Most lenders want some sort of proof that you can pay back any loan that you receive. That goes for credit cards, banks, or a cousin who floats you a few bucks until payday.

While most credit card applications just want proof of income, some still require proof of employment. We’ve done the work for you and found credit cards with no employment check so you can avoid those applications if you so choose.

Also, keep in mind that no-employment-check credit cards aren’t just for consumers with questionable credit histories. In fact, your options only increase if you have fair, good, or excellent credit, so be sure to check out our options in these categories, as well.

Bad Credit | Student | Secured | Prepaid | FAQs

Cards For Bad Credit With No Employment Check

If you’re near the bottom of the credit spectrum, you can still find plenty of options to fit your income and credit range. Our best choices, listed below, feature a mix of secured and unsecured cards, and some don’t even require income verification.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

While most secured credit cards require you to place a refundable security deposit that matches your credit limit (for example, a $300 deposit yields a $300 credit limit), the Capital One Platinum Secured Credit Card may require a smaller deposit for qualified applicants. Plus, Capital One could increase your credit limit — with no added deposit — after you make your first six payments on time.

The Surge® Platinum Mastercard® doesn’t require an employment check, and, if eligible, you won’t be on the hook for monthly maintenance fees. The card lets you prequalify on its website before applying. You may be offered a different card from Continental Finance depending on your qualifications.

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

Not only does the Milestone® Mastercard® not require an employment or income check, but the issuer welcomes applications from those with poor credit. Since Milestone® offers a few different credit cards, the application pairs qualified applicants with the card that best suits their needs and credit background.

Best Cards for Students With No Employment Check

Most student credit cards have strict requirements for applicants, including enrollment in a certain number of credit hours or classes. Many issuers also require proof of income to get approved for a student credit card, but there’s generally no minimum income requirement.

You can get approved for a student credit card with little income, but the card issuer needs to see that you can afford to make the minimum payment each month.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Cash Back offers rich cash back rewards for qualified student applicants. It is a great choice for any student seeking their first credit card. Discover is a reputable credit card company with a solid product that can live in your wallet for years to come.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Chrome is another card from Discover that offers cash back for students, but this one has a simpler rewards structure that doesn’t require quarterly activation. As is the case with its sister card, students with no income who are applying for a Discover it® Student Chrome card will need a co-signer to qualify.

Best Secured Cards With No Employment Check

If you’re working to rebuild poor credit after making a few mistakes, you may have to turn to a secured credit card to get back on track. These cards typically require a refundable security deposit that matches your credit limit. Other than that, a secured card works exactly like its unsecured brethren.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

Qualified Capital One Platinum Secured Credit Card applicants may not need to place a full deposit to match their new credit limit. That’s because all new Capital One Platinum Secured Credit Card cards start with a $200 limit. You may earn a credit limit increase after making your first six payments on time — and that increase won’t require an additional deposit.

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

The Discover it® Secured Credit Card is a rare secured card offering that provides cash back opportunities. Discover also checks your account after an introductory period to see if you qualify for an upgrade to an unsecured card. This card requires a minimum refundable security deposit to open the account, with the amount of your deposit determining your credit limit.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

Not only does the OpenSky® Secured Visa® Credit Card not require an employment check, but it’s one of the rare secured cards that doesn’t even require a credit check. OpenSky® will set your credit limit equal to your refundable deposit. It comes with a competitive interest rate but does charge a small annual fee.

Best Prepaid Cards With No Employment Check

Prepaid cards operate on credit card networks, but not every card includes a line of credit. Depending on your credit history, a lender might limit you to a debit card that allows you to make direct deposits of your paycheck or another source of income.

- Brink’s knows Security! 24/7 access to a suite of security benefits to help keep your account armored.

- Get access to over 100,000 Brink’s Money ATMs.

- Get paid faster than a paper check with direct deposit.

- Add funds to your Brink’s Armored Account and use Brinks Armored debit card anywhere Debit Mastercard is accepted.

- Account opening is subject to registration and ID verification. Terms & fees Apply. Deposit Account is established by Pathward®, N.A., Member FDIC.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fees

|

Not applicable

|

You won’t pay any monthly fees with a Brink’s Prepaid Mastercard® pay-as-you-go plan, as long as you keep your account active. Instead, you’ll pay a flat $1 fee for each signature transaction and $2 per PIN transaction.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The PayPal Prepaid Mastercard® lets you easily make transfers from your PayPal account to your prepaid card. It has a convenient mobile app for easily managing your account, and monthly fees are waived with qualifying direct deposits.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The Pink Netspend® Visa® Prepaid Card has two cardholder plan types: monthly and pay-as-you-go. With a pay-as-you-go plan, you pay $1.95 every time you use your card. The monthly plan charges a varying fee that can be waived with qualifying direct deposits.

Can You Get a Credit Card Without a Job?

There’s no set rule saying that you must have employment to apply for a credit card — but a job will certainly help your chances of getting approved. The only things credit card issuers truly require on an application are a legal name, address, Social Security number, phone number, and date of birth.

Almost every application will ask for your employment status and total income. While lenders will heavily weigh their decision on your answers to those two questions, they aren’t the only factors taken into consideration.

Many people who don’t have traditional employment still have a credit history and positive income to warrant credit approval. Take, for example, a retiree who wants to apply for a credit card.

You may also be a student, a freelancer, an independent contractor, or self-employed — which most banks don’t consider traditional employment but can still yield an income.

As long as you can provide the personal identification questions, you can submit an application for credit. But keep in mind that multiple applications can damage your credit score.

That’s because every time you apply for credit, the lender submits an inquiry to one or all three of the major credit reporting bureaus to view your credit history. Most credit scoring agencies allow around three inquiries on your credit report for every two-year period.

Your credit score can take a hit once you go beyond that number. Excessive applications tell a lender that you may be currently over your head with debt and need credit to stay afloat. That may make you look like a high risk and make it less likely that they’ll accept your application.

But showing active employment and gainful income goes a long way to prove to the lender that you can honor your debts and pay your bills on time.

Can You Get Approved For a Credit Card With No Income?

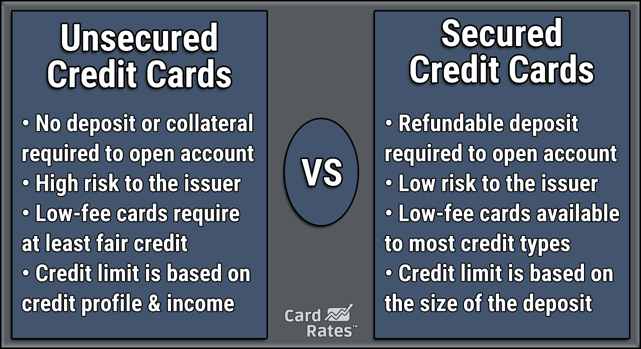

The answer to this question depends solely on the type of credit card you apply for — a secured or unsecured credit card.

A secured credit card often requires a refundable deposit that secures your account against default and determines your credit limit. For example, an issuer may require you to pay a $500 deposit to receive a credit card with a $500 limit.

Some secured credit cards still require income verification for approval. But since your account contains the security deposit, several card options won’t require income, employment, or even a credit check.

Unsecured credit cards, on the other hand, don’t require a deposit. But banks that extend this type of credit often want proof that you can repay your debt. That means proof of income — either from employment, a retirement account, investment, or another traceable source.

You may find exceptions to this rule if you include a cosigner on your application. A co-signer acts as a guarantor to your account should you default on your payments. Lenders typically require that your co-signer have an established credit history and proof of income.

While this path could net you approval, it doesn’t come without great responsibility. If you miss a payment or default on your loan, you and your co-signer take the credit score hit, and your co-signer could be on the hook to pay the debt for you. That can quickly ruin a relationship, a family bond, or a friendship.

Another option is to become an authorized user on an existing credit card. When this happens, a friend or family member with a credit card adds your name to the account, and the lender issues a card in your name that draws from the original credit line.

When you use a credit card as an authorized user, you’re tapping into the main user’s available credit, and the main user retains responsibility for any debt you incur. Not paying the bill makes the main cardholder responsible for your charges. Like cosigning, that can have bad consequences.

Finally, if you’re married and 21 years or older, some credit card issuers allow you to use your spouse’s income on your application. This becomes tricky if your spouse already has credit cards issued in his or her name that depend on that income.

What Is the Easiest Credit Card to Get Approved For?

Credit card issuers have worked for years to make it easy to apply for credit. Most online applications take less than five minutes to complete, and credit decisions often take less than a minute to receive.

But while applying may come easy, approval is a whole different ball game.

Your acceptance will likely depend on a mix of your income, credit history, and current debt. If you can meet the requirements on all three, you’ll likely find multiple issuers that will easily approve you. If you have one or more issues with those three, the options become limited.

If that’s the case, you’re best to start with a secured credit card. The OpenSky® Secured Visa® Credit Card has one of the highest approval rates because the card doesn’t require an income or employment check and doesn’t even ask for a credit check.

As with most secured credit cards, you’ll still have to submit a refundable security deposit to get your card.

Both secured credit cards and credit accounts can still help improve your credit score if you make your payments on time. That’s because both types of accounts report your payment history to at least one credit bureau monthly.

On the flip side, missing a payment or defaulting on your debt can result in the loss of your deposit and a big hit to your credit score.

Can I Lie About Employment On a Credit Card Application?

Lying on a credit card application is considered fraud. Because an application is a legal document, you would be committing loan application fraud.

Your application is likely to be denied, and you may be required to pay fines and, worst-case scenario, serve jail time. If you are tried and convicted, the fine is up to $1 million and jail time is up to 30 years!

MyBankTracker provides the following examples of people who have been convicted of loan application fraud:

- In 2015, Solomon Gordon Raymond of San Diego was sentenced to nearly five years in prison and ordered to pay $729,192 for committing loan application fraud.

- Also in 2015, a woman from Raleigh, North Carolina was sentenced to five years in prison for loan application fraud.

- In 2014, an Ohio woman was sentenced to fourteen years in prison and to pay $73,554 for her role in loan application fraud.

As you can see, lying on a credit card application is not just a bad idea, it’s a crime.

Using Credit Isn’t Advised If You Have No Income

They say money makes the world go ‘round — but it also makes paying your bills a whole lot easier. That’s why it’s important that you never take out a loan or open a credit card account that you know you cannot pay back.

A single payment that’s 30 or more days late can cause your credit score to drop by more than 100 points, which seriously hurts your chances of getting credit approvals in the future.

Even if you can make the minimum payment, credit card debt can result in constant interest charges and years of unnecessary payments that lead to a vicious debt cycle.

If your income isn’t what you’d like it to be, but you still want to rebuild your credit score, consider a secured credit card that can pull your credit rating out of the doldrums and have you ready for an upgraded card when your income and credit score improve.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Secured Credit Cards: No Credit Check ([updated_month_year]) 7 Best Secured Credit Cards: No Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/Best-Secured-Credit-Cards-with-No-Credit-Check.jpg?width=158&height=120&fit=crop)

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)

![2 Ways to Check Chase Credit Card Application Status ([updated_month_year]) 2 Ways to Check Chase Credit Card Application Status ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/chase-credit-application-status1-2.png?width=158&height=120&fit=crop)

![How to Check PREMIER Bankcard Application Status ([updated_month_year]) How to Check PREMIER Bankcard Application Status ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/How-to-Check-Your-PREMIER-Bankcard-Application-Status.jpg?width=158&height=120&fit=crop)

![Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year]) Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Credit-Card-Travel-Insurance-2.png?width=158&height=120&fit=crop)

![7 Best No Credit Check Loans ([updated_month_year]) 7 Best No Credit Check Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-No-Credit-Check-Loans--1.jpg?width=158&height=120&fit=crop)

![5 No-Credit-Check Auto Loans ([updated_month_year]) 5 No-Credit-Check Auto Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/05/No-Credit-Check-Auto-Loans.jpg?width=158&height=120&fit=crop)