Credit Card has no minimum credit score requirement and will not require a credit check during the application process. But that convenience comes with a cost in the form of an annual fee. But if you want to avoid a credit check and have the minimum $200 security deposit, the annual fee may be worth it.

This card comes with another catch — it has a seemingly low interest rate, but it has no grace period on purchases. That means your purchases begin to accrue interest the day you make the purchase. This card is a true credit builder option and meant only for small purchases that you pay off every month.

Credit rebuilders will like the fact that the OpenSky® Secured Visa® Credit Card does not conduct a credit check for approval. And while this card does charge an annual fee, the fee is lower than the fees for similar cards in this category.

This card also charges an average interest rate with no hidden or monthly fees to eat away at your available credit limit. If you’re making a purchase in a foreign currency, be aware that this card charges a foreign transaction fee to convert the transaction into your native currency.

This card is currently not available. Additional Disclosure: The information related to Bank of America® Customized Cash Rewards Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.4. Bank of America® Customized Cash Rewards Secured Credit Card

The Bank of America® Customized Cash Rewards Secured Credit Card allows you to earn cash back rewards while rebuilding your credit. Your rewards will include bonus cash back on purchases made in the category of your choice.

But if you keep your balance low and make your payments on time, Bank of America will consider refunding your deposit in full after 12 months with the card. If that happens, you will continue to enjoy all of the benefits of your card with no other changes to your cardholder status.

This card is currently not available. Additional Disclosure: The information related to BankAmericard® Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.5. BankAmericard® Secured Credit Card

The BankAmericard® Secured Credit Card doesn’t charge many of the annual, monthly, and transaction fees you’d expect from a secured credit card for bad credit. But the card does charge a higher-than-average interest rate that can make it pricey to carry a balance.

And just like its Cash Rewards sibling listed above, Bank of America may refund your entire security deposit, and keep your account active if you maintain a low balance and make on-time payments during your first year with the card.

This card is currently not available. Additional Disclosure: The information related to Citi® Secured Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.6. Citi® Secured Mastercard®

The Citi® Secured Mastercard® is one of the most inexpensive secured credit card options on this list — with no annual fees, a low minimum deposit requirement, and a potential path toward upgrading to an unsecured Citi credit card over time.

Keep in mind that Citi has slightly stricter requirements for applicants and will require a credit check for approval. But as a credit card for rebuilding credit, the bank will still consider applications from consumers who have a bad credit score.

This card is currently not available.7. Wells Fargo Business Secured Credit Card

Entrepreneurs can leverage the Wells Fargo Business Secured Credit Card to earn cash back and get up to 10 employee credit cards on their business credit account at no extra charge. Cardholders can also access the Wells Fargo Business Online® portal, which makes it easy to manage spending, payments, and balance transfers for your secured business credit card.

Just make sure you make your payments on time. This business credit card charges a tiered late payment fee that can climb as high as $50 depending on the amount of your balance.

(The information related to Wells Fargo Business Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Savings Secured Platinum Rewards Credit Card members can earn Flexpoints Rewards they can redeem for gift cards, merchandise, hotel stays, and airline tickets, among other perks. The card also comes with a host of benefits from Visa, including travel and emergency assistance services and lost luggage reimbursement.

An interesting feature of this card is that it does not charge a cash advance fee if you withdraw money from a State Department Federal Credit Union teller. That makes this one of very few cards — whether secured or unsecured — that waives this fee.

The Merrick Bank Secured Credit Card charges a moderate annual fee when you activate your card. After your first anniversary with the card, Merrick replaces the annual fee with a monthly fee.

Your credit limit is equal to the amount of your refundable security deposit. The perk here is that Merrick has a low minimum deposit requirement and allows for deposits that are higher than the average in this space.

The First Progress Platinum Prestige Mastercard® Secured Credit Card has a lower-than-average interest rate but offsets that affordability with a high annual fee, which makes this card less affordable than others on this list.

But if you tend to carry a balance from month to month, you may find the annual fee is less expensive than the interest charges you would accrue through other secured cards.

This card is currently not available.11. Progress Credit

Progress Credit provides a host of unsecured and secured credit card options that accept applications from consumers who have all types of credit histories.

If you aren’t sure which card you may qualify for, you can browse the issuer’s website to see which card best suits your needs and credit situation. You may be more inclined to apply for one of the bank’s secured or unsecured card offerings.

First Progress offers three distinct secured credit cards — and First Progress Platinum Elite Mastercard® Secured Credit Card has the lowest annual fee of the trio. With that said, it also has the highest ongoing APR of the bunch.

That may be OK if you pay your balance in full each month so you don’t have to worry about interest charges. But if that’s the case, then you may want to consider a different secured credit card that won’t charge you an annual fee for membership.

The First Progress Platinum Select Mastercard® Secured Credit Card has a middle-of-the-road interest rate and annual fee when compared with its sibling cards listed above. This card does not charge a monthly fee or application-processing fee and has a low minimum security deposit requirement.

What is a Secured Credit Card?

A secured credit card is an alternative to a traditional unsecured credit card. The only difference is that secured credit cards require a refundable security deposit for approval.

Most secured credit cards provide a spending limit that matches the deposit amount. For example, a $1,000 deposit will net you a $1,000 credit limit. The exception to this rule is the Capital One Platinum Secured Credit Card, which starts every new cardholder with the same credit limit and bases the amount of your required deposit on your credit score.

You will receive a full refund of your deposit as long as you close your account with no outstanding debts. Some card issuers, including Bank of America, will consider refunding your deposit early — starting at 12 months — if you maintain an account with a low balance and make on-time payments.

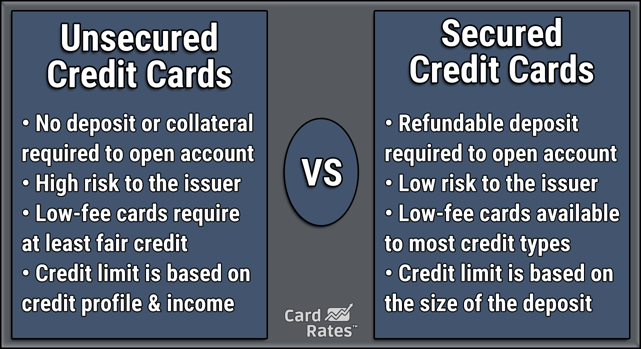

Since secured credit cards are designed for consumers who have no credit or bad credit, they often have forgiving approval requirements. Many secured credit cards do not require a credit check for approval, but you will likely find higher fees attached to these cards to offset the risk issuers take by extending this type of credit.

For example, a standard unsecured rewards credit card may charge an annual fee to offset the cash back or points rewards it offers to cardholders. A secured card may charge a similar fee but offer no rewards. This is somewhat common among financial products for bad credit applicants.

An unsecured card will base your credit limit on your personal credit history and will set your credit limit for you. A secured card, on the other hand, allows you to essentially set your credit limit by choosing the amount of your prepaid deposit.

Just keep in mind that most secured cards have a minimum deposit requirement that, on average, falls between $200 and $300. These cards will also have a maximum allowed deposit that can vary from as little as $250 to as much as $5,000.

Aside from the deposits and fee structure, unsecured and secured cards work similarly at the register. Each card has a revolving line of credit that will allow you to make in-store or online purchases, pay bills, or rent a vehicle or hotel room.

Credit card issuers then report your balance and payment history to the three major credit bureaus — TransUnion, Equifax, and Experian. If you keep your balance low and make on-time payments, this can improve your personal credit score. Adversely, you can further damage your credit history with high balances and/or late payments.

Some cards may only report to one credit bureau, while others may report to two or all three. Your payments and balance will only impact your credit score with the credit bureaus that receive your reports.

What is a Refundable Deposit on a Credit Card?

When you apply for a secured credit card, the card issuer will require you to submit a refundable security deposit to open your credit card account.

Your cash deposit acts like the security deposit you pay when renting an apartment. Your landlord may require a deposit to cover any damage you cause to the home. If you eventually move out without causing any damage, you get your money back. But, if there is damage, your deposit is used to cover the cost of repairs.

The same goes for your secured credit card. If you default on your account and still owe money, your deposit will cover your debt. But if you close your account in good standing and with no debt owed to the bank, the card issuer will send you a full refund of your cash deposit.

A card issuer may hold your deposit for up to 30 days to make sure you have no incoming charges to your credit card account after it is closed. After that period, the bank may mail you a check for your deposit amount, transfer it via direct deposit to a linked bank account, or refund it as a statement credit.

Your deposit does not serve as a monthly payment. For example, let’s say you submit a $500 security deposit to obtain a card with a $500 limit. When you get your card, you charge $250 to rent a car for an upcoming road trip. You will then owe $250 to your credit card company. Your deposit does not go toward that balance.

Instead, the card’s issuing bank will hold your deposit in a savings account until you close your account. In some cases — such as with the Bank of America portfolio of secured credit cards — you can receive an early deposit refund if you exhibit responsible behavior during your first 12 months with the card.

This essentially turns your card into an unsecured offering and allows you to still enjoy the same credit line and benefits you had before the refund.

Will I Get My Secured Credit Card Deposit Back?

You will receive a refund of your full secured credit card deposit as long as you have no outstanding debts when you close your account.

For example, let’s say you placed a $500 deposit for a secured card with a $500 limit. If you close your account with a $150 balance, the bank may deduct $150 from your deposit and refund you $350. If you closed that same account with a $0 balance, you would receive the entire $500 refund.

Banks typically send your refund as either a paper check in the mail or as a direct deposit payment into a linked checking account or savings account. If you’re upgraded to an unsecured account, the bank will likely refund your deposit as a statement credit.

Some banks may even refund your deposit before you close your account. Bank of America will check your account status after 12 months. If the bank decides you’re eligible for an account upgrade, it will refund your deposit and allow you to keep your card account open.

Capital One monitors accounts every six months to see whether they qualify for a credit limit increase. If yours does, the bank will boost your credit line without requiring more money.

In some cases, you may qualify for an upgrade to one of Capital One’s unsecured cards. If you do, the bank will refund your deposit and move you into a more lucrative credit card.

How Much of a Deposit Do I Need for a Secured Credit Card?

The deposit amount you submit for a secured credit card is up to you. Most banks set a minimum required deposit of between $200 and $300. A card may also have a maximum deposit amount of anywhere between $250 and $5,000. Your deposit amount typically equals your new card’s credit limit.

A general rule of thumb is to set your credit limit no higher than an amount that you can comfortably repay each month. Remember that your deposit does not serve as payment. You must repay any charges you make with your card.

If you make a large security deposit and receive a large credit line, you may be tempted to spend — which increases your debt and can hurt your credit score.

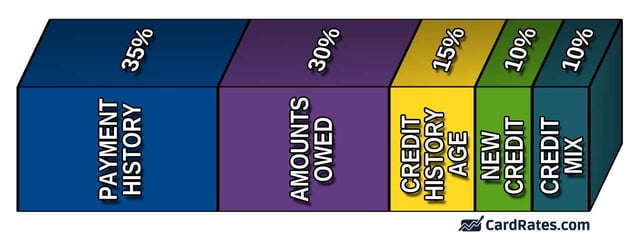

Approximately 30% of your FICO credit score is determined by the amount of debt you have. The higher your debt, the lower your credit score. The relationship between your credit card balances and your total available credit is called your credit utilization ratio or credit utilization rate.

You can calculate your credit utilization ratio by dividing your current credit card balance by the total amount of credit available to you by the credit card company. For example, a card with a $500 balance and a $1,000 credit limit has a 50% credit utilization ratio.

You should keep your credit utilization ratio under 30% to maintain a good credit score. But really, the lower you get your ratio, the better your score will be.

Keep in mind that a lower credit limit also makes it easy to surpass that 30% ratio. A $300 credit limit hits 30% when you have a balance of $90.

By limiting your deposit to an amount that you can confidently repay each month, you will keep your credit utilization ratio low, set a responsible budget for yourself, and avoid the temptation to spend that often leads to major debt problems.

Can a Credit Card Company Keep My Security Deposit?

A credit card company can only keep your refundable security deposit if you owe it money when you close your account. If you have no balance on your card when you cancel your account, you will receive a 100% refund of your deposit.

Banks require a security deposit for secured credit cards to protect themselves against consumers who may have a balance on their card and then stop paying down the debt, also known as defaulting on credit card debt.

Your security deposit sits untouched in a bank account during the life of your card account. If you default on your debt, the bank will remove that money and use it to pay your card’s balance. If you do not have any debt when your card closes, the bank must return the money to you.

How Much Will a Secured Credit Card Raise My Credit Score?

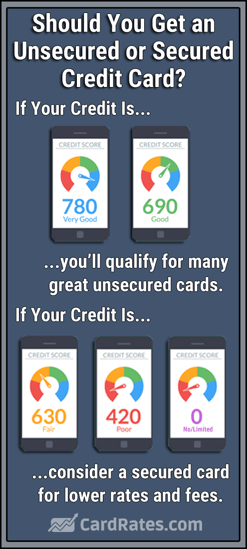

The impact that a secured credit card will have on your credit report is all relative to your credit score when you open your account. For instance, a very bad credit score will see more improvements than a good credit score will.

Think about this as you would a ladder. If you’re at the bottom of the ladder, you can move to the top by climbing several rungs. But if you’re in the middle of the ladder already, you have a shorter distance to climb to get to the top.

Lenders report all of your debts and debt payments to at least one credit bureau. There are three credit bureaus — TransUnion, Equifax, and Experian.

Each bureau uses the information it receives to create a file under your name. That info is used to calculate your credit score.

If you have several recent negative items on your credit report, your score will drop to a very low number. Those negative items will live on your credit history for up to seven years — but they will lose their impact on your score as they get older. And they’ll have even less of an impact if you replace those negative items with positive ones.

This is where a secured credit card can help. The bank that issues your credit card will report your balance and payment history to one, two, or all three credit bureaus each month. That positive information will work to move the previous negative information further down your credit file.

As you add more positive data, your credit score will improve.

The amount of movement will depend upon your credit score at the time you open your account. As mentioned earlier, a very poor credit score will get a much bigger boost if you add four or five months of on-time payments. This shows that you have turned a corner and are now exhibiting responsible behavior with your finances.

If you’re in the middle of the pack and your credit score is in fair territory, you may have a late payment or two on your credit history that lowered your score. In this case, a few on-time payments will help, but not as much as they would someone who has lots of negative items to overcome.

No two credit reports are the same, so your results may differ from someone else’s. But a person with a very low credit score (below 500) could experience an increase of 100 or more points after six months of on-time payments. Someone with fair credit (a score between 580 and 669) may only see a jump of 15 or 20 points in those six months.

While that may not seem fair, it’s all part of building credit. As your score increases, you will find it much harder to gain points than when it was lower. Once you obtain a good credit score, it’s not just about on-time payments. That’s when you start to factor in your credit mix, length of credit history, and other factors that can boost you into excellent credit territory.

A secured credit card can also help you earn your first credit score. A person who has no credit score, otherwise known as credit invisible, does not have enough recent information on his or her credit report to generate a reliable score.

With regular reporting from a secured credit card, you can earn a credit score between four and six months.

Am I Guaranteed Approval for a Secured Credit Card?

While a secured credit card is much easier to qualify for than an unsecured credit card, no one is guaranteed approval.

A credit card is a form of a loan — and banks decide who they want to loan money to. Even though your refundable security deposit acts as a safety net that makes banks feel better about lending you money, other factors may keep you from getting approved:

- A pending bankruptcy case: Most credit card issuers will decline your application if you have a bankruptcy case that is not yet signed off by the court. At this point, any new debt could be discharged by the judge. No credit card company wants to take that risk.

- Recent collections accounts: When you do not make a loan payment for a certain amount of time, the lender will charge-off the debt and sell it to a collection agency. This is one of the worst negative items you can have on your credit history, as it shows future lenders that you burned previous lenders. If you have a recent collections account on your credit file, a secured credit card company may decide to avoid the risk and decline your application.

- Outstanding tax debts: Whether it’s to a federal, state, or local governmental body, tax debts can signal big problems to a credit card issuer. If you do not pay those debts, the government can garnish your wages to get its money. If that happens, you may not be able to pay your monthly credit card bill. That’s a red flag for lenders.

These aren’t the only cases when a bank may decline your application. Every card issuer has its own set of standards that each applicant must pass. Most banks do not publicly display those standards.

If you apply for a secured credit card (or an unsecured card, for that matter) and are declined, the bank must send you an adverse action notice within 10 business days that outlines its reasons you did not receive the card.

Some banks will display that information on your screen when you apply online for a card. Take note of that data and use it as a guide for what you need to work on to increase your odds of approval next time.

And although it may be tempting, don’t jump right into applying for another card right away after receiving a rejection. Every time you apply for credit, the bank that receives your application places a hard inquiry on your credit report. This gives the bank access to your credit history to run a credit check.

Every inquiry will live on your credit report for two years. A few inquiries are fine, but once you surpass three or four, you could see a slight decrease in your credit score. If you have several inquiries in a short time frame, banks may see you as desperate for credit and reject your application.

If you’re declined, your best bet is to wait a few months and work on your credit before reapplying for another card. Although this may be hard to do, it’s better for your long-term financial health.

Do Secured Credit Cards Charge Annual Fees?

Some secured credit cards charge an annual fee and others do not. Any fees associated with a credit card are up to the bank and can change at any time.

An annual fee is usually charged when a secured card increases its lending risk, such as when the card does not require a credit check for approval, or if it offers rewards. The annual fee helps to offset those risks or liabilities.

Other cards may not charge an annual fee but replace that expense with a monthly service charge. So, instead of paying a $36 annual fee, you may pay 12 monthly payments that are deducted directly from your available credit line.

The Merrick Bank Secured Credit Card, for instance, charges an annual fee for your first year with the card. Once you reach your account anniversary, that annual fee goes away and is replaced with a monthly fee that breaks the charge down into 12 payments.

Some card issuers do this because many consumers only keep their secured cards for as long as it takes them to increase their credit score enough to get an unsecured card. For some, that is less than one year.

These banks want to make as much profit off you as they can during the time you remain a customer. That could mean charging you an annual fee, a monthly fee, or a foreign transaction fee that covers the cost of converting any purchase you make in a foreign currency.

A card may also charge you a balance transfer fee if you attempt to move an existing balance from an old credit card over to your new credit card. You may want to consider this if your new card has a lower interest rate and can save you money as you pay down the balance transfer debt.

What is the Easiest Secured Credit Card to Get?

In most cases, all secured credit cards are easy to qualify for — if you can afford at least the minimum required security deposit.

But there are instances, as mentioned above, in which a credit card company may see something on your credit history that triggers a declined application. That makes the cards that do not require a credit check the easiest secured cards to qualify for.

On the list above, the cards that do not conduct a credit check include:

Keep in mind that cards that are easy to qualify for often tack on extra fees to offset the risks associated with these cards. These fees may include an annual fee, monthly fees, or other transaction or service charges.

Keep in mind that cards that are easy to qualify for often tack on extra fees to offset the risks associated with these cards. These fees may include an annual fee, monthly fees, or other transaction or service charges.

If you decide to officially apply for the card, the bank will run a full credit check that will give it access to your entire credit history. If the bank finds something negative that was not listed on your soft credit check, you may not receive the credit decision you’d hoped for.

As a result, you should stick with a card that does not require a credit check if you want to find the absolute easiest path to a secured credit card. Just keep in mind that those cards may be more expensive over the long run.

But don’t choose these cards solely because you think your credit score will disqualify you from approval. Secured credit cards are designed for consumers who have bad credit. That means you may qualify for a card that does not charge an annual fee despite having very poor credit.

What Are the Best Secured Credit Cards to Rebuild Credit?

Every secured card can help you build credit if it reports your balance and payment history to at least one credit bureau. Some credit card issuers only report your information to one or two credit bureaus. Some report to all three.

You want your card to report to as many bureaus as possible. This is because you never know which bureau a lender will pull your credit report from when making a loan or credit decision.

Let’s say you have a secured card that only reports to TransUnion. Your on-time payments and responsible behavior will help boost your score with that bureau, but the other bureaus will have no record of those payments and will not include them in your scoring calculation.

So, if you attempt to apply for a loan and the lender pulls your Equifax score, the lender will not see your secured card payment history and may see a lower credit score. But if your card reports to all three bureaus, you will reap the rewards from your on-time payments on all three scores.

Some cards don’t publish which bureaus they report to. In most cases, those cards will only report to one or two. On the list above, the cards that state that they report to all three bureaus include:

- Capital One Platinum Secured Credit Card

- Applied Bank® Secured Visa® Gold Preferred® Credit Card

- OpenSky® Secured Visa® Credit Card

- Citi® Secured Mastercard®

If your sole intent in acquiring a secured credit card is to rebuild your credit, you may be best served by sticking with one of the cards listed above. These cards will ensure that your payment history and responsible behavior will impact all three of your important credit scores.

What is the Fastest Way to Build Credit?

You can build — or rebuild — your credit score in many ways. But not every method may be the right one for you.

Several factors make up your credit score. Small changes to each category can yield substantial changes to your overall score. To see how this happens, let’s break down each category:

- Amounts Owed (30% of your credit score): This calculates how much money you owe, in relation to how much credit you have issued to you (otherwise known as your credit utilization rate). You can enact big changes to your credit score by keeping your balances low and paying down any existing debt you have.

- Payment History (35%): This gives you credit for making on-time payments. If you have late payments on your credit file, you will need to have some patience until those negative entries get older and are replaced by positive data. Keep making on-time payments — even if just the minimum payment — and you will experience credit score growth.

- Length of Credit History (15%): There’s no shortcut for this one. Banks like to see that you have a long and positive history of working with lenders. A good length of history is around seven years. If you’ve had a credit card for 10 years and you cancel that card, it can reduce the age of your credit history and lower your credit score. That’s one reason you shouldn’t cancel old credit cards unless it’s absolutely necessary.

- New Credit (10%): Banks see great risk in consumers who open several credit accounts in a short amount of time — especially if those people don’t have a long credit history. Try not to open too many accounts in a short period of time if you can avoid it.

- Credit Mix (10%): Lenders like to see that you can handle multiple types of credit accounts at once — including credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans. If you have multiple accounts in good standing, it can improve your score. But don’t take on extra unnecessary debt just to boost your credit score.

While you may be able to increase your credit score faster by improving your credit mix, that means you are taking on more debt — which can lower your credit score.

Don’t take on loans just for the credit score impact. If you want to improve your credit mix, consider a credit builder account, otherwise known as a credit builder loan. These loans are typically issued by banks and essentially allow you to lend yourself money.

With a credit builder account, you make monthly loan payments that the bank places into a secured bank account. The bank reports your on-time payments to each credit bureau to help rebuild your credit score.

Once you make your final payment — usually after 12 months — the bank turns the account over to you. This is a great way to improve your credit mix and build a small nest egg along the way.

What is the Best Secured Credit Card with Rewards?

Multiple cards on the list above offer cash back rewards for cardholders. In our opinion, the best of these cards are the Bank of America® Customized Cash Rewards Secured Credit Card and the Wells Fargo Business Secured Credit Card.

Bank of America® Customized Cash Rewards Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Bank of America® Customized Cash Rewards Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

Cash back is a rare perk for secured cards, but these cards offer a generous rate of return that will offer a rebate for every qualifying purchase you make with your card. Some cash back rewards cards allow you to redeem your earned rewards in the form of a check, whereas others may limit you to using your rewards as a statement credit that erases a portion of your existing credit card debt.

While these perks are nice, you should never choose a secured credit card solely because it offers cash back unless you pay your balance off each month. The interest charges far outweigh the rewards you earn when you carry a balance from month to month.

Research the Best Credit Cards with Refundable Deposits Online

Secured credit cards are a great way to build — or rebuild — your credit score without paying expensive fees that drain your bank account.

These cards also provide a way for you to budget your income, since you can choose your credit limit by deciding the amount of security deposit you want to put down on your card. Keeping your balance low and always paying on time will help you increase your credit score and give you access to better credit cards, higher credit limits, and more lucrative rewards.

As with most things in life, you should create a plan and have patience with your credit-building journey. Rome wasn’t built in a day — and neither is an excellent credit score. But with the best credit cards with refundable deposits, you can lay the foundation for a better financial future.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![11 Credit Cards For Bad Credit: Deposits Needed ([updated_month_year]) 11 Credit Cards For Bad Credit: Deposits Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Credit-Cards-For-Bad-Credit-With-Deposit.jpg?width=158&height=120&fit=crop)

![9 Secured Credit Cards with Low Deposits ([updated_month_year]) 9 Secured Credit Cards with Low Deposits ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_740578252.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For Rebuilding Credit ([updated_month_year]) 9 Best Credit Cards For Rebuilding Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/rebuildcredit.png?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for No Credit ([updated_month_year]) 9 Best Credit Cards for No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/nocredit.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for New Credit Users ([updated_month_year]) 5 Best Credit Cards for New Credit Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-New-Credit-Users-Feat.jpg?width=158&height=120&fit=crop)

![7 Same-Day Credit Cards for Poor Credit ([updated_month_year]) 7 Same-Day Credit Cards for Poor Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Same-Day-Credit-Cards-for-Poor-Credit.jpg?width=158&height=120&fit=crop)