Whether you are a freshman in college or pursuing your master’s, the right student credit card can reward you handsomely for everyday purchases across some of your favorite spending categories. Other perks generally include no required credit score, 0% promotional APRs, entertainment benefits, and welcome bonuses.

Continue reading to learn more about the best student rewards credit cards, including their benefits, disadvantages, and how to choose the right card for your needs.

Best Overall Student Rewards Cards

Student rewards credit cards such as the Discover it® Student Cash Back and the Bank of America® Customized Cash Rewards credit card for Students offer exceptional benefits, including cash back rewards, no annual fees, and free FICO scoring. These benefits allow college students to monitor their credit scores and develop healthy credit habits over time.

Here are our preferred student rewards credit cards:

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% – 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% – 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Cash Back is one of the best student rewards cards. It offers cash back rewards and you can use the card virtually anywhere, as over 99% of merchants nationwide accept Discover.

At the end of your first year owning the card, you’ll be eligible for a dollar-for-dollar match of all cash back earned. For example, if you earned $400 in cash back rewards over 12 months, Discover will double it to $800. After you graduate from college, it can also be converted into a non-student credit card, and you may be eligible for a credit limit increase.

Rounding out this card’s benefits are no annual fees, several fun card designs, and a 0% introductory purchase APR offer with standard variable rates after that.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card for Students allows you to choose the category you want to earn its highest flat-rate cash back percentage, a unique perk among student rewards credit cards.

For example, do you spend the most on your monthly cable and internet plan? What about dining and take-out? Whatever the category, all you need to do is log into Bank of America’s mobile app and change it once every month before it takes effect.

Outside of this card’s “category of your choice” offering, it offers a cash rewards bonus after reaching a minimum spend within the first 90 days of account opening, as well as no annual fee, free FICO scoring, and a long 0% introductory APR offer on purchases and balance transfers, after which the regular APR applies.

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it’s misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Quicksilver Student Cash Rewards Credit Card is a well-rounded card. Leading the charge is unlimited cash back on every purchase and a cash bonus after reaching a minimum spend amount after opening the card.

This card offers complimentary benefits such as the use of the Capital One Entertainment platform, which provides access to event tickets, VIP packages, and dining reservations, including presale events. The Capital One mobile app also has a booking platform where you can purchase tickets.

Another great thing about this card is its lack of fees. It doesn’t charge annual or foreign transaction fees, which is great if you study abroad or plan on doing so.

In short, we highly recommend the Capital One Quicksilver Student Cash Rewards Credit Card if you’re a student looking for a low-cost card with a nice mix of cash back rewards, low fees, and access to special events.

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), with 1% on all other purchases

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One SavorOne Student Cash Rewards Credit Card is a solid workhorse, allowing you to earn tiered cash back when spending in select categories, along with an enticing one-time cash bonus after spending a minimum on purchases within the first three months of account opening.

Another benefit to using this card is its redemption options. You can redeem your rewards for a statement credit or gift card, among other options. We also appreciate its additional warranty protection on eligible items, complimentary concierge service, and free travel accident insurance, a particularly valuable perk for study-abroad students.

Lastly, the Capital One SavorOne Student Cash Rewards Credit Card charges no annual or foreign transaction fees. If you spend significant time abroad, this alone can potentially save you hundreds of dollars.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Unlimited Cash Rewards credit card for Students offers many student-friendly features, primarily an unlimited flat-rate cash back percentage on all purchases with no annual fee.

Aside from cash back, this card also offers a cash welcome bonus upon meeting the terms, a 0% introductory APR offer, and a free FICO score accessible through the Bank of America’s mobile app. The regular APR will apply after the introductory APR period for purchases and balance transfers expires.

We’re also big fans of the zero liability guarantee protecting against fraudulent transactions, overdraft protection, and account alerts. In short, this card offers a generous rewards program with enough extra perks to use it as your primary card.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don’t expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want – you’re not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Travel Rewards credit card for Students is one of the only travel cards specifically made for students. It awards points you can redeem for statement credits on eligible travel purchases, making it really easy to use and understand.

Though this card is chockfull of benefits, it’s worth noting that Bank of America student cards generally require good credit for approval. Most student cards don’t require a credit history because they’re tailored to young adults new to building credit.

But if you qualify, we highly recommend this card for its flat-rate points program and robust mobile app that emphasizes good credit habits that can help set you up for long-term success once you’ve entered the workforce and beyond.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% – 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% – 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Chrome card offers many of the same perks as the Discover it® Student Cash Back card but with a focus on gas stations and restaurants. Another benefit to using this card is its unlimited Cashback Match program, where you can enjoy a dollar-for-dollar match at the end of your first year. And if you refer a friend who gets approved for a card, you can receive a statement credit.

Cardholders will receive introductory APR promotions (after which the variable APR kicks in), pay no annual fees, and enjoy 99% nationwide acceptance. The Discover it® Student Chrome card has a mobile app to track cash back rewards, contact customer service, and receive alerts if your Social Security number appears on the Dark Web. It even offers free scrubbing of your personal info from reverse phone lookup sites.

With all these benefits, the Discover it® Student Chrome is one of the more versatile student cards we’ve reviewed.

Which Credit Card Is Best for Students?

The best credit card for students usually carries one more of the following features:

- No Annual Fee: Our preferred student rewards credit cards charge no annual fees. For comparison, fees on regular credit cards like the Chase Sapphire Preferred® Card and American Express® Gold Card typically range from $25 to $500+.

- 0% Intro APR: This perk offers 0% interest on purchases and/or balance answers within a set time after account opening. This period typically ranges from six to 15 months, with variable APRs applied to your unpaid balance afterward. To continue enjoying a 0% APR period, you must make payments on time or potentially forfeit the perk.

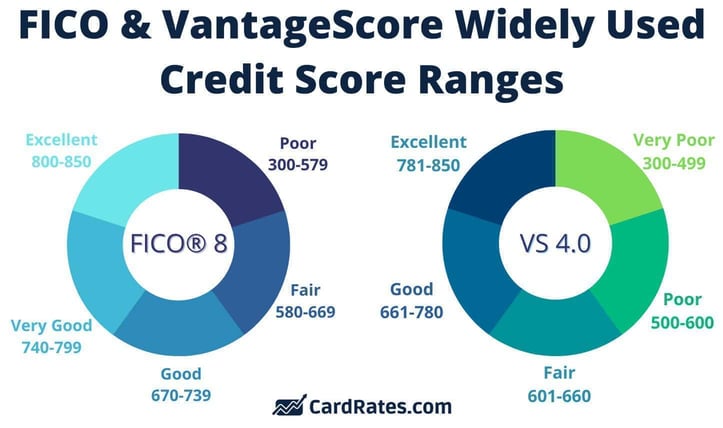

- Credit Building: Most student cards report payments to credit bureaus. Consistent, on-time payments help establish a positive credit history. Remember, the higher your credit score, the lower the interest rates you are eligible for.

- Portals: One popular perk with student rewards credit cards is easy-to-use booking platforms. For example, the Capital One Entertainment platform offers exclusive access to events, discounted tickets, and cash back on entertainment spending.

- Miscellaneous Perks: Some student rewards credit cards offer benefits that may take longer to notice, such as travel insurance, rental car coverage, and even purchase protection benefits to help you replace or repair eligible items. With these perks, you do not need to sign up for two different insurance and warranty providers individually.

Note that these perks are subject to change and vary by card type. For the latest updates, please check your credit card’s terms and conditions.

Is Getting a Student Credit Card Smart?

Under most circumstances, getting a student credit card is a good idea. One of the main reasons is the opportunity to build credit. Establishing a credit history will help you lock down larger loans, such as auto loans and mortgages.

Other transactions, such as securing an apartment, leasing a vehicle, or undergoing an employment screening, may require a good to excellent credit score.

Another reason taking out a student credit card is smart is its extensive signup bonuses and rewards programs. They allow you to earn rewards you can redeem as statement credits, direct deposits, or even physical checks, among other options. Another popular redemption method is using rewards to pay for Amazon or PayPal purchases when you link your card to these accounts.

All you need to do is use the card for everyday purchases, meet minimum spending requirements (for one-time bonuses), and do your best to pay the bill off each month to avoid hefty interest charges, unless your card qualifies for a 0% introductory rate.

Lastly, student credit cards teach you to manage credit and debt responsibility. Responsible credit card use allows you to develop strong financial habits, from budgeting to monitoring credit reports to paying bills on time.

Is It Better to Get a Student Credit Card or a Regular Credit Card?

Choosing between a student or a regular credit card depends on your circumstances.

Here are three main differences between the two:

- Annual Fees: Typically, student credit cards are cheaper to own than regular ones, with lower to no annual fees, a must for cash-strapped students. However, some non-student credit cards offer lucrative welcome bonuses, potentially making the card a better deal.

- Credit Limits: Thanks to limited credit history and lower income, student credit cards almost always have lower credit limits than regular credit cards. Expect limits from a few hundred up to $5,000. Regular credit cards can have credit limits starting at $10,000, with premium cards commanding $30,000 or even more. Still, these cards require good to excellent credit for approval and a decent income to warrant a high credit limit.

- Perks: Expect student credit cards to carry lower cash back rates across a narrow range of categories popular with students, such as groceries and gas. In turn, regular credit cards reward much higher cash back rates across a wide range of categories, including but not limited to travel and grocery purchases.

- Credit Score: Do you have a limited credit history? If so, a student card is probably your best bet. But if you have a bad credit score, you may need to get a secured credit card to help improve your credit score enough to qualify for an unsecured credit card later.

No one will know whether your card is a student credit card or a “regular” credit card but you.

Should I Get Two Credit Cards as a Student?

If you are a student, it may make sense to get one or two credit cards, depending on the following considerations:

- Credit Utilization: Can you keep your credit utilization at or below 10% using two student credit cards? With two credit cards, you’ll have more available credit, which can positively affect your credit score. How much debt you owe accounts for a large portion of your credit scores, so keeping your balances to a minimum is crucial.

- Money Management: With two credit cards, you also have two monthly due dates to worry about. Can you pay off both balances in full each month to avoid interest? Can you consistently keep track of two cards using the card issuer’s website or a third-party budgeting app? Setting up automatic payments and avoiding overspending is one great way to start.

- Credit Card Benefits: Different cards offer different benefits. One may offer an introductory 0% APR, and the other may have a rotating category rewards program. Choose cards that match your preferences and spending habits with little to no overlap to maximize their benefits.

In short, credit utilization, the ability to manage two payments, and rewards are three criteria you could use to determine whether one or two credit cards will work best for you.

What Are the Disadvantages of a Student Credit Card?

All those student rewards cards have many advantages but also have several drawbacks. Three disadvantages include high interest rates, low credit limits, and limited rewards programs.

Almost all student credit cards charge higher than average interest rates (often 20% or higher) than regular credit cards, thanks to a student’s credit profile, which typically means no credit history or a limited credit history.

Secondly, low credit limits may also be an issue, with credit limits typically not exceeding $1,000. You may need a higher limit for larger purchases, such as dorm room accessories or a celebratory vacation after graduation.

Lastly, do not expect the same robust rewards programs with student rewards cards as non-student credit cards for good or excellent credit. At best, expect rewards on everyday spending, e.g., groceries and gas, whereas regular credit cards reward points and statement credits across a broader range of categories (e.g., airline and hotel purchases).

That said, student cards provide an excellent opportunity to start building credit and eventually move on to more rewarding programs with traditional credit cards for good credit.

How Hard Is It to Get Approved for a Student Credit Card?

Getting approved for a student credit card is relatively easy. You must meet most, if not all, of the following eligibility criteria, depending on the card issuer:

- 18+ years old

- US citizen or green card holder

- Source of income (part or full-time work)

- Low debt-to-income ratio

- Proof of enrollment (student ID or school letterhead)

You do not need a credit history to get approved for a student card unless you choose a card from Bank of America, which requires its applicants to have good credit for approval. These cards may be better for grad students with established credit histories.

What Is the Average Credit Limit on a Student Credit Card?

The average credit limit credit card depends on several things, including the issuer, card terms, and the cardholder’s credit and income.

Student credit cards typically carry limits starting at $500 up to $5,000. With a high credit score (670+) or by using a cosigner with good credit, such as a parent or guardian, you can increase your chances of approval for a card with a higher limit.

Other factors that increase your chances of a higher credit limit include income and credit history. The higher your income and the more established your credit history, the higher your limit.

Why Do I Keep Getting Denied for Credit Cards as a Student?

You may be denied the best student rewards cards for many reasons, including but not limited to your credit history and low income. Here are the most common reasons for denial:

- Low Income & High Debt-to-Income Ratio: If your income is too low or your debt-to-income ratio (DTI) ratio is too high, your lenders are naturally concerned about your ability to repay them. When a significant portion of your income goes to debt or other expenses, it raises doubt among lenders that you will be able to repay new card debt.

- No Employment. Like low income and a high DTI, a lack of stable employment raises concerns to lenders that you will need help repaying your debt.

- Not Meeting Age Requirements. You must be 18 or older to get a credit card in your name.

When you’re denied a credit card, you’ll be sent an Adverse Action Notice detailing the reasons you were denied. This can help you create a plan to improve your approval odds.

You can work on your credit score to improve your chances of getting a student rewards card by never missing a payment, lowering your credit utilization ratio, diversifying your credit mix, and increasing your average account history by never closing a card, even if it carries a $0 balance.

Are Discover’s Student Cards Good?

We’re big fans of the student cards offered by Discover. They offer exceptional perks such as no annual fee, cash back rewards, free FICO scores, and security features such as zero liability, which helps protect against unauthorized charges.

Our two favorite Discover® student rewards cards are the Discover it® Student Cash Back and Discover it® Student Chrome — the main difference between the two is their cash back programs. If you’d rather not worry about rotating categories, the Discover it® Student Chrome may be the better card.

Our only knock on Discover’s student cards is its limited acceptance internationally. However, they have a 99% acceptance rate in the United States, which fits the bill for most college students.

Does Closing a Student Credit Card Hurt Your Credit?

Closing a student credit card will affect your credit score. However, it will have less impact than other factors, such as your payment history and credit utilization ratio.

FICO calculates credit scoring with the following criteria:

- Payment History (35%)

- Credit Utilization (30%)

- Length of Credit History (15%)

- Credit Mix (10%)

- New Credit (10%)

By closing your student card, your length of credit history will be affected. FICO calculates your length of credit history by averaging the age of all your accounts. Rather than close your credit card, we recommend keeping it open with a small charge to it every month, e.g., a Spotify or Apple subscription.

How Easy Is It to Get a Student Card from Discover®?

Qualifying for the Discover it® Student Cash Back is relatively easy for first-timers.

To qualify, you must be 18 or older with legal residency and currently enrolled in a two or four-year college program. You also need to demonstrate proof of income. Part-time jobs such as cafeteria work, Uber driving, concession stand workers, and other popular college gigs are all accepted, just as long as you can verify your income.

Finding The Right Student Rewards Credit Card

Finding the right student card can be very rewarding (no pun intended). From cash back on purchases to no annual fees, these cars are an excellent springboard to building credit and eventually graduating to regular credit cards with better rewards programs.

Be sure to find a card that aligns with your individual spending preferences (not just entertainment perks!) and compare a minimum of three options to best set you up for success.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Student Credit Cards For Bad Credit ([updated_month_year]) 9 Best Student Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Student-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Student Credit Cards With No Annual Fee ([updated_month_year]) 7 Best Student Credit Cards With No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Student-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![4 Best Student Credit Cards With 0% APR ([updated_month_year]) 4 Best Student Credit Cards With 0% APR ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Student-Credit-Cards-with-0-APR.jpg?width=158&height=120&fit=crop)

![Discover Student Credit Cards & 5 Alternatives ([updated_month_year]) Discover Student Credit Cards & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/12/Discover-Credit-Cards-For-Students.jpg?width=158&height=120&fit=crop)

![7 Highest-Limit Student Credit Cards ([updated_month_year]) 7 Highest-Limit Student Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Highest-Limit-Student-Credit-Cards.jpg?width=158&height=120&fit=crop)

![3 Steps: How to Choose a Student Credit Card ([updated_month_year]) 3 Steps: How to Choose a Student Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/How-to-Choose-a-Student-Credit-Card.jpg?width=158&height=120&fit=crop)

![6 Ways to Pay Student Loans With a Credit Card ([updated_month_year]) 6 Ways to Pay Student Loans With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Pay-Student-Loans-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)